20% OFF Sale

Receive 20% Off Any Purchase

As the prop firm industry shifts in 2026, many traders wonder if Funded Trading Plus remains a top-tier choice. This Funded Trading Plus review addresses the growing need for transparency and reliability in a highly competitive market. It is essential to verify if their trading conditions still support long-term success before committing your time.

To clear your doubts, we provide a detailed breakdown of their latest account types and risk management protocols. By reading this guide, you will master the nuances of their evaluation process and learn how to secure consistent payouts. This analysis empowers you to make an informed decision for your trading career based on real-time performance.

1. What is Funded Trading Plus?

Funded Trading Plus, legally FTP London Ltd, is a prominent UK prop firm established in 2021. They offer trading capital from $5,000 to $200,000, helping traders worldwide scale their professional portfolios.

The company was co-founded by CEO Simon Massey, who leveraged his 12+ years of experience to remove industry traps like strict time limits. Unlike many competitors, their mission is to foster a fair environment where performance is rewarded without unnecessary psychological pressure.

Traders can choose between 1-step, 2-step, or instant funding programs across Forex, Indies, Crypto, and Commodities using top-tier trading platform options. By ensuring fast execution and a clear evaluation process, FTP helps you transition into a successful professional trading career. Their commitment to excellence is reflected in their high profit-sharing models and exceptional customer service.

2. Our take on Funded Trading Plus

Funded Trading Plus is a prop firm that has fundamentally changed the funded trading landscape since 2021. After analyzing a wide range of proprietary firms at H2T Funding, in this Funded Trading Plus review, we want to highlight how they prioritize a stress-free experience. They offer a realistic environment where trading discipline is the primary key to success.

Their decision to remove evaluation time limits is a massive win for trader psychology. You can finally focus on your trading strategy without the constant fear of a ticking clock. This level of transparency regarding trading rules makes them a highly reliable partner.

The firm provides a stable bridge to managing significant trading capital with very competitive trading conditions. Their support team is remarkably active, ensuring that any account issues are resolved swiftly. For those seeking consistent payouts, the platform offers the technical stability needed for long-term growth.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funded Trading Plus websites before purchasing any challenge.

| Pros | Cons |

|---|---|

| No time limits on any evaluation phase. | Relative drawdown can be complex for beginners. |

| High payouts reaching up to 100% split. | Strict rules against any form of copy trading. |

| Fast execution across four different platforms. | Weekend holding is prohibited on specific accounts. |

| Support team is available 24/7 for assistance. | Higher entry fees for the Master account type. |

| Withdrawals are processed quickly and reliably. | Strict risk management regarding consistency. |

| Comprehensive mentorship and education suite. |

3. Funded Trading Plus programs

Funded Trading Plus provides three distinct program pathways designed to accommodate different levels of expertise and risk profiles. Whether you seek immediate funding or a structured challenge, these options offer unparalleled flexibility for professional growth.

Each program is built to support your unique trading strategy while maintaining high standards of transparency. By choosing the right model, you can maximize your earning potential and secure substantial capital efficiently.

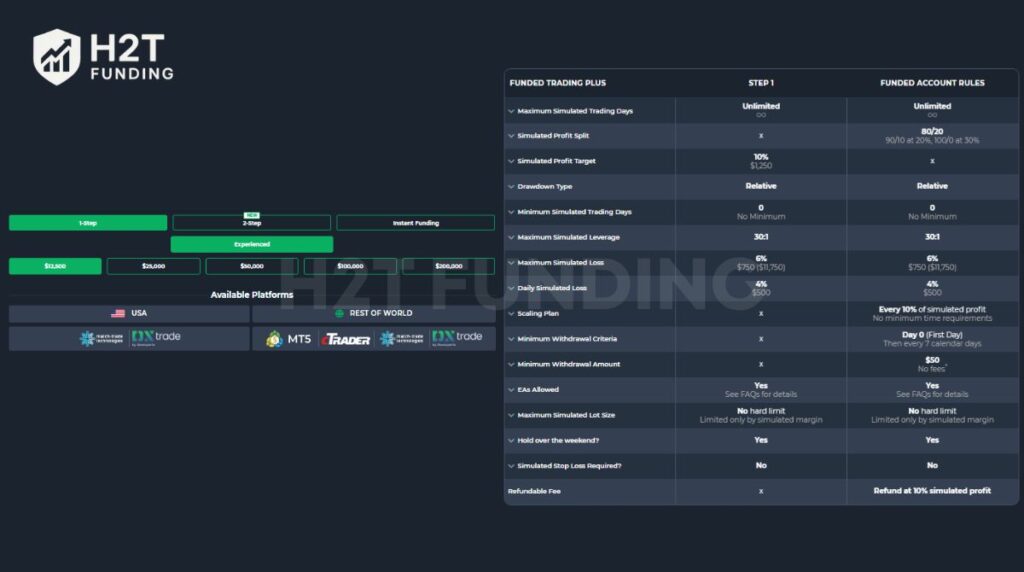

3.1. Experienced 1-step challenge

The Experienced Program is a single-phase evaluation designed for traders who want fast-track access to funding. It offers five account sizes, each with a fixed 10% profit target and no restrictive time limits.

This program allows for total flexibility with EAs and weekend holdings, making it ideal for various trading styles. Traders can operate without mandatory stop losses, providing a professional environment to showcase their true performance.

| Account Size | Profit Target (10%) | Max Loss (6%) | Daily Loss (4%) | Audition Fee |

|---|---|---|---|---|

| $12,500 | $1,250 | $750 | $500 | $119 |

| $25,000 | $2,500 | $1,500 | $1,000 | $199 |

| $50,000 | $5,000 | $3,000 | $2,000 | $349 |

| $100,000 | $10,000 | $6,000 | $4,000 | $499 |

| $200,000 | $20,000 | $12,000 | $8,000 | $949 |

Once you pass, the profit split starts at 80/20 and can scale up to a 100% share. You can request your first payout on day zero of reaching the funded stage, with subsequent withdrawals every seven days.

3.2. 2-step challenge

The 2-step challenge provides a structured framework for traders to demonstrate their consistency across two distinct evaluation phases. This model often appeals to those who prioritize lower initial profit targets while undergoing a more comprehensive risk assessment.

By separating the process into stages, the firm facilitates a gradual validation of trading performance. The systematic approach helps traders solidify their trading discipline before managing larger amounts of capital in a live environment.

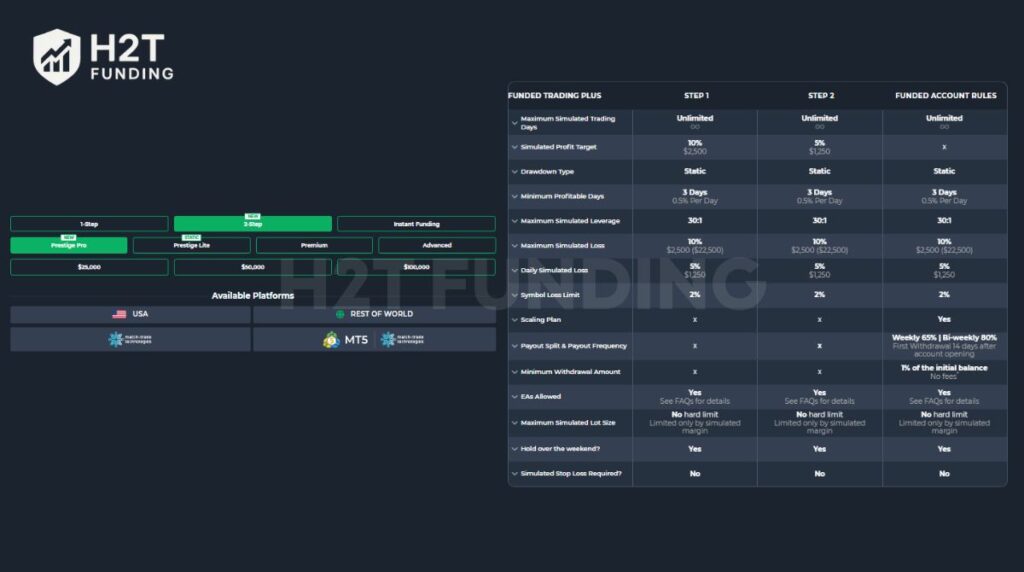

3.2.1. Prestige Pro account

The Prestige Pro Program is distinguished by its static drawdown model, offering a stable risk environment where the maximum loss limit does not trail your profits. This two-phase evaluation allows traders to prove their consistency while maintaining a fixed 10% total loss buffer based on the initial balance.

Traders must navigate both phases with a 5% daily loss limit and a specific 2% symbol loss limit to ensure professional risk control. This account type is particularly suited for those who prefer a more traditional risk assessment without the complexities of trailing drawdowns.

| Account Size | Phase 1 Target (10%) | Phase 2 Target (5%) | Max Static Loss (10%) | Daily Loss (5%) | Audition Fee |

|---|---|---|---|---|---|

| $25,000 | $2,500 | $1,250 | $2,500 | $1,250 | $139 |

| $50,000 | $5,000 | $2,500 | $5,000 | $2,500 | $259 |

| $100,000 | $10,000 | $5,000 | $10,000 | $5,000 | $469 |

A unique feature of this program is the choice between weekly or bi-weekly payouts. You can opt for a 65% split distributed weekly or an 80% split every two weeks. Additionally, you must achieve at least three profitable days with a 0.5% gain to qualify for your first withdrawal.

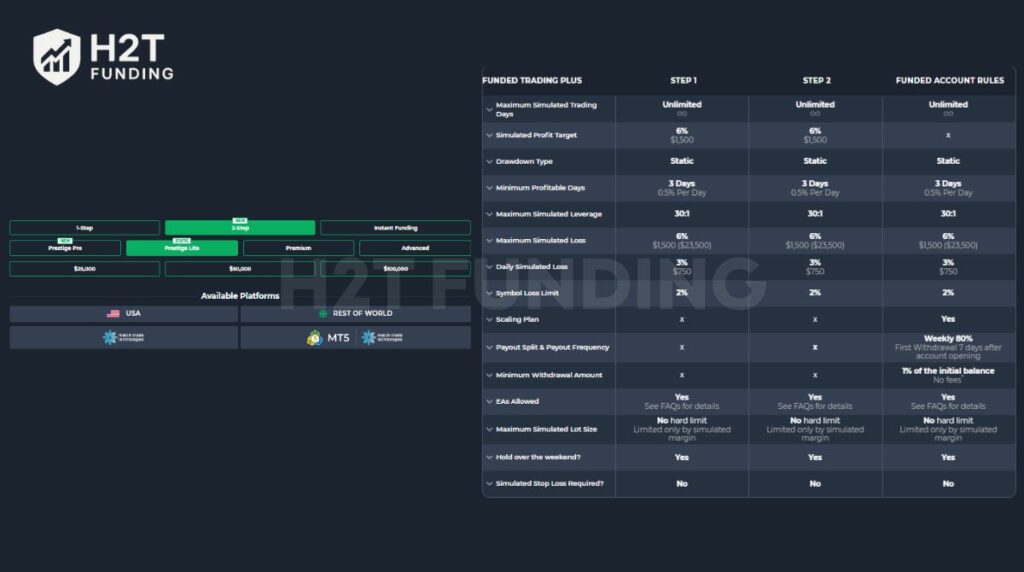

3.2.2. Prestige Lite account

The Prestige Lite Program is designed for traders seeking a static risk environment with lower profit targets. This two-phase evaluation requires a 6% gain in each stage, making the path to funding more achievable for those who prefer steady growth over aggressive targets.

Similar to the Pro version, this account features a fixed loss limit that does not trail your profits, providing a clear and permanent risk boundary. Traders must adhere to a 3% daily loss limit and a 2% symbol loss rule to ensure long-term portfolio protection and professional discipline.

| Account Size | Phase 1 & 2 Target (6%) | Max Static Loss (6%) | Daily Loss (3%) | Audition Fee |

|---|---|---|---|---|

| $25,000 | $1,500 | $1,500 | $750 | $129 |

| $50,000 | $3,000 | $3,000 | $1,500 | $209 |

| $100,000 | $6,000 | $6,000 | $3,000 | $389 |

Once you reach the funded stage, you benefit from a weekly 80% profit share, provided you meet the minimum withdrawal criteria. You must complete at least three profitable trading days with a 0.5% return and maintain a minimum withdrawal amount of 1% of your initial balance.

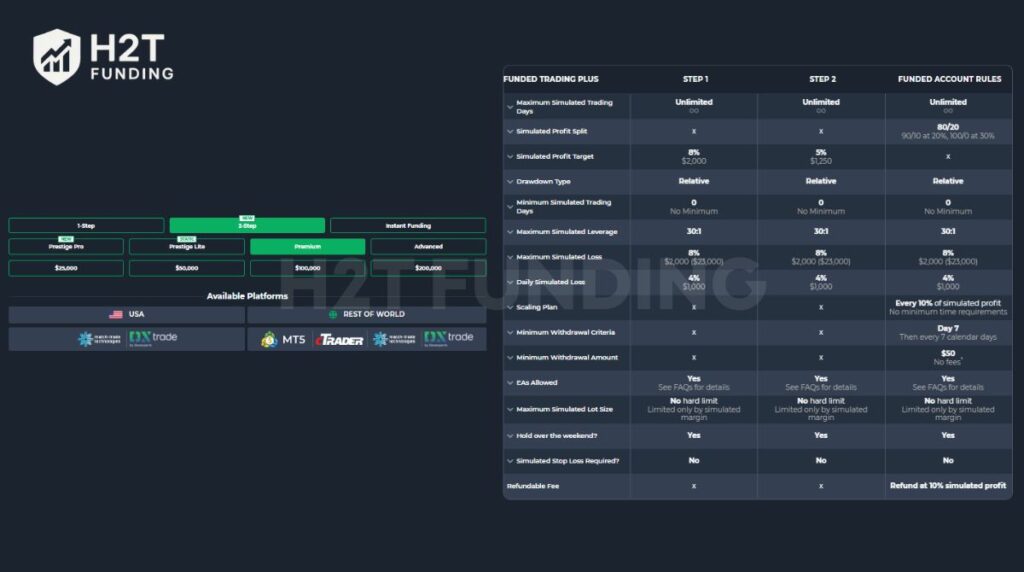

3.2.3. Premium account

The Premium Program caters to Smart Money and swing traders requiring high operational flexibility. It features balanced targets of 8% and 5% across two evaluation phases to ensure long-term consistency.

Traders operate with no mandatory stop losses and can hold positions over weekends. This allows for a more relaxed risk management approach compared to stricter industry standards.

| Account Size | Phase 1 Target (8%) | Phase 2 Target (5%) | Max Loss (8%) | Daily Loss (4%) | Audition Fee |

|---|---|---|---|---|---|

| $25,000 | $2,000 | $1,250 | $2,000 | $1,000 | $247 |

| $50,000 | $4,000 | $2,500 | $4,000 | $2,000 | $397 |

| $100,000 | $8,000 | $5,000 | $8,000 | $4,000 | $547 |

| $200,000 | $16,000 | $10,000 | $16,000 | $8,000 | $1,097 |

The payouts begin at an 80% split and can scale up to a full 100% share. Additionally, the audition fee is fully refundable once you reach a 10% profit milestone on your funded account.

You can request withdrawals every seven days once the initial seven-day period is completed. This frequent access to profit makes it a highly competitive option for active traders.

3.2.4. Advanced account

The Advanced Program provides a comprehensive two-phase evaluation with significantly higher drawdown allowances than other pathways. This structure is designed to offer maximum flexibility during market volatility, allowing traders more room to manage their positions effectively.

By utilizing a relative drawdown of 10% and a 5% daily limit, this program supports more aggressive risk profiles. It serves as an excellent bridge for those who want to scale their performance without restrictive loss boundaries during the initial stages.

| Account Size | Step 1 Target (10%) | Step 2 Target (5%) | Max Loss (10%) | Daily Loss (5%) | Audition Fee |

|---|---|---|---|---|---|

| $25,000 | $2,500 | $1,250 | $2,500 | $1,250 | $249 |

| $50,000 | $5,000 | $2,500 | $5,000 | $2,500 | $399 |

| $100,000 | $10,000 | $5,000 | $10,000 | $5,000 | $549 |

| $200,000 | $20,000 | $10,000 | $20,000 | $10,000 | $1,099 |

Once you pass both phases, you gain access to a funded account with payouts starting at 80%. Your profit share can eventually increase to 100% based on milestones, rewarding long-term consistency and disciplined execution.

Traders in this program must close all positions before the weekend to comply with firm risk protocols. However, you can access your first withdrawal on day zero of your funded stage, with subsequent payments processed every seven days.

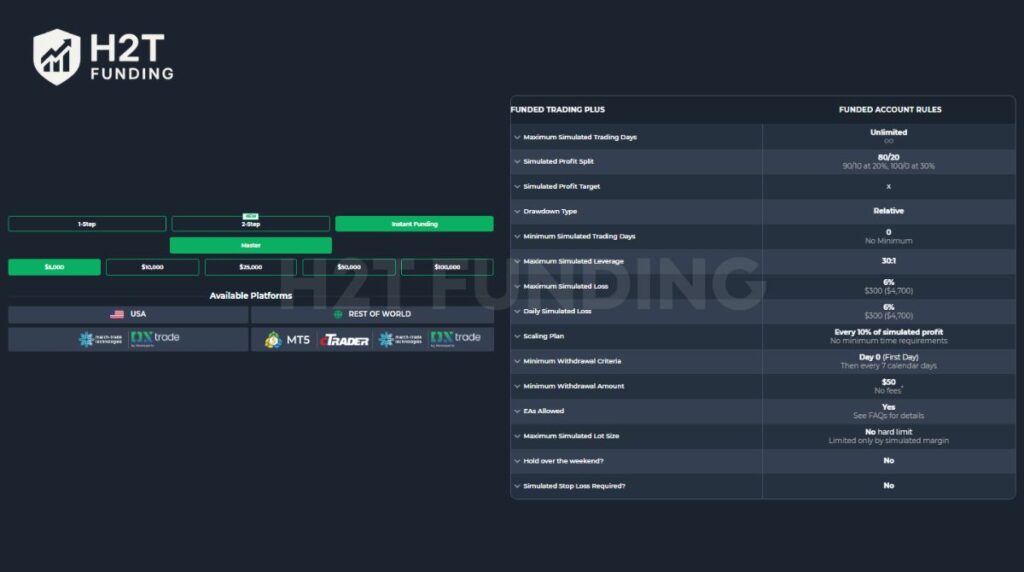

3.3. Master instant funding

The Master Program provides the fastest route to professional funding by completely removing the traditional evaluation phase. This model is ideal for traders who have proven strategies and wish to earn real profits immediately without hitting specific targets first.

Traders enjoy immediate access to simulated capital from day one, allowing them to focus entirely on consistent execution. The program supports both day and swing traders, though positions must be closed before the weekend to align with firm risk protocols.

| Account Size | Max Relative Loss (6%) | Daily Loss (6%) | Audition Fee |

|---|---|---|---|

| $5,000 | $300 | $300 | $225 |

| $10,000 | $600 | $600 | $450 |

| $25,000 | $1,500 | $1,500 | $1,125 |

| $50,000 | $3,000 | $3,000 | $2,250 |

| $100,000 | $6,000 | $6,000 | $4,500 |

One of the most attractive features is the scaling payout split starting at 80/20. As you reach specific milestones, your share can increase to 90% and eventually a full 100% based on your accumulated account performance.

Withdrawals are highly accessible, with the first payout available on your very first day of trading. Following the initial request, you can withdraw simulated profits every seven days, provided the balance exceeds the $50 minimum requirement.

Verdict on Funded Trading Plus funding programs

Funded Trading Plus offers one of the most diverse selections of funding pathways in the industry. The 1-step Experienced account is perfect for those seeking speed, while the Prestige accounts offer a safer static drawdown for conservative risk managers.

The Master Program remains a premium choice for high-conviction traders who want to skip tests. While the upfront fees are higher, the ability to withdraw on day zero provides an immediate return on investment that few other firms can match.

4. Funded Trading Plus rules

Funded Trading Plus operates with a high degree of transparency regarding its operational expectations. They categorize their requirements into hard rules, which result in account closure, and soft rules, where only the trade is penalized.

These protocols are designed to protect firm capital while fostering professional habits. Understanding these nuances is critical for maintaining your funded status and ensuring consistent progress toward your scaling goals.

4.1. General guidelines & allowed practices

The firm provides a flexible environment that encourages various trading styles, provided they align with sound risk management principles. They focus on allowing traders to operate without the typical pressure found at other prop firms.

- Unlimited evaluation access: Traders can purchase any number of challenges to demonstrate their edge across different strategies.

- Predictable static drawdown: Available on Prestige programs, this limit remains fixed regardless of account growth or profit peaks.

- Locked relative drawdown: Once your profit exceeds the initial loss limit, the drawdown permanently locks at the starting balance.

- Flexible trading activity: Accounts remain active as long as you place at least one trade every 30 days to register server activity.

- Account merging options: You can merge untraded live accounts up to $200,000 to centralize your capital management efforts effectively.

4.2. Prohibited trading practices

To ensure a fair environment, FTP strictly prohibits behaviors that bypass its risk assessment or manipulate market data. Violating these Hard Rules will result in the immediate termination of your account.

- Strict copy trading ban: You cannot mirror positions across multiple accounts, as simultaneous directional trades in the same market are forbidden.

- No account management: Third-party passing services are banned; the account owner must be the sole individual trading.

- Daily snapshot breaches: Equity must never drop below the daily limit calculated at the 16:59 EST reset snapshot.

- Maximum live account limits: Traders are generally restricted to two active funded accounts at one time (except for Prestige).

- KYC discrepancies: Using different names or payment methods during sign-up can trigger security flags and lead to account issues.

Verdict on Funded Trading Plus rules

The rules at FTP are remarkably fair, especially the drawdown that stops trailing once you are in profit. This is a massive advantage compared to firms where the drawdown follows you indefinitely.

The 30-day inactivity rule is standard, but the copy trading definition is quite strict. You must be careful not to open the same pair on two different accounts at the same time. Overall, the rules support disciplined traders rather than penalizing them for minor errors.

5. Funded Trading Plus payout structure

The payout system at Funded Trading Plus is designed to be as systematic and efficient as possible for successful traders. They focus on delivering simulated profits within a short timeframe once all program-specific criteria are met.

To initiate a request, your account must be completely flat with no open positions active in the market. The process is managed directly through your dashboard, where a green request button becomes available once you are eligible for payouts.

- Processing time: Standard reviews take approximately two business days, though many are processed the same day.

- Risk reviews: If an account is flagged for closer inspection, the ETA may extend to 5-7 business days for security.

- Withdrawal methods: Traders can choose between cryptocurrency (popular options like Binance/Coinbase) or direct bank transfers.

- Impact on drawdown: It is vital to remember that withdrawals do not lower your high-water mark, which affects your remaining room.

For example, if you earn $5,000 in simulated profit on an 80/20 split, you will receive $4,000 via your chosen method. The firm also reserves the right to issue withdrawals as refunds to your initial payment card when necessary.

Verdict on Funded Trading Plus payouts

The payout structure is one of the firm’s strongest selling points due to its consistency and speed. While the flat account requirement can be a minor inconvenience for swing traders, it ensures a clean risk assessment for the firm.

The 80% starting split is highly competitive, and the ability to scale up to 100% is a rare advantage in the industry. We find their transparency regarding processing times to be superior to many other firms that leave traders in the dark.

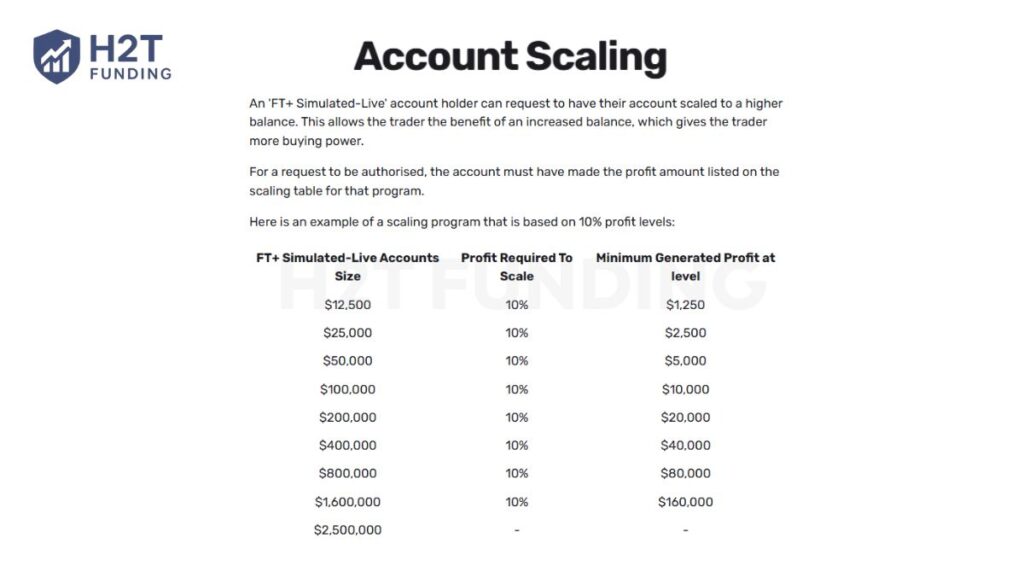

6. Scaling plan of Funded Trading Plus

The scaling plan at Funded Trading Plus is designed to reward long-term performance by significantly increasing your trading capital. Traders can grow their accounts up to a staggering $2.5 million in simulated funds, providing massive buying power for professional traders.

Unlike many competitors, this firm focuses on increasing your balance rather than just your drawdown. This approach allows you to scale your funded account size as often as daily, provided you meet the specific profit milestones required by your chosen program.

6.1. Scaling requirements by program

Each pathway has a tailored set of rules to ensure that risk management remains a priority while you increase your exposure. Below is the breakdown of how to reach the next level:

- Experienced, Premium, and Master Programs: You can request to scale once you reach a 10% simulated profit milestone. There are no time restrictions, and you can even choose to withdraw your profit while scaling (subject to new static loss limits).

- Advanced Program: Due to the higher drawdown allowances, this program requires a 20% simulated profit target to move to the next tier. Scaling is available as soon as this milestone is hit, with no minimum time requirement.

- Prestige Pro and Prestige Lite: These programs require more tenure, needing at least 2 months of account history and one approved withdrawal. Additionally, you must have a withdrawable profit of at least 20% of your starting balance to qualify for a scale-up.

6.2. How the scaling process works

To scale up, you must close all open trades and submit a support ticket. The operations team typically processes these requests within 48 business hours following a successful risk review to ensure your trading discipline remains consistent.

Once approved, your starting balance is increased, and your maximum loss limit is often locked at the new scaled account size. This provides a permanent and predictable risk boundary, allowing you to focus on capturing larger market moves with your increased trading capital.

Verdict on Funded Trading Plus scaling plan

The $2.5 million cap is one of the highest in the industry, making FTP a top destination for serious career traders. We especially like the daily scaling potential for Experienced and Master accounts, which allows for rapid portfolio growth.

While the Prestige programs have a slower 2-month wait time, they offer the most stable static drawdown environment for large-scale capital. Overall, this scaling plan is exceptionally fair and offers a clear, transparent path to professional-level funded trading.

7. Spreads & commission fees

Funded Trading Plus utilizes GooeyTrade as its primary tech provider to manage liquidity and real-time pricing feeds. This partnership ensures that trading conditions remain institutional-grade while maintaining high stability across all platforms.

The firm prides itself on a no-markup policy, meaning it does not add extra costs to default spreads. This transparency allows traders to execute their strategies with minimal slippage and predictable transaction costs.

For most major asset classes, the commission structure is straightforward and competitive. Below is the specific breakdown of trading fees currently applied to the accounts:

- Forex, Metals, and Energy: $7 per round lot.

- Indices and Cryptocurrency: No commission.

- Other Commodities: $7 per round lot.

Standard swaps apply for traders who choose to hold positions overnight for a week-long period. These fees are clearly displayed within the platform, ensuring you can calculate your net performance accurately before requesting withdrawals.

Verdict on Funded Trading Plus spreads & commission fees

The $7 commission for FX is standard, but the zero-commission structure for Indices and Crypto is a massive advantage. We find that the absence of spread markups provides a cleaner environment for scalpers. Overall, the trading conditions are highly optimized for professional-level execution.

8. Funded Trading Plus trading platform

Funded Trading Plus provides a highly flexible environment by offering multiple industry-leading trading platform options. Their current suite includes MT5, cTrader, DXtrade, and Match-Trader, catering to both traditional technical analysts and modern traders.

Each platform is optimized for fast execution and technical stability, ensuring that your trading experience remains professional and uninterrupted. The availability of diverse interfaces allows you to choose a tool that perfectly aligns with your specific charting and execution needs.

Verdict on Funded Trading Plus trading platform

Offering four distinct platforms is a significant advantage in the current market. It ensures that if one technology provider faces issues, traders have reliable alternatives to maintain their performance. The inclusion of cTrader and DXtrade is particularly beneficial for those seeking modern user interfaces.

9. Trading instruments & leverage

The firm offers a comprehensive range of markets, allowing for effective portfolio diversification across multiple asset classes. Traders can access FX Majors, Minors, Exotics, Spot Metals, and various Commodities to capture opportunities in different volatility cycles.

Additionally, the platform provides access to Indices and Cryptos, ensuring that you can trade your preferred edge regardless of the market environment. All trading instruments are subject to broker availability and are regularly updated to ensure optimal liquidity for funded accounts.

Leverage is consistently applied across all program types (Instant, 1-Step, and 2-Step) to support disciplined risk management. Below is the specific leverage ratio for each asset class:

| Asset Class | Instant | 1-Step | 2-Steps |

|---|---|---|---|

| Forex (FX) | 1:30 | 1:30 | 1:30 |

| Spot Metals | 1:30 | 1:30 | 1:30 |

| Indices | 1:20 | 1:20 | 1:20 |

| Energy | 1:30 | 1:30 | 1:30 |

| Cryptocurrency | 1:2 | 1:2 | 1:2 |

| Other Commodities | 1:30 | 1:30 | 1:30 |

Verdict on trading instruments & leverage

The 1:30 leverage for Forex and Metals is perfectly balanced for professional-level risk control. While the 1:2 leverage for Crypto is conservative, it serves as a crucial safety net against extreme volatility. This structure prioritizes long-term account survival over high-risk gambling.

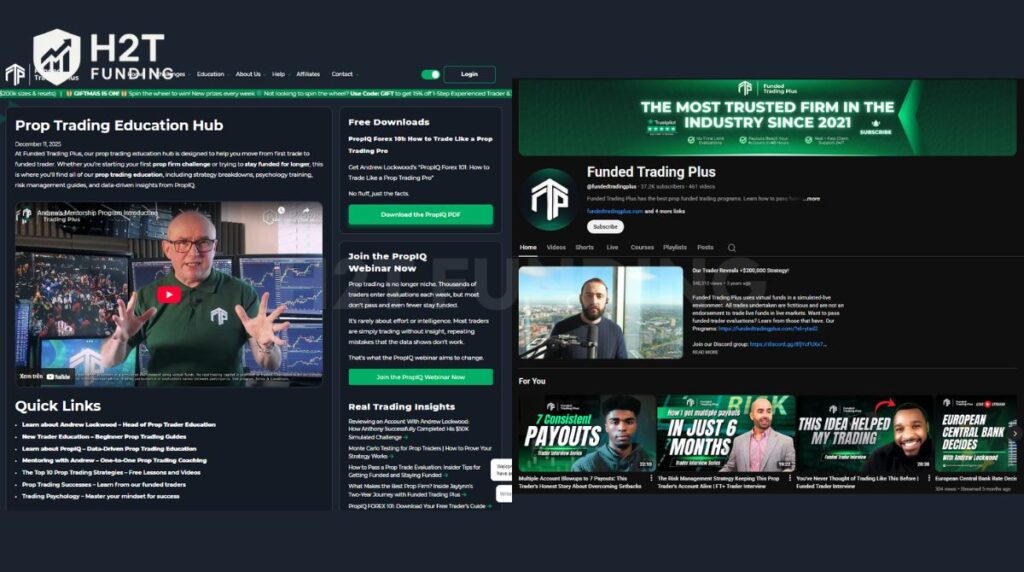

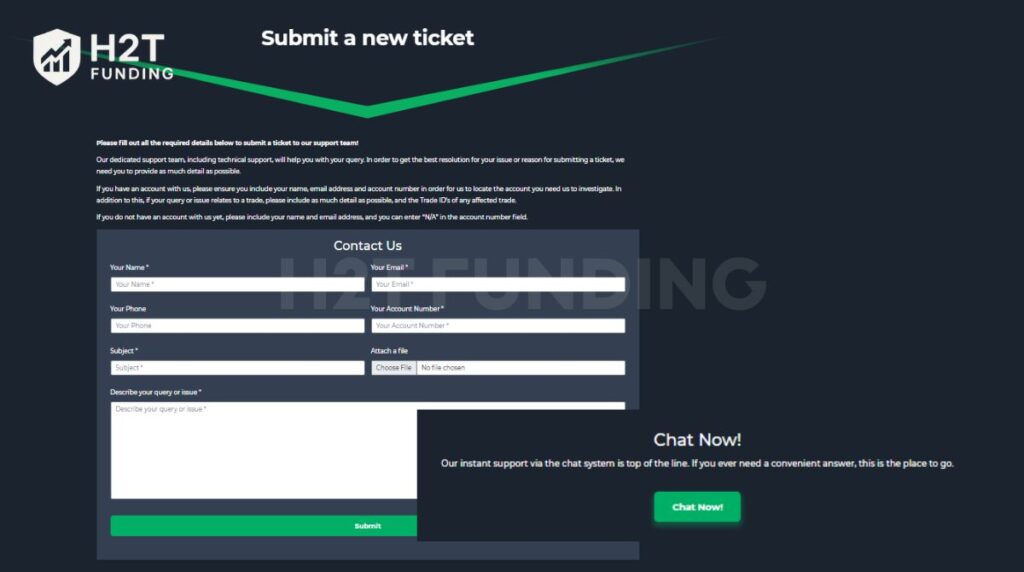

10. Education & customer support

Funded Trading Plus offers a robust support network through a 24/7 live chat and a dedicated email ticketing system. This ensures that traders worldwide can receive immediate assistance for account issues or program clarifications regardless of their time zone.

The platform also maintains a comprehensive Help Center featuring detailed drawdown and withdrawal guides. These resources are designed to provide total transparency, allowing you to master the firm’s specific protocols without needing to wait for a representative.

Beyond simple funding, the firm provides an extensive educational suite, including mentoring and success stories. Their content covers critical topics like trading psychology and beginner education, helping users refine their strategies and maintain long-term discipline.

Their active YouTube channel further supports the community with real-life trader interviews and deep-dive strategy reveals. By sharing proprietary data and expert insights, the firm fosters a transparent environment that encourages professional growth for all members.

Verdict on Funded Trading Plus education & customer support

The firm’s commitment to education is far superior to most silent prop firms that only provide capital. The 24/7 live chat is exceptionally responsive, and the inclusion of high-quality mentoring adds significant value to the overall experience. While the education is self-driven, the wealth of available resources and success stories provides a clear roadmap for anyone looking to scale their trading career.

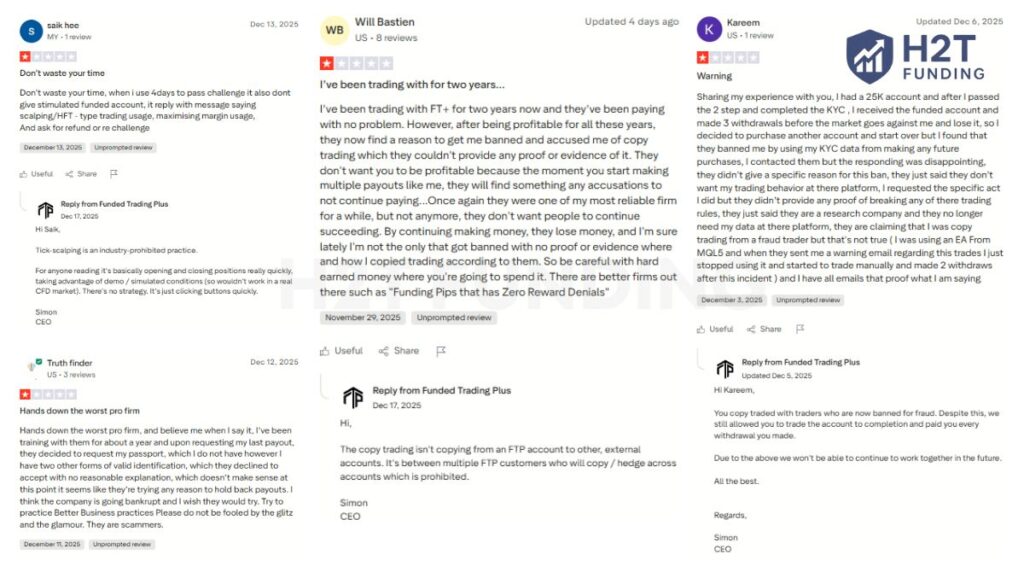

11. Real trader feedback: Funded Trading Plus Trustpilot and Funded Trading Plus review Reddit

As of December 30, 2025, Funded Trading Plus currently holds a strong Excellent rating of 4.4 stars on Trustpilot, reflecting high community trust across thousands of verified reviews. Most traders express significant satisfaction with the firm’s professionalism and the honesty of their account review process.

Positive testimonials frequently highlight the exceptional responsiveness of the support team, even during weekend hours. Successful traders often mention that the firm consistently honors its word regarding live account delivery, usually completing the transition within two business days.

It is also important to note that a noticeable portion of negative Trustpilot and Reddit feedback mentions delayed or declined payouts, strict KYC procedures, and accounts being closed after rapid profit accumulation. Some traders report that their accounts were flagged for risk violations even when they believed they were trading manually and within the stated rules.

These complaints indicate that Funded Trading Plus applies very strict internal risk reviews, and while many traders are paid without issue, there is a real risk of payout disputes for traders who use aggressive or high-frequency strategies.

On platforms like Reddit, users often discuss the nuances of the trading rules, suggesting that beginners should study the terms carefully before starting. Many experienced members of the community praise the three-day payout frequency and the robust scaling plan as major competitive advantages.

Some Reddit discussions compare FTP to other firms, noting that while the rules are strict, they provide a more realistic professional environment than gamified prop firms. This sentiment reinforces the firm’s reputation as a serious destination for those seeking long-term capital growth.

Overall, while there are occasional disputes regarding strict rule enforcement, the prevalent feedback still points to a highly reliable and legitimate firm. Many in the community view Funded Trading Plus as a top-tier choice for disciplined traders who prioritize fast payouts and clear communication. These are also key traits of the best prop firms with the fastest payout in the industry.

Important: As with most proprietary trading firms, trader experiences vary widely. Traders should carefully review all terms and trade conservatively to minimize the chance of payout issues.

For readers who want a broader industry perspective, this is are prop firms legit guide that provides helpful context before choosing any proprietary trading firm.

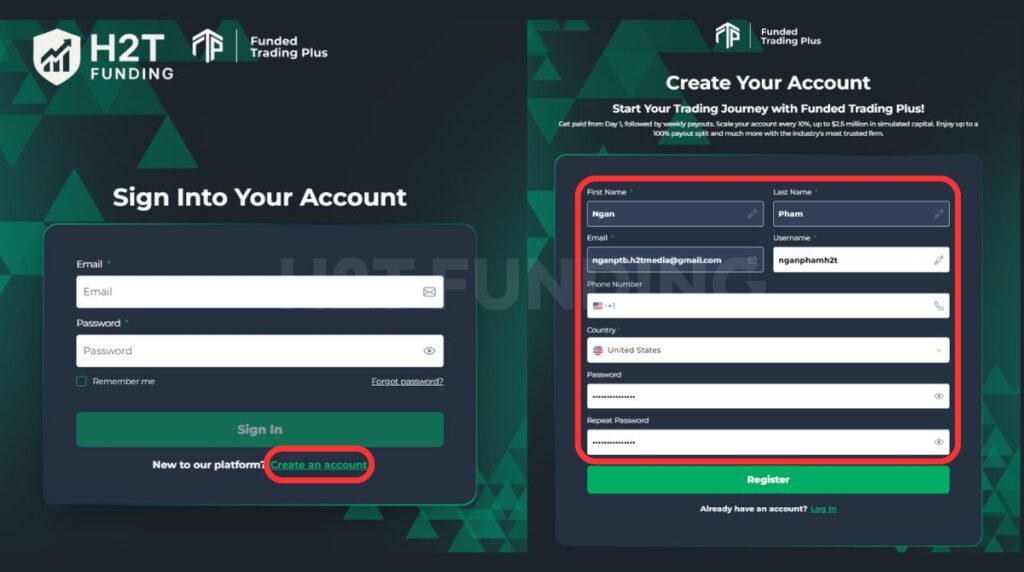

12. How to sign up for Funded Trading Plus

Joining Funded Trading Plus is a streamlined process designed to get you into the markets as quickly as possible. By following a structured registration path, you can establish your professional profile and secure your funding path in just a few minutes.

The registration process involves several key phases:

- Step 1: Creating your unique user credentials.

- Step 2: Accessing the member dashboard.

- Step 3: Selecting and customizing your specific challenge.

- Step 4: Completing the secure checkout process.

Read our detailed step-by-step instructions below to ensure your account is configured correctly from the start.

12.1. Step 1: Create your official account

Begin by visiting the official website and selecting the Login button to reach the sign-in screen. From there, choose Create an account and fill in your personal details, including your full name, email, phone number, and country of residence, to set up your secure profile.

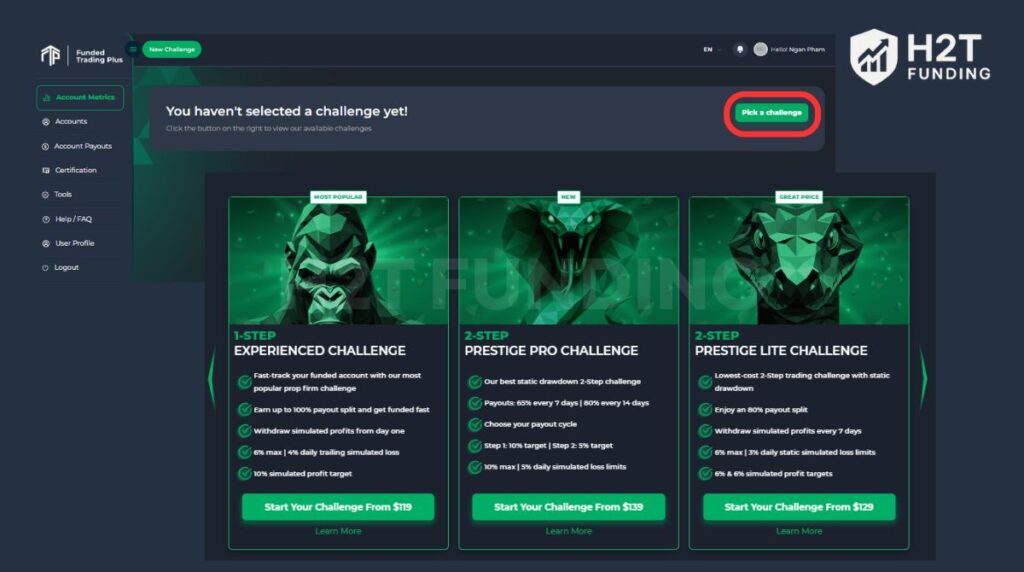

12.2. Step 2: Access the dashboard and pick a challenge

Once registered, log in to view your primary dashboard, which will prompt you to select a funding program. You can browse through the different challenge tiers, such as the Experienced, Prestige Pro, or Prestige Lite programs, and click the green button to begin your preferred path.

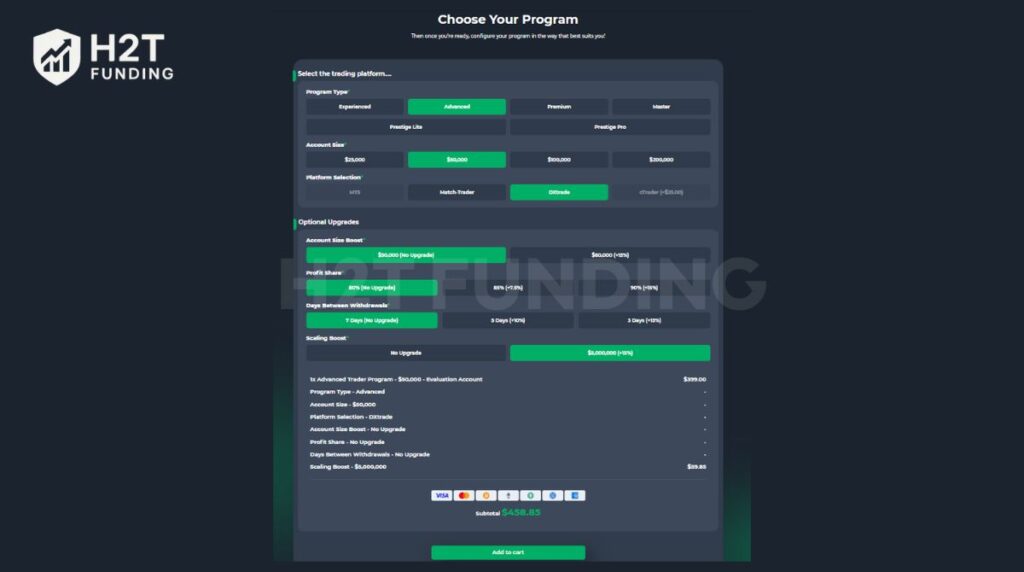

12.3. Step 3: Configure your program settings

After picking a challenge, you must define the specific parameters of your account. You’ll choose your initial account size and trading platform, such as MT5 or DXtrade. Optional upgrades include a 90% profit split and a 3-day withdrawal cycle.

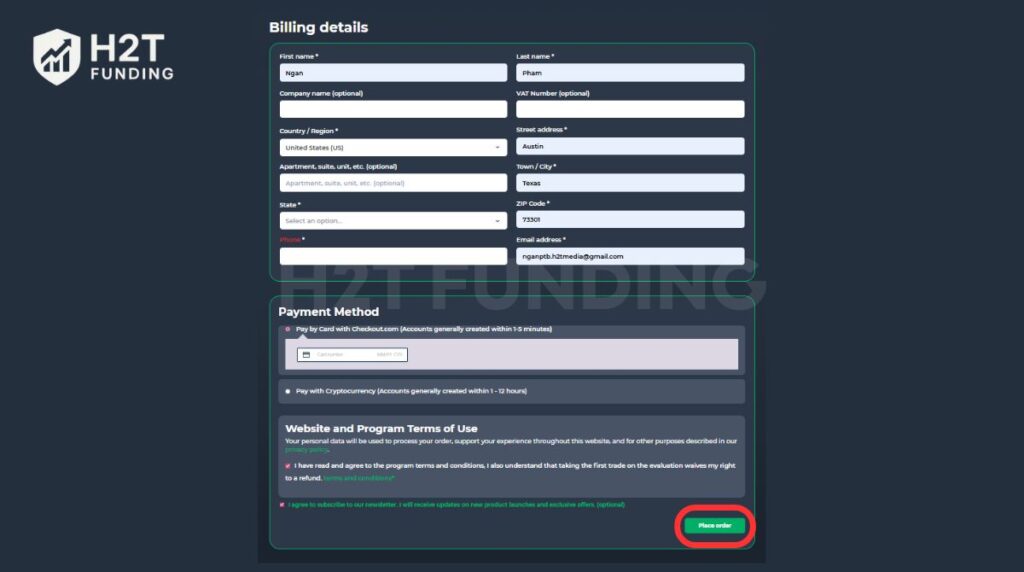

12.4. Step 4: Complete billing and payment

The final stage requires entering your billing address and selecting a payment method. You can pay instantly via credit card for a 5-minute setup or use cryptocurrency for a secure alternative. Once you agree to the terms and click Place order, your credentials will be delivered to your email inbox.

Following these steps ensures that you enter the evaluation phase with the correct settings and platform credentials. By carefully configuring your program and completing the secure payment, you can immediately begin your journey toward managing professional trading capital.

13. Funded Trading Plus restricted countries

Funded Trading Plus maintains a global presence but must adhere to strict international sanctions and regulatory frameworks. Consequently, certain jurisdictions are currently excluded from accessing their trading programs to ensure full operational compliance with global financial laws.

Traders residing in the following locations are prohibited from opening accounts:

- Cuba

- North Korea (Democratic People’s Republic of)

- Syria

- Islamic Republic of Iran

- Myanmar

- Ukraine (Specifically the regions of Crimea, Donetsk, Luhansk, Kherson, and Zaporizhzhya)

- Pakistan

- Vietnam

The firm strongly advises individuals in these regions against placing any orders or purchasing challenges. Because of the active sanctions, the company cannot guarantee the processing of refunds or the successful delivery of payouts earned through trading activity.

The company frequently reviews these restrictions to potentially offer services in more regions when legal conditions permit. It is your responsibility to regularly check the official legal disclaimer in the website footer, as the list of prohibited countries may be updated without prior notice.

14. Compare Funded Trading Plus vs other prop firms

Selecting the right partner requires a clear side-by-side evaluation of the industry’s top contenders. While Funded Trading Plus offers a high-performance environment, comparing it with alternatives like Maven, FundedNext, and SeacrestFunded helps identify the best fit for your specific trading goals.

The following table provides a direct comparison based on the core criteria most important to professional traders in 2026:

| Criteria | Funded Trading Plus | Maven Trading | FundedNext | SeacrestFunded |

|---|---|---|---|---|

| Challenge Fee | $119 – $4,500 | $13 – $440 | $32 – $1,099 | $40 – $500 |

| Account Types | 1-step, 2-step, Instant | 1-step, 2-step, 3-step, Instant | 1-step, 2-step, Instant | 1-step, 2-step, 3-step |

| Profit Split | 80% – 100% | 80% | 80% – 95% | 80% – 90% |

| Account Size | $5K – $200K | $2K – $100K | $2K – $200K | $5K – $100K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 10% | 3% – 8% | 4% – 10% | 5% – 10% |

| Platforms | MT5, cTrader, MatchTrader, DXtrade | MT5, cTrader, Match Trader | MT4, MT5, cTrader, Match Trader | MT5, Match Trader, TradingView |

| Asset Types | FX, Indices, Crypto, Commodities | Forex, Indices, Commodities | FX, Indices, Crypto, Commodities, CFDs | FX, Indices, Crypto, Commodities |

To help you choose the ideal platform for your trading style, we have analyzed the specific strengths of each firm:

- Funded Trading Plus: Best for professional traders seeking the highest possible capital scaling (up to $2.5M) and the potential for a 100% profit share.

- Maven Trading: Ideal for beginners or micro-account traders who want the lowest possible entry barrier with fees starting at just $13.

- FundedNext: Best for those who require MT4 access or seek a high starting profit split of up to 95% through specific add-ons.

- SeacrestFunded: The top choice for traders who prefer using TradingView as their primary execution interface or want a structured 3-step evaluation.

When evaluating these firms, it becomes clear that each caters to a different niche within the prop trading industry. Choosing the right firm depends on your initial budget and whether you prioritize specific platform access or long-term profit-sharing potential.

15. Should I choose Funded Trading Plus?

Deciding whether to commit your time and capital to Funded Trading Plus depends heavily on your specific trading style and professional goals. While they are a premier prop firm, it is essential to weigh their unique benefits against the strictness of their operational rules.

Why you should choose this firm

- Zero time pressure: The absence of evaluation deadlines allows you to wait for high-probability setups, which greatly improves your psychological well-being and long-term consistency.

- Superior scaling: The potential to manage up to $2.5 million makes them a top destination for those aiming to build a legitimate, high-level career in the industry.

- Program diversity: Whether you want to skip the challenge with instant funding or prove yourself via a 1-step evaluation, their account options offer unmatched flexibility.

Why you might reconsider

- Uncompromising risk rules: The firm has a zero-tolerance policy for copy trading or tick-scalping, which might feel too restrictive for certain aggressive strategies.

- Drawdown calculations: The relative drawdown on some programs can be complex for beginners to track, requiring meticulous attention to your account peaks.

- Weekend restrictions: Some programs prohibit weekend holdings, which could be a significant deal-breaker for long-term swing traders who hold positions over several days.

- Strict payout and compliance reviews: Some traders report delayed, declined, or disputed payouts due to internal risk investigations or KYC verification, which may be frustrating for traders who use fast or high-frequency execution styles.

In conclusion, Funded Trading Plus is an excellent choice for disciplined traders who value transparency and professional capital over gamified features.

If you are serious about trading discipline and want a reliable partner that rewards consistency with a 100% profit split, this firm is among the best. However, if your trading strategy relies on mirroring others or high-frequency automated execution, you may find their environment challenging.

16. Is Funded Trading Plus legit?

Yes, Funded Trading Plus is a legitimate and highly reputable prop firm based in the UK. Since its establishment in 2021, it has consistently delivered real-world payouts and maintained high transparency with its global community of traders.

Their legitimacy is proven by thousands of verified reviews on Trustpilot, where they maintain an Excellent rating. The firm is legally registered as FTP London Ltd, providing a secure environment for your trading career and significant capital growth.

17. Common mistakes that traders make result in payout delays at FTP

Even successful traders often face unnecessary hurdles because they overlook subtle procedural details. Avoiding these common traps is essential to ensure your profits are delivered on time without triggering security flags. Below are the primary reasons why withdrawals might be paused or denied during the review phase:

- Submitting requests with open positions: The most common technical error is attempting a payout while trades are active. The withdrawal button remains disabled until your account is completely flat, so you must close everything before clicking the request.

- Violating the copy trading policy: Many fail to realize that opening the same market positions across multiple FTP accounts simultaneously is prohibited. This counts as a hard breach and will likely result in a permanent denial of your earned profit.

- KYC and billing discrepancies: Using a third-party payment method or having a name mismatch on your ID causes severe delays. You must ensure all payment details align perfectly with your verified profile to pass the firm’s mandatory security checks.

- Incurring daily snapshot breaches: Misunderstanding the 16:59 EST equity reset can lead to accidental rule violations. Traders often forget that the daily limit uses the higher value of balance or equity, causing them to breach right before a payout.

- Using prohibited automated strategies: If your EA utilizes tick-scalping or HFT-style execution, the firm will flag it as “gaming” the simulated environment. You must verify that your algorithmic trading follows real-market logic to avoid having your payouts nullified.

Most delays are entirely avoidable if you treat the evaluation as a professional business operation. We recommend meticulously reviewing the FAQ and Help Center before your first request to ensure you meet all withdrawal criteria. By maintaining strict trading discipline and following the administrative rules, you can enjoy a seamless and fast payout experience.

18. FAQs

Traders can choose between MT5, cTrader, MatchTrader, and DXtrade. These platforms offer stable connections and institutional-grade tools to ensure high-performance execution across all account types.

The firm offers a highly competitive profit share that starts at 80% and can increase to a full 100% share. This progression is based on your account milestones and consistent performance over time.

Initial account sizes range from $5,000 to $200,000. Through the firm’s robust scaling plan, successful traders can grow their capital up to $2.5 million in simulated funds.

The platform supports a wide variety of assets, including Forex majors/minors, spot metals, indices, energy, and cryptocurrencies. This diversity allows you to capture opportunities across multiple global markets effectively.

Yes, the Master Program allows you to bypass the evaluation phase entirely. You can start trading with immediate capital and request payouts from your very first day of market activity.

The firm provides a maximum leverage of 1:30 for Forex and Metals, while Indices are set at 1:20. Cryptocurrency trading is restricted to a more conservative 1:2 ratio to manage extreme volatility.

Yes, news trading is fully permitted at Funded Trading Plus. The firm does not impose restrictive rules on news volatility, allowing you to execute your strategy during major economic releases.

Daily loss limits typically range from 3% to 6%, while maximum total drawdown is between 6% and 10%. These limits vary depending on whether you choose a static or relative drawdown program.

Profit withdrawals are processed via cryptocurrency or international bank transfers. You can request a payout directly through your dashboard once your account is flat and meets the withdrawal criteria.

Yes, the initial audition fee is 100% refundable on most challenge programs. You qualify for this refund once you reach a 10% profit milestone on your live funded account.

Internal hedging and copy trading across different accounts are prohibited. The firm requires all traders to execute their accounts independently and avoid mirroring positions to maintain fair risk assessment.

Customer support is available 24/7 via live chat and email ticketing. This ensures that traders in any time zone can receive immediate technical assistance or account clarifications whenever needed.

Standard withdrawal requests are usually reviewed and processed within two business days. Many traders report receiving their funds on the same day, making it one of the fastest systems in the industry.

Yes, the use of EAs and algorithmic trading is fully supported. However, you must ensure your tools do not utilize prohibited practices like tick-scalping, high-frequency trading (HFT), or latency arbitrage.

The lowest entry point is $119 for the $12,500 Experienced Challenge. This affordable fee makes it accessible for traders to begin their journey toward securing professional capital with minimal risk.

Yes, the firm is highly regarded for its consistent and reliable payout history. Most withdrawals are processed within 48 hours once the risk review is completed. You can find thousands of payment proofs shared by the community on Trustpilot and Reddit, confirming their financial credibility.

No, Funded Trading Plus is not authorized or regulated by the Financial Conduct Authority (FCA). This is because the firm does not provide regulated financial services; it offers simulated trading programs using virtual funds with no real monetary value. Since users are not investing their own capital and are trading in a simulated live environment, the firm’s services fall outside traditional financial regulation.

Yes, many professional traders earn a substantial income by managing the firm’s capital. Success is not guaranteed and depends entirely on your ability to maintain trading discipline and follow risk rules. Those who master their strategy enjoy profit splits of up to 100%, providing a significant financial reward for their expertise.

19. Conclusion

This Funded Trading Plus Review confirms that the firm remains a premier choice for traders in 2026. By eliminating time limits and offering a 100% profit share, it successfully addresses the core needs of professional individuals seeking stability.

While the strict ban on copy trading requires high trading discipline, the overall environment is highly conducive to long-term growth. It remains one of the most reliable platforms for securing substantial trading capital without the usual industry pressure.

If you are still evaluating your options, we invite you to explore our other prop firm reviews to find your perfect fit. Visit the H2T Funding to discover more in-depth insights and stay updated on the latest market shifts.