Finding a reliable Funding Traders review is essential before risking your hard-earned money on a new challenge. Most retail traders worry about unfair account terminations or whether the firm actually processes every withdrawal request. This analysis examines whether their capital programs are truly built for professional success.

At H2T Funding, we have thoroughly analyzed this Funding Traders prop firm to ensure it meets professional standards. Read on to see if this firm is a trusted partner or a potential risk for your career.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funding Traders websites before purchasing any challenge.

1. Our take on Funding Traders

Funding Traders was founded in 2023 by CEO Stan G.K. to offer structured access to institutional-style capital for retail traders who can demonstrate discipline. On paper, the firm presents a clean and modern setup, with strong emphasis on risk control, performance metrics, and scalability.

What stands out most is how system-driven the firm is. From the Metrix dashboard to the built-in AI Trading Coach, Funding Traders places heavy focus on preventing emotional trading and accidental rule violations. This structure benefits traders who already operate with a clear plan, but it leaves very little room for improvisation or aggressive recovery strategies.

The $2 million scaling plan is one of the firm’s strongest long-term incentives. However, scaling is not automatic and strongly favors traders who produce consistent, repeatable results rather than short bursts of high profitability.

Payout speed is frequently mentioned by traders as a positive experience. Based on user feedback and firm disclosures, payouts are typically processed within 24 hours once all conditions are met. That said, speed alone does not eliminate disputes; most conflicts arise from eligibility rules rather than payment delays.

Overall, Funding Traders feels less like a trader playground and more like a structured risk-management environment. This makes it attractive to disciplined traders, but frustrating for those who trade more aggressively or rely on volatility.

| Pros | Cons |

|---|---|

| Scaling opportunities up to $2M in capital. | Strict daily loss limits are applied to all accounts. |

| Rapid 24-hour average payout processing time. | Mandatory consistency score on instant accounts. |

| Active community engagement via the official Discord. | Limited to MT5 and TradeLocker trading platforms. |

| AI assistant for real-time risk coaching. | Potential for slippage during high-impact news. |

2. Funding program Funding Traders review

Selecting the right funding program is essential for aligning your strategy with the firm’s liquidity requirements. Funding Traders provides two distinct models designed to accommodate both cautious evaluators and those seeking immediate market entry.

This flexibility allows traders to select an account type that fits their specific risk profile and financial goals. Whether you prefer a multi-stage evaluation or an instant funded route, the firm maintains a clear and structured framework for every challenge.

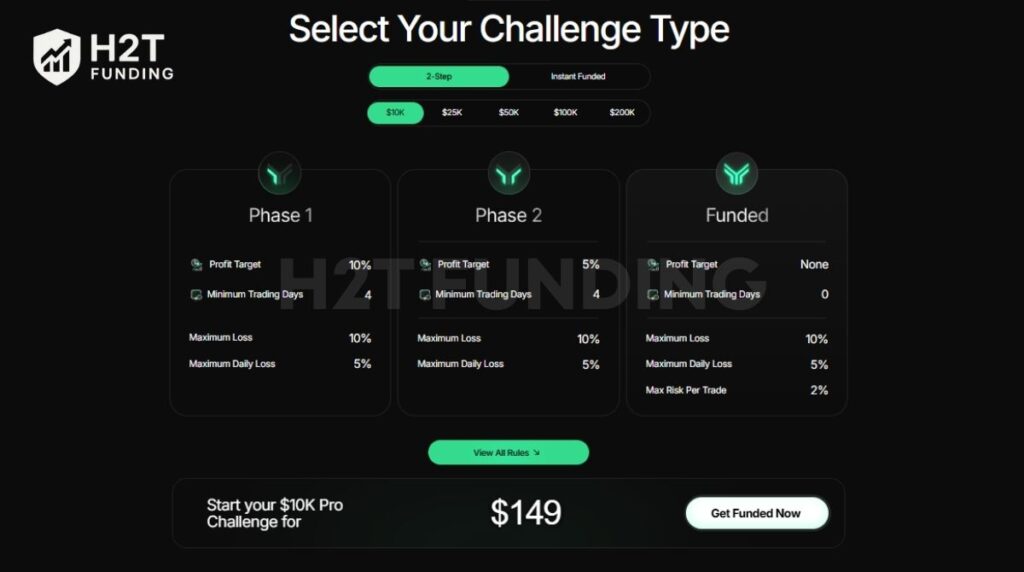

2.1. Two-step challenge

The two-step evaluation is a structured program where participants must verify their skills across two distinct phases. This model is built for those who prefer static drawdown limits and lower initial fees compared to instant funding options. It requires a balance of profit generation and strict adherence to risk management protocols and maximum loss limits.

In this program, you aim for a 10% profit target in Phase 1 and 5% in Phase 2. Both stages require a minimum of 4 active trading days to ensure the results are not the product of a single market event. Once you reach the funded stage, the 2% maximum risk per trade rule becomes active to protect the firm’s capital.

| Account Size | Evaluation Fee | Phase 1 Target (10%) | Phase 2 Target (5%) | Max Daily Loss (5%) | Max Total Loss (10%) |

|---|---|---|---|---|---|

| $10,000 | $149 | $1,000 | $500 | $500 | $1,000 |

| $25,000 | $249 | $2,500 | $1,250 | $1,250 | $2,500 |

| $50,000 | $399 | $5,000 | $2,500 | $2,500 | $5,000 |

| $100,000 | $599 | $10,000 | $5,000 | $5,000 | $10,000 |

| $200,000 | $1,199 | $20,000 | $10,000 | $10,000 | $20,000 |

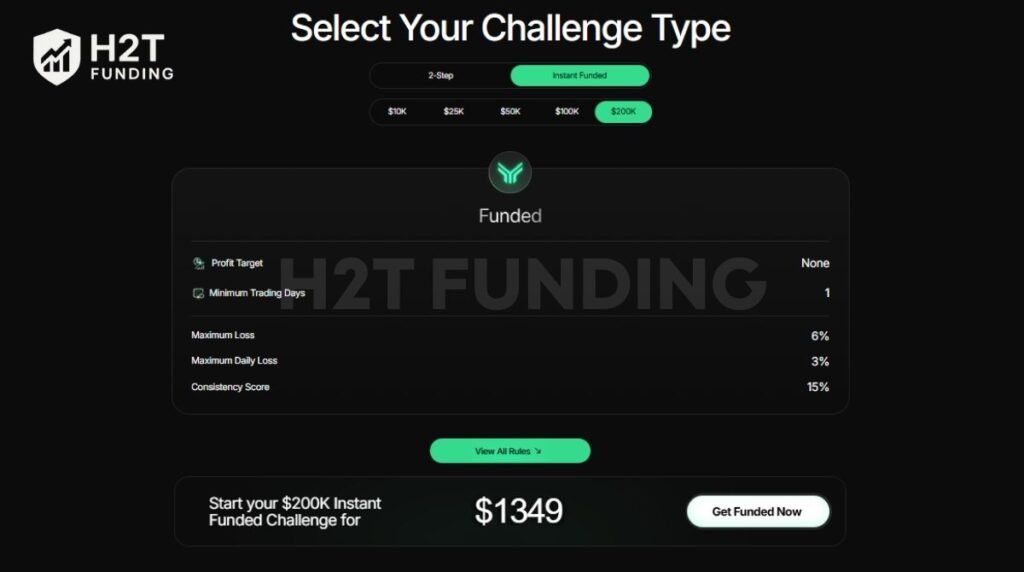

2.2. Instant Funded challenge

The Instant Funded challenge bypasses the evaluation phases entirely, providing immediate access to live capital. This model is built for individuals who want to commence earning payouts from the first day of trading. It serves as a direct liquidity solution for those who possess a ready-to-use strategy and wish to skip testing periods.

To maintain these accounts, participants must follow a tighter risk framework, including a 3% daily limit and a 6% total drawdown. A critical requirement is the 15% consistency score, which ensures profits are generated through a series of trades rather than one outlier. This rule is designed to foster long-term stability and professional execution across the board.

| Account Size | Evaluation Fee | Max Daily Loss (3%) | Max Total Loss (6%) | Consistency Score |

|---|---|---|---|---|

| $10,000 | $159 | $300 | $600 | 15% |

| $25,000 | $289 | $750 | $1,500 | 15% |

| $50,000 | $449 | $1,500 | $3,000 | 15% |

| $100,000 | $679 | $3,000 | $6,000 | 15% |

| $200,000 | $1,349 | $6,000 | $12,000 | 15% |

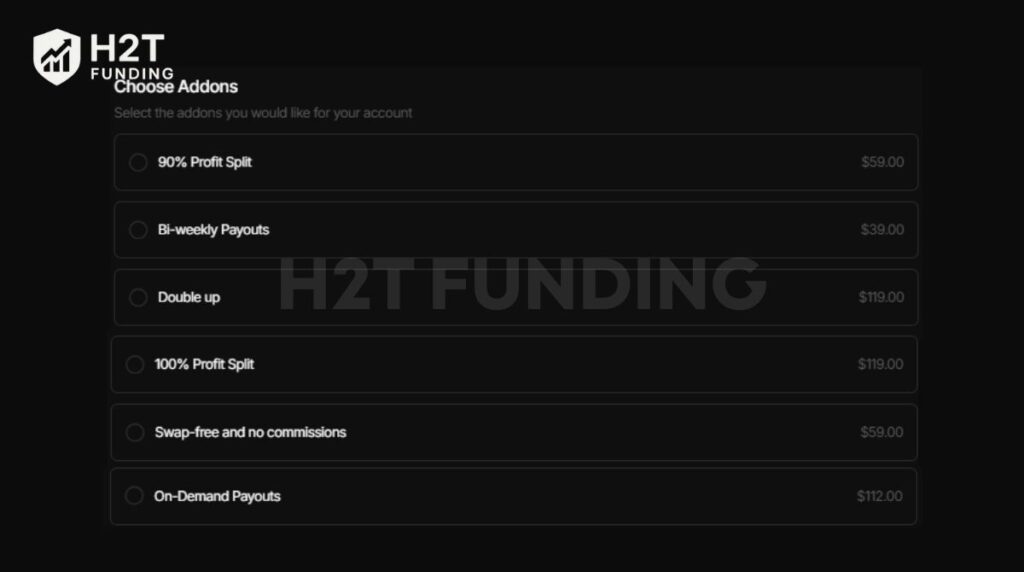

2.3. Funding Traders add-ons

Funding Traders provides several optional add-ons at checkout to customize your trading experience and financial rewards. These features are designed to adjust the core parameters of your account to better suit your specific strategy and risk tolerance.

- 90% or 100% Profit Split: This upgrade allows you to maximize your managed capital earnings by keeping nearly all generated profits.

- Bi-weekly or On-Demand Payouts: These options provide faster liquidity by reducing the standard wait time for your next payout request.

- Swap-free and No Commissions: A professional tool for swing traders that eliminates overnight fees and transaction costs from your performance.

- 30% Consistency Score: Increases the single-day profit limit to 30%, providing more leniency for payout eligibility on specific models.

- Double-Up: Rewards success by providing an extra refund bonus or a free second account after passing the challenge.

Important Note: Availability varies significantly by program. 2-step accounts generally support the profit split upgrades, bi-weekly payouts, swap-free options, and the double-up. Conversely, Instant Funded accounts are specifically eligible for the 100% profit-split and on-demand payout enhancements.

Verdict on Funding Traders programs

The dual-program structure offers a distinct choice between low-cost evaluation and immediate liquidity access. With the two-step model, the 10% total drawdown buffer provides more room for market fluctuations compared to the 6% limit on instant accounts. This reflects a higher risk-to-reward requirement for those skipping the testing phases.

Also, the 15% consistency score on instant accounts prevents aggressive all-in strategies. This rule ensures that earnings are distributed over multiple trades, fostering a professional approach. And the default 80% profit split, upgradeable to 100%, remains one of the most competitive offerings for skilled participants.

3. Funding Traders rules

Adhering to the established rules is critical for maintaining your account status and ensuring a successful payout. Funding Traders uses the Metrix system to monitor performance and detect any prohibited gambling behaviors. Their framework is designed to balance trader flexibility with institutional-grade risk management.

3.1. Allowed trading practices

The firm permits several advanced strategies, provided they align with its long-term consistency goals. Most traders find the environment accommodating for professional setups that utilize modern tools. Below are the primary activities allowed under their transparent guidelines:

- Internal copy trading: You can copy trades between your own funding accounts or from your personal external brokers.

- Risk management EAs: Expert Advisors are permitted if they focus on trade management or position sizing (consult support first).

- AI-assisted coding: AI-generated EAs are allowed if you completely understand the code and acted as the developer.

- Pro model flexibility: These accounts allow weekend and overnight holding, including crypto, plus news trading during evaluations.

- VPN Usage: Using a VPN is allowed to enhance your online security and privacy while managing your dashboard.

3.2. Prohibited trading practices

Engaging in prohibited trading practices can lead to warnings (soft breaches) or immediate account termination (hard breaches). Funding Traders strictly monitors the capital pool to prevent unrealistic or manipulative market behaviors. Key restrictions include:

- VWHT rule: Every trade must meet a 2-minute Volume Weighted Average Holding Time to reflect genuine market participation.

- HFT & latency: High-frequency trading or executions lasting under 15 seconds are strictly forbidden on funded accounts.

- Grid & reverse trading: Placing multiple orders at varied price intervals or taking opposite trades across accounts is prohibited.

- Inactivity clause: Accounts are permanently closed if no trade is placed within 30 days of the purchase date.

- Instant funding limits: You must close all positions one hour before Friday market close and follow a 20-lot limit.

- Risk management flagging: Risking over 2% per trade or all-or-nothing gambles will trigger a 1:30 leverage cap.

Verdict on Funding Traders rules

The firm’s regulatory framework is designed to reward professional discipline while filtering out high-risk gambling. While the 2-minute holding time and news restrictions require careful planning, they ensure a sustainable environment for the community. These guidelines are quite fair for those who prioritize long-term capital preservation and institutional standards.

4. Funding Traders payout structure

The process for receiving funds at Funding Traders is divided into specific cycles based on the chosen program. Both models prioritize timely profit distribution and clear eligibility requirements to ensure a professional experience for every participant.

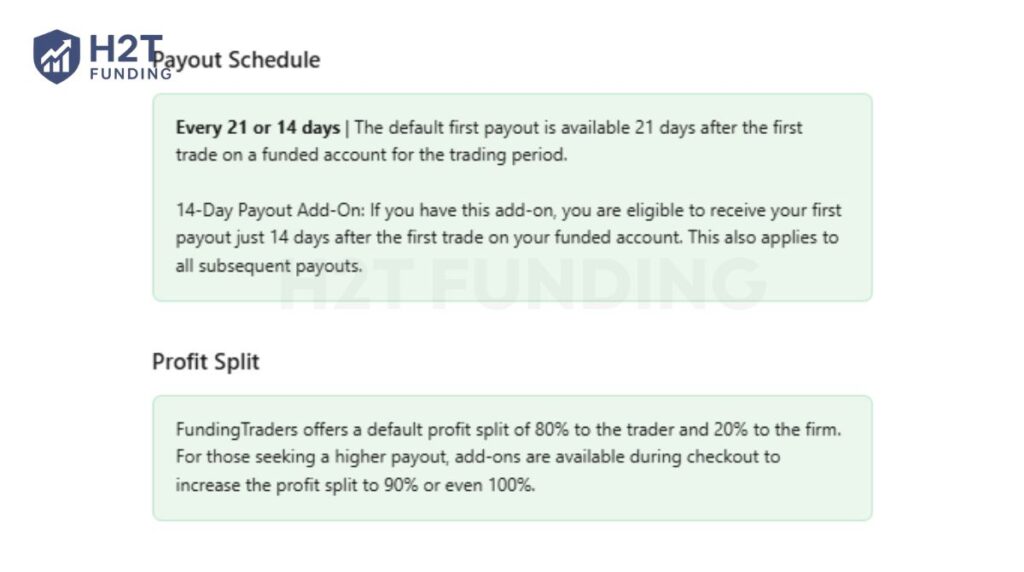

4.1. Payout details for 2-step account

The 2-step model operates on a standard 14-day payout cycle starting from the date of your first trade in the funded stage. Traders seeking faster liquidity can select an optional upgrade to 7-day payouts during the initial account checkout.

- Profit split levels: Starts at a default of 80% but can be increased to 90% or 100% with specific add-ons.

- Refund policy: A 100% refund of the evaluation fee is included in your first successful profit withdrawal.

- Minimum requirements: Profit requests are permitted once you reach $50 for crypto or $200 for bank transfers.

- Account reset: The balance resets to the initial starting amount after each request to allow uninterrupted trading.

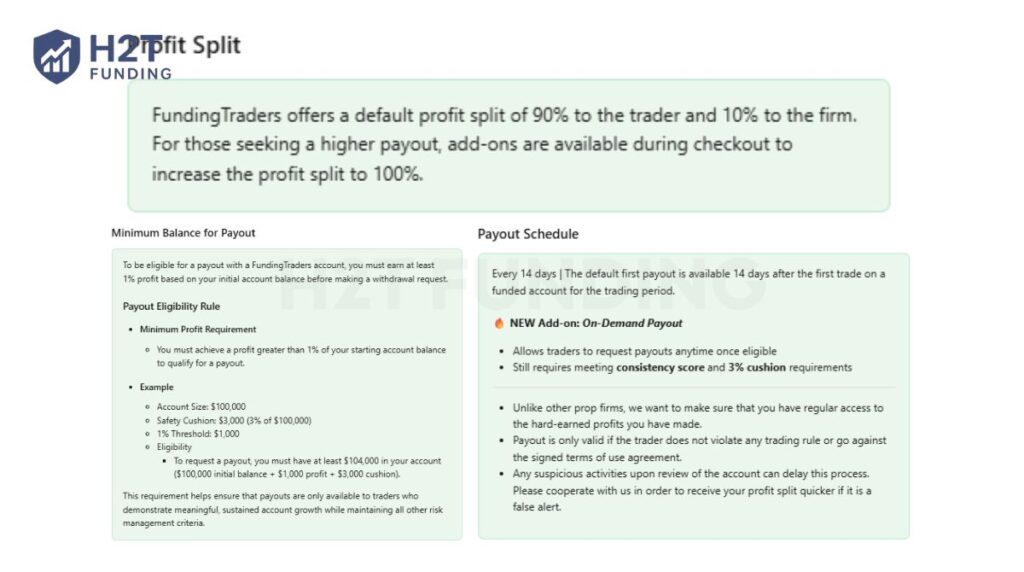

4.2. Payout details for instant account

Instant accounts offer a higher initial 90% profit split but require stricter adherence to consistency metrics. These rules are designed to verify professional discipline since the traditional testing phases are bypassed.

- Consistency score: Your single most profitable day must not exceed 15% of the total profit earned.

- Safety cushion: The first 3% of profit is non-withdrawable, acting as a buffer for the daily loss limit.

- Minimum activity: You must record at least 5 profitable trading days (+0.25% gain) within every 30-day cycle.

- Win-loss ratio: Your largest single loss must be equal to or smaller than your largest single winning trade.

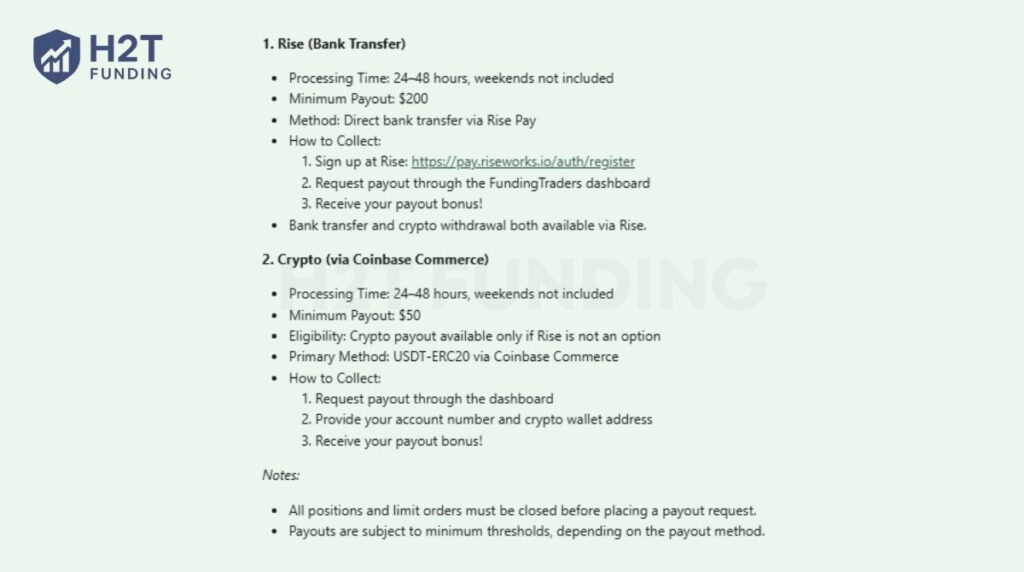

4.3. Payout methods and processing

Every payout request is managed through the Metrix dashboard and requires all trades to be fully closed. The firm utilizes recognized financial processors to ensure secure and timely global transfers.

- Rise Pay (Bank Transfer): Suited for larger withdrawals with a $200 minimum and an estimated about 24 to 48 hours, weekends not included, arrival time.

- Cryptocurrency (USDT-ERC20 via Coinbase Commerce): Time processing estimated at 24 to 48 business hours with a $50 minimum (available only if Rise is not an option).

Verdict on Funding Traders’ payout structure

The 100% profit split and fee refund options make the Pro model highly rewarding for disciplined participants. While the instant account safety cushion is restrictive, it provides the firm with necessary risk protection for providing immediate capital. The transparent 14-day schedule is a reliable mechanism for consistent income.

5. Scaling plan of Funding Traders

The scaling plan at Funding Traders provides a professional framework for career growth and increased capital access. It rewards long-term sustainability over high-risk, short-term volatility in the global markets.

Skilled individuals can expand their account size to access deeper liquidity without constantly purchasing new challenges. This system identifies consistently profitable behavior through a clear, performance-based roadmap for all participants.

- 25% balance increase: Your account size grows by a quarter of the initial balance every scaling cycle.

- Consecutive profitability: You must show a profit in two consecutive calendar months back-to-back to qualify.

- Scaling profit target: A total gain of at least 8% over the two months is required based on the starting balance.

- Scaling limit: The program allows for total growth up to a maximum of $2,000,000.

- Balance requirement: Scaling only occurs if the account is at its initial starting balance at the time of the request.

Verdict on Funding Traders’ scaling plan

This structure serves as a professional filter that prioritizes proven discipline over random market luck. While the two-month consecutive requirement is a high bar, it ensures that participants manage capital responsibly as they scale. For those aiming for institutional-size funding, the $2M limit offers one of the most ambitious growth trajectories currently available in the industry.

6. Spreads & commission fees

Managing the cost of execution is a vital part of maintaining long-term profitability in the prop space. Funding Traders offers a tiered commission structure that varies depending on the account type and the current stage of your challenge.

During the 2-step evaluation phase, the firm does not charge any commissions on FX, Metals, or Crypto. This allows traders to focus purely on hitting their targets without the drag of additional transaction costs.

Once you move to a 2-step funded account, a standard $3/lot round-trip commission applies to all instruments except indices. For those using Instant Funding, the commission increases to $6/lot round-trip as a trade-off for immediate capital access.

| Instrument Category | 2-step (Evaluation) | 2-step(Funded) | Instant Funding |

|---|---|---|---|

| Forex & Metals | $0 / lot | $3 / lot | $6 / lot |

| Crypto & Energy | $0 / lot | $3 / lot | $6 / lot |

| Indices | $0 / lot | $0 / lot | $0 / lot |

Verdict on Funding Traders spreads & commission fees

The commission-free evaluation period is a significant advantage for budget-conscious individuals. While the $6 fee on instant accounts is higher than some competitors, it reflects the premium for skipping the testing phases. To maximize returns, participants should monitor potential slippage during high-volatility sessions to ensure their execution remains efficient.

7. Funding Traders trading platform

Funding Traders provides access to both MT5 and TradeLocker to ensure stability and advanced charting for every participant. The choice between these platforms allows for a tailored technical experience based on your specific needs. Both options are integrated with the Metrix system to provide real-time updates on your objectives and risk limits.

- MetaTrader 5 (MT5): This is the industry standard for veteran traders who require complex indicators and automated scripts. It offers a robust environment for technical analysis and institutional-grade management of your account metrics.

- TradeLocker: A modern, web-based platform that features integrated TradingView charts directly in the interface. It is highly recommended for those who prioritize mobile accessibility and a clean visual layout for their funding journey.

Verdict on the Funding Traders trading platform

The combination of MT5 and TradeLocker creates a well-rounded technical ecosystem for modern participants. We analyze the execution quality across both platforms as stable, with minimal latency reported during standard hours. Providing both a traditional and an innovation-focused option ensures that the firm remains accessible to all trading styles.

8. Trading instruments & leverage

Funding Traders provides a diverse range of assets to ensure participants can build a well-rounded portfolio. You can access major currency pairs, metals, global indices, and volatile crypto assets through a single account interface.

The firm utilizes a tiered leverage model to align with institutional standards and manage risk effectively. This structure is designed to prevent over-exposure while still offering sufficient buying power for intraday strategies.

| Asset Class | Instant Funding | 2-Step Challenge |

|---|---|---|

| Forex (FX) | 1:50 | 1:50 |

| Metals | 1:20 | 1:20 |

| Indices | 1:20 | 1:15 |

| Energies | 1:10 | N/A |

| Crypto | 1:2 | 1:1 |

| Other Commodities | N/A | 1:1 |

A 1:50 leverage on FX majors is the standard for most funding programs, providing enough flexibility for scalpers. The lower ratios for crypto and indices help mitigate the impact of sudden market gaps and unpredictable price swings.

Verdict on Funding Traders’ instruments & leverage

Analysis indicates that the leverage provided is cautious and geared toward sustainability. While aggressive individuals might prefer higher ratios, these limits encourage professional position sizing and disciplined growth. This balanced approach ensures that traders can manage their managed capital without falling into the trap of reckless gambling.

9. Education & resource

Access to a knowledge base is a core part of the firm’s ecosystem. The official blog features checklists for selecting capital sizes and identifying reputable platforms. These articles provide a 3-minute read time, focusing on onboarding new participants into the proprietary space.

The YouTube channel serves as the primary hub for video content, hosting over 600 uploads. These materials are useful for understanding firm updates and policy changes directly from the source. However, a large portion of the video library is centered on promotional content and general industry news.

There is a significant absence of high-level technical analysis or institutional-grade strategy training. While the tutorials help with platform navigation, those seeking to master complex price action will need to rely on external study materials beyond what the firm provides.

Verdict on Funding Traders’ education & resources

The provided materials are sufficient for administrative guidance but lack depth for professional development. The focus on transparency is a positive sign, yet the resources remain entry-level and marketing-heavy overall.

10. Funding Traders’ customer support

Funding Traders provides 24/7 customer support through multiple direct channels, including Live Chat, WhatsApp, and Email. This multi-channel approach ensures that global participants can receive help regardless of their specific time zone.

The firm maintains an in-house support team of over 30 members to handle technical inquiries and account issues. This dedicated staff size is designed to provide faster feedback and resolve platform bugs more efficiently than smaller, outsourced operations.

A unique technical feature is the Free Personal AI Trading Coach, which functions as a specialized AI assistant. This tool provides automated guidance on risk and metrics, a topic frequently discussed within the funding traders Discord for peer-to-peer insights.

Verdict on Funding Traders’ customer support

The firm offers a highly accessible support infrastructure with a mix of human expertise and automated AI tools. While the 24/7 availability is a significant benefit, the true efficiency depends on the support team‘s ability to handle complex, non-routine disputes. We believe the variety of contact methods, especially WhatsApp, provides a convenient layer of transparency for modern traders.

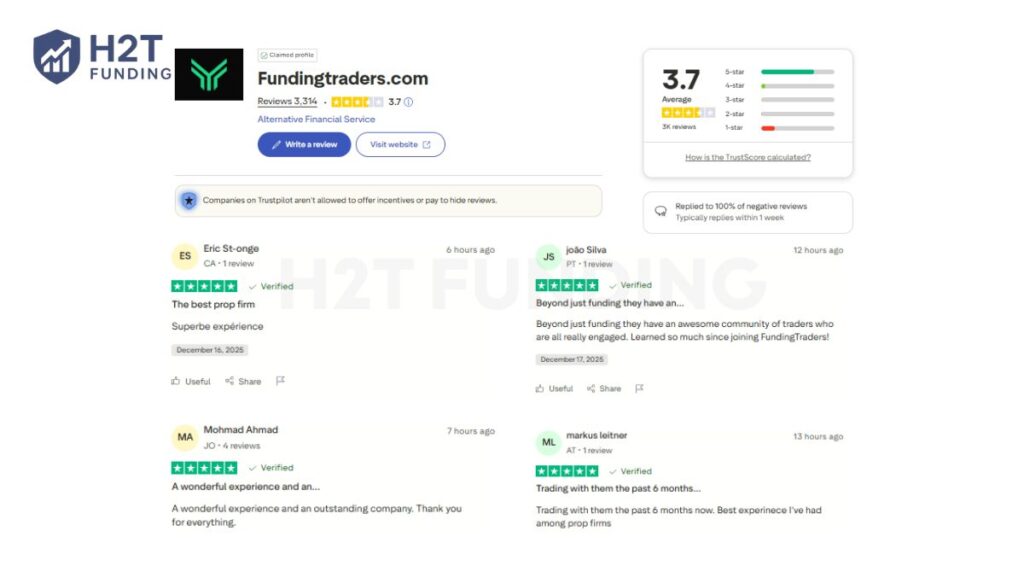

11. Real trader feedback: Funding Traders review Trustpilot and Funding Traders Reddit

Public sentiment around Funding Traders is clearly divided, and the tone differs significantly depending on the platform.

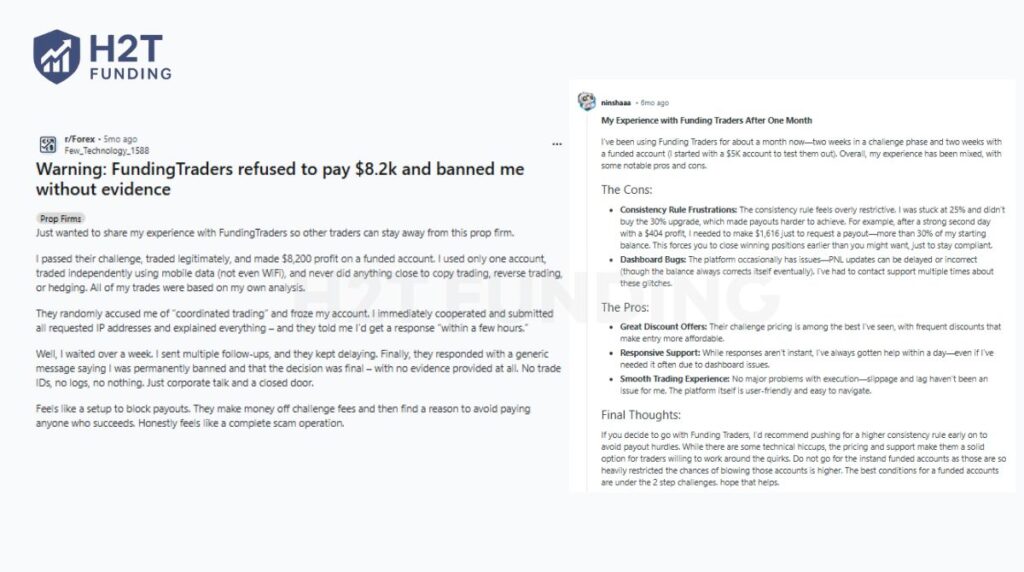

On Trustpilot, the firm maintains a 3.7-star rating with over 3,300 submissions. Many positive reviews focus on fast payouts, helpful support staff, and an active Discord community. Several traders report receiving withdrawals ranging from a few thousand dollars to five figures within their first months, often highlighting the 24-hour processing time as a key advantage.

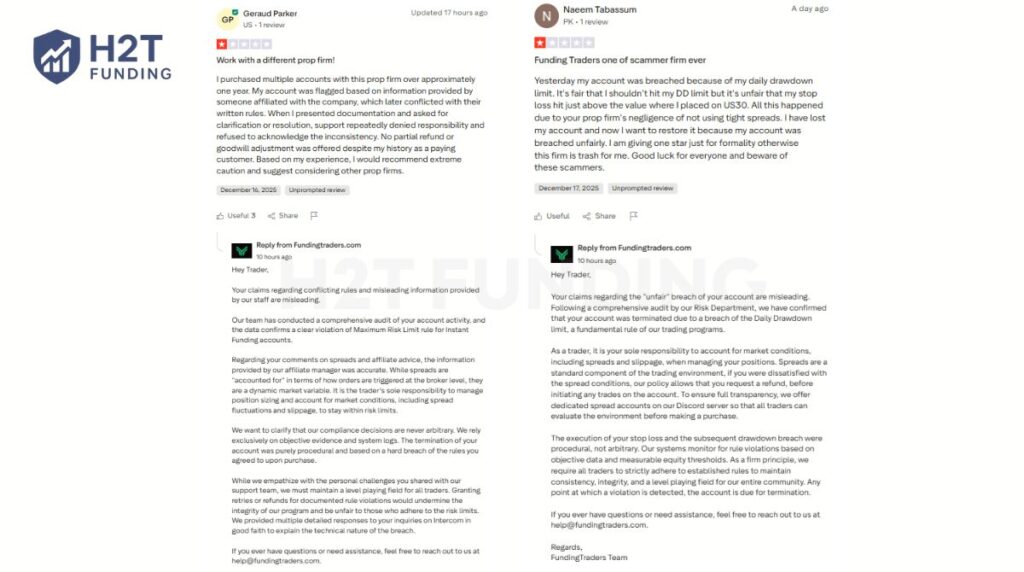

Negative Trustpilot reviews tend to follow a consistent pattern. Many traders believe they followed the rules, only to lose payout eligibility after a strong profit day. The most frequent complaints involve consistency limits, daily drawdown calculations, and execution timing during volatile market conditions.

In most cases, Funding Traders responds publicly with detailed trade logs and rule references. This suggests enforcement is systematic rather than selective, though the rules are not always fully understood by traders until a dispute occurs.

The Funding Traders Reddit space offers more detailed technical critiques, such as dashboard bugs and restrictive consistency rules. Users like ninshaaa suggest that while the experience is smooth, strict rules can force early closures of winning positions.

Serious warnings also exist, with some participants claiming the firm refused large payouts for alleged coordinated trading. These threads on Funding Traders review Reddit emphasize the need for extreme caution and absolute compliance with every fine-print regulation.

Overall, community feedback suggests that Funding Traders is generally reliable for traders who follow risk parameters precisely. The consistency score and spread-related breaches remain the most common pain points. Still, the firm’s high response rate to criticism indicates a visible effort toward transparency, even when individual disputes remain unresolved.

12. How to start with Funding Traders

Beginning your journey toward professional funding requires a few structured steps to ensure security and account compliance. The onboarding process is designed to be efficient and accessible for global participants looking to prove their skills.

- Step 1: Initial account registration and profile creation.

- Step 2: Selecting and customizing your preferred challenge model.

- Step 3: Providing billing information and completing the entry fee payment.

- Step 4: Completing the mandatory KYC verification for payout eligibility.

Follow the detailed breakdown below to ensure your account is set up correctly and ready for professional execution.

12.1. Step 1: Account registration

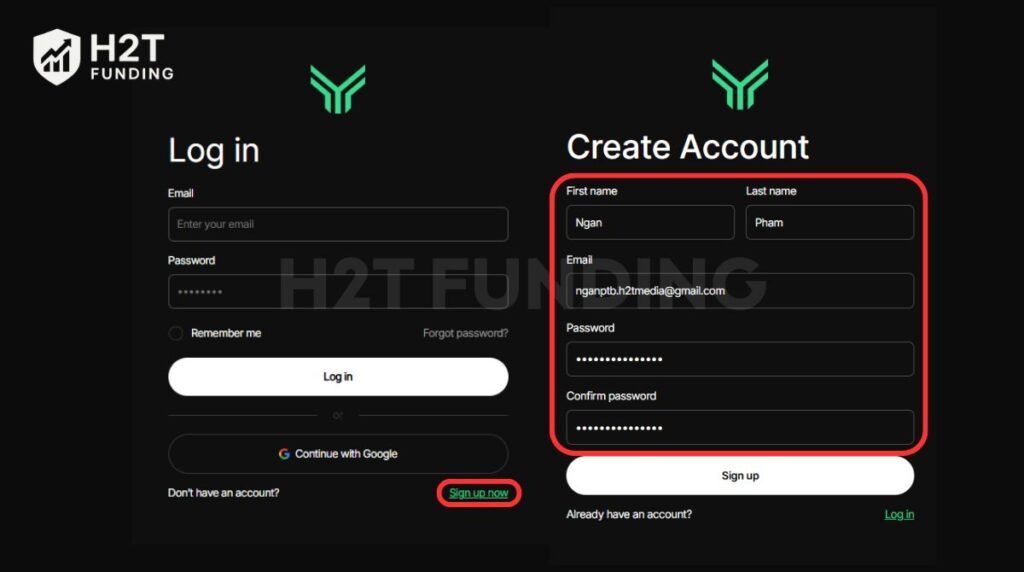

The first step is to visit the official website, choose Sign in -> Sign up now to navigate to the signup page to create your profile. You are required to provide your legal first name, last name, and a valid email address to establish your credentials.

12.2. Step 2: Program and challenge selection

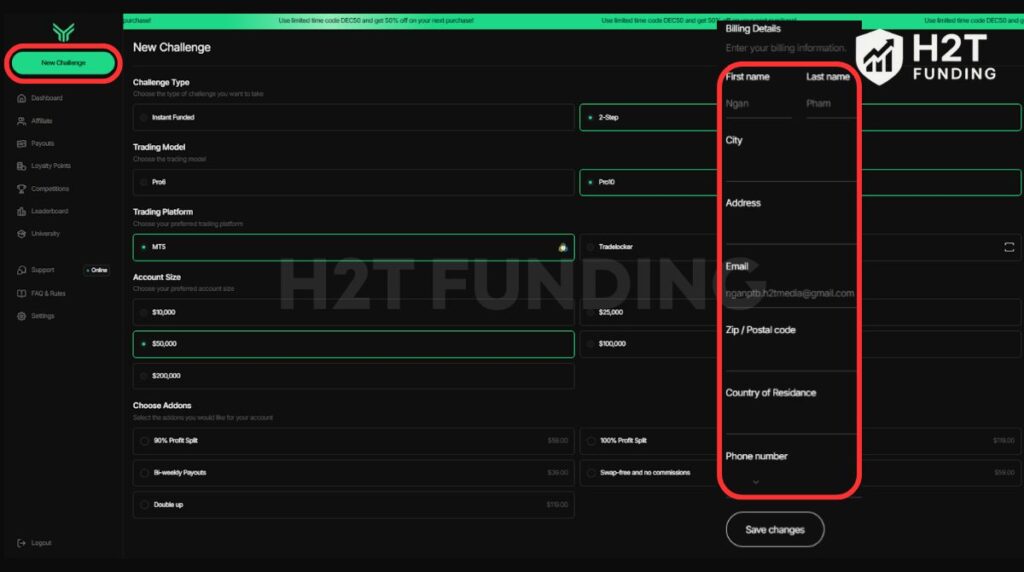

After logging into the dashboard, select the New Challenge tab to configure your trading parameters. You can choose between the 2-Step Pro model or Instant Funding, select your preferred platform (MT5 or TradeLocker), and pick an account size ranging from $10,000 to $200,000.

12.3. Step 3: Billing and payment completion

In the billing section, you must enter your residential address and contact details to finalize the purchase. The firm supports multiple payment methods, including credit cards and cryptocurrency. That allows you to apply a Funding Traders discount code to benefit from available discounts and reduce the initial cost.

12.4. Step 4: Mandatory KYC verification

To qualify for future payouts, all participants must verify their identity through a secure KYC process. This involves submitting a government-issued ID and a selfie via the automated Veriff system integrated into the dashboard.

If the automated system fails, a manual verification option is available via email support. This requires a proof of address and photos of your ID to ensure the legitimacy of the account holder.

The onboarding system is technically robust and emphasizes legal compliance through its KYC requirements. While the mandatory ID check adds an extra layer of effort, it is a standard practice for ensuring a secure and transparent trading environment. The ability to pay via crypto and use automated verification makes the setup process highly efficient for modern users.

13. Restricted countries by Funding Traders

Compliance with international financial regulations and sanctions means that Funding Traders cannot offer its services globally. Individuals residing in specific jurisdictions are currently ineligible to open an account or participate in any funding programs.

Before purchasing a challenge, it is vital to ensure your country of residence is not on the prohibited list. Residing in a restricted region will result in an automatic rejection during the KYC verification phase.

Based on the latest official data, the restricted countries include:

- Afghanistan

- Crimea (Region of Ukraine)

- Kazakhstan

- Mongolia

- Morocco

- Poland

- Russia

- Taiwan

- Ukraine

- Venezuela

- Vietnam

The list of restricted regions is relatively standard for firms operating within strict regulatory frameworks. We recommend verifying the restricted list directly on their website before starting, as these entries can change due to updated legal requirements.

14. Compare Funding Traders vs other prop firms

When choosing a proprietary firm, it is vital to analyze how different entities handle drawdown limits and fee structures. Each firm aims to attract specific types of participants by offering unique combinations of trading platforms and asset diversity.

We have compiled a detailed comparison between Funding Traders and three leading competitors. This data highlights the financial entry requirements and operational flexibility available in the current market, helping you identify the most efficient path for your career.

| Feature | Funding Traders | Goat Funded Trader | Top One Trader | AquaFunded |

|---|---|---|---|---|

| Challenge Fee | $149 – $1,349 | $36 – $1,998 | $64 – $2,537 | $23 – $1,074 |

| Account Types | 2-step, Instant | 1, 2, 3-step, Instant | 1, 2-step, Instant | 1, 2, 3-step, Instant |

| Profit Split | 80% – 100% | 80% – 100% | 80% – 100% | 90% – 100% |

| Account Size | $10K – $200K | $2.5K – $300K | $5K – $200K | $2.5K – $300K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Platforms | MT5, TradeLocker | MT5, TradeLocker, Volumetricatrading | MT5, cTrader, TradingView | MT5, cTrader, TradeLocker |

| Asset Types | FX, Metals, Indices, Crypto | FX, Stocks, Energy, Crypto | FX, Metals, Indices, Crypto | FX, Indices, Commodities |

Selecting the ideal partner involves matching your risk tolerance with their specific account frameworks. Every firm offers a unique blend of drawdown flexibility and capital scaling to support different trader profiles.

- Funding Traders: Best for those who require rapid payout processing and a structured pathway to managing up to $2,000,000 in funding.

- Goat Funded Trader: Suitable for beginners looking for the most affordable challenge fees to test their strategies in a live environment.

- Top One Trader: Ideal for users who need diverse platform integrations, including TradingView and cTrader, for advanced charting.

- AquaFunded: Recommended for participants who prioritize high initial profit splits and frequent bi-weekly withdrawal opportunities.

15. Is Funding Traders right for your trading style?

Funding Traders is not designed to suit every type of trader. Scalpers and news traders face the highest risk of failure due to spread sensitivity, VWHT requirements, and consistency limits. Aggressive strategies that rely on short holding times or high volatility are particularly vulnerable.

Swing traders may find success on 2-step accounts, especially when using swap-free options and controlled position sizing. However, patience is required, and over-leveraging even once can end the account.

Consistent day traders with fixed risk parameters and steady profit goals are the best fit for this firm. Traders who prioritize capital preservation, accept slower growth, and follow strict rules tend to survive and eventually scale.

If your strategy depends on frequent recovery trades, oversized positions, or emotional flexibility, Funding Traders will likely feel restrictive rather than supportive.

16. FAQs

On 2-step funded accounts, you cannot risk more than 2% of the initial balance per trade idea. Trades on the same symbol in the same direction opened within 2 minutes are counted as a single idea to prevent over-exposure.

It is a proprietary trading firm founded in 2023 by Stan G.K. that provides access to large-scale capital. Skilled individuals pass an evaluation to manage accounts and earn profit splits without risking their personal savings.

You select a challenge, pay the entry fee, and complete the evaluation objectives, such as profit targets and drawdown limits. Once verified, you move to a funded stage where you keep a portion of the earnings.

Key advantages include a personal AI Trading Coach, rapid 24-hour payout processing, and a professional scaling plan. These tools help participants maintain discipline and grow their managed balance sustainably.

You receive credentials for a funded account and become eligible for profit distributions. For Pro accounts, you also receive a 100% refund of your initial fee alongside your first successful payout.

Account sizes range from $10,000 to $200,000 for initial purchases. Through the scaling program, successful participants can eventually manage a total balance reaching up to a maximum of $2,000,000.

The firm offers up to 1:50 leverage on Forex majors. Other assets have lower ratios, such as 1:20 for metals and indices, to ensure proper risk management during volatile market conditions.

Yes, strategies like High-Frequency Trading (HFT), Martingale, and Grid trading are strictly prohibited. These rules protect the firm’s assets from unrealistic and unsustainable gambling behaviors.

Overnight and weekend holding is permitted on Pro accounts. However, Instant Funding accounts must close all positions at least one hour before the market closes on Friday to avoid automatic failure.

You can copy trades between your own Funding Traders accounts or from your external personal brokers. Copying trades from other individuals or sharing signals with other traders is strictly prohibited.

Accounts are permanently failed if no trade is placed within 30 days of the purchase date. This rule ensures that only active and engaged participants maintain access to the firm’s capital.

Traders can purchase upgrades like a 100% profit split, bi-weekly payouts, or a double-up feature. These options allow you to customize the account’s financial structure during the checkout process.

While you cannot physically merge balances, you are allowed to copy trades across multiple accounts you own. This allows you to manage a larger total volume while keeping the accounts technically separate.

Pro accounts start with an 80% profit split, while Instant accounts begin at 90%. Both models offer the option to upgrade to a 100% split, allowing you to keep all earned profits.

There is no hard lot limit for Pro accounts, though consistency is monitored. Instant Funding accounts have a 20-lot cap per trade; exceeding this limit results in immediate account termination.

Yes, trading from different locations is allowed, and VPN usage is permitted for security and privacy. However, you remain responsible for maintaining the safety and confidentiality of your login credentials.

EAs are allowed if they are used for risk management or were personally developed by you. Using off-the-shelf bots for automated trading is generally prohibited to ensure authentic market participation.

Support is available 24/7 through Live Chat, WhatsApp, and Email. You can also join their Discord community to interact with other participants and receive peer-to-peer assistance.

17. Conclusion

Funding Traders has established itself as a tech-driven choice for those seeking high-tier capital. This Funding Traders review highlights how their fast payout speed and AI tools benefit disciplined participants. Success requires strictly following the established rules to ensure long-term account safety.

However, traders who rely on aggressive entries, news volatility, or large single-day wins should approach with caution. At Funding Traders, one mistake is often enough to erase progress.

In short, this firm does not ask whether you can trade well for one week; it tests whether you can trade responsibly for months. If that aligns with your mindset, Funding Traders may be worth considering. If not, it is better avoided.

H2T Funding remains committed to providing the most accurate market insights for your success. We invite you to explore our comprehensive prop firm review section to find the best fit for your specific style. Visit our blog for further expert evaluations and professional trading strategies.