FundedNext has a slick, user‑friendly website, and the Stellar Light challenge makes entry easy and non‑intimidating. The 95% profit split, plus 15% payouts in each challenge phase, is truly generous. I also appreciate that the support is very quick, clear, and helpful. Overall, value, transparency, and support make this a standout among prop firms. Well recommended for traders.– Mostafa Elaffani, Trustpilot.

With over 35,000 trader reviews and a solid 4.6/5 Trustpilot score, FundedNext has earned a reputation for fast payouts, reliable support, and beginner-friendly policies. From unlimited free retries to 15% profit share during evaluations, this firm stands out for flexibility and transparency.

In this FundedNext review, I will break down the key features, real user experiences, and everything you need to know to decide if FundedNext is the right prop firm for you in 2026.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FundedNext websites before purchasing any challenge.

1. Our take on FundedNext

FundedNext is a proprietary trading firm that was founded on March 18, 2022, with a UAE headquarters and associated Cyprus presence. It offers traders up to $200,000 in initial capital, with the ability to scale to $4,000,000 as skills grow.

Uniquely, FundedNext pays a 15% share of profits even during the evaluation phase, meaning traders begin earning payouts before full funding. Accounts are now run through FundedNext’s proprietary brokerage, FNmarkets, giving the firm direct control over the trading environment and execution.

Overall profit splits are generous (up to 80–95%), and the firm’s public stats boast over 51,000 traders paid and ~$51 million in profits shared. In short, FundedNext stands out with high funding limits, early profit sharing, and strong regulatory ties.

Like any proprietary trading firm, FundedNext comes with its own set of strengths and limitations. Its flexible trading rules, generous profit sharing, and global accessibility make it attractive to both novice and experienced traders.

However, certain structural limitations and relatively new market presence may not suit all profiles.

| Pros | Cons |

|---|---|

| ✅ Unlimited free retries during the Challenge phase | ❌ Minimum 5 trading days requirement per phase |

| ✅ Profit share starts at 15% in Evaluation and scales to 90% | ❌ Relatively new firm, less track record than competitors |

| ✅ No restrictions on trading style, scalping, and EAs allowed | ❌ Longer payout cycle on some account types |

| ✅ Weekend and overnight holding permitted | ❌ Some marketing claims are perceived as exaggerated |

| ✅ Fast payouts, often processed in <24 hours | |

| ✅ Scaling up to $4M with performance-based growth | |

| ✅ Payout insurance up to $1,000 if delays occur | |

| ✅ News trading allowed | |

| ✅ Risk management tools & calculators provided | |

| ✅ Monthly competitions with prizes and free accounts |

FundedNext offers a compelling package for traders seeking flexibility, scaling potential, and strong support. However, those considering the platform should carefully review the specific rules tied to their chosen challenge model.

2. FundedNext rules

FundedNext imposes a set of trading rules to ensure fair, disciplined, and sustainable trading practices across its platform. These guidelines apply to both Challenge Accounts and FundedNext Accounts, fostering a transparent environment for traders.

2.1. Minimum trading days

In the Stellar Challenges, traders must typically complete at least 5 individual trading days. The Stellar 1-Step model requires a minimum of 2 days. Trading days do not need to be consecutive, offering flexibility, but the minimum trade requirement must be met to progress or qualify for payouts.

2.2. News trading restrictions

News trading is permitted across all Stellar and Stellar Lite Challenges. However, in FundedNext Accounts, a News Profit Split Rule applies: only 40% of profits from trades within a 10-minute window (5 minutes before and after high-impact news) count toward the account balance.

2.3. Copy trading guidelines

Copy trading is allowed between Challenge Accounts owned by the same individual, with a maximum capital allocation of $300,000 across accounts. One account must be designated as the “Master,” with others as “Slave” accounts.

Copy trading between accounts owned by different individuals (including friends or family) or between a FundedNext Account and external accounts is strictly prohibited, leading to account suspension or a permanent ban.

2.4. Expert advisors (EAs) and trading Bots

EAs and bots are permitted on MetaTrader 4 and MetaTrader 5 but not on cTrader. Traders must customize EA settings to reflect unique strategies and avoid identical trades across accounts.

A $300,000 capital allocation limit applies per EA strategy. Violations may lead to a soft breach, requiring a phase restart or account suspension for repeated breaches.

2.5. Hedging rules

Hedging (opening opposing buy and sell positions on the same asset) is allowed within the same account to manage risk.

Hedging across multiple accounts, even if owned by the same trader, is prohibited to prevent manipulation.

2.6. 1% risk limit rule

Applied to traders exhibiting high-risk behavior, such as using over 70% margin or overleveraging. It limits risk exposure to 1% of the account balance per trade.

Traders are notified via email if this rule is enforced. Non-compliance may lead to profit deductions, warnings, or account termination. Professional traders are encouraged to use 20-30% margin and risk no more than 1% per trade.

2.7. IP address and device usage

Traders must use personal devices exclusively and avoid shared devices to ensure account security. Multiple devices are allowed, but public Wi-Fi or VPNs must not use IP addresses from restricted countries.

For the FundedNext Trading Competition, only one device, email, and IP address per participant is permitted to prevent multiple account registrations.

2.8. Trading competition rules

Participants are limited to one account per email and IP address. A minimum of 5 trades over 5 non-consecutive days is required to be eligible for prizes.

Leverage is set at 1:100 for forex pairs and 1:30 for commodities/indices. Traders can place up to 50 trades daily, with a maximum of 5 open positions and lot size limits (5 lots for forex, 3 lots for indices/commodities). All trades auto-close 15 minutes before the competition ends.

2.9. Consequences of rule violations

Minor breaches may result in warnings, phase restarts, or profit deductions. Severe or repeated violations, such as prohibited strategies or gambling behavior, lead to account termination and potential denial of rewards.

FundedNext may honor partial payouts for eligible traders based on the severity of the violation, reflecting their commitment to fairness.

These rules are designed to promote responsible trading while allowing flexibility for diverse strategies. Traders should thoroughly review FundedNext’s Terms of Service and Help Center for specific details to avoid unintentional breaches.

Verdict on FundedNext’s rules

FundedNext’s rules lean toward the moderate-to-challenging side, fair, but not forgiving if you don’t pay attention. They’re designed to filter out reckless behavior while still allowing flexibility for traders with solid strategies and discipline.

In my first run with the Stellar 2-Step, I overlooked the news profit split rule and lost credit for a big trade. It was a wake-up call that even profitable trades can hurt if they don’t follow the fine print.

Later, I switched to Stellar Lite using a custom EA, stayed consistent, and passed smoothly. If you take time to understand the rules up front, they’re manageable, but they don’t leave much room for sloppiness.

3. Evaluation phases and pricing structure explained

FundedNext offers a variety of evaluation paths tailored to different trader experience levels and risk preferences, providing flexible and accessible routes to secure funded trading accounts.

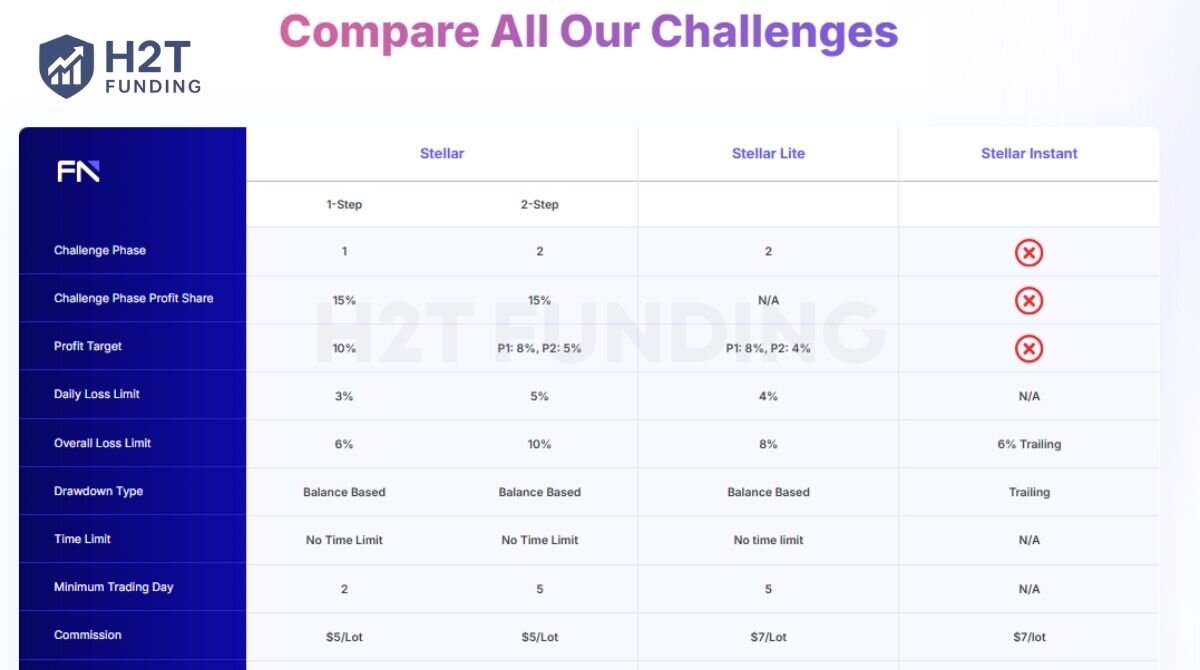

Currently, there are four main evaluation programs: Stellar 2-Step, Stellar 1-Step, Stellar Lite, and Stellar Instant, each with distinct profit targets, risk limits, and pricing structures.

| Criteria | Stellar 2-Step | Stellar 1-Step | Stellar Lite | Stellar Instant |

|---|---|---|---|---|

| Account Size Options | $6,000 – $200,000 | $6,000 – $200,000 | $5,000 – $100,000 | $5,000 – $20,000 |

| Initial Fee Range | $59 – $999 | $65 – $1,099 | $32 – $399 | $195 – $780 |

| Evaluation Structure | Two distinct phases | Single evaluation stage | Dual-phase | No evaluation |

| Profit Targets | 8% (P1), 5% (P2) | 10% target | 8% (P1), 4% (P2) | None |

| Daily Drawdown Cap | 5% | 3% | 4% | ✘ |

| Maximum Overall Loss | 10% | 6% | 8% | 6% trailing |

| Time Constraints | Unlimited duration | No deadlines imposed | No time restrictions | N/A |

| Trading Leverage | 1:100 | 1:30 | 1:100 | 1:30 |

| Commission Per Lot | $5 | $5 | $7 | $7 |

| Challenge Profit Share | 15% during the phase | 15% during the phase | Not available | Not applicable |

| Funded Account Profit Split | 95% | 95% | 95% | 80% |

| Minimum Trading Days | 5 days | 2 days | 5 days | ✘ |

| Initial Payout Timeline | Monthly | 5 business days | After 21 days | 14 days |

| Subsequent Payout Frequency | Bi-weekly | Every 5 business days | Bi-weekly | 14 days |

3.1. Stellar 2-step challenge

The Stellar 2-Step Challenge is a classic evaluation model built for traders who prefer a structured and methodical journey toward funding. This two-phase format helps demonstrate not just profitability, but also long-term consistency under moderate risk constraints.

The process is divided into two distinct stages:

- Phase One:

- Profit target: 8%

- Risk limits: 5% daily loss and 10% overall drawdown

- Time: No time restriction

- Minimum trading days: 5

- Phase Two:

- Profit target: 5%

- Risk limits: Same as Phase One (5% daily, 10% overall)

- Time: No limit, with 5 minimum trading days

This model is accessible to a wide range of traders, with fees starting at $59 for a $6,000 account and going up to $999 for a $200,000 account. The entire fee is refundable if both phases are successfully completed, making it a cost-effective option for serious traders.

Additionally, the program allows for up to 1:100 leverage, giving participants the freedom to apply different trading strategies within a manageable risk framework.

Here’s a clear look at the available account sizes and requirements:

| Account Size | Fee | Daily Loss (5%) | Overall Loss (10%) | Phase 1 Target (8%) | Phase 2 Target (5%) |

|---|---|---|---|---|---|

| $6,000 | $59 | $300 | $600 | $480 | $300 |

| $15,000 | $119 | $750 | $1,500 | $1,200 | $750 |

| $25,000 | $199 | $1,250 | $2,500 | $2,000 | $1,250 |

| $50,000 | $299 | $2,500 | $5,000 | $4,000 | $2,500 |

| $100,000 | $549 | $5,000 | $10,000 | $8,000 | $5,000 |

| $200,000 | $999 | $10,000 | $20,000 | $16,000 | $10,000 |

This model is ideal for traders who value gradual progress and want to build credibility over multiple evaluation stages. It rewards patience, consistency, and a well-managed approach to risk, traits essential for long-term success in proprietary trading.

3.2. Stellar 1-Step challenge

The Stellar 1-Step Challenge is a streamlined evaluation program designed for confident traders who want to get funded quickly. Unlike traditional two-step models, this one-phase challenge allows skilled individuals to prove their trading ability under stricter risk parameters while avoiding the hassle of multiple rounds.

To pass, traders must reach:

- Profit target: 10% profit required without time constraints.

- Risk limits: Daily drawdown capped at 3%, and overall drawdown limited to 6%.

- Minimum trading days: Only 2 trading days are required, enabling faster progression.

- Pricing: Range from $65 for a $6,000 account to $1,099 for a $200,000 account.

- Refund: Entry fees are refundable upon passing.

Here’s a full breakdown of the account tiers:

| Account Size | Fee | Daily Loss (3%) | Overall Loss (6%) | Profit Target (10%) |

|---|---|---|---|---|

| $6,000 | $65 | $180 | $360 | $600 |

| $15,000 | $129 | $450 | $900 | $1,500 |

| $25,000 | $219 | $750 | $1,500 | $2,500 |

| $50,000 | $329 | $1,500 | $3,000 | $5,000 |

| $100,000 | $569 | $3,000 | $6,000 | $10,000 |

| $200,000 | $1,099 | $6,000 | $12,000 | $20,000 |

This one-step format is ideal for experienced traders who want a fast-track route to trading firm capital and are confident in their ability to stay within tighter risk limits. It rewards precision, consistency, and discipline without unnecessary delays.

3.3. Stellar Lite Challenge

The Stellar Lite Challenge is a beginner-friendly, low-cost funding evaluation designed for traders who wish to start with smaller capital and manageable risk. This two-phase model provides a practical way to begin without compromising the core principles of risk management and consistency.

It’s particularly suited for newer traders or anyone testing their strategy before scaling up. The challenge includes two stages with reasonable targets and tighter drawdown limits:

- Phase One:

- Profit target: 8%

- Risk limits: 4% daily loss, 8% maximum loss

- Trading duration: Minimum 5 days, no time cap

- Phase Two:

- Profit target: 4%

- Same risk limits: 4% daily, 8% overall

- Requires at least 5 trading days to complete

Stellar Lite is also the most affordable plan in the lineup. Entry fees start from just $32 for a $5,000 account, making it ideal for budget-conscious traders. The highest fee is $399 for a $100,000 account, and as with other Stellar models, all fees are fully refundable if both phases are passed.

Here’s a breakdown of what each account tier includes:

| Account Size | Fee | Daily Loss (4%) | Overall Loss (8%) | Phase 1 Target (8%) | Phase 2 Target (4%) |

|---|---|---|---|---|---|

| $5,000 | $32 | $200 | $400 | $400 | $200 |

| $10,000 | $59 | $400 | $800 | $800 | $400 |

| $25,000 | $139 | $1,000 | $2,000 | $2,000 | $1,000 |

| $50,000 | $229 | $2,000 | $4,000 | $4,000 | $2,000 |

| $100,000 | $399 | $4,000 | $8,000 | $8,000 | $4,000 |

Overall, Stellar Lite provides a smart way to enter the world of prop trading with minimal upfront cost and realistic evaluation standards. It’s a great stepping stone for traders looking to prove themselves without taking on large initial risk.

3.4. Stellar Instant

The Stellar Instant Challenge is built for experienced traders who want to skip the evaluation process and start managing live capital right away. There are no profit targets or multiple phases, just pure live trading with immediate access to profit split, under tight trailing risk control.

- Profit target: No profit target. Traders begin with a funded account instantly.

- Risk limits: Overall drawdown is 6%, trailing from the account’s peak balance. No daily drawdown cap.

- Minimum trading days: None. Traders can request payouts after 14 calendar days.

- Pricing: Fees range from $195 for a $5,000 account to $780 for a $20,000 account.

- Refund: Entry fees are not refundable under this model.

| Account Size | Fee | Daily Loss | Overall Loss (6%) | Profit Split |

|---|---|---|---|---|

| $5,000 | $195 | ✘ | $300 | Up to 80% |

| $10,000 | $399 | ✘ | $600 | Up to 80% |

| $20,000 | $780 | ✘ | $1,200 | Up to 80% |

Verdict on the evaluation phases and the pricing structure of FundedNext

FundedNext’s tiered evaluation system is one of the most thoughtfully designed in the prop trading space. Whether you’re a complete beginner or a seasoned trader, there’s a model tailored to your risk appetite and strategy.

From my experience, I’d recommend choosing based on your trading rhythm. If you trade frequently and want speed, go with 1-Step. If you’re methodical, 2-Step builds lasting habits. And if you’re just getting started, Lite is the best bang for your buck.

As for Stellar Instant, I only recommend it if you already have a solid, proven strategy and don’t need the buffer of an evaluation phase. I’ve tested it with a $10K account, trailing drawdown made it unforgiving, but the immediate payout and live capital were a great motivator.

4. Challenge Add-Ons

FundedNext allows traders to enhance their challenge experience through optional add-ons, features that can remove certain restrictions, increase payout potential, or provide more flexibility. These upgrades are especially valuable for traders with specific goals, such as faster evaluation or a wider risk buffer during volatile markets.

Rather than redesigning the core model, these add-ons give you tools to customize the challenge to better fit your strategy or lifestyle. They’re available across all three models: Stellar 1-Step, Stellar 2-Step, and Stellar Lite, though availability varies by account size.

| Add-On | Additional Fee | Stellar 1-Step | Stellar 2-Step | Stellar Lite |

|---|---|---|---|---|

| Lifetime Payout 95% | +30% | All account sizes | All account sizes | All account sizes |

| Double Up | +40% | All account sizes | All account sizes | All account sizes |

| No Minimum Trading Days | +20% | ≤ $25K | ≤ $25K | All account sizes |

| 10% Overall Loss Limit | +25% | Not available | Not available | All account sizes |

| Bi-Weekly Payout | +15% | Not available | ≤ $25K | All account sizes |

| Swap-Free Account | +10% | All account sizes | All account sizes | All account sizes |

Each add-on adds a percentage-based fee on top of your original challenge cost. While the extra cost can increase your upfront investment, many traders find the flexibility well worth it, especially if it helps them pass faster or reduce pressure from strict rules.

Verdict on Challenge Add-Ons

From my perspective on FundedNext H2T Funding review, its add-ons are more than just upsells, they’re smart tools if used with intention.

Personally, I’d consider “No Minimum Trading Days” essential for confident traders aiming to pass quickly, while the 10% loss limit in Stellar Lite is a great safety net during choppy sessions. I wouldn’t stack too many add-ons at once, but choosing one or two based on your style can make a real difference.

5. FundedNext scaling plan

FundedNext offers a structured scaling plan that rewards consistent and disciplined traders with increased capital. The program is available across all funded account types.

To qualify for scaling, traders must meet all the following conditions within a four-month period:

- Achieve at least 10% total account growth over the four months.

- Receive a minimum of two payouts during the same period.

- End the final trading cycle with overall profit.

- Maintain drawdown below the allowed threshold (typically 10%).

If eligible, traders receive a 40% increase in account size. This can be repeated every four months until the account reaches the maximum cap of $4 million.

For example, a $100,000 account that qualifies would be scaled to $140,000. The new loss limits are also adjusted:

- 5% daily loss = $7,000 (4% = $5,600 in Stellar Lite)

- 10% overall loss = $14,000 (8% = $11,200 in Stellar Lite)

Traders who meet the growth target but fail to end the last cycle in profit are not eligible. In that case, their performance will be reviewed again after the next full four-month cycle.

This plan encourages long-term discipline rather than short-term luck. It aligns with FundedNext’s trader-first philosophy, offering serious traders the opportunity to scale up without paying additional fees or resetting challenges.

For those who follow the rules and perform consistently, the scaling model offers a clear, realistic pathway to managing seven-figure funded accounts.

Verdict on FundedNext’s Scaling Plan

FundedNext’s scaling plan is one of the more realistic and trader-friendly models I’ve seen. It doesn’t push for aggressive growth but instead rewards consistency over a four-month span. You’re not forced to hit wild targets, just trade profitably, manage risk, and stay steady.

6. Spreads and Commissions

As of May 2026, FundedNext has transitioned to using its own brokerage: FNmarkets, marking a major shift in how spreads, commissions, and order execution are handled.

Instead of relying on third-party brokers like Eightcap, all funded traders are now routed through FNmarkets’ proprietary trading infrastructure. This move enables greater transparency, consistency, and control over trading conditions.

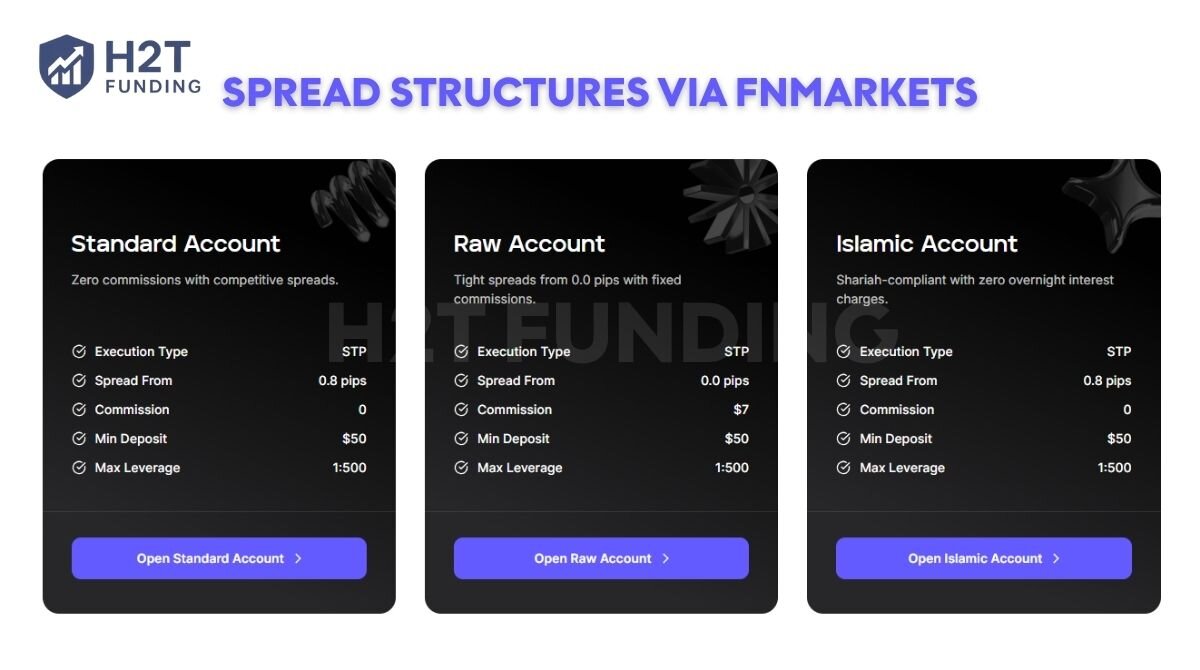

6.1. Spread structures via FNmarkets

FNmarkets offers a selection of three core account types, each designed to align with specific trading styles and individual trader needs:

- Standard Account: Offers spreads starting from 0.8 pips, with zero commissions. Ideal for traders who prefer fixed cost structures and simple fee models.

- Raw Account: Features tight spreads from 0.0 pips with a $7 commission per lot. Suitable for scalpers and active day traders who benefit from minimal spread environments.

- Islamic Account: Also starts from 0.8 pips, no commissions, and is fully Shariah-compliant with no overnight swap fees, ideal for Muslim traders or those avoiding interest.

All accounts are executed via STP (Straight Through Processing) with up to 1:500 leverage, providing fast order routing and competitive liquidity. These account structures are directly relevant to traders moving into funded stages with FundedNext, ensuring continuity in execution quality.

6.2. Commission fee breakdown by model

While spread types vary by FNmarkets account, commission fees depend on the challenge model you choose:

| Account Type | Forex | Commodities | Indices | Crypto |

|---|---|---|---|---|

| Stellar 1-Step & 2-Step | $5/lot | $5/lot | $0 | $0 |

| Stellar Lite | $7/lot | $7/lot | $0 | $0 |

| Stellar Instant | $7/lot | $7/lot | $0 | $0 |

FundedNext does not charge commissions on indices or crypto, making them attractive for cost-sensitive strategies. However, forex and commodity traders should factor in lot-based fees when evaluating profit potential, especially those using high-frequency or large-position trading styles.

Verdict on spreads and commissions

Overall, the internalization of brokerage services via FNmarkets is a strategic upgrade that gives FundedNext more control over execution quality and pricing consistency.

While they don’t yet display live spread data, the dual offering of Standard and ECN accounts makes it easier for traders to align account types with their trading styles.

7. FundedNext trading platforms

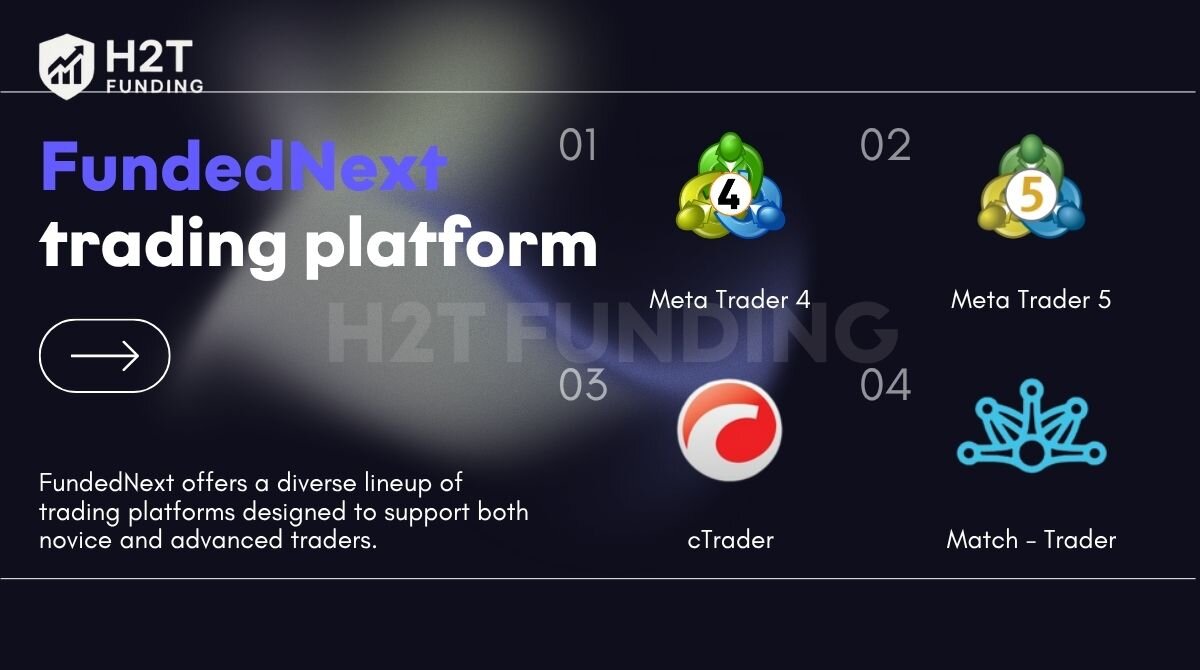

FundedNext offers a diverse lineup of trading platforms designed to support both novice and advanced traders. With the integration of MT4, MT5 with TradingView, cTrader, and Match-Trader, users have the flexibility to align their trading environment with their personal strategy.

| Platform | Stellar 1-Step | Stellar 2-Step | Stellar Lite |

|---|---|---|---|

| MetaTrader 4 | Free | Free | Free |

| MetaTrader 5 | Free | Free | Free |

| cTrader | $25 fee, not for 100K & 200K | $25 fee, not for 100K & 200K | $25 fee, not for 100K |

| Match-Trader | $25 fee, not for 100K & 200K | $25 fee, not for 100K & 200K | $25 fee, not for 100K |

7.1. MetaTrader 4 (MT4)

MT4 remains the go-to platform for many Forex traders due to its reliability and compatibility with thousands of custom indicators and Expert Advisors (EAs). It supports both manual and automated trading, using the MQL4 programming language.

Best for: Forex and commodities traders using bots or custom strategies.

Key Features:

- Wide EA and indicator compatibility

- Low system requirements

- Stable performance for long-term trading

7.2. MetaTrader 5 (MT5) with TradingView Integration

MT5 is a more advanced version of MT4 with multi-asset support, additional timeframes, and improved order management. Its integration with TradingView (once re-enabled) enhances its technical analysis capabilities.

Best for: Advanced traders and those using multi-asset strategies

Key Features:

- Built-in economic calendar

- Support for stocks, indices, and crypto CFDs

- Compatible with MQL5 EAs and TradingView charts

7.3. cTrader

cTrader is tailored for those who prefer transparency and speed. With Level II market depth, it’s great for scalpers and day traders who need real-time order book data and advanced order functionality. A $25 one-time fee applies, and it’s unavailable for 100K and 200K accounts.

Best for: Fast-paced manual trading

Key Features:

- Advanced order types (limit, stop, trailing)

- Clean UI with multi-device access

- True market depth visibility

7.4. Match-Trader

This web-based platform is focused on speed and ease of use. While it lacks some of the deep customization of MT5 or cTrader, it provides everything most traders need to execute trades effectively, without requiring any downloads or plugins.

Best for: Traders who prefer browser-based platforms

Key Features:

- No installation required

- Mobile-friendly interface

- Streamlined dashboard for performance tracking

Verdict on FundedNext’s trading platforms

FundedNext offers a strong range of platforms that cover all trading styles. The $25 fee is reasonable if you’re serious about your edge. If you’re new or want a light setup, Match-Trader is a great choice; just know its tools are more limited. Ultimately, the platform variety is a plus, but picking the right one based on your trading style matters more than platform popularity.

8. The trading environment

FundedNext creates a well-balanced trading environment that caters to both conservative and aggressive strategies. With a wide selection of asset classes and clearly defined leverage limits, traders can explore multiple markets while staying within risk-managed boundaries.

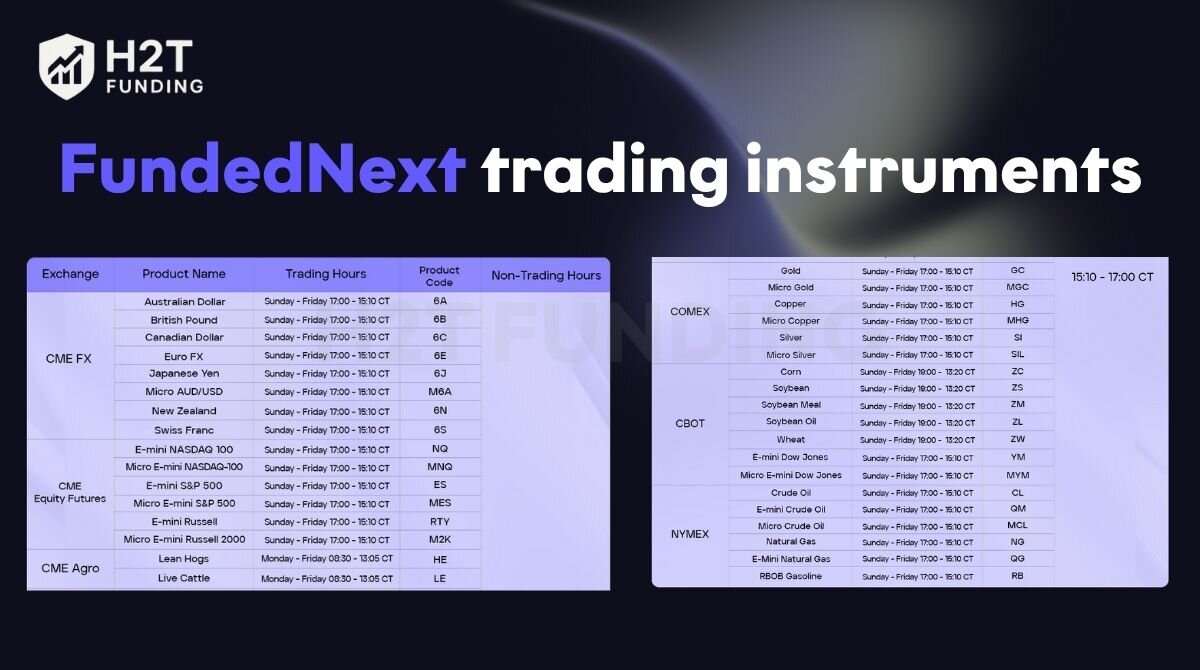

8.1. Trading instruments

FundedNext offers a diverse portfolio of tradable assets, allowing traders to diversify strategies across multiple markets:

- Forex: Over 50 currency pairs, including majors (EUR/USD, GBP/USD), minors, and exotics, providing ample opportunities for currency trading.

- Indices: CFDs on major global indices such as DAX (Germany), NASDAQ, Dow Jones, S&P 500 (US), FTSE 100 (UK), and others, enabling exposure to broad market movements.

- Commodities: Popular commodities like crude oil (WTI), Brent crude, gold, silver, and platinum, suitable for traders interested in energy and precious metals markets.

- Cryptocurrencies: A selection of leading digital assets including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), Litecoin (LTC), Monero (XMR), Chainlink (LNK), and Stellar (XLM). These are offered as CFDs with no leverage to mitigate volatility risk.

8.2. Trading leverage

Leverage levels at FundedNext are designed to balance opportunity and risk, varying by asset class and account phase, but generally as follows:

- Forex pairs: Up to 1:100 leverage, allowing traders to amplify positions while maintaining risk controls.

- Indices: Up to 1:15 leverage, reflecting the typically higher volatility of index CFDs.

- Commodities: Up to 1:25 leverage, balancing exposure to commodity price fluctuations.

- Cryptocurrencies: No leverage (1:1), due to the high volatility inherent in crypto markets.

These leverage limits apply consistently during both evaluation and live funded account stages, ensuring traders can execute impactful strategies without exceeding risk parameters.

Verdict on the trading environment

FundedNext offers a solid asset variety without going overboard on risk. I found the 1:100 leverage on Forex sufficient for most strategies, and raw spreads kept costs low. While crypto trading is capped at 1:1, it can help you avoid overexposure during volatile sessions.

9. Payout structure

FundedNext offers a transparent and flexible payout system designed to reward traders fairly and efficiently. Understanding the payment methods, processing times, and withdrawal conditions is essential for traders to manage their earnings smoothly throughout their funded journey.

9.1. Payment methods

FundedNext supports a wide range of payment and withdrawal options to accommodate traders worldwide, with a strong emphasis on cryptocurrencies and popular digital wallets:

Cryptocurrencies:

- USDT (Tether) on TRC20 and ERC20 networks

- USDC (USD Coin) on ERC20

- Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), Solana (SOL)

Digital wallets and payment services:

- PayPal

- Skrill

- Apple Pay

- Google Pay

- AstroPay

Other methods:

- RiseWorks: A payment gateway with a processing fee up to 3%.

- TC Pay: Exclusive for Iranian clients, supporting withdrawals from $20 to $5,000.

This variety ensures traders can choose the most convenient and cost-effective option for their region and preferences.

9.2. Profit sharing and payout schedules

Profit splits and payout frequencies depend on the account model, with opportunities to enhance earnings through scaling or add-ons. Below is a breakdown by model:

Stellar 1-Step account:

- Challenge phase: Traders earn a 15% profit share, withdrawable after achieving 10% growth in the FundedNext Account.

- FundedNext account: Offers a 90% profit split from the start, with payouts every 5 business days. The subscription fee reward bonus can be requested with the first payout.

- Scaling: Profit split increases to 95% upon meeting scale-up criteria.

Stellar 2-Step account:

- Challenge phases (1 and 2): Provides a 15% profit share, accessible after 10% growth in the FundedNext Account.

- FundedNext account: Starts with an 80% profit split. First payout is available after 21 days, with subsequent payouts every 14 days. The subscription fee reward bonus is included with the first payout.

- Scaling: Profit split rises to 90% after scaling up.

Stellar Lite Account:

- Challenge Phases (1 and 2): No profit share during the challenge phases.

- FundedNext Account: Begins with an 80% profit split, with the first payout after 21 days and subsequent payouts every 14 days. The subscription fee reward bonus is available with the third payout.

- Scaling: Profit split increases to 90% upon scaling.

Add-Ons: Traders can boost their profit split to 95% across Stellar models by opting for add-ons, which may increase challenge fees but enhance earning potential.

9.3. Processing times

FundedNext prioritizes speed, committing to process payout requests within 24 hours. The process includes:

- Withdrawal requests are handled promptly to provide traders with quick access to their profits:

- Payout requests are typically processed within 24 hours of submission.

- After a withdrawal request, traders receive a confirmation email along with a screenshot verifying the transaction.

- The actual time for funds to reach the trader’s account depends on the chosen payment method and the respective network or service processing times.

- Average payout speeds can be as fast as 5 hours, with a guaranteed maximum of 24 hours for processing by FundedNext.

9.4. Minimum and maximum withdrawal limits

To maintain efficient processing and comply with payment provider policies, FundedNext enforces minimum and maximum withdrawal amounts based on the payment method:

| Payment Method | Minimum Withdrawal | Maximum Withdrawal |

|---|---|---|

| USDT (TRC20) | $20 | $4,999 |

| USDT (ERC20) | $50 | $4,999 |

| USDC (ERC20) | $50 | $4,999 |

| RiseWorks | $50 (up to 3% fee) | No specified max |

| TC Pay (Iran only) | $20 | $5,000 |

| Other crypto & wallets | Varies | Varies |

Withdrawals below the minimum threshold (usually $20) are automatically rolled over to the next payout cycle. This ensures efficient transaction management and cost-effectiveness.

Verdict on payout structure

FundedNext offers one of the more trader-centric payout systems in the prop trading space. Profit splits are competitive, processing is fast (often under 24 hours), and payment options are globally accessible. Combined with scaling and add-on flexibility, the payout structure supports long-term growth and reliable earnings.

10. Customer support and education resources

FundedNext doesn’t just fund traders; it supports their growth with a comprehensive support system and educational ecosystem. Whether you’re stuck with a technical issue or looking to sharpen your trading edge, the platform offers real-time help and continuous learning across multiple channels.

10.1. Customer support

Traders have access to multiple support layers to resolve issues efficiently:

- 24/7 availability via live chat and email, ensuring help is available regardless of time zone.

- Live chat bot for instant answers to common questions, reducing wait times.

- Email support handles more complex concerns, especially account or payout-related.

- Pro support for funded traders connects users with internal experts for deeper technical assistance.

- Detailed FAQs & help center cover rules, platform setups, and account policies clearly.

- Minor limitations include occasional broken links or rigid chatbot screening, but human agents are available when needed.

10.2. Educational resources

FundedNext equips traders with layered, accessible education across platforms:

- On-site materials include trading guides, challenge tips, market breakdowns, and risk management tutorials.

- The economic calendar lets traders track high-impact news, with filters for relevance and timezone alignment.

- Psychology feed & trader dashboard offer mental strategy tips, journaling features, and community content like “Meet the Traders.”

- YouTube channel (100K+ subscribers, 1,200+ videos) dives into prop firm tactics, interviews, and weekly trading tips.

- Risk reward radio podcast brings real trader stories to life, ideal for learning from wins and mistakes.

Verdict on customer support and education

FundedNext excels in trader support and learning. While there are small tech hiccups in the support flow, the 24/7 access and Pro Support for funded users add real value. Its educational ecosystem, especially the YouTube channel and in-dashboard tools, makes it a standout choice for traders serious about growth and continuous improvement.

11. How to sign up with FundedNext

Joining FundedNext is a streamlined process designed to get you trading quickly. Whether you’re a beginner exploring prop trading or a seasoned trader ready to scale capital, the setup takes just a few minutes. Here’s a step-by-step breakdown of how to get started:

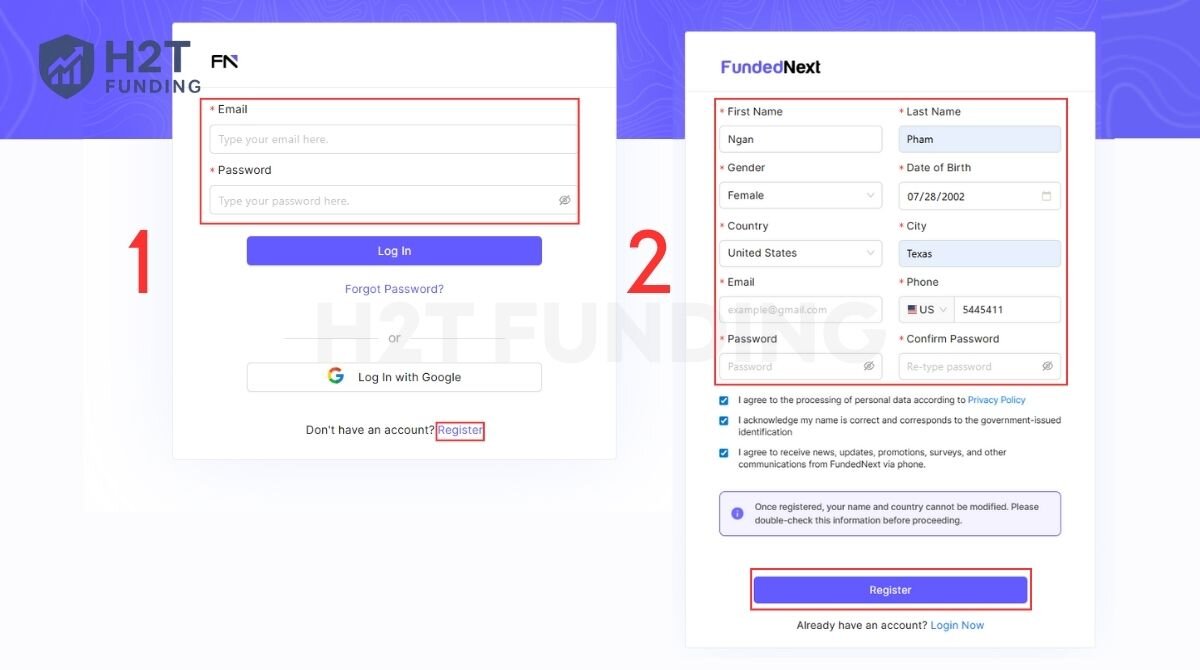

Step 1: Create your account

Go to the FundedNext website and click on “Register” located at the top right. You can sign up using your email, or speed things up by linking your Google or Facebook account.

Step 2: Enter your personal information

Complete the basic registration form with your name, email, and password. Make sure to agree to the terms and conditions, then click “Register” to proceed.

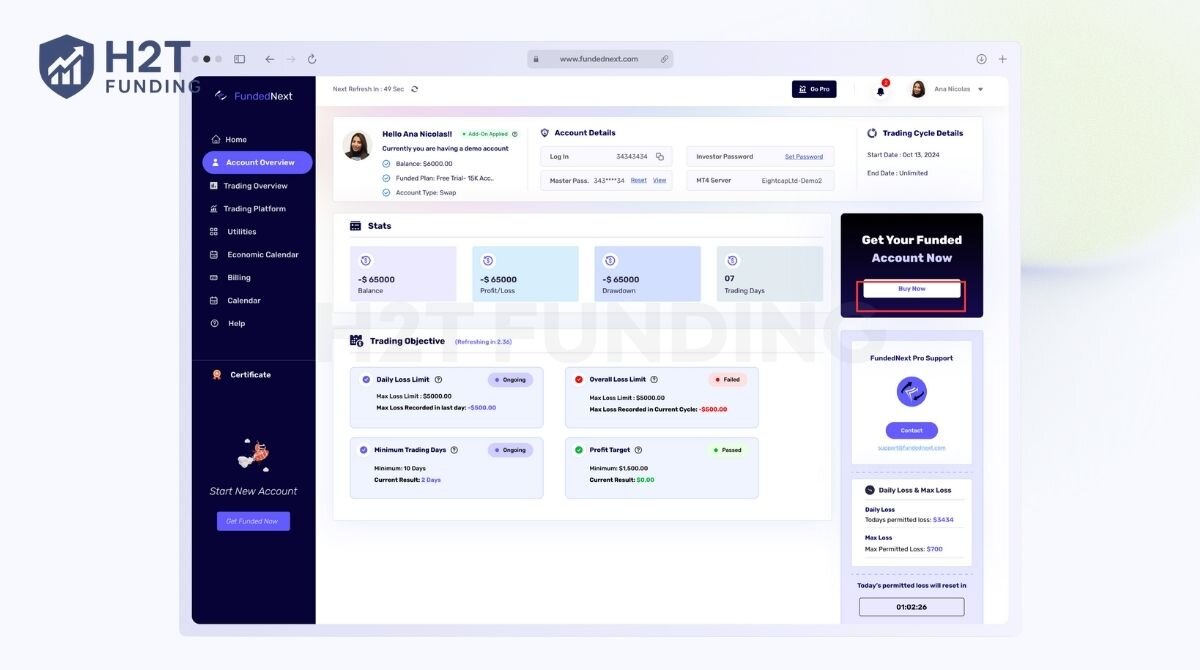

Step 3: Log in to the dashboard

After registering, return to the homepage and log in with your credentials. Once inside your Trader Dashboard, click the “Start Trading” button at the top to begin your application.

Step 4: Choose a challenge and platform

Select the funding model that fits your style (e.g., Stellar 1-Step, 2-Step, or Lite), choose your preferred account size and platform (MT4, MT5, cTrader, or Match-Trader), then click “Buy Now.”

Step 5: Make the payment

Select your preferred payment method: crypto, PayPal, or card. Enter the required details and confirm your payment. FundedNext will process it immediately.

Once payment is completed, you’ll receive a confirmation email along with login credentials for your trading account. From there, you can explore the portal, track your challenge progress, and begin executing trades on your chosen platform.

12. FundedNext vs other prop firms

FundedNext has rapidly gained recognition in the proprietary trading industry by offering flexible challenges, faster payouts, and trader-friendly policies.

When compared to well-known firms like FTMO, Funding Pips, and Alpha Capital, FundedNext distinguishes itself through several key features that appeal to a broad range of traders, from beginners to professionals.

Key differentiators of FundedNext:

- Profit sharing during challenge: Unlike many prop firms, FundedNext rewards traders with a 15% profit share even during the evaluation (challenge) phases, providing early income opportunities.

- No time limits on challenges: FundedNext allows traders to complete challenges at their own pace, removing the pressure of strict deadlines common at other firms.

- Fast payouts: FundedNext guarantees payout processing within 24 hours, significantly faster than many competitors who often pay monthly or biweekly.

- Flexible trading conditions: With low commissions, raw spreads, and support for multiple platforms (MT4, MT5, cTrader, and Match-Trader), FundedNext offers a versatile trading environment.

- Scaling opportunities: FundedNext provides a scaling plan that increases account size by 40% every four months for consistent traders, with a maximum funding cap of $4 million.

- Transparency and fair drawdown rules: Drawdown is calculated based on the balance at the start of the trading day, promoting fairness and clarity.

| Feature / Firm | FundedNext | FTMO | Funding Pips | Alpha Capital |

|---|---|---|---|---|

| Founded | 2022 | 2014 | 2020 | 2021 |

| Profit Share (Base) | 80%, up to 95% with add-ons | 80%, up to 90% with scaling | 70% – 85% | 80% |

| Profit Share During Challenge | 15% (unique feature) | None | None | None |

| Challenge Time Limit | None (trade at your own pace) | 30/60 days | 30 days | 30 days |

| Payout Speed | Within 24 hours | Monthly | Within 48 hours | Within 24-48 hours |

| Scaling Plan | 40% increase every 4 months, max $4M | 25% increase every 4 months, max $2M | Limited | Available |

| Supported Platforms | MT4, MT5, cTrader, Match-Trader | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5 |

| Minimum Entry Fee | Starting at $32 | Starting at ~$155 | Starting at $99 | Starting at $99 |

| Account Sizes | $5,000 – $200,000 | $10,000 – $200,000 | $10,000 – $150,000 | $10,000 – $200,000 |

| News Trading | Allowed (with profit restrictions on funded accounts) | Allowed with restrictions | Allowed | Allowed |

| Drawdown Limits | 5% daily / 10% overall (flexible enforcement) | 5% daily / 10% overall | 5% daily / 10% overall | 5% daily / 10% overall |

| Fee Refund | Full refund on passing | Refund after the first successful withdrawal | Partial refund | Refund on passing |

| Unique Features | Profit share during challenge, no time limit, fast payouts | Structured scaling, strong education | Low entry fees, fast payouts | Flexible account options |

13. FundedNext Trustpilot rating – Real user experience and verified trader reviews

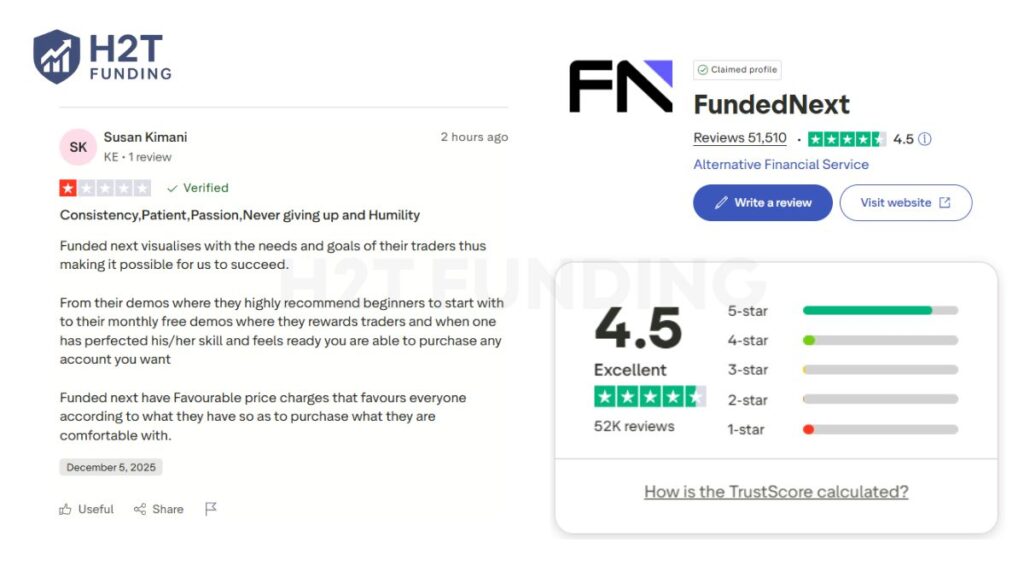

FundedNext holds a solid 4.5/5 rating from over 51,510 reviews on Trustpilot, evidence of generally high user satisfaction. The majority of reviews praise support speed, payout reliability, and flexible rules.

However, a closer look reveals some cracks in consistency, especially regarding account activation and communication clarity.

Key takeaways from live reviews:

- Responsive support: Most users get answers in under 10 minutes via live chat, especially during KYC and early account setup.

- Fast, reliable payouts: Some report receiving payouts within an hour, especially after their first request.

- Beginner-friendly terms: Unlimited free retries, 15% profit share during challenge, and no time limits ease pressure.

- Flexible trading options: Features like weekend holding, EA support, and news trading are widely appreciated.

“The Customer Support is on point. Great and accurate responses. Also did my KYC, and my funded account arrived within the dedicated time window. So far so good.” HourTrader, Trustpilot

But it’s not always perfect. Despite the high average rating, 6% of users gave FundedNext 1-star, and only 7% of negative reviews received replies, a clear sign of improvement needed in follow-up.

Common concerns include:

- Delayed account funding: Some users report passing challenges but waiting several days without updates.

- Automated chat limitations: Chat sessions may close too quickly if the user doesn’t respond instantly, leaving conversations unresolved.

- Uncertainty around payouts: A few traders express a lack of trust in the process when support feels vague or generic.

One verified user wrote:

“I passed my challenge on the 28th, and as of August 1, I still haven’t received a funded account… You get a message that you are about to close the conversation, so fast. It seems like the most crucial thing is closing the conversation.” Itai, Trustpilot

Tips & advice from seasoned FundedNext traders

- Track both MT4/MT5 and the dashboard equity daily to spot discrepancies early.

- Keep daily risk under 1 % of balance; staying well below the 5 % limit makes the free‑retry policy a real edge.

- Request the first small payout as soon as eligible; it validates the process and builds confidence.

- Use FundedNext’s position-sizing calculator and stick to a written plan; data shows disciplined accounts scale fastest.

- Engage in the Discord community; monthly competitions can win you a free account or a reset voucher.

FundedNext’s appeal lies in its speed, flexibility, and payout consistency, but not all experiences are frictionless. While many traders enjoy seamless journeys, others feel the support could be more responsive during sensitive phases. A little more transparency here could make a great service truly best-in-class.

14. FAQs about FundedNext

Yes. FundedNext processes payouts within 24 hours after a request. Many traders report actual receipt in under six hours, and the firm offers up to $1,000 compensation if the delay is due to their internal processes.

The platform restrictions (like limited access to cTrader or Match-Trader for big accounts) may also limit trader flexibility. Additionally, certain support links occasionally lead to broken pages, which can be frustrating during setup or issue resolution.

FTMO is better for traders seeking long-term stability, with a strong track record and structured evaluations. FundedNext suits traders looking for faster payouts, profit sharing during challenges, and more flexible scaling, offering up to $4M in funding compared to FTMO’s $400K.

FundedNext and FundingPips both launched circa 2022 in the UAE. FundedNext supports three platform options (MT4, MT5, cTrader) and offers early profit payouts. FundingPips offers similar evaluation paths but has a shorter operational history. If you prefer more platform options and challenge payouts, FundedNext edges ahead.

FundedNext appears legitimate, with ~4.6/5 Trustpilot ratings from 35K+ reviews. However, mixed scores on Sitejabber (1.5/5) and reviews.io (2.9/5) indicate that occasional payout or rule disputes do occur.

You can read verified user reviews on Trustpilot, where FundedNext scores around 4.6/5 based on over 30,000 reviews. These reviews cover trader support, payout experience, and platform reliability.

A trader can scale their account up to a maximum of $4 million, achieved through repeating the 40% scale-up every four months. Initial funded accounts can start at $300K live funded capital (or $50K for Stellar Lite), before scaling begins.

15. Final verdict

FundedNext is best suited for traders who value flexibility, fast payouts, and global accessibility. Whether you’re a disciplined beginner seeking fair evaluation terms or an experienced trader wanting to scale rapidly with profit splits up to 95%, FundedNext offers a compelling path forward.

Its standout features, such as unlimited free retries, weekend holding, and real-time support, make it especially appealing for those who need more than just capital but a responsive trading ecosystem.

That said, traders prioritizing long-established firms with slower but steadier processes may still prefer platforms like FTMO or The5ers. In contrast, FundedNext will likely attract a new generation of agile, strategy-driven traders in 2026.

For more insights beyond this FundedNext review, we invite you to explore other proprietary trading firm reviews and comparisons and in-depth platform guides on H2T Funding, your trusted source for trader-first content and prop firm evaluations.