The prop trading landscape is currently flooded with firms making grand promises, but FunderPro’s unique approach to real liquidity and technical flexibility has kept it in the spotlight for nearly two years. However, beneath the attractive Trade Your Own Way marketing lies a set of complex rules and community feedback that every trader should analyze before committing their capital.

In this comprehensive FunderPro Review, H2T Funding will break down the firm’s account types, hidden costs, and payout reliability. Our goal is to determine whether FunderPro is a genuine gateway to professional trading or a carefully constructed trap for unwary traders.

1. What is FunderPro?

Established in February 2023 and headquartered in the Republic of Malta, FunderPro has completed nearly two years of operation in the funding market. As a modern FunderPro prop firm, it provides retail traders with access to institutional-grade liquidity and account sizes ranging from $5,000 to $200,000 for professional trading.

Under the leadership of CEO Gary Mullen, the firm’s core mission is to solve transparency issues and eliminate predatory time constraints that often lead to trader failure. They emphasize a win-win partnership where the firm’s primary revenue is derived from successful market execution rather than just collecting challenge fees from participants.

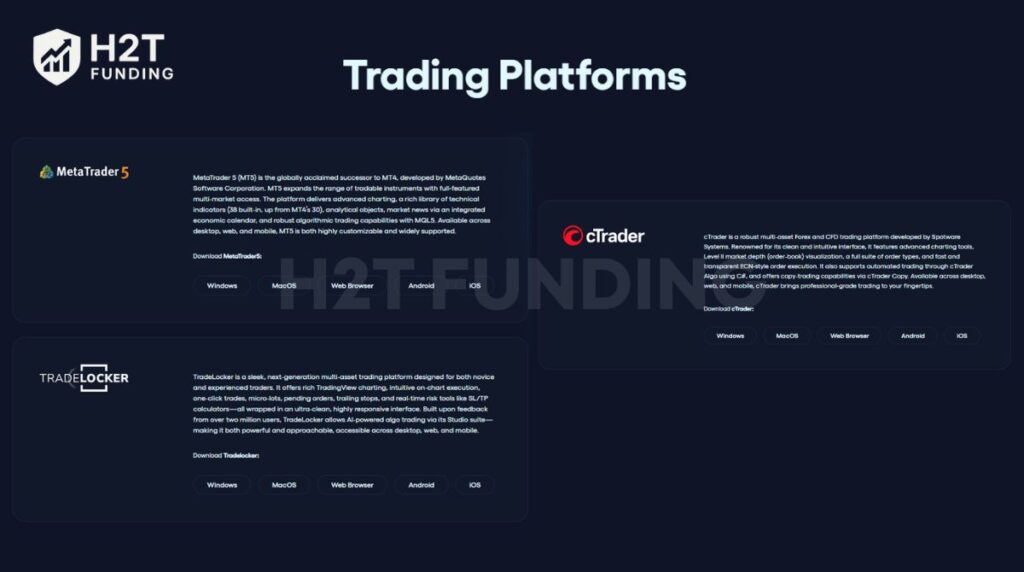

Traders can utilize various platforms like MT5, cTrader, and TradeLocker while benefiting from a flexible 80% to 90% profit split structure. By maintaining a strict no-time-limit policy, FunderPro has established itself as a steady contender in the industry by focusing on straightforward rules and long-term trader growth.

2. Our take on FunderPro

FunderPro entered the market when no time limit was a standout feature, but today, this is an industry standard. In my view, their real value now lies in platform diversity and the transparency of their liquidity. It remains a practical environment for those preferring modern systems like TradeLocker.

While the challenges feel flexible, the 20% margin cap on funded accounts introduces a significant layer of difficulty. This rule forces traders to be meticulous with position sizing, leaving no room for risk management errors. Choosing between Classic and Pro accounts requires a careful balance between profit splits and consistency rules.

The firm earns points for transparency by offering read-only accounts to check spreads before any purchase. However, the recent Trustpilot warnings regarding review integrity are a notable concern for their overall credibility. I recommend starting with a small account to personally verify execution speed and support quality before scaling up.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FunderPro websites before purchasing any challenge.

| Pros | Cons |

|---|---|

| Supports modern platforms, including MT5, TradeLocker, and cTrader. | The 20% margin cap on funded accounts is highly restrictive. |

| Offers weekly payouts for better trader cash flow. | The 3% daily drawdown on 1-step accounts is very unforgiving. |

| Provides read-only credentials to verify real-time spreads. | Pro account fees are not refundable after passing. |

| Classic accounts are free from restrictive consistency rules. | Currently facing Trustpilot warnings regarding review authenticity. |

3. FunderPro challenge

The FunderPro challenge is a professional evaluation designed to assess a trader’s risk management and consistency without the pressure of arbitrary time limits. This flexible approach allows participants to prioritize quality setups, ensuring a more sustainable path toward securing FunderPro prop firm capital.

Discover the specific requirements of their 1-step and 2-step programs in the sections below to find your ideal fit.

3.1. 1-step program

The 1-step program at FunderPro is specifically engineered for traders who seek a faster route to capital. By successfully reaching a 10% profit target, participants can transition directly into a funded account and start receiving an 80% profit split.

This program maintains a bi-weekly reward frequency, ensuring that successful traders have regular access to their earnings after the evaluation. While the unlimited time limit allows for a patient approach, the 3% daily drawdown requires meticulous risk management to avoid account termination.

This model is ideal for those who prefer a more direct path but are prepared to navigate the consistency rule and stricter drawdown parameters.

| Account Size | Price | Profit Target (10%) | Max Daily Loss (3%) | Max Overall Loss (6%) |

|---|---|---|---|---|

| $5,000 | $69 | $500 | $150 | $300 |

| $10,000 | $109 | $1,000 | $300 | $600 |

| $25,000 | $219 | $2,500 | $750 | $1,500 |

| $50,000 | $319 | $5,000 | $1,500 | $3,000 |

| $100,000 | $539 | $10,000 | $3,000 | $6,000 |

| $150,000 | $799 | $15,000 | $4,500 | $9,000 |

| $200,000 | $989 | $20,000 | $6,000 | $12,000 |

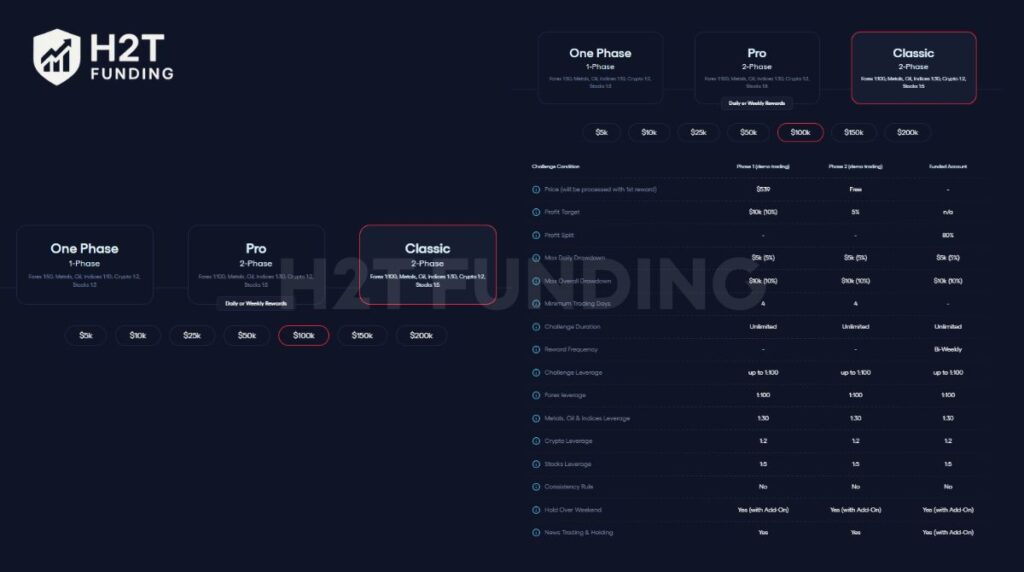

3.2. 2-step program

The 2-step program provides a balanced evaluation process that focuses on verifying your consistency and discipline over two distinct phases. Examine the specific features of the Pro and Classic accounts below to determine the best fit for your trading style.

3.2.1. Pro account

The Pro account is FunderPro’s flagship 2-phase evaluation, designed for traders who prioritize a higher drawdown buffer and frequent reward access. This program offers a more generous 5% daily loss limit and a 10% maximum overall drawdown, providing more breathing room compared to the 1-step alternative.

By completing both phases, traders can unlock an impressive profit split of up to 90% with the ability to request weekly or even on-demand payouts.

| Account Size | Price | P1 Target (10%) | P2 Target (8%) | Max Daily Loss (5%) | Max Overall Loss (10%) |

|---|---|---|---|---|---|

| $5,000 | $64 | $500 | $400 | $250 | $500 |

| $10,000 | $110 | $1,000 | $800 | $500 | $1,000 |

| $25,000 | $203 | $2,500 | $2,000 | $1,250 | $2,500 |

| $50,000 | $356 | $5,000 | $4,000 | $2,500 | $5,000 |

| $100,000 | $560 | $10,000 | $8,000 | $5,000 | $10,000 |

| $150,000 | $832 | $15,000 | $12,000 | $7,500 | $15,000 |

| $200,000 | $1,121 | $20,000 | $16,000 | $10,000 | $20,000 |

The evaluation phases require adherence to a consistency rule; this restriction is lifted once you reach the funded account stage. Traders also benefit from the freedom to engage in news trading and holding, though holding over the weekend requires a specific add-on.

3.2.2. Classic account

The Classic account is designed as a more accessible 2-phase evaluation, focusing on simplicity and ease of passing. Unlike the Pro version, the Classic Phase 2 profit target is reduced to just 5%, making the final step toward funding significantly more achievable for most traders.

Furthermore, this program completely removes the consistency rule, offering total freedom in how you approach your trading strategy during the challenge.

| Account Size | Price | P1 Target (10%) | P2 Target (5%) | Max Daily Loss (5%) | Max Overall Loss (10%) |

|---|---|---|---|---|---|

| $5,000 | $69 | $500 | $250 | $250 | $500 |

| $10,000 | $109 | $1,000 | $500 | $500 | $1,000 |

| $25,000 | $219 | $2,500 | $1,250 | $1,250 | $2,500 |

| $50,000 | $319 | $5,000 | $2,500 | $2,500 | $5,000 |

| $100,000 | $539 | $10,000 | $5,000 | $5,000 | $10,000 |

| $150,000 | $809 | $15,000 | $7,500 | $7,500 | $15,000 |

| $200,000 | $989 | $20,000 | $10,000 | $10,000 | $20,000 |

While it is easier to pass, the trade-off comes in the profit split and payout speed. The Classic account offers a standard 80% profit split and a bi-weekly reward frequency, which is slightly less competitive than the Pro account’s 90% and weekly/on-demand options.

However, it still maintains the unlimited duration and provides the same high-quality trading environment on MT5, cTrader, or TradeLocker.

Verdict on FunderPro challenges

In my view, the Classic account is the superior choice for intermediate traders who want a stress-free path to funding without worrying about consistency algorithms. The 5% target in Phase 2 is making it an easy win for those with a proven strategy. However, if you are a seasoned professional who demands the highest possible margins, the Pro account is better for the 90% split and faster cash flow.

The 1-step program remains a niche option only for those with flawless risk management, as the 3% daily drawdown is extremely punishing. If you value longevity and capital safety, stick to the 2-phase models where the 5% daily buffer allows you to survive occasional market volatility.

Ultimately, FunderPro’s strength lies in its unlimited time limit, which I believe is the most valuable feature for any trader’s mental health and performance.

4. FunderPro rules

The FunderPro rules are built on a foundation of transparency, aiming to eliminate the fine print that often trips up retail traders. This structure ensures that both the trader and the firm remain aligned toward sustainable, long-term profitability.

4.1. General guidelines & allowed practices

FunderPro is known for its Trade Your Own Way philosophy, offering significant freedom for various trading styles. Most strategies that are banned elsewhere, such as news trading or the use of EAs, are welcomed here under fair-use conditions. Below are the primary allowed practices that you can utilize to pass your FunderPro challenge:

- Scalping & Intraday: You are free to open and close positions frequently without any minimum hold time restrictions.

- Hedging: Permitted within a single account, allowing you to hold opposing positions on the same instrument.

- EAs & Automation: Personal bots and Expert Advisors are allowed on MT5, cTrader, and TradeLocker if you own the strategy.

- News Trading: Fully permitted during all Challenge phases; however, Funded accounts require the Swing Add-on to trade high-impact events.

- Weekend Holding: Positions can be kept open over the weekend only if the Swing Add-on is purchased and active.

- Martingale Strategies: Allowed but discouraged due to high risk; as long as you stay within drawdown limits, the strategy is valid.

- VPN/VPS Usage: Allowed for secure and flexible access, provided you do not connect from a restricted jurisdiction.

4.2. Prohibited trading practices

While the firm is flexible, it enforces strict prohibited trading practices to prevent platform abuse and gambling behavior. Understanding these boundaries is critical, as a violation can lead to immediate disqualification or loss of your FunderPro payout eligibility. Ensure your strategy avoids the following restricted behaviors:

- Inactivity Rule: Challenge accounts will fail automatically if no trading activity occurs for 30 consecutive days.

- Consistency Rule: In One-Phase (40%) and Pro (45%) accounts, your highest profit day must not exceed the specified percentage of total profit.

- Restricted Regions: Connecting directly or via VPN from countries like Russia, Belarus, or North Korea is strictly prohibited.

- Margin Rule (Funded): Funded accounts must not exceed a 20% margin cap per asset class (FX, Metals, Indices, etc.).

- Exploitative HFT: You cannot use high-frequency trading to exploit technical inefficiencies, latency gaps, or platform vulnerabilities.

- External Copy Trading: You may only copy trades between accounts you personally own; copying other users or signals is banned.

- Reckless Lot Sizing: Drastic, unjustified changes in lot sizes (e.g., jumping from 1 lot to 10 lots) may be flagged as gambling.

Verdict on FunderPro rules

In my experience, FunderPro offers one of the most honest rule sets in the prop firm space today. The removal of the consistency rule on Classic accounts is a huge advantage, as it allows for occasional home run trades without penalty.

However, the 30-day inactivity rule is a potential pitfall for swing traders who take long breaks between setups. Additionally, the 20% margin cap on funded accounts requires you to be very precise with your lot size calculations to avoid warnings. I highly recommend purchasing the Swing Add-on if you trade news, as the volatility of high-impact events is too profitable and risky to ignore.

Overall, the rules are fair-to-moderate in difficulty. They don’t restrict your talent, but they do demand a high level of professional discipline and account management. If you can handle the margin requirements of a live environment, FunderPro provides a very stable platform for growth.

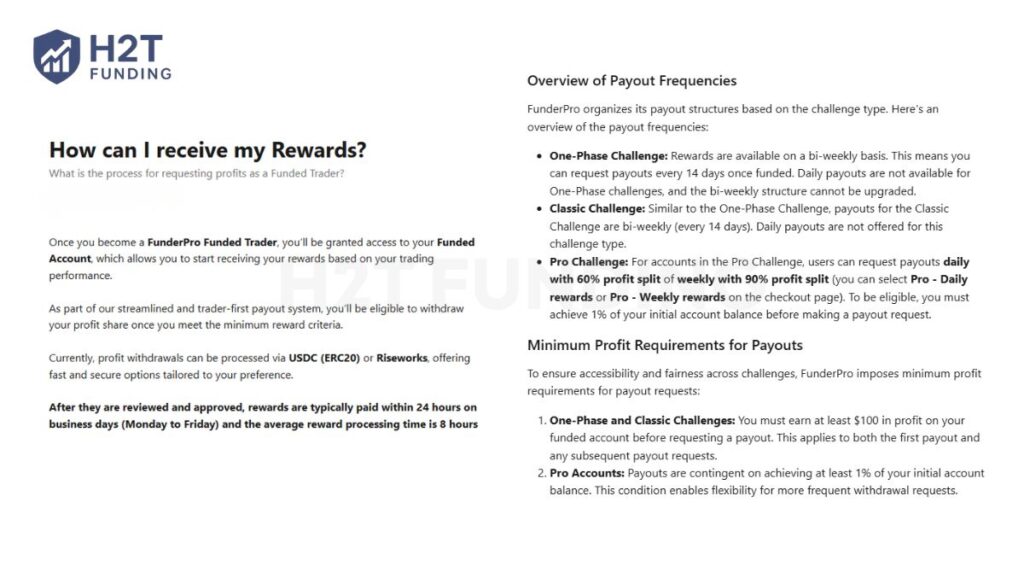

5. FunderPro payout structure

The FunderPro payout system is designed to provide traders with transparent and reliable access to their earned rewards. By offering different frequencies based on the challenge type, the firm ensures that both short-term scalpers and long-term swing traders can manage their cash flow effectively.

5.1. Payout eligibility and frequency

To maintain a professional trading environment, FunderPro implements specific requirements for withdrawal eligibility:

- One-Phase & Classic Accounts: Rewards are issued on a bi-weekly basis (every 14 days). Traders must earn at least $100 in profit to qualify for a withdrawal.

- Pro Accounts: Offers the most flexibility with daily or weekly rewards. Eligibility requires reaching at least 1% of the initial account balance before requesting a payout.

- Payout Speed: While the standard cycle is 14 days for Classic accounts, you can purchase a 7-Day First Reward add-on to access your initial profits sooner.

5.2. Profit splits and fee credits

The amount you take home depends on the specific program and your performance during the funded stage:

- Profit Split: Classic and One-Phase accounts offer a standard 80% split, while Pro accounts can reach up to 90% if the weekly reward option is selected.

- Challenge Fee Credit: For Classic and One-Phase programs, your initial fee is credited back to you alongside your first successful reward withdrawal of $100 or more.

- Pro Exception: It is critical to note that Pro Challenge fees are non-creditable, meaning the initial cost is not returned even after reaching the funded stage.

Verdict on FunderPro payout structure

The Pro Weekly plan is the strongest choice here because it offers a massive 90% profit split. While daily payouts are convenient, the 30% reduction in your share is a high price to pay for speed; I recommend the weekly option for serious traders.

The fee credit for Classic accounts is a great trust builder, effectively making the audition free for successful participants. Overall, the system is reliable and transparent, though you must stay mindful of the $100 minimum profit requirement on smaller accounts to ensure payout eligibility.

6. Scaling plan of FunderPro

The scaling plan at FunderPro is a performance-based incentive designed to help successful traders grow their managed capital significantly over time. This structure allows participants who demonstrate long-term consistency to move from retail-sized accounts to institutional-grade equity of up to $5 million.

To navigate the scaling process effectively, traders must adhere to a specific set of performance milestones and capital limits:

- Profit Milestone: You must achieve a minimum profit target of 10% per trading month.

- Consistency Window: This 10% target must be maintained for three consecutive months.

- Scaling Reward: Upon meeting the criteria, your initial account balance is increased by 50%.

- Initial Capital Limit: The maximum combined starting capital across all active accounts is capped at $200,000.

- Maximum Scaling Ceiling: This growth process is repeatable until your total managed balance reaches $5,000,000.

It is important to note that while your capital increases, the fundamental trading rules and drawdown limits remain the same. This ensures that you can continue using your proven strategy on a larger scale without having to adjust to more restrictive risk parameters as you grow.

Verdict on FunderPro scaling plan

A 10% monthly target for three consecutive months is a challenging requirement that demands a high-edge strategy and disciplined execution. While some firms offer scaling at lower profit thresholds, FunderPro rewards this greater difficulty with a very generous 50% balance increase per cycle.

This plan is best suited for experienced traders who can sustain double-digit returns while keeping risk controlled. The $5 million ceiling is one of the highest in the industry, providing a genuine professional path for those who view trading as a long-term career rather than a quick gain.

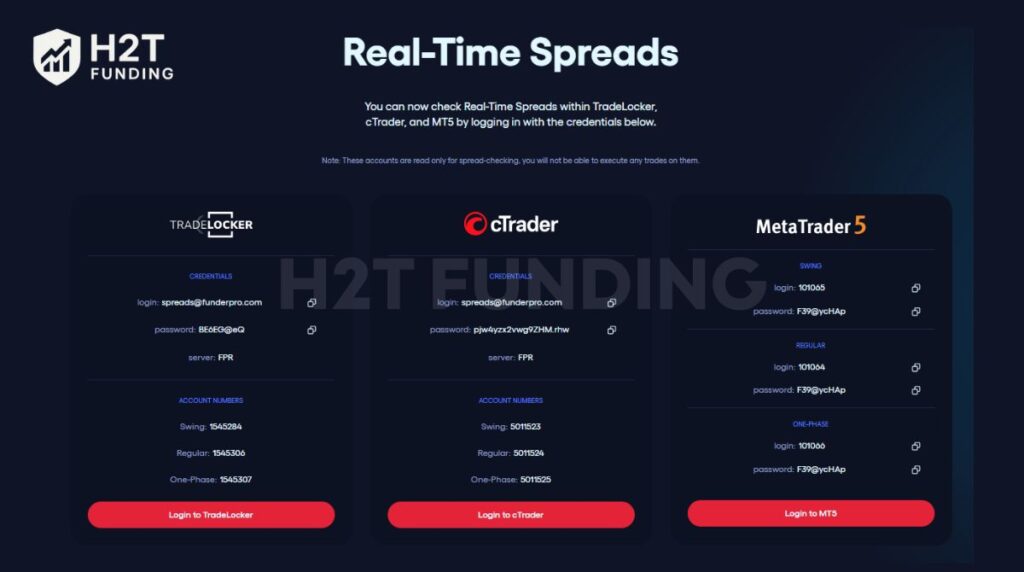

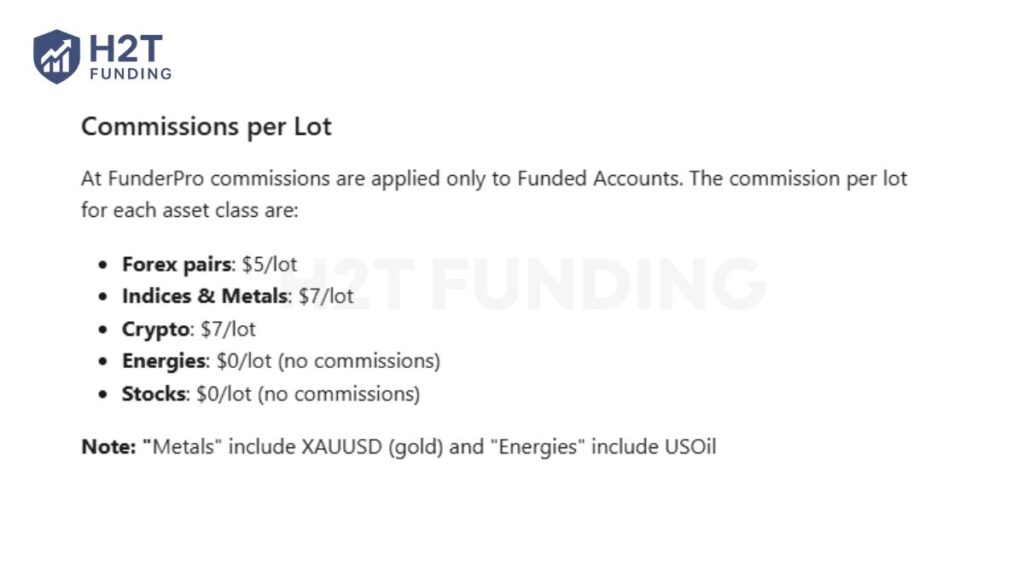

7. Spreads & commission fees

Cost efficiency is a critical factor for any professional trader, as high spreads or commissions can quickly erode your net profitability. FunderPro maintains a highly transparent fee structure, where commissions are applied primarily to Funded Accounts to ensure a realistic trading environment.

7.1. Real-time spread transparency

To ensure you aren’t surprised by slippage or wide spreads, FunderPro provides read-only credentials for all its platforms. This unique feature allows you to log in and monitor live market conditions before purchasing a challenge:

7.2. Commission breakdown by asset class

The firm uses a volume-based commission model that varies depending on the instrument you are trading. This allows for zero-commission trading on specific assets like equities and energies:

- Forex Pairs: $5 per lot (highly competitive).

- Indices & Metals (including Gold): $7 per lot.

- Cryptocurrencies: $7 per lot.

- Energies & Stocks: $0 per lot (Commission-free).

Verdict on FunderPro spreads & commission fees

The $5/lot commission on Forex is excellent, as many competitors still charge the standard $7/lot. This small difference can significantly impact the bottom line for high-frequency scalpers or day traders who execute a large number of trades monthly.

The most impressive aspect is their transparency with live credentials. Allowing traders to verify spreads on MT5 or TradeLocker before buying shows immense confidence in their liquidity providers. It effectively removes the risk of joining a firm only to find untradeable conditions later.

8. FunderPro trading platform

FunderPro offers a selection of industry-leading platforms tailored to various trading styles and technical requirements. These systems are available across desktop, web, and mobile, ensuring you can manage your capital efficiently anytime and from anywhere in the world.

To provide a professional and stable environment, the firm has integrated three distinct platform options:

- MetaTrader 5 (MT5): The powerful successor to MT4, featuring 38 technical indicators, advanced charting, and robust MQL5 algorithmic capabilities for professional automation.

- TradeLocker: A next-generation platform powered by TradingView charting, offering sleek interfaces, one-click execution, and helpful built-in SL/TP risk calculators.

- cTrader: Renowned for its Level II market depth and ECN-style execution, supporting C#-based automated trading and a clean, highly intuitive user interface.

It is important to emphasize that all MetaTrader 5 (MT5) services and related information on the site are not intended for U.S. citizens or residents. Users must ensure they are not accessing these services from jurisdictions where such use would violate local laws or regulations.

Verdict on the FunderPro trading platform

The integration of TradeLocker is a brilliant move, as it brings the professional charting power of TradingView directly into the trading execution process. This is ideal for modern traders who want a sleek, responsive interface without the clunky feel of more traditional software.

However, the U.S. restriction on MT5 is a critical point to consider if you are a resident of that region; you will likely need to explore their other platform offerings. Overall, having three high-quality choices provides a level of technical flexibility that few other prop firms can match, catering well to both manual and algo traders.

9. Trading instruments & leverage

FunderPro provides a broad selection of over 100+ assets, including Forex majors, minors, exotics, commodities, indices, and crypto. Traders can access high-liquidity markets like EURUSD, XAUUSD (Gold), and NAS100 to diversify their strategies. This wide selection ensures participants can find opportunities regardless of their preferred asset class or market conditions.

| Asset Class | Classic & Pro | One-Phase | Swing Add-On |

|---|---|---|---|

| FX Majors/Crosses | 1:100 | 1:50 | 1:30 |

| Indices/Metals/Energies | 1:30 | 1:10 | 1:10 |

| Shares | 1:5 | 1:3 | 1:2 |

| Cryptos | 1:2 | 1:2 | 1:1 |

The Swing Add-on is an essential upgrade for those needing to hold positions through high-impact news or weekends. In exchange for this flexibility, leverage is reduced to 1:30 for Forex and 1:10 for Metals to mitigate exposure to market gaps. This allows swing traders to execute long-term strategies without breaching the firm’s safety protocols.

Verdict on FunderPro instruments & leverage

The 1:100 leverage on standard accounts is the professional sweet spot, providing enough power to scale profits without encouraging reckless gambling. It is a highly balanced setup that rewards disciplined execution and aligns with institutional-grade risk management.

I highly recommend the Swing Add-on for fundamental traders, as the ability to hold over the weekend is worth the reduction in leverage. For active day traders, the standard 1:100 setup remains the most efficient choice for maximizing capital growth within the firm’s drawdown limits.

10. Education & resources

FunderPro offers a comprehensive suite of educational tools and market resources to help traders refine their edge. Through the FunderPro Lab, participants gain access to professional software designed to improve decision-making and trade accuracy.

- FunderPro Lab: Includes the Ultimate Economic Calendar, deep Asset Overview, and the Trade Validator for trade confirmation.

- FunderPro Blog: Provides insights on the scaling ladder, market news, and psychological toolkits for remote traders.

- Software Partners: Access to premium indicators and automated tools via TradesAI and Edgeful.

- Community Learning: Educational videos on YouTube and real-time insights shared within the Discord server.

Verdict on FunderPro education & resources

The Trade Validator is a standout feature, offering practical confirmation that helps prevent impulsive entries. Unlike firms that only provide generic videos, FunderPro provides functional software that adds immediate value to your trading process.

Their focus on mental health and trader isolation in the blog is also highly commendable. These resources show that the firm is invested in the long-term success of its traders rather than just selling challenge fees.

11. FunderPro customer support

Effective FunderPro customer support is available around the clock to ensure traders can resolve issues without disrupting their workflow. The firm prioritizes speed and transparency, offering multiple channels to connect with its technical and administrative teams.

- 24/7 Live Chat: The fastest way to get real-time assistance for account or platform issues.

- Discord Community: A high-transparency hub where you can interact with staff and other funded traders.

- Support Tickets: Available through the Get in touch form for complex inquiries and formal requests.

- Social Media & Newsletter: Stay updated on funderpro payout proof, flash sales, and news via Telegram, TikTok, and Instagram.

Verdict on FunderPro customer support

The 24/7 Live Chat provides essential peace of mind, especially when trading during high-volatility sessions. Having a human representative available at any hour is a hallmark of a top-tier prop firm that values its clients.

I also find the Discord community to be a vital resource for transparency. Seeing the firm interact openly with thousands of members builds a level of accountability and trust that is rare in the current funding landscape.

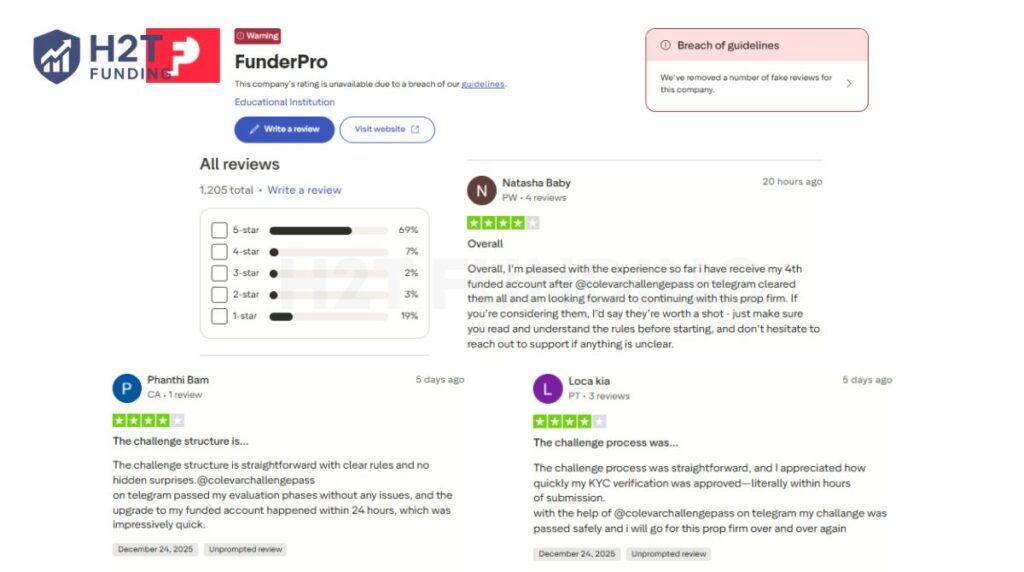

12. Real trader feedback: FunderPro reviews Trustpilot and FunderPro Reddit

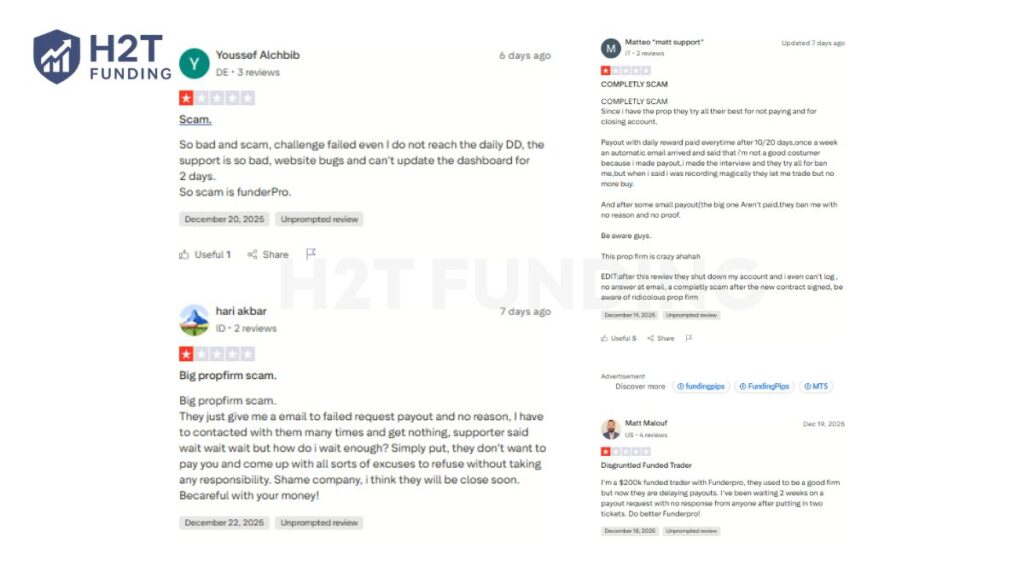

Analyzing community sentiment is a vital step in assessing the FunderPro reviews Trustpilot status, and general market reliability. Currently, FunderPro faces a notable warning on Trustpilot regarding a breach of guidelines, as the platform Trustpilot has issued a warning regarding review guideline breaches. This red flag suggests a need for high caution when evaluating their overall rating.

As of December 31, 2025, the feedback on Trustpilot is heavily polarized, featuring 69% 5-star ratings alongside a significant 19% of 1-star reviews (updated on Jan 10, 2026). While some users praise the firm for fast KYC and straightforward rules, others report being forced to retake phases or having accounts closed without clear justification. This mix of experiences highlights a lack of consistency in user satisfaction.

A deep dive into common FunderPro reviews complaints reveals several recurring technical and financial issues reported by the community:

- Payout Delays: Several traders mention waiting weeks for payout requests with little to no response from the support team.

- Technical Glitches: Reports of dashboard bugs and failed trades even when daily drawdown limits were not technically breached.

- Account Closures: Allegations of accounts being shut down shortly after a payout request was submitted.

The discussions on Reddit offer a more technical perspective, particularly regarding the learning curve of their platform choice. While some users confirm the firm is 100% legit and mention receiving refunds for platform errors, others criticize TradeLocker as an inferior version of TradingView. There are also critical warnings about FunderCrypto. live, a scam copycat site that traders must avoid.

In conclusion, the feedback for FunderPro reflects a high-risk, high-reward environment with significant reputational challenges. The Trustpilot warning about review manipulation is a serious concern that impacts the firm’s Trustworthiness score. Traders should proceed with caution, record all trading sessions for evidence, and strictly follow every rule to minimize the risk of a disputed account closure.

For readers who want a broader industry context before choosing any firm, this is are prop firms legit guide that offers an essential reference point.

13. How to sign up for FunderPro

Starting your journey with FunderPro is a streamlined process designed to get you into the trading dashboard quickly. By following a few simple steps, you can secure your evaluation account and begin working toward your funding goals.

- Step 1: Access the official registration portal.

- Step 2: Provide your initial account details.

- Step 3: Verify your identity via email.

- Step 4: Complete your personal profile.

- Step 5: Choose your challenge and finalize payment.

Follow the detailed guide below to ensure your account is set up correctly and ready for market execution.

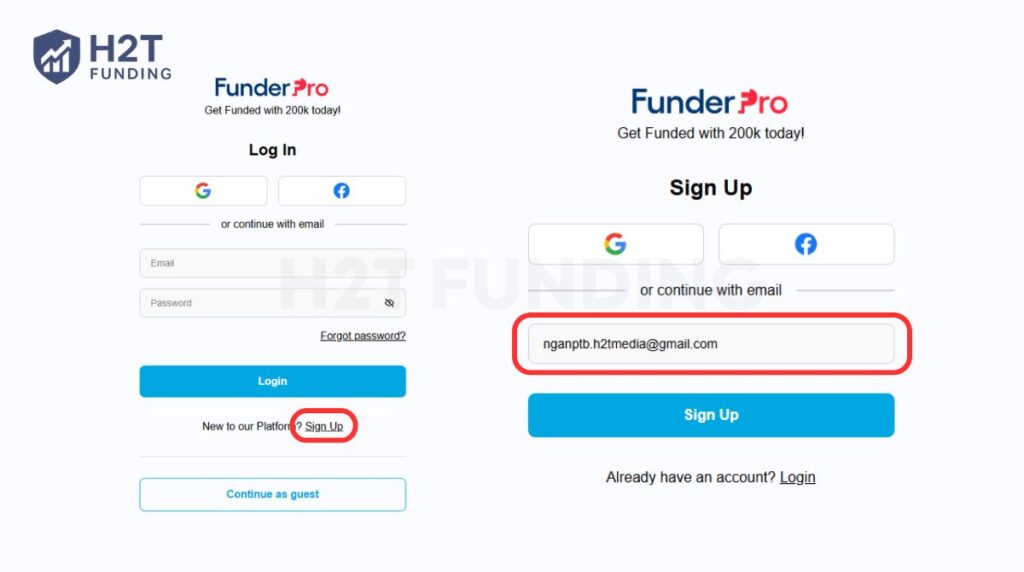

13.1. Step 1: Access the registration page

Visit the official website and click the Login / Register button located in the top right corner of the header. This will direct you to the secure portal where you can start the onboarding process.

13.2. Step 2: Sign up with your email

On the registration screen, you can choose to continue with Google, Facebook, or your email address. Enter a valid email and click Sign Up to initiate the creation of your new trading profile.

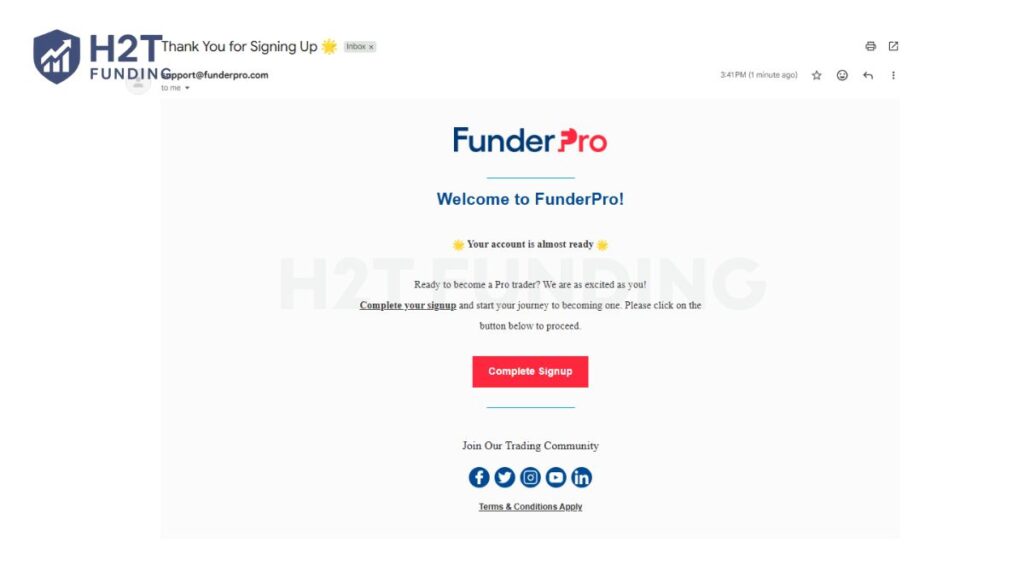

13.3. Step 3: Verify your email address

Check your inbox for a Thank You for Signing Up message from the support team. Click the Complete Signup button within the email to verify your address and unlock the next phase of registration.

13.4. Step 4: Complete your personal profile

Provide your full name, date of birth, phone number, and country of residence to comply with platform guidelines. Ensure this data matches your government-issued ID to avoid future issues with payout requests.

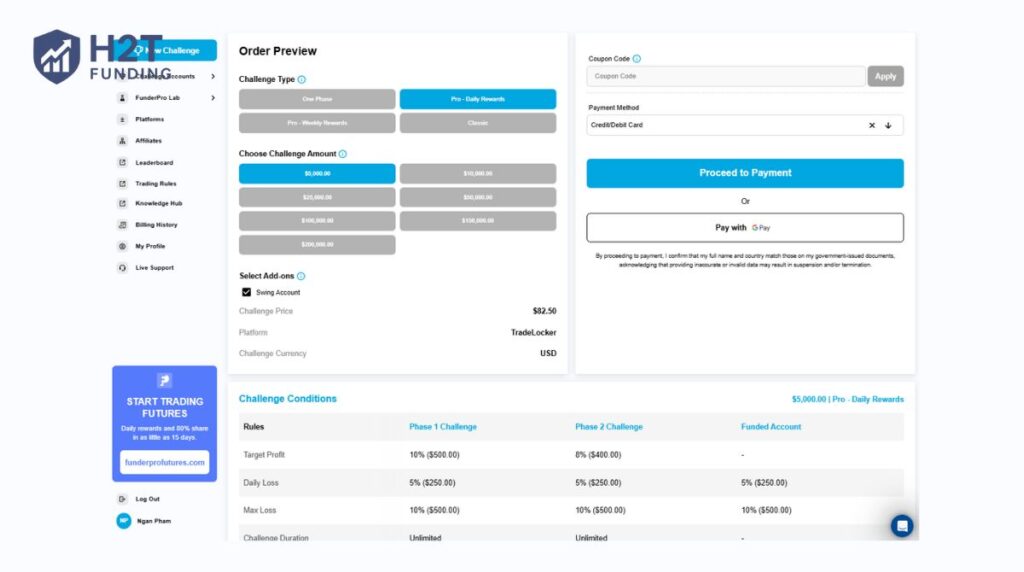

13.5. Step 5: Purchase your challenge

From the dashboard, select your preferred account type (Classic, Pro, or One-Phase) and the desired funding amount. You can also toggle the Swing Account add-on before proceeding to the final payment via credit card or Google Pay.

Once your payment is confirmed, your account credentials will be generated, allowing you to begin your evaluation immediately. This efficient setup ensures that you spend less time on administration and more time focusing on achieving your profit targets.

14. FunderPro restricted countries

To maintain legal compliance, FunderPro requires all participants to be at least 18 years of age. You must reside in a supported jurisdiction to successfully open an account and pass the mandatory KYC verification process.

The following countries and specific regions are currently restricted from accessing FunderPro’s services:

- Afghanistan

- Belarus

- Central African Republic

- Congo (the Democratic Republic of)

- Cuba

- Haiti

- Iran

- Iraq

- Libya

- Mali

- Myanmar (Burma)

- North Korea

- Somalia

- Sudan

- South Sudan

- Syria

- The Russian Federation

- Donetsk Region of Ukraine

- Zaporizhzhia Region of Ukraine

- Luhansk Region of Ukraine

- Kherson Region of Ukraine

- Crimea Region of Ukraine

- Sevastopol Region of Ukraine

- Venezuela

- Yemen

This list is subject to updates based on global regulatory shifts and internal policy changes. If you are unsure about your eligibility, it is highly recommended to consult the official Terms of Service or contact their support team directly before purchasing a challenge.

15. Compare FunderPro vs other prop firms

Choosing the right partner is essential for your long-term success, as each firm offers different advantages in terms of capital and rules. Below is a detailed comparison of FunderPro against other notable players in the market to help you evaluate the best fit for your strategy.

| Feature | FunderPro | Finotive Funding | Pipfarm | Goat Funded Trader |

|---|---|---|---|---|

| Challenge Fee | $64 – $1,121 | $29 – $3,299 | $40 – $1,200 | $36 – $2,888 |

| Account Types | 1-step, 2-step | 1-step, 2-step, Instant | 1-step, 2-step, Instant | 1/2/3-step, Instant |

| Profit Split | 80% – 90% | 70% – 100% | 70% – 99% | 80% – 100% |

| Account Size | $5K – $200K | $2.5K – $200K | $2.5K – $100K | $2.5K – $400K |

| Time Limit | No time limit | No time limit | 365 days | No time limit |

| Profit Target | 5% – 10% | 5% – 10% | 5% – 12% | 6% – 10% |

| Platforms | MT5, cTrader, TradeLocker | MT5 | cTrader | MT5, Match Trader, Volumetrica |

| Asset Types | FX, Metals, Indices, Crypto, Stocks | FX, Metals, Indices, Energy, Crypto, Stocks | FX, Metals, Indices, Crypto, Oil | FX, Commodities, Indices, Crypto, Stocks |

Based on these technical parameters, different firms cater to different trading psychologies and professional goals. Depending on your experience level and preferred trading environment, one of these firms may offer a distinct edge:

- FunderPro: Best for traders who want a stress-free evaluation with no time limits and the most diverse selection of modern platforms.

- Finotive Funding: Ideal for high-performing traders seeking up to 100% profit share and immediate access to capital via instant funding.

- Pipfarm: The top choice for cTrader enthusiasts who want to follow a structured career path with unique benefits like Payout Protection.

- Goat Funded Trader: Suitable for those requiring massive initial capital up to $400,000, though traders must be wary of their recent negative review trends.

In conclusion, while FunderPro provides a balanced and flexible environment, firms like Finotive and Pipfarm offer specialized programs for instant growth or platform-specific users. Carefully weighing the profit targets and capital caps of each firm will ensure you select a partner that aligns with your specific risk management style.

16. Should I choose FunderPro?

Deciding whether to partner with FunderPro depends on your ability to balance its innovative features against its current market reputation. For many, the lack of time-based pressure is the primary reason to join, but you must be prepared to navigate their specific technical restrictions and risk management rules.

16.1. Why you should choose FunderPro

The most compelling reason to choose this firm is the unlimited trading duration across all challenges, allowing for a stress-free environment. You should also consider them if you prefer modern platforms like TradeLocker and want to access a high 90% profit split. Additionally, their $5 million scaling plan offers a clear path for professional traders looking to manage institutional-grade capital.

16.2. Why you might avoid FunderPro

You should be cautious due to the recent Trustpilot warnings regarding review integrity and the 19% one-star rating from the community. The 3% daily drawdown on the 1-step program is also extremely tight, making it unsuitable for traders with volatile strategies.

Furthermore, the 20% margin cap on funded accounts and the MT5 restriction for U.S. residents may limit your operational flexibility.

Ultimately, FunderPro is a strong fit for disciplined traders who value technical innovation and long-term patience over quick, aggressive gains. However, if you require a firm with a flawless Trustworthiness score or a simpler margin structure, you may want to compare them with more established industry veterans.

17. Is FunderPro legit?

Yes, FunderPro is a legitimate proprietary trading firm that has been operating since early 2023 under the transparent leadership of CEO Gary Mullen. Based in Malta, the firm has established a track record of processing payout requests and maintaining an active, public community on Discord.

However, legitimacy does not always equate to a flawless user experience, especially given the recent Trustpilot warning regarding review integrity. It is highly recommended to start with a smaller account to verify their execution quality personally before committing to their larger funding tiers.

18. FAQs

No. FunderPro operates as a proprietary trading firm rather than a traditional brokerage. The company provides traders with capital and trading infrastructure, while all trades are executed through partnered liquidity providers.

FunderPro is headquartered and legally registered in the Republic of Malta. This European base allows the firm to operate under a stable regulatory and fintech-friendly legal framework.

Traders are required to achieve a profit target ranging from 5% to 10% while remaining within daily and maximum drawdown limits. Most programs have no time restrictions, allowing traders to complete the evaluation at their own pace.

FunderPro provides access to over 100 tradable instruments, including Forex pairs, spot metals such as gold and silver, global indices, energy products, and cryptocurrencies across all supported platforms.

The firm supports MetaTrader 5 (MT5), cTrader, and TradeLocker. All platforms are available on desktop, web, and mobile devices, offering flexibility for different trading styles.

Forex leverage can reach up to 1:100 on Classic and Pro accounts, while One-Phase accounts offer up to 1:50. If traders select the Swing Add-on, Forex leverage is adjusted to 1:30.

Initial account sizes start from $5,000 and go up to $200,000. Through the scaling program, traders can grow their managed capital to as much as $5,000,000.

Profit withdrawals are requested directly through the trader dashboard and are processed on weekly or bi-weekly cycles. A minimum of $100 or 1% of the account balance is required to be eligible for a payout.

Challenge fees are refunded with the first payout for Classic and One-Phase accounts. Fees for Pro accounts are non-refundable, even after the trader becomes funded.

If any drawdown rules are violated, the account will be closed immediately without a refund. Traders are allowed to purchase a new challenge and attempt the evaluation again.

No. FunderPro does not provide instant funding options. All traders must successfully pass an evaluation phase before accessing funded capital.

19. Conclusion

This comprehensive FunderPro Review has explored everything from their innovative no time limit challenges to their institutional-grade scaling plan. We have seen that while the firm offers high capital growth, it requires a significant level of technical discipline to maintain a funded account.

To answer our initial question: Is FunderPro a legit prop firm or just another trap? The evidence suggests it is a legitimate, tech-forward entity, but it can feel like a trap for those who ignore the strict 20% margin cap. For the patient and disciplined trader, it provides one of the most flexible and rewarding environments available in the current market.

Success in the funding world starts with choosing a partner that perfectly aligns with your specific trading style and risk tolerance. To discover more insights and compare top-tier providers, feel free to explore our extensive collection of expert prop firm reviews at the H2T Funding blog today.