The smallest account size to trade futures is often misunderstood. While many assume you need $25,000 or more to get started, the reality is much more accessible, especially with micro futures now widely available.

With micro contracts, traders can enter the market with as little as $500 to $1,000, though most experts recommend starting with at least $2,000 for better risk control. These contracts allow access to key markets like the S&P 500, Nasdaq, and gold with significantly reduced capital requirements.

This guide breaks down the capital you need, how to leverage micro futures, and the core strategies for managing risk and building consistency. If you want to trade smarter with a smaller account, your journey starts right here.

Key takeaways:

- The smallest account size to trade futures is not $25,000; traders can realistically start with $500 to $2,000.

- Micro futures are essential trading instruments that reduce capital requirements and make the market more accessible.

- Futures trading involves standardized contracts to buy or sell an asset at a set price on a future date.

- Strict risk management, including the one percent rule and predefined stop-losses, is crucial for protecting a small account.

- Understanding leverage and margin requirements is fundamental to managing risk and avoiding early liquidation.

- Successful strategies for small accounts prioritize capital preservation and consistency over chasing large profits.

1. What is futures trading?

Futures trading is the practice of buying or selling standardized contracts that obligate the trader to exchange an asset at a predetermined price on a specific future date.

These contracts are traded on regulated exchanges, such as the CME (Chicago Mercantile Exchange). They cover a wide range of assets, including commodities like crude oil and gold, as well as financial instruments like stock indices and currencies.

Futures trading allows traders to profit in both rising and falling markets through long and short positions. With flexibility and leverage, futures have become a popular choice for short-term traders and those seeking hedging opportunities.

2. What is the smallest account size to trade futures?

To put it simply, you can start trading futures with about $500, but that number is only the technical minimum. In real trading, most beginners feel far safer with $1,000–$2,000, because that extra cushion helps you stay calm when the market moves faster than expected.

I’ve seen many traders jump in with the smallest deposit possible, only to realize they don’t have enough room to place responsible stops or apply basic risk rules.

The actual amount you need changes for a few reasons. Micro contracts ask for far less capital than larger ones, and brokers often set different intraday margins. Some offer $50–$100 to open a micro position, while the exchange requires more.

If you want to understand how your entries depend on tools, it helps to learn how to trade using indicators, because weak entries usually force traders to risk more than they should. You’ll notice the same thing when you look at how margin is used in floating profit, as margin pressure can push you out of trades too early.

To stay on the safe side, many traders rely on a simple buffer rule. I often mention the margin of safety formula, as it reminds us that we need capital left over after placing a trade, not just enough to open it. When your account is too small, even minor swings feel stressful, and that pressure can lead to poor decisions.

So yes, the smallest amount you can use is around $500, but the smallest amount you should use is closer to $1,000–$2,000 if you want enough breathing room to trade with discipline instead of fear.

See more related articles:

3. Can you trade futures with $500 or $1,000?

So, let’s get straight to it. Can you really trade futures with just $500 or $1,000? The short answer is a definite yes. But honestly, it’s not as simple as just depositing the money and hoping for the best. Success when you trade a small account is all about using the right tools and, more importantly, the right mindset.

The absolute game-changer here is Micro E-mini contracts. To put it simply, these are just 1/10th the contract size of the standard E-Mini contracts. This means everything is scaled down: the margin requirements are lower, the value of each price tick is smaller, and your overall risk is far more manageable. This is how you get your foot in the door of the futures market without a massive bankroll.

Let’s make this real. Imagine you have a $1,000 account and want to start day trading the Micro E-mini S&P 500 (MES). Your margin to open a trade might only be around $50. Each full point the MES moves is worth $5. A 10-point swing against you is a $50 loss. See? With a $1,000 balance, that’s a manageable hit. You have enough breathing room to set a proper stop-loss and practice solid risk management.

However, let’s be honest; it’s not without its challenges. High volatility can still be dangerous, and a sharp move can hurt a small account badly. You also have to be very mindful of your commissions. Those small trading fees can really add up and eat into your modest profits if you overtrade.

So, what’s the bottom line? Starting with $500 to $1,000 is absolutely possible, but it’s a different game. Your goal isn’t to chase huge profits. Instead, it’s to learn the ropes, survive market volatility, and protect your capital above all else. Master that, and you’ll have a solid foundation to build upon.

4. Factors that define the smallest account size to trade futures

While some traders might start with as little as $500, the smallest account size isn’t just about your deposit. It’s about how your capital handles trading conditions, margin policies, and risk dynamics.

Several critical factors influence the actual minimum required to trade safely and sustainably:

4.1. Broker requirements and account types

Each broker sets its own minimum deposit and margin policies, depending on the type of futures account:

- Retail brokers may require a minimum deposit of $500 to $2,500, especially for micro contracts.

- Proprietary trading firms or futures-only brokers might have higher minimums but offer lower commissions or better data access, which sometimes includes advanced analysis across different markets, like learning how to use option block trades.

- Some brokers differentiate between cash accounts and margin accounts, affecting how much capital is needed to open or maintain a position.

Be sure to check the broker’s specific rules for day trading, overnight margin, and initial maintenance requirements.

4.2. Day trading margin vs. initial margin

Understanding margin types is essential for managing risk with a small account:

- Initial margin: Initial margin is the amount required by the exchange to open and maintain a position. According to CME Group, the Micro E-mini S&P 500 (MES) typically requires an initial margin of around $2,000–$2,300, depending on market conditions. Some brokers may offer much lower day-trade margins, usually $50–$100, but these reduced requirements apply only to intraday positions and do not reflect CME’s official margin standards.

- Day trading margin: Offered by some brokers, this is a reduced margin requirement for positions closed before market close, sometimes as low as 25% of the initial margin.

Relying on low day-trading margins is a classic rookie trap. To understand this dynamic without financial risk, practicing on one of the best free trading simulators is an excellent first step.

It feels like you have more buying power, but it dramatically shrinks your room for error. A single volatile swing against you can trigger an instant liquidation before you even have time to react. Use it with extreme care.

4.3. The power and danger of leverage

Leverage allows futures traders to control contracts much larger than their account size. This is both an opportunity and a risk:

- Pros: High capital efficiency. For example, $1,000 may control a contract worth $20,000.

- Cons: A small price move against your position can wipe out your account. Futures are marked to market daily, so losses are realized in real-time.

New traders should treat leverage cautiously. Start with micro contracts and avoid overexposing your account by opening multiple positions simultaneously.

Don’t miss it: Easiest prop firms to pass in 2026: 12 best picks

5. What are micro futures, and which is the best micro futures to trade for beginners?

Micro futures are smaller-sized futures contracts designed for retail traders who want exposure to the futures market with significantly lower capital requirements. Typically, a micro contract represents one-tenth the size of its standard E-mini counterpart, making it ideal for those managing a small account or just starting out.

Here are the most widely traded and beginner-friendly micro futures contracts:

- Micro E-mini S&P 500 (MES): Tracks the S&P 500 index. Each tick is worth $1.25, and the contract size is 1/10 of the E-mini S&P 500. Popular for its high liquidity and low volatility relative to other indices.

- Micro E-mini Nasdaq-100 (MNQ): Mirrors the tech-heavy Nasdaq-100. Volatile and fast-moving, with a tick value of $0.50. Ideal for traders who want exposure to tech stocks, but should be approached cautiously.

- Micro E-mini Dow Jones (MYM): Based on the Dow Jones Industrial Average. Each tick is worth $0.50. Less volatile than the MNQ, suitable for conservative index traders.

- Micro Gold Futures (MGC): Provides access to the gold market with smaller exposure. One tick equals $1.00, and the contract represents 10 ounces of gold. Great for commodity-focused beginners.

These contracts offer a practical entry point into the futures market, allowing traders to build experience, refine strategy, and grow confidence without overexposing their capital.

6. Micro e-mini vs. standard e-mini: Which is right for you?

This is one of the first major decisions you’ll make as a futures trader. Your choice will depend on your capital, appetite for risk, and current stage in your trading journey. Let’s break down the difference between Micro E-minis and their big brothers, the standard E-minis.

Key comparison: Micro e-mini vs. E-mini contracts

| Feature | Micro E-mini (e.g., MES) | Standard E-mini (e.g., ES) |

|---|---|---|

| Contract size | 1/10 of E-mini | Full-sized |

| Tick size | $1.25 (MES) | $12.50 (ES) |

| Day trading margin (approx.) | $50–$150 | $500–$1,000+ |

| Initial margin (overnight) | ~$2,000–$2,300 | ~$12,000+ |

| Capital recommended | $2,000+ | $10,000+ |

| Risk exposure | Lower | Higher |

| Liquidity | High | Very high |

For most new traders, micro contracts offer a safer, more accessible way to gain futures exposure. Once you build consistency and confidence, scaling up to standard contracts becomes a more natural and strategic next step.

7. How to manage risk when trading a small futures account

When you trade a small account, your number one job isn’t finding winning trades. Honestly, it’s about survival. Excellent risk management is what separates traders who last from those who quickly wash out. Think of these rules as your non-negotiable playbook for staying in the game.

- Master the one percent risk rule: This is the golden rule of small account futures trading. Never risk more than 1% of your account on a single trade. For a $2,000 account, your maximum risk is just $20. This forces you to stay disciplined and prevents one bad trade from destroying your capital. It’s the foundation of everything.

- Your stop-loss is an unbreakable contract: You must decide your exit point before you enter a trade. Why? Because the moment your money is live, emotion takes over. Your pre-trade plan was made by the smartest, most objective version of you. Honor it. Never, ever move your stop-loss further away in a losing trade. This is key to emotional management.

- Use proper position sizing: Position sizing is how you enforce the 1% rule. It’s not about how many contracts your leverage allows you to trade. It’s about how many you should trade to keep your risk at or below 1%. For beginner traders, this often means trading just one E-Micro contract at a time, and that’s perfectly fine.

- Keep a trading journal: Learning is impossible without tracking performance. A trading journal acts as a personal feedback loop. Documenting trades, the reasoning behind them, and associated emotions is key. This process builds priceless trading experience, helps identify repeating mistakes, and reveals which strategies actually work.

In short, these strategies are your defense. Mastering them isn’t just about preventing big losses; it’s the only reliable path to long-term account growth. Profit is simply the reward for excellent risk control.

8. How to trade futures with a small account: 5 essential strategies

Trading on a small account is a game of survival first, and profit second. It requires ruthless discipline and a non-negotiable approach to risk.

Forget home runs; your goal is to stay in the game. Here are five essential trading strategies that will not only help you survive but also give you a foundation to grow.

8.1. Start with a demo account first

Before risking real money, spend time on a simulated trading platform. Most brokers offer free demo accounts that mirror real market conditions.

- Practice entering/exiting trades

- Test different instruments (e.g., MES vs. MNQ)

- Build confidence without financial pressure

This step is crucial for understanding order types, volatility, and how leverage behaves in real time.

8.2. Master the one percent risk rule

Never risk more than 1% of your total account balance on a single trade. This simple rule protects you from catastrophic losses.

- For a $2,000 account, your max risk per trade = $20

- Adjust position size and stop-loss accordingly

- Focus on consistency, not big wins

By staying within this limit, you preserve capital for the long run.

8.3. Define your stop-loss before entering a trade

Your stop-loss is an unbreakable contract you make with yourself before you enter a trade. Why? Because before you have money on the line, you are logical and objective. The moment your trade goes live, emotion and ‘hope’ can take over.

Never move your stop-loss further away in the middle of a losing trade. Honor your original plan; it was made by the smartest version of you.

8.4. Scale in and out of positions with micro contracts

Micro contracts allow you to build or reduce positions gradually, instead of going all-in at once.

- Enter partial positions as the price confirms your bias

- Lock in partial profits at targets

- Reduce risk as volatility increases

Scaling provides flexibility and emotional control, especially when markets get choppy.

8.5. Avoid over-leveraging your account

Leverage is a double-edged sword. Even though micro futures require small margins, overtrading is a common killer of small accounts.

- Don’t trade multiple contracts just because you can

- Avoid revenge trading or “doubling down” after losses

- Prioritize capital preservation above profit chasing

Discipline in position sizing is what keeps small accounts alive through volatile cycles.

These five strategies are especially important when starting with the smallest account size to trade futures.

Read more:

9. Common mistakes for small accounts

When your account is small, every decision feels heavier. To be honest, I’ve seen traders burn through their balance not because the market was wild, but because a few simple habits were missing. Saying that out loud might sting a bit, but it’s true. Below are the mistakes I notice most often, especially from beginners trying to grow a small account. Hopefully, you’ll spot one or two before they cost you real money.

- Trading without a plan: Many beginners jump into a trade because the chart “looks good.” I’ve done that myself, and it rarely ends well. A plan gives you rules when emotions flare.

- Sizing positions too large: Small accounts explode fast when the size is wrong. One oversized position can wipe out multiple winning days. Simply put, small accounts survive on restraint.

- Skipping the stop-loss: It feels brave in the moment, but it’s really fear in disguise. Without a stop, a small account can’t absorb even a modest swing.

- Revenge trading after a loss: I’ve watched traders melt down in minutes because they tried to “win it back.” When emotion takes the wheel, logic disappears.

- Misunderstanding leverage: Leverage looks exciting, until it isn’t. A small move against you can feel huge when your account is tiny. That shock alone can force bad decisions.

- Overtrading during slow or choppy hours: Quiet markets tempt traders into taking weak setups. You end up paying commissions and stress for trades that never had a chance.

- Chasing moves without context: Following a breakout late feels thrilling, but you’re entering when others are exiting. It’s a painful lesson most traders learn the hard way.

- Ignoring contract details: Tick value, size, and margin matter more for small accounts. I’ve seen traders blow up because they underestimated how fast a contract moves.

Mistakes happen to all of us; I’m no exception. What matters is noticing them early, especially with a small account where every decision carries weight. If you can avoid these traps, you give yourself a real chance to grow with patience instead of panic.

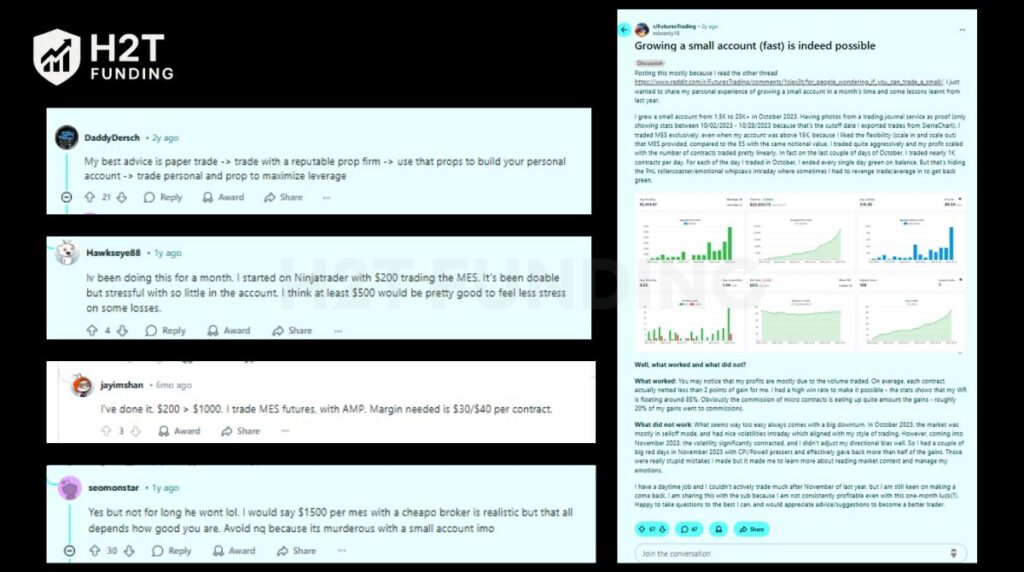

10. Futures trading small account Reddit

Theory is essential, but real-world stories provide raw insights. For many beginner traders, the hardest part is mastering their trading psychology. Forums like Reddit offer a candid look into this journey.

Users openly discuss everything from effective trading platforms to managing trading costs. These discussions provide a valuable layer of market context that textbooks often miss. Let’s explore what real traders are saying about their experiences.

These Reddit discussions reveal a clear consensus. The introduction of E-Micro contracts has been a game-changer. They provide essential trading flexibility for smaller accounts. This allows for smarter capital allocation and risk control. Ultimately, this approach supports sustainable account growth.

Traders emphasize that success isn’t just about aggressive profit scaling. It’s about managing market exposure and building consistency. These real-world examples confirm that with the right mindset, growing a small account is an achievable goal.

11. Frequently asked questions (FAQs)

The cost varies by market conditions and instrument, but margin requirements are typically around $50–$150 per contract for day trading. Overnight margin may require $800–$1,200, depending on the broker and product.

Yes, it’s possible using micro futures like MES or MNQ. However, $500 leaves little room for error or drawdowns. Starting with $1,000–$2,000 is safer and more sustainable.

Technically no. Most brokers require a minimum deposit of at least $400–$500, and even micro contracts need a margin above $50. $100 is insufficient for realistic or responsible futures trading.

Highly discouraged. $200 may not even meet the broker’s minimum deposit. Even if accepted, there’s virtually no margin for loss, which makes surviving volatility extremely difficult.

No. $5 isn’t enough to meet any broker or margin requirement. Futures trading involves leverage and real-time margin calls, which require a capital base to support.

No. That’s a common misconception, often confused with the $25,000 pattern day trading rule for stocks. Futures accounts aren’t subject to that rule. Many traders start with $2,000–$5,000 using micro contracts.

Yes. Each futures contract has its own margin requirements, tick value, and volatility profile. For example, crude oil futures need far more margin than a micro equity index.

Absolutely. Most brokers offer demo or simulated trading accounts, where you can practice under live market conditions without risking capital.

For standard E-mini contracts, most traders recommend starting with at least $10,000–$15,000. These contracts are more volatile and require higher margins than micro futures.

While you can technically start with as little as 500, a more realistic minimum is $1,500 to $2,000. This amount provides a necessary buffer to manage risk and absorb small losses without immediately depleting your account.

Micro futures contracts (like MES, MNQ, or MGC) are ideal. They are 1/10th the size of standard E-mini contracts, which significantly lowers the margin required and reduces your risk per trade, making them perfect for smaller capital.

There is no single answer, as margin requirements differ for each futures product. It depends on the contract’s value and volatility. However, day-trading margins for micro contracts are very low, often starting at just $50 per contract.

Yes, absolutely. Micro futures are the perfect starting point for beginners. They allow you to gain real-market experience and learn trading mechanics with significantly less capital and financial risk.

Yes. Unlike stocks, the futures market does not have a Pattern Day Trader (PDT) rule requiring a $25,000 minimum balance. This makes it much more accessible for traders with small accounts to actively day trade.

Yes, and it’s a popular option. Prop firms allow you to trade a large funded account (e.g., $50,000) by passing an evaluation that costs a small fee. This lets you trade with significant capital without risking your own money.

12. Conclusion: Starting your futures trading journey with confidence

Ultimately, determining the smallest account size to trade futures isn’t about finding a magic number. It’s about respecting the market and, more importantly, respecting your capital. Micro futures have opened the door for everyone, but they don’t suspend the rules of risk.

Start small, master your discipline with strategies like the 1% rule and iron-clad stop-losses, and focus on consistency. Profit is the byproduct of excellent risk management, not the other way around. Now that you have the map, it’s time to start your journey with confidence.

If you want to learn how to build a strategy for small accounts and develop deeper futures knowledge, explore our advanced guides in the Prop Firm & Trading Strategies section at H2T Funding. These resources are built to give you clearer direction, practical tools, and a structure you can actually use in fast-moving markets.