Choosing a partner that offers institutional-grade stability is vital when scaling your career to a $2,000,000 account. Blueberry Funded bridges this gap by operating as a broker-backed entity, ensuring that your trading environment remains professional and transparent.

This Blueberry Funded review provides a deep dive into their evaluation phases to help you navigate the specific trading rules effectively. You will discover how their scaling plans and payout structures actually perform under real-market conditions to secure your financial growth.

1. What is Blueberry Funded?

Blueberry Funded is a leading broker-backed proprietary trading firm powered by the infrastructure of Blueberry Markets. This strategic partnership ensures that traders operate within a highly stable environment with institutional-grade liquidity and execution.

The firm has established a strong reputation with over 15,000 active traders and a proven track record of $3.6M+ in total payouts. They offer various audition paths, including no-time-limit evaluations and instant funding, allowing for a flexible transition into professional trading.

Traders can manage up to $2,000,000 in simulated capital across diverse asset classes like Forex, Crypto, and Metals. By providing access to top-tier platforms such as MT4, MT5, and DXTrade, they cater to both traditional and modern technical requirements.

2. Our take on Blueberry Funded

Blueberry Funded is built for serious scaling, prioritizing consistent trade quality over high-risk gambling behaviors. It is refreshing to operate in an environment where the execution actually matches live market conditions without artificial slippage or platform freezes.

Reviewing their operational model reveals a clear focus on data integrity and transparency. The connection to Blueberry Markets serves as a massive safety net, but the professional rule set can be a double-edged sword. While it ensures firm longevity, rules like the news trading window and one-sided bets require a very disciplined approach.

For those specializing in Synthetic Indices, the 24/7 market access is an elite feature we haven’t found elsewhere. However, if you are a crypto-focused trader, the 1:2 leverage feels too restrictive and might limit your ability to capitalize on major market moves.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Blueberry Funded websites before purchasing any challenge.

| Pros | Cons |

|---|---|

| Offers unlimited time to complete evaluation phases without any calendar pressure. | Implements strict policies against one-sided bets and excessive position stacking. |

| Provides unique 24/7 Synthetic Indices for trading independent of traditional market hours. | Enforces a complex news trading window that can lead to profit removal. |

| Supports a diverse range of platforms, including MT4, MT5, DXTrade, and TradeLocker. | Utilizes trailing drawdown models for both Rapid and Instant funding accounts. |

| Features a professional scaling plan allowing growth up to $2,000,000 in capital. | |

| Allows traders to upgrade to a 90% profit split and weekly payout cycles. |

3. Blueberry Funded funding program

Blueberry Funded offers seven distinct funding models to match diverse risk appetites and strategic approaches. These programs feature flexible profit targets between 5% and 10% and provide a standard 80% profit split for successful traders.

The variety of accounts ensures that both aggressive scalpers and patient swing traders can find an optimal entry point. This multi-tiered structure is essential for traders looking to scale their managed capital professionally.

3.1. Rapid challenge

The Rapid challenge is a high-speed, single-phase evaluation designed for traders who want to access capital in the shortest time possible. Unlike traditional models, this program requires you to reach your profit target within a strict 7-day window, making it ideal for aggressive day traders.

Traders must navigate a 4% trailing drawdown while maintaining a 3% daily loss limit. Below is the detailed breakdown of the requirements for each account size:

| Account Size | Profit Target (5%) | Max Total Loss (4% Trailing) | Daily Loss (3%) | Audition Fee |

|---|---|---|---|---|

| $10,000 | $500 | $400 | $300 | $50.00 |

| $25,000 | $1,250 | $1,000 | $750 | $100.00 |

| $50,000 | $2,500 | $2,000 | $1,500 | $200.00 |

| $100,000 | $5,000 | $4,000 | $3,000 | $300.00 |

Once you pass and reach the funded stage, the minimum trading days requirement is 3 days. This model offers an 80% profit share with bi-weekly payouts, rewarding those who can handle high-pressure environments.

3.2. 1-step challenge

The 1-step evaluation provides a streamlined path to funding with no time restrictions. It allows traders to work at their own pace while aiming for a straightforward profit target without the pressure of a ticking clock.

This model utilizes a 6% static maximum loss, which is significantly safer than trailing drawdown models for long-term account management. Traders must maintain a 4% daily loss limit calculated based on the higher of the previous day’s equity or balance.

| Account Size | Profit Target (10%) | Max Total Loss (6% Static) | Daily Loss (4%) | Audition Fee |

|---|---|---|---|---|

| $5,000 | $500 | $300 | $200 | $40.00 |

| $10,000 | $1,000 | $600 | $400 | $75.00 |

| $25,000 | $2,500 | $1,500 | $1,000 | $150.00 |

| $50,000 | $5,000 | $3,000 | $2,000 | $275.00 |

| $100,000 | $10,000 | $6,000 | $4,000 | $550.00 |

| $200,000 | $20,000 | $12,000 | $8,000 | $1,100.00 |

A minimum of 3 trading days is required during both the evaluation and funded stages to ensure consistency. Successful traders receive an 80% profit share with payouts processed every 14 days, providing a reliable income stream for disciplined performers.

3.3. 2-step challenge

The 2-step evaluation is a traditional funding model that provides traders with more breathing room and higher leverage. By splitting the profit target into two phases, the firm allows you to demonstrate consistency while benefiting from a static 10% maximum loss.

This program offers FX leverage of 1:50, which is higher than the single-step models, giving you more flexibility in position sizing. There are no time limits, meaning you can wait for the perfect setups without the stress of an expiration date.

| Account Size | Phase 1 (10%) | Phase 2 (5%) | Max Loss (10% Static) | Daily Loss (5%) | Audition Fee |

|---|---|---|---|---|---|

| $5,000 | $500 | $250 | $500 | $250 | $35.00 |

| $10,000 | $1,000 | $500 | $1,000 | $500 | $60.00 |

| $25,000 | $2,500 | $1,250 | $2,500 | $1,250 | $125.00 |

| $50,000 | $5,000 | $2,500 | $5,000 | $2,500 | $250.00 |

| $100,000 | $10,000 | $5,000 | $10,000 | $5,000 | $500.00 |

| $200,000 | $20,000 | $10,000 | $20,000 | $10,000 | $1,000.00 |

A minimum of 3 trading days is required for each phase to ensure your performance is not based on a single lucky trade. Once funded, you maintain an 80% profit share with payouts every 14 days, supported by the stable execution environment found in this Blueberry Funded review.

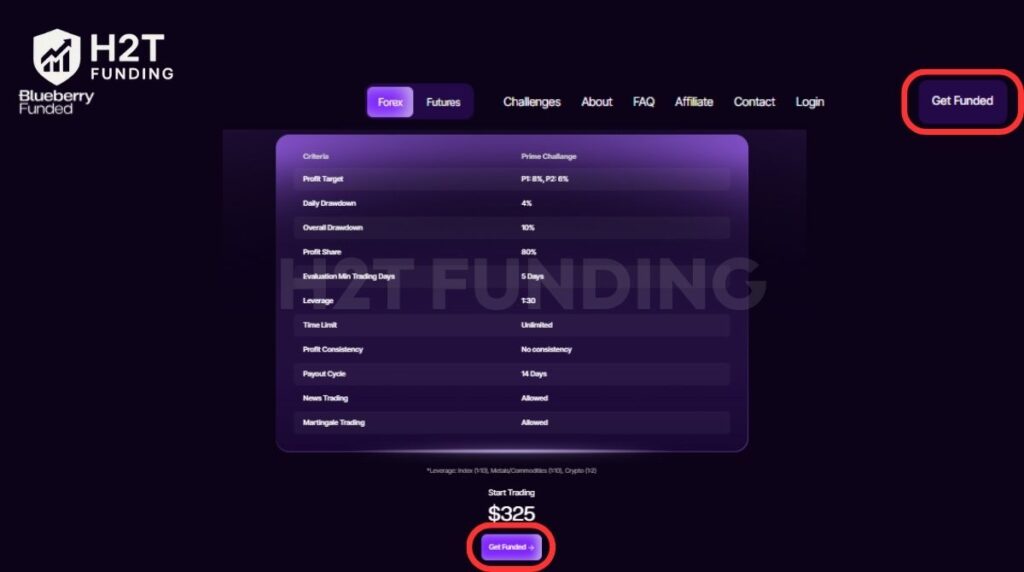

3.4. 2-step prime challenge

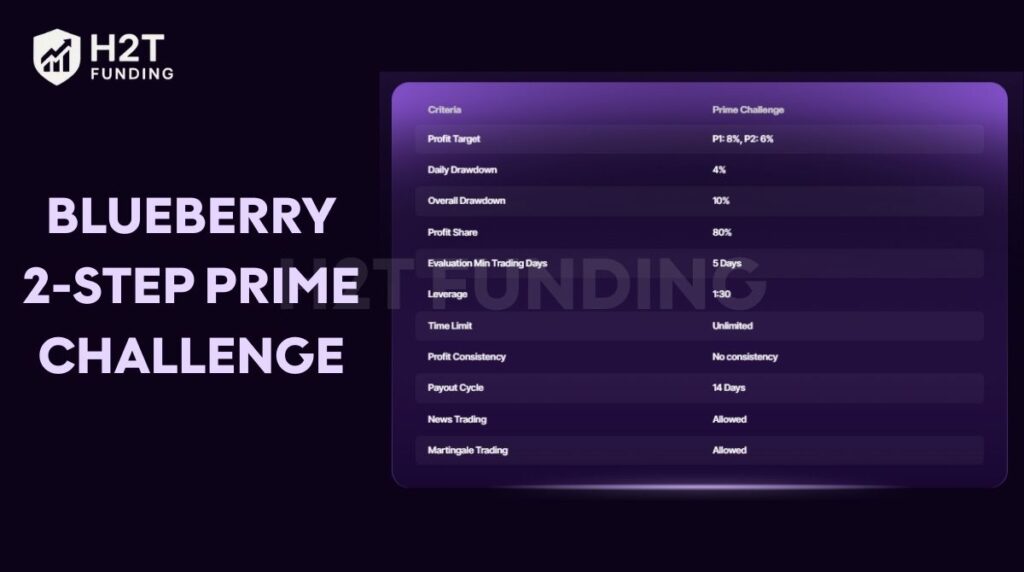

The Prime 2-step challenge is widely considered the most balanced and flexible funding path offered by the firm. It is specifically built for traders who require higher operational freedom, allowing for both news trading and martingale strategies.

Unlike other models, the Prime account has no profit consistency rules, ensuring that a single large trade won’t disqualify your payout eligibility. This program focuses on long-term professional growth by providing a generous 10% overall drawdown buffer and bi-weekly payout cycles.

| Account Size | Phase 1 (8%) | Phase 2 (6%) | Daily Loss (4%) | Overall Loss (10%) | Audition Fee |

|---|---|---|---|---|---|

| $5,000 | $400 | $300 | $200 | $500 | $55.00 |

| $10,000 | $800 | $600 | $400 | $1,000 | $90.00 |

| $25,000 | $2,000 | $1,500 | $1,000 | $2,500 | $165.00 |

| $50,000 | $4,000 | $3,000 | $2,000 | $5,000 | $325.00 |

| $100,000 | $8,000 | $6,000 | $4,000 | $10,000 | $650.00 |

Traders must complete a minimum of 5 trading days in each phase to prove their strategy’s reliability. With 1:30 leverage and no time limits, this challenge remains the top choice for those seeking a professional and unrestricted trading experience.

3.5. Synthetic challenge

The Synthetic challenge is a specialized two-phase evaluation designed for traders focusing on synthetic indices. It offers a unique opportunity to trade simulated markets 24/7, independent of traditional global economic hours or high-impact news events.

This model provides a robust risk structure with a 10% static maximum loss buffer. The daily loss limit is set at 4%, calculated based on the higher of the previous day’s balance, ensuring clear boundaries for capital protection during volatile moves.

| Account Size | Phase 1 (10%) | Phase 2 (5%) | Max Loss (10%) | Daily Loss (4%) | Audition Fee |

|---|---|---|---|---|---|

| $5,000 | $500 | $250 | $500 | $200 | $25.00 |

| $10,000 | $1,000 | $500 | $1,000 | $400 | $50.00 |

| $25,000 | $2,500 | $1,250 | $2,500 | $1,000 | $115.00 |

| $50,000 | $5,000 | $2,500 | $5,000 | $2,000 | $225.00 |

| $100,000 | $10,000 | $5,000 | $10,000 | $4,000 | $450.00 |

Traders can utilize 1:30 leverage on Synthetics with no time limits to complete the phases. A minimum of 3 trading days is required, and successful partners enjoy an 80% profit share with bi-weekly payout cycles for consistent performance.

3.6. Instant Elite

The Instant Elite program is specifically designed for seasoned traders who wish to bypass evaluation phases and begin earning immediately. This model removes the pressure of reaching specific profit targets, allowing you to focus entirely on consistent risk management and long-term capital growth.

A critical feature of this account is the Trailing Lock drawdown set at 10%. While the program offers the freedom of having no daily loss limit, traders must remain disciplined as the trailing mechanism locks to protect the firm’s simulated capital as their equity increases.

| Account Size | Profit Target | Max Total Loss (10% Trailing) | Funded Min Days | Audition Fee |

|---|---|---|---|---|

| $2,500 | None | $250 | 5 Days | $100.00 |

| $5,000 | None | $500 | 5 Days | $200.00 |

| $10,000 | None | $1,000 | 5 Days | $400.00 |

| $25,000 | None | $2,500 | 5 Days | $800.00 |

| $50,000 | None | $5,000 | 5 Days | $1,500.00 |

Traders can utilize 1:30 leverage on FX pairs with no time restrictions on their trading activity. Once you complete the minimum 5 trading days, you are eligible for an 80% profit share paid out every 14 days, making it one of the most direct paths to professional funding in this Blueberry Funded review.

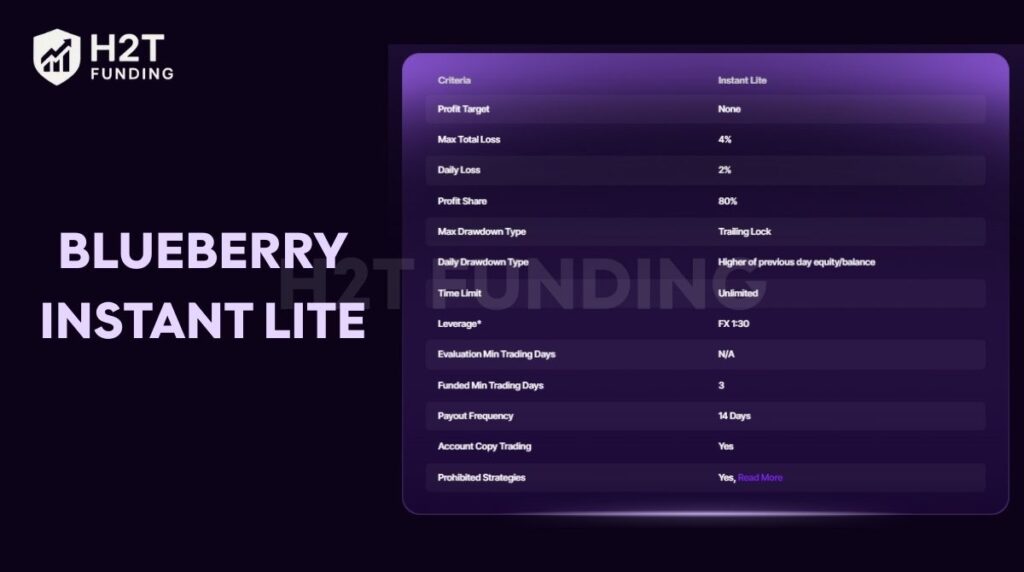

3.7. Instant Lite

The Instant Lite program provides an affordable entry into live-simulated funding without an audition phase. It is designed for traders who prioritize consistent risk control over large drawdown buffers, offering a direct path to an 80% profit share.

Unlike the Elite version, Lite features a tighter 4% trailing lock drawdown and a 2% daily loss limit. This requires a highly disciplined approach to ensure that short-term market noise doesn’t trigger a breach of the account’s strict limits.

| Account Size | Profit Target | Max Loss (4% Trailing) | Daily Loss (2%) | Audition Fee |

|---|---|---|---|---|

| $1,250 | None | $50 | $25 | $37.04 |

| $2,500 | None | $100 | $50 | $55.56 |

| $5,000 | None | $200 | $100 | $83.33 |

| $10,000 | None | $400 | $200 | $125.00 |

| $25,000 | None | $1,000 | $500 | $187.50 |

| $50,000 | None | $2,000 | $1,000 | $375.00 |

| $100,000 | None | $4,000 | $2,000 | $750.00 |

Traders must trade at least 3 days before withdrawing profits, with cycles occurring every 14 days. It is an ideal starting point for those wanting to test their execution on a live-payout account with minimal upfront financial commitment.

Verdict on Blueberry Funded funding program

The sheer variety of programs at Blueberry Funded is impressive, but it can be overwhelming for new traders. Having seven different models suggests they aim to capture every possible niche, from aggressive scalpers to long-term swing traders.

The Prime 2-step is undoubtedly their best product because it removes consistency rules and allows for news trading. If you are a disciplined professional, the static drawdown and larger buffer give you the highest probability of maintaining the account long-term.

On the other hand, the Rapid challenge feels like a high-risk gamble due to the 7-day limit and trailing drawdown. It only suits high-frequency scalpers with an extremely high win rate. The Instant accounts are expensive, but they are perfect for those with a proven edge who want to skip the evaluation stress entirely.

4. Blueberry Funded rules

Navigating the rulebook is the most critical part of any Blueberry Funded review. Because this firm is broker-backed, its guidelines are designed to filter out gamblers and reward those with professional risk management habits.

The firm emphasizes transparency and data integrity. They use your trading data to monetize in live markets, which is why they have specific restrictions on certain behaviors that disrupt market-neutral strategies.

4.1. General guidelines & allowed practices

Blueberry Funded is relatively flexible regarding holding styles and automation. Unlike many competitors, they allow you to maintain your edge across various market conditions without forcing you to close positions prematurely.

- Weekend & Overnight Holding: Fully permitted across all account types and phases. You can trade Cryptocurrencies 24/7.

- Copy Trading: Allowed between accounts you personally own. Software like Traders Connect or Social Trader Tools is compatible.

- Expert Advisors (EAs): Traders are welcome to use bots and EAs to automate their strategies, provided they don’t engage in prohibited high-frequency tactics.

- Stop Loss: Highly recommended but not mandatory. You won’t be blamed for forgetting a stop loss, though it is vital for long-term survival.

- Inactivity Rule: You must place at least one trade every 30 days to keep the account active and avoid suspension.

- IP & Device Policy: You can log into two devices simultaneously (e.g., PC and Mobile). Only one account per household/IP is allowed.

- International Travel: If trading from a different country, you must notify support via email with your itinerary to avoid an IP-related hard breach.

Minimum profitable trading days

Blueberry Funded has a unique requirement: a trading day only counts if you gain at least 0.5% of the initial balance.

| Account Size | Profit Required per Day (0.5%) | Min Days (1-Step/2-Step) | Min Days (Instant Elite) |

|---|---|---|---|

| $10,000 | $50 | 3 Days | 5 Days |

| $50,000 | $250 | 3 Days | 5 Days |

| $100,000 | $500 | 3 Days | 5 Days |

Tiered Lot Size Restrictions

To align risk with capital, the firm implements a maximum lot size system based on your account balance.

1-Step, 2-Step & Rapid challenges

| Asset Class | $5,000 | $10,000 | $25,000 | $50,000 | $100,000 | $200,000 |

|---|---|---|---|---|---|---|

| XAU/USD | ~0.10 | ~0.20 | ~0.5 | ~1 | ~2 | ~4 |

| XAG/USD | ~0.2 | ~0.4 | ~1.0 | ~2.0 | ~4.0 | ~8.0 |

| DJ30 | ~0.05 | ~0.1 | ~0.25 | ~0.5 | ~1 | ~2 |

| NAS100 | ~0.1 | ~0.2 | ~0.5 | ~1 | ~2 | ~4 |

| SP500 | ~0.4 | ~0.8 | ~2 | ~4 | ~8 | ~16 |

| GER40 | ~0.1 | ~0.2 | ~0.5 | ~1 | ~2 | ~4 |

| BTC/USD | ~0.05 | ~0.1 | ~0.25 | ~0.5 | ~1 | ~2 |

| ETH/USD | ~2 | ~4 | ~10 | ~20 | ~40 | ~80 |

| SOL/USD | ~2 | ~4 | ~10 | ~20 | ~40 | ~80 |

| FOREX | ~0.6 | ~1.2 | ~3 | ~6 | ~12 | ~24 |

| Other Indices | ~0.3 | ~0.6 | ~1.5 | ~3 | ~6 | ~12 |

| WTI / BRENT | ~4.5 | ~9 | ~22.5 | ~45 | ~90 | ~180 |

| JP225 | ~0.7 | ~1.4 | ~3.5 | ~7 | ~14 | ~28 |

| Other Cryptos | ~5 | ~10 | ~25 | ~50 | ~100 | ~200 |

Instant Funding accounts

| Asset Class | $1,250 | $2,500 | $5k | $10k | $25k | $50k | $100k |

|---|---|---|---|---|---|---|---|

| XAU/USD | ~0.05 | ~0.06 | ~0.08 | ~0.12 | ~0.30 | ~0.6 | ~1.2 |

| XAG/USD | ~0.10 | ~0.15 | ~0.20 | ~0.30 | ~0.6 | ~1.20 | ~2.40 |

| DJ30 | ~0.02 | ~0.03 | ~0.04 | ~0.06 | ~0.15 | ~0.30 | ~0.6 |

| NAS100 | ~0.05 | ~0.06 | ~0.08 | ~0.12 | ~0.30 | ~0.60 | ~1.20 |

| SP500 | ~0.20 | ~0.25 | ~0.30 | ~0.50 | ~1.20 | ~2.40 | ~4.80 |

| GER40 | ~0.05 | ~0.06 | ~0.08 | ~0.12 | ~0.30 | ~0.60 | ~1.20 |

| BTC/USD | ~0.02 | ~0.03 | ~0.04 | ~0.06 | ~0.15 | ~0.30 | ~0.6 |

| ETH/USD | ~1 | ~1.25 | ~1.50 | ~2.50 | ~6 | ~12 | ~24 |

| SOL/USD | ~1 | ~1.25 | ~1.50 | ~2.50 | ~6 | ~12 | ~24 |

| FOREX | ~0.3 | ~0.4 | ~0.45 | ~0.75 | ~1.80 | ~3.60 | ~7.20 |

| Other Indices | ~0.15 | ~0.20 | ~0.25 | ~0.40 | ~0.90 | ~1.80 | ~3.60 |

| WTI / BRENT | ~2.25 | ~2.75 | ~3.50 | ~5.50 | ~13.5 | ~27 | ~54 |

| Other Cryptos | ~2.5 | ~3 | ~4 | ~6 | ~15 | ~30 | ~60 |

Note: The Synthetic Plan comes with no lot size restrictions.

4.2. Prohibited trading practices

Blueberry Funded strictly prohibits toxic trading behaviors that exploit demo environments or create unmanageable risk profiles. Violating these is often considered a hard breach, especially for Instant accounts.

- News Trading: Restricted 2 minutes before and after high-impact (red folder) news.

- Exception: Positions held for over 6 hours that hit SL during news are allowed.

- Martingale & Grid: Progressively increasing lot sizes after losses or placing trades at fixed intervals without risk management is banned.

- One-Sided Bets: Predominantly trading in one direction without analysis or holding correlated exposures (e.g., Long EURUSD, XAUUSD, and BTCUSD simultaneously) is flagged as gambling.

- Position Stacking: Limited to 4 positions per asset and 7 total positions across all instruments.

- Excessive Scalping: Holding 50% or more of your trades for less than one minute.

- Hyperactivity: A warning is sent at 10,000 server requests/day. Accounts are automatically disabled at 20,000 requests.

- Reverse Hand: Entering the opposite direction of a losing trade within 5 minutes is prohibited to prevent revenge trading patterns.

Verdict on Blueberry Funded rules

The rules at Blueberry Funded are strict but logical for a broker-backed firm. The 0.5% profit requirement for a trading day is a hurdle that prevents flipping accounts quickly, forcing you to trade like a professional.

While the Lot Size Restrictions might feel tight for aggressive traders, they provide a safety net that ensures the firm’s longevity. The most dangerous rule to watch is the News Trading restriction, as even Take-Profit hits during the 4-minute window can lead to profit removal. However, the 6-hour exception for long-term trades is a very fair compromise we rarely see in other prop firms.

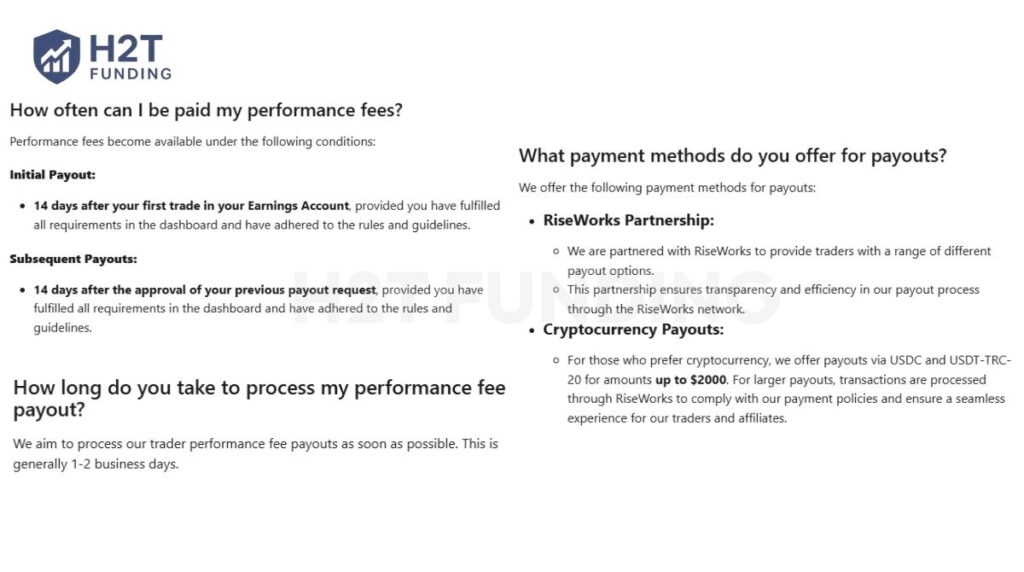

5. Blueberry Funded payout structure

Blueberry Funded aims to process performance fee payouts within 1-2 business days after approval, ensuring traders have quick access to their earnings. The firm operates with a professional standard, requiring all traders to complete KYC verification and sign a contract before their first withdrawal.

Explore the detailed breakdown of their withdrawal methods and bonus incentives below to discover how you can optimize your profit access.

5.1. Payout eligibility and requirements

Before you can request your performance fee, your trading activity must meet specific quality benchmarks. These rules ensure that payouts are based on consistent skill rather than lucky, high-risk gambles.

- Minimum Trading Days: You must complete at least 3 trading days before requesting.

- Profit Requirement: Each trading day must result in at least 0.5% closed profit of the initial balance to count.

- Minimum Withdrawal: Payout requests must be at least $100, except for Synthetic accounts, which require a $200 minimum.

5.2. Payout schedule and the 7-day option

The payout button will only appear in your trader dashboard after 14 days have passed from your account activation date. This initial buffer allows the firm to validate your strategy and ensure all risk guidelines are met.

- Standard Cycle: Default withdrawals are available every 14 days.

- 7-Day Payout Add-On: Available for 1-Step and 2-Step plans during checkout for an additional 20% fee.

- Flexibility: This add-on provides faster access to capital, aligning your income with your weekly trading performance.

5.3. Withdrawal methods and broker incentives

The firm partners with RiseWorks to facilitate global transparency and efficiency in fund distribution. For specialized needs, they offer several pathways:

- RiseWorks: The primary gateway for large-scale international payouts.

- Cryptocurrency: Payouts in USDC and USDT-TRC-20 are available for amounts up to $2,000.

- Broker Payouts: Direct transfers to a Blueberry Markets brokerage account come with a 10% non-withdrawable bonus credit.

- Matching Details: Your name, email, and physical address must match exactly between the prop firm and the brokerage portal to avoid rejection.

Verdict on Blueberry Funded payout structure

The 0.5% profit-per-day rule is the most significant hurdle, as it means you can’t just open a micro-lot to check off your trading days. While the 14-day activation period is standard, the Synthetic account’s $200 minimum is a detail many traders miss.

We find the Broker Payout incentive highly attractive for long-term traders. Receiving an extra 10% credit provides more margin for your personal trading, effectively turning your payout into a growth tool for your brokerage account.

6. Scaling plan of Blueberry Funded

Blueberry Funded provides a professional roadmap for disciplined traders to increase their account size up to $2,000,000 in simulated capital. This quarterly system rewards long-term consistency by offering both balance increments and profit split upgrades.

Understanding these requirements is vital for anyone planning to transition from retail trading to managing institutional-sized volume.

6.1. Eligibility criteria for capital growth

To qualify for a balance increase, you must prove that your strategy can withstand various market conditions over a consecutive three-month period. Meeting the profit target early does not bypass the fixed quarterly evaluation.

- Profit Target: Generate at least 10% net profit over 3 consecutive months.

- Payout Requirement: You must have processed at least 4 successful payouts within that same period.

- Time Requirement: Fulfill the criteria across at least 3 months to ensure performance stability.

- Rule Consistency: Your trading must remain within the established risk guidelines throughout the scaling phase.

6.2. Scaling trajectory and profit split upgrades

As your account grows, Blueberry Funded also increases your incentive by upgrading your profit split. Traders who successfully scale can earn up to 90% of their profits, providing a significant boost to their take-home earnings.

| Elapsed Time | Initial Balance ($200k Example) | Scaled Balance |

|---|---|---|

| 0 Months | $200,000 | $200,000 |

| 3 Months | $200,000 | $250,000 |

| 6 Months | $250,000 | $300,000 |

| 12 Months | $350,000 | $400,000 |

| 24 Months | $550,000 | $600,000 |

Even as your balance increases by 25% every quarter, your trading objectives remain the same. This means your drawdown limits and profit targets do not become more restrictive, allowing you to maintain your original strategy.

Verdict on Blueberry Funded scaling plan

The scaling plan is fair but demanding. The requirement to process 4 payouts in 3 months is a unique hurdle; it essentially forces you to take regular withdrawals rather than just letting the account compound.

The 90% profit split upgrade to be a massive draw for professional traders. While a 25% increase every 3 months is slower than some rapid scaling firms, the institutional stability of being broker-backed makes this a much more realistic long-term partnership.

7. Spreads & commission fees

As a broker-backed firm, Blueberry Funded provides traders with institutional-grade pricing directly from Blueberry Markets’ liquidity pools. This ensures that the costs you face in the simulation are identical to those in a professional live environment.

7.1. Transparent commission structure

Blueberry Funded utilizes a raw spread plus commission model, which is favored by scalpers and day traders for its transparency. This structure ensures that you are not battling hidden costs through artificially widened spreads.

- Currency Pairs (FX): A flat fee of $7 USD per standard lot (100,000 units).

- Gold (XAU/USD): Charged at the same competitive rate of $7 USD per lot.

- US Stocks: Heavily discounted at only $2 USD per standard lot.

- Timing: Commissions are applied instantly, one-half when the trade is executed and the remaining half when the position is closed.

7.2. Spreads, swaps, and hidden costs

While commissions are fixed, other market-driven costs can vary based on volatility and the specific instrument you are trading.

- Market Spreads: By offering raw spreads from 0.1 pips, the firm minimizes the entry drag on your trades, which is crucial for high-frequency strategies.

- Swap Fees: If you hold positions overnight, you will incur overnight financing charges. These are standard industry fees that depend on the interest rate differential between the currencies in your pair.

- Slippage: Because they use real-market liquidity, slippage is kept to a minimum, though it can still occur during extreme news events.

Verdict on Blueberry Funded spreads & fees

The $7 per lot commission for Forex is very standard for the prop firm industry, positioning them competitively among top-tier peers. However, the 0.1 pip raw spread is a significant advantage for high-frequency traders who need the tightest possible entry and exit points.

The US Stocks pricing ($2/lot) is a standout feature for equity-focused traders, offering a cost structure much lower than many competitors. Overall, the fee structure is fair and professional, providing a transparent environment where your trading strategy isn’t eroded by excessive or hidden markups.

8. Blueberry Funded trading platform

Blueberry Funded provides a versatile selection of industry-leading platforms to ensure high-speed execution and reliable market data. Depending on your chosen plan, you can access traditional tools or modern charting interfaces for a professional trading experience.

- MetaTrader 4 (MT4): The reliable industry standard favored for its stability and legacy Expert Advisor (EA) support.

- MetaTrader 5 (MT5): An advanced successor offering superior multi-asset capabilities and deeper technical analysis tools.

- TradeLocker: A next-gen interface featuring full TradingView integration, ideal for traders prioritizing high-quality charting.

- DXTrade: A robust, browser-based solution that provides a streamlined experience for both Instant and Evaluation accounts.

Verdict on Blueberry Funded trading platform

The combination of MetaTrader and TradeLocker ensures this firm remains accessible to both old-school algorithmic traders and modern manual chartists. While MT5 is the go-to for performance and automation, TradeLocker is a massive highlight for those who prefer the familiar TradingView ecosystem.

9. Trading instruments & leverage

Blueberry Funded provides access to the full institutional suite of products available at Blueberry Markets, ensuring traders can diversify across multiple sectors. A standout feature is their proprietary Synthetic Indices, which offer algorithmically generated volatility 24/7, independent of traditional market hours.

Leverage varies significantly depending on the challenge type you select, with the 2-Step evaluation offering the most flexibility for Forex traders. Below is the detailed breakdown of what you can trade and the buying power available for each asset class.

9.1. Traditional asset classes and leverage

The firm covers all major financial markets, including Forex, Metals, Energies, and Indices. Leverage is capped to maintain a professional risk environment, preventing the extreme over-leveraging that often leads to account failure.

| Asset Class | Instant Funding | 1-Step Challenge | 2-Step Challenge |

|---|---|---|---|

| Forex (FX) | 1:30 | 1:30 | 1:50 |

| Metals | 1:10 | 1:10 | 1:10 |

| Indices | 1:10 | 1:10 | 1:10 |

| Commodities | 1:10 | 1:10 | 1:10 |

| Crypto | 1:2 | 1:2 | 1:2 |

9.2. Synthetic Indices

Blueberry Funded Synthetics are algorithmically generated instruments designed to simulate market volatility in a controlled environment. These are available 24/7, making them ideal for traders who cannot trade during standard London or New York sessions.

- SYN Indices (50, 75, 100): Feature consistent volatility ranging from steady moves to intense 100% swings.

- Surge Indices (50, 75, 100): Designed for bullish strategies, offering a price surge every specific tick interval.

- Drop Indices (50, 75, 100): Built for bearish specialists, simulating sudden price drops at regular intervals.

- Leap Indices (50, 75, 100): Provide dynamic, rapid movements in either direction with varying degrees of volatility.

All 12 Synthetic instruments offer a fixed leverage of 1:30, providing a consistent trading experience regardless of the specific index chosen.

Verdict on Blueberry Funded instruments & leverage

The diversity of instruments is one of the strongest points of this firm. While 1:50 leverage on Forex remains competitive for 2-Step accounts, the 1:2 Crypto leverage feels overly restrictive for aggressive traders.

Notably, Synthetic Indices provide a unique advantage, enabling traders to stay active over weekends or bank holidays without reliance on real-world economic events. For technical analysts focused on pure price action, the Synthetic suite with 1:30 leverage stands out as a rare prop firm offering.

10. Blueberry Funded customer support & education

Support and education at Blueberry Funded rely heavily on the parent broker’s professional infrastructure. This ensures a high level of stability, but often means resources are split between two different platforms.

Traders gain access to a data-driven ecosystem designed to bridge the gap between retail knowledge and professional execution. Reviewing these resources is essential for anyone wanting to master the specific rules found in this Blueberry Funded review.

10.1. Multi-channel support and ticket system

The firm offers a comprehensive support network designed to handle technical issues, risk appeals, and account inquiries with high efficiency. Their centralized help widget allows you to navigate various specialized departments directly.

- Live Chat & Email: Direct access via support@blueberryfunded.com for rapid response needs.

- Specialized ticketing: Submit targeted requests for Credentials, UPI Reviews, or Risk Appeals to ensure the right experts handle your case.

- Discord server: A vibrant community where you can engage with over 46,500 active traders and get peer-to-peer assistance.

- Social media: Active presence on Instagram, Twitter (X), and YouTube for the latest platform updates and competitions.

However, a noticeable weakness is the lack of direct phone support, which can be frustrating during urgent account issues. The segmented ticketing process, while organized, may feel overly bureaucratic when seeking simple, immediate answers.

10.2. Professional education and the trader dashboard

While Blueberry Funded focuses on capital allocation, they provide institutional-level education through their partner broker, Blueberry Markets. This ensures that the content you consume is based on regulated market standards rather than just marketing hype.

- Markets academy: Access structured courses that cover everything from basic mechanics to advanced institutional trading.

- Market analysis: Regular breakdowns of global trends to help you anticipate volatility and high-impact news.

- YouTube channel: Features in-depth interviews with funded traders and market breakdowns, providing real-world proof of successful strategies.

- Advanced dashboard: A meticulously designed interface offering real-time statistics for streamlined risk management and performance tracking.

- Blog Content: Features regular updates on trading strategies and platform conditions, helping traders stay informed about industry changes.

Verdict on customer support & education

The support environment is exceptionally transparent and benefits from the parent broker’s established service protocols. The ability to file a formal risk appeal shows a level of fairness and accountability rarely seen in the prop space.

On the educational side, resources are fragmented across different websites, requiring traders to cross-reference multiple sources. While the dashboard analytics are excellent for self-correction, the firm lacks a centralized Prop School to help users navigate their complex news and consistency guidelines.

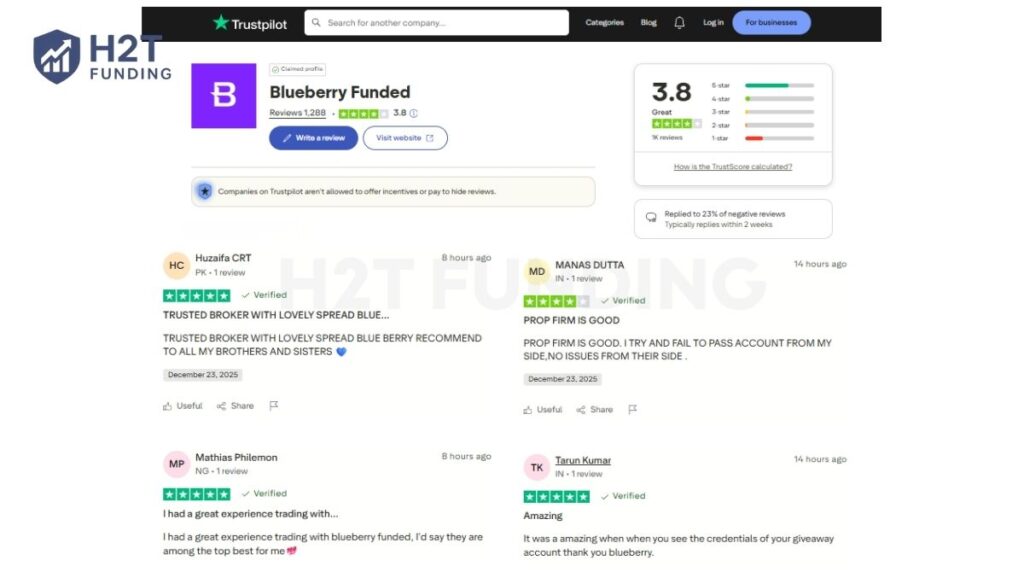

11. Real trader feedback: Blueberry Funded Trustpilot and Blueberry Funded review Reddit

Blueberry Funded currently holds a 3.8-star rating on Trustpilot based on over 1,200 reviews (updated on January 16, 2026), which is generally categorized as Great in the industry. Many traders express satisfaction with the competitive spreads and broker-backed infrastructure, often recommending it as a top choice for professional scaling.

Positive reviews often highlight the platform’s reliability and the transparency of the payout process. Even traders who failed their evaluations often admit that the issues were on their side, rather than a result of technical failures or manipulation by the firm.

However, a deeper search for a Blueberry Funded review Reddit reveals more critical discussions regarding their specific internal policies. One common point of friction is the one-sided bets rule, which has caused some profitable traders to have their payouts declined after focusing too heavily on a single direction.

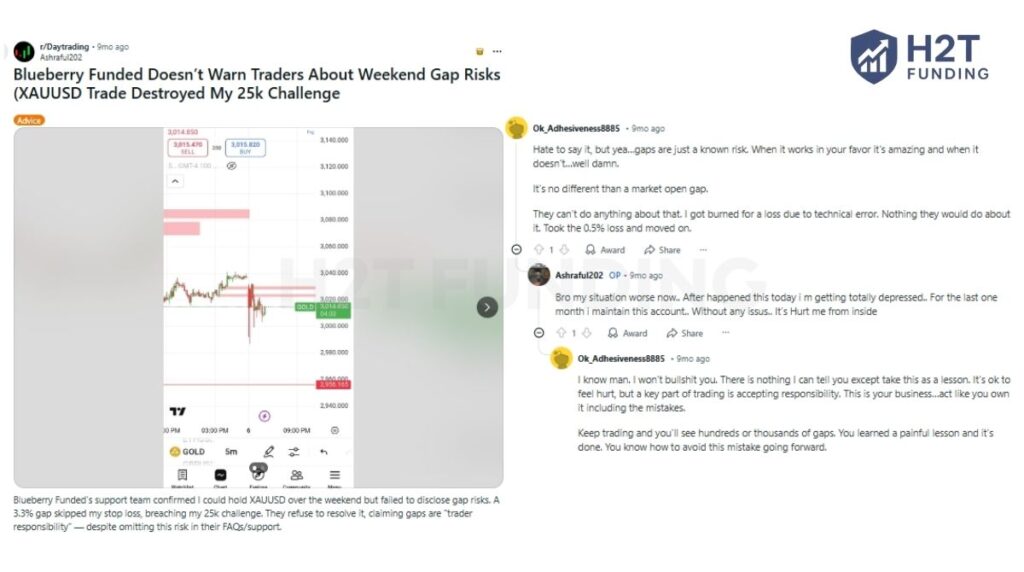

Another significant concern raised by the Reddit community involves weekend gap risks, specifically on assets like XAUUSD. One trader reported a 3.3% market gap that skipped their stop-loss and breached their 25k challenge, with support claiming gaps are a trader’s responsibility.

While holding over the weekend is officially permitted, these real-world examples show that market volatility can still be fatal to your account. The community sentiment suggests that while the firm is legitimate, you must manage risk manually and not rely solely on stop losses during market closes.

Overall, the feedback indicates that Blueberry Funded is a reliable payer with professional standards, but their rules require extreme caution. Success here depends on your ability to diversify your trade direction and stay alert to the fine print in their FAQ that might not be immediately obvious.

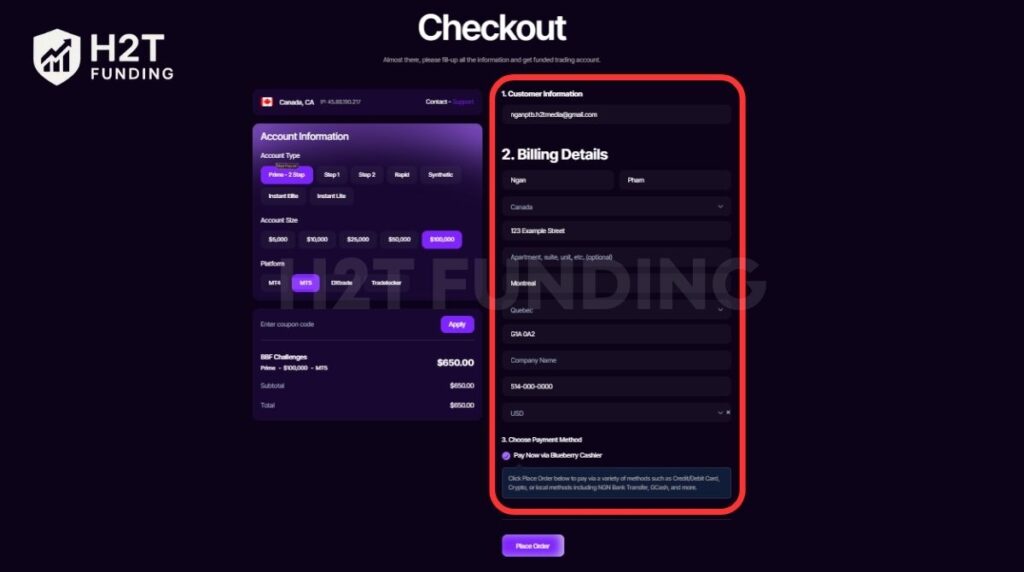

12. How to sign up for Blueberry Funded

Joining Blueberry Funded is a streamlined process designed to get you into the markets with institutional backing as quickly as possible. By following a few structured steps, you can secure your challenge account and begin your path toward professional capital management.

The registration process consists of these primary steps:

- Step 1: Access the official website and the Get Funded portal.

- Step 2: Configuring your account type, size, and platform.

- Step 3: Entering billing details and applying discount codes.

- Step 4: Finalizing the payment through the secure cashier.

Follow our detailed step-by-step guide below to ensure a smooth onboarding experience. Navigating these stages correctly ensures you are set up for success from the very first trade.

12.1. Step 1: Access the official website

Start by visiting the official Blueberry Funded homepage to explore current opportunities or access the Blueberry Funded login. Navigate to the top right corner of the navigation bar and click the Get Funded button to enter the secure registration portal.

12.2. Step 2: Select your challenge model

Browse through the available programs, such as the popular Prime – 2 Step or the Instant Elite paths. Select the specific account size that aligns with your risk tolerance and click the purchase button to proceed to the billing area.

12.3. Step 3: Enter customer and billing information

Fill in your email address, full name, and physical address in the Billing Details section. This information must match your government-issued ID, as this data will be verified during the mandatory KYC process later.

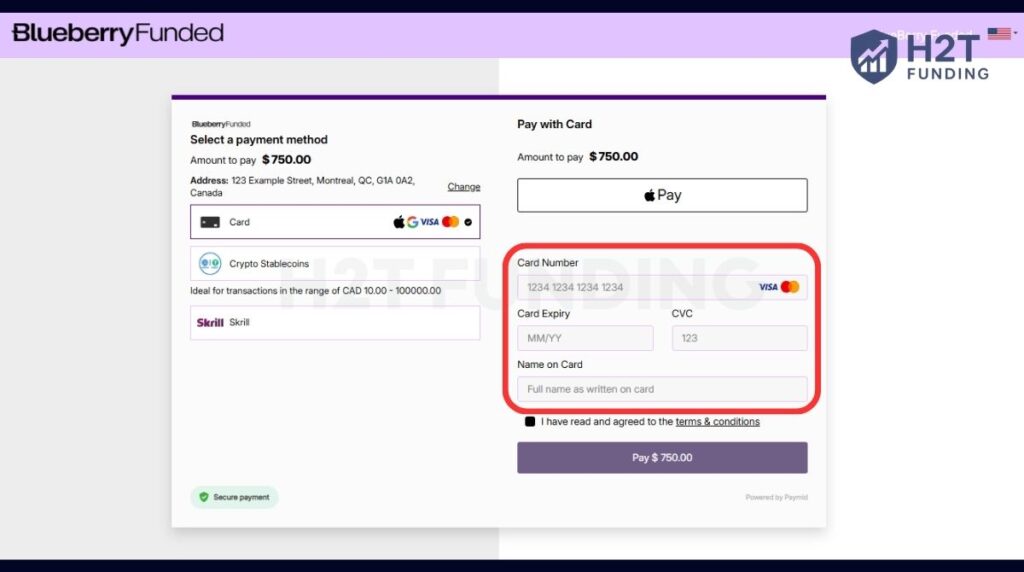

12.4. Step 4: Complete the secure checkout

You will be redirected to a payment page where you must enter your billing address and personal details. Choose from a variety of secure options, including Credit Card, Apple Pay, Skrill, or Crypto Stablecoins, to finalize your order.

12.5. Step 5: Configure credentials and start trading

Once payment is confirmed, your trading credentials will be sent to your registered email within minutes. Log in to your selected platform, such as MT5 or DXTrade, and ensure you have reviewed the specific rules set for your plan before opening a position.

The sign-up process is highly automated, allowing most traders to start their evaluation within the same hour of purchase. Ensuring your personal details match your payment method is the most critical factor in avoiding technical delays during the initial setup phase.

13. Blueberry Funded restricted countries

Before purchasing a challenge, it is essential to verify if your country of residence is eligible for service. Blueberry Funded maintains a list of restricted regions to comply with global financial regulations and international sanctions.

Traders residing in the following countries are currently prohibited from purchasing evaluations or managing funded capital:

- United States

- Australia

- Cuba

- Iran

- Iraq

- Myanmar

- North Korea

- Russia

- Somalia

- Syria

- United Arab Emirates

- Yemen

- Afghanistan

- Belarus

Specifically for the United Arab Emirates, you can purchase an evaluation if you reside there but hold official residency in a non-restricted country. Always verify your status with their support team before making a payment to avoid refund complications.

14. Compare Blueberry Funded vs other prop firms

Choosing the right prop firm depends on how their fee structures and platform options align with your specific trading goals. This comparison highlights how Blueberry Funded maintains its competitive edge by offering a diverse range of platforms and asset classes compared to other major players in the market.

| Criteria | Blueberry Funded | FXRK | Finotive Funding | ThinkCapital |

|---|---|---|---|---|

| Challenge Fee | $25 – $1,500 | $49 – $999 | $29 – $3,299 | $39 – $1,498 |

| Account Types | Rapid, 1-step, 2-step, Instant, Synthetic | 1-step and 2-step | 1-step, 2-step, and Instant | 1-step, 2-step, and 3-step |

| Profit Split | 80% (Up to 90%) | 80% – 90% | 70% – 100% | 80% – 90% |

| Account Size | $1.25K – $200K | $5K – $200K | $2.5K – $200K | $5K – $200K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 10% | 5% – 10% | 5% – 10% | 5% – 10% |

| Trading Platforms | MT4, MT5, TradeLocker, DXTrade | MT5 | MT5 | MT5, ThinkTrader, TradingView |

| Asset Types | Forex, Crypto, Metals, Energy, Index, Synthetics | Forex, Commodities, Stocks, Bonds, Futures, Indices | FX, Metals, Indices, Energy, Crypto, Stocks | Forex, Commodities, Indices, Crypto |

Navigating these differences allows you to select a partner that provides the best technical environment for your strategy. Each firm offers unique benefits that cater to different levels of experience and risk appetite.

- Blueberry Funded: Best for traders seeking multi-platform flexibility (MT4/MT5/DXTrade) and those interested in trading Synthetic Indices 24/7 with broker-backed security.

- FXRK: Suited for those looking for aggressive growth potential and unique perks like FXRK Points, though traders should be mindful of its unregulated status and transparency warnings.

- Finotive Funding: Ideal for high-performing professionals who aim for a 100% profit split and require fast funding with weekly payout frequencies.

- ThinkCapital: A top choice for traders who prefer a broker-backed environment with a focus on modern interfaces like ThinkTrader and TradingView integration.

While all these firms offer competitive no-time-limit challenges and standard profit targets, Blueberry Funded stands out through its extensive asset variety and platform stability. Selecting the right firm ultimately depends on whether you value maximum profit splits or the long-term security of a regulated broker infrastructure.

15. Which trading strategy suits Blueberry Funded?

Blueberry Funded’s diverse account types and broker-backed infrastructure provide a flexible environment for various market participants. Choosing the right strategy requires aligning your execution style with their specific risk and consistency rules to ensure long-term payout eligibility.

Selecting a strategy that complements the firm’s institutional liquidity can significantly increase your chances of passing. Below are the most effective approaches for navigating their current funding models:

- Swing Trading: With no time limits and permitted weekend/overnight holding, this firm is ideal for those catching large moves over several days.

- Intraday Scalping: The 0.1 pip raw spreads and high-speed MT5 execution cater to traders seeking quick profits with minimal entry drag.

- 24/7 Synthetic Trading: Technical analysts can use the Synthetic suite to trade algorithmically 24/7, avoiding the noise of traditional economic news.

- Martingale Specialists: Traders using recovery-based systems should focus exclusively on the Prime 2-Step challenge, where these strategies are explicitly permitted.

While the firm is flexible, certain high-risk behaviors can lead to account termination or payout denials. It is critical to avoid One-Sided Betting, where you only trade in a single direction (e.g., only shorting Gold) without a clear analytical justification, as this violates their gambling policy.

Furthermore, High-Frequency Trading (HFT) is restricted because sending excessive server requests triggers the hyperactivity rule, which automatically disables accounts. Unless you are on a Prime account, you must also avoid Pure News Trading during the 4-minute restricted window to prevent profit removal.

16. FAQs

Blueberry Funded is a legitimate proprietary trading firm backed by Blueberry Markets, a regulated Australian broker. It is a reputable entity with a Great rating of 3.8 on Trustpilot and a proven track record of over $3.6M in total payouts to traders globally.

Blueberry Funded is the proprietary trading arm of the Blueberry Markets brokerage. While the prop firm provides the simulated capital and evaluations, the actual trading execution and liquidity are powered by the parent broker’s institutional infrastructure.

Traders select a challenge (1-Step, 2-Step, or Rapid) and must reach a specific profit target (5%–10%) without hitting the daily or maximum loss limits. Once the objectives are met and the minimum trading days are fulfilled, you transition to an Earnings Account.

No, Blueberry Funded offers no time limits on most of its evaluation models. This allows traders to wait for high-probability setups and manage their risk without the pressure of an impending expiration date.

The firm supports MetaTrader 4, MetaTrader 5, TradeLocker, and DXTrade. You can trade a full suite of instruments, including Forex, Crypto, Metals, Energies, Indices, and exclusive algorithmically generated Synthetic Indices.

Leverage depends on the account type: 1:30 for Forex on 1-Step and Instant accounts, and 1:50 for Forex on 2-Step accounts. Metals and Indices are capped at 1:10, while Crypto leverage is restricted to 1:2.

Yes, they provide Instant Elite and Instant Lite accounts. These models allow you to skip the evaluation phases and start trading on a funded account immediately, though they come with stricter drawdown rules and higher entry fees.

Traders can start with accounts up to $200,000 and scale their way to a maximum of $2,000,000 through consistent performance. The standard profit split is 80%, which can be upgraded to 90% via the scaling plan.

The standard payout frequency is every 14 days from the date of account activation or the previous payout. However, traders can opt for a 7-day payout add-on during checkout for faster weekly access to their capital.

To be eligible, you must have a fully KYC-verified Blueberry Markets account with personal details (name, email, address) that match your prop firm profile exactly. You can set this up through the Blueberry Broker Portal and request the transfer directly from your funded dashboard.

No, evaluation fees at Blueberry Funded are generally not refundable. Unlike some firms that refund the fee with the first payout, this firm maintains a fee-based model to cover the costs of the institutional infrastructure and simulated data feeds.

If a hard breach occurs (such as hitting the max drawdown), the account is permanently disabled. You will not be eligible for a refund, and you must purchase a new challenge if you wish to try again.

Blueberry Funded does not accept traders from the United States, Australia, Russia, Belarus, (restricted countries may change – verify with support before purchase), or several other sanctioned or highly regulated regions like North Korea, Iran, and Syria. UAE residents are permitted if they hold residency in a non-restricted country.

Yes, the firm supports 24/7 Crypto trading. However, please note that swap fees are charged for positions held open overnight, and leverage is limited to 1:2, which requires a more conservative approach to position sizing.

17. Conclusion

This Blueberry Funded review confirms that the firm is a highly reliable partner for those who value broker-backed stability. While their rules on news trading and one-sided bets are strict, the institutional-grade execution and 24/7 synthetic indices offer a professional edge.

Is it truly trader-friendly? For disciplined traders who follow the guidelines, the answer is yes. The platform stability and direct link to a regulated broker provide a level of security that many offshore firms cannot match.

However, every trader has different needs, and what works for one might not suit another. We recommend exploring our other detailed prop firm reviews at H2T Funding to compare the best options available in 2026 and find the perfect match for your strategy.