You know the feeling. You’re in the zone, the trade is deep in the green, and your confidence is soaring. Nailing the exit right on time isn’t just about following a rule; it’s the signature of a trader who acts with intention and precision.

So if you’ve been wondering, Topstep trades closed by what time?, here’s your edge:

According to Topstep’s official Help Center, all positions must be closed by 3:10 PM CT (Monday–Friday) for both Trading Combine® and Funded Accounts. While the Risk Team may close positions automatically as a courtesy, it’s ultimately each trader’s responsibility to be flat by 3:10:00 PM CT. (Topstep Help Center: When and what products can I trade?)

In this guide, H2T Funding will walk you through exactly how to stay in control, protect your progress, and turn smart habits into long-term success.

Key takeaways

- All Topstep trades must be closed by 3:10 PM CT (Monday–Friday), no exceptions. Missing this cutoff can result in an automatic flatten and a rule violation.

- Holiday trading hours vary, often closing as early as 11:30 AM CT. Always check Topstep’s official calendar to avoid surprise violations.

- Not all products follow the 3:10 PM CT rule; some futures contracts (e.g., corn, soybeans, live cattle) close earlier. Always confirm with CME or your broker.

- Use Topstep’s official clock, not your system time. Even a few seconds off can end your Combine® or Funded Account.

- Relying on auto-flattening is risky. It’s a safety net, not a strategy. Consistent discipline around timing sets serious traders apart.

1. Understanding the 3:10 PM CT rule

Mastering this rule isn’t just about avoiding disqualification; it’s a sign you’re trading like a pro. Knowing exactly when Topstep trades close by what time shows you’re serious, disciplined, and ready for funding. It’s not a burden, it’s your edge.

1.1. The hard cutoff time and when trading resumes

The 3:10 PM CT deadline is a key guardrail that helps traders avoid unexpected overnight losses. All open positions must be closed before that time, no exceptions. This rule reflects Topstep’s core philosophy: protecting traders from unnecessary risk when markets turn unpredictable after hours.

Once the market closes, you’re free to resume trading at 5:00 PM CT for the next session. The new trading week kicks off every Sunday at 5:00 PM CT, giving you time to reset and prepare.

1.2. Use Topstep’s official clock

Don’t trust your phone clock; it betrayed me once, and it cost me an evaluation I’d spent three solid weeks passing with flying colors. Just a few seconds off, and my account was gone. That’s how brutal timing can be, especially under the consistency rule on Topstep Express account, where every detail matters.

The only time that matters is Topstep’s official clock. You’ll find it on your dashboard’s Resources Page. Make checking it a part of your pre-close ritual. It’s a small habit that prevents a world of frustration.

Read full Topstep reviews here: Topstep review: Best prop firm for futures trading

2. Navigating the 2025 holiday trading schedule

Holiday schedules are a silent trap for even seasoned traders. Markets shut early, and your trading window shrinks without warning. Miss that cutoff, even by a minute, and you’re facing an instant rule violation.

Worse still, the closing time isn’t always the same for the Trading Combine® and a Funded Account®. If you’re trading with real capital, the stakes are even higher. Don’t leave it to chance; know what you’re risking. Check out Topstep: What if I lose my live account? to see how one misstep could put everything you’ve worked for on the line.

| Holiday Name | Date | Trading Combine® Close Time | Funded Account® Close Time |

|---|---|---|---|

| Martin Luther King Jr. Day | Monday, Jan 20, 2025 | 11:45 AM CT | 11:30 AM CT |

| President’s Day | Monday, Feb 17, 2025 | 11:45 AM CT | 11:30 AM CT |

| Good Friday | Friday, April 18, 2025 | Market Closed | Market Closed |

| Memorial Day | Monday, May 26, 2025 | 11:45 AM CT | 11:30 AM CT |

| Juneteenth | Thursday, June 19, 2025 | 11:45 AM CT | 11:30 AM CT |

| Independence Day | Thursday, July 3, 2025 | 11:45 AM CT | N/A |

| Independence Day | Friday, July 4, 2025 | Market Closed | 11:30 AM CT |

| Labor Day | Monday, Sept 1, 2025 | 11:45 AM CT | 11:30 AM CT |

| Thanksgiving | Thursday, Nov 27, 2025 | 11:45 AM CT | 11:30 AM CT |

| Day After Thanksgiving | Friday, Nov 28, 2025 | 11:45 AM CT | 11:45 AM CT |

| Christmas Eve | Wednesday, Dec 24, 2025 | 12:00 PM CT | 11:45 AM CT |

| Christmas Day | Thursday, Dec 25, 2025 | Market Closed | Market Closed |

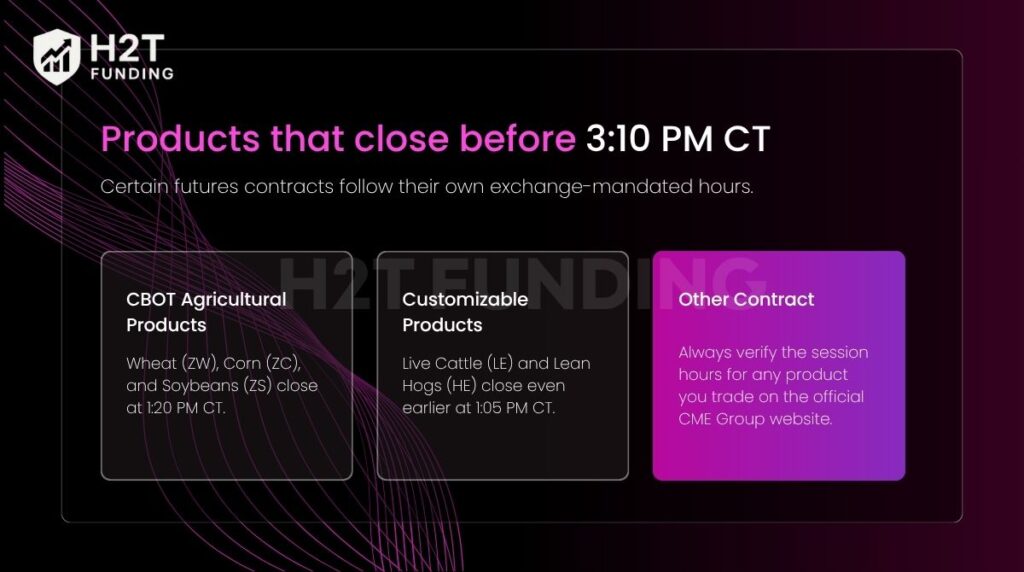

3. Products that close before 3:10 PM CT

While the answer to what time Topstep trades must be closed? It’s usually 3:10 PM CT, but it’s not always that simple. Assuming a one-size-fits-all closing time is a fast track to a rule violation. Certain futures contracts follow their own exchange-mandated hours (Topstep Help Center: When and what products can I trade?).

- CBOT Agricultural Products: Wheat (ZW), Corn (ZC), and Soybeans (ZS) close at 1:20 PM CT.

- CME Livestock Futures: Live Cattle (LE) and Lean Hogs (HE) close even earlier at 1:05 PM CT.

- Other Contracts: Always verify the session hours for any product you trade on the official CME Group website.

Even experienced traders have made costly mistakes by assuming all instruments follow the 3:10 PM CT rule. It’s a painful way to learn that not all products operate the same way.

Every great trader starts with one simple habit: double-checking the product’s official trading hours, whether through the CME website or your broker’s platform. It’s a small step that builds serious confidence.

And if you’re just starting, learning the best trading strategy for beginners gives you clarity, helps you stay focused, and turns rookie mistakes into valuable lessons. Getting the basics right feels good, and it sets you up for real progress.

4. What happens if you miss the closing time?

Failing to close your trades by the daily cutoff can trigger Topstep’s automatic protection system and lead to rule violations that may end your evaluation or funded account.

4.1. The automated flattening process

To shield traders from dangerous after-hours volatility, Topstep uses an automated flattening system that takes no chances. Around 3:08 PM CT, in the minutes leading up to the 3:10 PM CT cutoff, Topstep’s risk systems may begin flattening open positions.

On market holidays, the system may trigger even earlier, catching unprepared traders off guard. If you’re still holding positions at that point, you’re already too late.

But here’s the catch: if you’re counting on it day after day, that’s not smart risk management; that’s gambling with time. It shows a lack of control, and in this game, lack of control is the fastest way to fail. Prop trading rewards discipline, not delay.

If your dream is to prove yourself and trade real capital, don’t leave it to luck. Learn how to get a funded trading account with purpose, and start trading like your future depends on it, because it does.

4.2. The consequences of a rule violation

Relying on auto-flattening is risky. While the system may close positions automatically, any resulting breach of risk limits can still lead to a rule violation.

Unlike Topstep, some other prop firms, like Funding Pips, offer specific tools designed to help traders manage risk more proactively. So, before you assume every firm operates the same way, take a closer look: Does FundingPips have a risk management tool?

The right tools and the right habits can make or break your trading journey.

See more related articles:

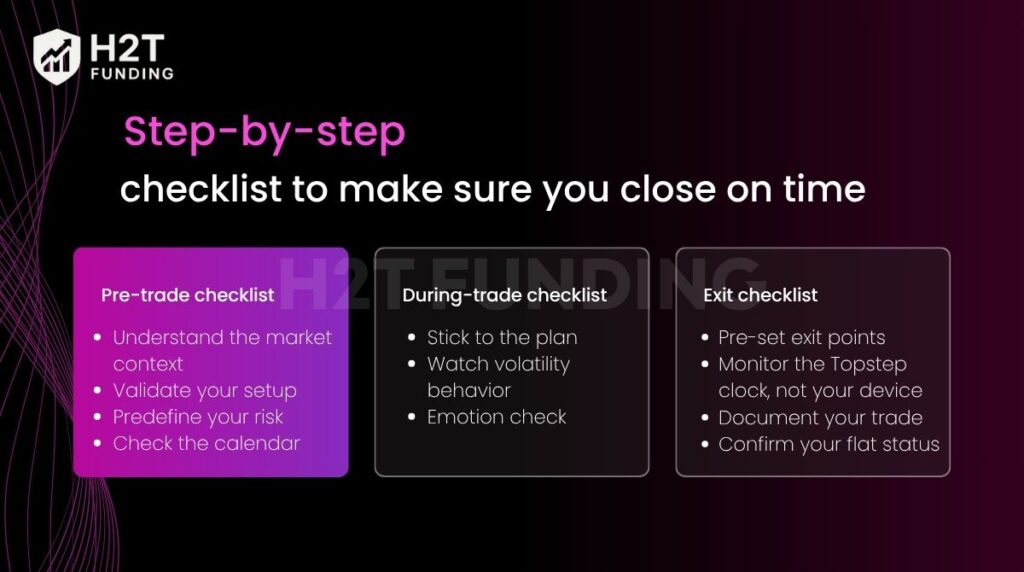

5. Step-by-step checklist to make sure you close on time

Even the best traders slip when discipline turns into assumption. That’s why having a solid, repeatable checklist before every session is your real edge to sharp, on time, and in control. Here’s a step-by-step checklist trusted by other traders and me to make sure you never miss the 3:10 PM CT close again.

5.1. Pre-trade checklist

Before you click “Buy” or “Sell”, make sure you’ve checked these four points:

- Understand the market context: Ask yourself: Is the market trending, ranging, or reacting to key levels? If the price is chopping sideways near support or resistance, skip the trade. Forced trades close late because they start wrong.

- Validate your setup: Don’t pull the trigger until your indicators agree, structure, volume, and confirmation candle. A setup that’s 80% ready isn’t ready.

- Predefine your risk: Know your max loss before entry. If your risk exceeds your daily drawdown, step back. Smart traders never let risk dictate timing.

- Check the calendar: Check for economic events at least twice, once in the morning and once an hour before the cutoff. Big reports (like NFP or FOMC minutes) can spike volatility right before close, throwing off your timing.

5.2. During-trade checklist

The closer it gets to 3:00 PM CT, the more emotions creep in. That’s when consistency separates professionals from hopefuls. While in a trade, focus on these principles:

- Stick to the plan: The worst mistakes happen in the last 10 minutes, moving stops, chasing a few extra ticks, or hesitating to flatten. If your plan said “exit at 3:05,” treat it like law.

- Watch volatility behavior: Liquidity fades fast near close. If you see erratic ticks or spreads widening, scale out early. No one remembers the extra $50 you could’ve made, but everyone remembers a rule violation.

- Emotion check: Ask yourself mid-trade: “Would I take this same setup right now if I weren’t already in it?” If the answer’s no, it’s probably time to exit. Discipline beats hope every time.

5.3. Exit checklist

Exiting properly isn’t luck; it’s craft. And it’s where most traders show who they really are. Before 3:10 PM CT, make these steps non-negotiable:

- Pre-set exit points: Define your take-profit and stop-loss before entry, then let the market decide, not your emotions.

- Monitor the Topstep clock, not your device: I’ve seen traders lose funded accounts because their phone clock was 15 seconds off. Always keep the Topstep clock pinned open on your dashboard, and set an alarm 10–15 minutes before close.

- Document your trade: Before you log off, write two lines in your journal: Why did I close when I did? What will I improve tomorrow? You’ll thank yourself six months from now when your habits turn into confidence.

- Confirm your flat status: Double-check that all positions are closed, no orders are pending, and your P&L is locked. Flat means freedom; it’s your reset button for the next round.

5.4. Weekly reflection

Consistency doesn’t come from luck or talent. It’s repetition. End each week with a 10-minute reflection:

- Review your trade logs and note what time you closed each day.

- Highlight any close calls or late exits, then fix the cause (was it distraction, setup delay, or greed?).

- Set a “buffer goal” for next week: Be flat by 3:05 PM CT instead of 3:10. Over time, this micro-discipline compounds into mastery.

When you follow this checklist consistently, “closing on time” becomes something you naturally do. And that’s when you move from surviving the Combine® to thriving in your Funded Account®.

6. Tips to avoid mistakes & maximize your success

In trading, mistakes are inevitable. What separates professionals from beginners isn’t the absence of errors; it’s how quickly they recognize, correct, and learn from them. Every misstep carries a lesson, and the faster you internalize it, the stronger your edge becomes.

These are the most common trading mistakes that cost traders money, confidence, and discipline, along with insights and examples that show how to avoid them.

6.1. Overtrading and emotional decisions

Futures markets move fast, and so do traders’ emotions. When positions are just one click away, it’s easy to trade too often or react to every tick. Overtrading usually starts with a simple thought: “I’ll make it back on the next one.” That mindset is dangerous under Topstep’s daily limits.

The fix is discipline. Set a defined number of trades per session and stick to it. If you hit your daily limit or face back-to-back losses, step away from the screen. Trading less, but with higher quality setups, leads to more consistent performance and keeps your rule compliance intact.

6.2. Trading without a stop-loss

Trading without a stop-loss in futures is like driving without brakes. One strong move against your position can wipe out your daily profit target in seconds.

Always place a stop-loss as soon as you open a trade. Topstep’s platform allows bracket orders that automatically attach both stop-loss and take-profit levels, ensuring you’re protected even if you step away. Once it’s set, don’t move it out of fear; that’s how small losses become account-ending ones.

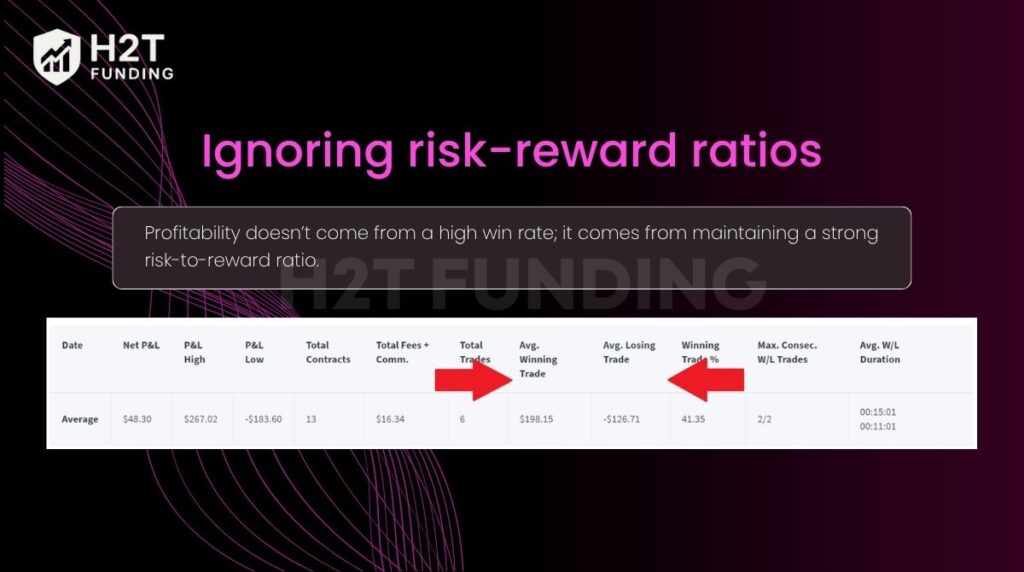

6.3. Ignoring risk-reward ratios

Many traders fixate on winning more trades instead of managing how much they win versus how much they lose. The truth is, profitability doesn’t come from a high win rate; it comes from maintaining a strong risk-to-reward ratio.

For example, in the performance summary below, the trader only wins about 41% of trades, yet the average winning trade ($198.15) is much larger than the average losing trade (-$126.71). This positive ratio keeps the account profitable even with fewer wins.

A solid rule for Topstep futures traders is to aim for at least a 1:2 or 1:3 ratio, risk $100 to make $200–$300. Maintaining this consistency protects you from emotional decisions, prevents overtrading, and builds a long-term statistical edge in the Combine® and beyond.

6.4. Failing to research the markets

Trading on gut feeling or tips from others may work once, but it’s not sustainable. Futures products differ greatly: E-mini S&P 500 (ES) behaves nothing like Corn (ZC) or Crude Oil (CL). Each contract has its own volatility, volume, and close time.

Before opening any position, understand the product:

- What are its trading hours and daily cutoffs?

- What economic factors influence its price (for example, USDA reports for grains, or API data for crude oil)?

- How much margin is required, and what’s its tick value?

Knowledge isn’t optional in futures trading; it’s your first layer of risk management.

6.5. Lack of a trading plan

Without a clear plan, traders fall into inconsistency. A trading plan sets your structure: strategy, entry conditions, risk per trade, time commitment, and maximum exposure.

For Topstep traders, a solid trading plan acts as a daily guardrail, keeping every decision aligned with Combine® rules. The real challenge is maintaining discipline to follow it, especially after losses. While it won’t guarantee profits, a well-executed plan is your framework for consistency and long-term survival.

6.6. Misusing leverage

Leverage magnifies both gains and losses. Futures traders are especially prone to overexposure because margin requirements can appear small relative to contract size.

Always calculate position sizing carefully. Never open a position larger than what your plan and Topstep’s risk parameters allow. As a general rule, if a single trade can violate your daily loss limit, the position is too large. Respect leverage; it’s a tool, not a shortcut.

6.7. Letting emotions lead

The biggest trading errors often happen after a strong win or loss. Overconfidence can push you into oversized positions; frustration can trigger revenge trades. Both are signs of emotional trading, not strategy.

To counter this, build neutral habits. Pause before entering after a win or a loss. Confirm every trade with your checklist:

- Is this setup in my plan?

- Does the risk-reward ratio make sense?

- Is this within my session limit?

If any answer is no, skip it. Emotional control is about structuring decisions so emotions never lead.

6.8. Ignoring your trading diary

Without reviewing your trades, progress becomes random. A trading journal helps you identify what’s working, what’s not, and why.

Record every trade’s setup, entry time, exit reason, and emotional state. Over time, patterns emerge, maybe you lose focus after 2:45 PM CT, or perform best in the first hour of the session. Journaling turns mistakes into data, and data into improvement.

6.9. Poor portfolio exposure and over-diversification

Some traders overload one market, while others spread too thin across multiple contracts. Both extremes hurt performance.

If you’re trading multiple futures products, make sure you understand each one’s margin, volatility, and correlation. Diversify across uncorrelated instruments, for example, ES and Crude Oil move differently, but don’t trade more contracts than you can actively manage. Balance is key.

6.10. Avoiding losses instead of embracing them

Losses are part of trading. The goal isn’t to avoid them, but to manage them intelligently. The most successful futures traders treat every loss as feedback. When a stop is hit, they review the setup, not the outcome.

Accepting small losses keeps you in the game long enough to compound good habits. In prop trading, longevity is everything; survival is success.

6.11. Over-reliance on software or automation

Algorithmic tools and trade managers can help you execute with precision, but no software replaces awareness. Markets shift, volatility spikes, and automated systems can misfire.

If you use automation, backtest thoroughly, and monitor live performance. Tools enhance discipline only when paired with human judgment.

Topstep’s rules exist to protect traders from themselves, not to limit opportunity. The traders who reach funding and stay funded aren’t the ones who chase every move; they’re the ones who follow structure relentlessly.

Focus on process over profit:

- Always trade with a stop-loss.

- Respect your time cutoff at 3:10 PM CT.

- Manage size, respect leverage.

- Review your trades weekly.

- Keep learning and refining.

Master these fundamentals, and the futures market becomes less of a gamble and more of a business you can grow.

7. FAQs about Topstep trades closed by what time

Topstep requires all trades to be closed by 3:10 PM Central Time (CT) on weekdays (Monday–Friday). On certain holidays, this time is earlier, so it’s always best to check the official trading calendar.

Yes. Topstep enforces a strict daily time limit; you cannot hold positions overnight or through the weekend. Every position must be closed before 3:10 PM CT each day.

There’s no minimum trade duration. You can open and close a position within seconds. The only time-related rule is the mandatory close by 3:10 PM CT.

You cannot hold an open position during official market closures. This includes the daily break from 3:10 PM CT to 5:00 PM CT, weekends (from 3:10 PM CT Friday to 5:00 PM CT Sunday), and full-day closures on major holidays like Good Friday or Christmas Day.

No, you can’t hold trades overnight or through the weekend on Topstep. The platform is designed strictly for day trading, meaning all open positions must be closed by 3:10 PM Central Time (CT) each trading day. Any trade left open beyond that cutoff is automatically flattened by Topstep’s Trade Desk to prevent overnight risk. Trading can resume once markets reopen at 5:00 PM CT, including Sundays when the new weekly session begins.

Yes, both follow the same 3:10 PM CT cutoff on regular days, but holiday hours differ. Funded Accounts must close positions 30 minutes before the early market close (e.g., by 11:30 AM CT if markets close at 12:00 PM CT). In the Trading Combine®, auto-flattening begins around 11:58 AM CT. These rules help protect traders from holiday volatility and ensure compliance with Topstep’s risk limits.

If trades remain open after the cutoff, Topstep’s risk system will auto-flatten your positions, usually around 3:08 PM CT. While this prevents overnight exposure, it’s considered a rule violation, and repeated offenses can end your Combine® or Funded Account®.

No. Overnight trading is not permitted in either the Trading Combine® or Funded Account®. You can only trade between 5:00 PM CT and 3:10 PM CT the next day. Holding positions beyond that window violates Topstep’s rules and triggers auto-flattening.

No, Topstep does not support 24/7 trading. While most futures markets operate nearly 23 hours a day, Topstep enforces a daily trading break from 3:10 PM to 5:00 PM Central Time (CT) and closes completely on weekends. This pause allows the platform to manage risk, reset accounts, and ensure traders start each new session with a clean slate.

Topstep uses an official trade clock on the Resources Page of your dashboard. This clock determines the exact cutoff time. Always follow it; even a few seconds’ difference from your device clock can lead to an unexpected rule violation.

8. Conclusion

Staying compliant on Topstep isn’t about fear; it’s about ownership. You’ve already put in the work, so let these habits become part of your winning routine:

- Always be flat before 3:10 PM CT, that’s your daily finish line.

- Keep an eye on the holiday calendar; early closings are easy to stay ahead of.

- Double-check your product’s trading hours; clarity keeps your edge sharp.

Learning Topstep trades closed by what time isn’t just following rules; it’s building the mindset of a focused, confident trader. And the more you master these small details, the more control you’ll feel over your growth.

Ready to level up? Explore H2T Funding hands-on guides, real-world strategies, and pro tips waiting for you in the Prop Firm & Trading Strategies section. Your progress is just getting started.

![Topstep Trades Closed By What Time [New Updated Guide]](https://cdn.h2tfunding.com/wp-content/uploads/Topstep-Trades-Closed-By-What-Time-New-Updated-Guide.jpg)