30% OFF Sale

Withdraw day 1 in Pro. 0 minimum days of profit required

Take Profit Trader has carved out a name in the prop trading space by advertising speed, simplicity, and day-one withdrawals. With competitive profit splits, over 18 platform connections, and a growing trader base.

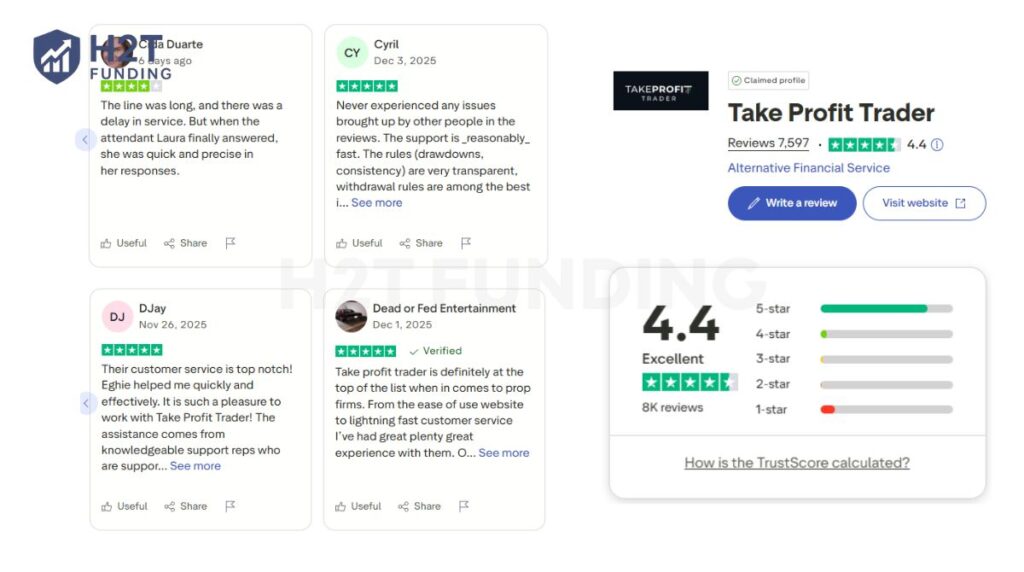

It positions itself as a straightforward gateway to funded trading. Take Profit Trader reviews. Trustpilot has a 4.4-star rating, backed by over 5,000 reviews, signaling credibility that many traders look for.

But headlines rarely tell the full story. Feedback from users, or some Take Profit Trader reviews, complaints about experiences with account rules, billing, or support, all add nuance to the picture.

In this Take Profit Trader review, H2T Funding will unpack its programs, rules, strengths, and limitations. This way, you can judge whether it matches your trading style or if other futures prop firms may be a safer fit.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Take Profit Trader websites before purchasing any challenge.

1. Our take on Take Profit Trader

Take Profit Trader is a U.S.-based proprietary trading firm founded in 2021 by James Sixsmith in Orlando, Florida. Unlike traditional brokers, it focuses exclusively on futures, offering traders access to over 40 instruments across CME, NYMEX, COMEX, and CBOT.

The structure is straightforward: traders who pass gain access to a PRO account with an 80/20 profit split and the option to withdraw from day one. Those who meet higher performance standards can move into a PRO+ account, unlocking a more favorable 90/10 split and additional benefits.

Unlike some competitors, TPT imposes no scaling plan, meaning traders can use the full contract size of their funded account from the start.

Our take is that Take Profit Trader’s simplicity and transparent terms make it appealing to futures traders seeking speed and flexibility. The balance of competitive payouts, same-day withdrawals, and clear rules explains why the firm has built a solid reputation. It currently holds an average of 4.4 stars on Trustpilot from thousands of reviews.

View review YouTube H2T Funding!

2. Take Profit Trader funding program

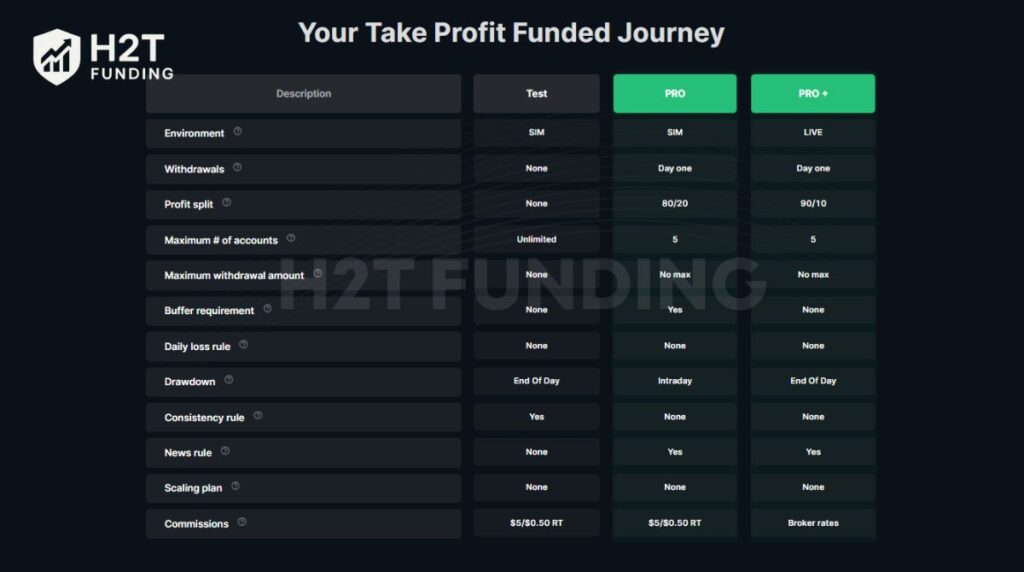

TPT prop firm structures its funding into three clear stages: Test (Evaluation), PRO (Funded Account), and PRO+ (Live Funded Account). Every stage has defined rules for risk, payouts, and progression. Traders begin in a simulated environment and, if consistent, move toward live capital with more favorable terms.

2.1. Test (Evaluation phase)

The Test phase is where every trader starts. You choose one of five account sizes, ranging from $25,000 to $150,000, by paying a monthly subscription fee. Your task is simple: reach the profit target without breaking the rules.

There is no maximum time limit. You can pass in as little as five trading days, or take longer if you prefer, as long as you maintain the subscription. The profit goal is set at +6% of the starting balance, with trailing drawdown limits applied.

| Account Size | Monthly Fee | Profit Target | Max Position Size | Trailing Drawdown | Daily Loss Rule | Notes |

|---|---|---|---|---|---|---|

| $25,000 | $150 | $1,500 | 3 Contracts / 30 Micros | $1,500 | Removed | Min 5 trading days |

| $50,000 | $170 | $3,000 | 6 Contracts / 60 Micros | $2,000 | Removed | – |

| $75,000 | $245 | $4,500 | 9 Contracts / 90 Micros | $2,500 | Removed | – |

| $100,000 | $330 | $6,000 | 12 Contracts / 120 Micros | $3,000 | Removed | – |

| $150,000 | $360 | $9,000 | 15 Contracts / 150 Micros | $4,500 | Removed | – |

2.2. PRO (Funded account)

After passing the Test, you pay a one-time $130 activation fee to unlock the PRO account. This stage still runs on simulation, but profits are now split 80/20; you keep 80% while TPT takes 20%.

A major advantage is instant withdrawals. You can request payouts from day one, provided your profits exceed the required Profit Buffer. This buffer is an amount equal to the account’s maximum drawdown. You can only withdraw profits earned above this buffer.

For example, on a $50,000 account with a $2,000 drawdown, your account balance must reach $52,000 before you can make a withdrawal. The buffer itself is not withdrawable.

PRO Account Overview

| Description | PRO Account |

|---|---|

| Environment | SIM |

| Withdrawals | Day one |

| Profit Split | 80/20 |

| Max Accounts | 5 |

| Maximum Withdrawal Amount | No max |

| Buffer Requirement | Yes |

| Daily Loss Rule | None |

| Drawdown | Intraday |

| Consistency Rule | None |

| News Rule | Yes |

| Scaling Plan | None |

| Commissions | $5 / $0.50 RT |

Crucially, the trailing drawdown rule shifts from being calculated at the End-of-Day (in the Test) to Intraday (in the PRO account), tracking your highest unrealized profit.

2.3. PRO+ (Live funded account)

Traders who show consistent results in PRO can upgrade to PRO+, the live account stage. The main requirement is usually earning at least $5,000 in profits on the PRO account, which triggers an invitation.

PRO+ is a true live brokerage account backed by TPT’s capital. The profit split improves to 90/10, and restrictions are lighter. For example, withdrawals have no buffer, and the drawdown reverts to an End-of-Day (EOD) calculation, which is less restrictive than the PRO account’s Intraday rule.

The trade-off is that your accumulated profit from the PRO account is not carried over; the PRO+ account starts with a $0 balance. This initial profit you generated serves as the firm’s risk capital for your live trading.

PRO+ Account Overview

| Description | PRO+ Account |

|---|---|

| Environment | LIVE |

| Withdrawals | Day one |

| Profit Split | 90/10 |

| Max # of Accounts | 5 |

| Maximum Withdrawal Amount | No max |

| Buffer Requirement | None |

| Daily Loss Rule | None |

| Drawdown | End of Day |

| Consistency Rule | None |

| News Rule | Yes |

| Scaling Plan | None |

| Commissions | Broker rates |

Verdict on Take Profit Trader’s funding program

The simplicity of the one-step evaluation is a huge plus; it takes a lot of pressure off. The PRO stage, though, is a bit of a mixed bag. Instant withdrawals sound great, but that profit buffer means you have to grind longer before you actually cash out, which can be a real hurdle.

For me, the program truly shines once you hit PRO+. A 90/10 split on a live account is the real prize, and the profit reset feels like a fair trade-off to get there.

3. Take Profit Trader rules trading

Take Profit Trader has a clear rulebook designed to protect its capital while giving traders enough room to prove their skill. The conditions vary slightly between the Test, PRO, and PRO+ phases, but the overall theme is the same: trade consistently, respect risk limits, and avoid outsized exposure.

3.1. Allowed trading practices

In both the Test and funded stages, traders have several freedoms that make the program flexible and appealing:

- News trading during the Test phase is fully permitted without restrictions.

- Day-one withdrawals are available in PRO and PRO+, provided buffer rules (in PRO) are respected.

- Copy trading is supported in PRO+, allowing you to mirror trades across up to five accounts.

- Intraday trading styles such as scalping, swing intraday, and scaling into trades are allowed as long as position limits are followed.

- Trade frequency is generous, with up to 50 executions per day, enough for active day traders.

- Multiple account options give flexibility to choose the right funding size and contract allocation.

3.2. Prohibited trading practices

Alongside these freedoms, certain practices are off-limits to protect both traders and the firm:

- Overnight or weekend holding is not allowed; all positions must be flat at least one minute before the daily market close.

- Restricted news trading in PRO and PRO+, including 1 minute before and after major events like FOMC, NFP, CPI, crude oil inventories, and bond auctions.

- Automated trading systems, EAs, or bots are prohibited; only discretionary/manual trading is permitted.

- Exceeding maximum contract sizes (minis or micros) is a violation that immediately ends the account.

- Consistency breach during Test: no single day may account for more than 50% of total profits when reaching the target.

- Trailing drawdown violations: whether calculated End-of-Day (during the Test and PRO+ phases) or Intraday (during the PRO phase), result in immediate account failure.

Verdict on the trading rules of Take Profit Trader

What stands out to me about TPT’s trading rules is the balance between freedom and discipline. On the one hand, the absence of a daily loss limit and the ability to trade news during the Test make the evaluation feel fair.

On the other hand, the restrictions in funded stages, especially around news events and overnight holding, can feel limiting. For traders who thrive on volatility, avoiding CPI or FOMC windows might mean sitting out some of the best opportunities.

The trailing drawdown rules are the trickiest part. Switching from end-of-day in the Test to intraday in PRO often catches traders off guard. Personally, I see this as the toughest hurdle in the program. It rewards tight risk management but can also feel punishing when profits evaporate too quickly.

4. Take Profit Trader payout structure

One of Take Profit Trader’s biggest selling points is its day-one payout policy. The firm advertises that traders don’t need to wait for fixed payout windows or meet minimum trading days.

As soon as you reach a profit above the buffer requirement in a PRO account, you can withdraw immediately. This freedom is rare in the prop firm space, where many competitors impose delays.

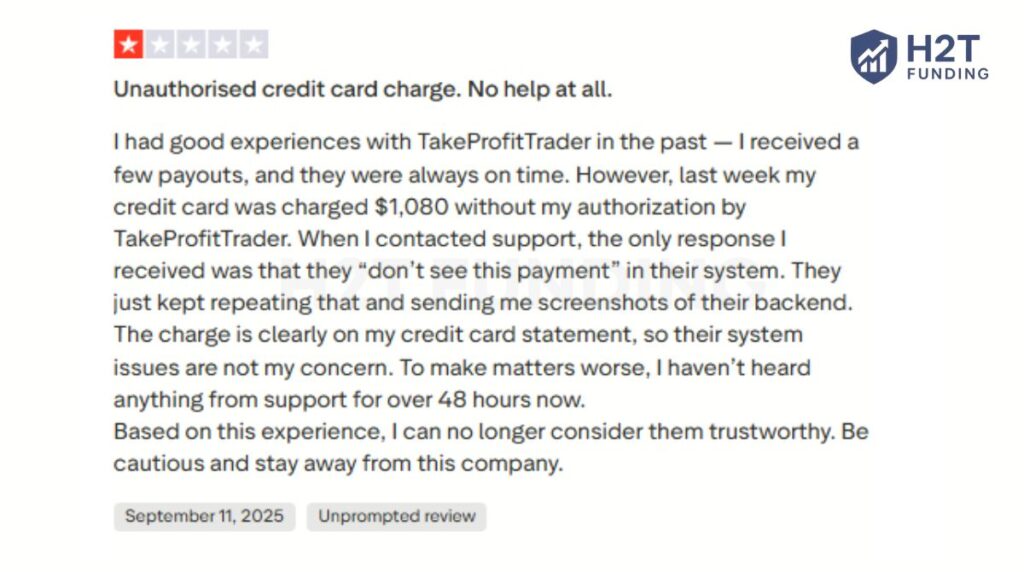

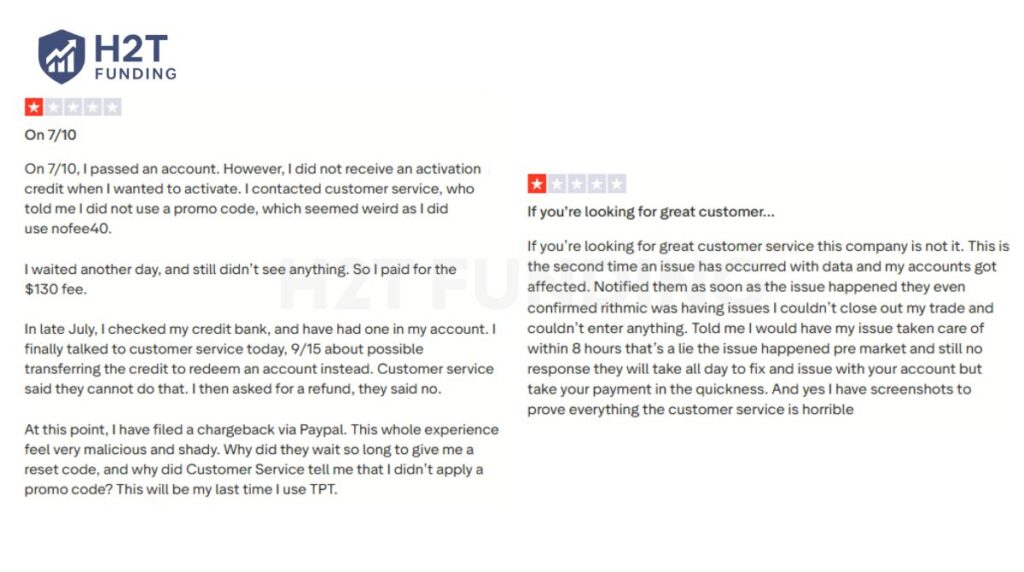

That said, not every trader’s experience has been flawless. Some reviews on Trustpilot highlight issues with support and billing, including reports of unauthorized charges and delays in response.

While these don’t directly affect the payout structure itself, they show that execution may not always match the advertised simplicity. It’s important for traders to weigh both the promise of instant payouts and the risk of occasional administrative hiccups.

Verdict on payout structure

The day-one payout policy is a standout feature, no question. It cuts out the frustrating wait times you see at other firms. That said, it’s worth noting the user reviews that mention billing issues. A great policy on paper only works if the execution is reliable every time.

5. Commissions of Take Profit Trader

Take Profit Trader applies a flat commission model across its accounts. For standard futures contracts, the commission is $5 per round-trip per contract. For micro contracts, the rate is $0.50 per round-trip per contract, making it cost-effective for traders who prefer smaller positions.

In PRO+ accounts, commissions are charged at broker rates since orders are routed directly through a live exchange feed. This means actual costs may vary slightly depending on the broker partner, but traders gain the benefit of direct market execution.

Verdict on commissions

In my experience, the commission setup at TPT feels fair and easy to manage. The flat $5 for contracts and $0.50 for micros keeps costs predictable, which is a relief when trading actively. Even though PRO+ moves to broker rates, I see this as a worthwhile trade-off for direct exchange access and better fills.

6. Trading platform Take Profit Trader

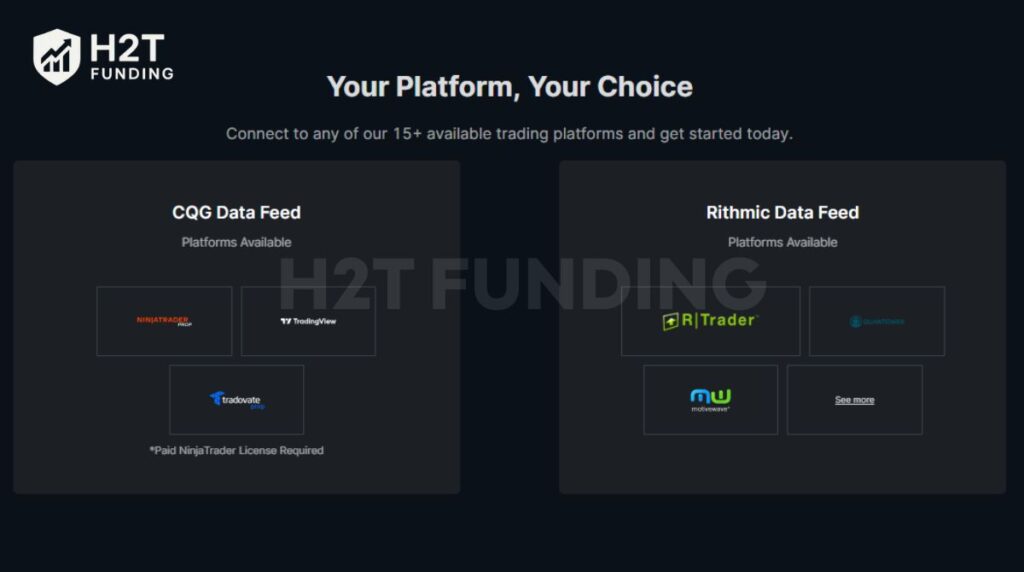

One of TPT’s strong points is its wide platform compatibility. Instead of forcing traders onto a single proprietary system, the firm supports both CQG and Rithmic data feeds. This setup makes TPT accessible on more than 15 platforms, including many industry favorites used by futures traders worldwide.

With the CQG feed, traders can connect to:

- NinjaTrader (license required for full version)

- TradingView

- Tradovate

With the Rithmic feed, options expand further to include:

- R Trader

- Quantower

- MotiveWave

- Bookmap

- AgenaTrader

- Sierra Chart

- MultiCharts

- Jigsaw Trading

- OrderFlow Trading

- eSignal

- Investor/RT

- Trade Navigator

- VolFix

- PhotonTrader

- QScalp

- ATAS

Overall, this wide compatibility is a major plus. Traders can stick with their favorite tools and test strategies across multiple platforms. They can also transition smoothly from the simulated Test/PRO stages to the live PRO+ account, where orders are routed directly to the exchange.

Verdict on the Take Profit Trader trading platform

The real strength of TPT’s platform setup lies in freedom. Instead of boxing traders into one system, the firm gives access to 15+ options through CQG and Rithmic. From scalping with Bookmap to charting on TradingView, it feels more like building your own workstation than adapting to a rigid template.

The only catch is that some platforms, like NinjaTrader, require a paid license or extra data fees, a small detail worth checking before you commit. For me, this variety is a big plus compared to firms that limit you to just one in-house platform.

7. Trading instruments & leverage

Take Profit Trader is a futures-only prop firm, giving traders access to contracts listed on major U.S. exchanges, including CME, COMEX, NYMEX, and CBOT.

Unlike some competitors, it does not support stocks, options, crypto, or CFDs. Instead, the program emphasizes depth within the futures market, from equity indices to commodities.

Leverage is defined not by ratios but by maximum contracts per account size, ensuring that exposure remains controlled while still offering room to scale positions.

| Account Size | Max Contracts | Max Micros |

|---|---|---|

| $25,000 | 3 | 30 |

| $50,000 | 6 | 60 |

| $75,000 | 9 | 90 |

| $100,000 | 12 | 120 |

| $150,000 | 15 | 150 |

With these limits, traders can choose from a broad range of futures instruments, such as:

- Equity indices: S&P 500, Nasdaq, Dow, Russell 2000

- Metals: gold, silver, copper

- Energy: crude oil, natural gas, gasoline

- Interest rate futures: U.S. Treasuries

- FX futures: euro, yen, pound, Canadian dollar

- Agricultural: corn, wheat, soybeans

This combination of strict contract caps and wide product choice makes the program suitable for intraday traders who value both structure and flexibility in futures trading. It keeps risk in check while still allowing access to the core instruments that drive global futures markets.

Verdict on trading instruments & leverage

From my perspective, this setup strikes a good balance. The contract caps keep risk realistic, while the variety of products lets traders focus on their strengths, whether that’s indices, commodities, or agricultural markets. It feels disciplined without being restrictive, which is exactly what a futures-focused prop program should deliver.

8. Education & resource

Take Profit Trader makes a clear effort to provide value beyond just funding. The firm offers a free playbook that outlines common mistakes, proven habits of funded traders, and practical tips such as mastering consistency rules. TPT positions its education as an accessible tool for anyone looking to pass evaluations.

Key topics from their materials include:

- Why traders often fail evaluations (beyond strategy mistakes)

- Insights from analyzing thousands of accounts

- The benefits and risks of trading larger accounts

- Simple adjustments to existing strategies rather than reinventing the wheel

This approach reflects the founder’s philosophy of moving away from expensive, “snake-oil” education and instead building a transparent ecosystem where learning is free and practical.

Verdict on education & resources

I find TPT’s decision to give away education for free refreshing in an industry filled with upsells. The playbook feels actionable, not gimmicky, and the focus on trader psychology and consistency rules is especially relevant. It’s not a full trading course, but as a companion to the funding program, it adds real value.

9. Customer support

Customer support is another area where TPT aims to differentiate itself. The firm promotes nearly 24/7 live chat access, email support, and a structured FAQ section for common questions.

They also maintain a presence on social media, with communities across Twitter, YouTube, Instagram, and LinkedIn. This multi-channel availability makes it easier for traders to get help quickly.

TPT emphasizes responsiveness, positioning customer service as a cornerstone of its “trader-friendly” vision.

However, user reviews are mixed. Many report fast assistance from the support team. Others have shared frustrations about delayed responses or unresolved billing issues. This inconsistency shows that while the infrastructure is in place, execution can vary depending on the issue.

Verdict on customer support

Having live chat is a definite plus and puts TPT ahead of some rivals. But the mixed reviews on reliability can’t be ignored. It seems that while the support channels exist, the quality of help can be inconsistent. So, I’d call it promising but not perfect, something to be aware of before you sign up.

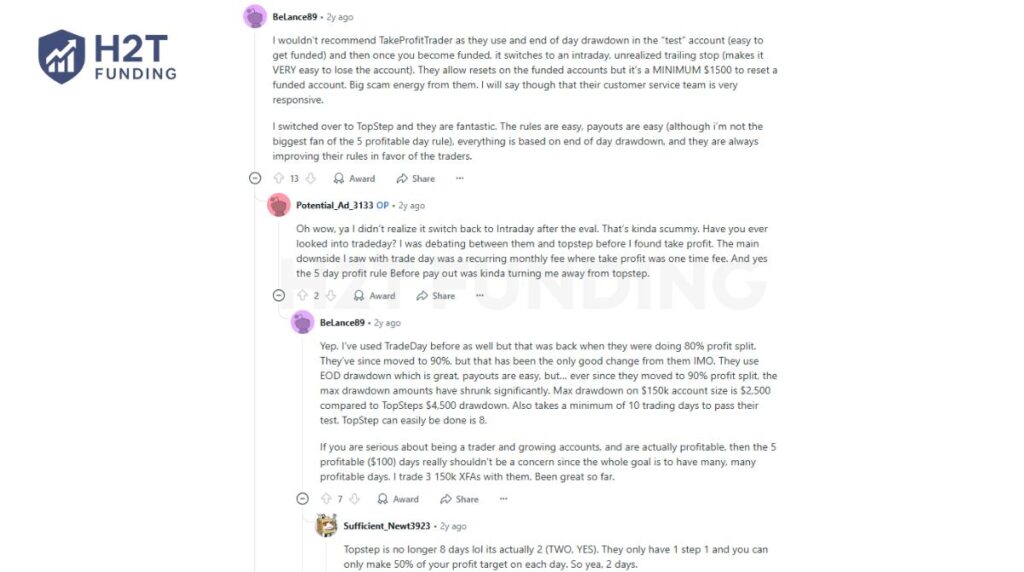

10. Experience of a real trader: Take Profit Trader Trustpilot, and Reddit review

On Trustpilot, many traders highlight fast payouts and transparent rules. One user reported hitting profit targets on five accounts and receiving payouts within 10 minutes of approval, a clear sign that TPT can deliver when the process works smoothly. Others praised quick support in resolving subscription or billing issues.

Negative reviews tell another story. Some traders reported experiencing unauthorized charges, disputes over promo codes, and delays in refunds.

A recurring frustration is the shift from end-of-day to intraday trailing drawdown, which critics say makes it too easy to lose funded accounts. Even so, a few admitted live chat agents were responsive, if not always effective.

On Take Profit Trader reviews Reddit, feedback mirrors this divide. Traders liked TPT’s high profit splits and same-day payouts, but many questioned the stricter drawdown rules once funded. Some compared it with Topstep or TradeDay, noting that while TPT has lower upfront costs, its long-term rules can feel like hidden hurdles.

11. How to start with Take Profit Trader

Getting started with Take Profit Trader involves a few simple but important steps. Here’s how the onboarding process works:

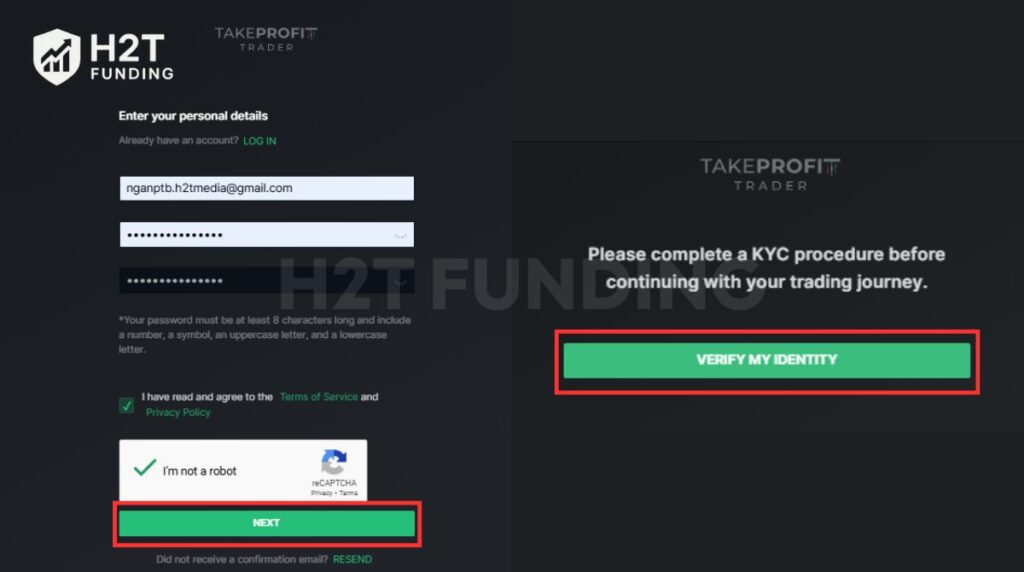

Step 1: Create your account

Go to the TPT website, enter your email, set a secure password, and agree to the Terms of Service and Privacy Policy. This creates your trading profile.

Step 2: Confirm your email

You’ll receive a confirmation email with a link. Click it to validate your account and activate login access. Without this step, you can’t move forward.

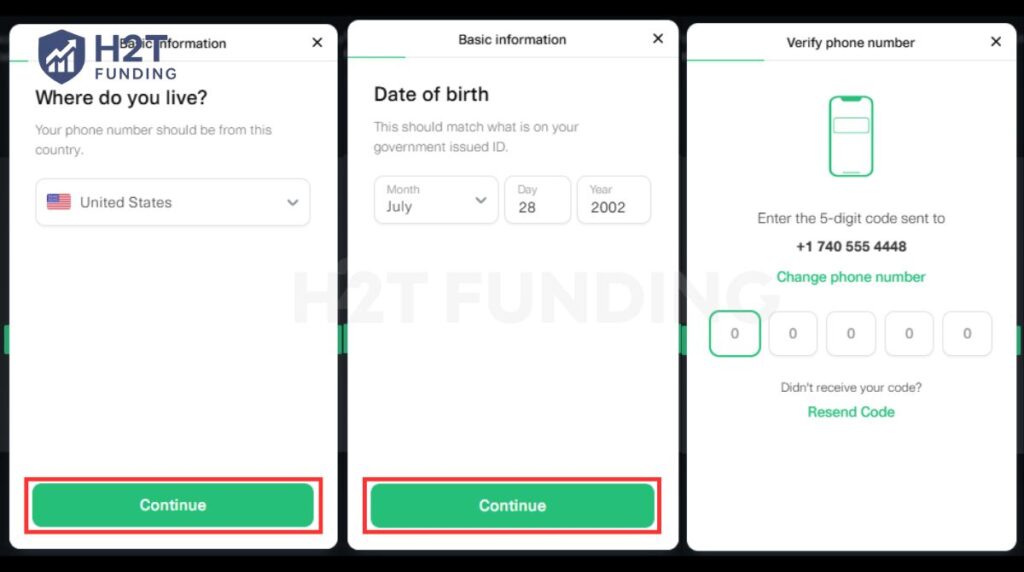

Step 3: Complete KYC verification

Before trading, TPT requires identity verification (KYC). You’ll upload a government-issued ID and possibly proof of address to meet compliance standards.

Step 4: Select your account size

Choose an evaluation account ranging from $25K to $150K, each with defined contract and drawdown limits. This choice sets your starting risk profile.

Step 5: Connect to a trading platform

Link your account to either CQG or Rithmic and select from supported platforms such as NinjaTrader, TradingView, Sierra Chart, or Bookmap.

Step 6: Begin the evaluation

Once setup is complete, start trading under TPT’s rules. Focus on hitting the profit target, managing drawdowns, and meeting consistency requirements to qualify for funding.

By following these steps, traders can move from registration to their first evaluation trade without confusion. The process feels structured but user-friendly, especially with automated email prompts and live chat support if anything goes wrong.

12. Compare Take Profit Trader vs other prop firms

With so many prop firms competing for attention, it helps to look at Take Profit Trader alongside some of the most reputable names like FTMO and Funding Pips. Each has a different structure, payout system, and set of rules, which makes them more or less attractive depending on your trading style.

| Feature | Take Profit Trader (TPT) | FTMO | Funding Pips |

|---|---|---|---|

| Evaluation Model | 1-step (Test) -> PRO / PRO+ | 2-step (Challenge + Verification) | 1-step, 2-step, or instant funding |

| Profit Split | 80% (PRO), 90% (PRO+) | 80–90% | 80–100% |

| Account Sizes | $25K – $150K | $10K – $200K | $5K – $100K |

| Scaling Plan | None | Yes (gradual scaling up to larger accounts) | Yes (up to $2M) |

| Time Limits | No time limit | No time limit | No time limit |

| Markets Offered | Futures only (CME, COMEX, NYMEX, CBOT) | Forex, indices, stocks, crypto, commodities | Forex, metals, indices, energy, crypto, CFD |

| Platforms | CQG & Rithmic (15+ options) | MT4, MT5, cTrader, DXTrade | MT5, cTrader, MatchTrader |

| Notable Features | Same-day payouts, no daily loss limit | Professional analytics, scaling plan | Zero payout denial policy, instant funding |

In short, Take Profit Trader is best for futures traders who want fast payouts and simple rules, even if long-term scaling is limited. FTMO remains the choice for traders seeking structure, advanced tools, and a proven reputation.

Meanwhile, Funding Pips appeals to those who want flexibility, higher potential splits, or instant funding options. Your decision depends on whether you value speed (TPT), structure (FTMO), or flexibility (Funding Pips).

13. Take Profit Trader FAQs

Take Profit Trader funds, traders go through a one-step evaluation called the Test. If you pass by reaching the profit target and respecting drawdown rules, you move to a PRO account. From there, you can earn payouts and even upgrade to PRO+ with better splits.

The cost depends on the account size. Subscriptions range from about $130 to $350 per month, based on whether you choose a $25K, $50K, $100K, or $150K account. Resets and other fees may apply if rules are broken.

A take profit is a preset order that closes your trade once it reaches a chosen profit level. It helps traders lock in gains automatically without having to monitor the market all the time.

The main risk is setting it too tight or too far. A tight take profit may close trades too early, cutting potential gains. A wide one may never get hit, leaving you exposed to market reversals.

Yes. Many traders report same-day payouts once funded, with profit splits of 80% (PRO) and 90% (PRO+). However, some reviews highlight delays or disputes, so consistency can vary.

Yes, but it depends on your trading discipline. The monthly fees and PRO activation can add up if you struggle to pass. But traders who hit the profit target quickly benefit from same-day payouts and strong splits of 80–90%.

Besides the monthly subscription, TPT charges commissions of $5 per round trip per futures contract and $0.50 for micros. These fees simulate real trading costs and apply during both evaluation and funded stages.

Once you pass the Test, you get a funded PRO account. You can withdraw profits above the buffer zone, and if you earn $5,000 or more, you may qualify for a PRO+ account with higher splits and fewer restrictions.

Take Profit Trader is owned and operated by James Sixsmith, who serves as the company’s founder and CEO. Established under the legal entity TakeProfitTrader LLC in Orlando, Florida, the firm is structured as a U.S.-based proprietary trading company.

14. Conclusion

In this Take Profit Trader review, we’ve seen how the firm sets itself apart with a one-step evaluation, same-day payouts, and profit splits of up to 90% in PRO+ accounts. Its futures-only focus and flexible platform access make it appealing to traders who want structure without unnecessary complications.

At the same time, strict trailing drawdown rules and recurring subscription costs can be challenging, especially for less experienced traders. Overall, Take Profit Trader offers a fast, simple, and fair path for disciplined futures traders, but it requires consistency and risk management to unlock its real benefits.

Want to explore more? Check out our other Prop Firm Reviews at H2T Funding, where we break down firms to help you compare options. And if you’ve had any experience with Take Profit Trader, share your thoughts in the comments. Your story might help the next trader make the right choice.