When traders search for a prop firm, the top concerns are usually transparency, payouts, and trading rules. SeacrestFunded, formerly MyFundedFX, has drawn attention by branding itself as a broker-backed prop trading company. Promising up to $400,000 in simulated funds and flexible evaluation programs.

With nearly 95,000 active users and millions in reported payouts, SeacrestFunded claims to provide quick withdrawals, diverse trading instruments, and freedom in trading styles. In this SeacrestFunded review, I’ll explore whether those claims hold, covering funding programs, trading challenges, commissions, platforms, and customer support.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official SeacrestFunded websites before purchasing any challenge.

1. What is Seacrest Funded?

Seacrest Funded is a proprietary trading firm backed by Seacrest Markets. The company launched in 2022 under the name My Funded FX and later rebranded to South Africa Ltd, expanding its presence to South Africa and Cyprus. Under the leadership of CEO Matthew Leech, the firm focuses on helping traders scale their skills and capital.

Instead of trading with personal capital, participants pay a one-time fee to join a challenge and, if successful, unlock access to large simulated accounts. The simulated accounts can go up to $400,000, allowing traders to test strategies and manage risk under real market conditions without risking personal money.

Profits earned on these demo-based accounts are then shared with the trader through payouts, while losses remain absorbed by the firm. This structure makes Seacrest Funded attractive to traders who want to scale faster without putting their own funds on the line.

2. Our take on SeacrestFunded

To me, SeacrestFunded has done a good job of evolving while keeping things straightforward. Once known as MyFundedFX, it rebranded in 2022 and refined its model to focus on accessible accounts from $5K to $100K, scaling to $1M. With profit splits of 80–90%, it offers a rewarding setup that feels fair to traders.

What stands out after the transition is its simplified challenge lineup. Seacrest Funded now offers three clear evaluation paths: 1-step, 2-step, and 3-step, replacing the older, more cluttered options. This streamlined structure makes it easier for traders to choose the path that fits their style and commitment level.

The flexibility to choose your own platform and broker, whether it’s MT5 with Seacrest Markets or Match-Trader/ TradingView with Match-Trader, is a huge plus. The rules are transparent, though not without limits. One trade every 30 days keeps accounts active, and traders must be profitable across three days.

Leverage is capped at 1:30 for forex, 1:10 for indices, and 1:2 for crypto, which may feel restrictive. Still, it’s a clear signal that the firm is focusing on sustainable trading over high-risk gambles.

Key highlights of SeacrestFunded

- Three evaluation models: 1-step, 2-step, and 3-step.

- Account sizes $5K–$100K, scaling to $1M.

- Profit split: 80% standard, 90% with add-ons.

- Platform choices: MT5 and Match Trader.

- Broker options: Seacrest Markets and Match-Trader.

- Rules: 1 trade per 30 days, 3 profitable days required.

SeacrestFunded Pros and Cons

| Pros | Cons |

|---|---|

| Multiple evaluation (1-step, 2-step, and 3-step) | Leverage capped at 1:30 (forex) |

| High profit splits up to 90% | News trading restrictions on some accounts |

| Scaling plan up to $1M | No free retry after failure |

| Flexible platforms & brokers | Limited educational resources |

| Active Discord and responsive support | Limited educational resources |

Overall, SeacrestFunded offers a clean, trader-friendly structure that emphasizes skill over shortcuts. The limited leverage may turn off high-risk players, but its fair rules, platform choice, and generous payouts make it stand out. It feels like a firm that values sustainability and long-term growth rather than gimmicks.

2. SeacrestFunded Funding Program

SeacrestFunded now offers three evaluation models for traders: the One-step Challenge, Two-step Challenge, and the newly introduced Three-step Challenge. All programs allow traders to unlock a live simulated account after demonstrating consistency, but each model differs in gain targets, loss limits, and total evaluation phases.

| Feature | One-step Challenge | Two-step Challenge | Three-step Challenge |

|---|---|---|---|

| Sim Gain Target | 10% (Verification) | Step 1: 8%Step 2: 5% | Phase 1: 6%Phase 2: 6%Phase 3: 6% |

| Daily Sim Loss | 4% | 5% (both steps) | 4% (all phases) |

| Overall Sim Loss | 6% | 8% (both steps) | 8% |

| Minimum Profitable Days | 3 days | 3 days each step | 3 days each phase |

| Trading Period | Unlimited | Unlimited | Unlimited |

| News Trading | Allowed | Allowed | Allowed |

| Sim Trading Leverage | 30:1 | 30:1 | 30:1 |

| Payout Split (Live Sim) | 80% | 80% | 80% |

| Payout Frequency | 14 days | 14 days | 14 days |

Understanding these structures is important for anyone learning how prop firm rules work in practice. Now, let’s start with a closer look at the One-step challenge.

2.1. One-step challenge

The One-step challenge is the faster route to becoming a SeacrestFunded trader. You only need to complete a single verification phase before moving to a live simulated account. The rules are simple: hit a 10% profit target while respecting daily and overall loss limits. With unlimited trading days and moderate leverage, this model suits confident traders who prefer quick access to payouts.

For many traders, the one-step model feels less drawn-out than multi-stage evaluations. However, the strict 4% daily drawdown means you’ll need tight risk management to avoid getting knocked out by a single bad day.

| Account Size | Registration Fee | Sim Gain Target (10%) | Daily Sim Loss (4%) | Overall Sim Loss (6%) |

|---|---|---|---|---|

| $5,000 | $50 | $500 | $200 | $300 |

| $10,000 | $100 | $1,000 | $400 | $600 |

| $25,000 | $200 | $2,500 | $1,000 | $1,500 |

| $50,000 | $300 | $5,000 | $2,000 | $3,000 |

| $100,000 | $500 | $10,000 | $4,000 | $6,000 |

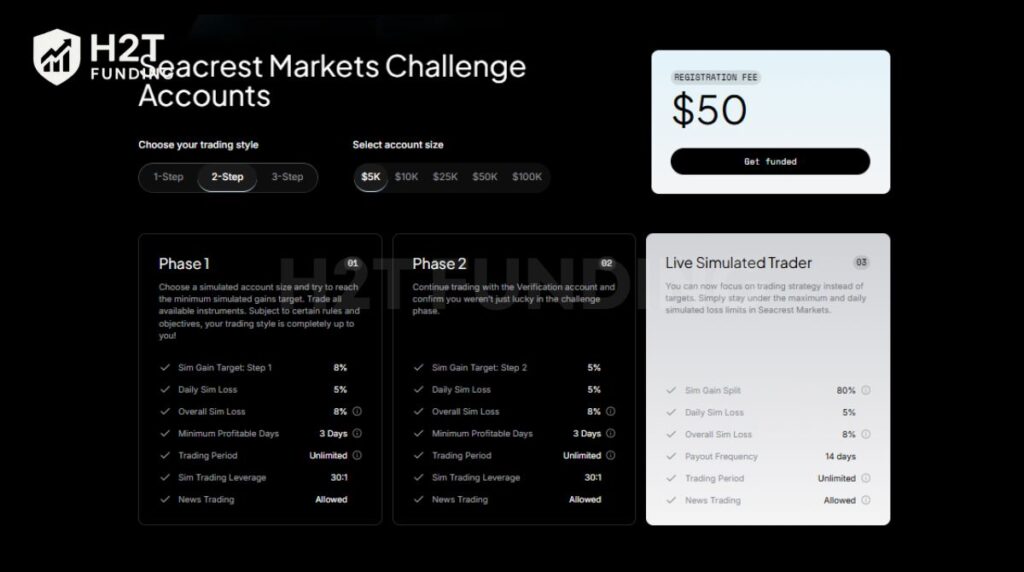

2.2. Two-step challenge

The Two-step challenge is designed for traders who prefer a slower, more structured evaluation. It requires completing both a trading phase and a verification phase before moving into a live simulated account. The profit targets are lower than the one-step model, but risk limits are slightly stricter.

From my experience, the two-step path reduces pressure since you don’t need to hit the entire 10% in one phase. Still, the 5% daily drawdown and 8% overall limit demand are consistent with risk control. It’s a good choice for traders who value stability and measured growth.

| Account Size | Registration Fee | Step 1 Target (8%) | Step 2 Target (5%) | Daily Sim Loss (5%) | Overall Sim Loss (8%) |

|---|---|---|---|---|---|

| $5,000 | $50 | $400 | $250 | $250 | $400 |

| $10,000 | $100 | $800 | $500 | $500 | $800 |

| $25,000 | $200 | $2,000 | $1,250 | $1,250 | $2,000 |

| $50,000 | $300 | $4,000 | $2,500 | $2,500 | $4,000 |

| $100,000 | $500 | $8,000 | $5,000 | $5,000 | $8,000 |

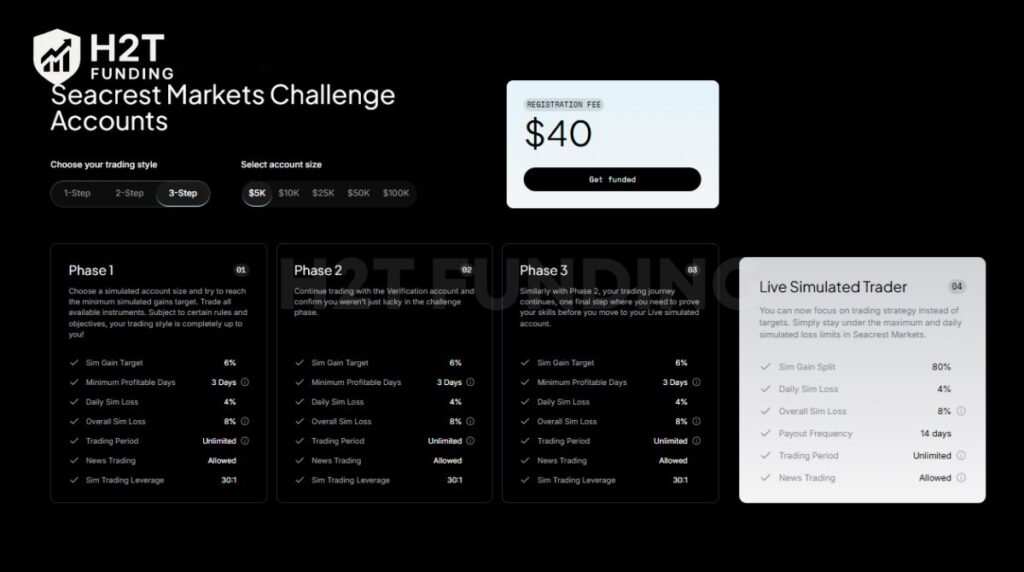

2.3. Three-step challenge

The Three-step challenge is SeacrestFunded’s newest and most gradual evaluation model. Instead of targeting large profits in a single phase, traders progress through three equal stages, each requiring a 6% gain. This structure reduces pressure and supports steady, consistent performance.

Each phase follows the same rules, making the evaluation predictable and beginner-friendly. With unlimited trading days, moderate loss limits, and news trading allowed, the model suits traders who prefer stability over speed. Although it takes longer than the one-step or two-step pathways, many traders find the phased approach easier to manage.

| Account Size | Registration Fee | Phase 1 Target (6%) | Phase 2 Target (6%) | Phase 3 Target (6%) | Daily Sim Loss (4%) | Overall Sim Loss (8%) |

|---|---|---|---|---|---|---|

| $5,000 | $40 | $300 | $300 | $300 | $200 | $400 |

| $10,000 | $50 | $600 | $600 | $600 | $400 | $800 |

| $25,000 | $125 | $1,500 | $1,500 | $1,500 | $1,000 | $2,000 |

| $50,000 | $250 | $3,000 | $3,000 | $3,000 | $2,000 | $4,000 |

| $100,000 | $400 | $6,000 | $6,000 | $6,000 | $4,000 | $8,000 |

2.4. VIP Program

For traders who consistently perform, SeacrestFunded rewards progress with its VIP Program. Advancing through VIP tiers unlocks benefits like higher profit splits (up to 92.75%), more flexible withdrawal options (from bi-weekly to anytime, even weekends), and increased loss allowances.

To qualify, traders must meet conditions such as a minimum of 3 months of trading, at least 5 payouts, low-risk strategies, and no rule violations.

This tiered system incentivizes long-term consistency. Tier 0 starts at the standard 80% split, while Tier 3 boosts traders to nearly 93%, making it one of the more rewarding progression models in the prop firm space.

Verdict on SeacrestFunded funding program

The funding setup at SeacrestFunded gives traders flexibility to choose between speed and consistency.

The One-step challenge is great if you want quick access to a funded account, though the 10% profit target and 4% daily loss cap can feel tight. The Two-step challenge lowers the target into smaller, more manageable goals, which often feels less stressful for building consistency. The new Three-step challenge adds an even smoother, low-stress progression with equal 6% targets across all phases.

Another point that stands out is the profit split. Traders start with 80% of profits, but with the VIP Program, it can increase to 93%, which is competitive compared to other firms in this space. If you’re serious about staying consistent, the extra perks and higher earnings make SeacrestFunded’s model worth considering.

3. SeacrestFunded trading rules

SeacrestFunded sets out clear trading rules that combine flexibility with strict risk controls. These guidelines are designed to allow traders room to operate while preventing practices that could harm the integrity of the program.

3.1. Allowed trading practices

SeacrestFunded gives traders several freedoms that make the evaluation process and funded stage more realistic and practical.

- Overnight trading: Positions can be held overnight in all phases, though swap fees apply, including triple swaps on Wednesdays.

- Unlimited evaluation time: There is no time limit to complete challenges, as long as you place at least one trade every 30 days to keep the account active.

- News trading during Challenge: Trading around high-impact news is allowed in the challenge stage, with some restrictions on the profit eligibility window.

- Use of EAs/Bots on MT5: Custom Expert Advisors are permitted on MT5, provided they do not fall into HFT or arbitrage strategies. (Match-Trader does not support EAs.)

- Account merging: Once evaluations are passed, untraded funded accounts can be merged to simplify capital management.

- VPN and VPS usage: Traders are allowed to use VPNs and VPS services for more stable and secure connections. However, only paid services should be used to avoid multiple IP/device overlaps that could trigger account flags.

3.2. Prohibited trading practices

Alongside the flexibility, SeacrestFunded enforces strict bans on activities that provide unfair advantages or abuse the system.

- Abusive copy trading: Includes account mirroring, group trading, account management services, or paying someone to pass the challenge.

- Arbitrage and HFT: All forms of latency arbitrage, one-leg/two-leg arbitrage, tick scalping, and order spamming are prohibited, with violations leading to account closure.

- Group hedging or reverse trading across accounts: Opening opposing trades across multiple accounts to artificially reduce risk is forbidden.

- Over-leverage trading: Gambling-style trading with oversized positions exceeding safe risk levels (above 2% account risk) is not allowed.

- Multiple accounts under one Client ID (CID): Managing more than one account with the same MT5 Client ID results in disqualification.

- Inactive accounts: Any account with no trades for 30 days from purchase will be terminated or marked invalid.

- IP address manipulation: Constantly changing IPs to bypass restrictions, trading from two different countries on the same day, or sharing devices with other traders is not permitted. All accounts must be tied to the trader’s own identity and not from prohibited regions.

Verdict on SeacrestFunded trading rules

The rules at SeacrestFunded strike a good balance between freedom and structure. Having unlimited time takes away a lot of pressure, and being able to hold trades overnight makes it easier to run strategies I normally use. The option to run EAs on MT5 is also a big plus for traders who automate parts of their system.

On the flip side, the strict daily drawdown can feel unforgiving; one bad day can end a challenge. However, the news trading restrictions can be a real hurdle for anyone whose strategy relies on short-term event volatility. Still, if you’re disciplined, the rules make sense and keep the environment fair for everyone.

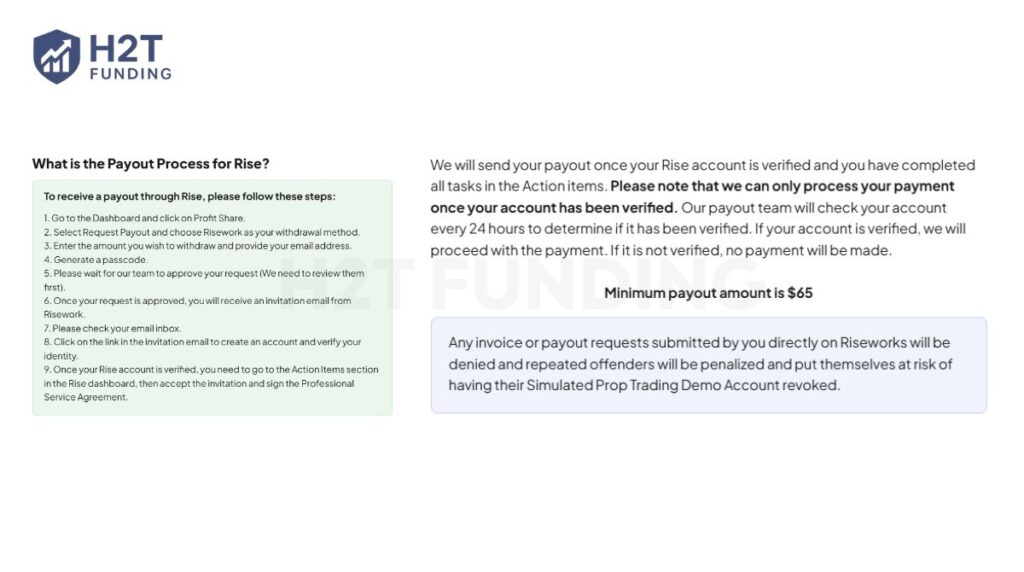

4. SeacrestFunded payout structure

Getting paid is always the biggest concern for traders, and SeacrestFunded lays out a fairly structured process. Once you pass the evaluation and move into a funded stage, profits generated on your simulated account can be withdrawn. Payments are mainly handled through cryptocurrency or Riseworks, a third-party service used to process and verify payouts.

The payout request starts directly from the trader dashboard. You select Profit Share, enter the withdrawal amount, choose Riseworks as the method, and submit your request. After submission, the SeacrestFunded team reviews it before Riseworks sends an invitation email.

At that point, you need to set up a Rise account, verify your ID, and sign a professional service agreement. Once everything is confirmed, the funds are released.

- Minimum payout: $65

- Verification required: payout only processed after identity and account verification on Riseworks

- Review cycle: payout team checks accounts daily for verification status

Attention: If your simulated account is breached, whether from hitting the daily or overall drawdown limit, the account is automatically closed. Even if it was in profit at the time, no payout is granted once a breach occurs.

Verdict on SeacrestFunded payouts

What I appreciate here is the clear structure: a low minimum payout of $65, multiple payment options, and a defined process. Still, having to verify through Riseworks can feel like an extra step, especially for first-time withdrawals. Once set up, though, payouts tend to be smooth, and the rules leave no room for confusion about breaches.

5. Scaling plan SeacrestFunded

SeacrestFunded offers a structured scaling plan that rewards consistency and growth. If traders achieve strong performance over time, the firm increases their simulated funding by 25% every 3 months. This creates a clear path to gradually manage larger accounts without adding extra risk upfront.

- Increase rate: +25% of the initial balance every 3 months.

- Requirement: At least 12% net gain within 90 days.

- Starting point: Must be a fresh account at the initial balance.

- Maximum scaling: Up to 5x the initial balance or $1M, whichever comes first.

- Withdrawal flexibility: Profits can still be withdrawn during scaling phases.

For example, a $100K account can scale to $125K after three months, $150K after six, and $200K by the end of the year. Over time, balances can reach $500K with steady performance. Traders can also merge scaled accounts, combining growth into one larger account for better management.

Verdict on SeacrestFunded scaling plan

The scaling program stands out because it doesn’t just set tough profit targets; it sets achievable milestones that reward steady performance. Hitting 12% over three months feels realistic for disciplined traders, and the option to merge accounts adds another layer of flexibility.

For anyone aiming to handle progressively larger balances without rushing, this plan creates a straightforward and motivating growth path.

6. Spreads & commissions

SeacrestFunded keeps trading costs competitive by offering near-zero spreads on major forex pairs, with commission fees depending on the platform. The two active platforms are Match-Trader and MT5, each with slightly different fee structures that affect your overall trading cost.

On Match-Trader, commissions are the lowest at $3 per lot round-turn for forex, metals, and oils, while indices and crypto are commission-free. This setup is attractive for cost-conscious traders who rely on frequent entries and exits. MT5, supported by Quality-FX liquidity, charges $5 per lot round-turn on forex and commodities but also provides broad market access and stability.

In both cases, indices come with no commission, and crypto trading is also commission-free but offered at lower leverage (1:2). With transparent costs and low spreads, traders can choose between the cheaper fees of Match-Trader or the familiarity and reliability of MT5.

Verdict on SeacrestFunded spreads & commissions

The fee model is straightforward and fair, with no hidden charges. Match-Trader stands out as the most cost-effective choice, while MT5 offers a good balance between affordability and professional-grade execution. Both platforms keep costs low enough to make active trading strategies viable within SeacrestFunded’s funding model.

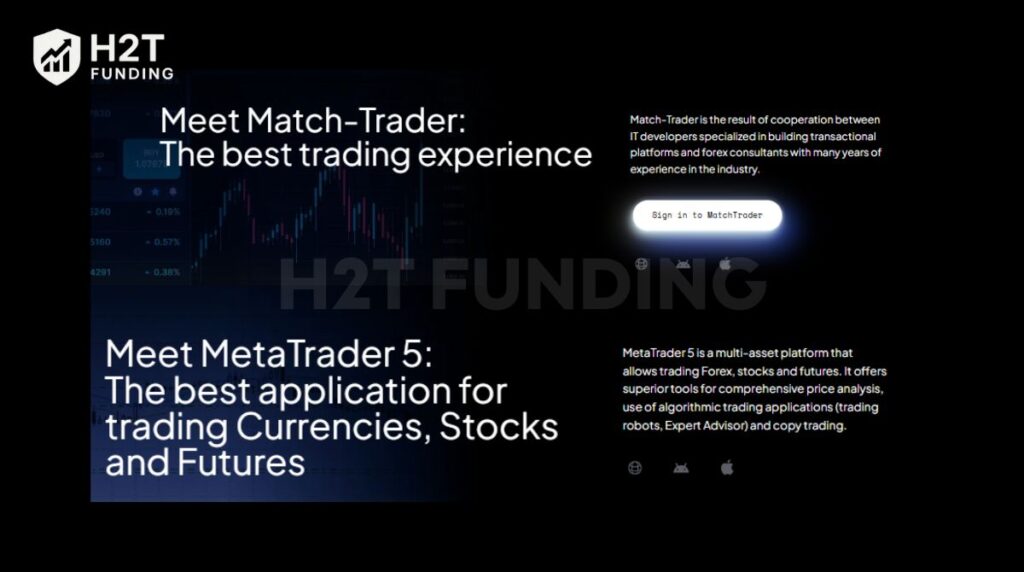

7. SeacrestFunded trading platform

SeacrestFunded gives traders access to two main platforms: Match-Trader and MetaTrader 5 (MT5). Each is linked to different liquidity providers, which impacts execution quality, spreads, and trading conditions. By offering both, the firm covers traders who prefer a cost-efficient setup as well as those who want a professional-grade trading environment.

- Match-Trader is connected to Match-Prime as its liquidity provider. It is known for low-cost execution, with $3 commissions per lot round-trip and near-zero spreads on major forex pairs. This platform is often preferred by traders who focus on active strategies like scalping or day trading, thanks to its cheaper fee structure.

- MetaTrader 5 (MT5) is powered by Seacrest Markets. It charges $5 per lot round-trip on forex and commodities but provides broader stability, advanced charting, and better compatibility with Expert Advisors. Many traders choose MT5 for its global recognition and reliability in managing larger accounts.

Verdict on SeacrestFunded trading platforms

The platform choice comes down to trading style. Match-Trader is best for minimizing costs, while MT5 offers a trusted environment with deeper functionality. Personally, MT5 feels more versatile for long-term strategies, but Match-Trader can save money if you trade actively with higher frequency.

8. Trading instruments & leverage

SeacrestFunded provides access to multiple asset classes, allowing traders to diversify their strategies and manage risk more effectively. From forex majors to commodities and crypto, the selection covers most instruments that retail and professional traders rely on.

Available instruments and leverage limits:

- Forex pairs: leverage up to 1:30, best for intraday and swing strategies.

- Metals (Gold, Silver, etc.): capped at 1:10, reflecting higher volatility.

- Indices (SPX, NASDAQ, DOW, etc.): leverage at 1:10, suitable for macro and news-based plays.

- Oils & commodities: set at 1:10, balancing opportunity with risk.

- Cryptocurrencies: limited to 1:2, protecting accounts from sharp market swings.

This tiered leverage system encourages responsible risk management. Traders can size positions more aggressively in stable markets like forex, while volatile assets like crypto are kept under stricter limits to avoid overexposure.

Verdict on instruments & leverage

The instrument range is wide enough for most trading styles, and the leverage setup feels fair. The 1:30 leverage on forex is generous enough, while the stricter limits on metals and crypto are smart; they help prevent accounts from getting wiped out too quickly. It’s a structure that promotes sustainable trading rather than short-term gambling.

9. Education & resource

SeacrestFunded puts strong emphasis on continuous learning, offering several resources to help traders improve their performance. The main channels include blog articles with strategy and market insights.

There are also video tutorials that explain platform usage. A YouTube channel provides trader interviews and rule breakdowns. Finally, the FAQ section covers payouts, rules, and account setup.

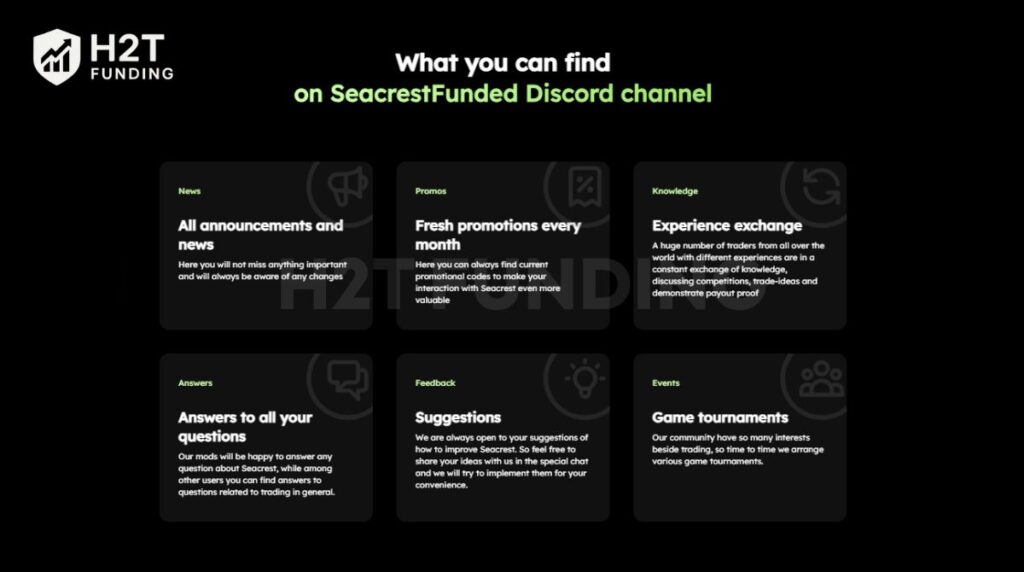

The Discord community is where most of the interaction happens. Traders get instant updates with news announcements, enjoy monthly promotions and discount codes, and join the knowledge exchange by sharing strategies, payout proofs, and ideas. There are also dedicated spaces for answers & feedback from moderators, along with events and tournaments that keep the community engaged beyond trading.

To complement these resources, traders can also explore the H2T Funding YouTube Channel, which delivers transparent prop firm reviews and practical trading insights. With breakdowns of firm rules, challenge structures, and real trading examples, the channel helps traders understand what works and avoid common mistakes.

Verdict on education & resources

Overall, SeacrestFunded’s educational support is practical but not extensive compared to firms with full training programs. However, the YouTube channel and Discord make a real difference by providing live interaction and peer learning.

For me, the Discord community is the real highlight. It acts as a real-time support hub where traders can get answers, share experiences, and feel less isolated in their journey.

10. Customer support of SeacrestFunded

Customer support is one of SeacrestFunded’s strongest points, with traders frequently highlighting the team’s fast response times and clear communication. Support is available through live chat, email, and Discord, giving users multiple channels to get help with account issues, payouts, or rule clarifications.

Having named agents also adds a personal touch, which many prop firms lack. This builds confidence for traders who want reassurance that their concerns will be handled by real people, not just automated replies. The availability of Discord moderators further strengthens support by creating a space where both staff and community members can assist each other.

Verdict on SeacrestFunded customer support

Support feels genuinely attentive and professional. The quick turnaround times and personal involvement from staff really do make a difference, especially compared to firms where responses are delayed or generic. The fact that traders call out agents by name shows a level of trust and reliability that can be a deciding factor when choosing a prop firm.

11. SeacrestFunded restricted countries

SeacrestFunded does not provide its services to traders from certain jurisdictions due to regulatory, compliance, or operational restrictions. Traders residing in these regions are not allowed to participate in any challenge or access live simulated accounts.

- Algeria

- Belarus

- Central African Republic

- Cuba

- Democratic Republic of the Congo (Congo Free State)

- Ethiopia

- Hong Kong

- Iran

- Kenya

- Lebanon

- Libya

- Morocco

- Myanmar (Burma)

- Nicaragua

- North Korea

- Philippines

- Republic of the Congo (Congo Brazzaville)

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- United Arab Emirates

- United States of America

- Venezuela

- Vietnam

- Yemen

SeacrestFunded continues to enforce strict geographic restrictions to remain compliant with global regulations. The exclusion of traders from the United States is particularly notable, as many prop firms avoid operating in US jurisdictions due to stricter financial requirements and oversight.

Traders outside the restricted regions, however, can freely join the evaluation programs and access SeacrestFunded’s simulated funding without limitation.

12. Real trader feedback of SeacrestFunded Trustpilot and Reddit

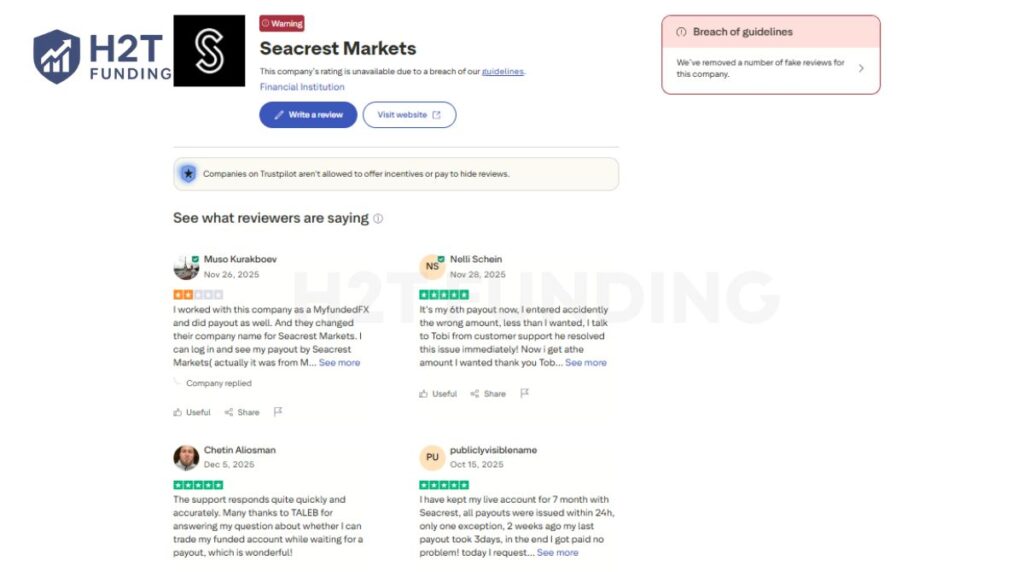

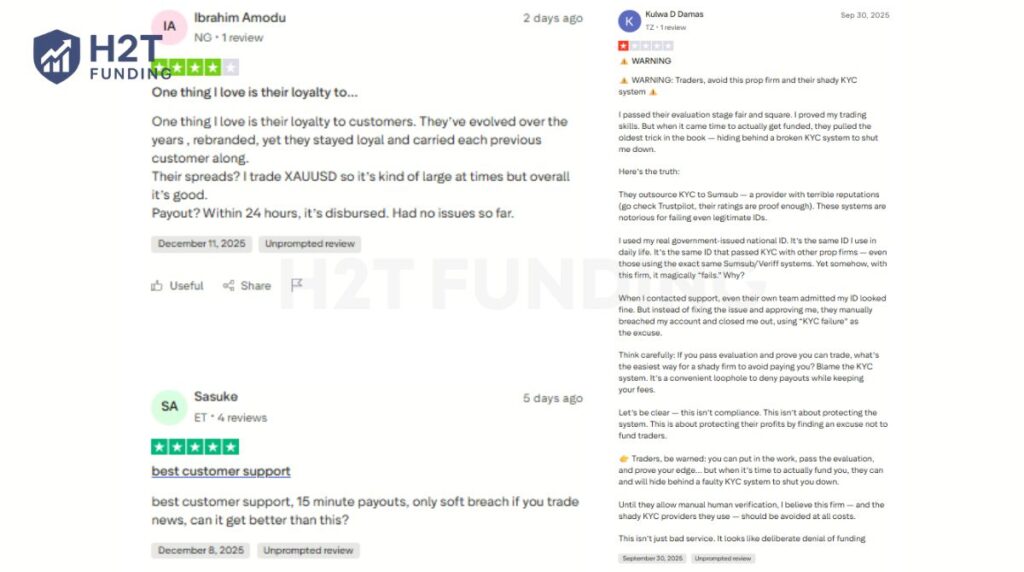

Trader feedback for SeacrestFunded is mixed, and one of the first things that stands out is the current Trustpilot restriction. Trustpilot has temporarily hidden the company’s rating due to guideline breaches, which usually happen when a platform detects abnormal or suspicious review activity.

Despite the restriction, some legitimate reviews still highlight positive experiences. Several traders mention that customer support is responsive, payouts are fast, and spreads feel reasonable for their trading style. These comments reflect smooth operation for users who follow the evaluation rules closely.

However, feedback isn’t universally positive. One review raises concerns about the KYC process, claiming that identification failed without a clear explanation. The trader felt the system worked against them during payout approval, suggesting frustration around verification procedures.

Reddit discussions provide additional context. Many traders confirm successful payouts, sharing screenshots and timelines that show quick approvals when accounts meet all requirements. These posts help balance the criticism seen on Trustpilot.

Overall, trader feedback shows that SeacrestFunded performs well for users who follow the rules carefully and maintain proper risk management. But as with any prop firm, understanding the verification process and reading the fine print can make a significant difference in the experience.

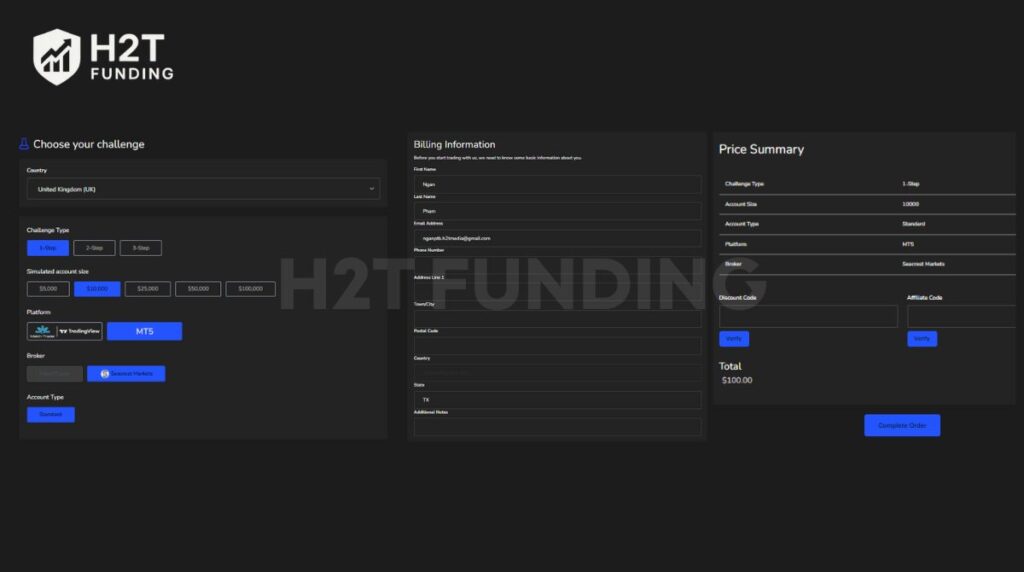

13. How to start with SeacrestFunded

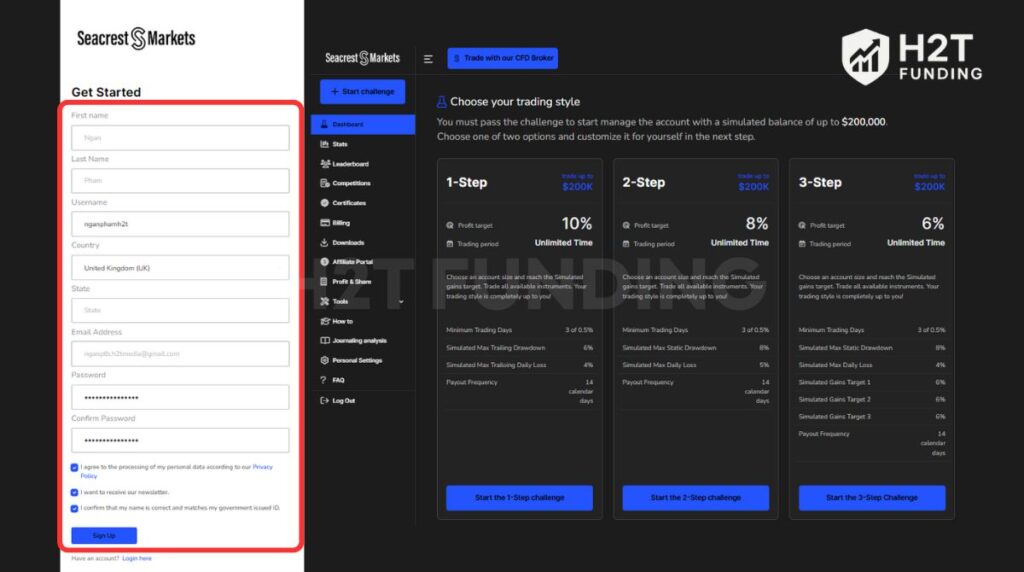

Getting started with SeacrestFunded is straightforward. The process includes creating your account, providing basic details, and completing verification before joining the evaluation program. Here’s a clear step-by-step guide:

- Step 1: Access the registration page

- Step 2: Provide your personal information

- Step 3: Log in to your dashboard

- Step 4: Verify your account

Keep reading the full guide on account setup below for a smoother experience.

13.1. Step 1: Access the registration page

Go to the official website, click Get Funded, and you’ll be directed to the account creation form.

13.2. Step 2: Provide your personal information

Fill in your full name, email, country of residence, and create a secure password. Accept the terms and click Sign Up to continue.

13.3. Step 3: Log in to your dashboard

Use your new credentials to log in. From here, you can manage your account, select a funding program, and monitor your progress. If you have a SeacrestFunded promo code, apply it at checkout to reduce your challenge fee.

13.4. Step 4: Verify your account

Once you pass the evaluation phases, you’ll need to submit identification documents for KYC verification. Only after this step can you request payouts from your funded account.

The onboarding process is designed to be quick and user-friendly, ensuring traders can focus more on their performance rather than administrative hurdles. By completing registration and verification properly, you set the foundation for moving through the challenges and accessing SeacrestFunded’s simulated capital.

14. Compare SeacrestFunded vs other prop firm

When choosing a prop firm, it’s important to look at fees, profit split, account size, and rules. Each firm has different strengths, so the best option depends on your trading style and goals. Below is a side-by-side comparison of SeacrestFunded and three other major competitors.

| Criteria | SeacrestFunded | FundedNext | FTMO | Ment Funding |

|---|---|---|---|---|

| Challenge Fee | $50 – $500 | $32 – $1,099 | €89 – €1,080 | $250 – $17,200 |

| Account Types | 1-step & 2-step challenges | 1-step, 2-step, Instant Funding | 2-step | 1-step |

| Profit Split | 80% standard, 90% with add-ons | 80% – 95% | 80% – 90% | 75% – 90% |

| Account Size | $5K – $100K | $2K – $200K | $10K – $200K | $25K – $2M |

| Time Limit | Unlimited | No time limit | No time limit | No time limit |

| Profit Target | 8% – 10% | 4% – 10% | 5% – 20% | 10% |

| Trading Platforms | MT5, Match Trader | MT4, MT5, cTrader, Match Trader | MT4, MT5, cTrader, DXTrade | MT4, MT5, Match Trader, DXTrade, cTrader |

| Markets Offered | Forex, Metals, Indices, Commodities, Crypto | Forex, Indices, Commodities, Crypto, Futures | Forex, Commodities, Indices, Stocks, Crypto | Forex, Crypto, Indices, Commodities, Stocks |

Choosing the right prop firm depends on whether you prioritize low entry costs, high payout percentages, or access to larger capital. Each option comes with unique benefits:

- SeacrestFunded: Best for traders who want affordable entry fees, unlimited time, and clear rules. A strong choice for beginners or disciplined intermediate traders.

- FundedNext: Attractive for those who want higher profit splits (up to 95%) and more funding paths, including instant funding.

- FTMO: Suited for experienced traders who can handle higher profit targets and prefer working with one of the most reputable firms in the industry.

- Ment Funding: Designed for professional traders aiming to manage large capital accounts, with funding up to $2M, but requiring significant upfront fees.

15. FAQs

Yes, SeacrestFunded is considered legit, with a Trustpilot score of 4.3/5 based on nearly 3,000 reviews. Most traders highlight fast support and transparent rules, though some reviews mention strict KYC and rule enforcement as drawbacks.

SeacrestFunded was originally launched in 2022 under the brand My Funded FX. It operates through MyFunded Capital (HK) Ltd in Hong Kong and MyFunded Capital Solutions Ltd in Cyprus. Leadership has changed since the rebrand, but the firm continues to expand globally.

SeacrestFunded is a proprietary trading firm that gives traders access to simulated accounts after completing evaluations. The company is registered in Hong Kong under MyFunded Capital (HK) Ltd and also has a Cyprus entity under MyFunded Capital Solutions Ltd.

The firm offers two evaluation types: a one-step challenge with a 10% profit target and a two-step challenge with 8% and 5% targets. Both come with unlimited time to complete.

Registration fees vary by account size. Prices start from around $50 for a $5K account and go up to $500 for a $100K account, making it one of the more affordable prop firms.

SeacrestFunded provides account sizes ranging from $5,000 to $100,000. Through the scaling plan, accounts can grow up to $1.5M or 5x the original balance.

Traders keep 80% of profits by default. With add-ons, the profit share can increase to 90%, which is competitive compared to other prop firms.

Payouts are processed every 14 days through crypto or Riseworks. The minimum payout amount is $65, provided the trader has passed verification.

Currently, traders can choose between Match-Trader and MetaTrader 5 (MT5). Match-Trader is cheaper on commissions, while MT5 is widely trusted for automated strategies.

You can trade forex pairs, metals, indices, commodities, oils, and cryptocurrencies. Leverage is set at 1:30 for forex, 1:10 for metals/indices/oils, and 1:2 for crypto.

Yes. News trading is allowed in the challenge phase, but with restrictions. If you open or close trades within three minutes before or after a high-impact release, any profits from those trades may be removed.

Yes, EAs and bots are allowed on MT5 as long as they are unique to the trader. High-frequency bots, arbitrage strategies, or copy trading tools are prohibited.

In the one-step challenge, traders must stay within a 4% daily limit and a 6% trailing maximum loss. The two-step evaluation uses a 5% daily cap with an 8% static overall limit. The three-step program follows a 4% daily restriction and an 8% maximum loss across all phases, offering a more gradual progression while maintaining firm risk boundaries.

Every 3 months, traders who achieve 12% net profit can request a 25% balance increase. Accounts can scale up to $1.5M or 5x the starting balance, rewarding consistent performance.

SeacrestFunded cannot accept traders from a wide list of restricted countries due to compliance rules. These include: Cuba, Iran, Lebanon, Syria, North Korea, Libya, Russia, Sudan, South Sudan, Somalia, Pakistan, Vietnam, UAE, Hong Kong, Malaysia, Belarus, Myanmar, Central African Republic, Democratic Republic of Congo, Congo, Ethiopia, Iraq, Nicaragua, Venezuela, Yemen, Philippines, Kenya, Algeria, Morocco, and the United States. Residents of these countries are currently not allowed to register or trade with the firm.

16. Conclusion

This SeacrestFunded review shows a prop firm that balances accessibility with strict trading rules. With affordable challenge fees, unlimited time, and flexible account scaling, it appeals to disciplined traders looking for long-term growth.

At the same time, restrictions around news trading, strict drawdown limits, and KYC enforcement mean the program is best suited for those who are comfortable with clear compliance.

If you’re considering your options, SeacrestFunded stands out for its cost-effective entry and transparent structure. Still, it’s worth comparing it with other major firms before making a decision.

Tip: Before you commit, scan a few SeacrestFunded prop firm reviews and check for an active SeacrestFunded discount code to lower costs.

For more insights, explore our full list of articles in the Prop Firm Review at H2T Funding. We break down leading other firms like FTMO, FundedNext, and Ment Funding to help you find the best fit for your trading journey.