My Funded Futures promotes a single-step evaluation, no activation fees, high payout caps, and up to five funded accounts per trader. They emphasize trust and transparency, with 24/7 support, an active Discord community, and even public payout certificates showing amounts like $13,500 from a $10K account.

In this My Funded Futures review, we will look past the marketing promises to see how their funding program, trading rules, costs, and payouts actually work. The goal is to give traders a clear view of both the opportunities and the risks before deciding whether this prop firm is the right fit.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official My Funded Futures websites before purchasing any challenge.

1. Our take on My Funded Futures

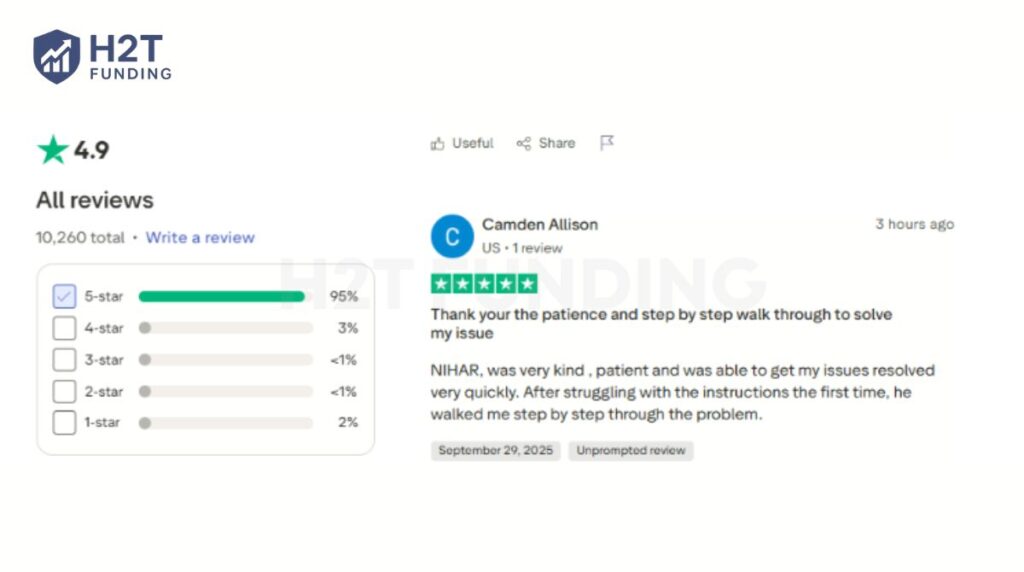

Founded in the U.S. in October 2023 by CEO Matthew Leech, My Funded Futures focuses solely on futures trading. Unlike firms that spread across forex and crypto, this niche approach gives traders a professional setup tailored to futures markets without risking personal capital. The firm currently holds a 4.9-star rating on Trustpilot, reflecting strong early feedback.

The structure is simple: one-phase evaluation, with fees from $77, profit targets at 6%, and account sizes of $50K–$150K. No time limit and profit sharing of 80% make the model feel accessible. The lack of daily loss limits is a particularly refreshing feature, as it allows more freedom in execution.

After two years, the firm is gaining traction with rapid payouts, transparent rules, and trusted platforms like NinjaTrader, Tradovate, and TradingView. However, the short track record means its long-term reliability is still being tested.

This makes it a promising yet unproven choice, though My Funded Futures review Reddit posts and trader experiences often mention fast payouts and fair conditions.

| Pros | Cons |

|---|---|

| One-phase evaluation simplifies access | Only two years in business |

| No daily loss limits on some plans | Markets are limited to futures |

| Automated trading (EAs/bots) allowed | Limited educational resources |

| Multiple professional platforms: NinjaTrader, Tradovate, TradingView | Reputation still developing |

| 4.9 Trustpilot rating shows strong early reviews |

My Funded Futures delivers a streamlined path to funding with fair fees and strong upside for futures traders. The focus on simplicity and flexible rules is a clear advantage. Still, its short operating history calls for caution until the firm builds a longer record of consistency.

2. My Funded Futures evaluation

On July 22, 2025, My Funded Futures officially introduced its new lineup: the Core Plan, Scale Plan, and Pro Plan. Branded under the signature 1 Evaluation – 3 ways to earn, these programs simplify the path to funding by keeping evaluation rules identical while tailoring payout structures and scaling opportunities.

Fees start low, and this section clarifies the My Funded Futures monthly fee you’ll pay until you pass. The changes addressed trader feedback and brought universal upgrades. The changes include a $100,000 payout cap, which replaced the previous $25K soft cap. The consistency rule in the funded stage was removed, and news trading became allowed in both the Core and Scale plans. Importantly, there is still no daily loss limit, and all evaluations carry a 50% consistency rule, making it possible to pass in just two days.

Legacy account types: Starter, Starter Plus, and Expert, are still available at checkout but will be phased out gradually. From September 10, 2025, the route to a live account is also streamlined: traders must now complete five consecutive payouts instead of the old “30 profitable days” rule.

| Feature | Core Plan (50k) | Scale Plan (50k) | Pro Plan (50k) |

|---|---|---|---|

| Replaces | Starter | Starter Plus | Expert |

| Price | $77/month | $127/month | $227/month |

| Profit target | $3K | $3K | $3K |

| Drawdown | $2,000 | $2,000 | $2,000 |

| Daily loss limit | None | None | None |

| Consistency rule | 50% in evaluation only | 50% in evaluation only | 50% in evaluation only |

| Payout policy | Max $1,000 request | Tiered: $1,500 → $3,500 | Up to $100K per user |

| Scaling | Yes | Yes (tiered) | Immediate larger size, buffer rule |

| News trading | Allowed | Allowed | Allowed (evaluation only) |

| Minimum payout | $250 | $250 | $1,000 |

| Live account transition | 5 payouts | 5 payouts | 3 payouts or $20K milestones |

Let’s break down each plan to see which one truly fits your trading style.

2.1. Core Plan

The Core Plan is the most affordable entry point and effectively replaces the old Starter plan. With a monthly fee of $77 for a 50K account, it is designed for traders who want the cheapest path to funding without unnecessary restrictions. Evaluation requires a $3,000 profit target and a 50% consistency rule, which means no single day can account for more than half of your total profit.

What makes Core appealing is the lack of a daily loss limit, a trailing drawdown limit of $2,000 on the 50K account, and a maximum position of 3 contracts. Once funded, payouts are capped at $1,000 per request, but the plan offers a clear and simple transition to live trading after five successful payouts.

| Core Plan (50K) | Details |

|---|---|

| Monthly fee | $77 |

| Profit target | $3,000 |

| Trailing drawdown | $2,000 |

| Max position | 3 contracts |

| Daily loss limit | None |

| Consistency rule | 50% (evaluation only) |

| News trading | Allowed |

| Payout cap | $1,000/request |

| Reset fee | $77 |

| Live account transition | After 5 payouts |

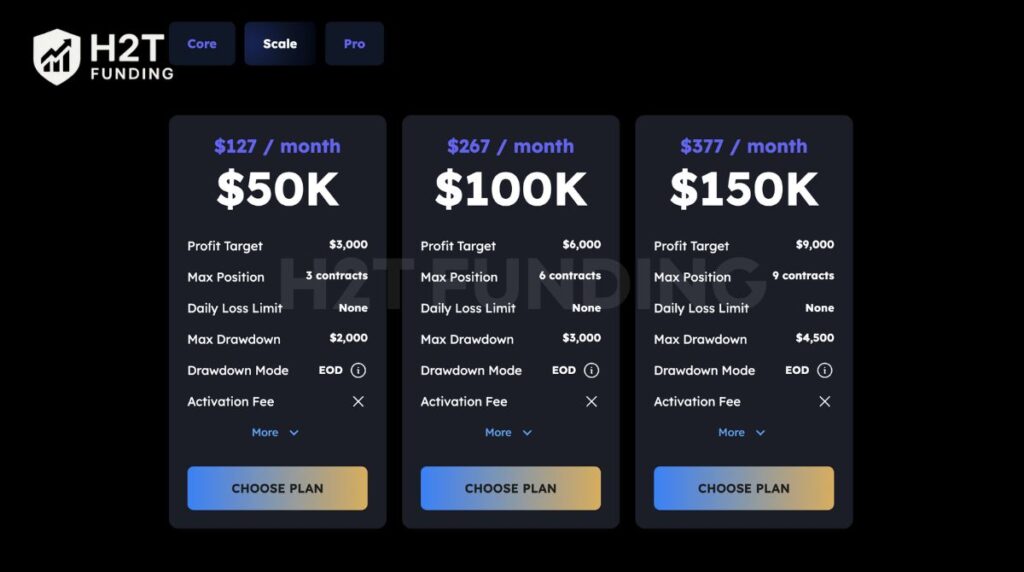

2.2. Scale plan

The Scale Plan is a step up from Core, designed for traders who want higher payout potential with a gradual, tiered system. Starting at $127/month for a 50K account, it keeps the same evaluation rules, 6% profit target, no daily loss limit, and 50% consistency rule. But once funded, the payout caps increase with each request. By the fifth payout, a 50K trader can request up to $3,500, while the 150K account can reach $7,500.

This plan also ensures a smoother transition to live accounts, with balances ranging from $3,000 to $5,000 depending on account size. The Scale plan strikes an effective balance. While not as cheap as Core, its growing payout ceiling makes it a compelling choice for consistent traders.

| Scale Plan | 50K | 100K | 150K |

|---|---|---|---|

| Price | $127 | $267 | $377 |

| Profit target | $3,000 | $6,000 | $9,000 |

| Max loss limit | $2,000 | $3,000 | $4,500 |

| Max position | 3 minis / 30 micros | 6 minis / 60 micros | 9 minis / 90 micros |

| Consistency (eval) | 50% | 50% | 50% |

| News trading | Allowed | Allowed | Allowed |

| Payout #1 | $1,500 | $3,000 | $4,500 |

| Payout #5 | $3,500 | $5,000 | $7,500 |

| Minimum payout | $250 | $250 | $250 |

| Live account | After 5 payouts | After 5 payouts | After 5 payouts |

| Live balance | $3,000 | $4,000 | $5,000 |

| Drawdown type | Static | Static | Static |

| Daily loss limit | $1,000 | $1,300 | $1,600 |

| Max contracts (live) | 2 | 3 | 4 |

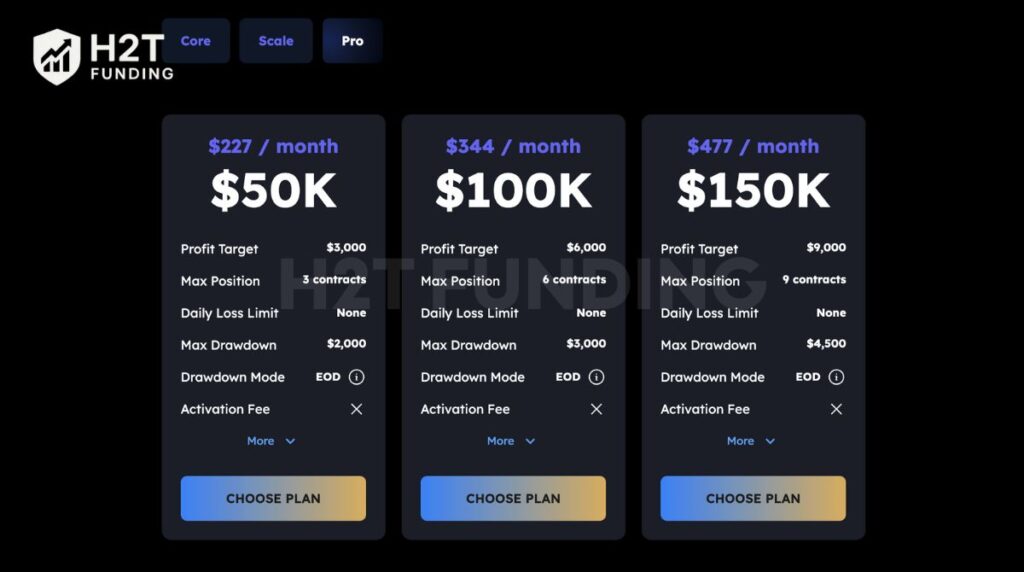

2.3. Pro plan

The Pro Plan is built for advanced traders willing to pay more upfront for the biggest upside. At $227/month for a 50K account, it offers higher contract sizes immediately once funded and a $100,000 max payout per user. The evaluation rules remain standard, but the funded stage introduces a buffer withdrawal system; you must clear a balance threshold before making unlimited requests.

Unlike Scale, news trading is not allowed once funded, and the minimum payout is $1,000. A key drawback is that micro traders face a 1:1 scaling rule instead of the 1:10 ratio available in other plans, limiting flexibility. Still, Pro accounts transition to live faster, after 3 payouts or a $20K profit milestone, with starting balances of up to $10,000 for the 150K option.

| Pro Plan | 50K | 100K | 150K |

|---|---|---|---|

| Price | $227 | $344 | $477 |

| Profit target | $3,000 | $6,000 | $9,000 |

| Max loss limit | $2,000 | $3,000 | $4,500 |

| Initial size | 3 minis / 30 micros | 6 minis / 60 micros | 9 minis / 90 micros |

| Consistency (eval) | 50% | 50% | 50% |

| News trading (funded) | Not allowed | Not allowed | Not allowed |

| New max size (funded) | 5 minis | 10 minis | 15 minis |

| Buffer level | $52,100 | $103,100 | $154,600 |

| Minimum payout | $1,000 | $1,000 | $1,000 |

| Max payout per user | $100,000 | $100,000 | $100,000 |

| Live transition | 3 payouts or $20K milestone | Same | Same |

| Live balance | $2K–$5K | $3K–$7.5K | $4K–$10K |

| Drawdown type | Static | Static | Static |

| Daily loss range | $700–$1,800 | $1,000–$2,500 | $1,300–$3,000 |

| Max contracts (live) | 2–4 | 3–5 | 4–6 |

Verdict on My Funded Futures evaluation program

Overall, the funding lineup at My Funded Futures is clear and flexible. Core gives the cheapest entry point, Scale offers a smooth progression with tiered payouts, and Pro unlocks the highest earning potential with faster access to live accounts. All three share the same evaluation rules, which keep the process straightforward for traders of any level.

Ultimately, the structure strikes a good balance. Core is great for new traders testing the waters, Scale suits those aiming for steady growth, and Pro rewards experienced traders willing to pay more upfront. The fact that there’s no daily loss limit across the board makes these plans less stressful and more attractive compared to many competitors.

3. My Funded Futures trading rules

Trading with My Funded Futures comes with a mix of clear allowances and strict prohibitions designed to create a fair and realistic environment. The firm promotes flexibility by removing daily loss limits and permitting news trading in most plans, yet it also enforces strong restrictions to prevent simulated market abuse.

Understanding this prop firm’s rules is essential because violations can lead to confiscated profits or immediate termination. Below, I’ll break down the practices that are explicitly allowed and those that are strictly prohibited so traders know exactly where the boundaries lie.

3.1. Allowed trading practices

My Funded Futures offers traders more freedom than many firms by removing daily loss caps and allowing news trading in most plans. Algo trading and trade copiers are also supported, making it easier to automate or mirror strategies. With platforms like NinjaTrader, Tradovate, and TradingView, execution feels professional and flexible.

One important requirement is account activity: traders must place at least one trade per week to keep funded accounts active. For those planning a break, contacting support can prevent accidental closure. Scaling is also clear, while evaluation allows a 1:10 micro-to-mini ratio, funded accounts move to 1:5, keeping trading size realistic.

| Allowed Practices at MFFU | Details |

|---|---|

| Consistency rule | 50% in evaluation only (Core, Scale, Pro) |

| News trading | Allowed in Core & Scale; allowed in Pro evaluation stage |

| Algo & copy trading | Permitted on all accounts |

| Inactivity rule | At least 1 trade per week required |

| Micro contracts | Eval 1:10 ratio; funded 1:5 ratio |

| Platforms supported | NinjaTrader, Tradovate, TradingView, Quantower, Volumetrica, Volsys |

| Multiple accounts | Up to 10 total; max 5 active funded (only with 50K accounts) |

3.3. Prohibited Trading Practices

Despite its flexibility, My Funded Futures enforces strict limits to prevent abuse of simulated trading. High-frequency trading, hedging, and Tier 1 news trading are not permitted, as these strategies exploit differences between demo fills and live markets. Using identical strategies across multiple accounts or devices is also banned to ensure fair play.

Other restrictions include order manipulation, illiquid market exploitation, and taking advantage of no-slippage fills with ultra-tight brackets. Violations can result in immediate termination, confiscation of profits, and review of evaluation results. The firm emphasizes ethical trading aligned with CME rules, ensuring that funded traders are prepared for live conditions.

| Prohibited Practices at MFFU | Details |

|---|---|

| High-frequency trading | Not allowed |

| Hedging | Prohibited across all accounts |

| Tier 1 news trading | Banned in Pro-funded stage |

| Order manipulation | No stacking identical limit orders |

| Illiquid market exploitation | Not permitted |

| Slippage exploitation | Using tight brackets to benefit from no slippage is banned |

| Device sharing | Multiple traders cannot use the same device |

| Copy trading other traders | Not allowed (only self-directed trading) |

| Collaborative trading | Executing mirrored or opposite trades across accounts is prohibited |

| Consequences | Termination, profit confiscation, failed evaluation process |

Notes on trading hours and rules

- Trading Window: Allowed from 6:00 PM EST (Globex open) until 4:10 PM EST (NY close).

- Overnight Trading: Holding overnight is permitted, but all positions must be closed by 4:10 PM EST.

- Auto-Liquidation: On regular days, any open positions at 4:10 PM EST will be closed automatically.

- Holiday Trading: On holidays, traders must manually close positions before markets shut, as auto-liquidation does not apply.

- Restricted Times: No trading is allowed during the daily market break from 4:15 PM to 6:00 PM EST.

Verdict on My Funded Futures rules

The trading rules at My Funded Futures strike a balance between freedom and control. Allowing algorithmic systems, news trading, and removing daily loss caps make the environment less restrictive compared to many firms. This kind of flexibility is designed to reduce stress and encourage traders to focus on strategy rather than micromanaging rules.

At the same time, the firm is clear about what won’t be tolerated. Banning hedging, HFT, and order manipulation keeps conditions closer to real futures markets. The trade-off feels fair: traders get the freedom to trade naturally, but any attempt to game the simulated system is shut down quickly.

4. My Funded Futures payout rules

MFFU is known for some of the fastest and most transparent payouts in the futures prop firm space. Most requests are approved instantly, while manual reviews rarely take more than 6–12 business hours. To receive your My Funded Futures first payout, traders must complete KYC on the dashboard and connect a Riseworks account, which handles all transfers.

The payout rules differ by plan. Core a minimum withdrawal starts at $250, capped at $1,000. Scale uses a tiered system growing up to $7,500, and Pro supports requests up to $100,000 once the buffer is cleared.

Payouts are delivered via Riseworks, offering flexible withdrawal options like bank or crypto transfers. Overall payout performance of MFF remains one of the strongest in the prop firm industry.

| Plan | Requirements | Minimum Payout | Max Payout (per request) | Notes |

|---|---|---|---|---|

| Core (50K) | 5 winning days, $100/day | $250 | $1,000 | Earn up to $5,000 total; Max Loss locks at $50,100 after first payout |

| Scale (50K/100K/150K) | 5 winning days, daily minimums ($100 / $200 / $300) | $250 | $1,500 → $7,500 (tiered) | Payout caps increase with each request |

| Pro (50K/100K/150K) | Request every 14 days; meet buffer ($2,100 / $3,100 / $4,600) | $1,000 | Up to $100,000 | 60% withdrawal allowed before buffer cleared |

Step-by-step payout process:

- Step 1: Confirm eligibility by passing the evaluation and meeting plan-specific rules.

- Step 2: Complete KYC on the MFFU dashboard under Personal Settings.

- Step 3: Open a Riseworks account to receive payments.

- Step 4: Submit payout request via the payout dashboard.

- Step 5: Sign agreements (first payout only), then withdraw to your bank or crypto wallet.

Verdict on payout rules

As you can see, the payout process at MFFU combines speed, structure, and flexibility. Scale’s tiered growth rewards consistency, while Pro offers unmatched potential for high performers. Though the buffer rule may feel complex for beginners, the overall system sets a high standard compared to other prop firms.

5. Scaling plans of My Funded Futures

Scaling is one of the features that helps traders grow beyond the evaluation stage. At My Funded Futures, both Core and Scale accounts follow structured scaling rules, while the Pro Plan takes a different path by giving larger positions upfront. This creates options for both cautious and aggressive traders.

Scaling plan by account type

| Plan | Scaling Approach | Details |

|---|---|---|

| Core | Traditional scaling | Starts with smaller contract sizes; gradually expands as consistency and payouts build up |

| Scale | Tiered growth model | Payout caps increase step by step ($1,500 → $3,500 for 50K); scaling tied directly to payout milestones |

| Pro | Immediate access | Traders start with higher max contracts (5 minis for 50K, 10 for 100K, 15 for 150K) but must manage a buffer system |

Verdict on scaling plan My Funded Futures

The scaling setup at MFFU is notably flexible and well-designed. This variety is a clear advantage, giving traders the freedom to choose between stability and growth.

Combined with the My Funded Futures max allocation policy and up to the maximum accounts allowed per trader, scaling feels both flexible and fair. However, newer traders may feel more comfortable with Core or Scale, as Pro’s buffer rules and larger positions can add pressure.

6. My Funded Futures leverage & commissions

Leverage at My Funded Futures is tied directly to account size. Core and Scale accounts follow a gradual cap, while Pro gives the same limits during evaluation but unlocks larger sizes once funded. This setup ensures traders can scale responsibly without facing unrealistic risk exposure.

| Plan | Details |

|---|---|

| Core | 50K account: Up to 3 minutes or 30 microseconds |

| Scale | 50K account: Up to 3 minutes or 30 microseconds 100K account: Up to 6 minutes or 60 microseconds 150K account: Up to 9 minutes or 90 microseconds |

| Pro | 50K account: Up to 3 minutes or 30 microseconds 100K account: Up to 6 microseconds or 60 microseconds 150K account: Up to 9 minutes or 90 microseconds (with larger sizes available once funded) |

When it comes to commissions, fees depend on the data provider and platform, typically Tradovate or Rithmic. The structure covers all major CME markets, including equities, forex, commodities, and interest rates. To keep things transparent, MFFU publishes full commission tables, which you can view in the images below for an accurate comparison.

Verdict on leverage & commissions

The leverage structure feels realistic and keeps trading conditions consistent across account sizes, preventing traders from overextending risk too quickly.

The decision to reward experienced traders on Pro accounts with a bigger size is a smart move, while Core and Scale offer a more conservative, risk-managed path. Commission costs are competitive and clearly published, giving MFFU an edge in transparency compared to many rivals.

7. My Funded Futures trading platforms

My Funded Futures gives traders access to a wide lineup of platforms, recognizing that no two traders work the same way. Some focus on simplicity, while others rely on advanced data and custom tools. By supporting both traditional and specialized software, MFFU ensures traders can build a setup that truly fits their strategy.

- NinjaTrader: Well known in the futures community, it combines strong charting tools, automation, and customizable indicators. Many traders value its stability and compatibility with third-party add-ons.

- Tradovate: A lightweight, cloud-based platform that focuses on simplicity and speed. It suits traders who want a clutter-free environment while still keeping advanced order types.

- TradingView: Offers one of the best charting experiences with a vast library of indicators and community scripts. At MFFU, it can be connected directly, though real-time CME data requires an extra subscription.

- Quantower: A versatile multi-asset platform with a modern interface. It provides features like advanced order management, portfolio tracking, and support for multiple brokers.

- Volumetrica: Specialized in order flow and volume profile analysis, it helps traders spot liquidity levels and hidden market behavior. Its unique visualizations make it powerful for futures scalpers.

- Volsys: Delivers real-time market depth and volume data with clean dashboards. Many traders use it to refine entries and exits with higher precision.

Verdict on trading platforms

The platform variety at My Funded Futures is one of its biggest strengths. Whether you’re a beginner wanting something simple or an advanced trader analyzing order flow, there’s a tool here that fits. Crucially, MFFU doesn’t force traders into a single ecosystem. This freedom to choose a platform based on individual style and needs is a major benefit.

This flexibility is especially valuable for futures traders, since execution speed and data depth often decide results. By offering everything from mainstream platforms like NinjaTrader to niche tools like ATAS, MFFU shows a real commitment to supporting traders at every level.

8. Trading instruments

My Funded Futures provides access to a wide range of futures contracts across major U.S. exchanges. Traders can work with indices, currencies, energies, metals, and agricultural products, all under standardized trading hours. This diversity allows strategies to range from intraday scalping on equity futures to long-term positioning in commodities.

| Exchange | Examples of Instruments | Highlights |

|---|---|---|

| CME | E-mini S&P 500 (ES), Nasdaq (NQ), Russell 2000 (RTY), Forex futures (6E, 6B, 6J), Micro contracts (MES, MNQ, M6E) | Covers U.S. indices and major currency pairs with both standard and micro contract options |

| COMEX | Gold (GC, MGC), Silver (SI, SIL), Copper (HG), Platinum (PL) | Popular metals for both swing and hedge strategies |

| CBOT | Corn (ZC), Soybeans (ZS, ZM, ZL), Wheat (ZW), Dow Jones (YM, MYM) | Wide agricultural coverage plus equity index futures |

| NYMEX | Crude Oil (CL, MCL, QM), Natural Gas (NG, QG), Heating Oil (HO), RBOB Gasoline (RB) | Key energy contracts for macro and commodity trading |

Verdict on Trading Instruments

The product lineup at My Funded Futures is robust, giving traders exposure to nearly every major futures sector. The inclusion of micro contracts is a welcome feature, making risk management more accessible. Overall, this breadth of markets is a real strength, allowing traders to diversify strategies.

Ultimately, the breadth of markets is a real strength, letting traders diversify strategies, whether focusing on equity indices or hedging with commodities. It’s not as broad as multi-asset prop firms offering forex or crypto, but for pure futures, the coverage is more than enough.

9. Education & resource

When it comes to education, My Funded Futures falls short compared to many competitors. The firm provides some blog posts and YouTube videos, but these are mostly general updates or promotional pieces. For beginners, there is no structured curriculum, which makes it difficult to build a foundation before stepping into funded trading.

Verdict on Education & Resources

Without a doubt, education is one of the weakest points for My Funded Futures. While the blogs and videos offer some insights, they are not enough to guide new traders through the complexities of futures markets.

For experienced traders, this may not be a deal-breaker, since the focus is on trading capital and fast payouts. But for beginners, the lack of structured training makes MFFU a poor starting point compared to prop firms that invest more in trader development.

10. Customer support

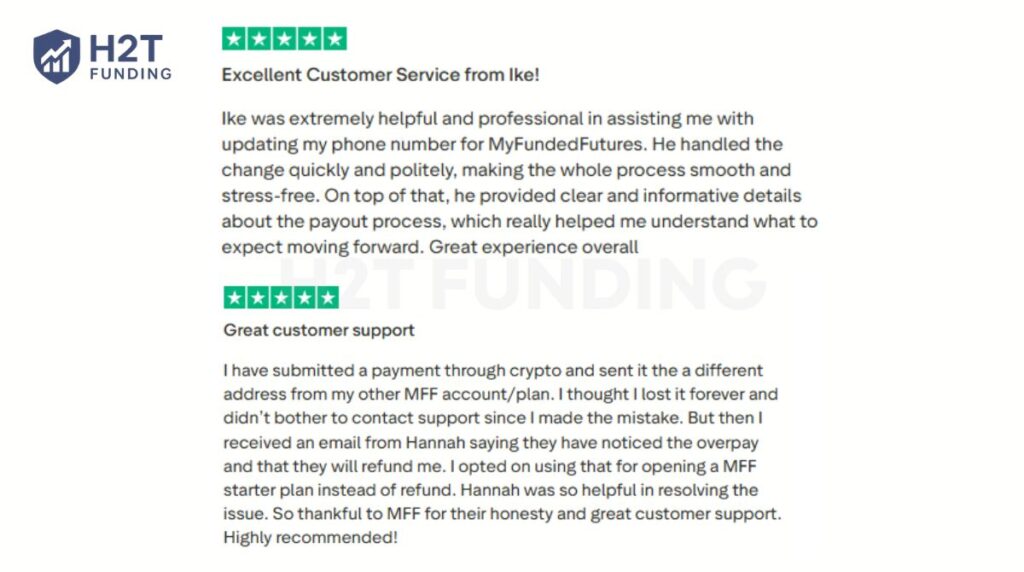

Customer support is one of the standout strengths of My Funded Futures. Traders get 24/7 live support, along with active community channels on Discord, YouTube, and social media. Reviews often highlight how responsive the team is, whether fixing account issues or clarifying payout rules, which makes the overall experience smoother.

Customer support overview

| Strengths | Weaknesses |

|---|---|

| 24/7 live chat support available | No dedicated account manager per trader |

| Quick resolutions (crypto payments, account updates, payout clarifications) | Some complex cases may still require manual review delays |

| Active presence on Discord, YouTube, Instagram, and X | Education-oriented support is limited |

| Positive Trustpilot reviews praising honesty and professionalism | Limited multilingual support noted by some users |

Verdict on Customer Support

In my experience, community support is one of the best aspects of MFFU. Having staff who respond quickly, even for payment errors or account adjustments, shows a level of honesty and professionalism not always found in prop firms.

The combination of 24/7 live chat and active community channels builds trust and makes traders feel supported. While not perfect, MFFU sets a high bar for customer service in the prop firm industry.

11. My Funded Futures Banned Countries

My Funded Futures operates globally but restricts access in several regions due to international compliance and legal obligations. These rules ensure trading transparency, protect user data, and keep the firm aligned with financial regulations. Traders from supported regions can still register freely once verified.

Eligible traders must be of legal trading age and complete the full KYC process. Verification includes government-issued ID, proof of address, and other documents to confirm identity. This helps maintain platform security and uphold anti-money laundering (AML) standards.

Below is the official list of restricted countries that My Funded Futures cannot currently support:

| A–C | C–L | M–S | S–Z |

|---|---|---|---|

| Afghanistan | Cuba | Mauritius | Slovenia |

| Albania | Congo (DR) | Macedonia | Somalia |

| Algeria | Ecuador | Malaysia | South Africa |

| Angola | Ethiopia | Mali | South Sudan |

| Bahamas | Ghana | Mongolia | Sri Lanka |

| Barbados | Gibraltar | Montenegro | Sudan |

| Belarus | Haiti | Mozambique | Syria |

| Bosnia & Herzegovina | Hong Kong | Nicaragua | Taiwan |

| Botswana | Iceland | Nigeria | Tanzania |

| Bulgaria | Indonesia | North Korea | Trinidad and Tobago |

| Burkina Faso | Iran | Pakistan | Tunisia |

| Burma (Myanmar) | Iraq | Panama | Turkey |

| Burundi | Jamaica | Papua New Guinea | Uganda |

| Cambodia | Jordan | Philippines | Ukraine |

| Cameroon | Kosovo | Qatar | United Arab Emirates |

| Central African Republic | Kenya | Romania | Vietnam |

| China | Laos | Russia | Venezuela |

| Côte d’Ivoire | Lebanon | Serbia | Yemen |

| Crimea | Liberia | Senegal | Zimbabwe |

12. Trader feedback and reputation – My Funded Futures Trustpilot

Independent My Funded Futures reviews with a 4.9/5 Trustpilot rating from over 10,000 reviews highlight quick payouts, responsive support, and fair conditions. Community notes from a My Funded Futures Reddit review often praise low costs and clear rules compared with peers, strengthening its reputation.

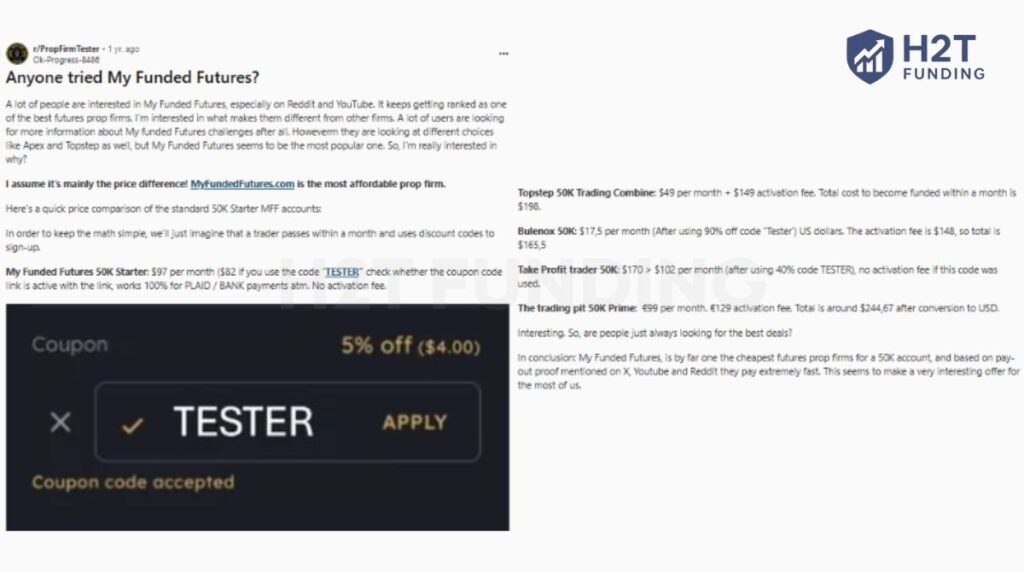

On Reddit, My Funded Futures vs Topstep Reddit threads frequently compare costs, payout speed, and even My Funded Futures copy trading options between platforms.

Traders mention that the firm is among the most affordable, especially for 50K accounts, with no activation fees and frequent discount codes. This makes it attractive compared to alternatives like Topstep or Bulenox.

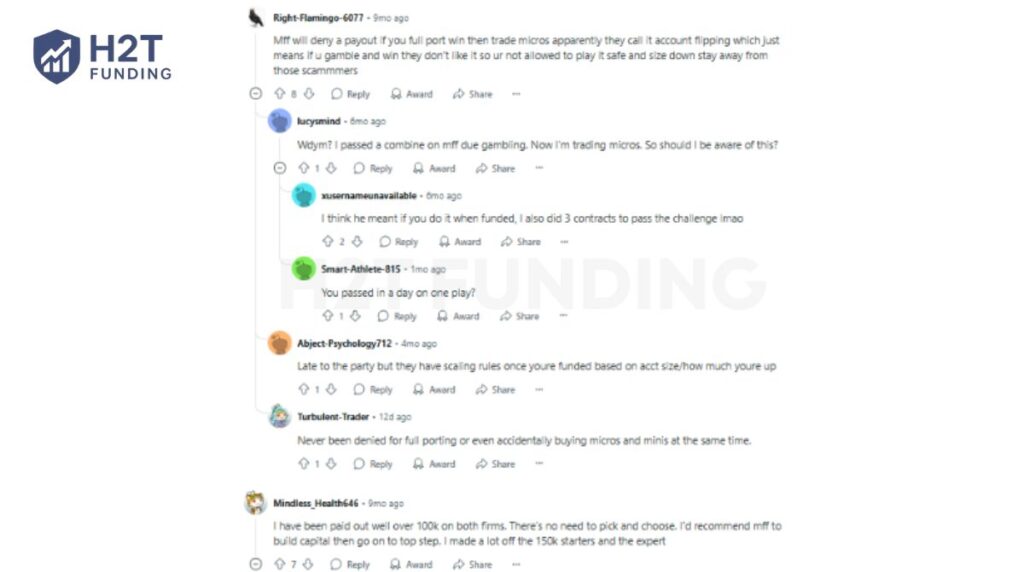

That said, not all feedback is purely positive. Some Reddit users raise concerns about account flipping or “gambling” strategies that might risk payouts if they breach fair play rules. Others debate scaling and contract usage, with a few claiming issues while many confirm they’ve been paid reliably, even over six figures.

Overall, the conversation around MFFU shows strong support for its transparency and payout speed, balanced by caution about rules and scaling expectations. For many traders, especially those focused on affordability and quick withdrawals, it remains one of the most compelling futures prop firm options available.

13. How to start/sign up for My Funded Futures

Getting started with My Funded Futures is designed to be straightforward so traders can begin trading funded accounts quickly. The process involves creating an account, verifying your identity, and selecting a challenge plan that suits your trading goals. Here’s a clear step-by-step outline:

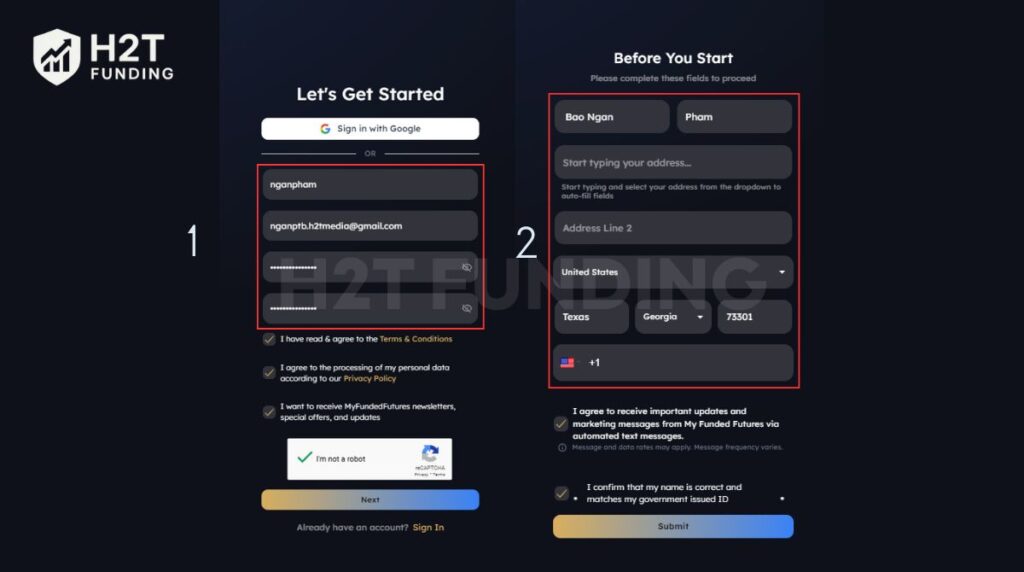

Step 1: Visit the official website

Open the My Funded Futures site on your browser and click the “Get Started” button to begin the registration.

Step 2: Create your login

Fill in a username, email, and password. Agree to the terms of service, then click “Next” to continue.

Step 3: Enter personal details

Provide your full name, phone number, and location information. Once submitted, your account is ready to purchase an evaluation.

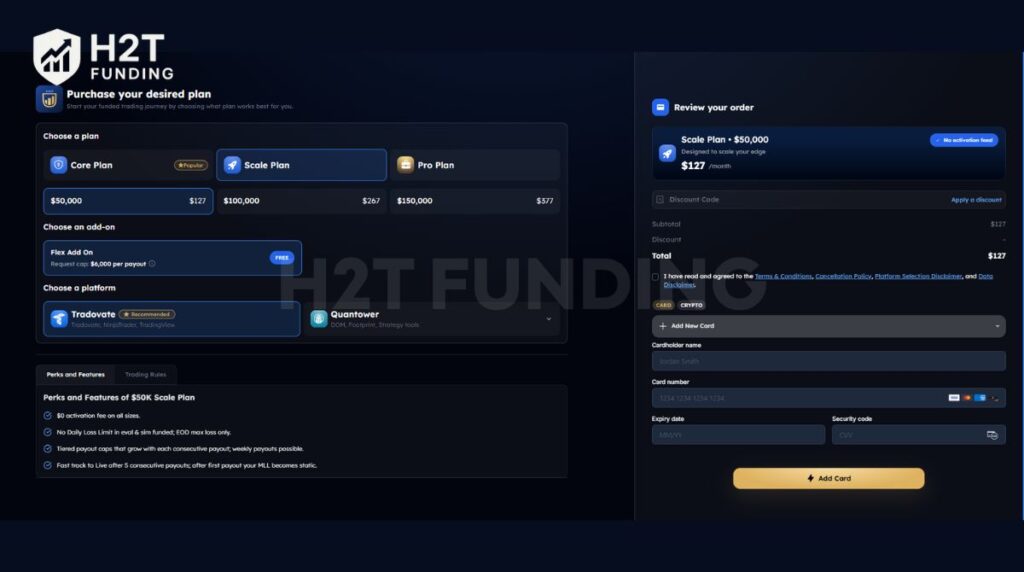

Step 4: Choose your plan

Select from Core, Scale, or Pro plans, with account sizes ranging from $50K to $150K, depending on your budget and objectives.

Step 5: Verify your account

To withdraw profits, you’ll need to upload verification documents, such as:

- Proof of identity (passport, driver’s license, or national ID)

- Proof of address (bank statement or utility bill)

Step 6: Start trading

Once your payment is confirmed, you’ll receive login credentials for your chosen platform and can start building your My Funded Futures live account. Successful traders can request profit withdrawals directly through the dashboard.

The sign-up process at MFFU is quick and user-friendly. With only a few steps from account creation to verification, traders can move from registration to trading funded accounts in less than a day.

14. Compare My Funded Futures vs other futures prop firms

Choosing the right futures prop firm depends on cost, payout structure, platform access, and long-term support. While My Funded Futures is known for affordability and fast payouts, competitors like Topstep and Apex Trader Funding also bring unique strengths.

Here’s a side-by-side comparison to help identify which firm fits your trading style best.

| Criteria | My Funded Futures (MFFU) | Topstep | Apex Trader Funding |

|---|---|---|---|

| Challenge Fee | $77 – $477 | $49 – $149 | $147 – $687 |

| Account Sizes | $50K – $150K | $50K – $150K | $25K – $300K |

| Profit Target | 6% | 6% | 6% |

| Profit Split | 80% | 90% – 100% | 90% – 100% |

| Time Limit | No limit | No limit | No limit |

| Daily Loss Limit | None (all plans) | Yes (plan-specific) | Yes (plan-specific) |

| Payout Speed | Instant approvals, same-day payouts | Weekly withdrawals | Fast but may require review |

| Platforms | NinjaTrader, Tradovate, TradingView, Quantower, ATAS, Volumetrica | TopstepX, TradingView | NinjaTrader 8, Tradovate, WealthCharts |

| Markets Offered | Futures only (indices, forex, commodities, energy, metals) | Futures + Foreign Exchange Futures | Futures (indices, currencies, commodities, interest rates, crypto) |

| Special Features | $0 activation fees, instant payouts, 5 active funded accounts | Long industry track record, strong education content | Largest account size options ($300K), frequent discount promotions |

From my perspective, My Funded Futures is the best option for cost-conscious traders who want simple rules and the fastest payouts. It’s particularly attractive for beginners to intermediate traders who prefer futures-only markets and dislike strict daily loss limits.

Topstep remains the safest choice for traders who value reputation and structured education, given its long track record. Meanwhile, Apex Trader Funding is better suited for aggressive traders aiming for larger account sizes and willing to pay higher fees upfront.

Ultimately, the right choice depends on whether you value affordability, reputation, or account size flexibility the most.

New traders can also strengthen their strategies by understanding key price zones, and see what is support and resistance are for practical guidance. If you want to spot institutional activity or unusual momentum while using these firms’ platforms, check out how to use option block trades to spot unusual options.

15. FAQs

Core and Scale plans follow gradual scaling tied to payouts, while Pro offers larger contract sizes immediately once funded. For example, Scale accounts increase payout caps step by step, while Pro starts with higher max contracts.

Payouts depend on the plan: Core allows up to $1,000 per request, Scale uses tiered caps up to $7,500, and Pro supports withdrawals up to $100,000. Most requests are approved instantly, making MFFU one of the fastest-paying firms.

For 150K accounts, Core and Scale allow up to 9 minutes or 90 microseconds during evaluation. Pro accounts expand further once funded, offering up to 15 minis on the same size.

Yes, the firm holds a 4.9 Trustpilot rating with thousands of reviews praising payouts and support. While it’s still young, trader feedback shows high levels of trust and reliability.

Yes, but it depends on the platform. TradingView requires an extra subscription for real-time CME data, while platforms like NinjaTrader and Tradovate include live feeds when linked through MFFU.

Most traders consider MFFU trustworthy due to transparent rules, instant payouts, and responsive customer support. The firm’s reputation is backed by consistent positive community feedback.

Yes, and this is one of the firm’s strongest features. Many traders confirm that payouts are approved instantly, with funds reaching accounts within the same day.

Yes, evaluation accounts are subscription-based. Fees range from $77 for a 50K Core plan to $477 for a 150K Pro plan, billed monthly until you pass or cancel.

With the 50% consistency rule, it’s possible to pass in as few as two trading days. However, most traders take longer to meet profit targets safely.

You can hold up to 10 accounts in total, with a maximum of 5 active funded accounts for a 50K size. For larger accounts (100K and 150K), the limit is 3.

No, like most prop firms, MFFU is not a regulated broker. It operates as a proprietary trading firm, funding traders on simulated accounts before transitioning to live ones.

Yes, payouts are a verified feature of MFFU. Traders report consistent, fast payments, often completed instantly, reinforcing the firm’s credibility.

16. Conclusion

This My Funded Futures review shows a firm that stands out for its simple one-phase evaluation, fast payouts, and broad platform choices. With no daily loss limits and competitive pricing, it offers a trader-friendly path to funding, though its short history and limited education remain areas to watch. For futures traders seeking speed and affordability, MFFU is one of the most compelling options available today.

If you want to compare My Funded Futures with other prop firms before making a decision, check out more articles in the Prop Firm reviews section at H2T Funding. There, you’ll find in-depth guides on Topstep, Apex, and other industry leaders to help you choose the firm that best fits your trading goals.

For more context, explore My Funded Futures prop firm reviews alongside Topstep and Apex to pick the best fit.