Let’s be real. After navigating the prop firm world for years and reviewing dozens of them, I’ve learned one thing: the flashy marketing hooks you, but the fine print is what really matters.

This Alpha Capital Group review isn’t just a rehash of their website. It’s built on a deep dive into their rulebook, payout structures, and the real chatter from traders in the trenches. I’m looking past the surface-level features to give you the unvarnished truth.

Alpha Capital has definitely gained traction with its multi-phase challenges and 80% profit split on platforms like MT5 and cTrader. But with a mixed bag of trader feedback and some tough risk protocols, is it a smart choice for your trading journey?

In this Alpha Capital Group H2T Funding review, I’ll walk you through the real pros, the cons, and the red flags to watch out for, so you can decide if this firm truly deserves your time and money.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Alpha Capital Group websites before purchasing any challenge.

1. Our take on Alpha Capital Group review

Alpha Capital Group is a London-based proprietary trading firm established in November 2021. It provides a selection of evaluation pathways, including 1‑step, 2‑step, 3‑step, and a swing‑focused 2‑step challenge, offering funded account opportunities up to $200K with a potential to scale to $2 million and an attractive 80% profit split.

Here’s what stands out:

- Generous profit split & scaling: An 80% cut with bi-weekly or on-demand payouts is a strong incentive for disciplined traders.

- A home for swing traders: The 2-step Swing challenge is a game-changer, allowing overnight and weekend holds that are perfect for longer-term strategies.

- Solid trading infrastructure: You get access to MT5, cTrader, DXtrade, and TradeLocker with reported execution speeds under 70ms in an environment powered by ACG Markets.

- Community & support: Many traders praise their responsive customer service and user-friendly dashboard.

| Pros | Cons |

|---|---|

| High profit split (up to 80%), fast scaling to $2 million | Trading remains simulated; no real-money execution |

| Free trial available | Minimum trading days required (3 days) for Alpha Pro & Alpha Swing Challenges |

| Leverage up to 1:100 | Lot size limits apply after funding |

| No commission fees | Minimum average trade duration: 2 minutes |

| No minimum trading days required for Alpha One-step Challenge | Occasional payout holds or denials; post-funding KYC may delay access |

| No maximum trading duration | Some rule interpretations and sudden account closures reported by traders |

| Bi-weekly payouts for Alpha Pro and Alpha Swing Challenges | Transparency on spreads and execution conditions is somewhat limited |

| Holding overnight positions is allowed | |

| Weekend holding allowed (except Alpha Pro Challenge after funding) | |

| News trading allowed (except after funding on Alpha Pro & Alpha One-step Challenges) | |

| Payouts are balance-based | |

| Diverse funding options, including swing trading | |

| Supports MT5, cTrader, DXtrade, and TradeLocker; low-latency execution (~70 ms) | |

| Community tools, educational resources, and responsive support |

So, what’s the bottom line here? Alpha Capital Group presents a very flexible and potentially lucrative opportunity, especially for swing traders. However, you’re always trading in a simulated environment, and the reports of sudden rule enforcement can’t be ignored. This means you need to be comfortable with their terms and ready for compliance checks at any time.

2. Funding program at Alpha Capital

So, what’s the path to getting funded? Alpha Capital gives you four different doors to choose from, allowing you to qualify for funded accounts with a consistent 80% profit split. Each program offers different levels of flexibility, speed, and risk management to suit a variety of trading styles.

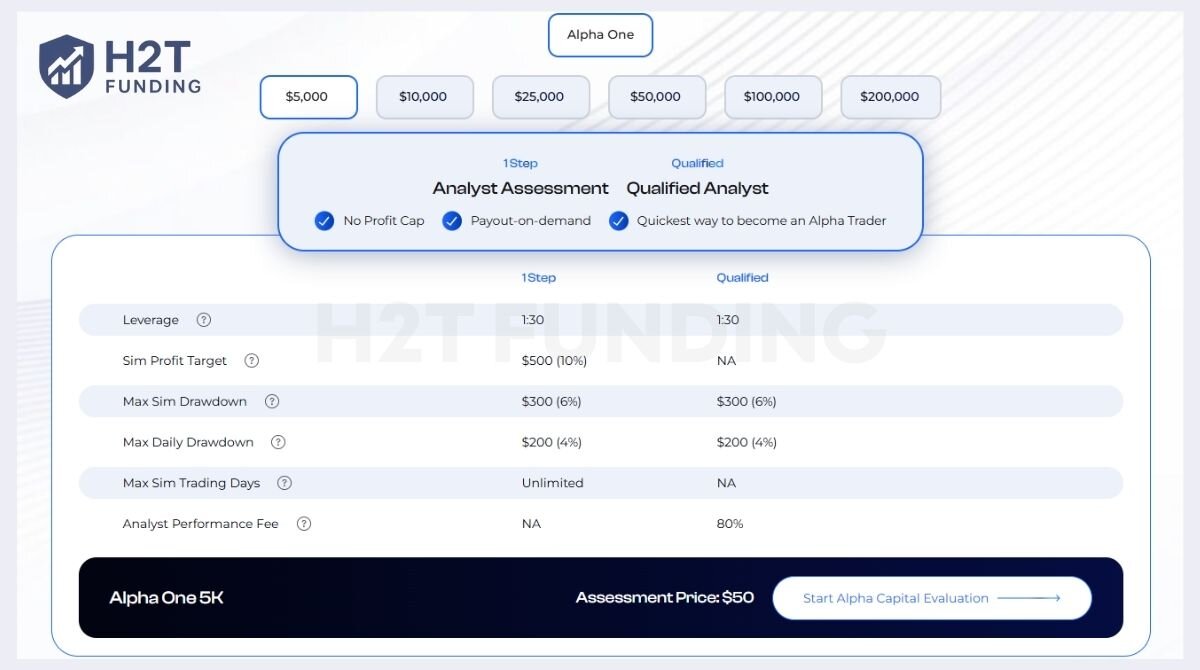

2.1. Alpha One – 1 Step

The Alpha One challenge is the fastest route to becoming a funded trader. With no time constraints, no minimum trading days, and a single-phase target, this program is ideal for experienced traders who are confident in achieving the 10% target quickly. The trailing drawdown rule encourages disciplined risk management.

Key program features include:

- Model: One-phase evaluation

- Profit target: 10%

- Max drawdown: 6% (trailing)

- Daily drawdown limit: 4%

- Time to complete: Unlimited

- Special rules:

- No minimum trading days

- Overnight and weekend holding allowed

- News trading allowed

- Entry fee: $50 – $997 depending on account size

| Account Size | Challenge Fee | Profit Target | Max Drawdown | Max Daily Drawdown |

|---|---|---|---|---|

| $5,000 | $50 | $500 | $300 | $200 |

| $10,000 | $97 | $1,000 | $600 | $400 |

| $25,000 | $197 | $2,500 | $1,500 | $1,000 |

| $50,000 | $297 | $5,000 | $3,000 | $2,000 |

| $100,000 | $497 | $10,000 | $6,000 | $4,000 |

| $200,000 | $997 | $20,000 | $12,000 | $8,000 |

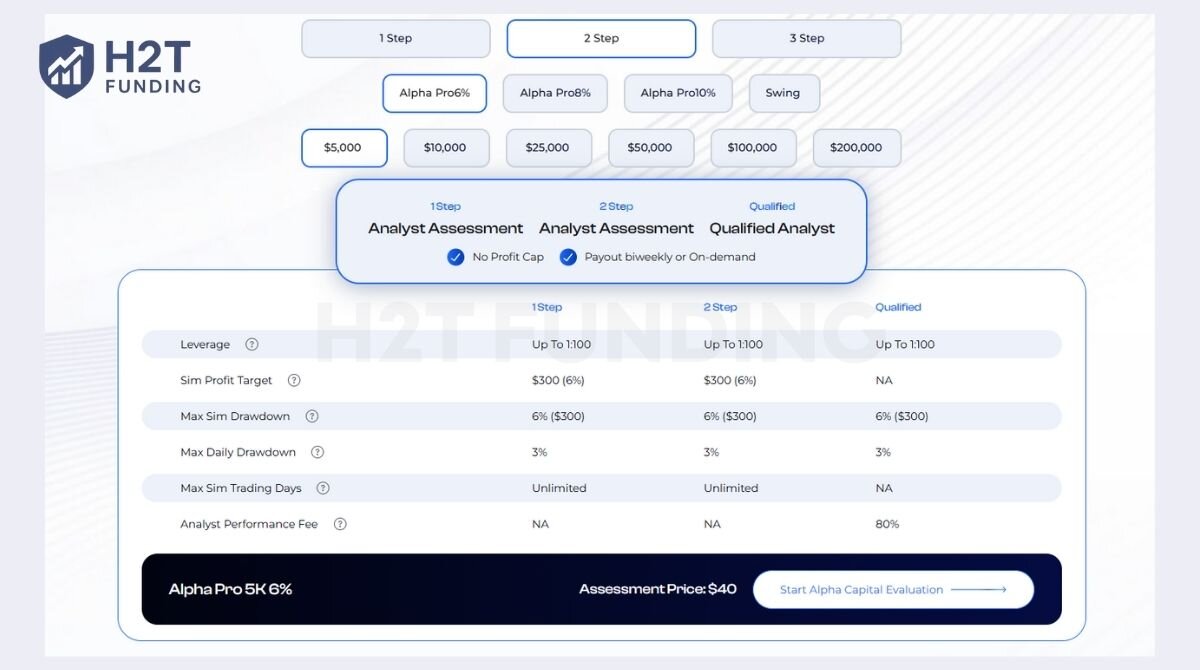

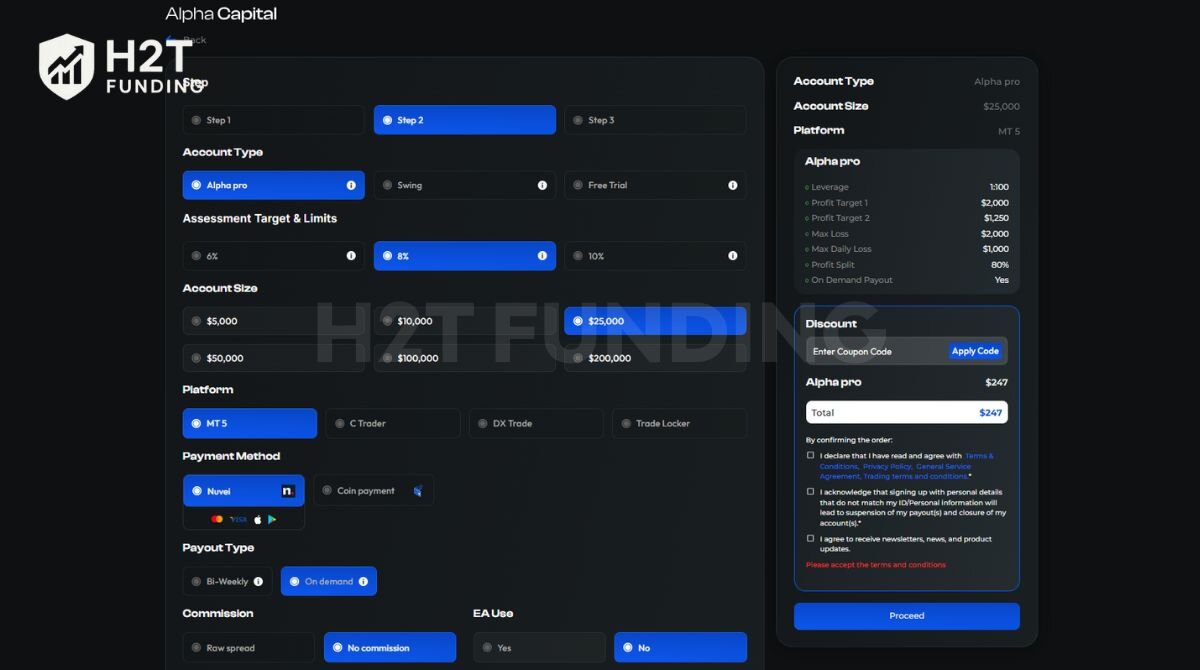

2.2. Alpha Pro – 2 Step

Alpha Pro is Alpha Capital’s most popular challenge. It provides a balance between accessibility and verification with a two-step process and flexible profit target options (6%, 8%, or 10%). This allows traders to match the risk level with their trading style while maintaining consistent performance.

This program is suited for those who prefer a structured path and are looking to prove their reliability across multiple phases before accessing real capital.

Key program features include:

- Model: Two-phase evaluation

- Profit targets:

- Step 1: 6%-8%-10%

- Step 2: 6%-5%-5%

- Max drawdown: 6%-8%-10%

- Daily drawdown limit: 3%-4%-5%

- Time to complete: Unlimited

- Special rules:

- Minimum 3 trading days per phase

- News trading and weekend/overnight holding allowed

- Entry fee: $50 – $997

| Account Size | Challenge Fee | Profit Target (Step 1) | Profit Target (Step 2) | Max Drawdown | Max Daily Drawdown |

|---|---|---|---|---|---|

| $5,000 | $50 | $500 | $250 | $500 | $250 |

| $10,000 | $97 | $1,000 | $500 | $1,000 | $500 |

| $25,000 | $197 | $2,500 | $1,250 | $2,500 | $1,250 |

| $50,000 | $297 | $5,000 | $2,500 | $5,000 | $2,500 |

| $100,000 | $497 | $10,000 | $5,000 | $10,000 | $5,000 |

| $200,000 | $997 | $20,000 | $10,000 | $20,000 | $10,000 |

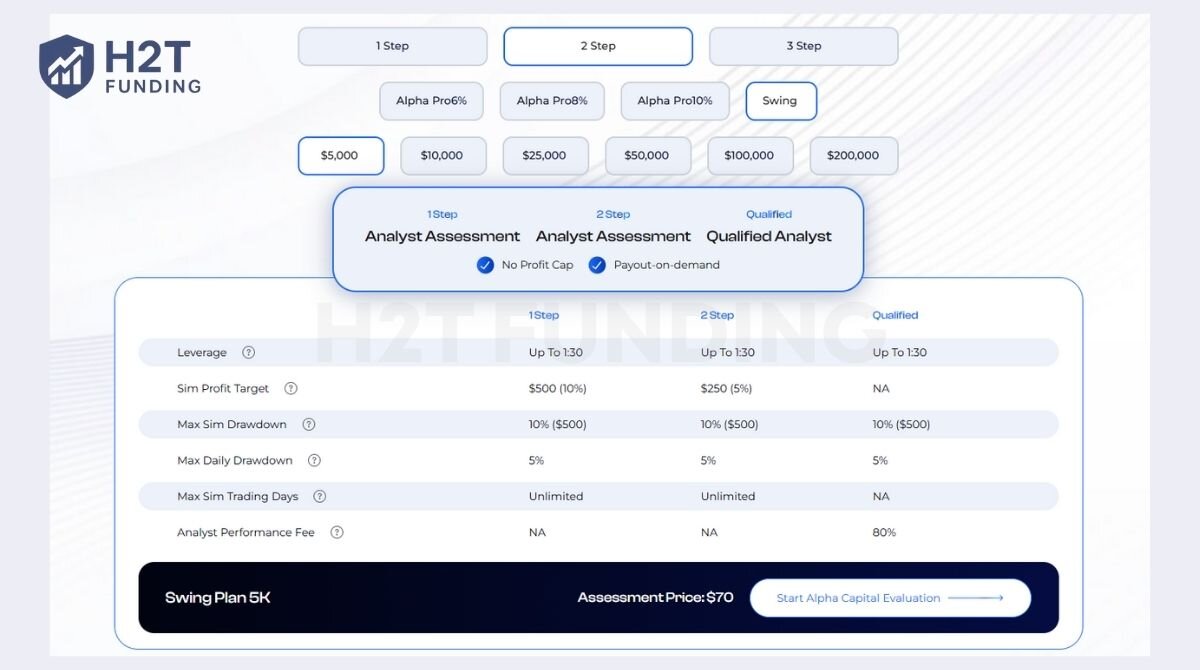

2.3. Alpha Swing – 2 Step

The Swing challenge is designed for traders who hold positions overnight or over weekends. It mirrors the Alpha Pro structure but removes all holding restrictions, ideal for swing or position traders who need flexibility in trade duration and timing.

It’s a strong choice for those who trade based on longer-term setups and don’t want to worry about flattening positions before market close.

Key program features include:

- Model: Two-phase swing trading evaluation

- Profit targets:

- Step 1: 10%

- Step 2: 5%

- Max drawdown: 10%

- Daily drawdown limit: 5%

- Time to complete: Unlimited

- Special rules:

- Minimum 3 trading days per phase

- Overnight and weekend holding allowed

- News trading permitted

- Entry fee: $70 – $1,097

| Account Size | Challenge Fee | Profit Target (Step 1) | Profit Target (Step 2) | Max Drawdown | Max Daily Drawdown |

|---|---|---|---|---|---|

| $5,000 | $70 | $500 | $250 | $500 | $250 |

| $10,000 | $147 | $1,000 | $500 | $1,000 | $500 |

| $25,000 | $247 | $2,500 | $1,250 | $2,500 | $1,250 |

| $50,000 | $357 | $5,000 | $2,500 | $5,000 | $2,500 |

| $100,000 | $577 | $10,000 | $5,000 | $10,000 | $5,000 |

| $200,000 | $1,097 | $20,000 | $10,000 | $20,000 | $10,000 |

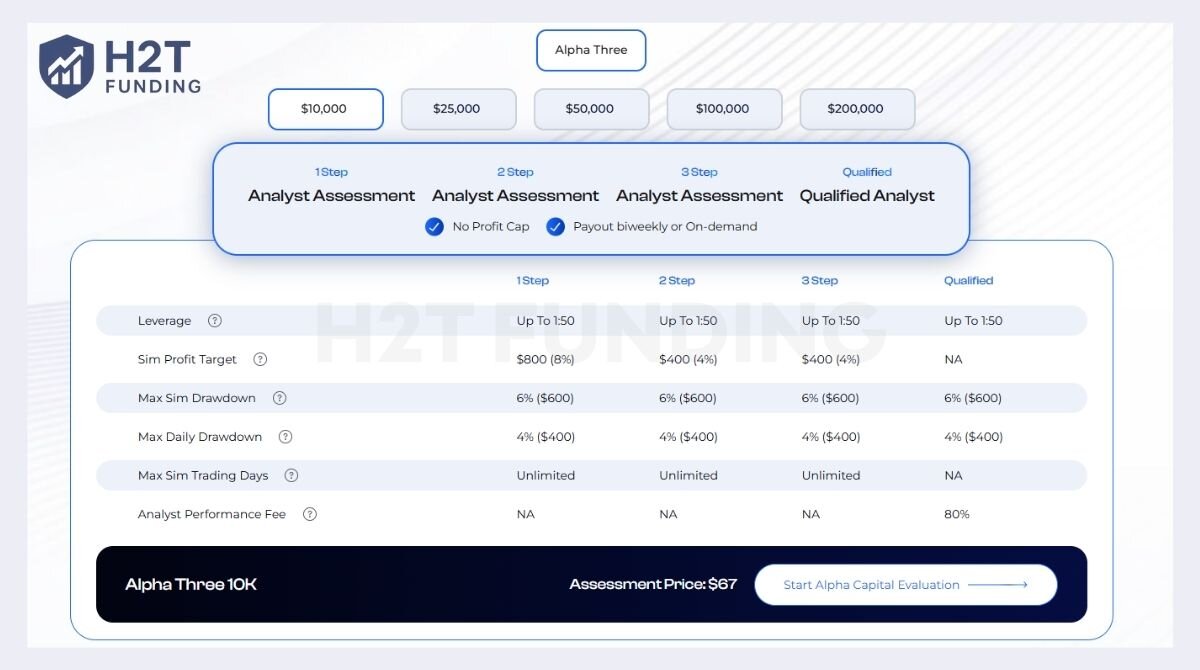

2.4. Alpha Three – 3 Step

Alpha Three is the most rigorous program Alpha Capital offers. Its three-phase format emphasizes long-term consistency, discipline, and gradual growth, perfect for traders who want to showcase sustained performance.

This is best for cautious traders and those who view prop funding as a long-term journey rather than a short-term goal.

Key program features include:

- Model: Three-phase evaluation

- Profit targets:

- Step 1: 8%

- Step 2: 4%

- Step 3: 4%

- Max drawdown: 6%

- Daily drawdown limit: 4%

- Time to complete: Unlimited

- Special rules:

- Minimum 3 trading days per phase

- Overnight/weekend holding and news trading allowed

- Entry fee: $67 – $697

| Account Size | Challenge Fee | Profit Target (Step 1) | Profit Target (Step 2) | Profit Target (Step 3) | Max Drawdown | Max Daily Drawdown |

|---|---|---|---|---|---|---|

| $10,000 | $67 | $800 | $400 | $400 | $600 | $400 |

| $25,000 | $157 | $2,000 | $1,000 | $1,000 | $1,500 | $1,000 |

| $50,000 | $247 | $4,000 | $2,000 | $2,000 | $3,000 | $2,000 |

| $100,000 | $397 | $8,000 | $4,000 | $4,000 | $6,000 | $4,000 |

| $200,000 | $697 | $16,000 | $8,000 | $8,000 | $12,000 | $8,000 |

Verdict on funding program

Alpha Capital Group’s funding options are among the most versatile in the industry. Whether you need fast access, long-term structure, or swing flexibility, the firm offers a tailored solution. All programs feature a competitive 80% profit split and clearly defined rules.

However, success depends on understanding the limits, especially the drawdown rules and risk controls. For traders who value transparency, flexibility, and multiple progression paths, Alpha Capital’s funding suite delivers strong potential with thoughtful design.

3. Alpha Capital Group trading rules

Alpha Capital Group enforces a well-defined set of trading rules designed to promote disciplined trading and ensure fair use of its evaluation system. The rules accommodate various trading styles while maintaining strict boundaries around risk and behavior.

3.1. Allowed trading practices

The good news is, they’re pretty flexible with how you trade. Whether you’re a scalper hitting the 5-minute charts or a swing trader holding for weeks, your style is generally welcome here.

- Supported strategies: Day trading, scalping, swing, and position trading are allowed across platforms like MT5, DXtrade, cTrader, and TradeLocker.

- Overnight and weekend holding: Allowed in all programs except the Alpha Pro-funded account, which requires trades to be closed before weekends.

- News trading:

- Swing program: Permits news trading as long as trades placed within ±2 minutes of a high-impact event remain open for at least 2 minutes.

- Other programs: Trading is restricted within 5 minutes before and after high-impact news releases.

- Expert Advisors (EAs): Allowed with prior disclosure and approval.

- Hedging and order stacking: Permitted within a single account, as long as trades aren’t mirrored across multiple accounts.

- No fixed time limit: Traders can take as long as needed to complete the evaluation phases, provided rules are respected.

- Multiple accounts allowed: Traders may operate multiple accounts, provided they are not copying trades between them.

3.2. Prohibited trading practices

Alpha Capital prohibits specific behaviors that undermine the integrity of its funding model:

- Technical exploit strategies: Arbitrage, latency exploitation, spoofing, and front-running are strictly forbidden.

- Order spam or manipulation: Rapid-fire orders to create false market signals are not allowed.

- Group or copy trading: Using third-party signals, signal services, or copying trades across accounts is prohibited.

- Gambling-style behavior: Abrupt increases in lot size or risking full account balance in a single trade are not tolerated.

- Third-party EAs or signals: Only pre-approved systems may be used.

- Mirrored trades: Creating offsetting trades across multiple accounts to avoid drawdown risk is a serious violation.

Verdict on trading rules

Alpha Capital Group’s trading rulebook strikes a balance between flexibility and risk discipline. It supports diverse strategies, including swing and news trading, and offers traders reasonable freedom within structured limits.

However, some nuanced rules, like the best-day restriction and lot size limits, require close attention to avoid unintended violations. Overall, the framework is suitable for disciplined traders who are attentive to risk and procedural details.

4. Alpha Capital payout rules

Alpha Capital Group provides an 80% profit split across all its funded accounts, with two main payout methods designed to accommodate different trading behaviors. These include a fixed bi-weekly payout option and a flexible on-demand alternative. Each method comes with specific conditions related to trading activity, minimum profits, and consistency rules.

4.1. Bi-weekly payout option

This method is available to traders using the Alpha Pro, and Alpha Three accounts. It is designed for those who prefer a structured payout timeline and are confident in maintaining steady profitability across regular intervals.

- Payouts are issued every 14 calendar days from the date of the first qualifying trade.

- The minimum gross profit required to request a payout is $100.

- Traders must complete at least 5 trading days within the 14-day cycle to be eligible.

- Payments are typically processed within 2 business days.

4.2. 2% On-demand payout

This payout type is available on all programs, including Alpha One and Swing accounts. It suits traders who want to withdraw profits as soon as they meet performance conditions, without waiting for a fixed cycle.

- Traders must accumulate at least 2% in gross profits in their account before initiating a payout request.

- At least 3 trading days must be completed within the last 30 days to qualify.

- The “Best Day Rule” applies: no single day may contribute more than 40% of total profits at the time of payout.

- Approved payouts are processed within approximately 2 business days.

4.3. The 40% Best Day Rule

Now for the big one, the 40% Best Day Rule. This is their way of making sure you’re not just a one-hit-wonder who got lucky on a single trade. They want to see consistent, bread-and-butter profits, not a Hail Mary pass that accounts for your entire payout.

- If your single most profitable trading day accounts for more than 40% of your total profits, payout eligibility is restricted.

- For example, if you made $800 on your best day, your total profit must exceed $2,000 before you can withdraw.

- The rule resets with each withdrawal cycle or after new trades are executed following a payout.

Verdict on payout

Alpha Capital Group offers a payout structure that caters to both systematic and opportunistic traders. The bi-weekly system supports those with regular trading schedules, while the on-demand model provides flexibility for more dynamic strategies.

However, conditions like minimum profit thresholds, activity requirements, and the 40% rule demand discipline. Traders should monitor their equity curve and trade frequency carefully to take full advantage of either option.

5. Scaling plan Alpha Capital Group

Alpha Capital Group offers a scaling plan designed to reward consistent performance, allowing traders to grow their funded account gradually up to $2 million. This tiered growth structure encourages disciplined trading and aligns with the core philosophy of Alpha Capital Group H2T Funding review: supporting sustainable expansion for successful traders.

Each time a trader secures a 10% gain, they become eligible to both scale their account size and withdraw profit, facilitating parallel growth in capital and earnings. Here’s how the process works and why it stands out among other scaling strategies:

- Trigger for scale-up: Achieve a 10% increase in the funded account balance.

- Account increase: Upon validation, the account receives a 10% boost relative to its original funded size.

- Simultaneous withdrawal: Traders may take out their performance fees at the same time they scale, thanks to split-timing flexibility.

- Higher position capacity: Once the second scale-up is processed, the maximum lot size increases by 10%, enabling larger position trades.

Why it matters:

- Think of their scaling plan as a reward system for not being a cowboy. They want to see you grow your account with steady gains, not by betting the farm. It forces you to focus on risk-adjusted growth.

- Traders retain full access to payouts, eliminating wait times or forced delays in profit-taking.

- The plan integrates with both fast-paced 1-step challenges and longer-term 3-step programs, making it versatile across trading styles.

Verdict on scaling plan

In summary, the scaling plan is a compelling feature of Alpha Capital’s funded account structure. It enables profitable traders to boost their capital responsibly and take earnings in tandem, a growth model aligned with long-term, disciplined trading approaches.

6. The commission fee and pricing

Alpha Capital Group charges a fixed one-time fee for each evaluation, ranging from $50 to $997, depending on the account size and challenge type. These fees are non-refundable, regardless of whether the trader passes, fails, or exits the program early.

Traders can choose between standard accounts with no commissions and raw spread accounts that apply a $2.50 per lot round-trip commission. The firm advertises spreads starting from 0.1 pips, but it does not disclose average or typical spreads for specific instruments.

The claim of offering both “raw spreads” and “commission-free trading” is conflicting. In standard industry practice, raw spreads come with added commission, while commission-free models often widen the spread to include fees.

There is no refund policy for failed or canceled challenges. Profits can also be withheld if Alpha Capital detects rule violations, though the specific criteria are not clearly outlined on their official channels.

Verdict on the commission fee and pricing

While Alpha Capital’s fees are competitive on the surface, the lack of pricing transparency and strict refund terms make it less ideal for beginners. Traders should evaluate effective trading costs during the challenge to ensure alignment with their strategy.

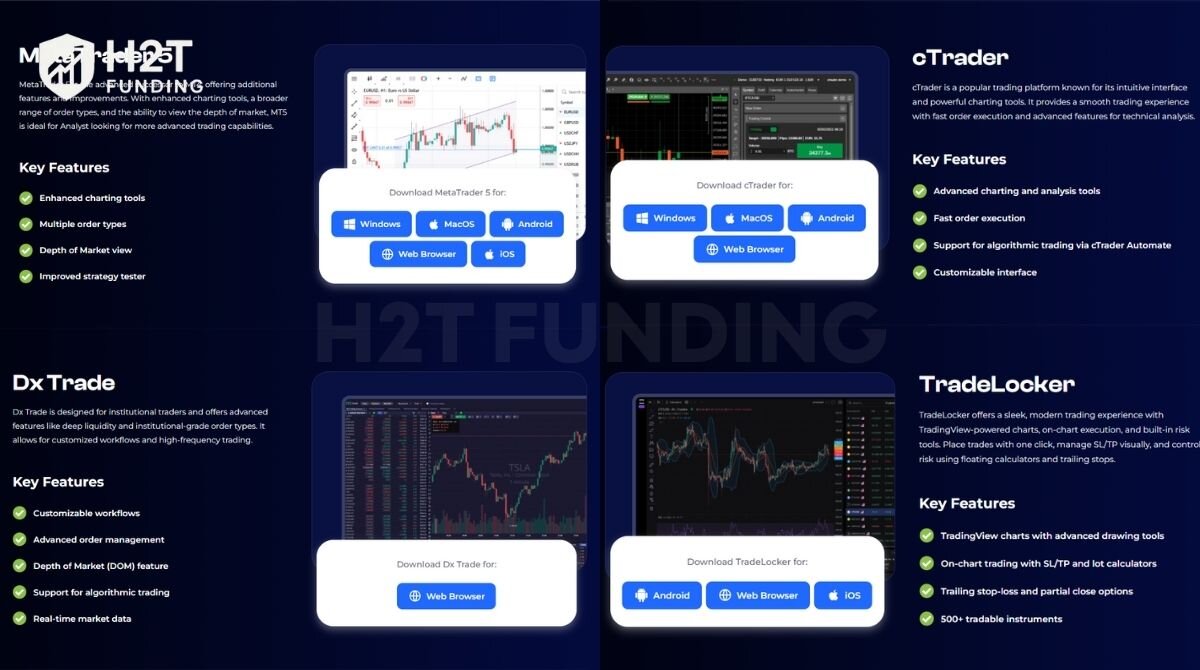

7. Trading platform Alpha Capital Group

Alpha Capital Group provides traders with access to a diverse range of platforms, ensuring flexibility for different trading styles and preferences. The lineup now includes MetaTrader 5 (MT5), cTrader, DXTrade, TradeLocker, and Alpha Trader, each with its own unique strengths. All trading is conducted in a simulated environment, even for funded accounts, so execution speed and fills may differ from live markets.

- MetaTrader 5 (MT5): Ideal for algorithmic and automated trading, MT5 supports Expert Advisors (EAs), multiple timeframes, and robust charting. Suited for traders who rely on automation or require in-depth technical analysis.

- cTrader: Known for a clean interface, one-click trading, and Level II market depth, cTrader appeals to scalpers and day traders. It delivers faster execution and clearer visibility into market liquidity.

- DXTrade: A more basic platform compared to MT5 and cTrader, DXTrade offers essential charting and order execution. It is the only platform available to U.S. residents, which may limit functionality for traders used to advanced tools.

- TradeLocker: Built on TradingView’s charting engine, TradeLocker delivers a modern interface with on-chart execution, SL/TP visualization, trailing stops, partial closes, and floating lot/risk calculators. Perfect for traders who want speed, precision, and visual control without third-party plugins.

- Alpha Trader: Alpha Capital’s proprietary platform designed for data-driven traders. Features TradingView-powered charts, integrated news feeds, an economic calendar, custom risk management tools, and in-depth performance analytics, ideal for refining trading discipline and strategy execution.

One important note: Alpha Trader is coming soon. For the most accurate and up-to-date details, we strongly recommend checking directly on Alpha Capital Group’s official website, as features and offers may change quickly.

Verdict on the trading platform

Alongside these, Alpha Capital integrates Autochartist, a market screener, economic calendar, trading journal, and live price feeds, enhancing decision-making and technical analysis. Despite this suite, traders must consider that all activity remains simulated, and platform behavior may differ under live-market conditions.

8. Trading instruments & leverage

Alpha Capital Group provides access to key asset classes: Forex, commodities, and stock indices, with varying leverage limits depending on your program. While the selection is more focused than some competitors, it covers the essential markets for most trader profiles.

1. Forex pairs

Alpha offers over 30 Forex pairs, including major, minor, and select exotic currencies. Its Alpha Pro accounts allow up to 1:100 leverage, while One and Swing accounts are capped at 1:30. The Three-step plan provides 1:50 leverage, balancing risk and growth potential.

2. Commodities

You can trade the usual suspects here: Gold, Silver, and both Brent and WTI oil. It’s a standard offering, but it covers the essentials.. The Alpha Pro program supports 1:30 leverage on metals and 1:10 on oil, while One, Swing, and Three-step accounts offer 1:9 on metals and 1:10 on oil, aligning with standard risk profiles.

3. Stock indices

Traders can access eight major indices such as the Dow Jones, the Nasdaq 100, and the DAX. Leverage varies by program: 1:20 for Alpha Pro and 1:10 for One, Swing, and Three-step accounts, providing adequate exposure without excessive risk.

Final verdict on instruments & leverage

Alpha Capital offers a solid range of tradable products with program-specific leverage designed to balance opportunity and risk. While traders have fewer instruments than some firms, the offerings are sufficient for most strategies. High leverage on FX for Pro accounts appeals to aggressive traders, whereas conservative limits on commodities and indices help maintain disciplined exposure.

9. Education & resource Alpha Capital Group

Alpha Capital Group places equal importance on trader development and capital provision, creating an ecosystem where skill growth and funding go hand in hand. Their educational infrastructure is designed to help traders progress systematically while leveraging professional-grade tools.

1. Formal Education Programs

Traders can gain access to structured training pathways that cater to all experience levels. The curriculum includes high-quality video tutorials, interactive online classes, and personalized one-on-one mentoring with seasoned trading professionals. Learning is tiered, allowing beginners to build a solid foundation before advancing to complex strategies and market structures.

2. Trading Support Tools

To complement education, Alpha Capital offers a suite of proprietary tools, including risk management software, a digital trading journal, integrated economic calendars, and advanced technical analysis utilities. These tools are built to support decision-making, improve consistency, and streamline performance tracking.

3. Community and Learning Environment

Alpha Capital maintains a highly active Discord community with over 100,000 members, providing an interactive space for traders to share insights, discuss strategies, and receive real-time peer support. While this community fosters collaboration, it is designed to enhance, not replace, the structured education provided by the Alpha Academy.

4. Exclusive Programs for Top Performers

The firm also runs the Alpha Prime program, an elite-level initiative featuring weekly strategy meetings, direct mentorship, and continuous skill refinement. This program is tailored for consistently profitable traders seeking to push their performance further.

Verdict on Education & Resources

From my perspective, Alpha Capital’s blend of structured training, hands-on mentorship, proprietary tools, and a thriving trader community positions it among the more well-rounded prop firms in the market. It’s particularly well-suited for traders who value a clear learning path, continuous improvement, and a supportive environment alongside funding opportunities.

10. Customer support

Alpha Capital’s support team is available via live chat, email, and Discord from 08:00 to 20:00 GMT on weekdays. Support generally responds quickly during business hours, though responses may slow over weekends.

TradingFinder notes smooth assistance during KYC and payout inquiries, but some users report delays or account pauses during challenge evaluations.

Overall, support is professional and accessible, though weekend responsiveness may affect workflow for active traders.

Verdict on customer support

The customer support offers reliable help during the week, but weekend limitations could disrupt some traders. For those seeking funding and self-driven skill growth, the environment is adequate.

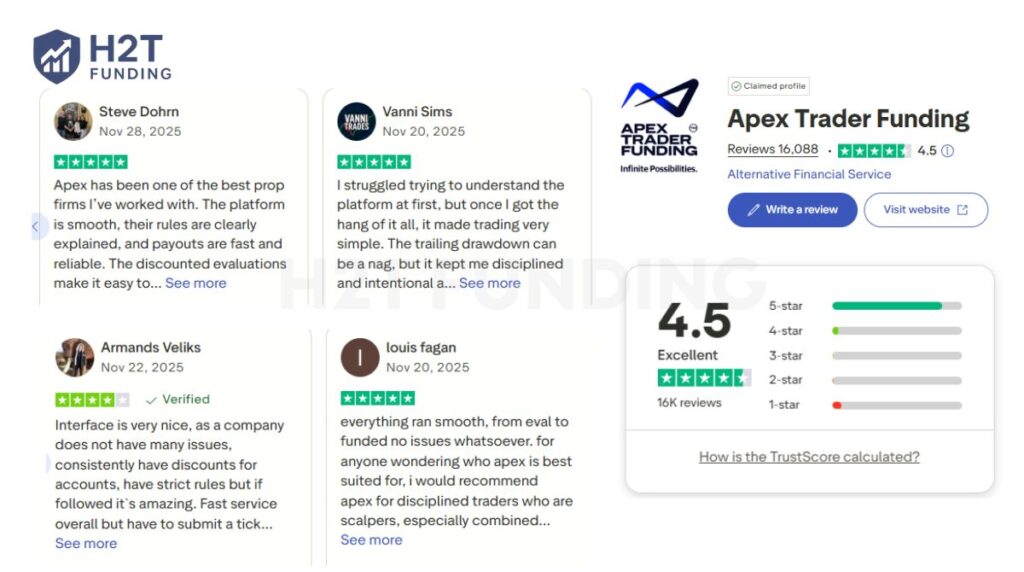

11. Trader feedback and reputation of Alpha Capital Truspilot ratings

On the surface, a 4.5 Trustpilot score looks fantastic. But as any seasoned trader knows, you have to read the 1-star reviews to get the full story. And that’s where things get interesting, many of which raise red flags regarding payout denials, sudden account closures, and strict post-evaluation KYC enforcement.

Some traders report having their accounts terminated or payouts withheld after passing the challenge. A recurring issue is the 40% best day rule under the 2% On-Demand payout model, which many claim is restrictive and never resets. One user wrote:

“I have funded account on this company and never again. I will never get payout because of payout on demand which has some consistency rule that best trading day has to be 40% of your payout which never resets and cannot be changed… You have to do video interview when you get funded or when you ask for a payout and wait for it for several days.” Tomislav Sodan, Trustpilot

Other users, however, report successful payouts and highlight helpful support staff:

“Minor hiccups on my side, but Alpha does pay. Just follow the rules. Big thanks to Rami, one of the Discord support members he was of great assistance reassuring me of how good Alpha is and assisting me with getting my payout.” Banks, Trustpilot

Alpha Capital also maintains a strong presence on social platforms, with over 70K followers on Twitter, 73.4K on Instagram, and 32.8K subscribers on YouTube. These channels are mainly used to share success stories, announcements, and tips. However, some traders who raise concerns on Discord reportedly get banned or silenced, which casts doubt on the firm’s transparency.

Verdict on feedback and reputation

Despite Alpha Capital’s impressive public image and sizable social media following, there are consistent and credible concerns from funded traders about payout restrictions, rule changes post-evaluation, and delayed communication.

While some users praise their experience, the pattern of critical feedback suggests this firm may not be ideal for traders seeking full transparency and long-term trust. Traders should approach with caution and thoroughly review all policies before committing.

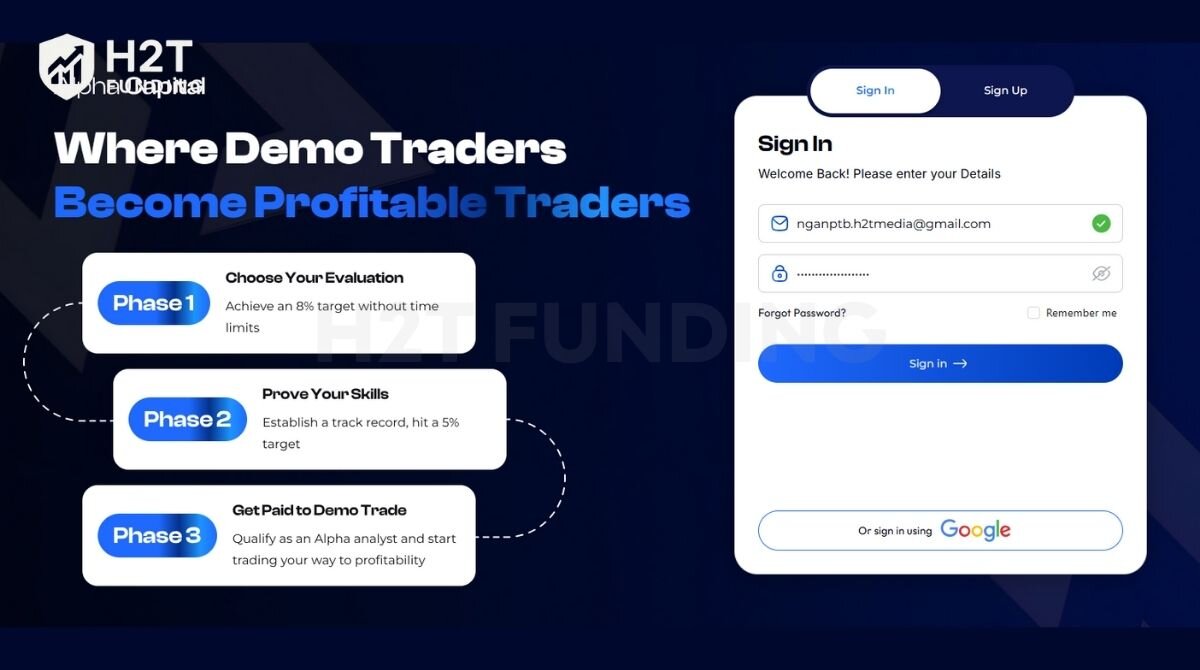

12. How to sign up with Alpha Capital Group

Getting started with Alpha Capital Group is a straightforward process, but it involves strict compliance with KYC and IP address policies. Traders must ensure they fully understand the firm’s evaluation rules and risk guidelines before joining.

Step-by-step sign-up process:

- Step 1: Create an account: Register on Alpha Capital Group’s official website using a valid email and password. You’ll receive an email verification link to confirm your identity before continuing.

- Step 2: Select a funding challenge: Choose from one of the firm’s four funding evaluations based on your trading style and risk tolerance:

- Alpha One (1-Step): Fast-track access to funding with a single evaluation phase.

- Alpha Pro (2-Step): A balanced challenge for consistent traders with flexible drawdown tiers (6%, 8%, or 10%).

- Swing (2-Step): Similar to Alpha Pro, but allows for overnight and weekend positions.

- Alpha Three (3-Step): A multi-phase challenge ideal for proving long-term discipline.

- Step 3: Purchase your challenge: Pay for your selected challenge using credit/debit cards, bank transfer, or supported online payment services. Crypto is not accepted at this time.

- Step 4: Start your evaluation: Once payment is confirmed, you’ll receive your demo account credentials and can begin trading under the evaluation rules. Carefully monitor drawdown limits, profit targets, and minimum trading days.

- Step 5: Complete all evaluation phases: If your challenge includes multiple steps, such as Alpha Pro or Alpha Three, you must meet the profit target and risk requirements at each level before progressing.

- Step 6: KYC verification: Before receiving a funded account, you must pass Alpha Capital’s KYC process. This includes uploading a government-issued ID and, in some cases, completing a risk interview to validate your strategy and compliance.

- Step 7: Access your funded account: Once verified, you’ll gain access to a simulated funded account. At this stage, you’re eligible to earn profits under Alpha Capital’s payout policies, such as biweekly or 2% On-Demand.

Important notice: Alpha Capital enforces strict IP and activity monitoring. Violations of their geographic or behavioral policies may result in disqualification, even after passing evaluations.

While the sign-up journey is relatively easy, traders must thoroughly understand all terms, rules, and payout conditions before committing. Non-compliance with KYC or IP policy is one of the leading causes of account closure, so transparency and caution are key.

13. Compare vs other Prop Firm

To help you make an informed decision, here’s a comparison between Alpha Capital Group and two well-known competitors: FTMO and TopTier Trader. These firms offer similar funded-account models and are frequently considered by the same category of traders.

| Criteria | Alpha Capital Group | FTMO | TopTier Trader |

|---|---|---|---|

| Evaluation difficulty | Medium – 1‑ to 3‑phase models with varying drawdown options | Medium – standard 2-phase challenge (10% -> 5%) | Low – flexible 1‑ or 2‑phase options with add-ons |

| Profit split & scaling | 80%, with scalable account growth up to $2 million | 80% -> 90% after scaling; scaling available | 80% -> 90–95% with scaling models |

| Trading rules | Daily Drawdown 4–5%, Max Drawdown 6–10%, news trading allowed (Swing only) | Daily Drawdown 5%, Max Drawdown 10%, limited news trading | Flexible rules; news & weekends allowed with add-ons |

| Platforms supported | MT5, cTrader, DXtrade, and TradeLocker | MT4, MT5, cTrader, and DXtrade | MT4, MT5, and TradeLocker |

| Instruments | Forex, indices, metals, oil | Forex, indices, commodities, crypto | Forex, commodities, indices, crypto |

| Evaluation fee | ~$50–997 depending on size | ~$300 USD for $100K challenge (refundable on success) | €99 ($110) refundable after passing |

| Payout frequency | Bi-weekly or on-demand (2% rule) | Bi-weekly after funding; first payout from 30 days | Weekly payouts from day one |

| Trustpilot rating | 4.6/5 with 9% 1-star reviews | 4.8/5 with 24K+ reviews | 4.0/5 with 4K+ reviews |

14. FAQs

Yes, Alpha Capital does pay out to funded traders. Payment is issued via bi-weekly or on-demand methods and typically arrives within 2 business days after approval. However, some users have reported delays or additional checks before disbursement.

Alpha Capital was founded in November 2021 and operates as a prop trading firm that issues simulated funded accounts. While it has grown rapidly, some traders report account closures or payout issues after passing challenges, typically due to rule breaches or KYC/IP concerns.

Traders must ensure that the average duration of trades exceeds 2 minutes, and more than 50% of profit must come from trades lasting longer than 2 minutes. Violating this rule during evaluation or funding resets the phase or removes profits.

For funded accounts, Alpha Capital enforces a 1% maximum risk per position based on the initial balance. Exceeding this limit, especially through cumulative or paired trades in the same symbol, can lead to account suspension or reset.

Yes, Alpha Capital Group is a legitimate proprietary trading firm founded in the UK in 2021. While it’s not regulated as a broker, it partners with ACG Markets, an FSA-regulated brokerage, to provide pricing and liquidity in a simulated environment. However, mixed community feedback suggests that traders should carefully review its rules and policies before signing up.

Alpha Capital offers funding through simulated trading accounts. Traders purchase a challenge (1-step, 2-step, or 3-step), meet profit targets, and follow strict risk rules. If successful, they receive a funded simulated account and can earn payouts based on performance. All trading takes place in a demo environment, not live markets.

Yes, Alpha Capital accepts traders from the U.S. However, U.S. clients are restricted to using the DXTrade platform only, due to regulatory limitations on MT5 and cTrader access.

Alpha Capital is backed by ACG Markets, a Seychelles-based broker regulated by the FSA. ACG provides simulated pricing and liquidity for Alpha Capital’s evaluation and funded accounts. However, trading remains in a simulated environment with no real-money execution.

15. Conclusion

This Alpha Capital Group review highlights a prop firm offering a structured approach to funding, with multiple evaluation tracks (1-step, 2-step, 3-step), 80% profit split, and access to MT5, cTrader, and DXTrade. The payout system and scaling plan are attractive for those who prioritize long-term consistency.

That said, strict KYC enforcement and occasional payout-related complaints mean traders must fully understand the rules before committing. While the trading is in a simulated environment, the firm’s ecosystem is professional and performance-driven.

This firm is best suited for experienced traders who value flexibility in evaluation types and can maintain strict discipline regarding trading rules, platform usage, and account security.

Have you traded with Alpha Capital Group? Share your experience in the comments or join the conversation in our community.

Explore more detailed comparisons in our full Prop Firm Review or check out other top funding firms on our curated list at H2T Funding.