Have you ever been stopped by Topstep for opening a position larger than allowed? That comes from the Topstep scaling plan, a rule designed to protect traders and capital. Many feel it limits profit, but in reality, it’s a roadmap to grow your account safely.

This guide from H2T Funding breaks down what the scaling plan is, how it works, and how to use it to your advantage. You’ll see real trade examples, comparisons with other prop firms, and tips to avoid violations that could cost your funded account.

Key takeaways:

- The Topstep scaling plan is a trading rule that limits maximum contracts based on daily Trade Reports, forcing traders to grow step by step.

- Express Funded Accounts use fixed scaling checkpoints, while Live Funded Accounts apply Dynamic Live Risk Expansion with profit-based tiers.

- A $50K account starts with 2 contracts, scales to 3 above $1,500 profit, and reaches 5 contracts past $2,000.

- The plan protects traders from over-leverage, ensures consistency, and rewards equity growth with more buying power.

- Platforms like TopstepX integrate scaling rules directly, while others (Tradovate, NinjaTrader, Rithmic) may block oversizing, but not always.

- The best way to surpass the plan is patience, trade smaller, respect rules, and let equity unlock higher limits naturally.

1. What is Topstep scaling plan?

The Topstep scaling plan is a trading rule that sets how much buying power a trader can use as their account grows. Instead of giving unlimited freedom right away, Topstep gradually expands the maximum position size allowed. This system is meant to balance opportunity and safety, especially in the Express Funded Account.

The scaling rule exists to protect both traders and firm capital. By limiting contract size early, Topstep helps traders build consistency and survive drawdowns by preventing the classic mistake of over-leveraging. Once equity increases, the plan unlocks higher position limits, giving traders room to scale up without exposing the account to sudden, oversized risks.

Put simply, the scaling plan isn’t a punishment; it’s a framework. It teaches discipline, enforces proper risk management, and ensures funded traders grow step by step instead of rushing into positions that could wipe out their accounts.

It’s a structure built for futures trading, where leverage magnifies both gains and losses. In short, the Topstep-funded scaling plan is a structured path to grow in size without reckless leverage.

See also:

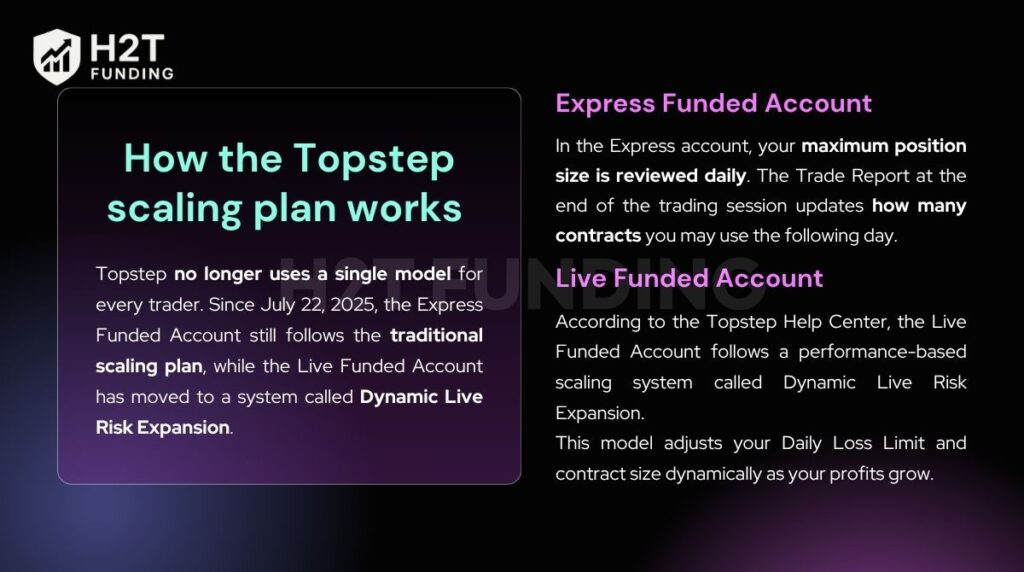

2. How the Topstep scaling plan works in funded accounts

Topstep no longer uses a single model for every trader. Since July 22, 2025, the Express Funded Account still follows the traditional scaling plan, while the Live Funded Account has moved to a system called Dynamic Live Risk Expansion. Understanding both is key to managing position size and avoiding violations.

2.1. Express Funded Account

In the Express account, your maximum position size is reviewed daily. This is the Topstep Express Funded scaling plan that governs position size day to day. The Trade Report at the end of the trading session updates how many contracts you may use the following day. Profits expand your contract limits, while losses reduce them until equity recovers.

- Scaling applies only once per day after the report update.

- You cannot increase lots during the same session, even if balance qualifies.

- Micros are counted as full contracts, meaning 1 ES = 1 MES.*

- If you hold simultaneous long and short positions, the platform sums them toward your cap.

*On the primary TopstepX™ platform, the scaling plan is based on a 10:1 ratio, meaning 10 Micro contracts are equivalent to 1 Mini contract. However, on third-party platforms like Tradovate or NinjaTrader, Micros are counted as full-size contracts (1 MES = 1 ES).

This design ensures that traders increase in size gradually. For example, a $50K account starts at 2 contracts, unlocks 3 once profits exceed $1,500, and can trade 5 lots above $2,000.

Read more about what platform Topstep uses to understand how each system handles scaling and contract limits differently.

2.2. Live Funded Account – Dynamic Live Risk Expansion

According to the Topstep Help Center, the Live Funded Account follows a performance-based scaling system called Dynamic Live Risk Expansion.

Unlike the fixed scaling checkpoints used in the Express Funded Account, this model adjusts your Daily Loss Limit and contract size dynamically as your profits grow.

At the starting tier, the Daily Loss Limits are defined as follows:

- $50K account → $2,000 Daily Loss Limit

- $100K account → $3,000 Daily Loss Limit

- $150K account → $4,500 Daily Loss Limit

As you accumulate profits, the Live Funded Account automatically transitions through progressively higher risk tiers. Each tier unlocks a larger Daily Loss Limit and provides greater flexibility for managing larger positions.

| Net Profit | $50K Account Daily Loss Limit | $100K Account Daily Loss Limit | $150K Account Daily Loss Limit |

|---|---|---|---|

| $0 (Starting Tier) | $2,000 | $3,000 | $4,500 |

| $15,000 | $2,500 | $3,500 | $5,000 |

| $20,000 | $3,000 | $4,000 | $5,500 |

| $50,000 | $3,500 | $4,500 | $6,000 |

| $100,000 | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| $200,000 | Up to $20,000 | Up to $20,000 | Up to $20,000 |

| $550,000 | Up to $50,000 | Up to $50,000 | Up to $50,000 |

| $1,000,000 | Up to $100,000 | Up to $100,000 | Up to $100,000 |

To advance to a higher tier, traders must complete at least 10 Active Trading Days within their current tier while maintaining compliance with all program rules. Once these conditions are met, the account’s Daily Loss Limit is automatically increased to the next level.

In addition, traders who reach Tier 4 or higher and maintain a minimum Live Funded Account balance of $100,000 may request Expanded Contract Sizing, allowing for greater position sizes upon Topstep’s approval.

This performance-based system rewards consistency and disciplined risk management. As equity grows, traders gain more breathing room and position flexibility, fostering sustainable account growth rather than overexposure.

3. Trading example with scaling plan

Imagine a trader starting with a $50K Express Funded Account. Under the Topstep scaling plan, the initial maximum position size is limited to 2 contracts. This keeps exposure small while the trader proves consistency.

After reaching the first equity milestone, shown in the daily Trade Report, the account qualifies for 3 contracts in the next trading session. If profits continue and the balance crosses higher thresholds, the trader can move up to 4 and eventually 5 contracts.

Example: Topstep scaling plan $50 K Account

| Account Balance (End of Day) | Maximum Contracts Allowed |

|---|---|

| $50,000 – $52,499 | 2 contracts |

| $52,500 – $54,999 | 3 contracts |

| $55,000 – $57,499 | 4 contracts |

| $57,500+ | 5 contracts |

This step-by-step growth highlights the role of risk management. Instead of jumping from 2 to 5 lots immediately, the scaling plan forces gradual sizing. It helps traders survive drawdowns, avoid over-leveraging, and expand their account responsibly.

To apply this properly, traders must also stay compliant with all Topstep trading rules to avoid a funded account delay in payouts.

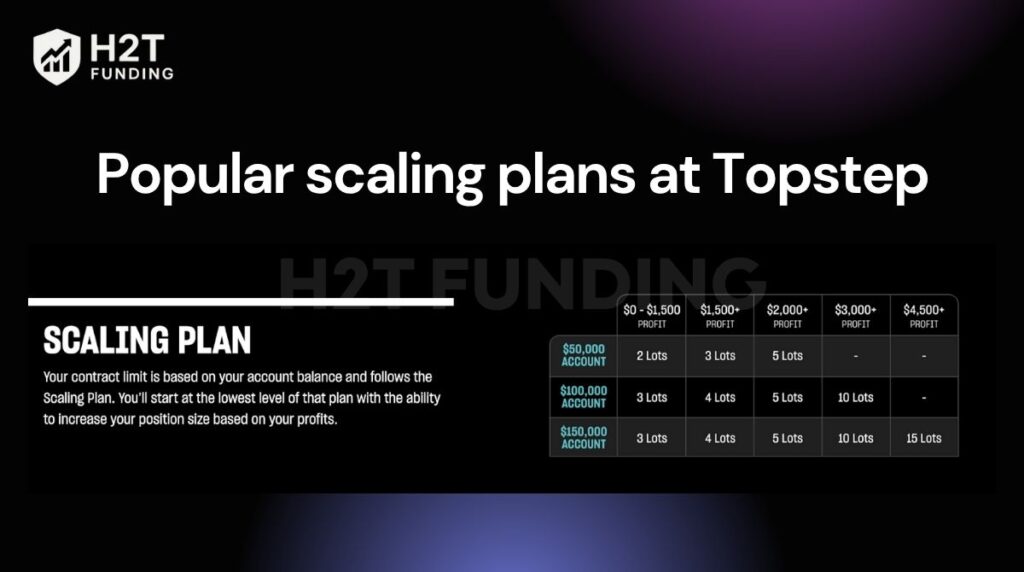

4. Popular scaling plans at Topstep

Topstep builds different account sizes with specific scaling levels. Each plan is tied to your end-of-day balance, and the upgrade applies the next trading day.

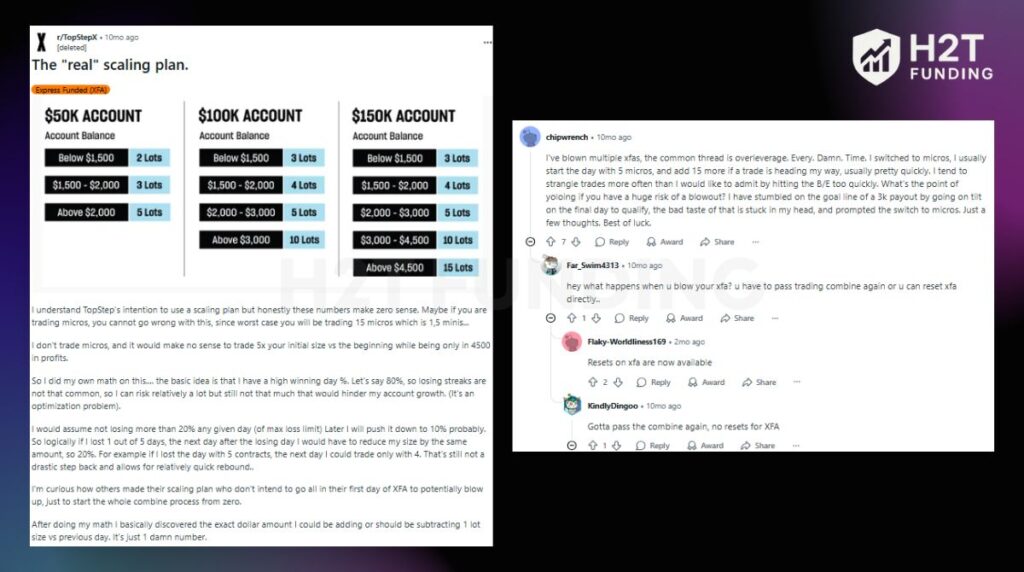

All thresholds below refer to the Topstep Express scaling plan and are updated after the Trade Report. Rules apply across major commodity trading contracts (e.g., CL, GC) under the same caps.

Scaling thresholds at Topstep:

| Account Type | Balance Range | Max Contracts Allowed |

|---|---|---|

| $50K Account | Below $1,500 | 2 lots |

| $1,500 – $2,000 | 3 lots | |

| Above $2,000 | 5 lots | |

| $100K Account | Below $1,500 | 3 lots |

| $1,500 – $2,000 | 4 lots | |

| $2,000 – $3,000 | 5 lots | |

| $3,000 – $4,500 | 10 lots | |

| Above $4,500 | 15 lots | |

| $150K Account | Below $1,500 | 3 lots |

| $1,500 – $2,000 | 4 lots | |

| $2,000 – $3,000 | 5 lots | |

| $3,000 – $4,500 | 10 lots | |

| Above $4,500 | 15 lots |

These limits are tied to the end-of-day Trade Report and apply only in the Express Funded Account. They ensure traders increase exposure gradually instead of jumping straight to large positions.

It’s important to note that scaling rules do not change during the trading session. If your balance qualifies for more contracts, the upgrade activates only the following day. This step-by-step model provides a structured path for responsible growth and reduces risks tied to sudden over-expansion.

Scaling rules don’t change during a session; upgrades take effect the next day. For clarity on automation policies, see Topstep automated trading rules.

5. How does the scaling plan affect traders?

The scaling rule changes the way traders build confidence. The clear benefit is capital protection. By keeping the size small early on, you avoid the trap of over-leveraging. Many funded accounts are lost not because of a bad strategy, but because of taking on too much risk too soon.

The challenge is that scaling can feel restrictive. Even when you are trading well, the system will not let you push beyond your current tier. A trader who knows they could manage 10 contracts might still be capped at 5. That delay can be frustrating, especially when strong setups appear.

Trust me, the trade-off is worth it. It’s a classic rookie mistake to rush your size and blow up a funded account in days; I’ve seen it happen more times than I can count. On the other hand, those who followed scaling rules built steady records that later unlocked bigger buying power. Discipline in the first weeks is the real test, not just profit targets.

Scaling plans may look limiting, but they often save traders from themselves. By forcing gradual growth, Topstep gives you a longer runway to prove skill and keep the account alive.

Tips to adapt:

- Treat the first stage as training, not profit chasing.

- Use smaller positions even when the limit increases.

- Focus on consistency and equity growth, and the contracts will follow.

Read more:

6. Detailed instructions for joining and passing the scaling plan

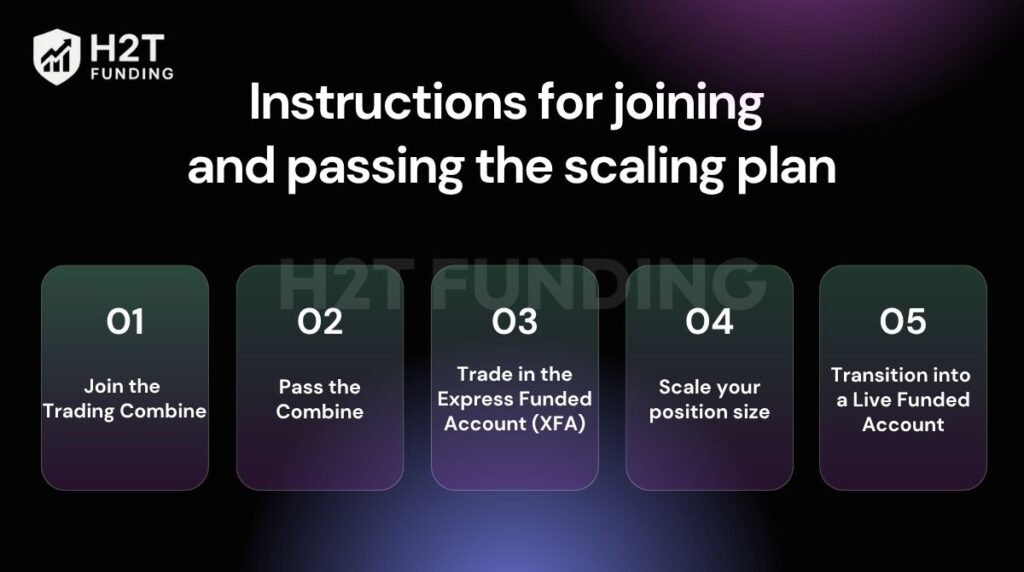

The scaling plan isn’t a separate signup process; it’s automatically built into your Topstep journey. You’ll move through multiple stages:

- Step 1: Join the Trading Combine

- Step 2: Pass the Combine

- Step 3: Trade in the Express Funded Account (XFA)

- Step 4: Scale your position size

- Step 5: Transition into a Live Funded Account

Each phase has its own requirements for profit targets, loss limits, and trading discipline. When registering from another country, check Topstep’s KYC and country change rules to confirm your verification and payout eligibility.

6.1. Step 1: Join the Trading Combine

The journey begins when you select an account size ($50K, $100K, or $150K) and pay the subscription fee. At this stage, you must prove discipline under set conditions. This is the core trader evaluation before you advance to funded stages:

- Profit Target: Each account has a minimum profit you need to achieve.

- Consistency Rule: Your best day cannot exceed 50% of total profits.

- Daily Loss Limit: -$1,000 for $50K, -$2,000 for $100K, and -$3,000 for $150K accounts.

- Maximum Loss Limit: If equity ever falls below this threshold, your Combine ends immediately.

Thin trading volumes can widen spreads; consider it before moving to a higher tier.

6.2. Step 2: Pass the Combine

To advance, you must hit the profit target while staying inside both daily and maximum loss rules. All trades must also follow permitted trading hours. For example, positions must be closed by 3:10 PM CT or by the product’s official market close. Breaking this schedule can invalidate progress.

Note: Review the list of prohibited conduct to avoid accidental disqualifications.

6.3. Step 3 – Trade in the Express Funded Account (XFA)

Once you pass, you earn an Express Funded Account. This is still simulated trading with real rules. The account uses the scaling plan to expand your maximum contracts step by step as profits grow. Many traders call this the Topstep XFA scaling plan, since your limits advance inside the Express stage.

- You can hold up to 5 active XFA accounts at once.

- Your Trade Report updates daily, and new limits apply the following session.

- The Daily Loss Limit still applies, except for traders on TopstepX, where rules differ.

6.4. Step 4: Scale your position size

The Express account starts with small lot sizes. As your balance increases, new levels unlock, e.g., 2 lots at the start of a $50K account, 3 lots once above $1,500 profit, and 5 lots past $2,000. You don’t need to trade the maximum size, but you must never exceed the allowed number.

Platforms like Tradovate, NinjaTrader, and Rithmic often block oversized orders, but errors can slip through. On Rithmic platforms, hard caps help, but you must still verify size before sending.

If you overtrade by mistake and fix it within 10 seconds, it usually won’t count as a violation. Still, consistently monitoring your net exposure is critical. Expect platform error messages like “maximum order quantity met” if you exceed limits.

6.5. Step 5: Transition into a Live Funded Account

After showing stable results in the XFA, you can move into a Live Funded Account. Here, the rules shift to Dynamic Live Risk Expansion, which increases your Daily Loss Limit and contract size as profits grow.

- Starting daily loss limits: $2,000 (50K), $3,000 (100K), $4,500 (150K).

- Each profit tier requires 10 active trading days before moving up.

- At higher profits, you can scale much larger (up to 100 contracts with $1M profit in a $150K account).

Passing the scaling plan means more than just hitting profit milestones. It requires strict respect for loss limits, trading hours, and daily discipline. By mastering these steps in the Combine and Express phases, you prepare for the Live account, where consistency is rewarded with expanded buying power and real payouts.

7. Compare the scaling plan Topstep with other prop firms

Each prop firm designs its scaling model differently. Some focus on strict contract limits, while others reward consistent profits with larger account balances and higher payouts. Below is a side-by-side comparison of how Topstep, FTMO, and TopTier Trader approach scaling.

| Prop Firm | Scaling Method | Max Growth Potential | Key Features |

|---|---|---|---|

| Topstep | Contract-based scaling via daily Trade Reports | Up to 100 contracts (Live tiers) | Gradual lot increase, no intraday scaling, strong focus on discipline |

| FTMO | Balance growth + profit split increase | Up to $2M account | 25% account balance boost every 4 months, profit split up to 90% |

| TopTier Trader | Balance growth + profit split (Pro only) | Up to $2M combined | 25% account increase, 5% higher profit share (max 95%), scaling reviewed with payouts |

In short, Topstep suits traders who want structure and strict risk control, and FTMO is attractive for those aiming for large account growth and high payout ratios. TopTier appeals to traders looking for both balance expansion and better profit share.

However, choosing a prop firm should never be based only on the scaling plan. Other factors, such as evaluation rules, payout conditions, and platform stability, are just as important. For a complete picture, explore the prop firm reviews on H2T Funding, where each firm is broken down in detail.

8. How to use the scaling plan to grow your account

The scaling plan is designed as a growth path rather than a barrier. Always track your net position size to avoid hidden exposure when scaling. Trading smaller than the maximum position size in the early days keeps you safe from accidental trades and reduces the chance of rule violations.

A disciplined start helps build confidence and prepares you for higher limits later. Use reliable market data; gaps or delays can distort risk when sizing up.

Your Trade Report is the daily checkpoint. Reviewing it after each trading session tells you exactly how many contracts you can use the following day. This prevents confusion and ensures you never size up too soon.

Platform choice also plays a role. In the past, platforms like Tradovate, NinjaTrader, or Rithmic would attempt to block oversized orders, while the T4 platform offered no automatic protection. Today, all new accounts can only trade on TopstepX, where scaling rules are built into the system.

This reduces errors but does not replace your responsibility to watch net position size and open orders. TopstepX lowers system risk, but vigilance is still required when increasing the size.

To keep your account safe and growing, traders should adopt a few habits:

- Monitor your dashboard daily to confirm scaling levels.

- Keep contract limits visible on your trading platform.

- Turn on order confirmations so accidental clicks can’t push you over the cap.

- Avoid last-minute size changes near the close; they’re a common rule violation trigger.

- Enable order confirmations to avoid accidental oversizing.

- Correct errors immediately; fixing within seconds is often ignored, but delays risk account review.

The real value of the scaling plan is patience. Each level you unlock is a reward for consistent equity growth. By letting profits guide your size increases instead of emotion, you protect yourself from over-leveraging and show the discipline needed to stay funded over the long run.

Continue reading: Topstep Ninjatrader Connection: Complete Step-By-Step Guide

9. Common mistakes leading to scaling violations

Many traders lose funded accounts not because of a bad strategy, but due to simple misunderstandings about the Topstep scaling plan. These mistakes appear repeatedly across Express Funded (XFA) accounts and are mostly preventable with better awareness.

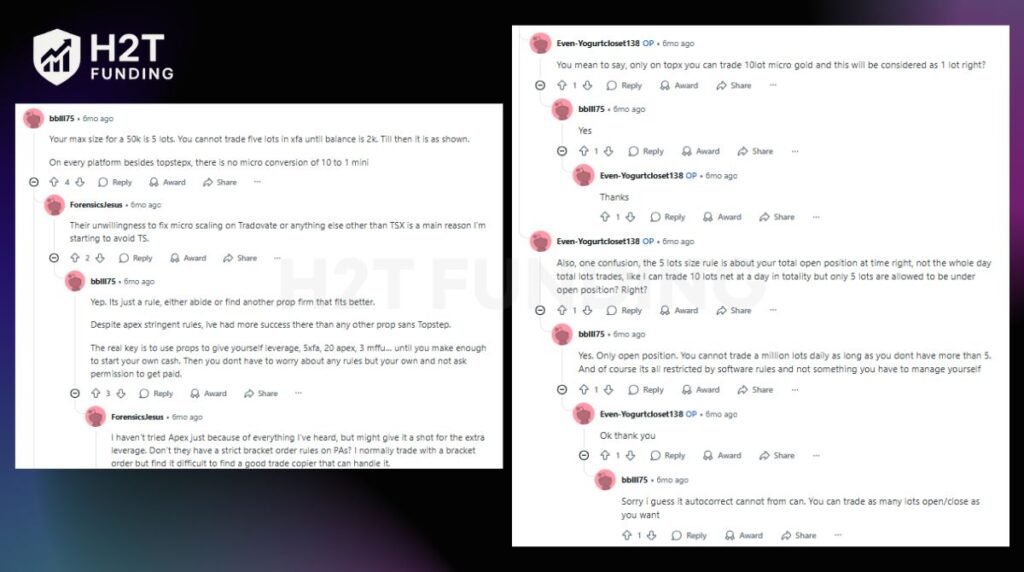

One common issue is misunderstanding the 5-lot rule. Many traders think it limits total trades per day, but it actually refers to open positions at any time. You can trade multiple times daily, but never hold more than the allowed contracts simultaneously.

Another frequent mistake comes from platform scaling differences. On TopstepX, 10 Micros equal 1 Mini, but on Tradovate or NinjaTrader, this ratio doesn’t exist. Traders often violate limits when copying setups between platforms without checking conversion rules.

A third trap is scaling too soon after small profits. Some traders rush to increase size before the Trade Report confirms the upgrade. In Express accounts, scaling applies only the next day, so acting early usually triggers violations.

Others fail after trying to recover losses too quickly. When equity drops, your lot cap drops too, but many ignore it and trade previous sizes, causing instant violations. Several traders have blown XFAs just by overleveraging recovery attempts.

The takeaway is simple: most scaling violations come from impatience, not ignorance. Always review your Trade Report, respect platform rules, and never increase size mid-session. The scaling plan protects your account; it’s a discipline tool, not a restriction.

10. Tips to follow and surpass your scaling plan

Scaling is not only about following limits; it is about showing you can grow responsibly while staying consistent. The key to surpassing a scaling plan is discipline, backed by a clear strategy and daily habits that reduce errors. I’ve seen many traders fail not because they lacked skill, but because they ignored simple routines that keep accounts safe.

From experience, these are the practical tips that make the biggest difference:

- Set clear goals for each stage: Treat every scaling level as a checkpoint rather than rushing to maximize contracts.

- Use scalable tools: Keep your platform workspace clean, display positions and orders, and enable order confirmations to avoid accidental trades.

- Trade below your limit: Just because the plan allows more doesn’t mean you should always use it. Leaving a buffer often prevents rule violations.

- Automate where possible: Use alerts for net position size, daily loss limits, or contract caps so you never rely on memory alone.

- Review and adjust: After each trading session, look at your Trade Report and ask yourself what worked, what didn’t, and how to improve tomorrow.

Every successful trader eventually learns that consistency, not speed, is what keeps them in the game. Some traders on Topstep scaling plan Reddit discussions complain that it slows them down, but in reality, this system filters out reckless behavior. By respecting the plan, you prove to both Topstep and yourself that you can handle a larger size without letting emotions control your trades.

11. FAQs

Yes. The scaling plan is a required rule for Trading Combine and Express Funded Accounts. Traders must follow it daily, and only Live Funded Accounts now use Dynamic Risk Expansion instead of the traditional scaling plan.

Exceeding your maximum position size is considered a rule violation. If the oversized position is left open for more than 10 seconds, your account may be reviewed and potentially disqualified.

No. Scaling levels are tied to end-of-day balance updates. You cannot scale mid-session or request a manual upgrade. The new level applies only after the daily Trade Report resets.

Yes, it applies to futures, but how Micro contracts are counted varies by platform. On the TopstepX™ platform, the ratio is 10 Micros to 1 Mini contract. On third-party platforms like Tradovate, they are counted at a 1:1 ratio. (Note: Topstep primarily focuses on futures, not forex.)

The 2% rule means traders should not risk more than 2% of their account on any single trade. This guideline supports better risk management and aligns with Topstep’s funding philosophy.

Yes, but only in line with the rules. Scaling is controlled by Topstep’s system, so you may increase size only when the account balance qualifies and the daily Trade Report confirms it.

You can have up to 5 active Express Funded Accounts at one time. This applies across different sizes, including the 50K account.

In the Trading Combine, you need to hit the profit target for the 100K account while following all consistency and loss limit rules. Typically, the profit target is $6,000.

Yes. New accounts must trade on TopstepX, where scaling rules are integrated into the platform. This reduces errors, but you are still responsible for monitoring net position size.

If you correct the mistake within 10 seconds, Topstep usually ignores it. Leaving the order open longer may count as a violation and could lead to account review.

Yes. You are not required to trade the maximum contracts allowed. Many traders choose to stay under the cap as a buffer to avoid errors and reduce pressure.

12. Conclusion

The Topstep scaling plan may seem restrictive at first, but in reality, it is a framework designed to protect traders and help them grow steadily. By starting small, respecting daily limits, and letting equity unlock larger positions, you not only stay funded longer but also build the discipline that separates successful traders from the rest.

For traders who value risk control and structured growth, Topstep offers one of the clearest pathways in the prop firm industry. If you adapt to its rules, you can scale responsibly, avoid costly mistakes, and eventually trade with significant buying power. This mindset is the basis of responsible trading under prop firm rules.

This is only one part of mastering prop trading. To deepen your knowledge, explore the full range of articles in the Prop Firm & Trading Strategies section on H2T Funding. There, you’ll find reviews, comparisons, and practical guides that will help you choose the right prop firm and sharpen your trading edge.