Prop trading is growing fast, and new firms appear almost every month. Among them, AquaFunded has attracted a lot of attention with its wide range of challenges, instant funding options, and high profit splits. Traders often ask if this firm is truly reliable or just another short-term player in the market.

In this detailed AquaFunded review, I’ll cover everything from challenge models and trading rules to payout structure, spreads, and real trader feedback. By the end, you’ll have a clear idea of whether AquaFunded fits your trading style or if another prop firm may be a better choice.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official AquaFunded websites before purchasing any challenge.

1. Our take on AquaFunded

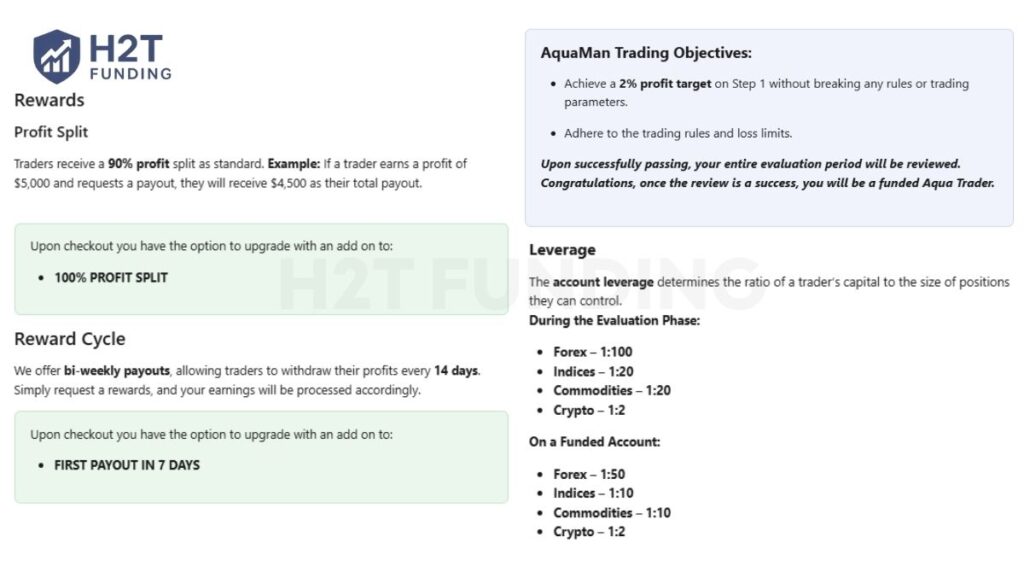

AquaFunded, launched in 2023, is headquartered in Dubai and quickly gained attention with flexible funding models ranging from 1-phase challenges to instant funding. The headline perks include up to 100% profit split, bi-weekly payouts (on-demand or 7-day with an add-on), and account scaling up to $4 million.

However, after digging into the details, I’ve noticed a few sticking points. The post-funding rules feel tighter than what you’d find at competitors, especially the consistency requirements and restrictions around news trading. If you’re not careful, these can eat into your profits even when you’re trading well.

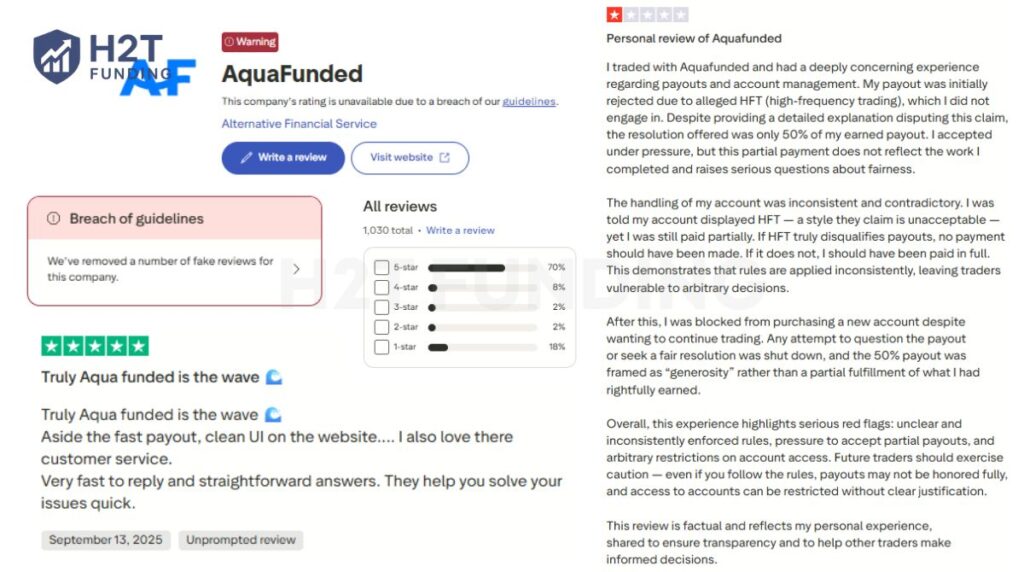

Another red flag is transparency. On Trustpilot, AquaFunded has been flagged for guideline breaches after several fake reviews were removed. These mixed AquaFunded reviews reinforce the need to verify terms directly before you buy.

AquaFunded pros and cons

| Pros | Cons |

|---|---|

| Instant funding up to $400K | No published average spreads |

| Scaling program up to $4M | Stocks and futures are not available |

| Up to 100% profit split | Strict post-funding consistency rules |

| Bi-weekly fast payouts (with add-ons for on-demand or 7-day) | Limited educational support for beginners |

| Multiple challenge types (1-phase, 2-phase, 3-phase, instant) | Restrictions on news trading windows |

| EAs and automated trading allowed | Trust signals are weaker than those of top-tier firms |

Ultimately, AquaFunded presents itself as an interesting choice for experienced traders who can leverage its frequent payouts, multiple funding models, and allowance for EAs. For beginners, though, the lack of educational resources and strict compliance checks could feel overwhelming.

2. AquaFunded Funding Program

AquaFunded’s funding structure is diverse, covering one-step, two-step, three-step, instant, and even a limited-time “AquaMan” challenge. On the surface, this gives traders plenty of flexibility, but the fine print tells a different story.

With no reset option, stricter AquaFunded consistency rule than most competitors, and occasional confusion in rule enforcement, traders need to be cautious before committing. You can use the quick table below to compare the core rules at a glance before you dive into the fine print.

| Model | Fee Range (USD) | Account Size | Profit Target | Daily / Max DD | Consistency Rule | Profit Split |

|---|---|---|---|---|---|---|

| 1-Step Standard | $67 – $1,017 | $5K – $200K | 9% | 3% / 3% | None | 90% (100% w/ add-on) |

| 1-Step Pro | $59 – $899 | $5K – $200K | 6% | 3% / 3% | 25% | 90% (100% w/ add-on) |

| 2-Step Standard | $57 – $997 | $5K – $200K | 8% -> 5% | 5% / 5% | None | 90% (100% w/ add-on) |

| 2-Step Pro | $39 – $925 | $5K – $200K | 10% -> 5% | 5% / 5% | 25% | 90% (100% w/ add-on) |

| 3-Step | $77 – $677 | $10K – $200K | 6% / 6% / 6% | 4% / 4% | None | 90% (100% w/ add-on) |

| AquaMan (Limited-Time) | $34 – $440 | $2.5K – $100K | 2% | 3% / 5% | 15% | 90% (100% w/ add-on) |

| Instant Funding Standard | $64 – $1,810 | $5K – $300K | None | None | 20% | 90% (100% w/ add-on) |

| Instant Funding Pro | $60 – $2,449 | $2.5K – $400K | None | 3% | 15% | 90% (100% w/ add-on) |

Note: Before purchasing any challenge, it’s worth checking if an Aquafund discount code is available to reduce upfront costs.

2.1. One-step challenge

The One-step Challenge is AquaFunded’s most direct evaluation model, designed for traders who want quick access to funded accounts without multiple phases. With no time limit, a single profit target, and clear drawdown rules, it balances simplicity with discipline.

Traders can choose between Standard and Pro versions, each offering different levels of risk and payout conditions.

2.1.1. One-step Standard

The One-step Standard challenge is AquaFunded’s most straightforward path to funding. Traders face a single evaluation phase with a 9% profit target, a 3% daily loss limit, and a 6% trailing max drawdown.

There’s no time limit, so you can trade at your own pace. The tight risk parameters still demand consistent discipline. This model works best for traders who like a clear structure and can handle pressure without overtrading.

You only need 3 profitable days with at least 0.5% gain each to qualify, making it more flexible than many competitors. Once funded, however, a 25% consistency rule applies: if more than a quarter of your profits come from a single day, payouts are delayed until performance evens out.

| Account Size | One-Time Fee | Profit Target (9%) | Daily Drawdown (3%) | Maximum Drawdown (6%) |

|---|---|---|---|---|

| $5,000 | $67 | $450 | $150 | $300 |

| $10,000 | $113 | $900 | $300 | $600 |

| $25,000 | $227 | $2,250 | $750 | $1,500 |

| $50,000 | $327 | $4,500 | $1,500 | $3,000 |

| $100,000 | $527 | $9,000 | $3,000 | $6,000 |

| $200,000 | $1,017 | $18,000 | $6,000 | $12,000 |

* Payouts are bi-weekly with a starting 90% profit split (upgradeable to 100% via add-ons). Leverage is capped at 1:100, and all accounts use a trailing drawdown model that locks after the profit target is reached, with a 1% buffer for withdrawals.

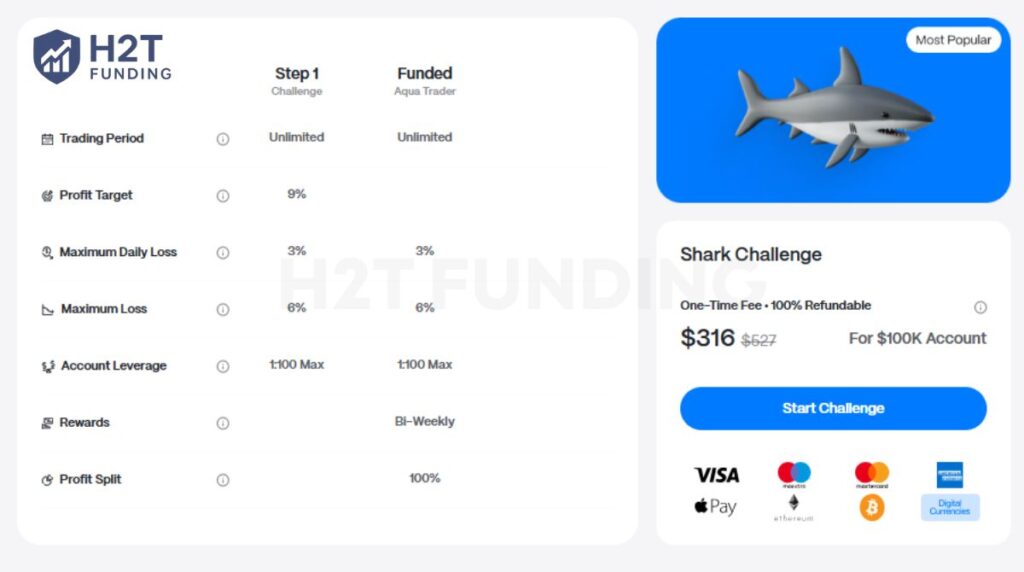

2.1.2. One-step Pro

The One-step Pro challenge follows similar parameters as the standard model, a 6% profit target, and a 6% trailing max drawdown. While traders still benefit from unlimited time, the risk parameters are tighter, requiring sharper execution and stronger money management.

This naturally makes the model better suited for advanced traders who are confident in adapting to stricter rules in exchange for higher payouts.

You need at least 3 profitable days to qualify. Once funded, the 25% consistency rule applies; no more than a quarter of total profits can come from a single day. This rule can delay payouts if your trading style is heavily skewed toward big wins, making it a common pitfall for aggressive strategies

| Account Size | One-Time Fee | Profit Target (9%) | Daily Drawdown (3%) | Maximum Drawdown (6%) |

|---|---|---|---|---|

| $5,000 | $59 | $450 | $150 | $300 |

| $10,000 | $99 | $900 | $300 | $600 |

| $25,000 | $199 | $2,250 | $750 | $1,500 |

| $50,000 | $289 | $4,500 | $1,500 | $3,000 |

| $100,000 | $459 | $9,000 | $3,000 | $6,000 |

| $200,000 | $899 | $18,000 | $6,000 | $12,000 |

* Leverage is capped at 1:50 on funded accounts (1:100 during evaluation). Payouts remain bi-weekly, and profit splits start at 90% with the option to boost to 100% through add-ons.

2.2. Two-step challenge

The Two-step Challenge is AquaFunded’s balanced model, aimed at traders who prefer a structured path to funding rather than a one-shot evaluation. Splitting the profit targets into two phases reduces pressure in each stage and gives traders more breathing room.

With unlimited time to complete both steps, this challenge suits swing traders and those with limited trading hours.

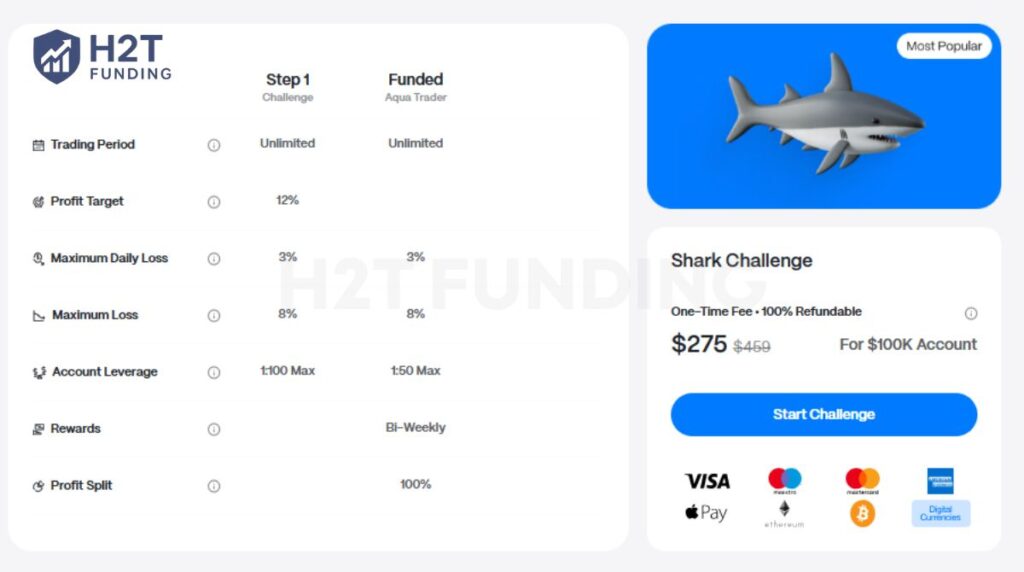

2.2.1. Two-step Standard

The Standard version of the Two-step Challenge sets profit targets of 8% in step 1 and 5% in step 2. Drawdowns are static, with a 5% daily loss limit and an 8% overall cap, which provides clarity and consistency across both steps.

Another benefit is the absence of a consistency rule, even after you’re funded. You only need a minimum of 3 trading days per step, and there’s no calendar deadline, so traders can pace themselves without rushing.

| Account Size | One-Time Fee | Profit Target (Step 1: 8% / Step 2: 5%) | Daily Drawdown (5%) | Maximum Drawdown (8%) |

|---|---|---|---|---|

| $5,000 | $57 | $400 / $250 | $250 | $400 |

| $10,000 | $103 | $800 / $500 | $500 | $800 |

| $25,000 | $217 | $2,000 / $1,250 | $1,250 | $2,000 |

| $50,000 | $317 | $4,000 / $2,500 | $2,500 | $4,000 |

| $100,000 | $517 | $8,000 / $5,000 | $5,000 | $8,000 |

| $200,000 | $997 | $16,000 / $10,000 | $10,000 | $16,000 |

* Leverage is capped at 1:100, payouts are bi-weekly, and profit splits start at 90% (up to 100% with add-ons).

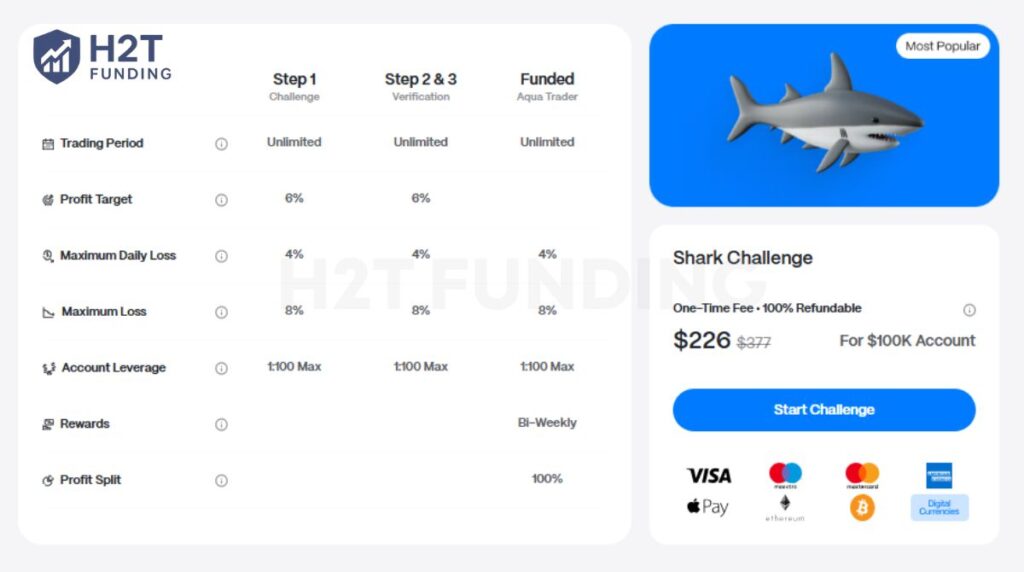

2.2.2. Two-step Pro

The Pro version of the Two-step Challenge raises the bar with a 10% profit target in step 1 and 5% in step 2. It uses a trailing drawdown system with wider overall risk limits, capped at 5% daily and 10% maximum loss. This makes the Pro challenge more demanding but also more flexible for aggressive strategies.

A key difference is the consistency rule: once funded, no more than 25% of your total profits can come from a single day. This rule doesn’t apply during the evaluation stages, but it often affects traders who rely on big breakout moves. You’ll also need at least 5 active trading days per step to pass.

| Account Size | One-Time Fee | Profit Target (Step 1: 10% / Step 2: 5%) | Daily Drawdown (5%) | Maximum Drawdown (10%) |

|---|---|---|---|---|

| $5,000 | $39 | $500 / $250 | $250 | $500 |

| $10,000 | $76 | $1,000 / $500 | $500 | $1,000 |

| $25,000 | $138 | $2,500 / $1,250 | $1,250 | $2,500 |

| $50,000 | $247 | $5,000 / $2,500 | $2,500 | $5,000 |

| $100,000 | $460 | $10,000 / $5,000 | $5,000 | $10,000 |

| $200,000 | $925 | $20,000 / $10,000 | $10,000 | $20,000 |

* Leverage is 1:50 during evaluation and on funded accounts. Profit splits start at 90% and can be upgraded to 100%. Payouts are processed bi-weekly, giving traders consistent access to their earnings.

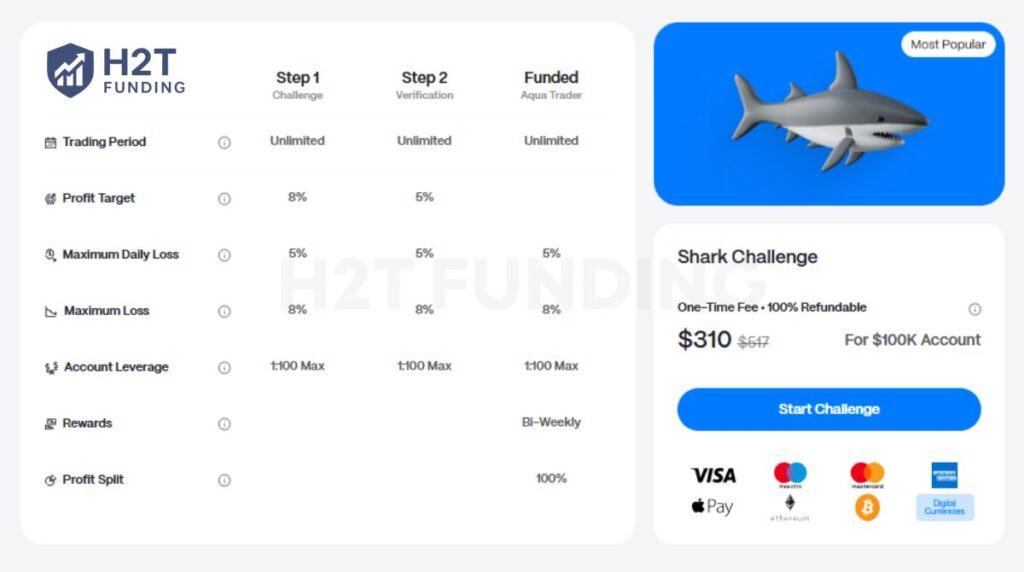

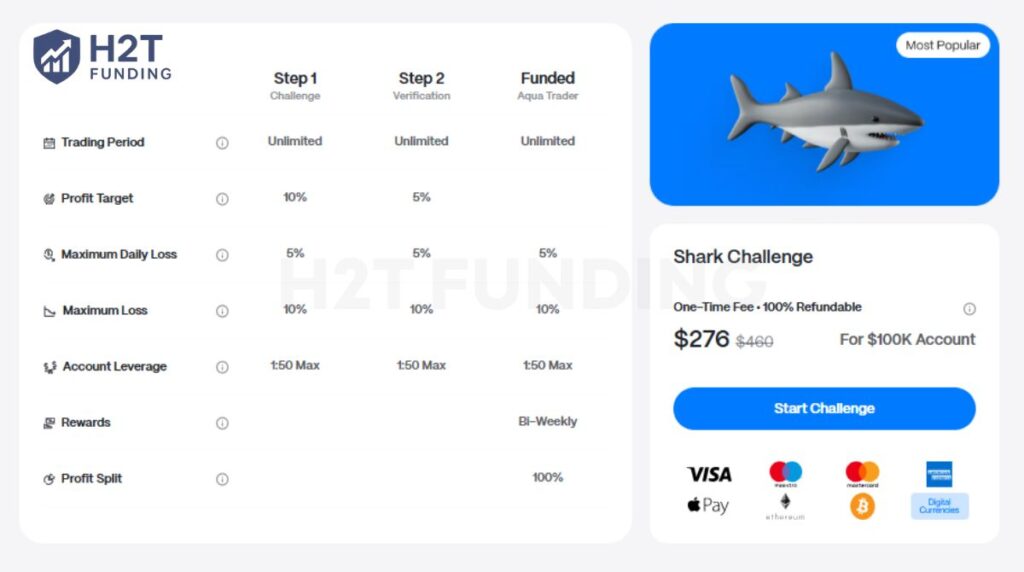

2.3. Three-step challenge

The Three-step Challenge is AquaFunded’s most gradual path to funding, designed for traders who prefer a slower, more structured evaluation. With profit targets spread across three equal phases of 6% each, it reduces the pressure of achieving large gains in one go.

Risk limits are relatively lenient, with a 4% daily drawdown and 8% maximum loss. There are no minimum trading days, giving flexibility to both swing traders and those with limited screen time.

Another standout point is that no consistency rule applies, even after funding. This makes it attractive for traders who rely on big breakout moves, as profits are not penalized for being concentrated in a single day.

However, it’s also the most time-intensive model, starting from $10K accounts and requiring patience to move through all stages.

| Account Size | One-Time Fee | Profit Target (Step 1: 6% / Step 2: 6% / Step 3: 6%) | Daily Drawdown (4%) | Maximum Drawdown (8%) |

|---|---|---|---|---|

| $10,000 | $77 | $600 / $600 / $600 | $400 | $800 |

| $25,000 | $157 | $1,500 / $1,500 / $1,500 | $1,000 | $2,000 |

| $50,000 | $237 | $3,000 / $3,000 / $3,000 | $2,000 | $4,000 |

| $100,000 | $377 | $6,000 / $6,000 / $6,000 | $4,000 | $8,000 |

| $200,000 | $677 | $12,000 / $12,000 / $12,000 | $8,000 | $16,000 |

* Leverage is 1:100 across all phases. Profit splits reach up to 100%, with bi-weekly payouts available for funded accounts.

2.4. Instant Funding

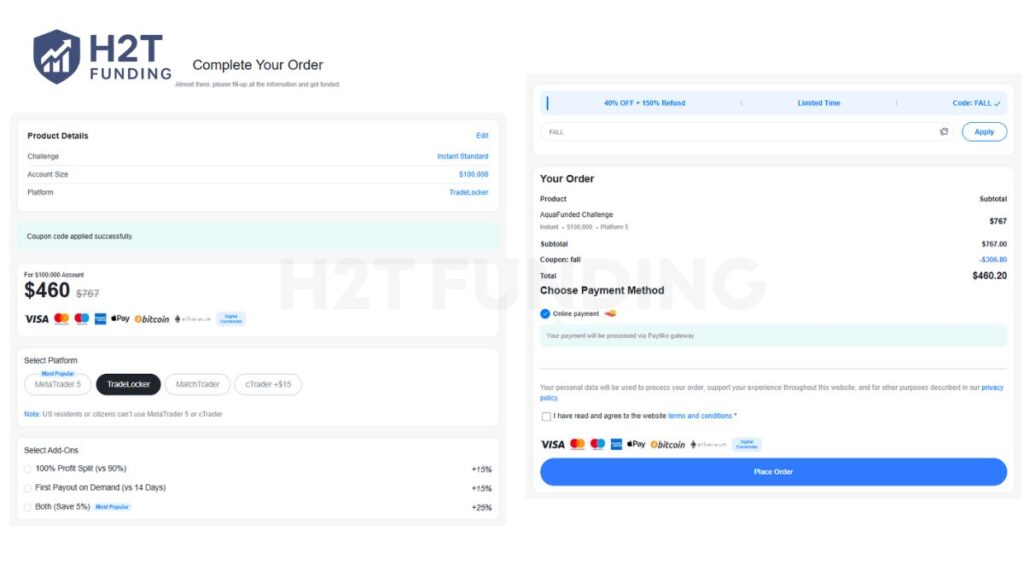

For traders who don’t want to spend time on evaluations, AquaFunded’s Instant Funding option provides direct access to capital. Instead of clearing profit targets and trading days, you can start trading right away with strict loss limits in place.

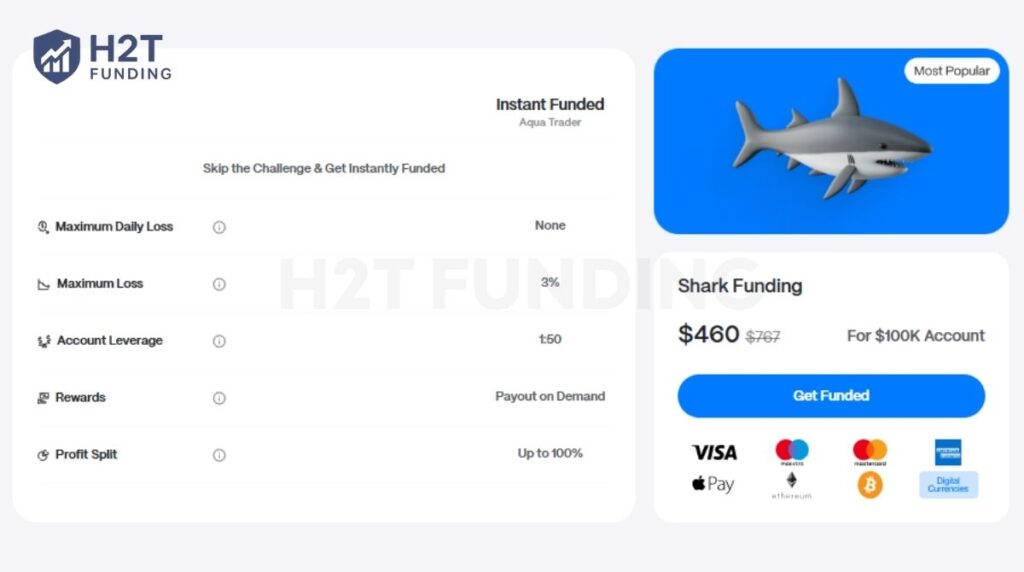

2.4.1. Instant Funding Standard

The Standard Instant Funding plan allows traders to bypass evaluations and trade live funds right away. With no daily loss limit and a fixed 3% maximum drawdown, this model is simple but leaves little room for error.

Unlike evaluation accounts, there’s no consistency rule here, but strict drawdown conditions mean careful risk management is essential. Payouts are available on demand, making this program attractive for those who value fast access to profits.

| Account Size | One-Time Fee | Daily Loss | Maximum Loss (3%) |

|---|---|---|---|

| $2,500 | $64 | None | $75 |

| $5,000 | $158 | None | $150 |

| $10,000 | $94 | None | $300 |

| $25,000 | $317 | None | $750 |

| $50,000 | $475 | None | $1,500 |

| $100,000 | $767 | None | $3,000 |

| $200,000 | $1,265 | None | $6,000 |

| $250,000 | $1,560 | None | $7,500 |

| $300,000 | $1,810 | None | $9,000 |

* Leverage is fixed at 1:50. Profit splits start at 90% and can be upgraded to 100%. Payouts are processed on demand for fast access to earnings.

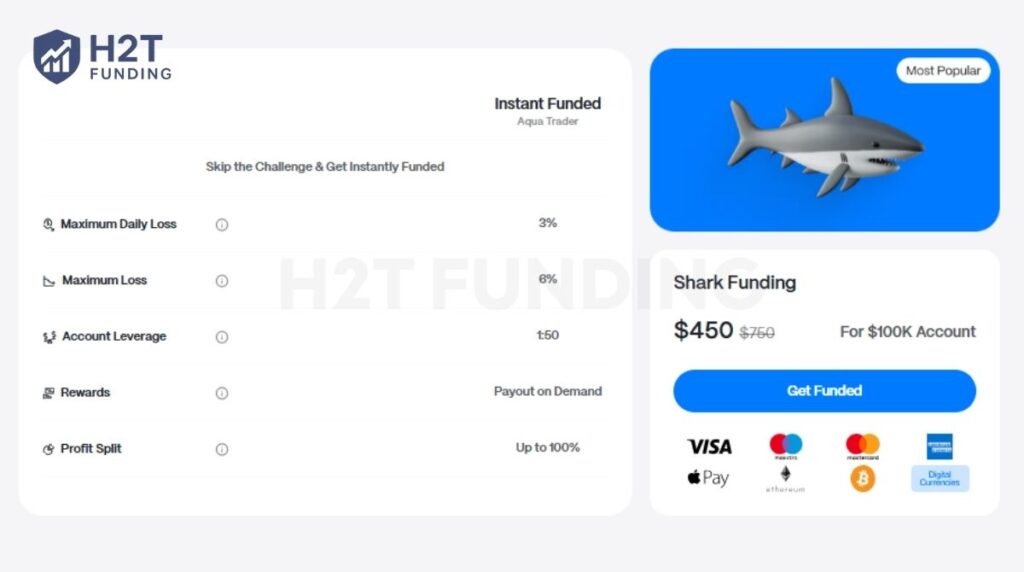

2.4.2. Instant Funding Pro

Compared to the Standard tier, Instant Funding Pro offers higher flexibility but also applies stricter loss limits. Every account enforces a 3% maximum daily loss and a 6% total maximum loss, making disciplined risk management essential.

With leverage fixed at 1:50, traders have enough room to scale positions while keeping risks under control. Profit splits can reach up to 100%, allowing funded traders to retain the full reward of their performance.

Another advantage is the on-demand payout system, which eliminates waiting periods and ensures earnings are accessible whenever needed.

| Account Size | One-Time Fee | Maximum Daily Loss (3%) | Maximum Loss (6%) |

|---|---|---|---|

| $2,500 | $60 | $75 | $150 |

| $5,000 | $115 | $150 | $300 |

| $10,000 | $155 | $300 | $600 |

| $25,000 | $310 | $750 | $1,500 |

| $50,000 | $465 | $1,500 | $3,000 |

| $100,000 | $750 | $3,000 | $6,000 |

| $150,000 | $980 | $4,500 | $9,000 |

| $200,000 | $1,250 | $6,000 | $12,000 |

| $250,000 | $1,540 | $7,500 | $15,000 |

| $300,000 | $1,790 | $9,000 | $18,000 |

| $400,000 | $2,449 | $12,000 | $24,000 |

* Leverage is fixed at 1:50 on both the evaluation and funded stages. Profit splits start at 90% and can be upgraded to 100%. Payouts are processed on demand, giving traders full control over when to access their earnings.

2.5. Aquaman challenge

The AquaMan Challenge is a special, weekend-only program that gives traders a fast-track route to funding. Unlike other models, it sets an ultra-low 2% profit target, making it one of the easiest entry points in the AquaFunded lineup.

However, strict 3% daily drawdown and 5% trailing max loss rules apply, so risk control remains crucial.

This challenge is not always available; it typically appears twice a month and runs only during specific weekends. Traders must stay updated through the AquaFunded website or Discord to secure their spot when registration opens.

Once funded, the rules become more restrictive. A 15% consistency rule is applied, meaning no more than 15% of total profits can come from a single day. While this encourages steady performance, it can be a hurdle for those who rely on breakout trades to hit large wins quickly.

Verdict on AquaFunded Program Challenge

From my perspective, AquaFunded offers one of the most diverse challenge portfolios in the industry. Whether you prefer quick evaluations or a slower, multi-step process, there’s a model tailored for almost every trading style.

However, the strict drawdown rules and post-funding consistency requirements mean you need to read the fine print carefully before committing.

- One-step challenge: Best for traders who want quick access to funding. Strict drawdown limits make discipline a must.

- Two-step Pro: A balanced model that combines challenge with flexibility, well-suited for experienced day traders.

- Three-step model: Ideal for patient traders who prefer steady compounding. No consistency rule makes it less restrictive.

- AquaMan challenge: A short-term option for smaller accounts, but post-funding consistency rules may cap bigger profits.

- Instant Funding: Attractive for skipping evaluations, but only suitable for disciplined, proven traders due to high fees and tighter rules.

Finally, I appreciate that AquaFunded gives traders optional add-ons like faster payouts (weekly instead of bi-weekly) and 100% profit splits. While not mandatory, these extras show that the firm tries to cater to traders who want more control over their earnings.

3. AquaFunded rules trading

AquaFunded aims to give traders freedom while keeping clear boundaries to protect capital. You can use many trading strategies without heavy restrictions, but some practices are closely monitored or banned. Breaking these rules can result in profit removal or even account closure.

3.1. Allowed trading rules

AquaFunded gives traders the flexibility to trade in their own style. There are no forced stop-loss rules, no lot size caps, and no restrictions on holding positions overnight or over weekends. Crypto trading is also available 24/7.

What you can do:

- Hedging: Allowed within the same account.

- Expert Advisors (EAs): Permitted on all platforms, including discretionary and automated trading.

- Trade copiers: Allowed between your AquaFunded accounts or linked personal accounts.

- Martingale strategies: Accepted, but only if used responsibly.

- News trading: Allowed during the evaluation phase.

- Overnight & weekend trades: No restrictions, including crypto markets.

3.2. Prohibited trading rules

Some strategies are banned to ensure fairness and protect liquidity providers. Violating these rules may result in profits being voided or accounts being terminated.

Not allowed:

- News trading on funded accounts: No trades 5–10 minutes before or after high-impact news; FOMC events are fully restricted.

- Arbitrage: Latency, reverse, hedge, or any manipulative arbitrage strategies are forbidden.

- High-frequency trading (HFT): Tick scalping or systems exploiting platform delays are prohibited.

- Overleveraging: Using more than 80% of margin or going “all-in” is not allowed.

- External copy trading: Copying signals or trades from outside AquaFunded is banned.

- Cheating: Any exploit of demo environments, price feed delays, or system bugs leads to account closure.

Verdict on AquaFunded trading rules

From my perspective, AquaFunded does a good job of giving traders freedom while still protecting its capital. The weak point lies in funded accounts, where restrictions become tighter. Bans around red-folder news and FOMC events can limit strategies that depend on volatility spikes.

Overall, I see the rules as fair and transparent. They reward disciplined, long-term trading and filter out exploitative strategies. Still, traders who want complete freedom in news trading or high-frequency systems might find these limitations restrictive.

4. AquaFunded payouts structure

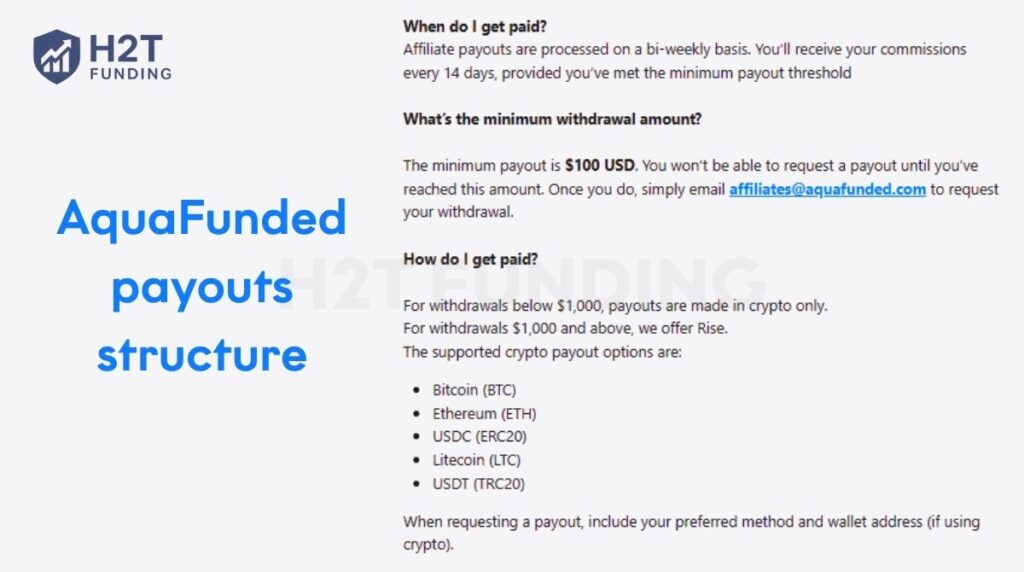

AquaFunded follows a bi-weekly payout schedule, giving traders regular access to profits. The first withdrawal can be requested 14 days after the first funded trade, or in 7 days if the fast-payout add-on is used.

To request a payout, traders must meet three conditions:

- Achieve at least $100 in profit.

- Account balance must be above the initial account balance with no violations recorded.

- No open positions or open orders when submitting the withdrawal.

- Eligible for 14 days from the first trade on the funded account.

Note: Minimum trading days vary by model (e.g., 5 days for Instant Funding models).

Profit splits by account type:

- Instant Standard → 90%, upgradeable to 80%

- Instant Pro → 90%, upgradeable to 100%

- Evaluation accounts → Start at 90%, upgradeable to 100% with add-ons

Payments are processed via Rise or crypto withdrawals, while deposits can be made with Visa, Mastercard, Apple Pay, or Crypto. Most transactions are processed quickly.

However, traders should be aware of extra conditions. Consistency rules vary by model type: Instant Funding Standard has a 20% rule, Instant Funding Pro and AquaMan have a 15% rule, while 1-Step Pro and 2-Step Pro funded accounts have a 25% rule. These rules state that no single trading day’s profit can equal or exceed the specified percentage of total profits during a payout period.

Verdict on payout structure

AquaFunded’s payout system is competitive and trader-friendly. High profit splits, frequent cycles, and multiple payment options make it appealing for serious traders.

The downside is the buffer and consistency rules, which can delay or reduce payouts if not managed carefully. This setup is clearly built for traders who prioritize steady, rule-compliant profits over chasing one or two oversized winning days.

5. Scaling plan AquaFunded

AquaFunded offers a structured scaling plan that allows traders to grow their account size over time, with a maximum allocation of up to $4 million. The plan is designed to reward consistent profitability and responsible risk management rather than one-off lucky trades.

To qualify, traders must achieve at least 12% profit within any 3 months. Once this milestone is met, the account balance is increased by 25% of its original size.

This creates a steady path for capital growth without putting traders under unnecessary pressure. For instant funding accounts, there is also a route to reach 95–100% profit splits if you maintain 4% profit for four consecutive months.

Scaling Criteria

| Criteria | Details |

|---|---|

| Scaling Interval | Every 3 months |

| Profit Requirement | 12% over the interval |

| Growth Rate | 25% of the original balance per scale |

| Profit Split | Up to 95 – 100% with conditions |

| Maximum Allocation | $4 million |

| Rules | All trading guidelines must be respected |

Verdict on the Scaling Plan of AquaFunded

AquaFunded’s scaling model is realistic and supportive, focusing on measured growth rather than aggressive targets. I find the rules transparent, and the fact that trading conditions don’t change as you scale is a strong advantage.

This plan best suits traders with a long-term mindset who aim for sustainable compounding and consistent withdrawals. While it may feel slower compared to firms promising faster 100% boosts, its stability and clarity make it more reliable for professional development.

6. Spreads & commissions of AquaFunded

AquaFunded uses raw ECN pricing, so spreads come directly from liquidity providers without markups. Traders can check live spreads in the test environment, but the firm doesn’t publish historical or average data. This makes it harder to benchmark pairs like EUR/USD or XAU/USD and to estimate long-term trading costs.

The lack of transparency is a drawback, especially compared to other prop firms that share average spread tables. Without consistent benchmarks, traders cannot easily calculate the true all-in cost (spread + commission). These affect scalpers, high-frequency traders, and beginners who rely on clear cost data for planning and backtesting.

On the positive side, commission fees are simple and predictable. AquaFunded charges $5 per lot on forex, metals, and commodities, while indices and crypto remain commission-free. With no hidden platform or data feed fees, the cost structure stays clear across all account types.

Commission Fee Structure

| Asset Class | Commission per Lot |

|---|---|

| Forex | $5 |

| Metals | $5 |

| Commodities | $5 |

| Indices | $0 |

| Crypto | $0 |

Verdict on Spreads & Commissions

AquaFunded’s simple and transparent commission model is a definite strength. The absence of fees on indices and crypto can be attractive for traders focused on those markets.

However, the lack of published average spreads holds the firm back. It forces traders to rely on short-term platform checks instead of clear cost benchmarks. This is a recurring theme in many AquaFunded reviews, where traders cite the lack of average spread tables as a hurdle for planning.

7. Trading platform AquaFunded

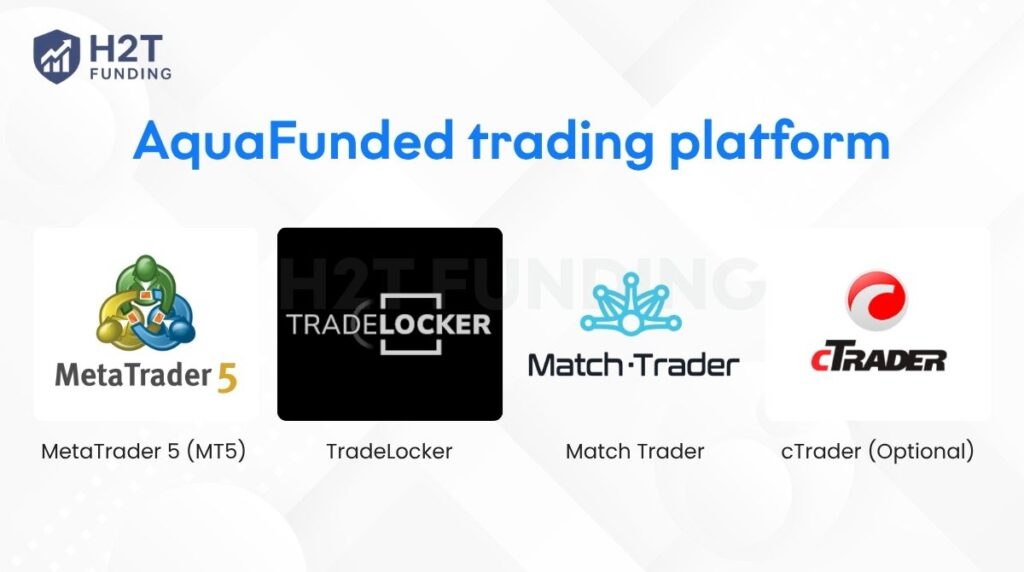

AquaFunded provides access to three core platforms: MT5, Match Trader, and TradeLocker, all with live ECN pricing and no extra platform or data fees. Traders can use EAs and trade copiers across accounts, provided they comply with strategy rules.

7.1. MetaTrader 5 (MT5)

MT5 is AquaFunded’s most advanced platform. It supports raw spreads, Depth of Market (DOM), partial bracket orders, and full algorithmic trading. With its powerful charting and automation features, it’s ideal for traders who depend on precision and complex setups.

Note: US residents or citizens cannot use MT5.

7.2. TradeLocker

TradeLocker is web-based, fast, and integrates seamlessly with TradingView. It includes tools like risk calculators, trailing stops, and on-chart execution. The layout is clean and mobile-friendly, making it a strong choice for beginners or traders who prefer a simplified interface.

7.3. Match Trader

Match Trader offers a modern design with desktop-level stability, supports automated trading, live ECN spreads, and zero commission on crypto and indices. It feels smoother than MT5 but more advanced than TradeLocker, positioning it as a balanced middle ground for most traders.

7.4. cTrader (Optional)

For traders who prefer cTrader, AquaFunded provides access for an additional $15 fee. This platform is favored for its intuitive interface and advanced order execution, though the extra cost may deter newer traders.

Verdict on trading platforms

AquaFunded earns strong marks for platform variety. MT5 caters to professionals, Match Trader provides a polished balance, and TradeLocker keeps things simple and mobile-ready. The addition of cTrader (with a $15 fee) broadens choice further, although it comes at a cost.

The main drawback is the lack of MT5 access for US traders, which may limit options in that market. Still, the ability to trade on multiple platforms with ECN pricing and EA support makes AquaFunded’s offering flexible and competitive compared to many prop firms.

8. AquaFunded trading instruments & leverage

AquaFunded gives traders access to forex, metals, indices, commodities, and crypto. Stocks and futures are not included, which limits diversification. Forex is the strongest market with 28 pairs, while other asset classes are thin, with only two metals, two commodities, and four crypto pairs.

Leverage of AquaFunded is determined by asset class and funding model rather than account size. This makes conditions predictable, but restrictions kick in after funding.

Evaluation accounts benefit from the highest ratios, while funded accounts, particularly Standard models, experience reduced leverage. Crypto trading remains the most limited, with a fixed cap of 1:2.

Leverage by Asset Class

| Asset Class | Instruments | Max Leverage (Evaluation) | Max Leverage (Funded – Instant) | Max Leverage (Funded – Standard) | Max Leverage (Funded – Pro) |

|---|---|---|---|---|---|

| Forex | 28 | 1:100 | 1:50 | 1:30 | 1:50 |

| Indices | 7 | 1:20 | 1:10 | 1:10 | 1:10 |

| Commodities | 2 | 1:20 | 1:10 | 1:10 | 1:10 |

| Crypto | 4 | 1:2 | 1:2 | 1:2 | 1:2 |

Risk controls are also enforced indirectly. Traders are expected to keep individual trades within 1–2% risk and avoid using more than 80% of total margin. While there are no hard lot-size limits, these rules act as a safeguard for both the firm and its traders.

Verdict on Trading Instruments & Leverage

AquaFunded covers the essentials and offers enough range for most common strategies, particularly in forex. The transparency around leverage by asset class is helpful, and risk guidelines encourage disciplined trading.

That said, the limited depth in metals, commodities, and crypto, combined with the sharp drop in leverage post-evaluation, makes the setup less flexible than top-tier firms.

9. Education & resource

AquaFunded provides traders with basic educational support through its FAQ section, blog articles, and platform walkthroughs. The FAQs cover essential topics such as challenge rules, payout conditions, and trading limits, making them useful for quick answers.

The blog includes posts on trading psychology, strategies for passing challenges, and general market insights. However, updates are irregular, and there’s no structured learning path or formal training program. Compared to firms that run webinars or offer coaching, AquaFunded feels light in this area.

Verdict on Education & Resources

AquaFunded’s education tools are beginner-friendly but limited. They provide a foundation for new traders but lack depth for advanced development.

If you already have trading experience, the resources may be sufficient, but newcomers will likely need to seek outside training. Overall, it’s functional but not competitive with firms that invest heavily in trader education.

10. Customer support

AquaFunded offers multiple support channels, including live chat, email, Telegram, and Discord. Live chat is handled via Intercom and is usually responsive during business hours (Mon–Fri, Dubai time). Email responses can take up to 24 hours, and weekend support is not available.

There is no dedicated phone line for immediate assistance, though some sources list a Dubai office number. Support is only offered in English, and complex questions may require several follow-ups. Discord is more active, serving as both a support hub and a community platform with trader discussions and payout proofs.

Verdict on Customer Support

AquaFunded’s support covers the essentials, but doesn’t go much further. The absence of weekend coverage can be frustrating, as can the sometimes uneven detail in responses. Overall, it’s a serviceable system for routine questions, but perhaps not reliable enough for urgent or complex help.

11. Real trader feedback about AquaFunded Trustpilot

On Aqua Funded Trustpilot, the firm has 1,000+ reviews on Trustpilot, with 70% being 5-star ratings and 18% being 1-star. This shows a split reputation; many traders are satisfied, but a notable number report serious issues.

Some negative reviews focus on payout problems. One trader said their profit withdrawal was cut in half after being accused of using HFT, which they denied. They still received only 50% of their earnings and were later blocked from opening a new account. For them, AquaFunded’s rules felt inconsistent and unfairly enforced.

On the positive side, traders also highlight fast payouts, a clean website interface, and responsive customer service. One reviewer praised the team for providing quick replies and clear solutions when issues came up.

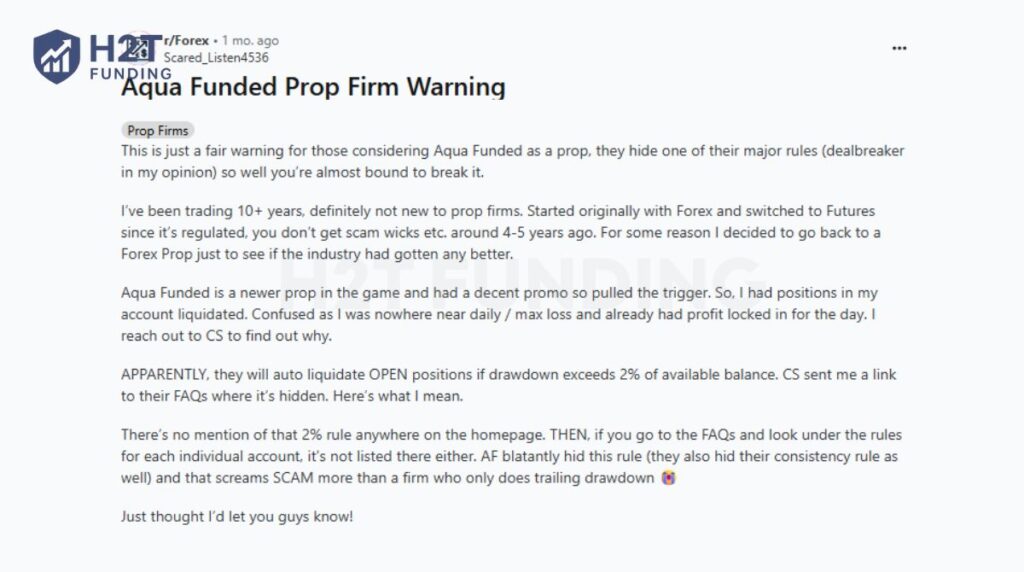

Beyond Trustpilot, Aqua Funded review Reddit discussions also raise concerns. A long-time trader warned that AquaFunded “hides” key rules, such as a 2% drawdown limit that triggered account closure without clear notice. For them, this pointed to a lack of transparency in how rules are communicated.

AquaFunded has also faced a Trustpilot warning for guideline breaches, including suspected fake reviews. This further fuels doubts about credibility.

Overall, community feedback is divided. AquaFunded’s fast payouts and user-friendly platform are strong positives, but hidden rules and transparency concerns remain a major drawback. In my view, it’s a reasonable choice if you want to test with smaller accounts and can manage strict rules. But if you plan to commit large capital, caution is essential.

12. How to sign up for AquaFunded – AquaFunded login

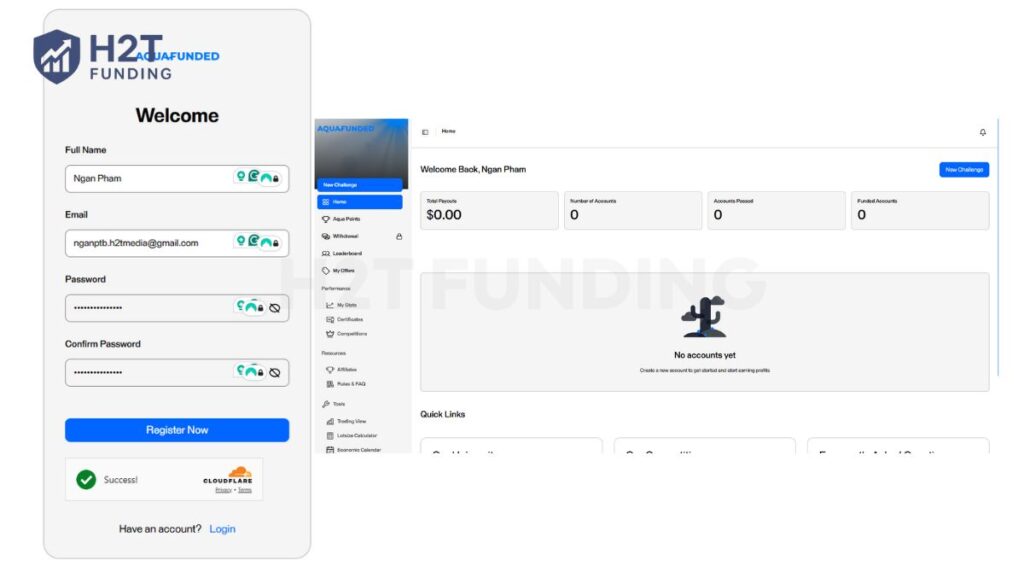

Getting started with AquaFunded is simple and fully online. The whole process only takes a few minutes, and you can begin trading right after payment. Here’s the step-by-step breakdown:

Step 1: Add extras (optional): You can upgrade profit splits to 100% or unlock faster 7-day payouts before checkout.

Step 2: Register your account: Enter your email, set a password, and confirm your details. Once registered, you’ll get direct access to the trading dashboard.

Step 3: Choose your model, and select account size: Decide how much capital you want to trade with. Options range from $2.5K up to $300K, depending on the model.

Step 4: Pay the one-time fee: Complete your purchase using Visa, Mastercard, Apple Pay, or crypto. There are no recurring charges or hidden costs.

Step 5: Start trading: Evaluation challenges activate right after purchase. Instant funding accounts are live immediately without waiting.

Step 6: Meet the objectives: Trade until you hit the required profit target and follow the rules for drawdown and consistency (if applicable).

Step 7: Complete KYC: Before your first payout, submit identity verification documents. This is immediate for instant accounts.

Step 8: Get funded & withdraw: Once you pass, your account is funded. Payouts are processed via Riseworks every 14 days, or 7 days if you added the fast-payout option.

The sign-up flow is quick and beginner-friendly, with no hidden hurdles. Whether you want to test yourself in an evaluation or skip straight to instant funding, AquaFunded keeps the onboarding smooth so you can focus on trading.

13. Compare AquaFunded vs other prop firm

When deciding between AquaFunded and its competitors, it’s important to look beyond marketing claims and review the details of each program. Factors like profit split, scaling, and drawdown rules can make a big difference depending on your trading style.

Below is a side-by-side comparison with Finotive Funding, BrightFunded, and E8 Markets.

| Parameters | AquaFunded | Finotive Funding | BrightFunded | E8 Markets |

|---|---|---|---|---|

| Minimum Challenge Price | $39 | $29 | €55 | $33 |

| Maximum Fund Size | $4,000,000 | $3,000,000 (via scaling) | Unlimited | $400,000 |

| Evaluation Steps | 1-Step, 2-Step, 3-Step, Instant, AquaMan | 1-step, 2-step, and Instant Funding | 2-Step | 1-Step, 2-Step, 3-Step, Instant |

| Profit Share | Up to 100% | 65% – 100% | 100% | 100% |

| Max Daily Drawdown | 4 – 5% (varies by model) | 5% | 5% | 7% |

| Max Drawdown | 3 – 10% | 10% | 8% | 14% |

| First Profit Target | 2% – 12% (depending on challenge type) | 5% – 10% (depending on challenge type) | 10% | 8% (Phase 1), 5% (Phase 2) |

| Challenge Time Limit | Unlimited | Unlimited (extensions possible) | Unlimited | Unlimited |

| Payout Frequency | 14 days (7 days or on-demand with an add-on) | Weekly or bi-weekly, depending on account type | 14 days | Weekly |

| Trading Platforms | MT5, TradeLocker, Match Trader (+cTrader $15 add-on) | MT5 | Proprietary | MT5, Match Trader |

Choosing the right prop firm depends on your strategy, risk tolerance, and payout expectations:

- AquaFunded: Best for traders who value flexibility in evaluation models, want unlimited time, and prefer optional add-ons for a 100% profit split.

- Finotive Funding: Fits those who want higher asset variety, weekly payouts, and broader instrument coverage, especially if they trade stocks or bonds.

- BrightFunded: A good match for traders seeking a straightforward 2-Step evaluation with a guaranteed 100% profit share.

- E8 Markets: Works well for traders who prefer higher drawdown buffers and weekly payouts but don’t need very large account sizes.

All four firms have strong offerings, but they appeal to different types of traders. The right choice depends on whether you prioritize challenge variety, payout speed, or market access.

14. FAQs

Yes. AquaFunded is a registered prop firm based in Dubai and has attracted a large trader community. However, it has also faced warnings from Trustpilot for guideline breaches and received mixed trader reviews. Some report smooth payouts, while others highlight disputes and hidden rules. It is not a scam, but traders should proceed with caution.

The minimum withdrawal is $100. You also need at least three active trading days and no open trades when submitting the request.

AquaFunded is a prop firm that gives traders access to capital after passing an evaluation or buying an instant funding account. You trade under set rules, keep a share of the profits, and follow drawdown and consistency limits.

The company is based in Dubai, United Arab Emirates, with its office registered at Algaroud Center.

Yes, AquaFunded accepts US traders. However, MetaTrader 5 is not available to US residents, so they must use TradeLocker, Match Trader, or cTrader instead.

Payouts are processed every 14 days. If you purchase the fast-payout add-on, the first withdrawal is available in 7 days.

AquaFunded partners with multiple liquidity providers and offers trading on platforms like MT5, Match Trader, TradeLocker, and cTrader. Exact broker names are not publicly disclosed.

The 3-Step model allows a 4% daily loss with an 8% maximum overall loss. 1-Step models have a 3% daily loss and a 6% trailing drawdown. The 2-Step Standard model permits a 5% daily loss and an 8% maximum total loss, while the 2-Step Pro model keeps the 5% daily loss but uses a 10% trailing drawdown. For Instant Funding, the Standard version includes a 3% daily loss with a 3% or 6% trailing drawdown, and the Instant Funding Pro offers a 3% daily loss with a 6% trailing drawdown.

If you break a rule, profits from those trades may be removed. In serious cases, the account can be terminated. For example, news trading violations on funded accounts often lead to profit removal but not a full account reset.

Yes, challenge fees are refundable. Once you pass the evaluation and get funded, the one-time fee is returned.

AquaFunded has the following country restrictions: Fully Restricted (no access): Cuba, Iran, Syria, Pakistan, Vietnam, Kenya, Albania, Algeria, North Korea, and Senegal. Restricted Access (Instant Funding models only, max $50K per trader): Thailand, Brazil, Bulgaria, Japan, Jordan, Singapore, Malaysia, Indonesia, and the Philippines.

15. Conclusion: Finally, our verdict about AquaFunded

After going through this AquaFunded review, it’s clear that the firm offers both strengths and challenges. On the positive side, AquaFunded gives traders a wide choice of challenge models and the chance to scale accounts up to $2 million.

But still, concerns remain. Rules can feel strict, especially post-funding, and the lack of published spread data limits cost transparency. Real trader feedback also shows mixed experiences, with some praising fast payouts while others point to payout disputes and inconsistent enforcement.

In the end, AquaFunded is best for traders who are disciplined, confident in following rules, and value flexibility in evaluation models. For those who prefer broader market depth or lighter restrictions, other prop firms may be a better fit.

To compare fairly, check out more prop firm reviews by H2T Funding before you decide where to trade.