Finding a reliable prop firm is increasingly difficult as many traders struggle with hidden rules and delayed payment requests. You likely worry about whether your hard-earned profits will actually reach your wallet or if you’ll face sudden account terminations.

QT Funded has emerged as a popular choice for those needing significant capital to scale their trading experience. This firm offers various evaluations that cater to different skill levels, using modern platforms like TradeLocker and MT5.

Our comprehensive QT Funded review dissects their rulebook, customer support quality, and real user feedback. You will gain a clear verdict on their reliability to decide if this platform is worth your time and investment.

1. Our take on QT Funded

QT Funded, also known as Quant Tekel, entered the market with a clear mission to provide institutional-grade infrastructure to retail traders. Established in the UK and led by CEO Tanswell Sassman, the firm has positioned itself as a QT Funded prop firm.

Unlike many competitors that rely on third-party brokers, Quant Tekel operates with its own brokerage roots and holds an FSCA license. This regulatory footprint provides a layer of security that is often missing in the unregulated prop trading industry.

In my view, the most significant advantage here is the direct control over the trading environment. By being broker-owned, they can offer highly competitive spreads and potentially faster execution on forex and indices. This setup reduces the technical issues often caused by the middleman bridge software.

However, a potential downside to consider is their strict adherence to compliance. While the FSCA license adds trust, it also means a very rigid KYC process and strict monitoring of trading experience data. Some traders might find the oversight a bit more intense compared to grey-label QT Funded firms.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official QT Funded websites before purchasing any challenge.

| Pros | Cons |

|---|---|

| FSCA-regulated (License 53227), enhancing financial safety. | MT5 is currently unavailable for traders in the USA or Canada. |

| Customer support is available 24/7 with a large dedicated team. | Relative newcomer (founded in 2023) compared to industry giants. |

| Choice of multiple platforms like MT5, TradeLocker, and cTrader. | Consistency rules can be challenging for aggressive trading style users. |

| High leverage and a generous profit split up to 90%. |

2. Funding program QT Funded

QT Funded provides multiple evaluation paths to cater to different levels of expertise and risk tolerance. Whether you are a seasoned pro or a developing trader, their account structures allow for a tailored trading experience.

There are three primary tracks: QT Instant, QT Prime, and QT Power. Each fund option is designed with specific rules to balance the firm’s capital safety with the trader’s need for growth and consistent payout potential.

2.1. QT instant

The QT Instant program is designed specifically for experienced traders who want to skip the traditional evaluation phase. This model provides immediate access to a live account, allowing you to start generating a payout without the typical multi-step hurdles.

Traders can choose between MT5 and TradeLocker for their execution, offering flexibility for different technical setups. This is the fastest way to reach funded status. However, it comes with a strict 25% consistency rule to ensure profits are generated through a stable strategy rather than a single lucky trade.

| Account Size | One-Time Fee | Daily Drawdown (3%) | Max Drawdown (6%) | Min Withdrawal Target (5%) |

|---|---|---|---|---|

| $1,250 | $26 | $37.50 | $75.00 | $62.50 |

| $2,500 | $52 | $75.00 | $150.00 | $125.00 |

| $5,000 | $84 | $150.00 | $300.00 | $250.00 |

| $10,000 | $132 | $300.00 | $600.00 | $500.00 |

| $25,000 | $250 | $750.00 | $1,500.00 | $1,250.00 |

| $50,000 | $460 | $1,500.00 | $3,000.00 | $2,500.00 |

| $100,000 | $1,080 | $3,000.00 | $6,000.00 | $5,000.00 |

All QT Instant accounts feature a fixed 80% profit split, which is highly competitive for a non-evaluation model. From a personal perspective, the Daily Drawdown of 3% is quite tight for an instant fund. You must be extremely careful with your leverage and position sizing to avoid early termination.

2.2. QT Prime

QT Prime is designed for sustainability and long-term professional growth. Unlike the Instant model, this path completely removes the consistency rule, offering a much more flexible trading experience.

A standout premium feature here is the On-demand payout toggle. This allows qualified traders to potentially bypass standard bi-weekly cycles, providing faster access to their earned payout whenever needed.

I believe this is their most balanced program because it prioritizes skill over speed. The On-demand flexibility is a game-changer for full-time traders who require consistent liquidity from their funded account.

2.2.1. Two-step challenge

The 2-step challenge follows a traditional structure but with enhanced drawdown limits. Phase 1 requires an 8% profit target, while Phase 2 targets a more manageable 5% to demonstrate consistency.

The 10% maximum drawdown is a huge plus, providing ample breathing room for various trading style approaches. It effectively safeguards against breached accounts caused by minor market fluctuations or unexpected news volatility.

| Account Size | One-Time Fee | Phase 1 Target (8%) | Phase 2 Target (5%) | Daily Drawdown (4%) | Max Drawdown (10%) |

|---|---|---|---|---|---|

| $5,000 | $60 | $400 | $250 | $200 | $500 |

| $10,000 | $110 | $800 | $500 | $400 | $1,000 |

| $25,000 | $230 | $2,000 | $1,250 | $1,000 | $2,500 |

| $50,000 | $360 | $4,000 | $2,500 | $2,000 | $5,000 |

| $100,000 | $680 | $8,000 | $5,000 | $4,000 | $10,000 |

| $200,000 | $1,300 | $16,000 | $10,000 | $8,000 | $20,000 |

2.2.2. Three-step challenge

The 3-step challenge is marketed as the QT Funded easiest route due to its lower profit targets per phase. Each of the three stages only requires a 6% gain, significantly reducing psychological pressure.

In my view, this is an excellent choice for conservative traders who prefer lower-risk targets. While it takes longer to reach the funded fund, the lower bar for each phase makes the journey much smoother.

| Account Size | One-Time Fee | Phase Target (6%) | Daily Drawdown (4%) | Max Drawdown (10%) |

|---|---|---|---|---|

| $5,000 | $54 | $300 | $200 | $500 |

| $10,000 | $99 | $600 | $400 | $1,000 |

| $25,000 | $216.67 | $1,500 | $1,000 | $2,500 |

| $50,000 | $366.67 | $3,000 | $2,000 | $5,000 |

| $100,000 | $625 | $6,000 | $4,000 | $10,000 |

| $200,000 | $1,166.67 | $12,000 | $8,000 | $20,000 |

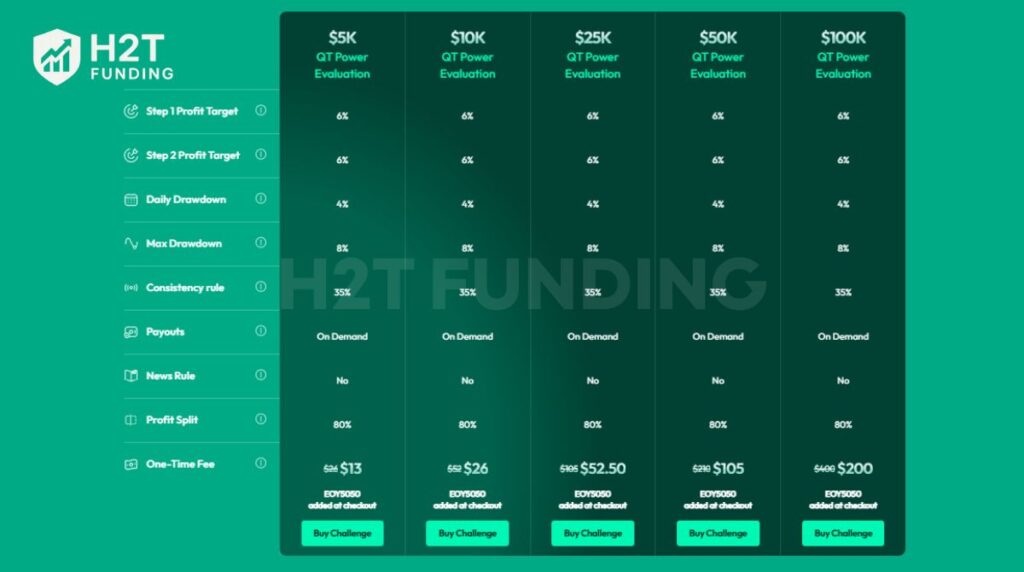

2.3. QT Power

QT Power is positioned as the highest-value option, offering the most affordable entry fees within the Quant Tekel ecosystem. It features a simplified 2-step evaluation process specifically designed for beginners or those with limited capital.

The standout feature of this plan is the No News Rule, which is rare for an affordable challenge. Coupled with On-demand payouts, it offers a level of freedom usually reserved for much more expensive premium accounts.

In my view, while the low price is tempting, you must be mindful of the 35% consistency rule. This means no single day should account for more than 35% of your total profit. It encourages steady growth rather than gambling on a single trade.

| Account Size | One-Time Fee | Phase Target(6%) | Daily Drawdown (4%) | Max Drawdown (8%) |

|---|---|---|---|---|

| $5,000 | $26 | $300 | $200 | $400 |

| $10,000 | $52 | $600 | $400 | $800 |

| $25,000 | $105 | $1,500 | $1,000 | $2,000 |

| $50,000 | $210 | $3,000 | $2,000 | $4,000 |

| $100,000 | $400 | $6,000 | $4,000 | $8,000 |

Verdict on QT Funded funding programs

The QT Funded program structure is impressively diverse, offering something for every trading style. Whether you prioritize speed (Instant), safety (Prime), or affordability (Power), the choices are well-defined.

My personal recommendation is QT Prime for serious traders who want to avoid consistency hurdles. However, QT Power is an excellent low-risk entry point for those testing their strategies. Overall, their account variety is a major competitive advantage in the current market.

3. QT Funded trading rules

Success at Quant Tekel requires more than just technical skill; it demands strict adherence to their operational framework. These rules are designed to filter for professional consistency rather than short-term luck.

A major advantage here is the firm’s transparency regarding its partnership with Prop Firm One. This allows for cross-firm copy trading, though you must always prioritize risk management to avoid automated flags.

3.1. General guidelines & allowed practices

QT Funded allows for a high degree of flexibility, including the use of modern tools. However, they emphasize transparency and require prior communication for certain automated strategies.

- Expert Advisors (EAs) & Copy Trading: Both are permitted but require pre-approval via email. This ensures your EA doesn’t engage in toxic behaviors that could harm the firm’s liquidity.

- Max Allocation: You can manage up to $400,000 in total. If you manage less than $400k, you can copy trades between accounts; however, exceeding this limit requires using different strategies for each account.

- VPN and VPS Usage: These are fully supported for stability. While multiple IPs are allowed, the verified person who passed the KYC must be the only one executing trades.

- Inactivity Rule: You must place at least one trade every 30 consecutive days. Failure to do so will result in the account being permanently deleted.

- Code of Conduct: Quant Tekel maintains a high standard of professionalism. Any public negativity intended to damage the community or harassment of customer support can result in a permanent ban.

In my observation, the pre-approval for EAs is a professional touch. It prevents traders from accidentally using prohibited plug-and-play bots that might lead to a hard breach during the payout phase.

3.2. Account-specific rules (instant, prime, power)

Each funding pathway has unique restrictions. Understanding these differences is the key to choosing the right trading experience for your needs.

3.2.1. QT Prime rules

- Consistency: No consistency rule applies here, making it the most flexible option.

- News Trading: Restricted in the Funded stage (5 minutes before/after), unless you use the On-Demand payout feature.

- Max Risk: Funded traders must not expose more than 2.5% of the initial balance at any one time.

- Minimum Days: 4 trading days are required during evaluations.

3.2.2. QT Power rules

- Consistency: Requires a 35% consistency score, meaning no single day can exceed 35% of your total profit.

- Max Risk: A strict 2% max risk per trade or overall open positions is enforced as a hard breach.

- News Trading: Fully allowed in both challenge and funded stages.

3.2.3. QT Instant rules

- Consistency: A 25% consistency rule is applied during withdrawal requests.

- Risk Limits: Enforces a 2% max risk rule and a fixed 3% daily drawdown.

- Payout Requirements: You must trade for at least 5 separate days and reach a 5% profit target before your first withdrawal.

3.3. Prohibited trading practices

QT Funded maintains a strict Anti-Gambling policy. They actively monitor for Toxic behaviors that bypass actual market analysis in favor of exploiting price feeds.

- Toxic Strategies: Latency trading, arbitrage, and High-Frequency Trading (HFT), like tick scalping, are strictly banned.

- All-or-Nothing Approach: This refers to risking more than 75% of your drawdown limit on a single event or trade. Such aggressive behavior is viewed as gambling rather than professional trading.

- Group Hedging: You cannot open opposite positions on the same asset across different accounts to manipulate the evaluation outcome.

- Layering Rule: Previously, traders couldn’t have 3+ positions on the same asset. Note that this rule has been removed for most accounts purchased after April 2025.

The All-or-Nothing clause is their way of filtering out luck-based traders. It forces you to maintain disciplined risk management, which ultimately benefits your long-term career as a funded trader.

Verdict on QT Funded rules

The rules at QT Funded (Quant Tekel) are well-structured but require careful attention. The contrast between QT Prime (no consistency) and QT Power (35% consistency) means you must be honest about your own trading style before buying.

Overall, their framework is designed for professional growth. If you use MT5 or TradeLocker with a standard strategy and respect the news windows, you shouldn’t face any issues. They provide a very safe environment for those who prioritize discipline over fast, risky gains.

4. QT Funded payout structure

QT Funded offers a flexible and rewarding payout system that varies depending on your chosen account type. Traders can earn between 80% and a rare 100% profit split, provided they meet specific consistency and profit thresholds.

The firm utilizes a bi-weekly cycle for most plans, but On-Demand options are available for those who prioritize liquidity. It is crucial to monitor your payout window, as missing a request day may require you to complete an entirely new cycle.

Each fund pathway has specific requirements that must be met before profits can be successfully withdrawn to your wallet.

- QT Instant: Traders are eligible for an 80% profit split every 14 days. To qualify, you must generate a minimum of 5% profit and maintain a strict 25% consistency score.

- QT Prime: Offers the most flexibility. You can choose bi-weekly payouts (80% split) or On-Demand payouts. The On-Demand option is highly attractive as it offers a 100% profit split, but it requires a 3% minimum profit and a 35% consistency score.

- QT Power: On-demand payouts are the standard here. You receive an 80% profit split as long as you meet the minimum trading days and the 35% consistency score.

| Feature | QT Instant | QT Prime (Standard) | QT Prime (On-Demand) | QT Power |

|---|---|---|---|---|

| Profit Split | 80% | 80% | 100% | 80% |

| Frequency | Every 14 Days | Bi-weekly | On-Demand | On-Demand |

| Min. Profit | 5% | 1% or $100 | 3% | 1% or $100 |

| Consistency | 25% Score | None | 35% Score | 35% Score |

The 100% profit split in the QT Prime On-Demand model is a standout feature in the prop industry. However, do not underestimate the 35% consistency score; it requires you to spread your wins evenly rather than relying on a single home run trade.

One critical technicality to note is the minimum payout threshold. For most accounts, this is 1% of the balance or $100 (whichever is higher). If you are using QT Instant, the bar is higher, requiring 5% of the profit margin before you can initiate a request.

Verdict on QT Funded payouts structure

The payout structure at QT Funded is exceptionally competitive, especially with the potential for a 100% profit split. Their system rewards disciplined traders who can maintain a steady trading style over time.

However, the missed request policy is quite punishing. If you forget to hit the request button on your designated day, you might have to wait another full cycle. I recommend setting a calendar reminder for your payout dates to ensure you don’t leave your hard-earned funds sitting in the account longer than necessary.

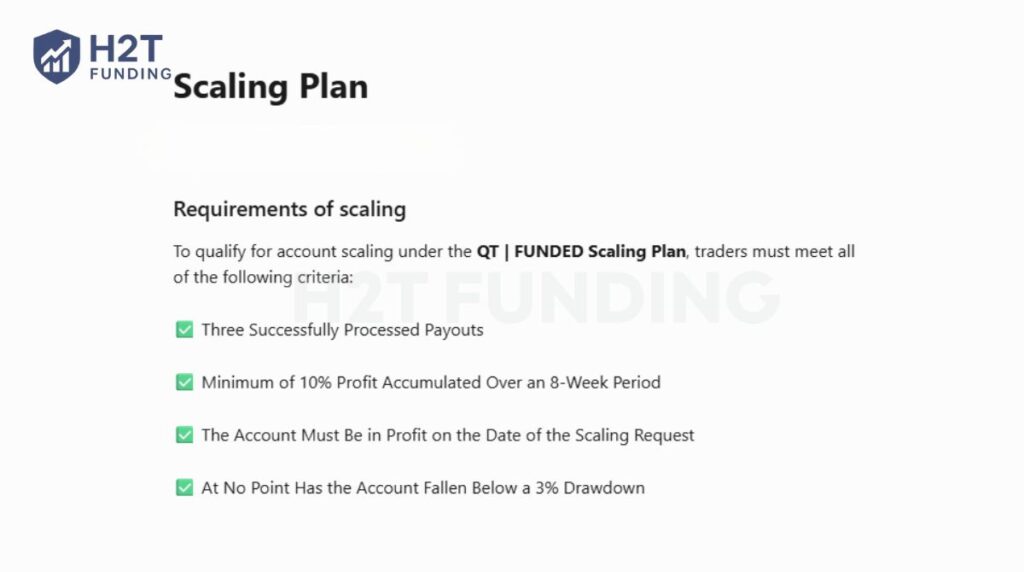

5. Scaling plan of QT Funded

The QT Funded scaling plan is a professional career roadmap rather than a simple balance top-up. It aims to transition successful individuals into a salaried institutional role within the Quant Tekel ecosystem.

To qualify for this progression, your trading style must demonstrate extreme stability. You are required to meet four strict criteria to prove your readiness for larger capital:

- Three processed payouts: You must successfully withdraw profits at least three times.

- 10% profit accumulation: Maintain a minimum 10% gain over a consistent 8-week period.

- Profitable status: The account must be in the green on the day of your scaling request.

- 3% drawdown floor: Crucially, the fund must never have fallen below 3% drawdown at any point.

| Time Frame | Account Size (Example) | Additional Benefits & Institutional Perks |

|---|---|---|

| 8 Weeks | $220,000 | Initial capital expansion based on consistent performance. |

| 16 Weeks | $240,000 | +1% Max Drawdown, +5% Profit Split, +10% Lot Allocation. |

| 24 Weeks | $260,000 | Salary Offer becomes available for qualifying traders. |

| 32 Weeks | $280,000 | +1% Daily Drawdown and a physical Office Seat offer. |

| 40 Weeks | $300,000 | Potential Salary up to $120,000/year as a lead trader. |

The benefits beyond 24 weeks are unique, especially the transition into a salaried position. This hedges your income, providing financial security regardless of monthly market fluctuations in forex or indices.

However, the 3% drawdown floor is an exceptionally high bar that effectively filters out aggressive strategies. It leaves only the most disciplined professionals to reach the highest levels of the evaluation path.

Verdict on QT Funded scaling

This plan is the most QT Funded in the industry, but requires a very low-volatility approach. While the $120k salary is a massive incentive, the 3% drawdown limit is a brutal filter for most retail traders.

6. Spreads & commission fees

QT Funded leverages its direct brokerage background to offer a highly transparent fee structure across all trading instruments. Traders can choose between two execution models: Raw Spreads with a commission or a commission-free Variable Spread model.

The Variable Spread model is ideal for a swing-oriented trading style as it eliminates direct transaction fees. Meanwhile, the Raw model is built for scalpers using MT5 or TradeLocker who require the tightest possible entry and exit points.

A standout feature of Quant Tekel is that all account types are swap-free by default. This is a massive advantage for long-term traders, as it eliminates overnight carry costs that typically eat into profit margins over time.

| Instrument | Raw Spread Commission | Variable Spread Commission | Specific Plans ($4/lot Raw) |

|---|---|---|---|

| Forex (FX) | $4 per round trip | $0 Commission | Power, Prime (Raw), Instant |

| Metals | $4 per round trip | $0 Commission | Power, Prime (Raw), Instant |

| Indices | $4 per round trip | $0 Commission | Prime (Raw), Instant |

| Crypto | $4 per round trip | $0 Commission | Power, Prime (Raw), Instant |

| Oil | $0 Commission | $0 Commission | All QT Programs |

Interestingly, QT Power and QT Prime Variable offer zero commissions on indices, which is rare for affordable challenges. Furthermore, Oil remains commission-free across every single funding program, providing excellent value for commodity traders.

In my view, the $4 per lot round-trip is extremely competitive compared to the industry average of $7. This lower overhead directly increases your chances of hitting profit targets and successfully requesting your first payout.

Verdict on QT Funded spreads & commission fees

The pricing at Quant Tekel is top-tier because of the flexibility it offers. The swap-free status and the $0 commission on Oil make it a highly cost-effective environment for both high-frequency and long-term traders.

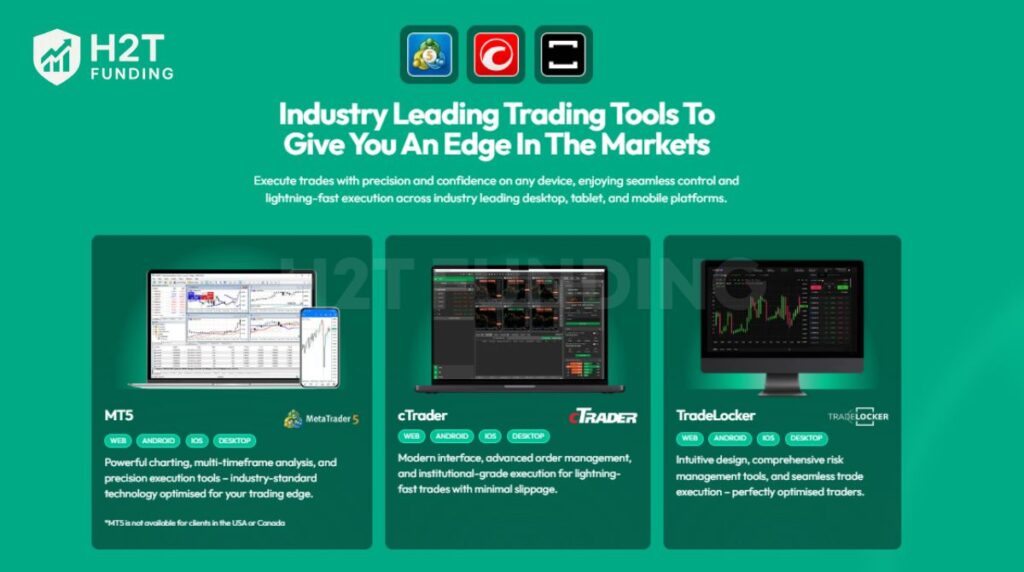

7. QT Funded trading platform

QT Funded provides three elite platforms: MT5, cTrader, and TradeLocker, allowing you to choose an interface that matches your trading style. This variety ensures a high-quality trading experience for both mobile users and technical analysts.

- MT5: The industry standard for those using Expert Advisors (EAs).

- cTrader: Built for professional scalpers with premium execution tools.

- TradeLocker: A modern, TradingView-integrated platform accessible to all regions.

| Platform | Regional Restrictions | Ideal For |

|---|---|---|

| MT5 | Restricted in the USA & Canada | EA users and technical analysts. |

| cTrader | Restricted in the USA | Professional order management. |

| TradeLocker | No Restrictions | USA/Canada traders & mobile users. |

Direct licensing agreements mean that USA and Canada residents cannot use MT5, and USA residents are excluded from cTrader. You must avoid logging in via IP addresses from these countries to prevent technical issues or account pauses.

Verdict on QT Funded trading platforms

The choice is excellent, but regional restrictions are strict. If you are in North America, TradeLocker is your only reliable option to manage your fund without breaching compliance.

8. Trading instruments & leverage

QT Funded provides a comprehensive selection of trading instruments, allowing you to diversify your portfolio across forex, metals, indices, and cryptocurrency. The firm operates on a CFD model, ensuring you can capitalize on both rising and falling markets.

The leverage provided varies significantly based on the number of steps in your evaluations and the specific asset class. The 2-step challenges offer the highest buying power, while the Instant and 3-step models are more conservative.

| Asset Class | Instant Funding | 2-Step Challenge | 3-Step Challenge |

|---|---|---|---|

| Forex (FX) | 1:50 | 1:100 | 1:50 |

| Metals | 1:15 | 1:35 | 1:15 |

| Indices | 1:20 | 1:35 | 1:20 |

| Crypto | 1:1 | 1:2.5 | 1:1 |

| Other Commodities | 1:20 | 1:35 | 1:20 |

In my observation, the 1:100 leverage on 2-step forex accounts is excellent for capturing large swings with smaller initial margins. However, the 1:1 leverage for crypto on other plans is quite low, which might limit the trading experience for dedicated digital asset traders.

Verdict on QT Funded trading instruments & leverage

The range of instruments is robust, covering over 80 forex pairs and global indices. If you prioritize high leverage, the 2-step evaluation is the clear winner, though you must maintain strict risk management to avoid a hard breach.

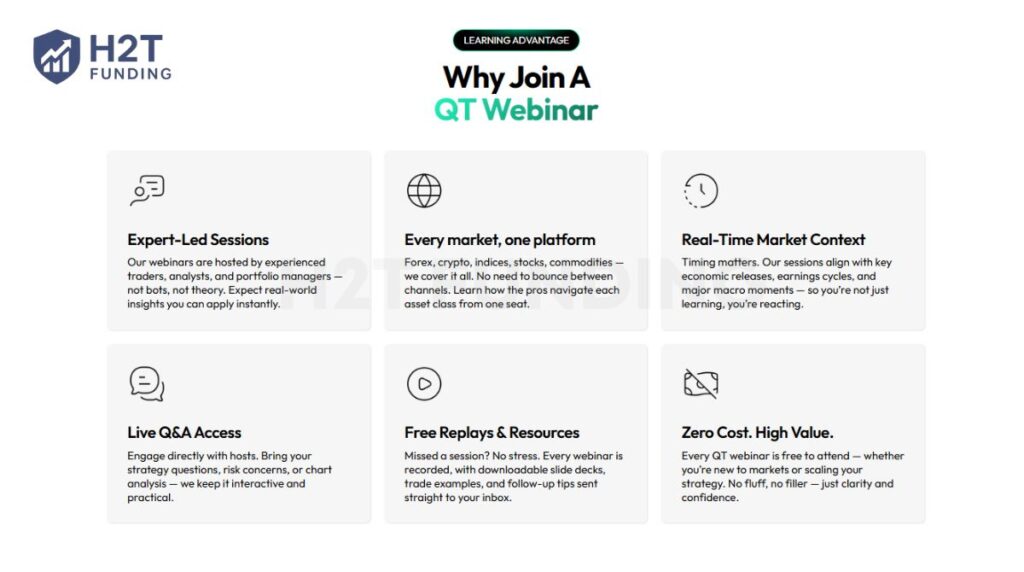

9. Education & resource

QT Funded provides a variety of resources, primarily through the QT Funded Blog and live webinars. These tools are designed to keep you informed about market trends and firm updates within the forex and crypto sectors.

The blog serves as a hub for macro weekly briefings and strategy tutorials. It provides real-time context on economic releases, such as the Fed tone and PMI data, which is essential for managing a funded account.

- Expert-Led Webinars: Interactive sessions featuring live Q&A access and market analysis.

- Macro Briefings: Weekly breakdowns of key economic indicators and their impact on indices.

- Strategy Tutorials: Insights into both beginner and advanced technical trading methods.

However, a significant limitation is the lack of a structured education academy. Unlike competitors that offer step-by-step courses, Quant Tekel relies on scattered blog posts and periodic workshops.

Beyond written content, the firm hosts regular QT Webinars led by experienced traders and portfolio managers. These sessions are entirely free and provide a Learning Advantage that adds immense value to your trading experience.

- Expert-led sessions: Real-world insights from pros, moving beyond simple theory or automated bots.

- Live Q&A access: Direct interaction with hosts to resolve strategy questions or specific chart analysis concerns.

- Free replays & resources: Recorded sessions with downloadable slide decks sent straight to your inbox for review.

The combination of the blog, market news, and live workshops ensures that traders are never left navigating the markets alone. This level of support is particularly beneficial for those currently in the evaluation phase.

Verdict on QT Funded education & resource

The resources are good for experienced traders who want market updates. By providing real-time macro context and expert-led workshops at zero cost, they prove to be a partner invested in trader growth. However, the absence of a structured curriculum is a clear weakness for those still in the early evaluation phase.

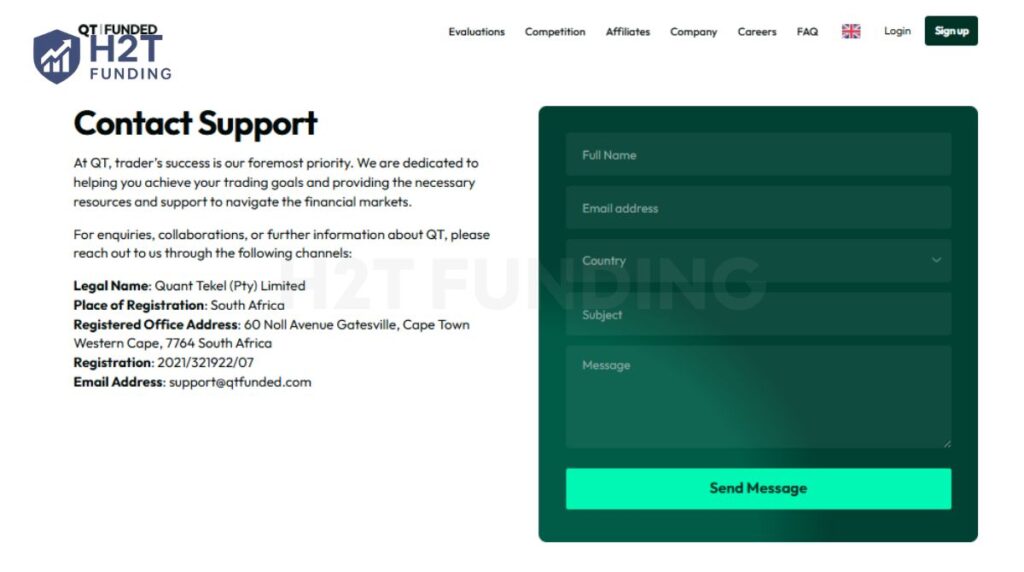

10. QT Funded customer support

QT Funded provides customer support through email, a direct messaging form, and an internal ticketing system. They focus on helping traders navigate the financial markets and resolving technical issues related to the QuantTekel login or dashboard metrics.

The firm is transparent about its legal identity, operating as Quant Tekel (Pty) Limited, based in Cape Town, South Africa. This physical presence adds a layer of accountability that many offshore prop firms lack.

- Email Support: You can reach their primary desk at support@qtfunded.com for general enquiries and collaborations.

- Ticketing System: Available for existing users to open a ticket or submit formal Complaints regarding account breaches.

- Direct contact form: Located on their website, allowing you to send messages by providing your full name, email, and subject.

- Live Chat: Operated by an AI agent named Alex, you must explicitly request to talk to a person for specialized help.

Verdict on QT Funded customer support

The support system is functional but occasionally inconsistent. While the legal transparency and 24-hour account issuance are pros, the heavy reliance on AI and occasional technical glitches with chat links are clear weaknesses. It is a solid setup, but it lacks the personal touch found in smaller, more boutique prop firms.

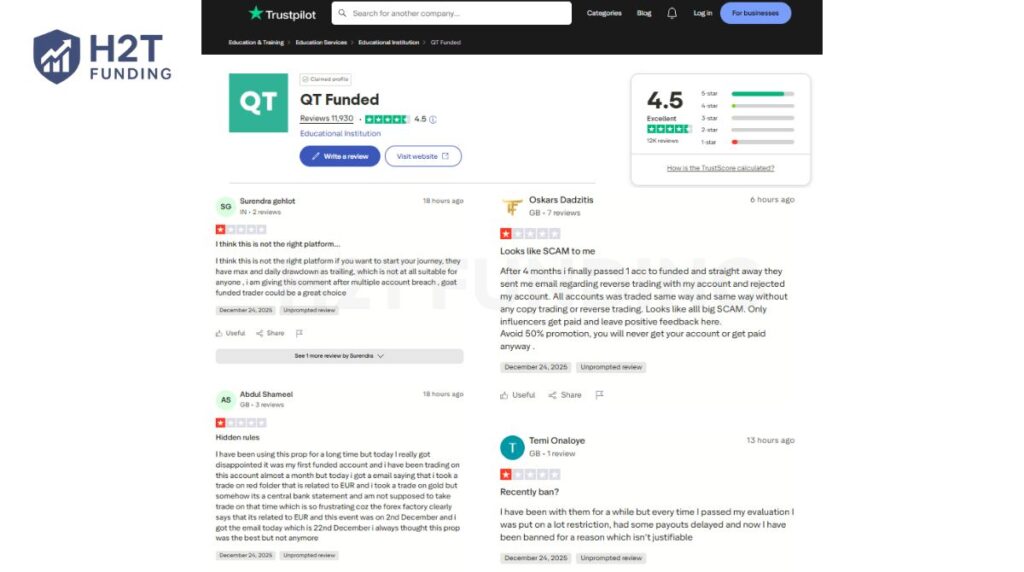

11. Real trader feedback: QT Funded Trustpilot and QT Funded reviews Reddit

The public reputation of Quant Tekel is a mix of high praise for its professional infrastructure and sharp criticism regarding its strict rule enforcement. On Quanttekel Trustpilot, the firm maintains a strong 4.5 rating with over 12,000 reviews (updated on Jan 04, 2025)

Many users highlight a positive trading experience, specifically noting that customer support is fast and effective at resolving dashboard issues. This indicates that the firm is well-staffed and handles high volumes of inquiries professionally.

However, looking at recent QT Funded reviews, a recurring theme of frustration has emerged in late 2025. Several traders have reported account rejections for reverse trading or unjustifiable bans immediately after passing their evaluations.

A significant number of complaints focus on hidden rules regarding news trading. For instance, some traders were penalized for trading gold during the EUR-related central bank statements, leading to unexpected breached accounts despite following the standard calendar.

On QT Funded reviews on Reddit, the sentiment is often more skeptical. Experienced members frequently argue that the firm’s business model might be more dependent on challenge fees than on the long-term success of funded traders.

Specific technical contradictions are often discussed, such as the 2% risk rule. Some users claim that an initial Stop Loss is not strictly required at entry. However, the AI system may still flag a breach if the SL is not immediately detected by the server.

Despite these critiques, there is a consistent flow of positive feedback regarding payout reliability. Many traders continue to receive their profit shares on time and appreciate the responsiveness of specific support agents like John and Fury.

Ultimately, the community feedback suggests that QT Funded is a legitimate but high-maintenance partner. To succeed, you must move beyond basic strategy and meticulously study their evolving rulebook to avoid automated technical violations.

12. How to sign up for QT Funded

Signing up for a Quant Tekel account is a streamlined process designed to get you into the markets quickly. Before you begin, ensure you have your identification ready for the later KYC stages.

To start your journey toward a funded account, follow these essential steps:

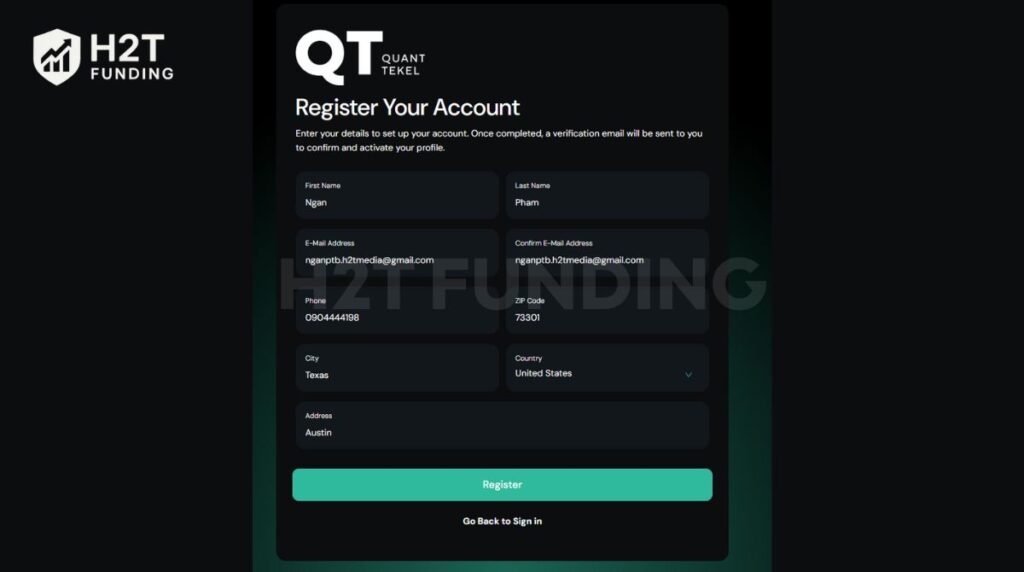

- Step 1: Visit the official website and register your personal details.

- Step 2: Verify your email address via the automated link.

- Step 3: Choose between CFD or Futures evaluations.

- Step 4: Configure your challenge settings and apply a promotion code.

- Step 5: Complete the billing information and select a payment method.

Follow our detailed guide below to ensure your registration is successful and your trading experience begins without delay.

12.1. Step 1: Account registration

Click the Sign up button on the top navigation bar of the homepage. You will be directed to a form where you must enter your full name, email, phone number, and physical address.

I recommend double-checking your country selection here. This ensures you are offered the correct account types and platforms permitted in your specific region.

12.2. Step 2: Email verification

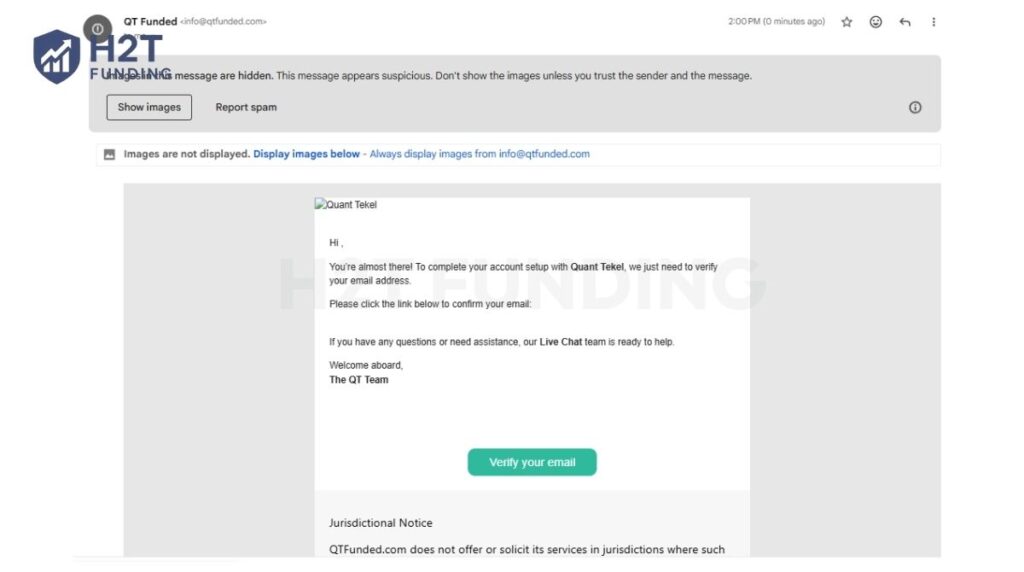

Once you click Register, Quant Tekel will send a verification email to your inbox. You must click the Verify your email button to activate your profile and gain access to the Quanttekel login portal.

If you don’t see the email within two minutes, check your spam folder. You cannot proceed to select a fund challenge until this step is completed.

12.3. Step 3: Select your evaluation path

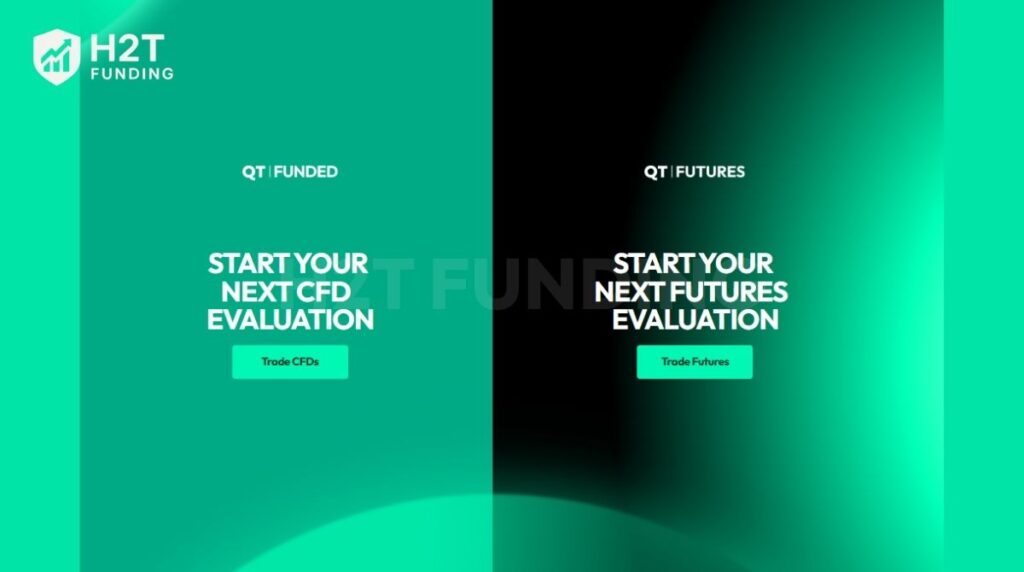

After logging in, your dashboard will present two main options: Start Your Next CFD Evaluation or Start Your Next Futures Evaluation. Most retail traders choose CFDs for access to forex and indices.

12.4. Step 4: Configure the challenge and add-ons

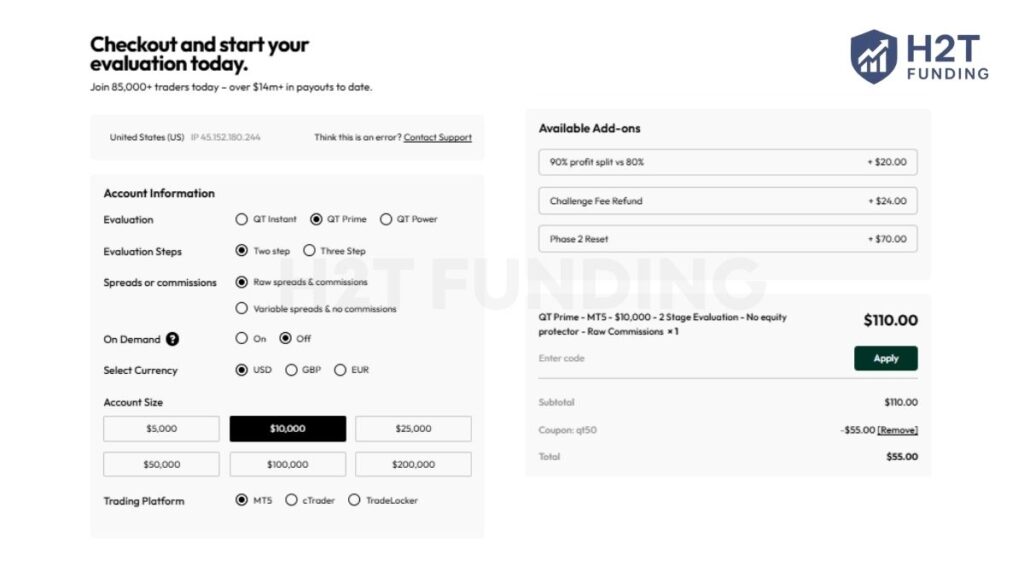

The checkout page allows for deep customization of your account. You will select your preferred evaluation (Instant, Prime, or Power), the number of steps, and your trading platform, like TradeLocker or MT5.

This is also where you can select Add-ons such as a 90% profit split, a challenge fee refund, or a Phase 2 reset. These features provide extra security for your investment during the evaluation phase.

Important: Before proceeding to the payment, check the Enter code box. Ensure your discount code is applied and the total price has successfully decreased before clicking Apply.

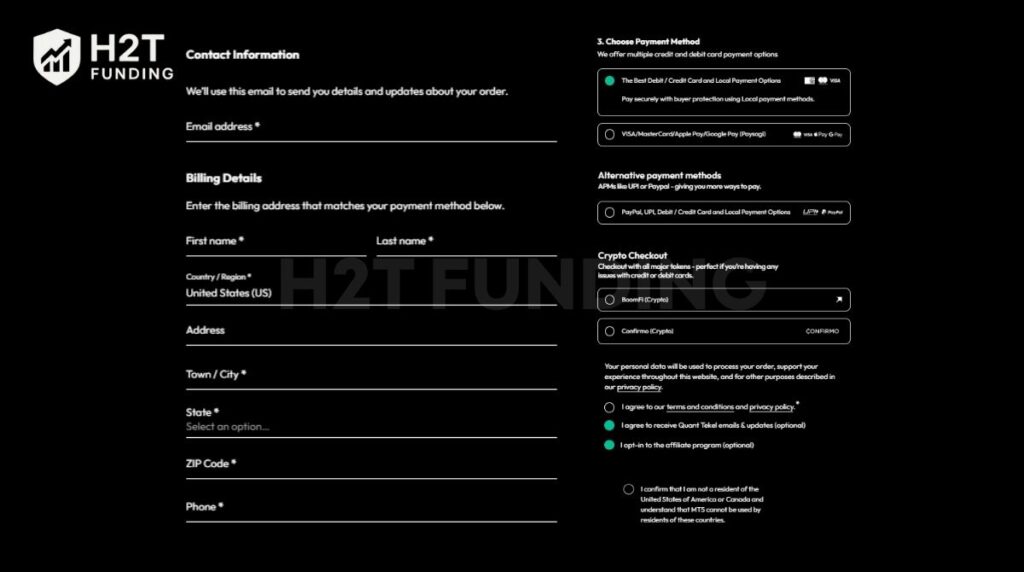

12.5. Step 5: Billing and payment methods

Finally, you will fill in your billing details to match your payment method. QT Funded offers a wide variety of ways to pay, making it accessible to a global audience.

- Credit/Debit Cards: Standard Visa and Mastercard options via Paysagi.

- Alternative Methods: PayPal, UPI, and local payment options for specific regions.

- Crypto Checkout: Fast and secure payments via BoomFi or Confirmo using major tokens.

By following these steps and ensuring your discount is applied, you can efficiently secure your challenge and start working toward your first payout.

13. Restricted countries by QT Funded

QT Funded maintains a strict compliance policy regarding international sanctions and local financial regulations. While they serve most of the world, certain jurisdictions are currently prohibited from opening an account or managing a fund.

The following regions are currently restricted from participating in their programs:

- Cyprus

- Iran

- North Korea

- Sudan

- Syria

- Russia

It is important to note that this list may expand to include any other jurisdiction where offering virtual trading programs would be contrary to local laws. Always verify your residency status during the KYC process to avoid any future technical issues.

In summary, if you reside in a restricted country, you will not be eligible for their evaluations. For eligible traders, staying informed about these regional policies ensures a smooth and secure trading experience from start to finish.

14. Compare QT Funded vs other prop firms

Choosing the right partner is vital for a successful trading experience. We have compared QT Funded against other industry leaders to help you determine which fund model aligns best with your goals.

This comparison focuses on the core metrics that affect your bottom line, including evaluation costs and profit splits. Each firm has unique strengths depending on your preferred trading style and capital needs.

| Criteria | QT Funded | FundedNext | SeacrestFunded | AquaFunded |

|---|---|---|---|---|

| Challenge Fee | $26 – $1,300 | $32 – $1,099 | $40 – $500 | $23 – $1,074 |

| Account Types | 2-step, 3-step, Instant | 1-step, 2-step, Instant | 1-step, 2-step, 3-step | 1-step, 2-step, 3-step, Instant |

| Profit Split | 80% – 90% (up to 100%) | 80% – 95% | 80% – 90% | 90% – 100% |

| Account Size | $1.25K – $200K | $2K – $200K | $5K – $100K | $2.5K – $300K |

| Profit Target | 4% – 8% | 4% – 10% | 5% – 10% | 5% – 12% |

| Trading Platforms | MT5, cTrader, TradeLocker | MT4, MT5, cTrader, Match Trader | MT5, Match Trader, TradingView | MT5, TradeLocker, Match Trader, cTrader |

| Asset Types | Forex, Metals, Indices, Crypto, Commodities | Forex, Indices, Commodities, Crypto, CFDs, Futures | Forex, Indices, Crypto, Commodities | Forex, Indices, Commodities, Crypto |

Selecting the most suitable partner depends on your individual goals and capital requirements. Each firm caters to a different niche, from budget-friendly challenges to high-tier professional environments for managing an account.

- QT Funded: Best for traders seeking swap-free accounts and a clear career path via a salaried scaling plan. It is ideal for those using TradeLocker in restricted regions.

- FundedNext: Perfect for those wanting the highest starting profit split (up to 95%) and access to the legacy MT4 platform.

- SeacrestFunded: A strong choice for budget-conscious traders who prefer a structured path and TradingView integration.

- AquaFunded: Best for experienced professionals aiming for a 100% profit split and massive scaling potential up to $2 million.

Ultimately, your choice should depend on which platform you are most comfortable with and whether you can navigate the specific risk management rules. Comparing these account types ensures you don’t face unexpected issues during your first payout.

15. Should I choose QT Funded?

QT Funded is ideal for disciplined professionals who prioritize long-term capital growth over high-risk, short-term flips. If you are a swing trader, the swap-free by default policy is a massive advantage for holding positions across the week without costs.

Regarding strategy, Trend Following and Price Action thrive here due to the generous 10% maximum drawdown on Prime accounts. These methods allow for natural market swings without triggering the tight daily drawdown limits found in other fund models.

Intraday traders using fixed risk (around 0.5% – 1% per trade) will easily comply with the 2% max risk rule. However, news traders must be selective, as only the Power and Prime On-Demand plans allow for unrestricted trading during high-impact forex events.

You should avoid this firm if your trading style relies on High-Frequency Trading (HFT) or latency arbitrage, as these are strictly prohibited. The firm also filters out All-or-Nothing gamblers who risk over 75% of their drawdown on single events.

16. FAQs

Yes. QT Funded (Quant Tekel) is a broker-backed firm regulated by the FSCA (License 53227). They have paid out millions to traders and maintain a high rating on Trustpilot.

Most account types offer a standard 80% profit split. However, the QT Prime On-Demand model allows traders to keep 100% of the profits if they meet specific targets.

No. All evaluations at QT Funded are designed with no time limits. This allows you to manage your account at your own pace without the psychological pressure of a 30-day deadline.

Yes, but you must obtain pre-approval from their risk team at passes@qtfunded.com. Only risk-management EAs are permitted; toxic strategies like HFT or latency arbitrage will result in breached accounts.

The QT Prime and QT Power plans require a minimum of 4 trading days per phase. QT Instant requires 5 separate trading days before your first payout.

Copy trading is permitted only between accounts personally owned by the same trader. Using group trading or copying from external providers is strictly prohibited.

Standard payouts are processed bi-weekly (every 14 days). For QT Power and QT Prime users, On-Demand payouts are available once the consistency score is met.

News trading is allowed during all evaluations. In the funded stage, QT Power has no restrictions, but Instant and Prime have a 5-minute window restriction around red-folder events.

The highest leverage is 1:100 for forex on 2-step accounts. Other assets like indices offer up to 1:35, while cryptocurrency is limited to 1:1 on most plans.

Prohibited behaviors include latency arbitrage, tick scalping, group hedging, and the All-or-Nothing approach, which involves risking more than 75% of your drawdown.

There is no fixed maximum lot size. However, you must adhere to the Excessive Exposure rule, ensuring your open positions do not exceed prudent risk thresholds.

The minimum payout is $100 or 1% of the account balance, whichever is higher. For QT Instant, you must generate at least 5% profit before the first withdrawal.

17. Conclusion

To summarize this QT Funded review, the answer to whether this prop firm is truly legit in 2026 is yes, but it comes with significant caveats. While Quant Tekel is a regulated entity with institutional roots, its environment is one of the most demanding and rigid in the industry.

The firm’s strengths lie in its FSCA regulation, swap-free accounts, and the flexibility of TradeLocker for restricted regions. However, it is far from perfect. The 35% consistency rule and the strict 2% max risk per trade can be a major hurdle for many professional trading style approaches.

Furthermore, the lack of a structured education academy and the punishing nature of their news rules are clear weaknesses. The requirement to never drop below 3% drawdown for scaling is also an exceptionally high bar that very few retail traders will ever actually reach.

QT Funded is not for beginners or high-volatility traders. It is a specialized platform for the most disciplined professionals who can navigate a minefield of technical rules to secure a payout. If you cannot adhere to their strict risk parameters, your account is likely to face a hard breach.

If you are still searching for the right fit, we recommend exploring more options in our Prop Firm Review section at H2T Funding. Comparing different firms is the best way to ensure your strategy isn’t restricted by a partner’s specific rulebook.