For many retail traders, the prospect of managing an eight-figure portfolio sounds like a marketing myth. However, as a prominent Lux Trading Firm UK-based entity, Lux Trading Firm has built its reputation on transitioning successful individuals from demo environments to live market accounts.

In this Lux Trading Firm review, H2T Funding dissects the reality behind their $10M scaling plan. We strip away the marketing fluff to examine the firm’s strict trading rules, cost structures, and operational transparency. This guide empowers you to decide if Lux provides the right professional environment for your long-term trading career.

1. What is Lux Trading Firm?

Lux Trading Firm is a boutique UK-based prop firm founded in January 2021, specifically designed to transform retail traders into institutional asset managers. They offer a unique Career Trading Program that provides real A-book liquidity and a professional path to managing up to $10,000,000 in capital.

Unlike many firms that rely on simulation-only environments, Lux emphasizes real money execution and audited track records accepted by banks and hedge funds. Their 1-step evaluation process has no time limits, catering to disciplined individuals who value consistency and professional risk management over high-turnover gambling.

A standout feature of this prop firm is its professional support system, which includes a stable monthly salary for top-tier traders and access to premium trading platforms. This environment ensures your responsibility as a trader is rewarded with the financial security needed to focus entirely on market execution.

2. Our take on Lux Trading Firm

Lux Trading Firm is a high-tier prop firm based in the UK, designed to filter for traders with the potential to become legitimate fund managers. At H2T Funding, we view this firm not as a place for the masses but as a professional arena for those who prioritize long-term capital stability.

When navigating their trading environment, it is clear that Lux focuses entirely on execution quality through an A-Book model. You won’t encounter the artificial slippage or virtual market intervention common in B-Book firms, ensuring complete transparency for your trading strategy.

However, the price for this institutional access is a set of unforgiving regulations. Lux requires a high level of responsibility, specifically regarding risk consistency and the mechanical application of stop-loss settings on every single position.

To help you evaluate the firm before committing to a login, we have summarized the primary advantages and drawbacks below:

| Pros | Cons |

|---|---|

| Provides real A-Book liquidity rather than demo-only funds. | Enforces extremely rigid and complex rules. |

| Offers a massive scaling roadmap reaching up to $10,000,000. | Profit targets of 10% – 15% are high compared to competitors. |

| No time limits allow for a patient, stress-free audition. | The 6% static drawdown is a very tight constraint. |

| 100% refund of the enrollment fee after Stage 1. | High disqualification rate due to minor risk violations. |

| Supports high-end platforms like Lux Trading Firm MT5. |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Lux Trading Firm websites before purchasing any challenge.

Based on our assessment, Lux Trading Firm is an ideal training ground for discipline. If you have a proven system and do not feel rushed by a calendar, this is a perfect launchpad into live capital. Conversely, if you still struggle with costly mistakes in capital preservation, this environment may feel too restrictive for your current level.

3. Lux Trading Firm programs

Lux Trading Firm provides two primary paths for traders: Instant funding for immediate market access and a 1-stage evaluation for a structured growth journey. These programs are the initial steps in a career path that can eventually lead to managing up to $10,000,000.

Explore the specific mechanics and requirements of each account type below to determine which program best supports your professional goals.

3.1. Instant funding

The Instant Funding program is designed for experienced traders who want to bypass evaluation phases and start trading with significant capital immediately. Lux Trading Firm currently offers an exclusive $400,000 account that allows you to generate real profits from day one.

This program requires a 12% profit target to move to the next scaling stage, while offering a generous 80% profit share. For a one-time enrollment fee of £699, traders gain access to professional liquidity and the potential for a $38,400 payout upon reaching the initial target.

Unlike traditional challenges, there are no demo hurdles here; you are placed directly into a live-market environment. This setup is ideal for those with a proven trading strategy who want to capitalize on market opportunities without waiting weeks for account verification.

3.2. 1-stage evaluation

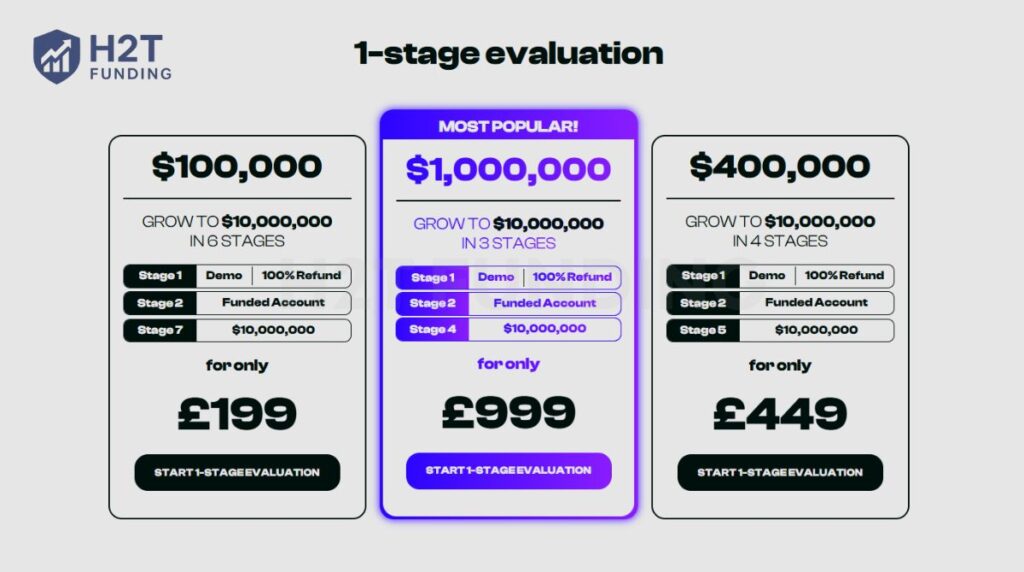

The 1-Stage Evaluation is Lux Trading Firm’s most popular path, offering a structured journey from a demo environment to a $10,000,000 professional fund. Each account size is designed to test your consistency with a single audition phase before granting access to live capital.

A standout benefit of these programs is the 100% refund of your enrollment fee upon successfully passing the first stage. This ensures that dedicated traders are eventually trading with the firm’s capital at zero net cost for the evaluation itself.

Below is a detailed comparison of the initial stage for each account size to help you choose the right starting point:

| Criteria | $100,000 Account | $400,000 Account | $1,000,000 Account |

|---|---|---|---|

| Price | £199 | £449 | £999 |

| Profit Target (Stage 1) | $10,000 (10%) | $48,000 (12%) | $150,000 (15%) |

| Maximum Loss | $6,000 (6%) | $24,000 (6%) | $60,000 (6%) |

| Drawdown Limit | $94,000 | $376,000 | $940,000 |

| Min. / Max. Trading Days | None | None | None |

| Fee Refund | 100% Refund | 100% Refund | 100% Refund |

| Steps to $10M | 7 Stages | 5 Stages | 4 Stages |

| Profit Split | 80% | 80% | 80% |

Verdict on Lux Trading Firm programs

The $100,000 account stands out as the most practical entry point for the majority of traders. At just £199, it offers the lowest profit target (10%) and allows you to adapt to the firm’s specific environment without significant financial pressure.

For experienced professionals, the $1,000,000 account is a high-stakes, high-reward option. While the 15% target is quite steep, the ability to jump straight to Stage 4 significantly accelerates the journey toward managing the full $10,000,000.

A critical observation across all plans is the 6% maximum loss limit. This is a tight constraint that leaves very little room for costly mistakes, making a conservative risk management strategy essential from the very first trade.

4. Lux Trading Firm rules

The Lux Trading Firm rules are designed to mirror the environment of a professional hedge fund. These regulations prioritize capital preservation and long-term consistency over short-term aggressive gains.

Understanding these guidelines is crucial, as the firm utilizes an A-Book model. This means trades are passed directly to liquidity providers, ensuring complete transparency without dealing-desk intervention.

4.1. General guidelines & allowed practices

Lux encourages professional habits through a structured framework. Unlike firms that use trailing drawdowns, Lux employs a more stable approach to account protection.

- Static drawdown: All accounts use a 6% static drawdown. This is fixed at the starting balance and does not move up as your account grows, giving you more room as you profit.

- Mandatory stop-loss: Every trade must have a stop-loss order set before entering the market. This is essential for calculating the Remaining Risk Capital (RRC).

- Copy trading: The firm allows copy trading and trade mirroring tools. You are free to follow other accounts as long as all trades comply with individual risk rules.

- Risk consistency: Traders must maintain uniform risk allocation. The maximum permissible risk is capped at 5% of your Remaining Risk Capital (RRC).

- Dedicated risk manager: Once you reach the Funded Stage, you are assigned a professional risk manager to guide your risk management and protect the firm’s capital.

4.2. Prohibited trading practices

To maintain their institutional integrity, Lux strictly prohibits strategies that exploit technical glitches or create excessive server load.

- High-frequency trading (HFT): HFT is strictly banned. This includes generating more than 2,500 server messages within 24 hours or using fully automated bot systems that spam trades.

- News bracketing: You cannot place simultaneous pending buy and sell orders around high-impact news events to exploit extreme volatility.

- Arbitrage trading: Any form of latency arbitrage, price feed manipulation, or mirroring across multiple accounts to secure risk-free profit will result in account termination.

- Single trade profit limit: Realized profit from a single position (or highly correlated positions) is capped at 5% of the stage’s profit target. Example: On a $100k account (Target $10,000), no single trade can contribute more than $500 toward the goal. This forces traders to show consistent trading over multiple setups.

Verdict on Lux Trading Firm rules

The rules at Lux are objectively Hard compared to standard retail prop firms. The 5% single-trade profit cap is the biggest hurdle, as it prevents you from passing the challenge with one or two lucky home runs.

However, the 6% static drawdown is a massive advantage. Most firms use trailing drawdowns that chase your profit, effectively tightening your leash. Lux’s static model actually rewards you with more breathing room as your balance grows.

If you are a disciplined swing trader or day trader with a high win rate, these rules will feel like a professional safety net. If you rely on gambling or all-in news plays, you will likely find this environment too restrictive.

5. Lux Trading Firm payout structure

The payout system at Lux Trading Firm is designed to reward long-term professional behavior rather than short-term luck. Since the firm operates on an A-Book model, payouts are derived from real market profits once you transition to the funded stages.

- Profit split: A standard 80% split is applied across all funded stages, including the final $10,000,000 Fund Manager level.

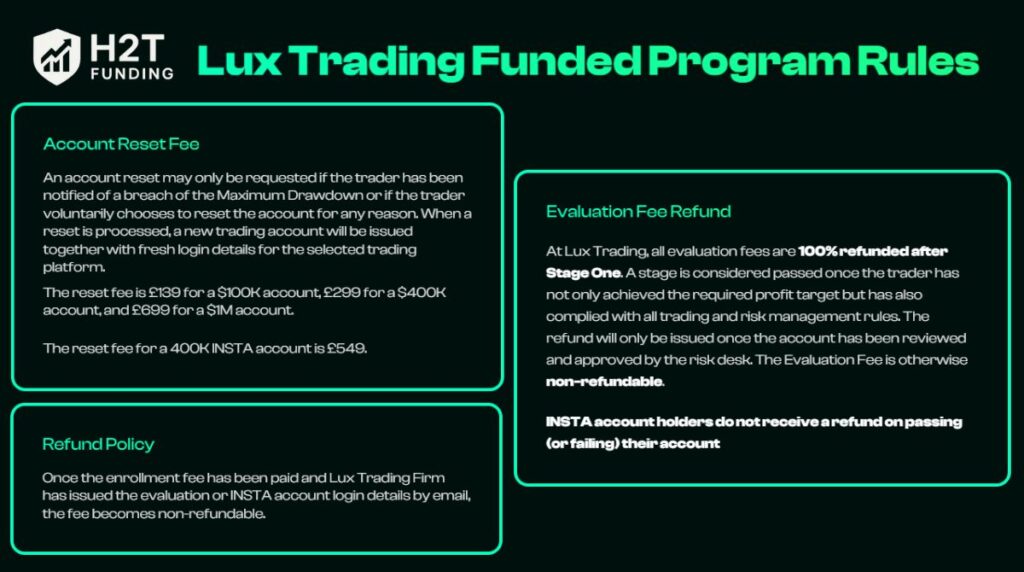

- Enrollment fee refund: You receive a 100% refund of your initial enrollment fee once you successfully pass the first evaluation stage and move to a funded account.

- Withdrawal process: Lux is known for a reliable withdrawal process, typically handled via bank wire or crypto. Payouts are usually processed every month to align with institutional accounting.

- Non-refundable policy: It is important to note that once your Lux Trading Firm login details have been issued via email, the initial fee becomes non-refundable as a purchase.

- Account resets: If you violate a rule, such as the maximum drawdown, you can request a reset to start over without paying the full enrollment fee again.

Account reset fees

| Account Type | Reset Fee |

|---|---|

| $100,000 Account | £139 |

| $400,000 Account | £299 |

| $1,000,000 Account | £699 |

| $400,000 INSTA Account | £549 |

Verdict on Lux Trading Firm payout structure

The payout structure is exceptionally transparent. While some firms offer instant daily withdrawals, Lux’s monthly cycle is more realistic for an A-Book environment where real capital must be settled with liquidity providers.

The reset fees are a fair middle ground. Instead of losing your entire investment after one of those costly mistakes, the ability to reset for as low as £139 (on the $100k account) provides a vital safety net.

However, you must be certain about your commitment before purchasing. Since the fee is non-refundable the moment you receive your credentials, we recommend thoroughly reviewing the Lux Trading Firm rules to ensure you are ready to hit the ground running.

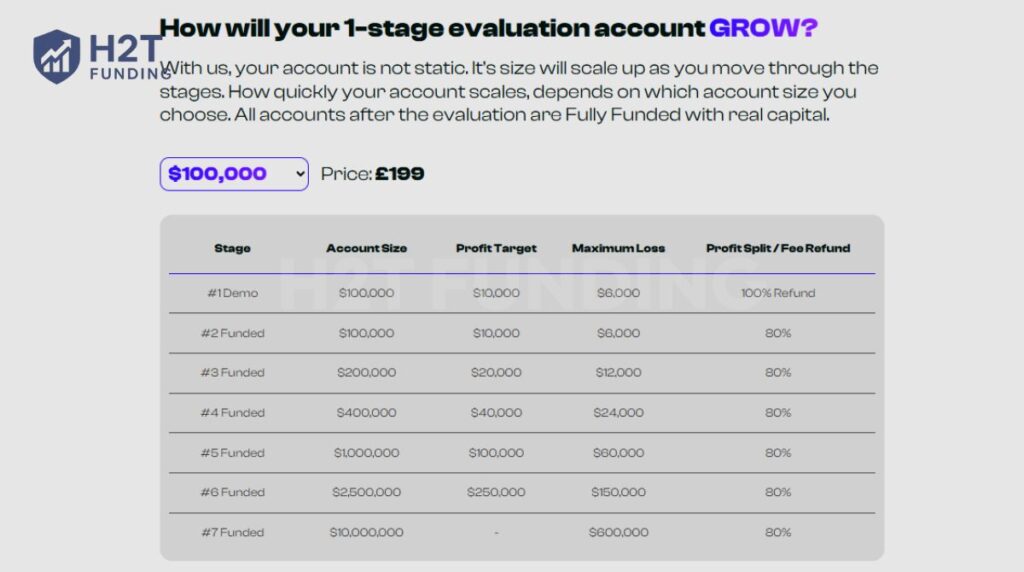

6. Scaling plan of Lux Trading Firm

The scaling plan is the crown jewel of the Lux Trading prop firm ecosystem. It is specifically engineered to transition you from a retail trader into a professional fund manager. Unlike standard firms that offer small capital bumps, Lux provides a clear, aggressive roadmap that culminates in a $10,000,000 Fund Manager position.

Each stage requires you to reach a specific profit target to unlock the next level of capital. Below is a comprehensive look at how each of the three evaluation paths scales toward the final eight-figure goal:

| Stage | $100,000 Path | $400,000 Path | $1,000,000 Path | Profit Split |

|---|---|---|---|---|

| #1 Audition | $100,000 (Demo) | $400,000 (Demo) | $1,000,000 (Demo) | 100% Refund |

| #2 Funded | $100,000 (Live) | $400,000 (Live) | $1,000,000 (Live) | 80% |

| #3 Funded | $200,000 | $1,000,000 | $2,500,000 | 80% |

| #4 Funded | $400,000 | $2,500,000 | $10,000,000 | 80% |

| #5 Funded | $1,000,000 | $10,000,000 | – | 80% |

| #6 Funded | $2,500,000 | – | – | 80% |

| #7 Manager | $10,000,000 | – | – | 80% |

Verdict on the Lux Trading Firm scaling plan

Lux’s scaling logic is one of the most transparent we have reviewed. The fact that the $1,000,000 account can reach the $10M goal in just 4 stages is an incredible value proposition for high-conviction traders. It effectively short-circuits years of traditional capital building.

However, the make-or-break factor is the 6% maximum loss limit. While a $600,000 buffer at the $10M stage sounds massive, it remains a tight percentage. This plan essentially forces you to adopt an institutional trading strategy where capital preservation is more important than moon-shot profits.

The consistency of the 80% profit share throughout the scaling process is a huge plus. Many competitors lure traders in with 90% splits but restrict capital growth. Lux does the opposite; they offer real-world splits but provide a path to institutional-grade liquidity that most retail traders would never access otherwise.

7. Lux Trading Firm platform and trading conditions

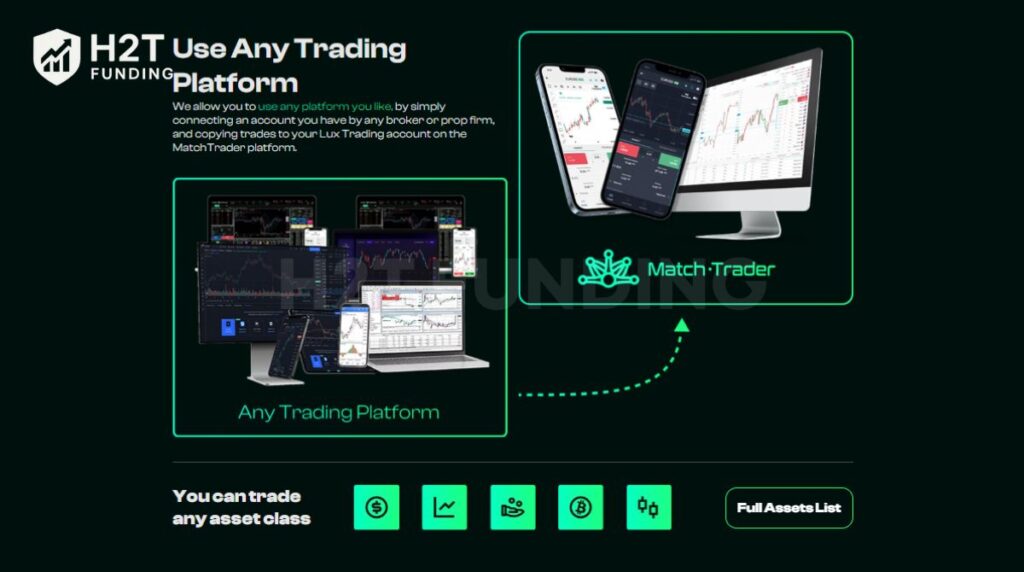

Lux Trading Firm provides a highly flexible trading environment by offering institutional-grade execution and a bring your own platform approach. Because they operate on a transparent A-Book model, the trading conditions mirror the live market with ultra-tight spreads and no dealing-desk intervention.

7.1. Trading platforms

While many firms lock you into a single interface, Lux gives you access to the industry’s most powerful trading platforms, including MT4, MT5, and cTrader.

A standout feature is their Use Any Trading Platform policy. You can trade on any broker or platform you prefer and simply copy your trades to your Lux account via the MatchTrader platform. This is a massive advantage for those who have spent years perfecting a setup on a specific broker’s interface.

7.2. Trading instruments & leverage

The asset selection at Lux is vast, covering almost every liquid market globally. This allows for diverse trading styles, from scalping major forex pairs to swing trading international stocks.

Traders can access over 40 Forex pairs, global benchmarks like the US30 and DAX, and hundreds of individual Equity CFDs from the US and EU. High-liquidity Cryptocurrencies like Bitcoin and Ethereum are also available for those following a multi-asset trading strategy.

Regarding Lux Trading Firm’s leverage, the firm employs a professional, institutional-grade model across all Evaluation, Advanced, and Professional accounts. This ensures that risk exposure remains sustainable for long-term capital management.

- Forex, Indices, Energies, and Metals: Available with 1:30 leverage.

- Equity CFDs (Stocks) and Cryptocurrencies: Available with 1:5 leverage.

Unlike retail firms that offer high-risk ratios like 1:500, Lux’s capped leverage is designed to prevent costly mistakes. This disciplined approach aligns with the firm’s goal of transforming retail participants into professional fund managers.

7.3. Spreads and trading fees

Lux manages costs through its partner brokers (such as Global Prime), which provide raw market spreads.

- Tight spreads: Major pairs like EUR/USD often see spreads as low as 0.0 pips during high liquidity.

- Commission structure: The firm typically does not charge direct trading fees. Instead, costs are built into the 80/20 profit-sharing model, meaning the firm only profits when you do.

- Execution: Real A-Book execution means you benefit from institutional fills without the artificial slippage often found in B-book prop firms.

Verdict on the Lux Trading Firm platform and conditions

The platform flexibility here is genuinely refreshing. The ability to trade on MT5 while having your trades mirrored onto their professional liquidity pool via MatchTrader solves the bad broker problem many traders face elsewhere.

If you prioritize execution quality and a massive range of assets (especially stocks), Lux is superior to almost any other prop firm. If you are looking for high leverage to flip a small account, their professional restrictions may feel limiting.

8. Education & customer support

Lux Trading Firm positions itself as a Career Trading Program, which means it invests heavily in the professional development of its traders. Their support system is about providing the institutional knowledge required to manage millions in capital.

8.1. Education & resources

The firm provides a wealth of free educational content designed to refine your trading experience. Unlike many firms that offer generic how-to guides, Lux focuses on high-level concepts like market psychology, quantitative modeling, and the legality of the prop industry.

The Lux Blog: A deep repository of articles covering complex topics such as the drawbacks of back-testing and realistic earnings expectations in Forex.

YouTube Channel: With over 7,000 subscribers and hundreds of videos, their YouTube presence is a goldmine for developing traders. They frequently post interviews with successful funded traders (like Victor H. and Andre T.), providing transparency into what a winning trading strategy actually looks like at this level.

8.2. Real-world professional presence

One of the strongest trust signals for Lux Trading Firm is its physical presence at major global financial events. They are not a ghost firm operating solely behind a website.

Lux is a regular participant in prestigious events like the London Trader Show. In October 2023, the team met with thousands of traders in person at Novotel London West, proving their commitment to the UK trading community.

8.3. Customer support

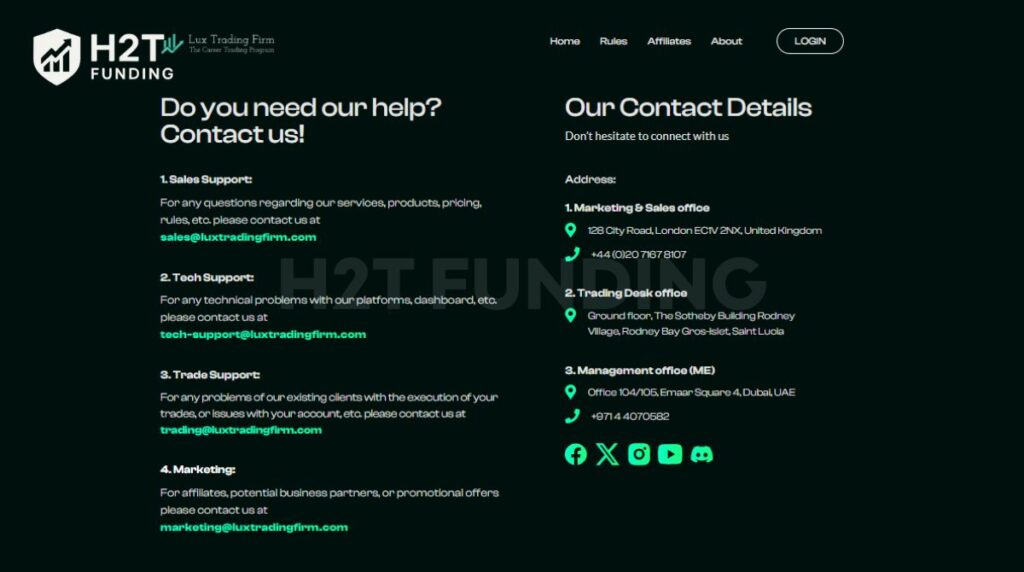

When you need help, Lux provides specialized departments rather than a generic one-size-fits-all help desk. This ensures that technical, sales, or trade-specific issues are handled by experts in those fields.

Dedicated support channels:

- Sales Support: sales@luxtradingfirm.com (For pricing and rules).

- Tech Support: tech-support@luxtradingfirm.com (For dashboard and platform issues).

- Trade Support: trading@luxtradingfirm.com (For execution and account-specific queries).

- Global Offices: They maintain physical offices in three strategic locations: London (UK), St. Lucia, and Dubai (UAE).

Verdict on Lux education & support

The quality of customer support at Lux is vastly superior to the industry average. Most prop firms rely on automated chatbots or outsourced workers, but Lux provides direct access to a professional trading desk environment.

The educational content is also No-BS. They don’t promise easy millions; instead, they show you the hard work required through real trader interviews. The fact that they show up at the London Trader Show in person gives them a level of authority that offshore, anonymous firms simply cannot match.

If you are a trader who values a human connection and professional guidance over just having an account, Lux is the clear leader in this category. Their multi-hub presence in London and Dubai ensures that support is available across almost all major time zones.

9. Common reasons traders fail at Lux Trading Firm (Before blaming the rules)

Many traders label Lux as too difficult or a scam without realizing they are applying a retail gambling mindset to an institutional-grade environment. At H2T Funding, we have identified that most failures result from technical misunderstandings of the firm’s professional infrastructure.

9.1. Mismanaging Remaining Risk Capital (RRC)

Traders often fail because they calculate risk based on the total account balance instead of the Remaining Risk Capital (RRC). If you have a $100,000 account with a $6,000 drawdown limit, your real capital is only $6,000.

Risking 1% of a $100,000 balance ($1,000) actually means you are risking nearly 17% of your available RRC. This level of over-leveraging can quickly trigger a breach of risk consistency rules after only a few consecutive losses.

9.2. Violating the 5% single-trade profit cap

Lux requires that no single position contribute more than 5% of the total profit target. This rule is designed to filter out lucky gamblers who pass a challenge by catching one massive news-driven move.

Many traders fail by allowing a winning trade to run past this cap without scaling out or taking partial profits. Violating this limit demonstrates a lack of consistent trading and is one of the most common reasons for account termination.

9.3. Confusing static drawdown with trailing or equity-based drawdown

Retail traders are often used to trailing drawdowns that chase their profits. At Lux, the static drawdown is fixed at 6% of the initial starting balance and does not move up as you gain profit.

Confusion arises when traders misjudge how much real buffer they have left during a losing streak. Understanding that your floor is permanently set at 94% of the starting capital is vital for proper account management.

9.4. Using a retail mindset in an institutional trading environment

A retail mindset focuses on high-leverage flips and quick gains, whereas an institutional environment prioritizes capital preservation. Traders often fail because they ignore mandatory stop-loss settings or attempt high-risk plays.

Success at Lux requires a transition to fund-manager thinking, where every trade is measured by its risk to the firm’s liquidity. This mental shift from gambler to asset manager is the hardest hurdle for most retail participants to overcome.

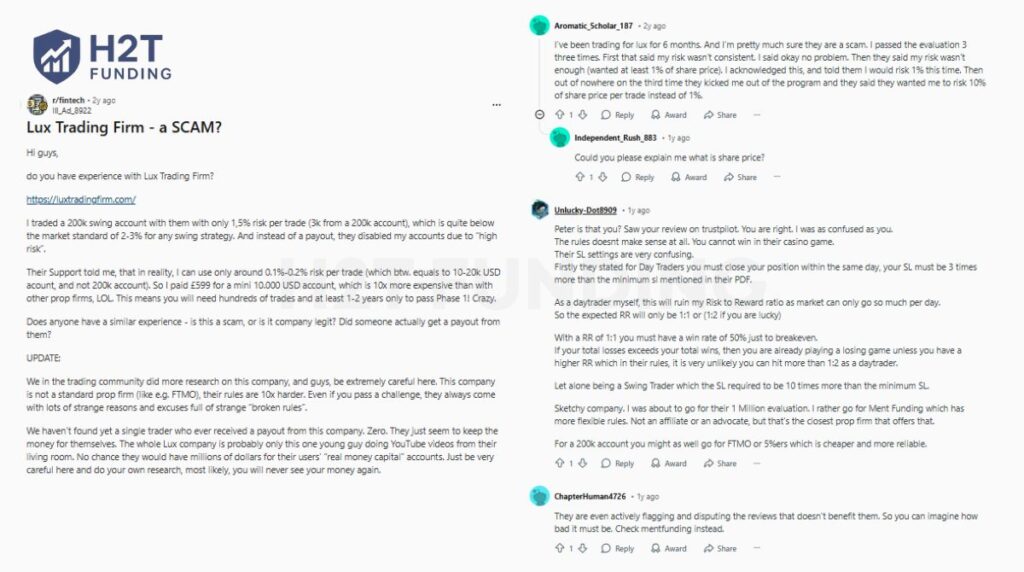

10. Real trader feedback: Lux Trading Firm Trustpilot and Lux Trading Firm Reddit

As of December 30, 2025, the feedback for Lux remains deeply polarizing. With only 646 reviews on Trustpilot, the user base is relatively small, which raises significant questions about its long-term reliability and payout frequency.

Trustpilot shows a 4.0 rating with some positive comments from traders like Joao and Johnny. They appreciate the institutional feel and A-Book execution, though these experiences seem to be the exception rather than the rule.

However, many Lux Trading Firm review entries point toward trap-like mechanics. The 5% risk limit on available capital often leads to immediate disqualification, causing many traders to lose their initial enrollment fee without a fair chance.

The customer support is often criticized for being overly technical and defensive. Instead of offering help, they frequently provide long, complex explanations to justify account closures, leaving many traders feeling cheated and frustrated.

On the Lux Trading Firm Reddit, the sentiment is even darker, with frequent SCAM accusations. Users report accounts being disabled for high risk even when following standard swing or day trading styles, suggesting the firm thrives on fee collection.

Skeptics on Reddit argue that the $10M goal is an unreachable marketing myth designed to lure people in. They claim the firm profits more from failed challenges than from actual market success, making the environment feel like a casino game.

Ultimately, the findings as of December 30, 2025, suggest that Lux is an extremely high-risk choice that leans toward a scam-like environment. The heavy volume of broken rule complaints and account disabling makes it difficult to recommend.

If you choose to sign up, you should consider your fee a high-stakes gamble rather than a career investment. Unless you are willing to risk your capital against near-impossible constraints, it is likely safer to avoid this firm entirely.

11. How to start Lux Trading Firm

Getting started with this Lux Trading prop firm involves a multi-stage onboarding process designed to verify your identity and ensure professional compliance. Unlike retail firms with one-click signups, Lux maintains institutional standards from the very first step.

To begin your journey toward a $10M fund, you will need to complete the following:

- Step 1: Select your preferred account size and program.

- Step 2: Completing the mandatory Identity Verification (KYC).

- Step 3: Reviewing and accepting the strict Trading Rules and Terms.

- Step 4: Finalizing the checkout with your chosen payment method.

Follow the detailed step-by-step breakdown below to navigate the registration and Lux Trading Firm login activation process smoothly.

11.1. Step 1: Choose your preferred account size

First, visit the official website and select the program that aligns with your trading strategy and budget. You can choose between the 1-Stage Evaluation ($100k, $400k, or $1M) or the $400k Instant Funding option.

Each path offers a different entry fee and a specific number of stages required to reach the final $10,000,000 goal. Once you have made your selection, click the arrow to proceed to the verification area.

11.2. Step 2: Confirm your identity (KYC)

Lux requires a high level of responsibility, starting with a mandatory Know Your Customer (KYC) check. You must provide your full name, email address, and official government documentation.

Prepare a clear scan of your ID card and a valid proof of residence, such as a utility bill or bank statement. These files must be well-lit and all elements clearly visible to avoid delays in your evaluation process.

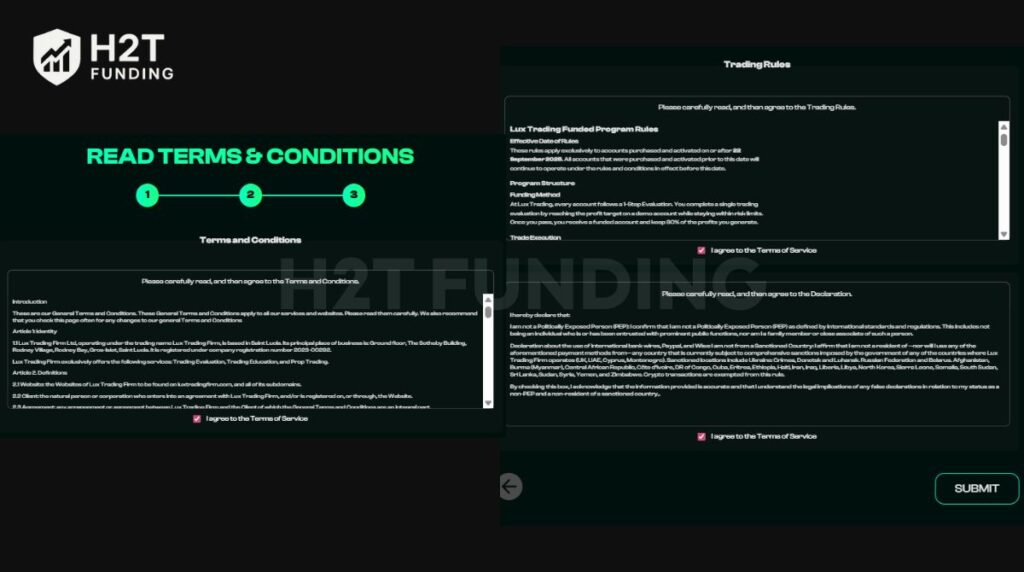

11.3. Step 3: Review and accept the Terms & Rules

Before paying, you must carefully read and agree to the General Terms & Conditions and the specific rules. This includes a formal declaration regarding your status as a non-politically exposed person.

This stage ensures you fully understand the A-Book execution model and the 6% static drawdown constraints. Checking these boxes signifies your legal agreement to operate within their professional trading environment.

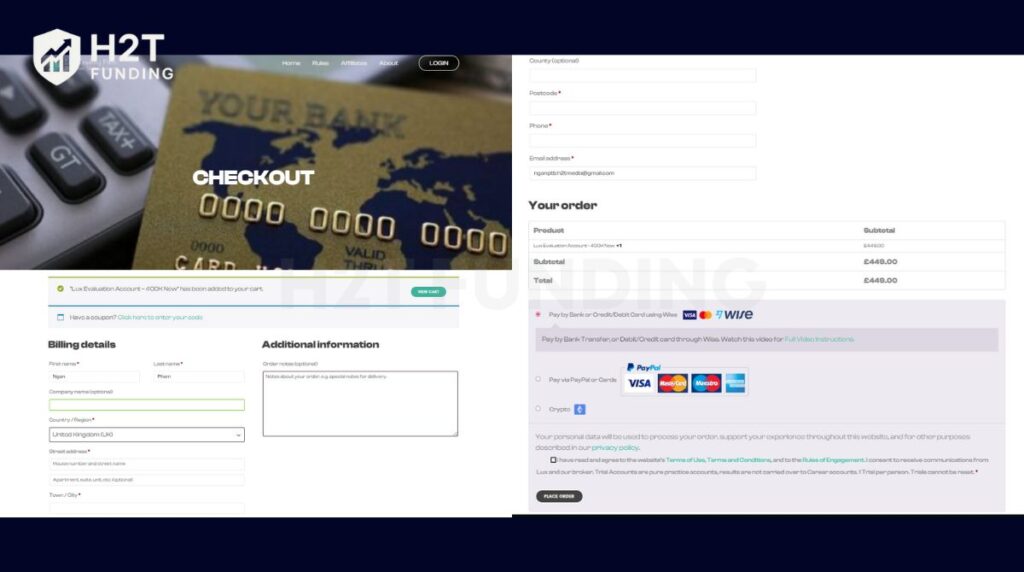

11.4. Step 4: Complete the Checkout and payment

In the final phase, enter your billing details, including your physical address and contact number. Double-check your cart to ensure the correct account size, such as the 400K New evaluation, is listed.

Lux provides several flexible payment methods, including Bank Transfer or Credit Card via Wise, PayPal, and even Cryptocurrencies like Ethereum. After ticking the final agreement box and clicking Place Order, your credentials will be generated.

By completing these four steps, you officially secure your position in the program and receive your Lux Trading Firm login credentials. This structured onboarding ensures that only serious traders who are willing to follow professional protocols enter their liquidity pool.

12. Lux Trading Firm restricted countries

Lux Trading Firm operates as a professional training and prop trading entity with legal registrations in Saint Lucia, London (UK), and Dubai (UAE). It is important to clarify that Lux is not a broker and does not accept deposits; instead, it partners with regulated clearing firms.

Because Lux focuses solely on prop trading and education, it is not required to be authorized by retail financial regulatory authorities. All clearing activities and market data feeds are handled by authorized institutional partners to ensure a professional and transparent trading environment.

However, the firm enforces strict compliance regarding geographical locations. Traders residing in sanctioned jurisdictions are barred from using traditional payment services like international wire transfers, PayPal, or Wise. Violating these restrictions results in immediate account termination without the right to a refund.

Based on the firm’s declaration of compliance, residents of the following countries and regions are restricted from participating in the program:

- Afghanistan

- Belarus

- Burma (Myanmar)

- Central African Republic

- Côte d’Ivoire

- Cuba

- Democratic Republic of the Congo

- Eritrea

- Ethiopia

- Haiti

- Iran

- Iraq

- Liberia

- Libya

- North Korea

- Russian Federation

- Sierra Leone

- Somalia

- South Sudan

- Sri Lanka

- Sudan

- Syria

- Ukraine (specifically Crimea, Donetsk, and Luhansk regions)

- Yemen

- Zimbabwe

Please note that while crypto transactions are currently exempt from certain payment-specific restrictions, every trader must still provide a valid proof of residency during the checkout process. Attempting to bypass these rules will lead to a permanent ban from the Lux Trading Prop Firm ecosystem.

Failure to provide current residency documentation during onboarding will prevent you from accessing the trading platforms. You must ensure your country is not on the sanctioned list before paying the enrollment fee, as refunds are not granted for residency violations.

13. Compare Lux Trading Firm vs other prop firms

Selecting the right prop firm depends on your preferred asset class and risk tolerance. Below is a detailed comparison between Lux Trading Firm and three other prominent industry players to help you identify the best fit for your trading strategy.

| Criteria | Lux Trading Firm | Lucid Trading | FTMO | Funding Traders |

|---|---|---|---|---|

| Headquarters | United Kingdom | United States | Czech Republic | United States |

| Established | 2021 | 2024 | 2015 | 2023 |

| Account Types | 1-Step & Instant | 1-Step & Instant | 2-Step | 2-Step & Instant |

| Profit Split | 80% – 100% | Up to 90% | 80% – 90% | 80% – 90% |

| Max Account Size | $1M (Scales to $10M) | $150,000 | $200,000 | $200,000 |

| Platforms | MT4, MT5, cTrader | NinjaTrader, Tradovate | MT4, MT5, cTrader | MT5, TradeLocker |

| Asset Types | Multi-asset (Stocks Focus) | Futures Contracts | Forex, Crypto, Stocks | Forex, Metals, Crypto |

Based on these metrics, each firm caters to a specific type of trader:

- Lux Trading Firm: Best for institutional-minded traders who want to manage up to $10,000,000 and value professional A-Book execution across stocks and forex.

- Lucid Trading: Ideal for futures specialists in the US who prefer 90% profit splits and professional platforms like NinjaTrader or Quantower.

- FTMO: The go-to choice for traders seeking a 10-year track record, reliable bi-weekly payouts, and a standard 2-step evaluation process.

- Funding Traders: Suited for those looking for rapid payout speeds, AI-driven risk coaching, and competitive fee structures on the MT5 platform.

In summary, while Lux Trading Firm offers the highest capital scaling potential in the industry, firms like FTMO and Lucid Trading provide higher initial profit splits. Your choice should align with whether you prioritize long-term capital growth or immediate high-percentage payouts.

We recommend comparing these rules against your historical performance to see which environment minimizes your risk of costly mistakes.

14. Should I choose Lux Trading Firm?

Deciding whether to join Lux Trading Firm depends on your professional goals and your ability to trade like a fund manager. This prop firm is built for a specific type of professional, and it is certainly not a one-size-fits-all solution.

You should choose Lux Trading Firm if:

- Long-term scaling: You are committed to a multi-year career path and want a legitimate roadmap to managing $10,000,000 in live capital.

- No time pressure: You prefer a no time limit environment where you can wait for the perfect setups without the stress of a 30-day deadline.

- A-book execution: You value transparency and want to ensure your trading strategy is executed in real market conditions rather than a simulation.

- Institutional discipline: You already use mandatory stop-loss settings and follow a strict risk management plan as part of your daily routine.

You should avoid Lux Trading Firm if:

- High-leverage needs: You rely on high leverage (like 1:100 or 1:500) to flip small accounts quickly.

- Aggressive styles: Your strategy involves all-in news trading or martingale techniques, which are often flagged by their risk desk analysis.

- Tight budget: You cannot afford to lose your enrollment fee, as the high profit targets and 6% static drawdown make the failure rate quite high.

- Rule flexibility: You find strict rules, like the 5% single-trade profit cap, too restrictive for your specific trading styles.

Ultimately, Lux is a high-stakes choice. If you are part of the disciplined 1% who can avoid costly mistakes under institutional scrutiny, Lux offers a career-changing opportunity. However, based on the skepticism found on Lux Trading Firm Reddit, average retail traders might find more success with firms that offer higher flexibility and lower profit hurdles.

15. Is Lux Trading Firm legit?

Yes, Lux Trading Firm is a legitimate UK-based entity with registered offices in London, Dubai, and Saint Lucia. Their legitimacy is supported by their physical presence at major financial events like the London Trader Show and their transparent A-Book execution model. That uses real liquidity providers rather than just simulated environments.

However, being legit does not mean they are trader-friendly. Most scam accusations on Reddit stem from their extremely strict rules, which often catch retail traders off guard.

At H2T Funding, we view Lux as a high-barrier institutional firm. They are a real company with real capital, but their rigid risk constraints mean only the most disciplined professionals will ever see a payout.

16. FAQs

Lux uses a 1-Stage evaluation process with no time limits. You prove your skills on a demo account by hitting a profit target while staying within the 6% maximum loss limit. Success leads to a live account and a 100% refund of your initial enrollment fee.

Profit targets are 10% for the $100k account, 12% for the $400k account, and 15% for the $1M account. Since there is no deadline, you can adjust your trading strategy to wait for high-probability setups without feeling rushed.

Lux enforces a 6% static drawdown across all programs. This limit is fixed to your starting balance and does not trail your profits. This model provides more security for your risk management as the account grows.

No, Lux does not currently enforce a daily loss limit. Your only hard constraint is the 6% total static drawdown. However, you must always maintain risk consistency and use mandatory stop-losses on every trade.

Yes, news trading is allowed, but with two strict rules. You cannot use news bracketing strategies, and you are prohibited from adjusting your stop-loss within 30 seconds of high-impact news events.

Traders have access to MT4, Lux Trading Firm MT5, and cTrader. You can also trade on any preferred broker and mirror those trades to your Lux account through their MatchTrader integration.

The firm offers a massive selection, including over 40 Forex pairs, global Indices, Commodities, and high-liquidity Cryptocurrencies. They also provide access to hundreds of individual Stocks, which is rare for a Lux Trading prop firm.

You receive an 80% profit share on funded accounts. The withdrawal process is typically handled monthly via bank wire or crypto once you have closed all active positions and met the minimum profit threshold.

The scaling plan is a professional roadmap that can grow your capital to a $10,000,000 Fund Manager position. Depending on your starting account, you can double your capital every time you hit a 10%-15% profit target.

It is only worth it for highly disciplined traders who can follow strict institutional rules. If you find the feedback on Reddit concerning or prefer high-leverage gambling, this firm is likely not the right fit for you.

17. Conclusion

This Lux Trading Firm review concludes that while the $10M goal is structurally real, it remains a marketing myth for the vast majority of traders. The 5% single-trade profit cap and rigid rules ensure that only the most elite, disciplined professionals can ever navigate the path to the final fund manager stage.

For serious professionals, Lux offers a legitimate A-book path to institutional capital, but the environment is unforgiving. If you struggle with strict risk management or prefer high-leverage gambling styles, you will likely lose your enrollment fee quickly under their intense institutional scrutiny.

Ultimately, Lux is a career firm that demands perfection and is not suited for average retail traders. To find a platform that might better align with your specific goals and risk tolerance, explore our other expert prop firm reviews at H2T Funding before committing your capital.