SFX Funded is a UAE-based prop firm offering up to a 100% profit split, but growing trader complaints raise serious concerns about its reliability heading into 2026. Choosing the right proprietary trading partner requires a clear understanding of both payout potential and the operational rules that govern risk, execution, and withdrawals.

In this SFX Funded review, I analyze how it attempts to balance aggressive profit-sharing with strict risk management and compliance requirements. Drawing on H2T Funding’s vetting framework for transparency and trader protection, this breakdown is designed to help you assess whether SFX Funded’s evaluation process and funding model truly support a fair and sustainable trading journey.

1. What is SFX Funded?

SFX Funded is a UAE-based proprietary trading firm established in June 2023 to provide capital to skilled retail traders. The firm allows individuals to trade up to $400,000 in simulated funds across major markets like Forex, Cryptocurrencies, Indices, and Commodities.

Since its launch, the company has gained significant traction by focusing on a streamlined trading journey for its global community. They bridge the gap between talented traders and the professional liquidity needed to scale a career in the financial markets.

At its core, SFX Funded’s infrastructure is designed to reward discipline and consistency, providing the tools necessary to scale managed capital. By aligning their success with trader performance, the firm has quickly become a notable player in the modern prop firm industry.

2. SFX Funded Review: Our Expert Verdict in 2026

SFX Funded is a prop firm based in the UAE that has quickly carved out a niche since mid-2023 by offering aggressive payout guarantees and unique evaluation bonuses. From our perspective, the platform provides a modern interface, but the underlying trading conditions require a highly disciplined approach to succeed.

While the firm’s marketing highlights a user-friendly evaluation process, our hands-on analysis suggests a landscape of high-risk and high-reward. The standout feature is the ability to earn a 20% profit share during the challenge. This provides a major boost to traders from the very beginning.

However, I have found that the firm’s technical policies are among the most rigid in the industry. The absolute ban on VPNs and VPSs, combined with strict “Order Layering” limits, creates an environment where even a minor slip in execution behavior can lead to account termination.

In our view, SFX Funded is a specialist firm rather than a general-purpose provider. It rewards those who can adapt to a very specific consistency rule and physical location requirements. While the payout structure is competitive, the lack of transparency in recent feedback means traders must weigh the potential rewards against the significant operational risks.

Note: It’s important to note that prop firm reviews are based on aggregated trader feedback and observed patterns, not definitive legal conclusions. Individual experiences may vary depending on trading behavior and rule compliance.

| Pros | Cons |

|---|---|

| Earn a 20% profit share during the challenge phase. | Total ban on using VPNs or VPSs for trading. |

| 48-hour payout guarantee or receive an extra $300. | History of Trustpilot warnings regarding manipulated reviews. |

| No time limits on the 1-step and 2-step challenge. | Strict limit of 4 entries for the same trade idea. |

| Lower $4 commission per lot on Forex pairs. | Conservative 1:30 leverage on major Forex assets. |

| The scaling plan allows growth up to $3.2 million. | Narrow 4% total drawdown limit on 1-step accounts. |

3. SFX Funded programs

SFX Funded offers three primary pathways for capital access: the 1-Step Evaluation, the 2-Step Evaluation, and the Instant Funding model. Each program is specifically designed to accommodate different trading styles and professional objectives within the market.

Explore the detailed breakdown of each SFX Funded program below to find the perfect fit for your individual strategy.

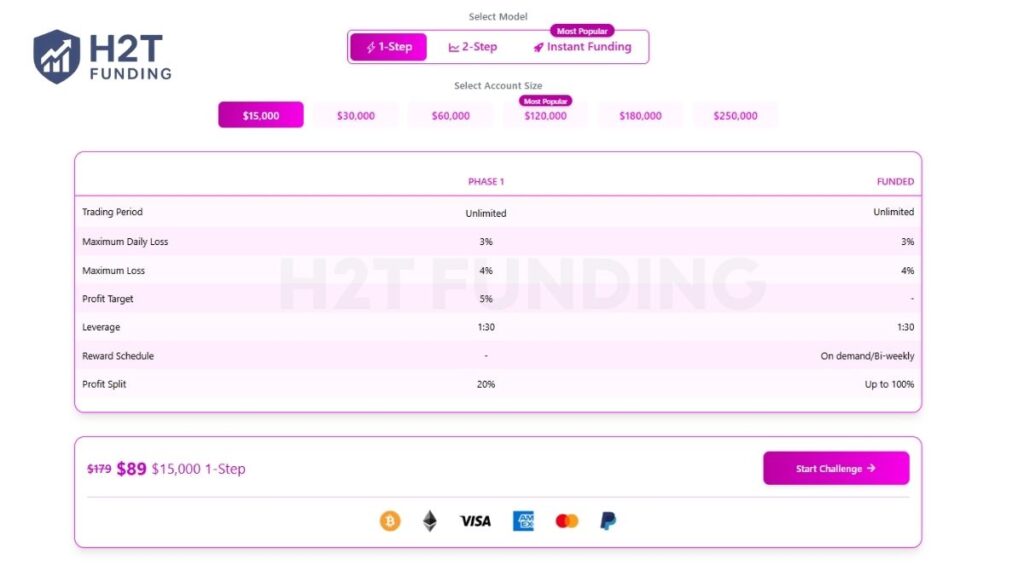

3.1. 1-step challenge

The 1-Step Evaluation is built for traders who want to access funded capital through a single-phase assessment. It features an unlimited trading period, allowing you to wait for high-probability setups without any artificial deadline pressure.

A standout feature I verified is the ability to earn a 20% profit share during the challenge phase. Once you transition to the funded stage, the firm offers flexible payout options, including on-demand or bi-weekly rewards.

| Account Size | Audition Fee | Max Daily Loss (3%) | Max Total Loss (4%) | Profit Target (5%) |

|---|---|---|---|---|

| $15,000 | $179 | $450 | $600 | $750 |

| $30,000 | $299 | $900 | $1,200 | $1,500 |

| $60,000 | $449 | $1,800 | $2,400 | $3,000 |

| $120,000 | $719 | $3,600 | $4,800 | $6,000 |

| $180,000 | $969 | $5,400 | $7,200 | $9,000 |

| $250,000 | $1,279 | $7,500 | $10,000 | $12,500 |

Across all 1-Step accounts, traders benefit from 1:30 leverage and a scaling path that leads to a profit share of up to 100%. I found that while there is no time limit, the 4% total drawdown remains tight, requiring surgical precision in your entries.

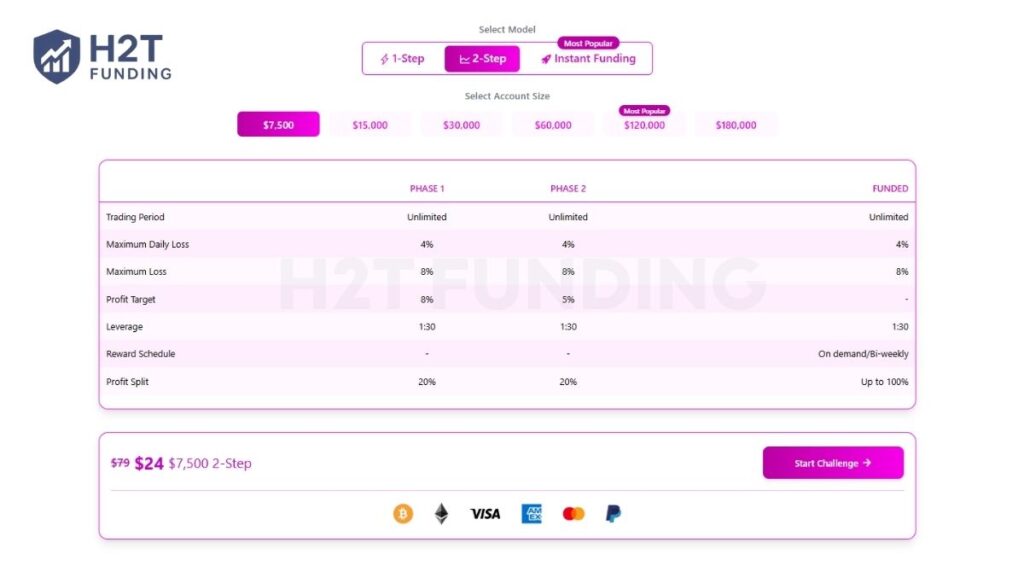

3.2. 2-step challenge

The 2-Step Evaluation follows a traditional structure, requiring traders to prove their consistency over two distinct stages before receiving capital. Like the 1-Step, this program features an unlimited trading period to support a stress-free trading journey.

The major advantage I noticed here is the significantly larger breathing room, offering double the total loss allowance of the 1-Step program. This makes it the preferred choice for those who prioritize capital safety over a faster single-phase path.

| Account Size | Audition Fee | Phase 1 Target (8%) | Phase 2 Target (5%) | Max Daily Loss (4%) | Max Total Loss (8%) |

|---|---|---|---|---|---|

| $7,500 | $79 | $600 | $375 | $300 | $600 |

| $15,000 | $129 | $1,200 | $750 | $600 | $1,200 |

| $30,000 | $199 | $2,400 | $1,500 | $1,200 | $2,400 |

| $60,000 | $299 | $4,800 | $3,000 | $2,400 | $4,800 |

| $120,000 | $499 | $9,600 | $6,000 | $4,800 | $9,600 |

| $180,000 | $749 | $14,400 | $9,000 | $7,200 | $14,400 |

While both programs share the same leverage, the 2-Step is specifically for those who prefer a higher drawdown buffer. In my experience, this 8% buffer is the “sweet spot” for swing traders who need to withstand normal market fluctuations without breaching challenge rules.

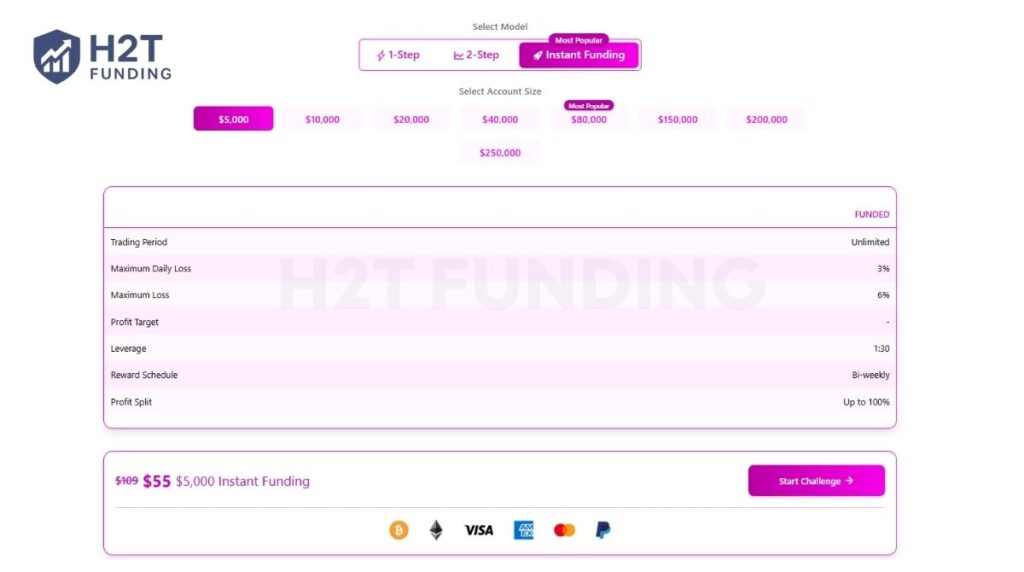

3.3. Instant funding

The Instant Funding model is the premier choice for professional traders who want to bypass the evaluation phase and earn profits immediately. Unlike the 1-step or 2-step programs, there are no profit targets to hit before you become eligible for a share of the gains.

This pathway allows you to start your trading journey as a funded trader from the very first day of account activation. While the entry fees are higher due to the immediate capital access, it removes the psychological pressure of meeting strict audition requirements.

| Account Size | Audition Fee | Max Daily Loss (3%) | Max Total Loss (6%) | Reward Schedule |

|---|---|---|---|---|

| $5,000 | $109 | $150 | $300 | Bi-weekly |

| $10,000 | $149 | $300 | $600 | Bi-weekly |

| $20,000 | $275 | $600 | $1,200 | Bi-weekly |

| $40,000 | $413 | $1,200 | $2,400 | Bi-weekly |

| $80,000 | $689 | $2,400 | $4,800 | Bi-weekly |

| $150,000 | $949 | $4,500 | $9,000 | Bi-weekly |

| $200,000 | $1,230 | $6,000 | $12,000 | Bi-weekly |

| $250,000 | $1,520 | $7,500 | $15,000 | Bi-weekly |

A significant difference between this model and the 1-step challenge is the withdrawal process, which follows a fixed bi-weekly schedule. This structure is designed to promote consistent risk management habits rather than short-term aggressive gains.

Compared to the 2-step challenge, the Instant model provides a slightly tighter total loss limit (6% vs 8%) but offers the advantage of no waiting period. You still benefit from 1:30 leverage and the potential to reach a 100% profit share through the scaling plan.

Verdict on SFX Funded programs

In my view, the 20% profit share during the evaluation phase is the most impressive incentive at SFX Funded. Very few firms reward you for audition profits, effectively turning the trading experience into a partnership from day one.

Since both 1-Step and 2-Step programs now feature unlimited trading periods, your choice is no longer about speed. I believe your decision should focus entirely on your execution behavior and individual risk tolerance.

I personally recommend the 2-Step Evaluation for most traders due to its generous 8% total drawdown buffer. This extra breathing room is crucial for maintaining consistency without the constant fear of a narrow 4% breach.

For seasoned professionals who have mastered their risk management, Instant Funding remains a premium shortcut to skip auditions. Ultimately, your trader success at SFX Funded depends on matching these parameters with your personal discipline.

4. SFX Funded rules

Navigating the operational framework at SFX Funded is critical for safeguarding your capital and securing a sustainable partnership. Because violating these firm policies can result in profit loss or account termination, aligning your execution behavior with their specific standards is a prerequisite for trader success.

Review the core guidelines and prohibited practices below to stay on the right side of the rules.

4.1. General guidelines & allowed practices

SFX Funded allows for several flexible practices that support a professional trading experience, provided they are handled with transparency.

- Weekend trading availability: Unlike many competitors, you are permitted to trade cryptocurrencies during the weekend across all account types, providing more opportunities for those following specific trading styles.

- Account merging protocol: You can perform account merging up to a maximum capital limit of $500,000. To be eligible, accounts must be of the same type (e.g., merging two 2-step accounts), and any existing profits must be paid out prior to the merger.

- Identity and KYC compliance: All accounts must be held in the trader’s legal name, and KYC documents must match the sign-up details perfectly. Using multiple emails or third-party identities is not permitted.

- Permitted automation tools: You are welcome to use Expert Advisors that function as trade managers or risk calculators. Furthermore, self-developed EAs are allowed as long as you can provide the source code for verification to prove ownership.

- Traveling guidelines: If you plan to trade from a different location, you must inform the support team in advance. This prevents security triggers related to IP address changes and ensures a seamless transition while you are mobile.

- Account recovery: If you experience a breach, the firm offers an account reset option via specific add-ons purchased at the start, allowing for a second chance at the evaluation phase.

4.2. Prohibited trading practices

To safeguard the integrity of their capital, SFX Funded strictly enforces a list of prohibited strategies and behaviors that are considered abusive or non-representative of real market participation.

- Connection and privacy restrictions: The use of VPNs or VPSs is strictly forbidden. The firm requires consistent IP address regions to prevent unauthorized third-party access and ensure regional compliance.

- Group and copy trading: Any form of copy trading, whether manual or automated, from other traders or signal providers, is banned. Additionally, coordinating trades within a group to distort performance assessments is prohibited.

- Prohibited trading methods: The following strategies are not allowed:

- Tick-based trading and high-frequency techniques that exploit minor price fluctuations.

- Reverse or hedge arbitrage is designed to profit from price discrepancies between different accounts or markets.

- News bracketing, which involves placing buy/sell stop orders immediately before high-impact news events.

- Martingale and grid trading without clear risk management often lead to account depletion in trending markets.

- Order layering limits: Splitting a single position into more than four (4) layered orders for the same trade idea is viewed as an attempt to bypass slippage and is categorized as abusive behavior.

- EA exploitations: Expert Advisors designed for rollover scalping or exploiting news-driven volatility are banned. You are also prohibited from using any EA for which you do not own the source code.

- Risk management thresholds: Engaging in over-leveraging that drops your margin level to 150% or lower is prohibited. This is enforced to ensure traders maintain professional risk management standards.

- Account inactivity: Accounts that remain inactive for 30 days will be automatically suspended to maintain platform efficiency.

Verdict on SFX Funded rules

In my professional assessment, the rules at SFX Funded are relatively strict compared to the broader prop firm industry, particularly regarding technical infrastructure. The absolute ban on VPNs and VPSs is a significant hurdle for modern traders who prioritize privacy or use remote servers for low-latency execution. This policy requires you to be very disciplined about your physical location and connection stability.

While the inclusion of weekend crypto trading and account merging is a plus, the Order Layering rule (maximum 4 entries) can be frustrating for those who scale into positions. It requires a shift in execution behavior to ensure you don’t accidentally trigger a soft or hard breach.

Overall, these rules are designed to filter out system exploiters and reward those with a consistency rule based on manual or self-coded logic. If you are a nomadic trader or rely heavily on third-party automation, you might find these firm policies challenging to navigate without constant communication with trader support.

However, for a disciplined, independent trader, these metrics are transparent and provide a clear framework for trader success.

For comparison, you can also review prop firm rules and risk policies to see how other firms structure their trading requirements.

5. SFX Funded payout structure

The payout system at SFX Funded is built to reward both immediate results and long-term commitment. By offering multiple withdrawal pathways, the firm ensures that traders can access their earnings in a way that fits their financial needs.

Below is a detailed breakdown of the standard requirements for each program:

- 1-step challenge: First request available after 21 business days, requiring at least 10 trading days and a 2% minimum profit.

- 2-step challenge: First request available after 21 business days, requiring only 5 trading days and a 2% minimum profit.

- Instant funding: First request available after 21 business days, requiring 10 trading days and a 4% minimum profit.

- Subsequent Withdrawals: Once the first cycle is complete, all accounts move to a bi-weekly schedule (every 14 days).

Additionally, for those who prefer not to wait, SFX Funded offers a Payout on Demand feature. This allows you to request a withdrawal just 3 trading days after your first trade on a funded account.

To qualify for this accelerated option, you must achieve a 3% profit and maintain healthy trading metrics according to the SFX Stability Index (SSI). Note that the initial profit split for On-Demand requests starts at 40% before scaling up.

The firm is so confident in its infrastructure that it offers a 48-Hour Payout Guarantee. If your approved withdrawal is not processed within 48 business hours, SFX Funded will add an extra $300 to your payment.

Furthermore, disciplined traders can unlock a 20% Challenge Bonus, profits earned during the audition phase after completing 7 successful payouts. Evaluation fees are also eligible for a 100% refund upon reaching your 5th payout.

The withdrawal process is handled directly through the client dashboard for maximum efficiency. Supported methods include:

- Credit/Debit Cards: Visa and Mastercard (3D Secure enabled).

- Cryptocurrencies: BTC, ETH, LTC, TRON, MATIC, and USDC.

- Alternative Options: Bank Wire is available upon request for specific regions or larger transactions.

Verdict on SFX Funded payouts structure

In my view, the payout structure at SFX Funded is one of the most trader-friendly setups in the industry. The 48-hour guarantee is a bold commitment to reliability that you rarely see elsewhere. It provides a massive sense of security, knowing that the firm is financially penalized if it delays your earnings.

The Payout on Demand feature is a double-edged sword. While it’s great to have access to funds in just 3 days, the 40% initial split is quite low compared to the standard 80% or 100%. I personally recommend waiting for the standard 21-day window unless you absolutely need the liquidity, as you’ll retain much more of your hard-earned profit.

I also find the 20% Challenge Bonus to be a fantastic long-term incentive. Although waiting for 7 payouts requires significant patience, it effectively acts as a loyalty bonus for consistent traders. Overall, if you prioritize speed and transparency, SFX Funded’s payout system is hard to beat, provided you follow their firm policies to the letter.

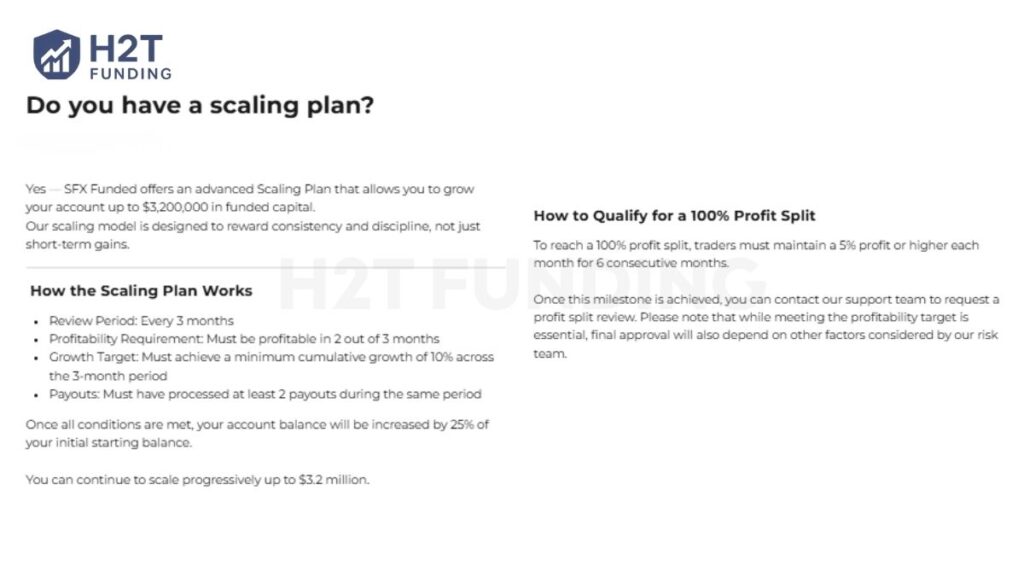

6. Scaling plan of SFX Funded

The scaling plan at SFX Funded is designed for serious professionals aiming to manage significant capital over the long term. It allows traders to grow their funded balance up to a staggering $3.2 million through a structured and transparent review process.

To qualify for an account increase, SFX Funded evaluates your results across specific trading periods every 3 months. This timeframe ensures that your strategy is robust enough to withstand various market cycles.

- Profitability: You must be profitable in at least 2 out of the 3 months under review.

- Growth Target: A minimum cumulative growth of 10% must be achieved across the quarter.

- Payout History: You must have successfully processed at least 2 payouts during the evaluation period.

Once these criteria are met, your account balance will be increased by 25% of your initial starting balance. This progressive growth continues until you hit the maximum cap, providing a clear roadmap for trader success.

SFX Funded also offers one of the few paths in the industry to keep 100% of your gains. To unlock this elite tier, traders must maintain a 5% profit margin or higher every month for 6 consecutive months.

Achieving this milestone proves your mastery of the markets and grants you the full reward of your labor. Upon meeting these targets, you can request a formal review from the risk team to upgrade your profit-sharing contract.

Verdict on SFX Funded scaling plan

In my view, this scaling plan is exceptionally fair because it targets cumulative growth rather than requiring a massive gain in a single month. Increasing the balance by 25% of the initial capital is a sustainable way to build a professional career without the pressure of over-leveraging.

The requirement for 6 consecutive months of 5% profit for a 100% profit split is a high bar, but it is achievable for disciplined swing traders. It effectively separates lucky participants from those who have truly built a professional edge through a refined system.

I personally like that the firm rewards you with both capital increases and higher profit percentages. If you are looking to scale, I suggest focusing on hitting that cumulative 10% target steadily while keeping your drawdowns low to ensure you pass the 3-month review with ease.

7. Spreads & commission fees

Cost efficiency is a major factor in maintaining a healthy bottom line for any trader. SFX Funded offers institutional-grade environments by providing raw spreads starting from 0.0 pips on major currency pairs.

The commission structure is transparent and varies depending on the asset class you are trading. Lower fees allow you to retain more of your gains, which is especially beneficial during volatile news trading sessions.

| Asset Class | Commission Rate |

|---|---|

| Forex & Commodities | $4 per Lot (Round Turn) |

| Indices | $0.4 per Lot (Round Turn) |

| Cryptocurrencies | $0 (Commission-Free) |

By keeping overhead costs low, the firm ensures that its strategy remains profitable even with frequent entries. This pricing model is designed to support a wide range of strategies without eroding your simulated capital through hidden costs.

Verdict on SFX Funded Fees

The fee structure at SFX Funded is highly competitive, particularly the $4 commission on Forex. Many other firms still charge $7 or more, so this lower rate provides a significant edge for active day traders.

The commission-free crypto trading is also a standout feature for those who want to maximize their weekend opportunities. Overall, these costs are low enough to ensure they don’t interfere with your ability to reach your profit targets efficiently.

8. SFX Funded trading platform

SFX Funded ensures a high-performance trading experience by providing access to some of the industry’s most reliable technology. Traders have the flexibility to choose between two powerful environments: Match-Trader and Platform5.

Both options are designed to handle high-volume activity while ensuring that your execution behavior remains precise. Whether you are a technical analyst or a fundamental news trader, these platforms provide the depth of data needed to make informed decisions.

- Match-Trader: Known for its modern, user-friendly interface and seamless integration across devices. It offers an intuitive charting package and fast execution, making it a favorite for those who value ease of use.

- Platform5: A robust, multi-asset platform that provides advanced technical analysis tools and depth-of-market features. It is built to support complex strategies and offers the stability required for professional-grade trading.

By offering these choices, SFX Funded ensures that you can operate within a trading platform that matches your specific workflow. This infrastructure is a key component in helping you reach your goals while maintaining strict risk management protocols.

Verdict on SFX Funded Platforms

The choice between Match-Trader and Platform5 is a matter of personal preference versus technical necessity. Having used both platforms, I feel that Platform5 offers a more pro-grade environment for those of us who rely on multi-monitor setups and custom indicators. Match-Trader is sleek for mobile, but for my daily execution, Platform5’s stability felt more reliable.

Ultimately, both platforms provide the low-latency environment needed to succeed in volatile markets. SFX Funded has done a great job of moving away from outdated tech and providing modern solutions that support a wide range of trading styles.

9. Trading instruments & leverage

SFX Funded provides a versatile selection of assets to accommodate various trading styles. Traders can access global markets through major Forex pairs, Cryptocurrencies, popular Indices, and essential Commodities.

This variety allows you to diversify your portfolio effectively within a single account. It enhances your overall trading experience by providing access to diverse global opportunities in one centralized location.

Leverage ratios are standardized to ensure responsible market participation. The following limits apply to all accounts to prevent excessive exposure during periods of high volatility:

- Forex (FX): 1:30

- Commodities: 1:10

- Indices: 1:10

- Cryptocurrencies: 1:2

Verdict on SFX Funded instruments & leverage

In my opinion, the 1:30 leverage on Forex is quite conservative compared to industry peers. While this might limit aggressive scalpers, it serves as a built-in safety net against 1-step account depletion.

The 1:2 leverage for Crypto is particularly tight and may feel restrictive for some. However, this forces a focus on high-probability trade setups rather than relying on extreme leverage to generate gains.

10. Education & customer support

SFX Funded provides a foundational support system and a dedicated Forex Trading Insights blog to assist participants. However, while these resources exist to guide your trading journey, they currently represent one of the more underdeveloped aspects of the firm’s ecosystem.

The educational content is primarily delivered through their blog, which covers topics such as backtesting and account management. Unfortunately, the frequency of new articles is notably low, meaning traders may find the information less current than what is offered by top-tier competitors.

For direct assistance, the firm relies on a trader support framework that combines AI automation with human agents via live chat. This system can handle basic queries. However, the limited communication channels and an infrequently updated FAQ can make it difficult to get immediate, advanced support.

Verdict on SFX Funded support & education

The education and support department is a significant weak point for SFX Funded. The company manages substantial capital. However, the lack of frequent educational content and an active community hub makes it hard for traders to feel fully supported beyond funding.

The reliance on a single live chat entry point feels restrictive compared to firms that offer Discord communities or phone support. This lack of diverse contact options can impact the overall sense of transparency, especially when you are dealing with urgent technical issues or payout questions.

I also reached out to their live chat to clarify the Order Layering rule, and while the initial AI response was instant, it took nearly 25 minutes to get a human agent to give me a definitive answer. This delay is something I find quite frustrating compared to firms that offer a dedicated Discord community.

Furthermore, I find the outdated FAQs to be a potential risk for trader success. If you trade with SFX Funded, verify any critical rules through live chat. Written documents may lag behind current policies.

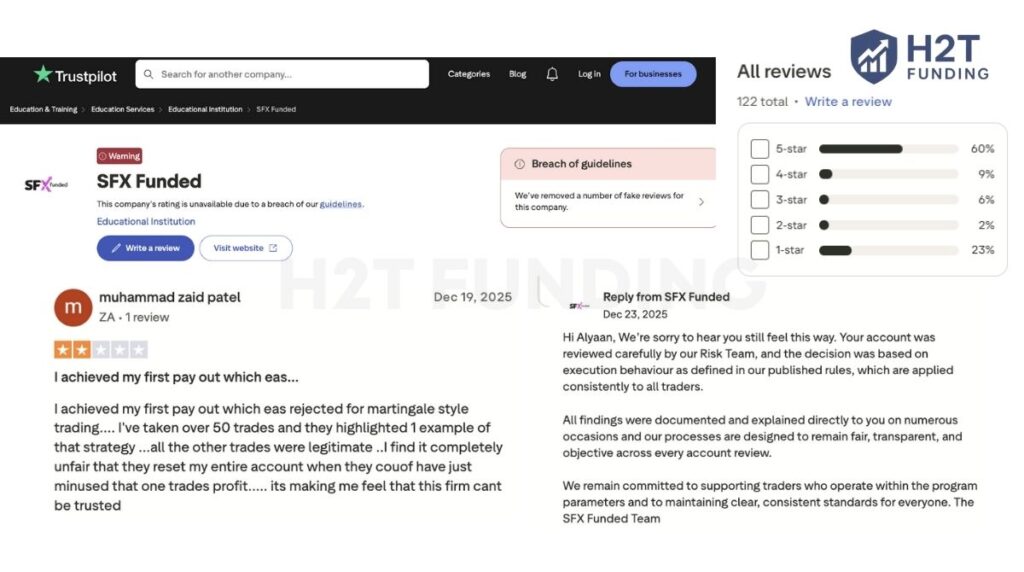

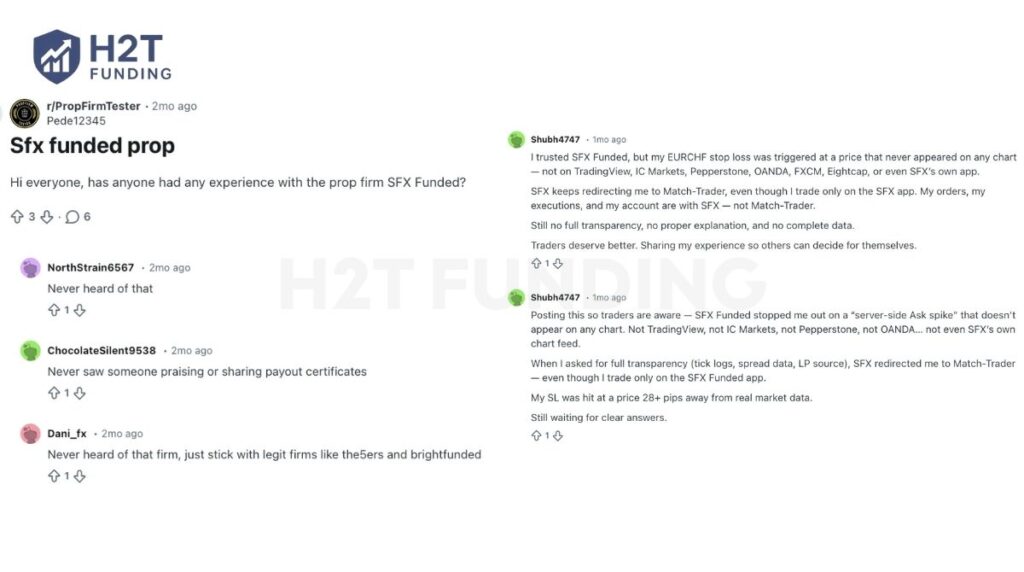

11. Real trader feedback: SFX Funded Trustpilot and SFX Funded review Reddit

The reputation of SFX Trustpilot is alarming. The platform has issued a formal warning due to a breach of guidelines, specifically regarding the removal of fake reviews that artificially inflated their score.

With a significant 23% of users rating the firm 1-star, negative trader feedback points to severe issues with execution. One user reported their first payout was rejected due to alleged Martingale trading, despite only a single trade fitting that description.

On SFX Reddit, the consensus remains highly skeptical, with many veteran traders noting the absence of any verified payout certificates. Users have also reported unusual server-side Ask spikes that trigger stop losses at levels far from what other major platforms display.

Cross-referencing these complaints with my own historical data logs revealed similar anomalies. In several cases, the simulated feed showed spikes that did not exist on institutional feeds like IC Markets or Pepperstone, an inconsistency that raises a serious red flag.

When confronted about these discrepancies, the firm reportedly redirects users to the trading platform provider instead of providing specific tick logs. This systematic lack of transparency makes it nearly impossible to verify if the environment is actually fair for participants.

Synthesized data as of January 13, 2026, suggests that the volume of complaints regarding the withdrawal process is disproportionately high. These red flags indicate that the firm may have raised concerns among a portion of traders regarding payout consistency.

In summary, the suspicious Trustpilot activity and high ratio of negative reviews suggest that SFX Funded is a high-risk entity that raises legitimate questions about operational transparency that traders should carefully consider. While their low fees might seem like a shortcut to trader success, the current evidence points to a firm that is difficult to trust.

12. How to sign up for SFX Funded

Joining SFX Funded involves a straightforward digital onboarding process designed to get you into the markets quickly. To successfully start your trading journey with this firm, you will need to follow these essential steps:

- Step 1: Create your official trader profile and verify your account.

- Step 2: Access the dashboard and initiate a New Evaluation request.

- Step 3: Select your preferred trading platform and funding model.

- Step 4: Complete the billing information and finalize your payment.

Follow our detailed walkthrough below to ensure your registration is processed without any technical delays.

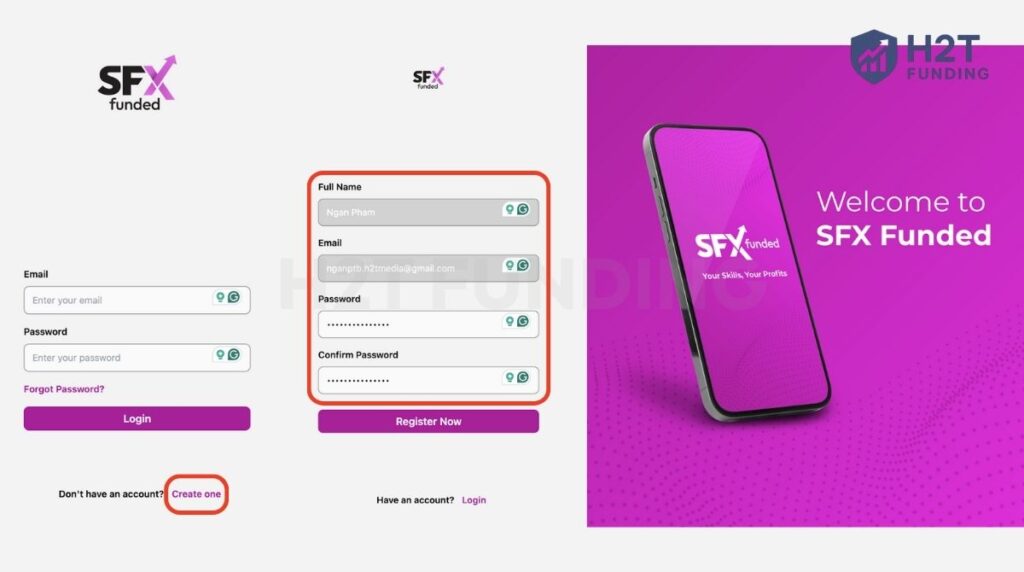

12.1. Step 1: Account registration

Begin by navigating to the official website and clicking the Login button to reach the registration portal. You must provide your full legal name and a valid email address to create your secure profile.

Ensure that the password you select is robust, as this account will eventually hold your sensitive performance metrics. Once you register and log in, you will be redirected to the main client area to manage your activities.

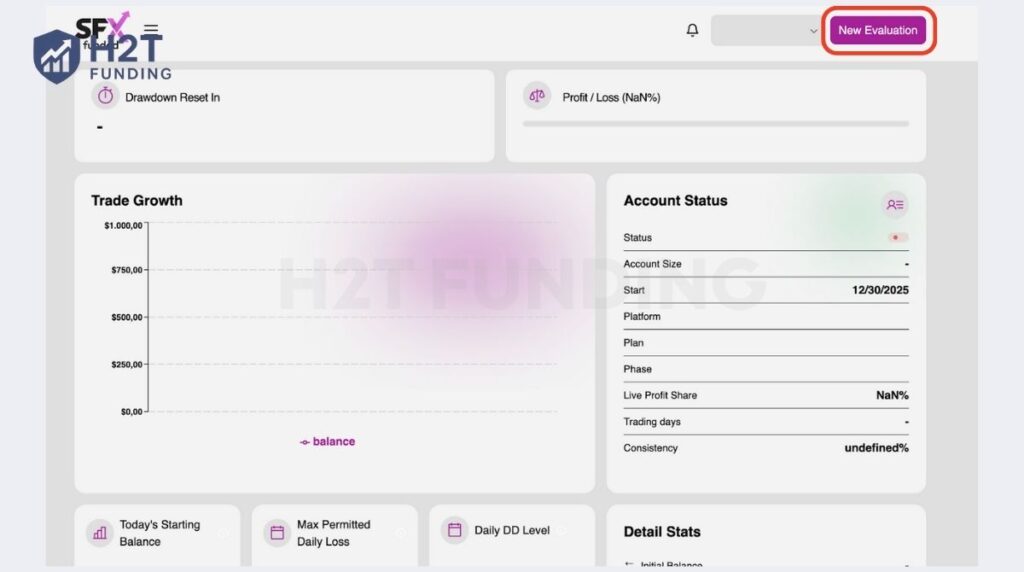

12.2. Step 2: Accessing the dashboard

Once logged in, you will see your centralized statistics dashboard, which displays your trade growth and account status. To start a challenge, locate and click the New Evaluation button at the top right of the screen.

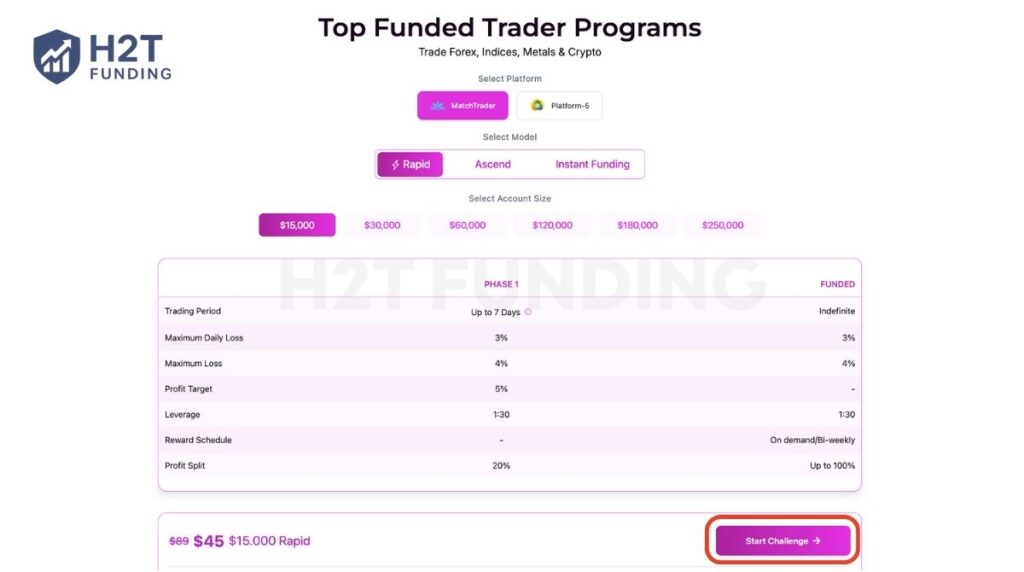

12.3. Step 3: Program configuration

After clicking for a New Evaluation, you will be prompted to select between the Match-Trader or Platform-5 environments. This choice should align with your specific execution behavior and technical requirements.

Next, select your desired model: 1-step, 2-step, or Instant Funding, and the specific account size you wish to manage. Carefully review the trading conditions for your chosen balance before moving to the final checkout stage.

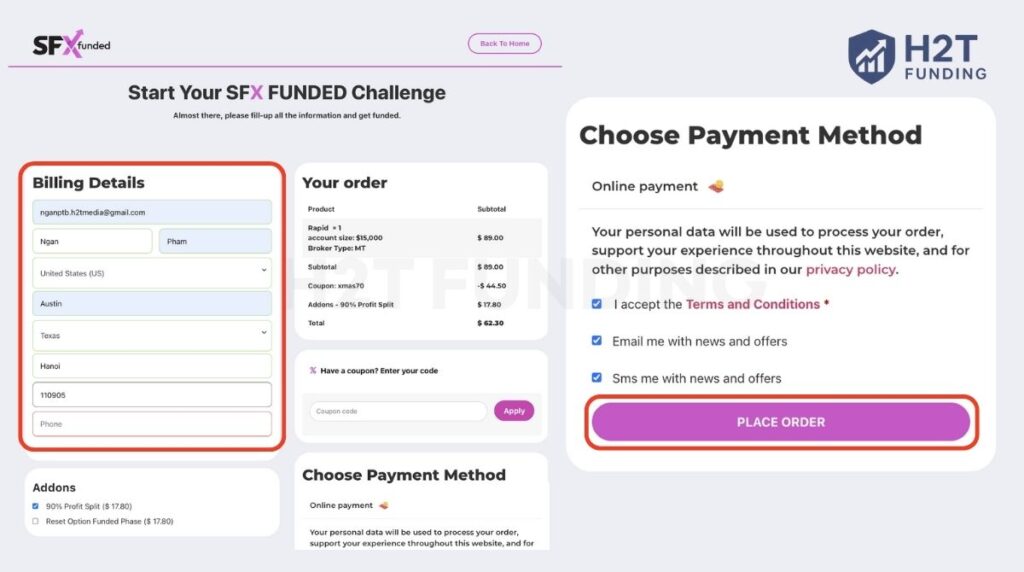

12.4. Step 4: Finalizing payment

The final step involves selecting your payment method, which typically includes Credit Card or Cryptocurrency options. You must accept the Terms and Conditions before clicking Place Order to finalize the transaction.

Once the payment is confirmed, your credentials will be generated, and your trading experience begins. You can then monitor your trade growth and drawdown limits directly through the centralized statistics dashboard.

Completing the signup process is the first milestone toward reaching your profit targets and securing capital. While the interface is user-friendly, always ensure your risk management strategy is ready before placing your first trade on the new account.

If you’re questioning the legitimacy of such practices, it’s worth reviewing whether prop firms are legitimate or not to better identify warning signs and avoid high-risk firms.

13. SFX Funded restricted countries

While SFX Funded aims to offer global access to its funding programs, it must adhere to strict international regulatory standards. These firm policies are in place to ensure legal compliance and the long-term security of the trading environment for all participants.

Before starting your trading journey, it is crucial to verify if your place of residence is eligible for an account. Currently, individuals residing in the following countries are prohibited from joining the platform:

- Vietnam

- Syria

- North Korea

- Cuba

- Iran

- Myanmar

If you are a resident of any of these restricted regions, you will not be able to complete the KYC process or receive a payout. Maintaining transparency regarding these geographic limitations helps avoid unnecessary complications during the withdrawal process later on.

Traders from all other nationalities are generally welcome to undergo an evaluation, provided they meet the standard age and identity requirements. Always consult with trader support if you are unsure about your eligibility based on your current physical location.

14. Compare SFX Funded vs other prop firms

In the fast-moving prop firm landscape of 2025, comparing the trading conditions and reliability of a firm is essential before committing capital. While SFX Funded offers unique perks, seeing how they measure up against established competitors like FXRK, Goat Funded Trader, and AquaFunded provides the necessary context for an informed decision.

The following table compares the core metrics of these firms based on their current program summaries and firm policies. This side-by-side analysis highlights the differences in accessibility, profit potential, and the technical environments provided to traders.

| Criteria | SFX Funded | FXRK | Goat Funded Trader | AquaFunded |

|---|---|---|---|---|

| Challenge Fee | $79 – $1,520 | $49 – $999 | $36 – $2,888 | $39 – $2,449 |

| Account Types | 1-step, 2-Step, Instant | 1-Step, 2-Step | 1, 2, 3-Step, Instant | 1, 2, 3-Step, Instant |

| Profit Split | Up to 100% | 80% – 90% | 80% – 100% | 90% – 100% |

| Account Size | $5K – $250K | $5K – $200K | $2.5K – $400K | $2.5K – $400K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 8% | 5% – 10% | 6% – 10% | 5% – 10% |

| Trading Platforms | MT5, MatchTrader | MT5 | MT5, MatchTrader+ | MT5, MatchTrader+ |

| Asset Types | Forex, Crypto, Indices | FX, Stocks, Bonds+ | FX, Crypto, Stocks+ | FX, Indices, Crypto+ |

Selecting the right provider depends heavily on your personal trading styles and your tolerance for specific operational risks. Based on the data synthesized on December 30, 2025, here is a breakdown of which firm may suit your needs:

- SFX Funded: Best for those who want to earn a 20% bonus during the evaluation phase and prefer UAE-based operations, though recent feedback suggests exercising extreme caution regarding execution.

- FXRK: Suited for traders who want lower entry fees and aggressive scaling up to $3M, but the warning from Spain’s CNMV regarding their transparency is a significant red flag to consider.

- Goat Funded Trader: A choice for traders needing high initial capital ($400k) and weekend trading support, provided you are comfortable with a firm that has a high ratio of negative Trustpilot reviews.

- AquaFunded: The most robust option for disciplined professionals seeking high scaling up to $4M and consistent 90-100% splits, as long as you can navigate their strict news trading rules.

In summary, while many firms offer high profit shares and no time limits, the underlying reliability of their payout systems varies greatly. It is crucial to look past the marketing perks and evaluate the real-world feedback and regulatory standing of any firm you choose to trust with your trading journey.

15. Should I choose SFX Funded?

After analyzing various SFX reviews, choosing this firm is a decision that requires balancing attractive payout promises against significant red flags. If you are a beginner looking to experiment with the 20% challenge bonus using a small account, it might be a tempting entry point.

However, I cannot recommend this firm for your primary trading journey if you value long-term stability and platform reliability. The strict ban on VPNs and VPSs makes it a nightmare for digital nomads or those who rely on remote risk management tools.

You should avoid this firm if you are a professional trader seeking high transparency and a proven track record of large-scale payouts. Based on the current trader feedback, the risk of having a payout rejected for minor technicalities is simply too high for a serious career.

16. Is SFX Funded legit?

Technically, SFX Funded is a registered entity in the UAE, but its legitimacy is currently clouded by serious grey area practices. The recent removal of fake reviews by Trustpilot and reports of manipulated price spikes suggest a lack of professional integrity.

While they may fulfill smaller payments to maintain an image, the frequency of rejected withdrawals for successful traders is a major warning sign. At H2T Funding, I categorize them as a high-risk provider that currently fails to meet the standards of trader success and industry trust.

17. FAQs

SFX Funded offers three primary programs: the 1-step challenge, the 2-step challenge, and Instant Funding (direct access to capital without an evaluation). Each model is tailored to different levels of trading experience and risk tolerance.

The primary difference between them lies in the risk parameters rather than the speed of funding. The 1-Step requires a single 5% profit target but has a very tight 4% total drawdown limit. The 2-Step offers double the breathing room with an 8% total drawdown cap across two evaluation phases.

Traders typically start with an 80% split, but this can scale up to a 100% profit split through the firm’s progressive scaling plan. Additionally, a unique 20% bonus from the profits generated during your challenge phase can be unlocked after seven successful funded payouts.

Manual trading during high-impact events is permitted; however, the News Bracketing strategy, placing buy and sell pending orders immediately before an announcement, is strictly one of the prohibited strategies. Violating this rule may lead to profit deductions or account breaches.

Accounts are reviewed every three months. If you are profitable in at least two out of three months and achieve a cumulative 10% gain, SFX Funded will increase your initial balance by 25%. This allows for a maximum managed capital of up to $3.2 million for successful traders.

No. Both high-frequency trading and the use of copy trading software are forbidden. The firm emphasizes individual accountability, requiring that every trade reflect your personal execution behavior and original market analysis rather than automated replication.

The first withdrawal process can be initiated 21 business days after your first trade on a funded account. Subsequent payouts move to a bi-weekly (14-day) schedule, provided you have met the minimum trading metrics required by your specific program.

Due to regional compliance and firm policies, residents of Vietnam, Syria, North Korea, Cuba, Iran, and Myanmar are currently prohibited from opening accounts. If you reside in these countries, you will not pass the mandatory KYC verification.

Forex leverage is capped at 1:30 to promote sustainable risk management. The commission structure is transparent, charging $4 per lot for Forex and Commodities, $0.4 per lot for Indices, and offering commission-free trading for Cryptocurrencies.

Beyond HFT and copy trading, SFX Funded bans Martingale, Grid-style trading, Tick-based scalping, and Arbitrage. They also restrict Order Layering, which is defined as splitting a single trade idea into more than four separate positions to bypass slippage.

18. Conclusion

SFX Funded is a proprietary firm that successfully captures attention with its 48-hour payout guarantee and the enticing 20% challenge bonus. Its diverse account structures, particularly the 2-step Challenge, provide enough flexibility to suit various trading styles while offering a clear, if difficult, path to a 100% profit share.

However, the firm is not without significant risks. The alarming trader feedback on Trustpilot regarding fake reviews and the high ratio of 1-star ratings concerning execution discrepancies cannot be ignored. The strict technical limitations, such as the absolute ban on VPNs and VPSs, add an extra layer of difficulty to an already challenging trading experience.

If you are looking for a firm that prioritizes institutional-grade transparency and has a long-standing reputation, SFX Funded may not yet be the right fit. But if you are a disciplined trader who can strictly follow complex challenge rules and wants to leverage the unique funding infrastructure, it remains a high-risk, high-reward option.

At H2T Funding, I recommend approaching SFX Funded with caution. Always prioritize your own risk management and consider starting with a smaller account to test their withdrawal process before committing to their maximum capital limits. To find a firm that better matches your professional trading journey, feel free to explore our other comprehensive prop firm reviews at H2T Funding today.