A monthly budget planner printable is a surprisingly effective tool for getting a handle on your finances. Instead of wondering where your money went, a good template helps you see where every dollar is actually going, set goals that feel achievable, and start making intentional choices for your future.

Whether you’re trying to save more, pay down debt, or just get organized, using a printable budget planner is a low-effort, high-impact move.

In this guide, H2T Funding breaks down how to use one effectively and where to find the best templates so you can stop guessing and start planning with clarity. If you’re new to budgeting, you can also learn how to create a personal budget to build a strong foundation.

Key takeaways

- A monthly budget planner printable helps you track income, expenses, and savings, giving you clarity and control over your financial future.

- To use it effectively, start by recording income, listing fixed/variable expenses, setting savings and debt goals, tracking daily spending, and reviewing monthly results.

- You can choose from various budgeting systems, like the 50/30/20 rule, 60/30/10 budget, zero-based budget, or cash envelope system, and apply them using a free monthly budget planner printable.

- The most effective budget is the one you stick to consistently, whether through a monthly budget worksheet printable free or another format that matches your lifestyle.

1. Why should you create a monthly budget planner?

A well-structured monthly budget planner is more than just a spreadsheet of numbers; it’s a strategic tool that gives you control over your finances and peace of mind. For those who prefer digital tracking, a personal budget template Excel version can provide the same clarity with automated calculations.

Financial experts agree: understanding your spending habits is the first step toward reducing financial stress. It’s easy to lose track of small purchases, but they add up. For example, someone earning around $3,000 a month might not realize that their frequent food delivery orders are costing them nearly $500, money that could have gone toward savings or paying down debt.

When you plan your expenses ahead of time, you create room for intentional saving.

- By allocating a fixed percentage of your income to savings, say 20%, you’re more likely to build an emergency fund or work toward bigger goals like a vacation or home renovation, especially if you can automate savings, which will make it effortless.

- Research from NerdWallet shows that people who follow a monthly saving schedule are 60% more likely to have three months’ worth of emergency funds.

A monthly budget planner also helps prioritize debt repayments, especially high-interest loans like credit card balances or payday loans.

For instance, using the 50/30/20 budgeting rule, you can set aside 20% of your income for debt reduction while still covering needs and discretionary spending.

Many certified financial coaches recommend using printable budgeting tools to track each payment and measure progress monthly.

Discover more: 15 Best money saving apps of 2026

2. How to use a monthly budget planner printable effectively?

Using a monthly budget planner printable is one of the simplest ways to stay consistent with your financial goals. When approached methodically, it can help you become more intentional with every dollar you earn and spend.

Here are the steps to use your monthly budget planner effectively:

- Step 1: Identify income sources and total monthly earnings

- Step 2: List all fixed and variable expenses

- Step 3: Allocate funds for savings and debt repayment

- Step 4: Track spending daily using the printable template

- Step 5: Review and adjust the budget at month’s end

Step 1: Identify income sources and total monthly earnings

Begin by listing every income stream you receive during the month. This should include not just your main job, but also any side gigs, passive income, or government benefits.

- For example, someone working full-time while tutoring on weekends might note around $2,800 from their salary and an extra $400 from tutoring, giving them a total monthly income of $3,200.

- Write this number at the top of your planner to guide the rest of your planning.

Step 2: List all fixed and variable expenses

Next, categorize your spending. Fixed costs are regular monthly expenses that don’t change, while variable costs may fluctuate.

- Fixed expenses can include rent, insurance, internet bills, or car payments.

- Variable expenses include groceries, fuel, dining out, and entertainment.

- A practical approach is to review your last month’s bank statement to make sure nothing is overlooked.

Step 3: Allocate funds for savings and debt repayment

Before you budget for anything else, decide what you’ll pay yourself first. This means allocating money toward your savings goals and any high-interest debt you want to tackle. A common target is 20% of your income for savings, but any amount is a great start.

For debt, decide how much you’ll commit to paying this month; even paying slightly more than the minimum on credit cards can make a big difference over time. Treating these as non-negotiable expenses is a powerful shift in mindset.

Step 4: Track spending daily using the printable template

Once your plan is in place, use the printable planner, or download a free printable budget planner PDF, to record actual spending day by day.

- A daily tracker section might include columns for date, item, category, and amount.

- You could jot down a $4 coffee under “Dining” on June 5, followed by a $60 grocery run later that week.

- At a glance, you’ll be able to spot trends, such as overspending in a certain category, and take timely action.

Step 5: Review and adjust the budget at month’s end

At the end of the month, take a look back. Compare what you planned to spend with what you actually spent. This isn’t about judging yourself; it’s about learning. Did you underestimate your grocery bill? Did a subscription you forgot about pop up? No problem; just adjust for next month. Your budget is a living document, not a test you pass or fail.

Maybe you should know:

3. Other budgeting methods and systems

Beyond using a monthly budget template printable or a monthly budget worksheet printable free, you can explore different budgeting systems. Each approach offers a unique structure, helping you find a budget planner example that matches your financial goals and lifestyle.

| Method | Meaning | Example |

|---|---|---|

| 50/30/20 Rule | Allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. | With a $3,000 income: $1,500 (Needs) $900 (Wants) $600 (Savings) |

| 60/30/10 Budget | 60% for essentials, 30% for savings/investments, 10% for flexible spending. | With a $3,000 income: $1,800 (Essentials) $900 (Savings) $300 (Flexible) |

| Zero-Based Budget | Every dollar is assigned a job, so income minus expenses equals zero. | $3,200 income must equal $3,200 in planned spending + saving + debt repayment. |

| Cash Envelope System | Divide cash into envelopes for categories (food, fuel, shopping). Once an envelope is empty, no more spending. | $400 allocated to “Food” means you only spend within that limit. |

| Pay-Yourself-First Budget | Prioritize savings by setting aside a fixed amount immediately after getting paid. Spend what’s left on expenses. | From $3,200 income, transfer $500 to savings first, then budget the rest. |

| 70/20/10 Budget | 70% for living expenses, 20% for savings/investments, 10% for giving or personal growth. | With a $3,000 income: $2,100 (Expenses) $600 (Savings) $300 (Giving) |

Using these methods with tools like a monthly budget worksheet printable free or a free monthly budget planner printable can help you stick to your financial plan and achieve sustainable money habits.

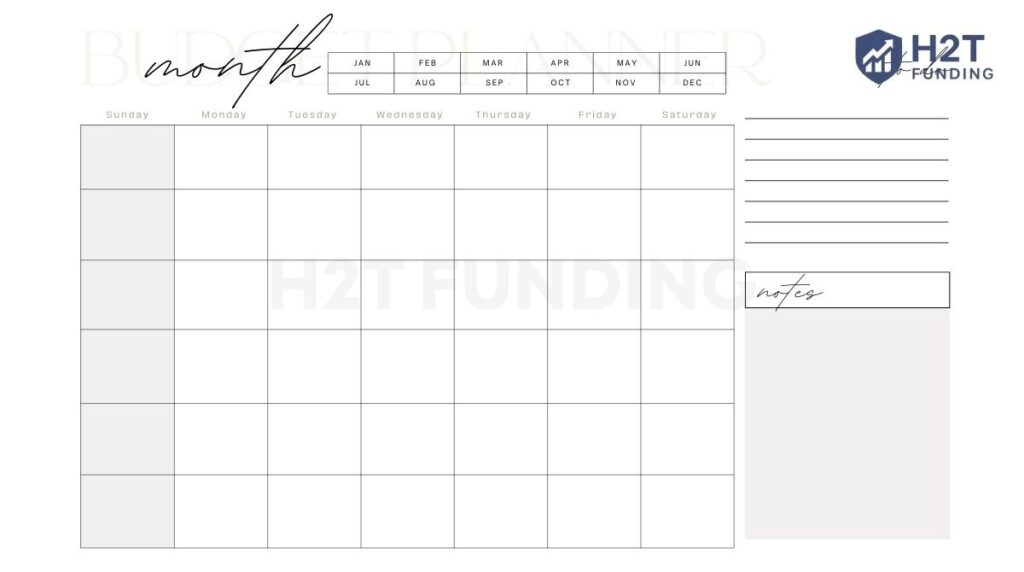

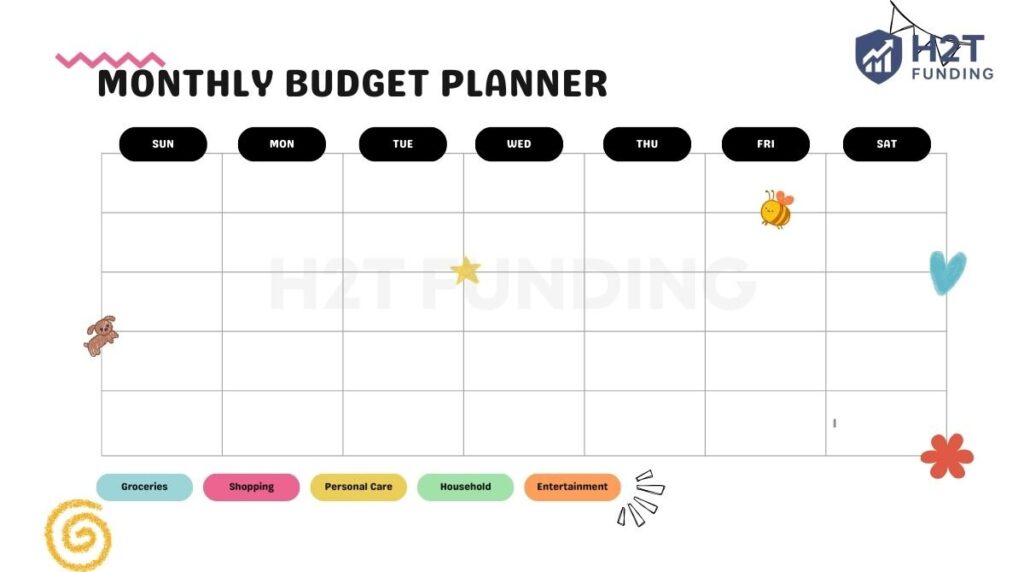

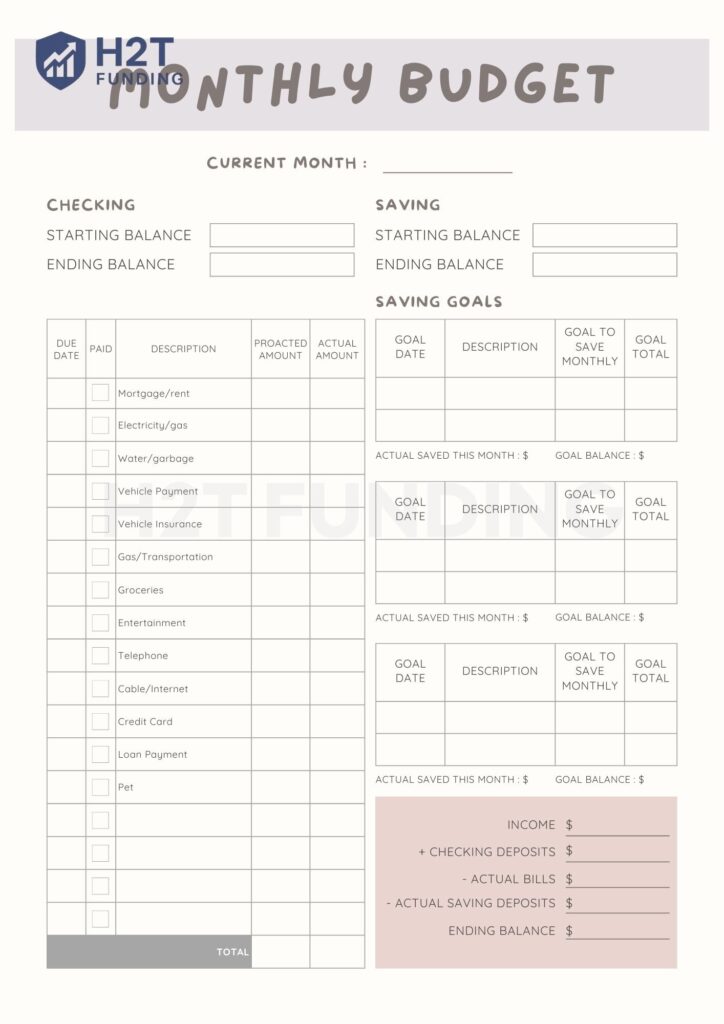

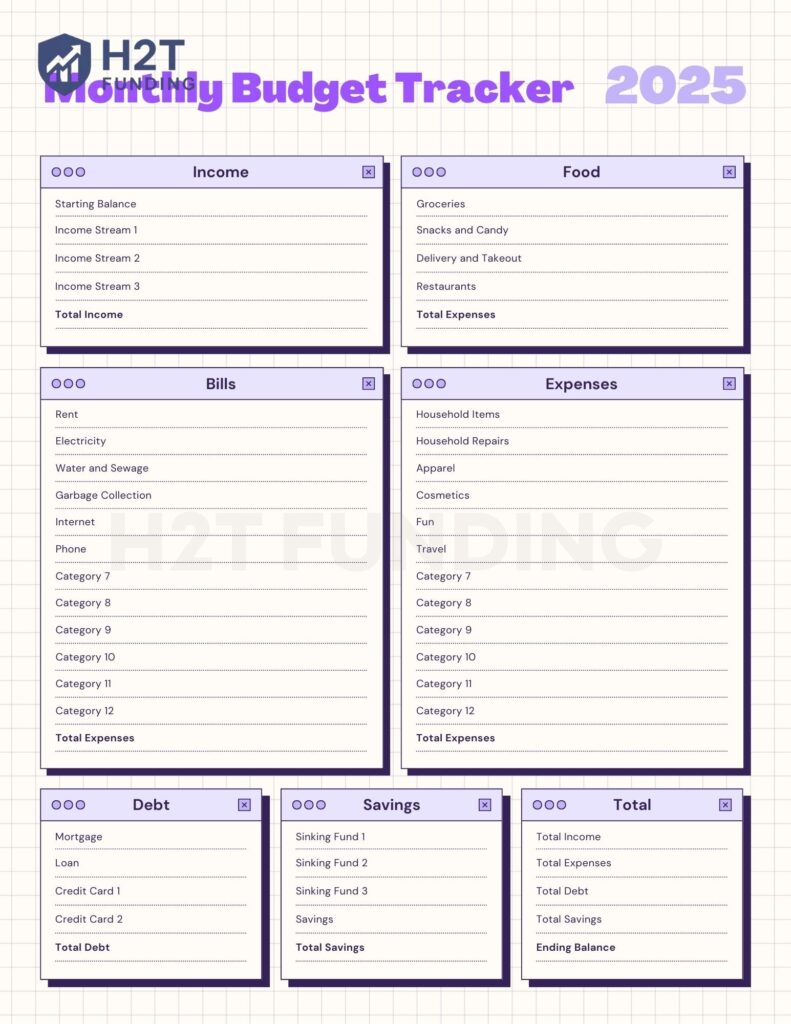

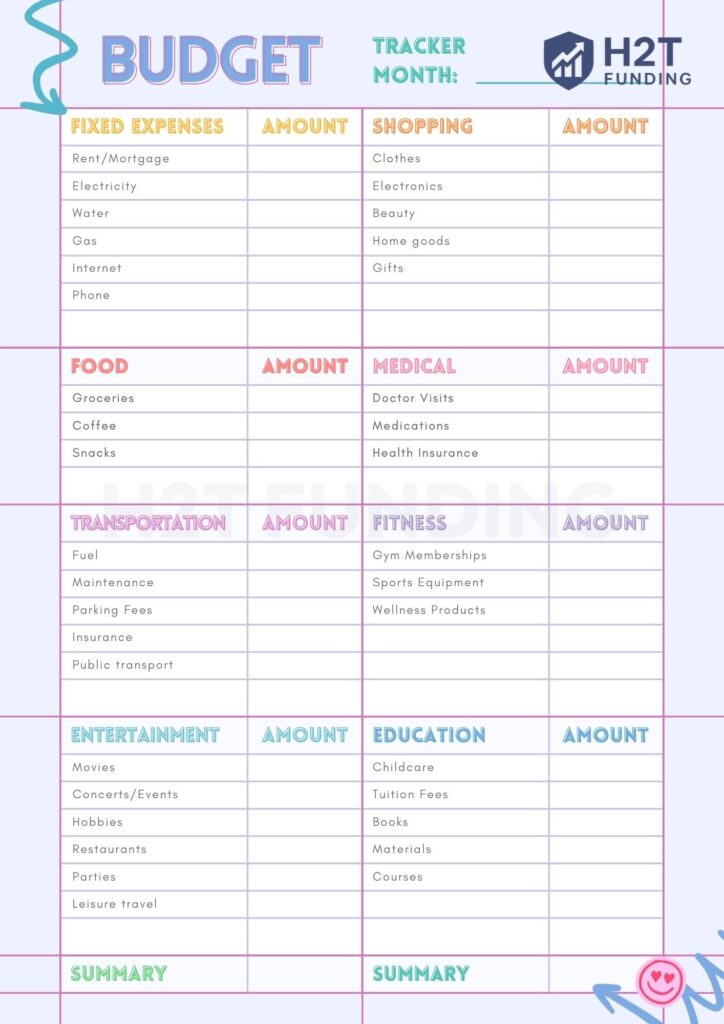

4. 20+ top monthly budget planner printable templates

Finding the right printable budget planner can make all the difference in how consistently and motivated you stay with your financial goals. Whether you’re just starting or managing a complex household budget, there’s a wide variety of templates to suit your needs.

You can also find a monthly budget worksheet PDF free download option for quick setup. To explore a curated selection of free monthly budget templates, download our collection to discover more monthly budget planner printable that work for every lifestyle.

5. Conclusion: Start budgeting with a monthly budget planner printable

A monthly budget planner printable is a tool for empowerment. It helps you take control of your finances with clarity and purpose. By tracking income, planning expenses, and reviewing progress regularly, you can reduce financial stress, stay accountable, and move confidently toward your goals.

Don’t wait for the “perfect” time to start. Download a template, grab a pen, and take the first small step today. You might be surprised at what you discover. Remember, the most effective budget is the one you’ll stick to, so choose a format or budget plan template that fits your lifestyle and build the habit day by day.

Have a go-to template or personal tip that works for you? Share your thoughts or favorite printable planners in the comments below. We’d love to hear what’s working for you.

Looking for more ideas to strengthen your financial habits? Check out other articles in our Strategies section at H2T Funding for expert-backed tips on saving, budgeting, and building wealth sustainably.

Sources:

- Free and Easy Budget Template – https://www.ramseysolutions.com/budgeting/budget-template

- Monthly Budget Planners – https://www.printabulls.com/finance/monthly-budget-planners/