When you come into some extra money, the question often arises: Should you save it or invest it? It’s a common question with no easy answer. I’ve personally weighed this choice regularly, balancing the security of a savings account with the potential growth from investing.

In this guide, we’ll break down the saving vs investing pros and cons, helping you make an informed choice that matches your money objectives. Whether you’re just starting or looking to refine your financial planning, our article offers valuable insights based on real experiences.

Key takeaways

- Saving is the practice of putting aside money you don’t need immediately, focusing on security and convertibility for short-term needs or emergencies.

- Saving offers strong security, quick access to funds, and minimal risk, making it suitable for short-term goals. However, it typically delivers modest returns, and rising prices can gradually reduce the real value of your savings.

- Investing is allocating money to assets to grow wealth over time, typically suited for future-focused goals like retirement.

- Investing can deliver stronger growth, helping your wealth maintain or increase its purchasing power. However, it comes with higher risks, including the possibility of losing money, and may require more knowledge and patience to navigate market fluctuations.

- Saving accounts include high-yield savings accounts, certificates of deposit (CDs), and money market accounts, all of which are low-risk and easily accessible.

- Investing includes stocks, bonds, mutual funds, ETFs, and real estate, each offering varying levels of risk and return, with the potential for higher long-term growth.

1. Understanding saving and investing fundamentally

To truly weigh the saving vs investing pros and cons, it’s essential to understand the key differences between saving and investing. While both are important financial strategies, they serve different purposes and align with different goals. Let’s break them down.

1.1. What is saving?

Saving refers to setting aside money you don’t immediately need for future use. It’s about preserving your capital rather than seeking to grow it significantly.

- Key characteristics: Saving is low risk, high safety, and highly liquid. Your principal is secure, and you can easily access the funds when needed. The downside is that the return is typically lower, and it may not always keep pace with inflation.

- Common purposes: Saving is ideal for immediate goals like buying a car, going on a vacation, or creating a safety cushion for unexpected expenses.

- Common places to save: Popular saving options include high-yield savings accounts, certificates of deposit (CDs), or simply keeping cash in a secure location. However, keep in mind that keeping money in cash offers no growth and carries its own risks.

1.2. What is investing?

Investing involves putting your money into assets with the expectation that they will grow in value or generate income over time. The primary aim of investing is to build wealth.

- Key characteristics: Investing offers the potential for higher returns than saving but comes with greater risks, including the possibility of losing some or all of your investment. The financial fluidity of investments can also vary, meaning some may be harder to access quickly.

- Common purposes: Investing is typically aligned with long-term goals such as retirement planning, building substantial wealth, or funding large future expenses like education.

- Common types of investment: Some common investment options include stocks (equity in companies), bonds (loans to governments or corporations), mutual funds, ETFs (pools of stocks or bonds), and real estate.

Understanding saving and investment macroeconomics can provide valuable insights into how individual financial choices interact with broader economic trends. For instance, while saving is crucial for maintaining financial security, investing plays a key role in wealth accumulation and retirement planning.

Continue reading: What is compound interest? Beginner’s guide

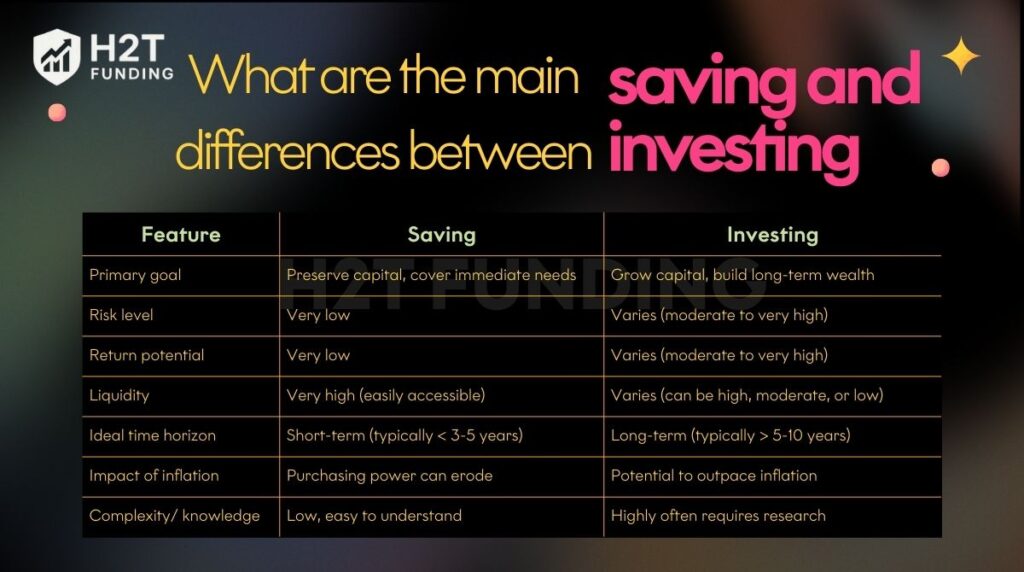

2. What are the main differences between saving and investing

Making an informed decision between saving and investing requires a clear framework for comparison. It’s not just about understanding each option, but how they compare based on factors important to your financial well-being. This section will highlight these key criteria before diving into the specifics of investing vs. saving.

2.1. Side by side comparison table: Saving vs Investing

Let’s begin with a high-level comparison. This table outlines the key differences between saving and investing across several important aspects. Understanding these distinctions helped shape my personal financial strategy, and it can do the same for you.

| Feature | Saving | Investing |

|---|---|---|

| Primary goal | Preserve capital, cover immediate needs | Grow capital, build long-term wealth |

| Risk level | Very low | Varies (moderate to very high) |

| Return potential | Very low | Varies (moderate to very high) |

| Liquidity | Very high (easily accessible) | Varies (can be high, moderate, or low) |

| Ideal time horizon | Short-term (typically < 3-5 years) | Long-term (typically > 5-10 years) |

| Impact of inflation | Purchasing power can erode | Potential to outpace inflation |

| Complexity/ knowledge | Low, easy to understand | Often highly required research |

When you look at saving vs. investing, it’s clear that each approach serves a different purpose. Savings are typically used for near-term goals, offering low risk but also low returns. Whereas investing is focused on long-term wealth accumulation and comes with greater risk and higher return potential.

Don’t miss out: How to avoid lifestyle inflation and save more money

2.2. Understanding the comparison criteria

Let’s break down why these criteria matter when evaluating saving vs. investing:

- Risk level: The chance of losing some or all of your initial capital. This directly impacts your financial security and how comfortable you feel with uncertainty. Everyone has a different capacity for risk.

- Return potential: This is the amount of profit or growth you can expect. It helps determine how quickly your wealth can grow, especially for long-term goals. Investing for beginners should focus on understanding return potential as it shapes future financial strategies.

- Liquidity: This measures how easily you can turn an asset into cash without significant loss. Easy access to cash is crucial when unexpected expenses arise.

- Impact of inflation: Inflation reduces the purchasing power of your money. Understanding its effect on saving vs. investing is key to maintaining and growing your real wealth.

- Time horizon: It’s how long you plan to allocate money to a particular strategy or asset. This affects whether saving v investing is better suited for your goal, depending on how long you have to invest.

- Complexity/knowledge required: This refers to the amount of understanding or research needed. Simpler options are more accessible, while more complex strategies may offer higher returns but require more effort.

In summary, what is the main difference between saving and investing? Saving is typically low-risk and best for near-term goals, while investing offers the potential for higher returns over the long term but comes with more risk. Knowing your risk, time horizon, and financial goals will help you decide whether personal investing or saving is best for you.

2.3. When does saving make more sense, and when is investing better?

Based on these criteria, we can start to see where each approach shines:

Saving generally makes more sense when:

- You have short-term goals (e.g., saving for a vacation in six months, a down payment in two years).

- You are building or maintaining an emergency fund (typically 3-6 months of living expenses). This money needs to be safe and readily accessible.

- You have a very low risk level, and the thought of any potential loss causes significant stress.

- You need guaranteed access to your principal shortly.

My personal rule is straightforward: any money I’ll need for a specific goal within the next two years stays in a high-yield savings account. For me, the security of knowing the principal is safe for a short-term goal outweighs any potential investment gains.

I only started investing seriously after I made it a priority to build a solid buffer fund and pay off my high-interest credit card debt. Hitting those milestones was key; it gave me the stability to start investing for the long term without the stress of needing that money unexpectedly.

Investing generally becomes more appropriate when:

- Your future wealth-building targets, such as retirement or large purchases decades away.

- You have already established a solid emergency fund through saving.

- You have a higher risk tolerance and are comfortable with the possibility of market fluctuations (and potential short-term losses) in exchange for potentially higher long-term returns.

- Your goal is to grow your money and outpace price increases over time.

I now realize that if I had invested too early, without a safety net, market fluctuations would have been more stressful. I might have made reactive decisions due to a lack of stability and knowledge. Understanding these differences and knowing when each strategy is appropriate is key to making informed financial decisions.

3. The pros and cons of saving money

Saving money is a foundational financial strategy, offering several benefits but also some limitations. Here’s a breakdown of the pros and cons:

| Pros | Cons |

|---|---|

| High safety and security: Savings accounts are often insured by government-backed schemes, ensuring your principal is safe. | Low returns and minimal growth potential: Savings accounts usually offer low interest rates, limiting the potential for growth. |

| Excellent convertibility for urgent needs: Money in savings accounts can be accessed quickly, which is ideal for emergencies. | Low returns and minimal growth potential: Savings accounts usually offer low interest rates, limiting the growth potential. |

| Simplicity and ease of understanding: Saving is straightforward and doesn’t require a financial advisor, making it an easy first step in personal finance. | Missed opportunity for wealth building: Keeping all funds in savings means missing out on higher returns from investments. |

| Ideal for short-term goals & emergency funds: Saving is perfect for goals like vacations or for building a financial buffer. |

The benefit of saving money lies in its safety and simplicity. However, to grow your wealth in the long term, it’s important to balance saving with investing. For more ideas on how to improve your savings habits, check out some save money challenge ideas to create better financial practices.

4. The pros and cons of investing money

Having examined the pros and cons of saving, the next step is to understand the specific advantages and drawbacks of investing. Investing offers significant opportunities, but it also requires careful consideration and carries inherent risks.

Here’s a breakdown of the pros and cons of investing money:

| Pros | Cons |

|---|---|

| Higher potential returns to outpace inflation: Investing offers the chance for much higher returns than savings accounts, which is essential for growing wealth and beating inflation. | Inherent risk of loss with no guarantees: Unlike savings accounts, most investments carry the risk of losing some or all of your money, with no guaranteed return. |

| The power of compound interest: Reinvesting earnings generates more returns, leading to exponential growth over time. | Market volatility: Financial markets can be unpredictable, and price fluctuations can be stressful for investors, especially in the short term. |

| Achieving financial freedom: Investing helps build wealth for the long term, like retirement or funding education, making it an essential tool for financial independence. | Complexity and need for knowledge: Investing requires understanding different asset classes, market strategies, and risk management, making it more complex than saving. |

| Opportunities for diversification: You can spread investments across various asset types, reducing overall risk by balancing investments. | Potentially lower convertibility for some assets: Not all investments are easily converted into cash, especially in real estate or private equity. |

Investing is a powerful tool for building wealth over time. However, it comes with higher risks, requires more knowledge, and demands patience to navigate market volatility.

I remember when I first started investing with a simple S&P 500 ETF. The first time the market took a dip, seeing my account in the red was jarring. My gut reaction was to sell. Holding steady through that period was a powerful lesson in emotional discipline and focusing on the long-term plan.

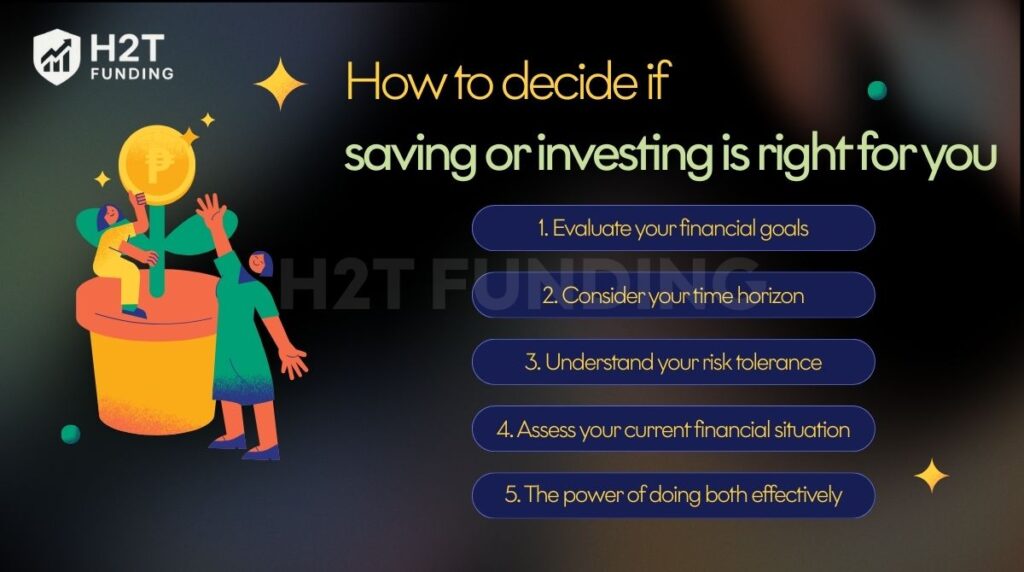

5. How to decide if saving or investing is right for you

Having explored the detailed saving vs investing pros and cons, the crucial question remains: which approach is right for you, and when? The answer isn’t always a simple “either/or”; often, it’s a “both/and,” with the balance shifting based on your individual circumstances. Here are 5 key factors to consider to make an informed decision.

5.1. Evaluate your financial goals

Your financial goals are the starting point. What are you trying to achieve with your money?

- Short-term goals (typically less than 3-5 years): If you’re saving for a down payment on a car next year, a vacation in 18 months, or a home renovation project within three years, saving is generally the more appropriate choice. The safety of your principal and easy access are paramount for these objectives.

- Long-term goals (typically more than 5-10 years): For goals like retirement planning, funding a child’s future education decades from now, or building substantial wealth, investing offers the growth potential necessary to reach these larger targets.

Clearly defining financial goals was a game-changer for me. It immediately helped me decide whether the money allocated for that goal should be in a safe savings account or could be put to work in investments.

5.2. Consider your time horizon

Closely related to your goals is your time horizon – the length of time you have before you need to access the money.

- Shorter time horizon: Less time means less opportunity to recover from potential market downturns. Therefore, lower-risk savings vehicles are more suitable.

- Longer time horizon: A longer timeframe (e.g., 10, 20, or 30+ years) generally allows you to take on more investment risk. You have more time to ride out market fluctuations and benefit from the power of compounding.

5.3. Understand your risk tolerance

This is your emotional and financial capacity to handle potential losses in your investments.

If the thought of your account balance dropping even slightly causes you significant stress or would jeopardize your essential needs, then the safety of saving is likely a better fit for the bulk of your money.

On the other hand, if you understand that market fluctuations are normal and are comfortable with the possibility of short-term losses in pursuit of potentially higher lasting gains, then investing may be suitable.

When I was starting out, I found it helpful to take a few online quizzes that assessed my comfort level with financial risk. While not definitive, they gave me a clearer idea of how much risk I was willing to accept, which guided my initial allocation between safer and riskier options.

5.4. Assess your current financial situation

Your overall financial health plays a critical role. Before diving into investing, prioritize setting aside a robust financial buffer to handle unforeseen events.

- Emergency fund first: This fund should cover 3-6 months of essential living expenses and should be kept in a highly liquid, safe savings account. This is your financial safety net for unexpected events like job loss, medical emergencies, or urgent repairs.

- High-interest debt: It’s also wise to consider paying off high-interest debt (like credit card debt) before making significant investments, as the interest you’re paying on such debt can often outweigh potential investment returns.

This was probably the best piece of advice I ever received and acted upon: Build that financial buffer first! Knowing I had that cushion in place gave me immense peace of mind and the confidence to start investing a portion of my money without constantly worrying about needing to pull it out unexpectedly for a crisis.

5.5. The power of doing both effectively

For most individuals, the optimal strategy isn’t choosing between saving and investing, but rather finding the right balance of both.

- Saving for stability and immediate needs: Use savings for your financial buffer, upcoming large purchases, and general financial security.

- Investing for future-focused growth: Use investments to build wealth over time, achieve long-range goals, and combat price costs.

The specific allocation between saving and investing will vary based on your age, goals, and financial situation, and it may change over your lifetime. I personally don’t see it as an either/or choice. Instead, I view saving and investing as two essential tools in my financial toolkit, each used strategically for different purposes to optimize my overall financial plan.

By carefully considering these factors, you can make more personalized and effective decisions when navigating the saving vs investing pros and cons.

Read more help articles:

6. FAQs

A common recommendation is to first build an emergency fund covering 3-6 months of essential living expenses. This fund should be in a safe, liquid savings account. Additionally, it’s wise to pay off high-interest debts (like credit card balances) before allocating significant funds to investing, as the interest paid on such debt can negate investment gains.

While starting early provides the maximum benefit from compounding, it’s never truly “too late” to start investing. Even if you’re starting later in life, investing can still help your money grow more than if it were just sitting in savings. The key is to adjust your strategy according to your shorter time horizon. Even a few years of disciplined investing can make a difference, and it’s certainly better than not starting at all.

The risk of losing your principal (the initial amount you deposited) in a bank savings account is very low, especially if your deposits are within the limits covered by government-backed deposit insurance schemes. The primary concern with saving in a bank is the gradual erosion of purchasing power over time when interest rates fail to keep pace with rising prices.

The absolute first step is education. Before you invest any money, take the time to learn the basics about different investment options (stocks, bonds, mutual funds/ETFs, etc.), understand your financial goals, assess your risk tolerance, and learn about fundamental concepts like diversification and compounding. My first step was simply to read as much as I could from reputable sources designed for beginner investors.

Many people prefer saving because it offers safety and predictability. Money in savings accounts is easy to access and usually insured, making it ideal for emergencies and short-term goals. Saving also helps build disciplined financial habits without exposing funds to market risks.

Investing generally offers higher potential returns and the chance to outpace rising prices, but it comes with risks and requires knowledge. Saving provides safety and simplicity, but returns are lower and may not keep up with inflation. The choice depends on your goals, risk tolerance, and time horizon.

The 70 20 10 rule suggests allocating 70% of your income to essentials, 20% to savings or investments, and 10% to personal spending or near-term goals. This strategy balances living expenses, wealth building, and discretionary spending while encouraging consistent investment habits over time.

The 10/5/3 rule of investment is a simple guideline to allocate money across different asset classes based on typical returns: 10% to stocks, 5% to bonds or debt instruments, and 3% to cash or savings. It helps investors set realistic expectations and balance growth with safety, though actual returns depend on market performance.

Investing $100 monthly for 10 years can grow significantly due to compound interest. Assuming a 7% annual return, the total contributions of $12,000 could grow to roughly $18,500. This demonstrates the power of consistent investing and the benefits of starting early, even with small amounts.

7. Conclusion: Making smart choices for your financial future

When it comes to saving vs investing pros and cons, the key takeaway is that both are essential, serving different but complementary roles in your financial strategy. To decide between saving, investing, or a combination of both, consider these factors:

- Your financial goals

- Your time horizon for each goal

- Your risk tolerance

- The status of your emergency fund

There is no one-size-fits-all approach. What matters is making conscious, informed decisions that fit your current life stage and financial resources. Start with what works for you, stay adaptable, and celebrate progress along the way.

Curious about investment options? Ready to build your financial foundation? Learn our practical tips for effective saving. You can find them all in the Cash Flow & Saving Strategies by H2T Funding. Explore our beginner’s guide to start your investment journey.