Are you trying to quantify the risk in your business or investment? You know there’s a buffer between profitability and falling into the red, but expressing that cushion as a clear, actionable figure can be challenging. This is where the margin of safety formula percentage becomes one of the most vital tools in your financial arsenal.

However, a common point of confusion is its different applications in accounting and investing. This guide will demystify the concept, providing you with a straightforward formula, practical examples for both business and finance, and the confidence to apply it immediately.

Key takeaways:

- The margin of safety has distinct definitions in accounting and value investing. In accounting, it is the sales cushion over the break-even point, while in investing, it refers to the discount of a stock’s market price to its intrinsic value.

- Provides the straightforward margin of safety formula percentage: [(Current Sales – Break-even Sales) / Current Sales] x 100, along with a step-by-step guide for its application.

- Explains how legendary investors like Benjamin Graham use the margin of safety to reduce risk by purchasing assets for significantly less than their estimated true worth.

- Explores how this single metric helps managers assess risk, make confident financial plans, and protect profitability against sales fluctuation.

- Identifies frequent mistakes, such as using overly optimistic projections or miscalculating the break-even point, to ensure the analysis is accurate and reliable.

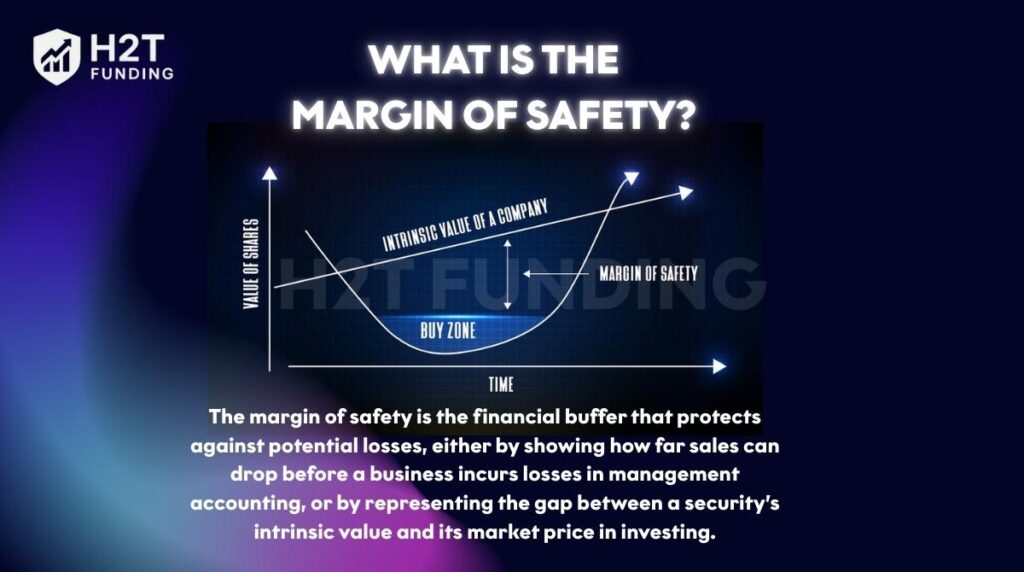

1. What is the margin of safety?

The margin of safety (MOS) is a core principle in finance and accounting that quantifies the buffer against potential losses. While its goal is always risk reduction, its application and calculation differ significantly between management accounting and investing. The investment concept, in particular, was pioneered by Benjamin Graham. He considered it the central tenet for protecting capital in philosophies like deep value investing and growth at a reasonable price.

- In management accounting, the margin of safety in accounting is the difference between current sales and the break-even point. It reveals how much revenue can decline before a company is exposed to the risk of loss, making it a critical metric for budgeting. Understanding this concept is similar in mindset to what is drawdown in trading, where traders monitor declines from peak values to manage risk and avoid significant losses.

- In securities investing, the margin of safety in investing is the discount between a security’s estimated intrinsic value and its market price. Value investors determine this intrinsic value through methods like analyzing discounted future income and then purchasing assets below that perceived worth, creating a buffer against market downturns.

The margin of safety is a vital tool for risk management across both fields. For a business, it signals operational health and resilience, while for an investor, it is the key to mitigating the risk of capital loss. In both scenarios, it provides a crucial cushion against forecasting errors and unexpected negative events.

2. Basis for calculating the margin of safety

Before calculating the percentage, it is essential to understand the basic safety margin formula. This foundational calculation provides an absolute figure, either in dollar amounts or in units, that represents the size of the company’s performance cushion.

The basic safety margin calculation in an accounting context is as follows:

Margin of Safety (in dollar amounts) = Current Sales Revenue – Break-even Sales Revenue

Margin of Safety (in units) = Current Sales – Break-even Sales

Example:

If a company has current sales of $120,000 and a break-even sales revenue of $90,000, the margin of safety in dollars is: $120,000 – $90,000 = $30,000.

This means sales could drop by $30,000 before the company starts making a loss.

This formula directly quantifies how far sales can drop before the business is no longer profitable. While simple, it serves as the necessary first step for a more detailed percentage-based analysis.

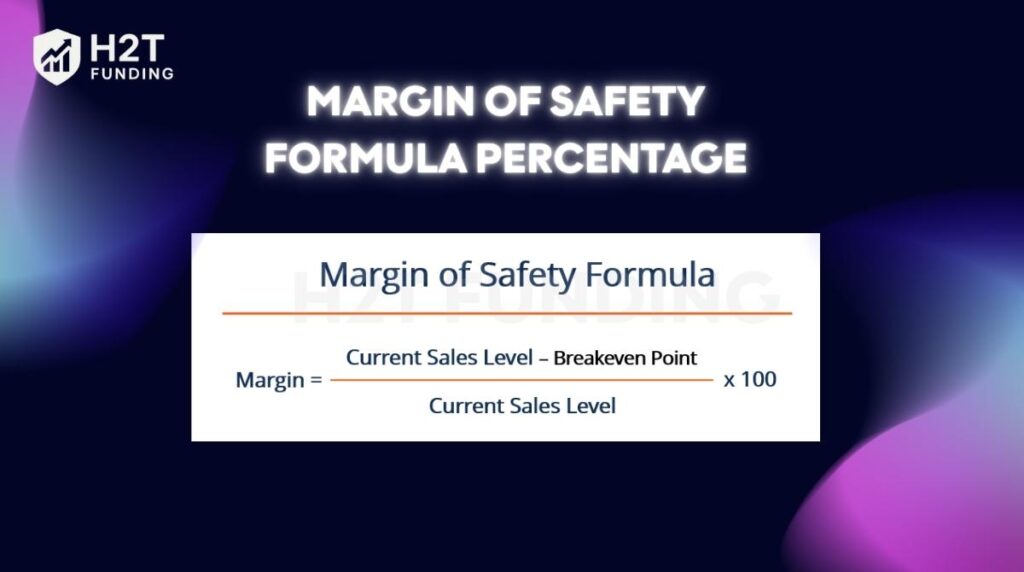

3. Margin of safety formula percentage

While showing the margin of safety in dollars or units can be helpful, presenting it as a percentage offers a stronger basis for comparison. This is determined using the margin of safety percentage formula.

The most common percentage of the margin of safety formula is:

Margin of Safety Percentage = [(Current Sales Level – Break-even Point) / Current Sales level] x 100

Example:

If a company has current sales of $120,000 and break-even sales of $90,000, the margin of safety percentage is: [(120,000 – 90,000) / 120,000] x 100 = 25%.

This means 25% of the sales revenue acts as a buffer before the company starts making a loss.

This margin of safety in percentage formula shows the proportion of sales that are above the break-even point.

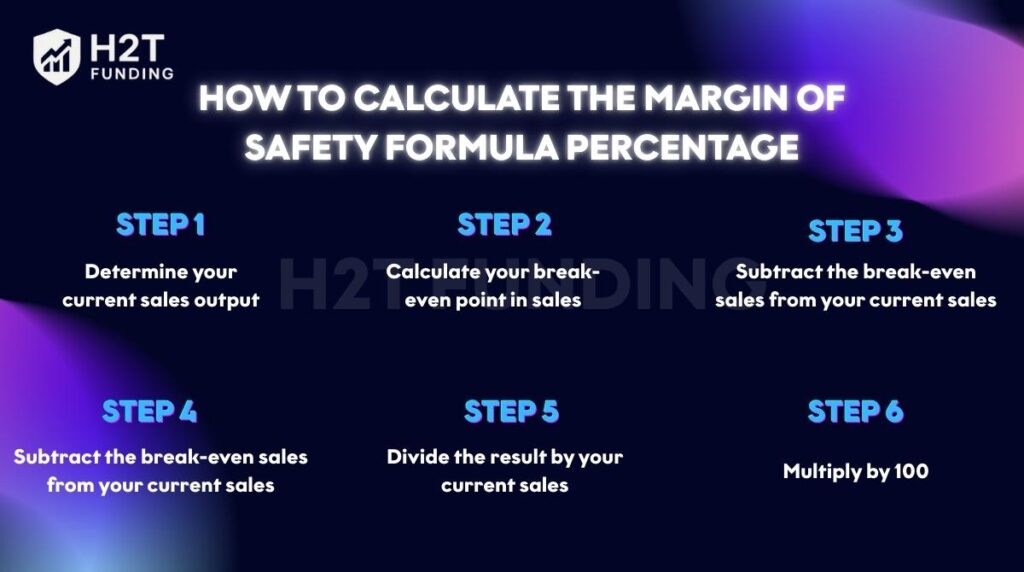

4. How to calculate the margin of safety formula percentage

This section explains how to calculate the margin of safety percentage, providing a step-by-step guide to follow:

- Determine your current sales output: This can be your actual sales for a period or your budgeted sales from your financial statements.

- Calculate your break-even point in sales: This is the level of sales where your total revenue equals your total operating costs. To find this, you need to know your fixed costs and your contribution margin ratio.

Break-even Sales = Fixed Costs / Contribution Margin Ratio

where Contribution Margin Ratio = (Sales − Variable Costs) / Sales

- Subtract the break-even sales from your current sales: This gives you the margin of safety in dollar amounts.

- Divide the result by your current sales: This step converts the absolute dollar buffer into a ratio.

- Multiply by 100: Convert the ratio into a percentage to get your margin of safety percentage.

By following these steps, you can effectively use a margin of safety formula calculator or a simple spreadsheet to monitor this vital aspect of your business performance.

Example:

- Current Sales: $250,000

- Fixed Costs: $80,000

- Variable Costs: $120,000

Calculate the contribution margin ratio:

- Contribution Margin Ratio = (250,000−120,000) / 250,000 = 130,000 / 250,000 = 0.52

Calculate break-even sales:

- Break-even Sales = 80,000 / 0.52 ≈ 153,846

Calculate the margin of safety in dollars:

- Margin of Safety = 250,000 − 153,846 ≈ 96,154

Calculate the margin of safety percentage:

- Margin of Safety % = 96,154 / 250,000 × 100 ≈ 38.46%

In this example, the business can withstand a 38.46% drop in sales before reaching the break-even point, showing a healthy margin of safety.

5. Why is the margin of safety formula important?

The margin of safety formula is a critical tool for effective financial planning and risk assessment. It serves as an essential indicator for management to evaluate risks associated with revenue fluctuations. A business with a healthy margin of safety is better equipped to handle market downturns or unexpected increases in operating costs.

This metric directly impacts business decisions. For instance, a low margin might signal a need to reduce expenses or adjust marketing strategies to boost sales revenue. Conversely, a high margin provides the confidence to invest in expansion or other growth opportunities. It is a key element in assessing overall business performance and resilience against sales volatility.

6. Applications of the margin of safety

The margin of safety has practical applications across two primary domains: business management and investing.

Budgeting & break-even analysis: In business operations, the MOS is a cornerstone of financial management. It quantifies how much sales can fall before the company becomes unprofitable, guiding crucial decisions on pricing, operating costs, and risk management related to sales variability.

For example:

| Product/Department | Current Sales ($) | Break-even Sales ($) | Margin of Safety ($) | MOS (%) |

|---|---|---|---|---|

| Product A | 200,000 | 150,000 | 50,000 | 25% |

| Product B | 120,000 | 100,000 | 20,000 | 16.7% |

| Product C | 300,000 | 250,000 | 50,000 | 16.7% |

This table allows managers to quickly see which products or departments have the highest risk if sales decline.

Investing: For investors, it is a defensive principle central to value investing strategies like deep value investing and growth at a reasonable price. By purchasing a security only when its market price is significantly below its estimated intrinsic value, an investor creates a buffer against valuation errors and unexpected market downturns.

For example:

| Stock | Estimated Intrinsic Value ($) | Market Price ($) | Margin of Safety ($) | MOS (%) |

|---|---|---|---|---|

| Stock A | 120 | 90 | 30 | 25% |

| Stock B | 50 | 40 | 10 | 20% |

| Stock C | 200 | 150 | 50 | 25% |

Investors can use such tables to prioritize purchases with higher MOS for safer investment decisions.

7. Example of calculating the margin of safety

To better understand the concept, let’s look at examples in accounting, finance, and trading prop firms, which also illustrate key lessons on how to be more disciplined in your trading.

Accounting example:

Imagine a company has current monthly sales of $200,000. Through analysis of its accounting statements, it determines that its break-even point is $150,000 in sales.

- Margin of Safety in Dollars: $200,000 (Current Sales) – $150,000 (Break-even Sales) = $50,000.

- Margin of Safety Percentage: ($50,000 / $200,000) x 100 = 25%.

This means the company’s sales can drop by 25% before it starts incurring losses.

Investing example:

An investor analyzes a stock and, using various valuation methods, estimates its intrinsic value to be $150 per share. The stock is currently trading at a market price of $120 per share.

Margin of Safety Percentage: [($150 (Intrinsic Value) – $120 (Market Price)) / $150 (Intrinsic Value)] x 100 = 20%.

The investor has a 20% cushion, meaning the stock is trading at a 20% discount to its estimated fair market price. This buffer helps protect against the risk of overpaying or errors in the intrinsic value calculation.

Trading prop firm example:

A trader is participating in a prop firm evaluation with a $50,000 funded account. The firm sets a maximum daily loss limit of $1,000. On a particular day, the trader’s account rises to $52,000.

- Margin of Safety in Dollars: $52,000 – ($50,000 – $1,000 limit) = $3,000

- Margin of Safety Percentage: ($3,000 / $52,000) x 100 ≈ 5.8%

This means the trader can experience a 5.8% drawdown from the current account value before hitting the daily loss limit, providing a clear buffer for risk management.

8. Common mistakes when using MOS

While the margin of safety is a powerful tool, it’s not immune to errors in application. Avoiding these common pitfalls is crucial for accurate risk evaluation.

8.1. Overly optimistic projections

A frequent mistake is using aggressive or unrealistic sales forecasts when calculating the MOS. This inflates the safety cushion on paper but provides a false sense of security.

Sales forecasts are rarely perfect. This model often overlooks critical variables like seasonality, where revenue might spike during one quarter but fall sharply in another. An MOS based on an annual average can mask the real risk of unprofitability during off-peak periods. Relying on a single, optimistic sales forecast without stress-testing for lower outcomes is a significant error.

8.2. Ignoring business quality

In investing, focusing solely on a cheap price without assessing the underlying quality of the business can be dangerous. A low price might be justified if the company has fundamental problems, such as poor management, an obsolete product, or is facing bankruptcy risk. A margin of safety is only meaningful when applied to a fundamentally sound asset.

8.3. Incorrect break-even calculation

In accounting, calculation errors in determining the break-even point, such as misclassifying fixed and variable costs, will lead to a flawed MOS. The standard break-even model carries simplifying assumptions. A key one is that variable cost per unit remains constant, but this is often not the case.

At higher production levels, a company might achieve economies of scale, lowering the per-unit cost. Conversely, it might face higher costs from overtime labor. This means the break-even point is not a static number but a dynamic target that shifts with production volume.

8.4. Failing to revisit the analysis

Market conditions and operating costs change. Failing to regularly update the MOS analysis can render it obsolete and irrelevant for current business decisions. The MOS is a snapshot in time, not a one-time calculation.

Assuming the break-even point is fixed over the long term is a critical mistake. Rent (fixed cost) can increase, and raw material prices (variable costs) can fluctuate. A business must periodically re-evaluate its cost structure and sales reality to ensure its MOS remains a relevant and reliable indicator of risk.

8.5. Subjectivity in valuation

Determining a security’s intrinsic value is inherently subjective. Each analyst may use different assumptions regarding growth rates, discount rates, and future cash flows. Relying on a single valuation figure without considering a range of potential outcomes can be misleading. It is more prudent to think of intrinsic value as a probable range rather than a precise number.

9. FAQs

Generally, a higher margin of safety is better. In business, a percentage of 20-25% may be acceptable for companies with mostly variable costs, while those with high fixed costs should aim for 50% or higher. For investors, many seek a margin of at least 20-30% to provide a significant buffer against valuation errors and market volatility.

In accounting, you calculate the margin of safety by subtracting break-even sales from your current or budgeted sales. To express it as a percentage, you then divide that result by the current or budgeted sales and multiply by 100.

The two definitions differ in both their inputs and the type of risk they measure. The accounting version quantifies operational risk by comparing actual sales against the break-even point, a calculation based on concrete sales data. In contrast, the investing approach assesses investment risk by comparing a stock’s market price to its subjective estimation of intrinsic value.

It is crucial for managers because it indicates how much sales can decline before the company becomes unprofitable. This insight is vital for risk management, budgeting, and making strategic decisions regarding costs, pricing, and marketing efforts.

Yes, a margin of safety can be negative. A negative MOS means the company’s sales are below the break-even point, and it is currently operating at a loss.

The margin of safety percentage is computed with the formula: [(Current Sales – Break-even Sales) / Current Sales] x 100.

A 30% margin of safety is considered a substantial cushion. In business, it means sales can fall by 30% before reaching the break-even point. In investing, it means an asset is being purchased at a 30% discount to its estimated intrinsic value.

No, they are different concepts. The margin of safety measures the cushion above the break-even point in terms of sales. Operating leverage, on the other hand, measures how sensitive a company’s operating income is to a change in sales. While related to a company’s cost structure, they measure different aspects of risk.

10. Conclusion

The margin of safety formula percentage is more than a formula; it’s a mindset. It instills a discipline of seeking buffers against market uncertainty and inevitable human error. While this mindset is foundational, it should never be used in isolation.

For robust business and investment decisions, it is most powerful when combined with other financial indicators. These can include metrics such as Return on Investment (ROI), Net Present Value (NPV), and Discounted Cash Flow (DCF) analysis. This principle of a risk-first approach is not limited to long-term valuation.

The next logical step is to see how this core concept is applied in a real-world trading environment. Explore opportunities to secure trading capital by delving into our H2T Funding programs, featured in the Prop Firm & Trading Strategies category.