The Funded Trader vs FundedNext? The Funded Trader is known for more flexible trading conditions and a strong reputation for fast payouts. FundedNext stands out with stricter rules but a more structured evaluation model and consistent scaling opportunities.

H2T Funding breaks down these differences so you can clearly see which prop firm aligns with your style, whether you prefer freedom and speed or structure and long-term growth. Read the full comparison below to choose the firm that fits you best.

Key takeaways:

- The Funded Trader (TFT): Famous for diverse evaluation process models (Standard, Royal, Knight, Dragon), offering a profit split that can reach up to 95% for VIP traders.

- FundedNext: Distinguishes itself with payout speeds (often under 24 hours), Instant Funding programs, and unique access to futures trading markets.

- Both firms cover forex, indices, and cryptocurrencies, giving traders ample room to diversify their portfolios.

- Choose TFT if you prefer a structured environment with massive scaling potential. Choose FundedNext if you prioritise payment speed and platform flexibility.

1. Overview of each firm: The Funded Trader vs FundedNext comparison

In simple terms, a Funded Trader vs FundedNext review is a comparison between two completely different prop trading philosophies.

On one side, you have The Funded Trader (TFT). Think of it as a massive kingdom (as they call themselves). It is built for traders who love structure, discipline, and a very clear, gamified career path. It fits those who want consistency and don’t mind following a strict set of rules to climb the ladder.

On the other hand, we have FundedNext. This firm feels more like a modern tech accelerator. They are all about flexibility and execution speed. With their focus on funding programs that pay out fast, sometimes in under 24 hours, they are targeting traders who want to see the rewards of their performance immediately.

Here is the deal on how they compare side-by-side:

| Criteria | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Founded / Trust Level | 2021 / Highly Visible Brand | 2022 / Fast-Growing & Reliable |

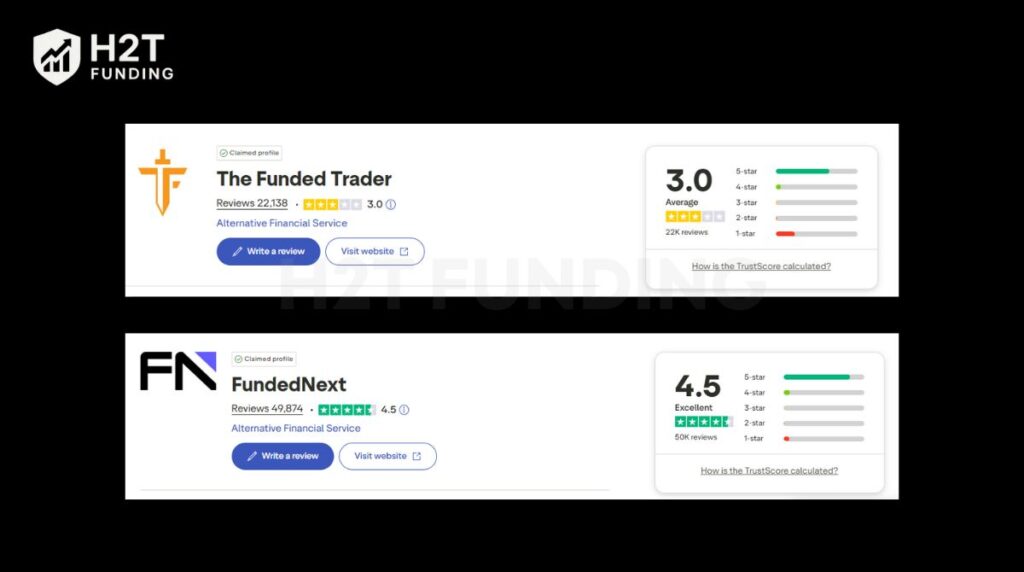

| Trustpilot Rating | ~3.0 (Average – Recent volatility) | ~4.5 (Excellent – Highly praised) |

| Challenge Models | 1-Phase, 2-Phase, 3-Phase (Dragon) | 1-Phase, 2-Phase, Instant Funding |

| Tradable Assets | Forex, indices, metals, crypto | Forex, CFDs, indices, crypto, futures |

| Trading Platforms | MT4, MT5 | MT4, MT5, cTrader, MatchTrader |

| Profit Split | 80%–95% (VIP options) | 80%–95% (potential for 100%) |

| Minimum Trading Days | Very low (often 0-5 days) | Very low (No minimum on some) |

| Scaling | Up to $1.2M (Challenge balance) | Aggressive, up to $4,000,000 |

| Payout Process | Weekly / Biweekly | Biweekly / Instant (24h) |

| Drawdown | Static & Balance-based options | Static & Balance-based |

| Risk Restrictions | Medium (some lot limits) | More flexible |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official The Funded Trader and FundedNext websites before purchasing any challenge.

The figures in the comparison table are just the tip of the iceberg. To truly decide where to place your trust (and your capital), we need to dive deeper into the operational details, specific pros and cons, and real-world experiences of each firm. Let’s start our deep dive with the first giant.

The Funded Trader

#1

Account Types

1-step, 2-step, and 3-step

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on The Funded Trader

The Funded Trader has really made a name for itself by turning the evaluation process into a challenge that feels like a game. They offer an incredible variety of account types: Standard, Rapid, Royal, Knight, and the unique 3-phase Dragon Challenge.

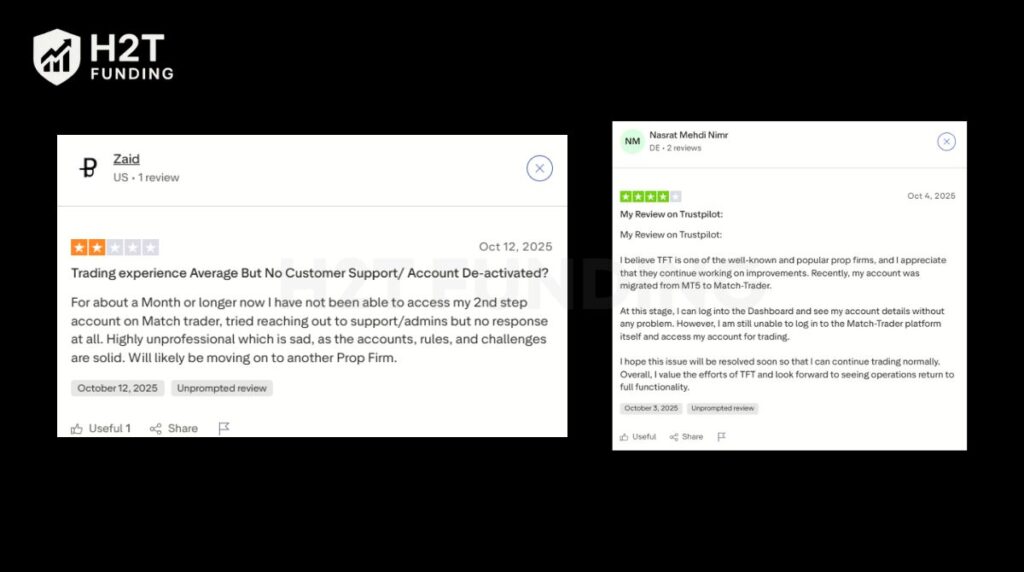

If you like using Expert Advisors (EAs) or holding trades over the weekend, the Royal Challenge is specifically designed for you. However, it is worth noting that recent feedback suggests they have faced some operational hurdles, reflected in a mixed Trustpilot score recently. But for trading capital scaling, they remain a giant.

| 💳 Challenge Fee | $42 – $1,100 |

| 👥 Account Types | 1-step, 2-step, and 3-step |

| 💰 Profit Split | 80% – 99% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto |

FundedNext

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

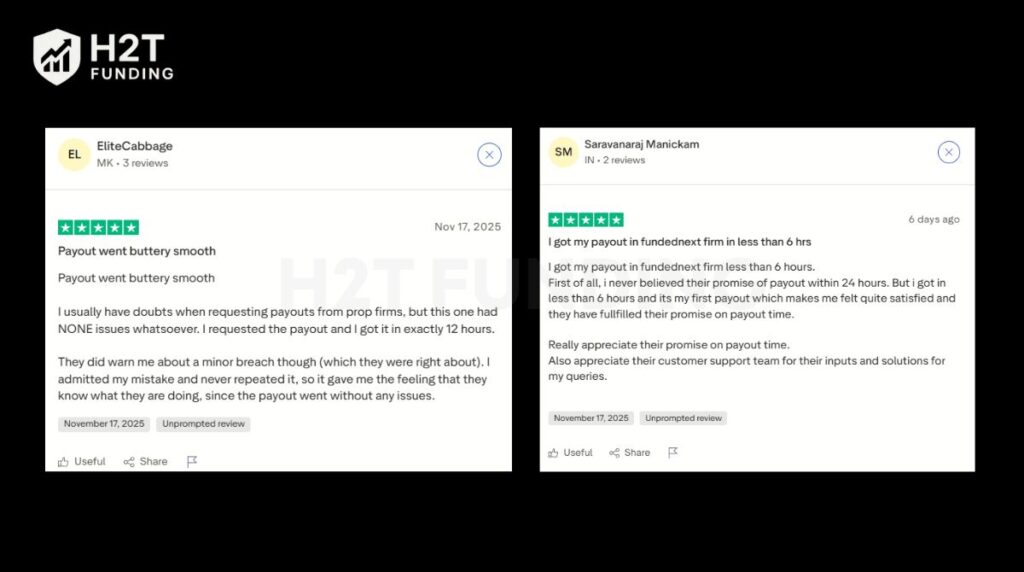

To be honest, FundedNext is impressive because it solves the biggest pain point for traders: waiting to get paid. They are one of the few prop firms that promise a payout within 24 hours of a request.

Their infrastructure is robust, supporting multiple trading platforms like cTrader and MatchTrader, which many modern traders prefer over MT4. Plus, if you are into cryptocurrencies or CFDs, their execution speed and spreads are top-tier. Their Stellar and Express models are designed to get you funded fast without jumping through unnecessary hoops.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Read more:

2. Core models & key rules: The Funded Trader vs FundedNext

While both prop firms offer a structured path to funding, honestly, the actual trading feel is very different between the two. One focuses on gamified discipline, while the other prioritises speed and accessibility.

2.1. Profit targets & minimum trading days

Let’s talk targets. If you hate waiting to get paid, this section matters. The Funded Trader typically sticks to industry norms with their targets, requiring a few minimum days to ensure you aren’t just getting lucky.

On the flip side, FundedNext really shines here by removing time pressure. In my opinion, their “no time limit” policy on challenges like Stellar is a massive stress reliever for trading styles that require patience.

| Feature | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Profit Target (Phase 1) | Typically 8% to 10% (varies by Challenge) | 8% to 10% (Stellar/Evaluation) |

| Profit Target (Phase 2) | Usually 5% | 5% (Consistent across models) |

| Minimum Trading Days | 5 days (Standard/Royal) | 0 days (Stellar) / 5 days (Evaluation) |

| Instant Funding | No (Evaluation based only) | Yes (Express Model – start earning immediately) |

Summary: Simply put, TFT pushes for consistency through minimum days. FundedNext offers superior flexibility, allowing you to pass as fast as you can trade.

2.2. Drawdown & daily loss limits

Managing risk is the hardest part of this game. Trust me, hitting a daily loss limit because of a single bad wick is a nightmare.

TFT generally uses equity-based drawdown on their standard accounts, which can be tricky if you hold floating losses. However, FundedNext’s Stellar program calculates the daily limit based on your balance, which is a huge advantage for swing traders.

| Feature | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Maximum Drawdown | 10% (Standard/Royal) / 6% (Knight) | 10% (Evaluation/Stellar) / 6% (Express) |

| Daily Loss Limit | 5% to 6% (Equity/Balance based) | 5% (Balance-based on Stellar is key) |

| Calculation Type | Mostly Equity + Balance hybrid | Balance-based options available |

| Risk Management | Stricter rules on scaling in | More breathing room for floating loss |

Summary: FundedNext wins on risk management flexibility with its balance-based drawdown rules. TFT is solid but requires you to watch your equity curve like a hawk.

2.3. News, overnight & automation policies

Can you trade during high-impact news? What about holding trades when the market closes? These rules make or break specific trading strategies.

I really like that TFT created the Royal Challenge specifically for traders who need freedom with EAs and weekends. However, FundedNext seems to apply these liberal rules across almost all its accounts by default, which simplifies things.

| Feature | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| News Trading | Allowed (Royal/Knight) / Restricted (Standard) | Allowed (Evaluation/Stellar) |

| Weekend Holding | Allowed (Royal Challenge only) | Allowed (Stellar/Evaluation) |

| Expert Advisors (EAs) | Allowed (Royal/Knight) | Allowed (All accounts) |

| Trading Hours | 24/5 (Crypto 24/7) | 24/5 (Crypto 24/7) |

Summary: TFT is stricter and segments rules by challenge type (Royal is best for freedom). FundedNext is generally more flexible, allowing news and weekend holding across most plans without needing a specific account type.

3. Fees, refunds & cost efficiency when comparing Fundednext vs The Funded Trader

Let’s be real for a second, nobody likes paying fees, especially when you are just starting out. But in this industry, you often have to spend money to make money. The good news is that both firms are actually quite affordable compared to the old days of proprietary trading.

The real difference lies in the value for your money. The Funded Trader generally follows a standard, transparent fee structure. They are famous for their frequent discount codes (seriously, check their Discord!), which can drop the price significantly.

On the other hand, FundedNext has introduced some incredibly low-cost options, like their Stellar Lite plan. This is perfect if you are on a tight budget and want to test your skills without risking much.

Here is a breakdown of what you can expect to pay and get back:

| Criteria | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Fee Type | One-time registration fee for evaluation | One-time fee (Evaluation/Stellar) |

| Refund Policy | 100% Refund with your first payout | 100% Refund with your first payout |

| Starting Cost | Competitive (e.g., ~$59 for Standard) | Very Low (Starts at ~$32 for Stellar Lite) |

| Hidden Costs | None (High transparency) | None (Commissions are standard) |

| Payout Cycle | Bi-weekly (can upgrade to Weekly) | Bi-weekly or Instant (depending on plan) |

| Value for Money | Great for high maximum balance goals | Excellent for low-cost, fast entries |

My Verdict: If you are looking for a standard, reliable cost structure for a traditional two-step evaluation, TFT is solid and very transparent. However, if you want the absolute lowest barrier to entry or prefer a one-step evaluation, FundedNext is arguably the more cost-efficient choice right now.

Read more: How Many Accounts I Can Have on Funded Next?

4. Profit split & scaling of The Funded Trader and Fundednext

Let’s be honest, we are all here for the money. The percentage of profits you keep and how fast you can grow your account are probably the most critical factors in your decision.

The Funded Trader starts you off with a solid 80% profit split. If you prove your consistency over time, you can qualify for their VIP program, pushing that number up to a massive 95%. I think their scaling plan is perfect for traders who want a structured, long-term career path.

FundedNext, however, is incredibly aggressive with its rewards. They don’t just match the industry standard; they try to beat it. Not only can you reach a 90% split (and sometimes 100% during promos), but they also offer a performance reward of 15% from the challenge phase profits. That is a huge morale booster right at the start.

| Criteria | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Profit Share | Starts at 80%, scales to 95% | Starts at 80%, scales to 90% (up to 100%) |

| Challenge Phase Reward | None (standard refund only) | 15% Profit Share from the challenge phase |

| Scaling Frequency | Every 3 months (typically) | Every 4 months (typically 40% growth) |

| Scaling Potential | Strong, up to huge balances | Aggressive, up to $4,000,000 |

| Payout Process | Bi-weekly (upgradeable to Weekly) | Bi-weekly / Instant turnaround |

Summary: If you want a traditional, high-paying career ladder, TFT is reliable. But if you want to get paid for your challenge phase performance and scale fast, FundedNext offers arguably the best trading conditions for growth.

5. Platforms & tradable assets: The Funded Trader vs Fundednext

Your trading platform is essentially your cockpit; if the tech feels clunky, your performance suffers. It is that simple.

The Funded Trader sticks to the classics we all know and trust: MT4 and MT5. To me, this feels like a reliable, old-school approach that just works. However, FundedNext feels significantly more modern.

They have embraced newer trading technology like cTrader and MatchTrader, which is a breath of fresh air if you care about advanced charting or one-click execution speed. Also, the variety of trading instruments available can limit or expand your strategy significantly.

| Criteria | The Funded Trader (TFT) | FundedNext |

|---|---|---|

| Platforms | MT4, MT5 | MT4, MT5, cTrader, MatchTrader |

| Instruments | Forex, Indices, Metals, Crypto | Forex, CFDs, Indices, Commodities, Futures |

| Execution | Reliable, standard speed | Fast (Direct access feel) |

| Leverage | Generally up to 1:100 | Up to 1:100 (Varies by asset) |

| Dashboard | Gamified Trade Hub | Clean, modern analytics |

Summary: If you want rock-solid stability on classic software, TFT is a safe bet. But if you need to trade futures, crave the sleek feel of cTrader for your CFDs, or want a wider range of assets, FundedNext is definitely the more versatile playground.

6. Payout & trust: Trader reviews

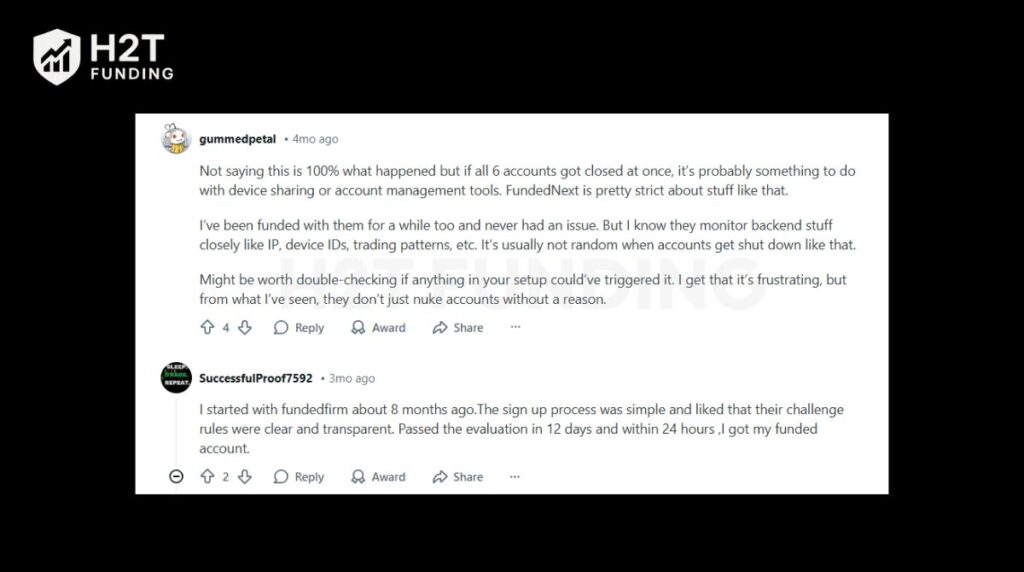

Look, marketing claims are one thing, but what really matters is whether traders are actually getting paid. When you strip away the flashy websites, the community’s voice is the only truth meter we have.

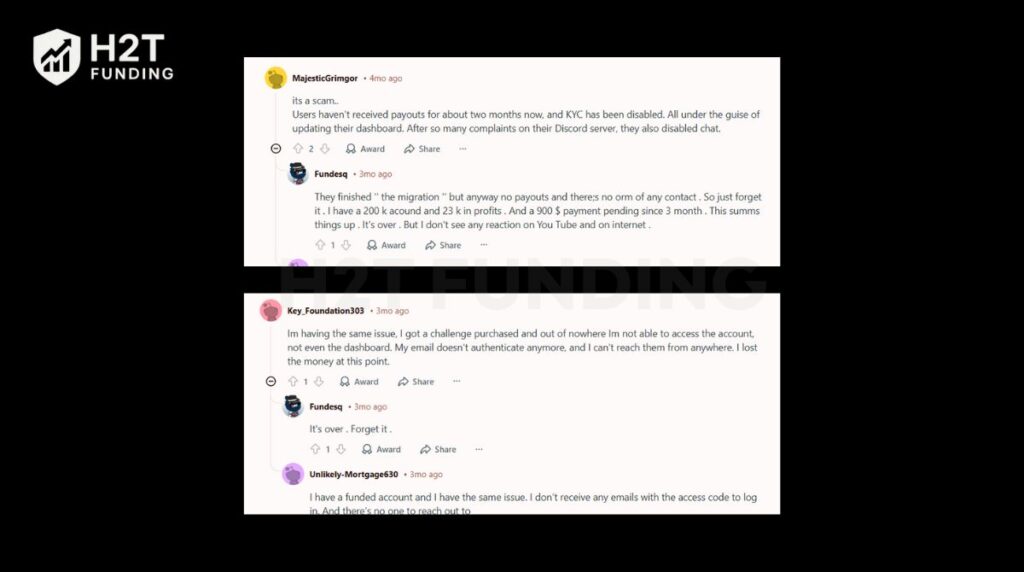

I have spent hours digging through Trustpilot, Reddit, and Discord to see what real users are saying about The Funded Trader vs FundedNext. Honestly, the sentiment has shifted quite a bit recently. While one firm is riding high on praise for its speed, the other is facing a storm of complaints regarding platform migrations and accessibility.

Here is what the community is saying right now:

To put it simply, FundedNext is currently winning the trust war. Their Trustpilot ratings are solid (4.5/5), and the feedback on their payout process is overwhelmingly positive. Traders love the 24-hour turnaround.

The Funded Trader, unfortunately, is struggling (3.0/5). While they are a giant in the space, the recent tech issues and platform migration excuses have frustrated thousands.

If trustworthiness and immediate access are your top priorities right now, the choice seems pretty clear based on these trader reviews.

7. Which prop firm is easier to pass?

Let’s cut to the chase. Easy is subjective, but trading rules are not. If you are asking me which one gives you a better statistical shot at getting funded, the answer lies in the drawdown rules and time limits.

In my honest opinion, FundedNext currently has the edge for most traders, specifically with their Stellar programs. Why? Because they calculate daily drawdown based on balance, not equity (on specific accounts). This is a huge deal. It means your floating profits don’t count against you if the market snaps back.

The Funded Trader is solid, but their rules can feel a bit tighter. For example, the Knight Challenge (their 1-step option) uses a trailing drawdown, which follows your highest equity point. That is significantly harder to manage than a static balance-based limit.

Here is the raw comparison of their easiest paths:

| Feature | The Funded Trader (Royal/Standard) | FundedNext (Stellar 1-Step/2-Step) |

|---|---|---|

| Profit Target (Phase 1) | 8% (Royal) / 10% (Standard) | 10% (1-Step) / 8% (2-Step) |

| Time Limit | Unlimited (No stress) | Unlimited (Take your time) |

| Drawdown Type | Equity / Trailing (Knight) | Balance-Based (Stellar) |

| Weekend Holding | Allowed (Royal only) | Allowed (Standard feature) |

| News Trading | Allowed (Royal only) | Allowed |

| Leverage | 1:200 (Royal) | 1:30 (1-Step) / 1:100 (2-Step) |

If you struggle with time pressure, both are great because they have removed time limits. However, if you are a swing trader who holds trades overnight, FundedNext’s Stellar model is likely easier to pass because the drawdown calculation is more forgiving. You don’t have to worry about a winning trade turning into a rule breach just because it pulled back a little.

But, if you need high leverage (like 1:200) to make your strategy work, TFT’s Royal Challenge might be the smoother ride for you, despite the equity-based drawdown. Choose the rules that fit your bad habits, not just your winning ones!

8. Who should choose which firm?

When learning how to choose a prop firm, deciding between these two isn’t just about which one is “better” in a vacuum; it’s about which one fits your specific vibe. Are you a methodical sniper or a machine-gun scalper?

Honestly, after testing both environments, I think the choice becomes pretty obvious once you know your own trading personality. Here is my breakdown of who belongs where:

| Trader Type | Best Choice | Why? |

|---|---|---|

| Beginners | The Funded Trader | Their structured rules act like guardrails. It feels safer when you are learning the ropes of discipline. |

| Fast-Paced Scalpers | FundedNext | Speed is king here. The execution feels sharper, and the flexible risk rules let you breathe during volatility. |

| Long-Term Consistency | The Funded Trader | If you want to build a career, their scaling plan is massive. It’s built for the marathon, not the sprint. |

| Crypto Fanatics | FundedNext | They just get crypto better. Lower spreads and often better leverage conditions for digital assets. |

| Risk-Averse Traders | The Funded Trader | The drawdown rules are strict but very clear. You always know exactly where the line in the sand is. |

| News / HFT Traders | FundedNext | Fewer headaches. While TFT has restrictions on some accounts, FundedNext generally lets you trade through the chaos. |

If you want a structured job in trading, go with The Funded Trader. If you want a flexible business where you get paid fast, FundedNext is the move.

9. FAQs

Honestly, yes, but for different reasons. The Funded Trader is great if you need structure; their strict rules teach you discipline. FundedNext, especially their Stellar Lite model, is amazing for beginners because it’s affordable and has no time limits, so you don’t feel rushed.

It depends on what you want. If you want variety, TFT offers unique challenges like the Dragon and Knight. However, if you want innovation, FundedNext offers a dedicated Futures program and an Instant Funding model that lets you skip the evaluation entirely.

FundedNext wins here, hands down. They promise payouts within 24 hours, and user reviews confirm they often hit that target. TFT is reliable, but their standard payout processing can take a few days to a week.

Both firms support the classics: MT4 and MT5. However, FundedNext goes a step further by offering cTrader and MatchTrader, which is a huge plus if you prefer modern, sleek interfaces over the clunky old-school look.

TFT can be tricky because some accounts calculate drawdown based on equity (floating profit). FundedNext is generally more forgiving, particularly on their Stellar account, which uses a balance-based drawdown. This means your open profits won’t hurt you if they retrace.

Historically, The Funded Trader has been the “kingdom” for career traders. However, given their recent platform migration issues, FundedNext currently feels like the safer, more stable ship for the long haul.

Definitely FundedNext. Their Stellar Challenge has 0 minimum trading days. You could literally pass in one day if you catch a monster trade. TFT usually requires at least 5 days.

As of late 2025, FundedNext is sitting pretty with a 4.5/5 Excellent rating. The Funded Trader has taken a hit recently, dropping to around 3.0/5 due to complaints about platform access.

Yes, absolutely. Despite some recent operational hiccups at TFT, both companies have paid out millions to traders worldwide. They are real businesses, not fly-by-night scams.

Yes, both firms allow it. FundedNext is slightly better for this because they often have better spreads and execution for digital assets compared to standard forex prop conditions.

FundedNext offers a massive ceiling of up to $4,000,000 if you keep winning. The Funded Trader also has a strong scaling plan, typically capping around $600k in funded accounts (or $1.2M in challenge capability).

Yes. TFT restricts EAs to specific accounts like the Royal Challenge. FundedNext is generally more open, allowing EAs and bots across most of its funding models without needing a special account type.

Yes. While many firms have pulled out due to regulations, TFT has worked hard to keep US clients by migrating to platforms like DXTrade or MatchTrader. Just check their latest announcements, as this changes fast.

This isn’t a firm rule, but a golden rule of survival. It means you should never risk more than 1-2% of your account on a single trade. Both firms will encourage this because if you risk more, you will likely hit their 5% daily loss limit instantly.

Prices fluctuate with promos, but typically, a 25K Stellar evaluation sits around $199. If you catch a sale or choose a lower-tier plan, it can be cheaper.

They are very global, but they do restrict service to sanctioned nations. Generally, if you are in North Korea, Syria, Iran, or Russia, you cannot trade with them. Everyone else is usually welcome.

10. Conclusion

So, who actually wins the battle of The Funded Trader vs FundedNext? Honestly, it really comes down to what you value most right now: rigorous structure or speed and reliability.

- The Funded Trader → Best for structured, long-term, professional prop trading.

- FundedNext → Best for fast payouts, flexible rules, and traders who want more freedom.

Ready to start your challenge? Check the full comparison and updated prop firm rankings on H2T Funding.