Many traders today are searching for prop firms that combine flexible rules, reliable payouts, and real growth opportunities. This ThinkCapital review takes a close look at whether the firm can live up to those expectations or if its promises sound better than reality.

ThinkCapital markets itself as a prop firm with advanced trading platforms, profit sharing up to 90%, and scaling plans that reach $1.5M. On paper, the offers look strong, but the real question is how these conditions play out for active traders.

In this article, I’ll walk through every core feature, funding program, trading rules, payouts, and support. While also sharing a practical view of how these policies might impact traders in real conditions.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official ThinkCapital websites before purchasing any challenge.

1. Our take on Thinkcapital prop firm

ThinkCapital is a relatively new prop firm launched in 2024, headquartered in the United Arab Emirates and also present in the UK market. Backed by a regulated broker, ThinkMarkets Group, ThinkCapital quickly gained attention for offering funded accounts with accessible fees and biweekly payouts.

Traders with ThinkCapital can access a wide range of instruments, including Forex, commodities, indices, cryptocurrencies, and oil. Supported platforms such as MetaTrader 5, ThinkTrader, and TradingView provide flexibility for both manual and automated trading.

With account sizes ranging from $500 to $200K and scaling up to $1.5 million, the firm positions itself as a growth partner for active traders who want long-term wealth development.

ThinkCapital prop firm pros & cons

| Pros | Cons |

|---|---|

| Backed by regulated broker ThinkMarkets | Still a young firm with a limited track record |

| Offers up to 90% profit sharing | Limited payment options (mainly crypto and cards) |

| Three evaluation models: Lightning, Dual Step, Nexus | Trading restrictions around major news events |

| Bi-weekly payouts with free retry options | No dedicated mobile app for challenge access |

| Low entry fees starting at $39 | Educational resources are limited |

| Leverage up to 1:100, automation-friendly (EAs supported) | Crypto leverage capped, often 1:2–1:5 |

In practice, the most appealing part for me is the biweekly payout structure. Getting access to profits every 14 days makes cash flow predictable, something many traders undervalue until they face delays elsewhere.

On the flip side, the limits around news trading can feel restrictive if you enjoy taking advantage of volatility. Still, for the fee range of $39 to $1,099 and up to 90% profit share, ThinkCapital delivers strong value for traders who want structure without feeling boxed in.

2. ThinkCapital funding program

ThinkCapital provides three evaluation models: Lightning (one-phase), Dual Step (two-phase), and Nexus (three-phase). Each program is designed with its own profit targets, drawdown rules, and leverage settings, giving traders different paths to a funded account.

Account sizes range from $5,000 to $200,000, with the option to scale up to $1.5 million for consistent performers. This flexibility makes ThinkCapital appealing to both beginners who want long-term wealth and those aiming for higher allocations.

| Feature | Lightning (One-Phase) | Dual Step (Two-Phase) | Nexus (Three-Phase) |

|---|---|---|---|

| Minimum Trading Days | 3 Days | 3 Days | 3 Days |

| Phase 1 Profit Target | 10% | 8% | 7% |

| Phase 2 Profit Target | – | 5% | 6% |

| Phase 3 Profit Target | – | – | 5% |

| Leverage | 1:30 | 1:100 | 1:100 |

| Daily Loss Limit | 3% | 4% | 4% |

| Max Loss Limit | 6% | 8% | 8% |

| Profit Split | Up to 90% | Up to 90% | Up to 90% |

| Payout Frequency | 14 days | 14 days | 14 days |

If you’re curious about an even more structured option, continue reading the three challenges below.

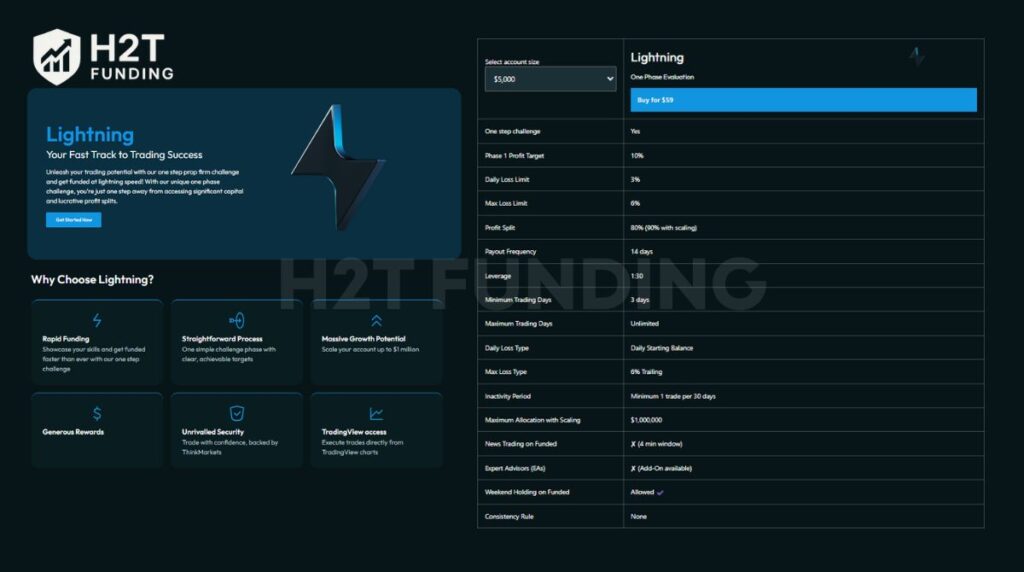

2.1. Lightning evaluation (One-Phase)

The Lightning Challenge is the simplest way to access a ThinkCapital-funded account. With just one evaluation step, traders only need to reach a 10% profit target while managing risk under a 3% daily and 6% maximum loss limit. This makes it straightforward for anyone who wants quick funding without going through multiple phases.

Leverage is capped at 1:30, which feels conservative but helps enforce discipline in trade management. In practice, I found that leveraged accounts set up encourage steadier strategies instead of over-leveraging. If you’re new or prefer a less complex start, Lightning can be a practical choice.

| Account Size | One-Time Fee | Profit Target (10%) | Daily Loss Limit (3%) | Max Loss Limit (6%) |

|---|---|---|---|---|

| $5,000 | $59 | $500 | $150 | $300 |

| $10,000 | $99 | $1,000 | $300 | $600 |

| $25,000 | $199 | $2,500 | $750 | $1,500 |

| $50,000 | $299 | $5,000 | $1,500 | $3,000 |

| $100,000 | $499 | $10,000 | $3,000 | $6,000 |

| $200,000 | $1,099 | $20,000 | $6,000 | $12,000 |

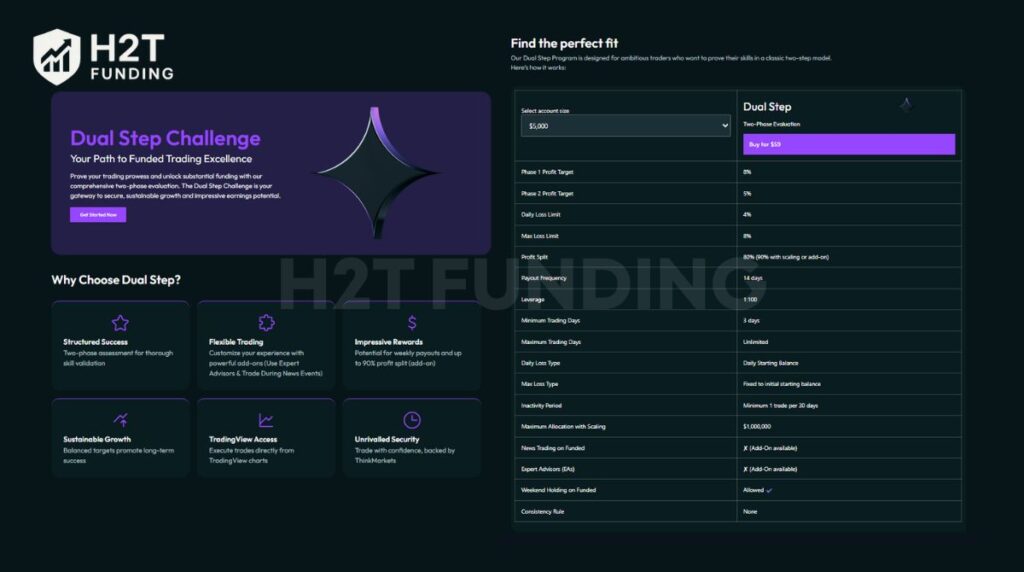

2.2. Dual-Step evaluation (Two-Phase)

The Dual Step Challenge strikes a balance between structure and flexibility. Traders must reach an 8% profit target in Phase 1 and an additional 5% in Phase 2, for a total of 13%. With a higher leverage of 1:100, this model is more suited for active day traders or swing traders who want room to scale positions.

What I noticed is that the two-phase setup creates a psychological break. Hitting the first target builds confidence, but the second phase tests whether traders can remain consistent under the same drawdown rules. It’s a fair way to filter out one-off lucky runs and reward genuine skill.

| Account Size | One-Time Fee | Phase 1 Target (8%) | Phase 2 Target (5%) | Daily Loss Limit (4%) | Max Loss Limit (8%) |

|---|---|---|---|---|---|

| $5,000 | $59 | $400 | $250 | $200 | $400 |

| $10,000 | $99 | $800 | $500 | $400 | $800 |

| $25,000 | $199 | $2,000 | $1,250 | $1,000 | $2,000 |

| $50,000 | $299 | $4,000 | $2,500 | $2,000 | $4,000 |

| $100,000 | $499 | $8,000 | $5,000 | $4,000 | $8,000 |

| $200,000 | $1,099 | $16,000 | $10,000 | $8,000 | $16,000 |

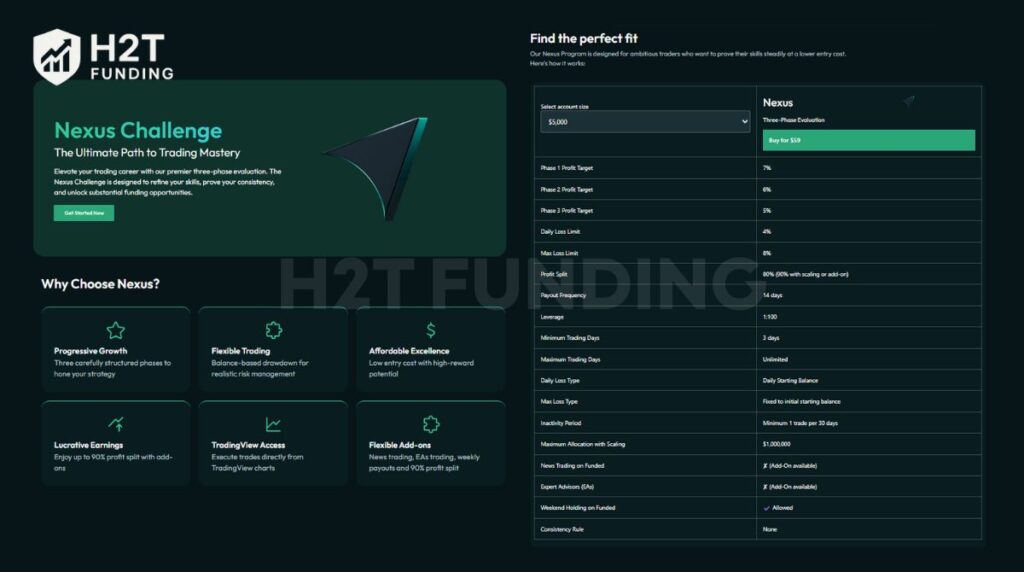

2.3. Nexus evaluation (Three-Phase)

The Nexus Challenge is the most comprehensive evaluation at ThinkCapital. Traders must complete three profit targets: 7% in Phase 1, 6% in Phase 2, and 5% in Phase 3, for a total of 18%. With leverage set at 1:100, the program encourages diverse strategies while still requiring disciplined drawdown control.

This challenge is designed to filter out short-term luck and highlight traders who can deliver performance across multiple market conditions. I find it best suited for experienced traders who value long-term consistency over quick wins.

| Account Size | One-Time Fee | Phase 1 Target (7%) | Phase 2 Target (6%) | Phase 3 Target (5%) | Daily Loss Limit (4%) | Max Loss Limit (8%) |

|---|---|---|---|---|---|---|

| $5,000 | $39 | $350 | $300 | $250 | $200 | $400 |

| $10,000 | $79 | $700 | $600 | $500 | $400 | $800 |

| $25,000 | $139 | $1,750 | $1,500 | $1,250 | $1,000 | $2,000 |

| $50,000 | $199 | $3,500 | $3,000 | $2,500 | $2,000 | $4,000 |

| $100,000 | $349 | $7,000 | $6,000 | $5,000 | $4,000 | $8,000 |

| $200,000 | $749 | $14,000 | $12,000 | $10,000 | $8,000 | $16,000 |

2.4. ThinkCapital challenge add-ons

Beyond the standard evaluation models, ThinkCapital provides a set of add-ons that traders can purchase to customise their challenge experience. These extras are optional, but they can significantly change how flexible the evaluation feels, from increasing payout frequency to easing profit targets.

The add-ons are tied to specific platforms and challenge types. For example, Expert Advisors (EAs) are only available on MT5, while options like 90% profit split or weekly payouts apply to the Dual Step and Nexus programs. Accountants who rely on short-term volatility may also find the news trading add-on valuable, as it unlocks opportunities that are usually restricted.

| Add-On | Lightning (MT5 Only) | Dual Step (ThinkTrader & MT5) | Nexus (ThinkTrader & MT5) | Extra Cost |

|---|---|---|---|---|

| Expert Advisors (EAs) | Yes | Yes (MT5 only) | Yes (MT5 only) | +25% of the fee |

| 90% Profit Split | No | Yes | Yes | +25% of the fee |

| News Trading | No | Yes | Yes | +25% of the fee |

| Weekly Payouts | No | Yes | Yes | +25% of the fee |

| Classic 10% / 5% | No | Yes | No | +10% of the fee |

2.5. ThinkTrader trial program (Free 14-Day Demo)

ThinkCapital also offers a free 14-day ThinkTrader Trial Program. This trial lets you test the platform and trading conditions before paying for a real challenge. It feels simple, but it still follows real evaluation rules, so you know exactly what to expect.

Key Features

- Duration: 14 days

- Minimum active days: 3

- Profit target: 5%

- Daily loss limit: 4%

- Max loss limit: 8%

- Leverage: 1:100

- Platform: ThinkTrader only

- Weekend holding: Allowed

- Weekend crypto trading: Allowed

- News trading: Allowed

- EAs: Not allowed

- Account sizes: $5K, $10K, $25K, $50K, $100K

The free trial runs for 14 days and uses real market conditions on ThinkTrader. You trade normally but stay within a 5% target and the loss limits. You only need three active trading days, and you can hold trades over the weekend. The rules help you practice discipline before joining a paid challenge.

You start by signing up on the ThinkCapital website. After creating your account, you log in to the Client Dashboard and activate the trial. Once it’s active, you receive instant access and can begin trading right away. Each trader can only open one trial account at a time.

Verdict on ThinkCapital funding program

After reviewing all three evaluations, I see the ThinkCapital funding program as one of the more flexible setups in the prop firm space. The Lightning challenge is ideal for traders who prefer simplicity and speed, while the Dual Step challenge strikes a balance between fairness and structure. For advanced traders, the Nexus challenge offers the deepest test of consistency, making it a serious benchmark.

I especially value that ThinkCapital allows traders to choose their challenge style instead of forcing a one-size-fits-all model. If your goal is steady progress with real accountability, ThinkCapital’s model delivers a fair shot at long-term funded trading.

3. ThinkCapital rules

ThinkCapital applies a set of strict trading rules across all challenge types and funded accounts. These guidelines aim to keep trading fair and aligned with real market conditions. Whether you are new or experienced, knowing what is allowed and what is restricted will help avoid violations that could cost your account.

3.1. Allowed Trading Practices

ThinkCapital allows a wide range of trading methods as long as they follow risk management principles and reflect genuine market behaviour. These permissions give traders flexibility to use their own style without being boxed in, but still within clear compliance limits.

- Manual trading: All trades must come from your own decisions and market analysis.

- Trading styles: Scalping, swing, and trend trading are supported if they respect the firm’s risk rules.

- Position holding: It is permitted to keep trades overnight or across weekends, provided the drawdown thresholds are not violated.

- Internal copy trading: Allowed between ThinkCapital accounts using the EA add-on on MT5, but never from external accounts.

- Risk management: Approaches that emphasise steady growth, stop-loss placement, and careful position sizing are encouraged.

3.2. Prohibited Trading Practices

Certain strategies are completely off-limits because they distort fair play or mimic gambling behaviours. Violations of these restrictions can result in immediate account suspension or loss of profits, so traders need to stay alert to these rules.

- News trading: Without the add-on, no trades may be opened, closed, or modified two minutes before and after high-impact news events.

- Expert Advisors (EAs): Automated trading bots are banned unless the EA add-on is purchased and used on MT5.

- High-Frequency Trading (HFT): Ultra-fast strategies, latency arbitrage, or manipulative bots are not permitted.

- Grid or martingale systems: Methods that double trade size after losses or hedge across accounts are prohibited.

- Account control: Sharing access, reselling accounts, or letting someone else trade on your behalf leads to termination.

- Market manipulation: Exploiting delayed price feeds, unnatural order layering, or collusion with other traders is strictly forbidden.

Verdict on ThinkCapital rules

The rules here feel balanced and professional. Traders get freedom to use different strategies and even hold positions long term, but shortcuts like martingale or news scalping without add-ons are filtered out.

These restrictions make sense: they protect the program’s integrity and push traders to act as if they were handling their own capital. For anyone serious about longevity, ThinkCapital’s framework offers the ideal balance of flexibility and accountability.

Check all the guides for a detailed overview of general prop firm rules.

4. ThinkCapital payout structure

One of the strongest selling points of the ThinkCapital prop firm is its transparent and flexible payout system. Instead of long waiting periods, traders have access to profits on a bi-weekly cycle, and in some cases, even weekly. This consistency helps build trust and supports smoother cash flow for active traders.

- Frequency: Standard schedule is every 14 days after the first trade, with an optional weekly upgrade for Dual Step challenge and Nexus accounts.

- Profit split: Default split starts at 80%, which can be increased to 90% through an add-on.

- Processing speed: Payouts are typically processed within three business days. Crypto withdrawals often arrive within 24–48 hours.

- Withdrawal methods: Currently limited to cryptocurrency (mainly USDT) and card-based options, with bank transfers expected in upcoming updates.

- Minimum payout: There is no hard limit, but profits must generally exceed $100 to cover transaction costs.

- Fee refunds: On your first successful payout, ThinkCapital refunds your challenge fee, making the evaluation effectively cost-free if you pass.

Verdict on ThinkCapital payout structure

The payout model at ThinkCapital feels well thought out and trader-friendly. Bi-weekly cycles work well for those who value stability, while the weekly add-on offers flexibility for traders who rely on quicker access to profits.

With a 90% profit split, the upgrade is competitive with industry leaders, and refunding the initial challenge fee on the first withdrawal is a practical bonus. The only drawback right now is the reliance on crypto for payouts, but with bank transfers planned, this should improve over time.

5. ThinkCapital scaling plan

The scaling plan at ThinkCapital is designed to reward consistent traders by gradually increasing their account size. Instead of chasing short-term gains, this system focuses on steady growth over a three-month cycle. Hitting performance targets not only secures profits but also unlocks larger capital allocations, giving traders more room to apply their strategies over time.

| Requirement | Details |

|---|---|

| Eligibility | Minimum 10% profit within 3 months (≈3.33% monthly average) |

| Scaling increase | +20% of the original account balance per scaling event |

| Review cycle | Conducted every 3 months |

| Withdrawal condition | Must complete 3 withdrawals during each review period |

| Maximum allocation | Up to $1M on MT5 accounts, or $1.5M on ThinkTrader |

| Restriction | No splitting, merging, or switching between platforms |

Verdict on ThinkCapital scaling plan

The scaling program feels like a realistic pathway for traders aiming at long-term success. Rather than pushing for huge profits in one shot, the structure encourages sustainable returns of around 3% per month. What stands out is that each scale-up is based on the original balance, making the growth predictable and transparent.

For example, starting at $100,000, the first increase brings the account to $120,000, then $140,000, and eventually $160,000. This step-by-step progression adds both motivation and discipline, creating a fair system that rewards patience and consistency.

Read more:

6. Spread & commissions of ThinkCapital

Trading costs at ThinkCapital prop firm depend mainly on the platform you choose. MT5 is designed for traders who want raw spreads, but it applies small commissions on certain assets.

ThinkTrader, on the other hand, keeps things simple with commission-free trading across all instruments, though spreads are slightly wider. This dual structure gives traders the flexibility to match cost models with their trading style.

| Platform | Asset Class | Commission | Spread Type |

|---|---|---|---|

| MT5 | Forex (FX) | $4 per lot per side | Raw, very tight |

| Gold & Silver | $4 per lot per side | Raw, tight | |

| Indices | $0 | Raw | |

| Oil | $0 | Raw | |

| Crypto | $0 | Raw | |

| ThinkTrader | All assets (FX, metals, indices, oil, crypto) | $0 | Standard (slightly wider) |

During testing, spreads on ThinkTrader for EUR/USD started around 0.8 pips, expanding to 2.5 pips or more on minor pairs. MT5 spreads proved tighter and better suited for scalping or strategies where every pip counts.

However, the commission of $4 per side (about $8 round trip) on FX and metals is slightly higher than some competitors that charge $6–$7 total per lot.

Verdict on ThinkCapital spreads & commissions

The fee model here feels both transparent and flexible. MT5 offers raw pricing for traders who prioritise tighter spreads, even if it means paying a small commission. ThinkTrader, meanwhile, appeals to those who prefer a flat zero-commission structure with predictable costs, even if spreads are wider.

Having both options is a strength; scalpers and active forex traders can stick with MT5, while long-term or multi-asset traders may find ThinkTrader the more straightforward and cost-effective choice.

7. ThinkCapital trading platform

ThinkCapital supports two main platforms: MetaTrader 5 (MT5) and ThinkTrader with TradingView integration. Both provide advanced tools for charting, trade execution, and strategy testing, giving traders the freedom to choose between automation-ready setups or a more user-friendly experience. The availability of two distinct platforms makes the firm suitable for both technical scalpers and discretionary traders.

7.1. MetaTrader 5 (MT5)

MT5 is widely recognised in the trading world for its multi-asset support, powerful charting, and automated trading systems. It’s a natural choice for traders who rely on Expert Advisors (EAs), though activation requires purchasing the EA add-on.

MT5 also offers access to multiple asset classes with tight raw spreads, making it a solid option for forex-focused strategies or high-precision scalping. However, traders based in the United States and its territories cannot use MT5 due to regional restrictions, which is an important limitation.

7.2. ThinkTrader TradingView

ThinkTrader, enhanced by TradingView integration, provides a modern and intuitive interface. It’s designed for traders who value easy charting, built-in risk calculators, and seamless trade management. The TradingView link adds community-driven insights and collaborative chart sharing, which can be useful for those who prefer a more visual and interactive approach.

Spreads on ThinkTrader are slightly wider than MT5, but the benefit is zero commissions across all assets, making it straightforward for cost-conscious traders.

Verdict on ThinkCapital trading platforms

Overall, ThinkCapital delivers strong flexibility in platform choice. MT5 is tailored to advanced traders who want raw spreads, automation, and customizable tools, while ThinkTrader + TradingView appeals to those who prefer simplicity and collaboration.

The restriction on MT5 for US-based traders is a drawback, but the ThinkTrader setup ensures everyone has access to professional-grade tools. Having both platforms available makes ThinkCapital competitive, as traders can align platform choice directly with their trading style.

8. Trading instruments & leverage

ThinkCapital provides traders with access to a wide range of markets, including forex, indices, commodities, oil, and cryptocurrencies. Each category comes with its own leverage settings, which vary depending on the challenge type and platform. This flexibility allows traders to tailor exposure based on both strategy and risk appetite.

8.1. Forex

Forex is the core market at ThinkCapital, offering majors, minors, and exotic currency pairs. Leverage is 1:30 in the Lightning evaluation and 1:100 in Dual Step and Nexus accounts across both MT5 and ThinkTrader. This setup gives new traders a conservative entry point while still allowing experienced traders to scale up positions in advanced phases.

8.2. Indices

Traders can access global benchmarks such as NAS100, SPX500, and GER40. On both MT5 and ThinkTrader, leverage is set at 1:5 for Lightning accounts and 1:15 for Dual Step and Nexus. This controlled leverage prevents overexposure while still letting traders capture broad market trends.

8.3. Commodities (Gold & Silver)

Precious metals remain a favourite for safe-haven strategies. On MT5, leverage is 1:10 for Lightning and 1:15 for Dual Step/Nexus. ThinkTrader offers higher leverage, from 1:20 to 1:30, making it more attractive for traders who want stronger exposure to gold and silver swings.

8.4. Oil

Both Brent and WTI crude oil are supported across platforms. Leverage is consistent: 1:10 on Lightning accounts and 1:15 on Dual Step and Nexus accounts. This balanced approach ensures that energy traders can participate actively without taking excessive risk.

8.5 Cryptocurrencies

ThinkCapital includes major digital assets like BTCUSD, ETHUSD, and BCHUSD. MT5 accounts run with conservative 1:1 leverage, while ThinkTrader doubles this to 1:2, giving more flexibility for those who want exposure to volatile crypto markets.

Verdict on ThinkCapital instruments & leverage

The instruments at ThinkCapital cover all major asset classes, from traditional forex to modern crypto. The key difference lies in leverage: MT5 is stricter, which suits risk-conscious traders, while ThinkTrader offers higher exposure in metals and crypto. This dual approach makes the firm adaptable, appealing both to cautious traders seeking control and to active ones aiming for greater market opportunities.

9. Education & resources

ThinkCapital doesn’t just provide trading accounts; it also supports traders with a growing set of educational materials. These resources are aimed at improving skills, building confidence, and helping traders better navigate both the evaluation and funded stages.

Available resources

- YouTube video library: Over 100 tutorials covering platform setup, trading strategies, and market analysis.

- Trading psychology content: Videos and guides focused on mindset, discipline, and handling pressure.

- Strategy insights: Case studies and interviews with funded traders, giving real-world perspectives.

- Risk management training: Practical sessions showing how to size positions and control drawdowns.

Verdict on Education & Resources

The content offered is both practical and accessible. Having tutorials directly tied to ThinkCapital’s platforms makes onboarding smoother, while broader topics like psychology and risk management add depth. For traders who want structured growth, the resources provide real value rather than just surface-level tips.

10. Think Capital customer support

Reliable support is critical when trading with a prop firm, and ThinkCapital ensures traders have multiple ways to get assistance. The system is designed to handle both urgent issues and general queries, so traders can stay focused on trading instead of technical hurdles.

Support channels

- Live chat: The fastest way to resolve urgent issues, available directly on the ThinkCapital website.

- Email support: Ideal for detailed or non-urgent inquiries, with responses typically within 24 hours.

- Contact form: A simple option for traders who want to submit structured requests without using live chat.

- Social channels: Updates and announcements are also shared via YouTube, the official ThinkCapital Discord, and other community platforms.

Verdict on customer support

The support team feels responsive and approachable. Live chat works well for immediate needs, while email ensures more complex questions are handled properly. Combined with the firm’s active online presence, these channels provide a reliable safety net for both new and experienced traders.

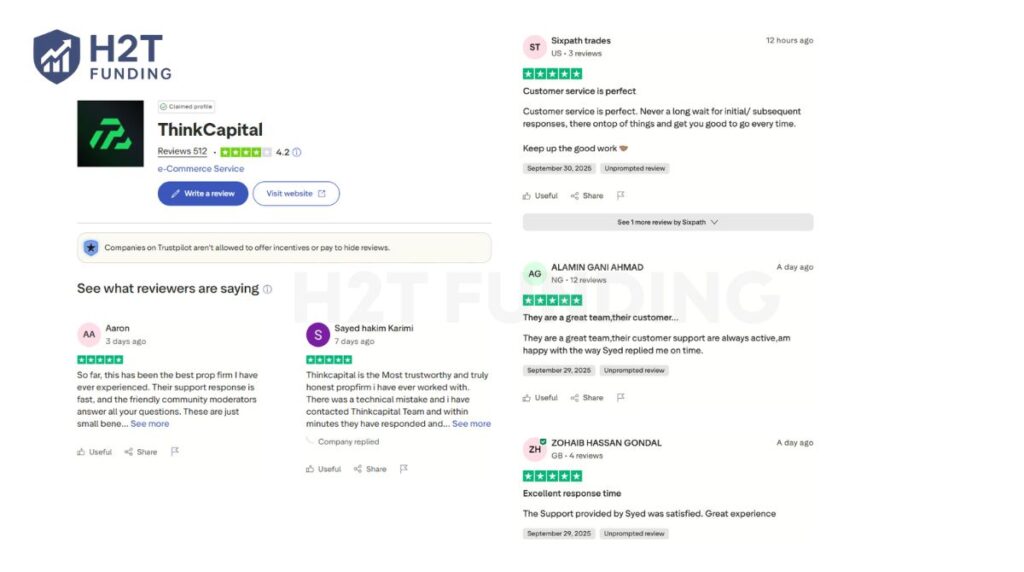

11. Trader feedback with ThinkCapital Trustpilot, and ThinkCapital Reddit

Reputation is always a key factor when evaluating a prop firm. ThinkCapital reviews have a Trustpilot rating of 4.2/5 (based on 512 reviews), which shows a strong overall image. However, digging deeper reveals a mix of highly positive experiences and some serious concerns raised by traders.

Multiple reviews specifically praised the quick response times of ThinkCapital’s team, mentioning names like Syed for timely assistance. Others point out that the live chat system works efficiently, giving them confidence that issues won’t delay their trading journey.

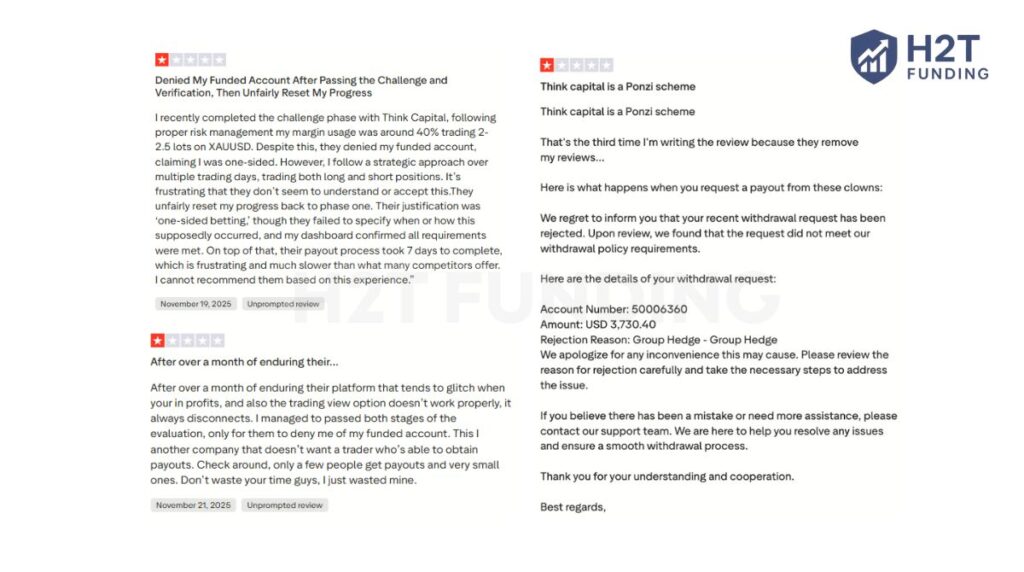

On the flip side, some traders report serious issues with withdrawals. Complaints about payout rejections due to “group hedging” appear multiple times, with users stating they were banned or had profits voided without clear evidence. A few even accused ThinkCapital of operating unfairly, using terms like “Ponzi scheme” in their reviews. These criticisms raise red flags for traders who prioritise transparent payout policies.

The community’s view on ThinkCapital is split. Many traders praise the responsiveness of the support team and find the platform experience smooth, while others express frustration over payout disputes and account bans. Overall, ThinkCapital’s reputation is promising but not flawless.

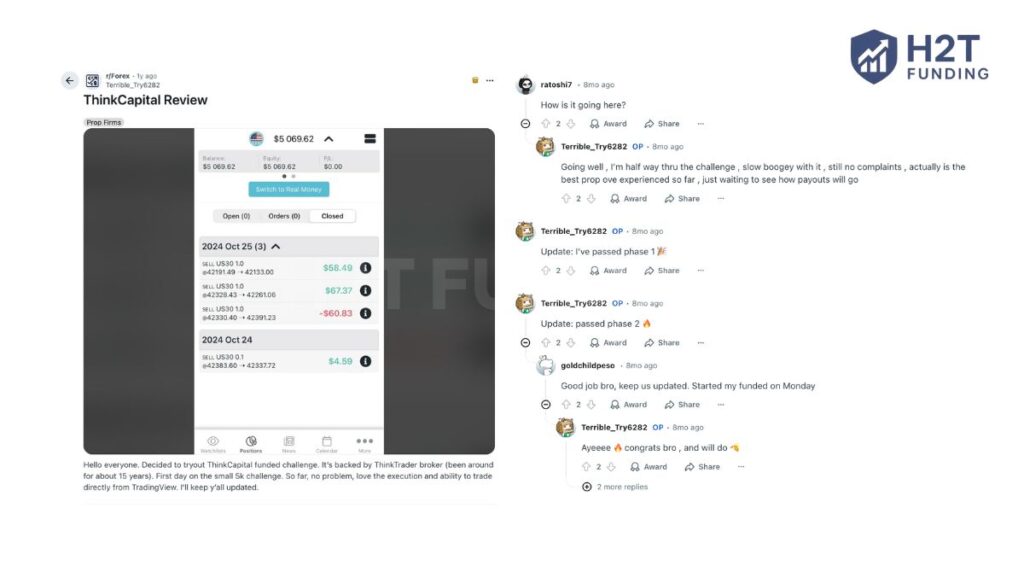

On Reddit, some traders also shared their real progress with ThinkCapital. In one post, a trader started the $5K challenge and showed his early trades on ThinkTrader. He said the execution felt smooth, and he liked trading directly from TradingView.

The same trader later updated the thread and said he passed Phase 1 and then Phase 2. He mentioned that the challenge felt fair, and he had no complaints during the evaluation. These updates suggest that some traders have a positive experience with ThinkCapital’s rules and trading conditions.

It appeals to those who value customer service and platform choice, yet it leaves questions around the enforcement of rules like group hedging. Anyone considering the firm should weigh mixed reviews carefully before joining.

12. How to sign up for an account on ThinkCapital

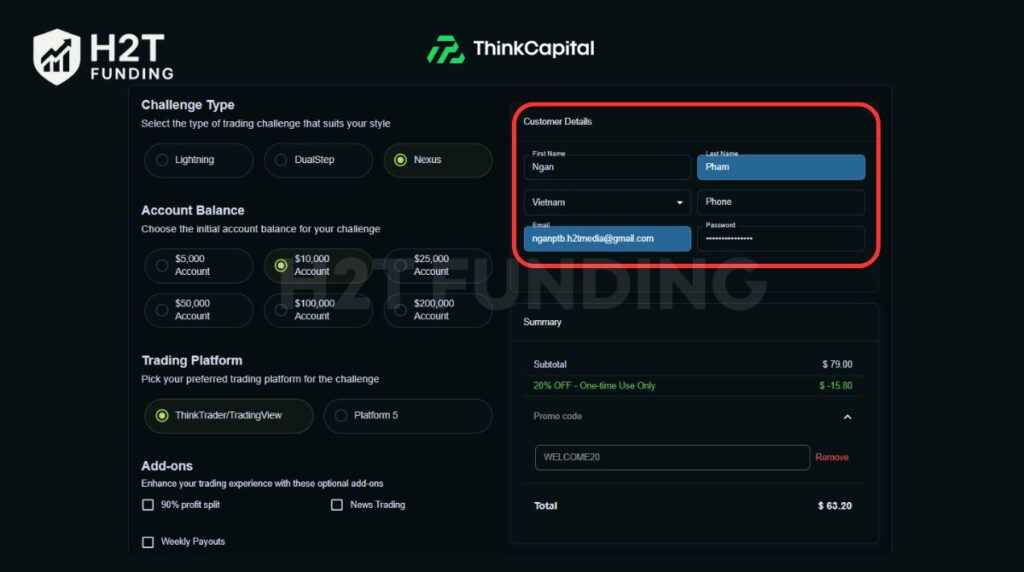

The ThinkCapital login setup is simple enough for traders to access their dashboard within minutes. Here’s how it works step by step:

12.1. Step 1: Select your challenge type

Go to the official ThinkCapital website and click on the Get Funded button. This will take you to the challenge selection page, where you can compare the three programs: Lightning, Dual Step, and Nexus, along with their requirements and features.

12.2. Step 2: Customise account settings

After picking a challenge, you’ll configure your account by choosing:

- Account balance (from $5,000 up to $200,000)

- Trading platform (MT5 or ThinkTrader with TradingView)

- Add-ons such as weekly payouts, 90% profit split, or news trading access

This customisation ensures the account setup matches your preferred trading style.

12.3. Step 3: Enter personal details

Next, you’ll complete a short registration form with your first and last name, email, phone number, country of residence, and password. There’s also an optional field for a ThinkCapital promo code. Accurate details here prevent verification delays later.

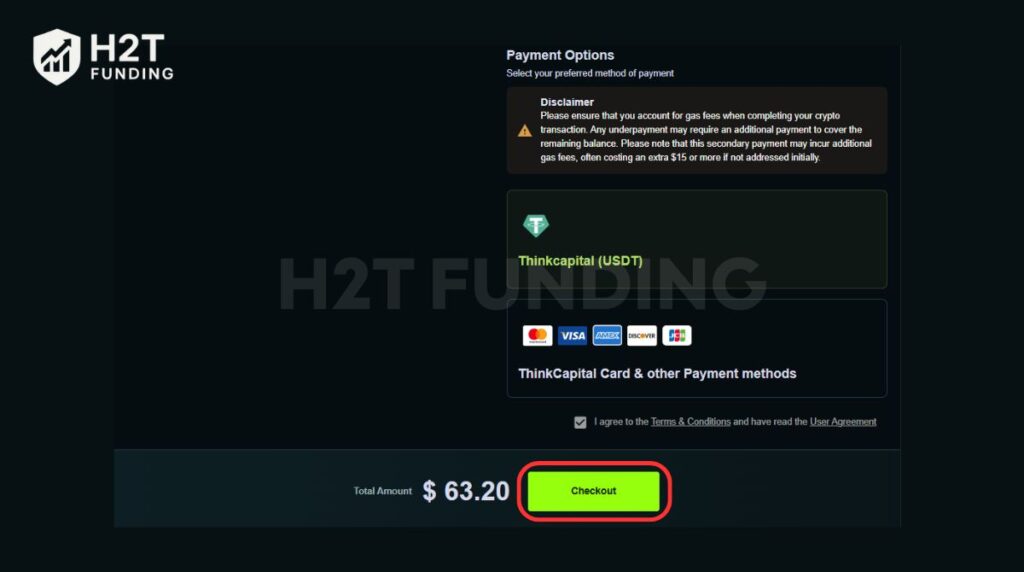

12.4. Step 4: Complete payment

Finally, you’ll select a payment method and confirm your order. ThinkCapital currently accepts:

- Cryptocurrency (USDT) for fast processing

- Credit/Debit cards such as Visa, MasterCard, AMEX, JCB, Discover

Once payment is successful, your account is activated. You’ll receive login credentials via email and can start trading almost immediately.

13. Compare ThinkCapital vs other prop firm

When choosing a prop firm, traders often weigh fees, profit splits, account sizes, and trading conditions. ThinkCapital competes with names like Ment Funding and E8 Funding, both of which have their own strengths. A side-by-side comparison highlights the main differences and helps identify which firm aligns best with specific trading styles.

| Criteria | ThinkCapital | Ment Funding | E8 Funding |

|---|---|---|---|

| Challenge Fee | $39 – $1,099 | $250 – $17,200 | $40 – $4,460 |

| Account Types | Lightning (1-phase), Dual Step (2-phase), Nexus (3-phase) | One Phase Evaluation | E8 One, E8 Classic, E8 Track |

| Profit Split | Up to 90% | 75% – 90% | 80% – 100% |

| Account Size | $5K – $200K (scalable to $1.5M) | $25K – $2M | $5K – $500K |

| Time Limit | No time limit | No time limit | No time limit |

| Profit Target | 7% – 10% (depends on challenge) | 10% | 4% – 8% |

| Platforms | MT5, ThinkTrader + TradingView | MT4, MT5, Match Trader, DXTrade, cTrader | MT5, cTrader, Match Trader, TradeLocker |

| Markets | Forex, Indices, Commodities, Oil, Crypto | Forex, Crypto, Indices, Commodities, Stocks | Forex, Commodities, Indices, Crypto, Energy |

Choosing between these firms depends on your trading style, account needs, and growth expectations. Here’s a quick breakdown of which prop firm suits which type of trader:

- ThinkCapital: Best for traders who want multiple evaluation models (1-phase, 2-phase, 3-phase) and scalability up to $1.5M, with useful add-ons like news trading and weekly payouts.

- Ment Funding: Appeals to those managing very large accounts (up to $2M), though high fees make it less suitable for beginners.

- E8 Funding: A good fit for traders who prefer lower profit targets (4%–8%) and potentially a 100% profit split, though scaling stops at $500K.

14. Countries not supported by ThinkCapital

While ThinkCapital serves traders worldwide, there are specific regions where services are restricted due to regulatory, compliance, or risk-related concerns. Residents and citizens of these countries cannot open new accounts or trade under ThinkCapital’s funding programs.

Restricted countries:

- Afghanistan

- Albania

- Australia

- British Columbia (Canada)

- Burma (Myanmar)

- Burundi

- Central African Republic

- Cuba

- Cyprus

- Guinea

- Haiti

- Iran

- Iraq

- Kosovo

- Lebanon

- Libya

- Mali

- Midway Islands

- North Korea

- Republic of the Congo

- Samoa

- Somalia

- Sudan

- Syria

- Vatican City State

- West Bank

- Western Sahara

- Yemen

- Zambia

- Ukraine

- Russia

- Vietnam (New accounts not allowed; existing users may trade but cannot purchase new challenges)

These limitations are part of ThinkCapital’s legal compliance obligations. They reflect sanctions, financial regulations, or regional laws that prevent the firm from operating freely in these jurisdictions. Traders should carefully review their eligibility before signing up to avoid account rejections or complications later.

15. Is ThinkCapital legit?

Yes, ThinkCapital is legit because ThinkMarkets is a regulated broker. This means the firm follows financial regulations, audits, and compliance standards, providing real capital for traders. It runs structured funding programs with clear rules, enforced drawdowns, and monitored trading to prevent abuse or unfair practices.

The firm holds a 4.2/5 rating on Trustpilot, showing that most users report positive experiences. Traders praise timely payouts, responsive support, and reliable account management. The combination of regulated backing, transparent processes, and consistent community feedback makes ThinkCapital a trustworthy choice for funded trading.

16. FAQs

For all challenges, the minimum trading period is 3 days. This ensures you demonstrate consistency before moving forward.

Yes, ThinkCapital processes payouts. Profits are paid biweekly by default, with an option to upgrade to weekly payouts via an add-on.

By default, payouts occur every 14 days. If you activate the weekly payout add-on, you can access profits once per week.

ThinkCapital is headquartered in the United Arab Emirates and the UK, with operations linked to ThinkMarkets Group.

You select one of three challenges (Lightning, Dual Step, Nexus). Each requires you to meet profit targets under defined drawdown rules before qualifying for funding.

Traders can choose between MetaTrader 5 (MT5) and ThinkTrader integrated with TradingView, depending on their style.

The firm offers forex, indices, commodities, oil, and cryptocurrencies, giving traders broad exposure across markets.

Leverage depends on account type and platform, ranging from 1:30 on Lightning to 1:100 on Dual Step/Nexus for forex, with lower levels for indices and crypto.

You can start with as little as $5,000 and scale up to $200,000, with long-term progression up to $1.5M under the scaling plan.

Yes, ThinkCapital refunds your challenge fee after your first successful payout, provided you meet the conditions.

If you breach the rules, the challenge ends. However, you can repurchase the evaluation to try again.

No, ThinkCapital does not offer instant funding. Traders must pass one of the evaluation programs before accessing funded capital.

Yes, but beginners may find the Lightning Challenge most approachable since it has a single profit target and lower leverage, making it less complex.

17. Conclusion

This ThinkCapital review has explored every key aspect of the firm, from funding programs and trading rules to payouts, platforms, and community feedback. ThinkCapital stands out for its flexible evaluation models, scalability up to $1.5M, and practical add-ons like weekly payouts and news trading access.

For those seeking a prop firm that balances structure with growth potential, ThinkCapital offers a compelling choice. Still, it’s always wise to compare multiple options before making a decision. Explore more insights and comparisons in our dedicated prop firm review section at H2T Funding to find the firm that best matches your trading goals.