The direct answer is a confident yes. Moving to a new country is an exciting chapter, but for a dedicated trader, it brings a critical question: KYC can i change countries Topstep? The answer is yes, you can, but navigating the process correctly is essential for protecting your account and your profits.

This is not just about updating an address; it’s about complying with global financial regulations. This in-depth guide, based on real-world scenarios and official policies, provides the expert roadmap you need to ensure your move is seamless, both in life and in your trading career.

Key Takeaways:

- KYC can I change countries Topstep: You can change countries, but you must comply with the KYC verification process to protect your account and profits.

- Purpose of KYC: The KYC process aims to comply with international laws, secure accounts, and ensure a smooth payment process.

- Updating KYC when changing countries: This is mandatory to comply with global financial laws and prevent the system from flagging suspicious activity.

- 3-step process: Proactively contact support, prepare the necessary documents, and complete the re-verification process.

- Checking eligibility: Before moving to a new country, always check Topstep’s official website for the list of restricted countries.

1. What is KYC?

KYC stands for Know Your Customer. It’s a mandatory process that financial institutions and businesses undertake to verify the identity of their clients. The primary goal of KYC is to combat money laundering (AML), terrorist financing (CFT), and other illicit financial activities.

When you sign up or update your personal information with a platform like Topstep, the KYC process ensures that you are who you claim to be. This helps protect both you and the financial system from fraudulent activities and security breaches.

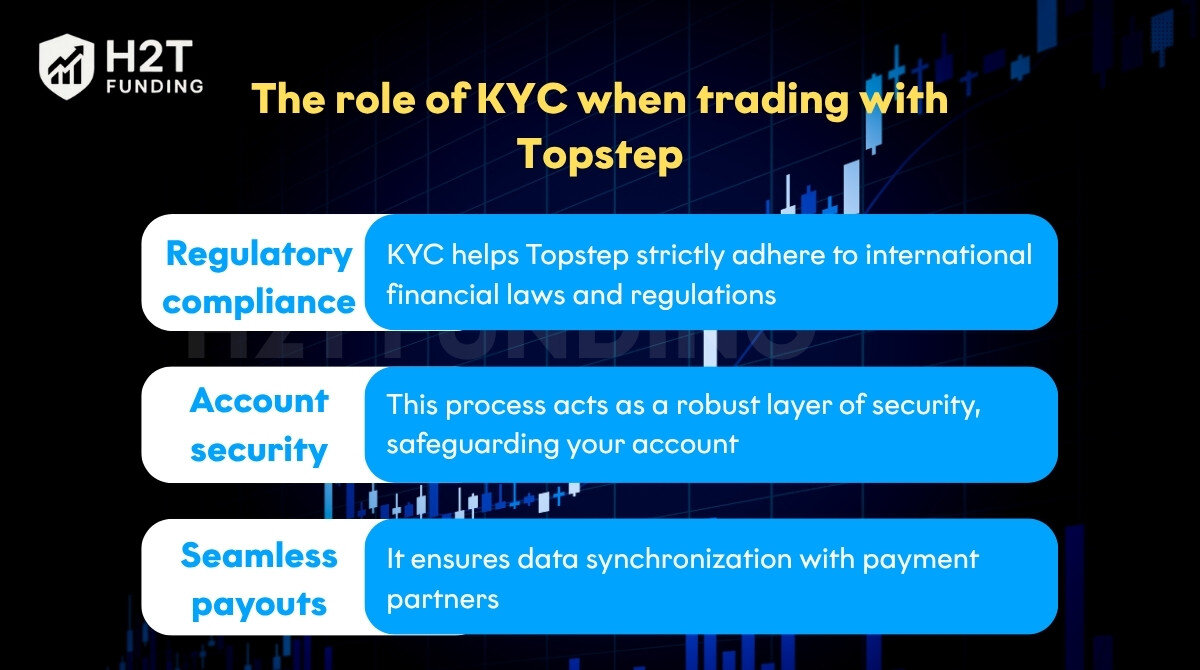

2. The role of KYC when trading with Topstep

For a financial firm like Topstep, KYC plays an indispensable role.

- Regulatory compliance: First and foremost, it helps Topstep strictly adhere to international financial laws and regulations, especially those in the U.S. concerning anti-money laundering.

- Account security: Secondly, this process acts as a robust layer of security, safeguarding your account from unauthorized access and ensuring your profits are paid to the rightful owner.

- Seamless payouts: Finally, KYC ensures data synchronization with payment partners, which is crucial for making your withdrawal process smooth and hassle-free.

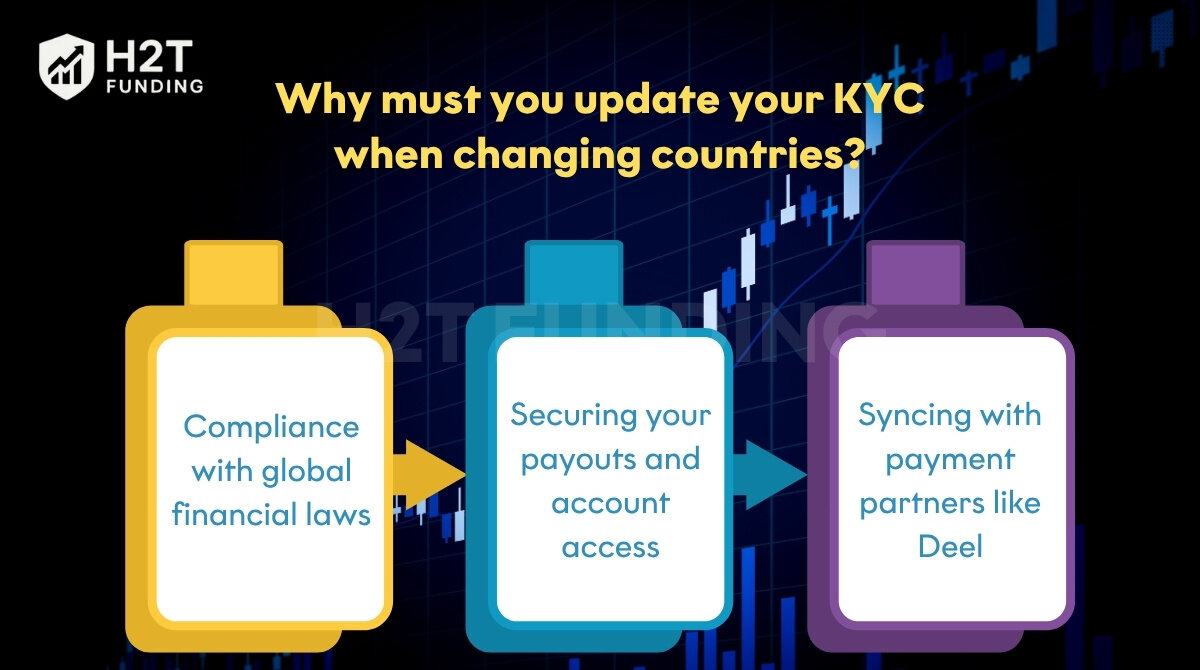

3. KYC can I change countries Topstep? Why must you update your KYC?

This is the most critical section to understand. The “why” behind the KYC update is non-negotiable and rooted in law, security, and operational reality.

3.1. Compliance with global financial laws

Topstep, as a U.S. company, is legally bound by strict financial regulations. These include policies set by the Office of Foreign Assets Control (OFAC) and global Anti-Money Laundering (AML) frameworks. These are not Topstep’s internal rules; they are international laws. Verifying your identity and physical location is a mandatory part of this compliance.

3.2. Securing your payouts and account access

Imagine this real-world scenario: A trader, let’s call him Alex, moves from Germany to Portugal. He doesn’t update his details and uses a VPN to make his login IP look like it’s still from Germany. He has a profitable month and requests a payout to his German bank account.

Topstep’s system flags a conflict: the withdrawal request came from an IP address that, despite the VPN, shows traces of originating in Portugal, while the banking details are German. This mismatch is a major red flag for potential account hijacking.

The result? The payout is frozen and the account suspended until Alex can prove he is the legitimate owner and is physically in Portugal. The KYC process prevents this exact situation.

3.3. Syncing with payment partners like Deel

To facilitate international payments, Topstep collaborates with specialized third-party services, with Deel being a primary example. Deel is a separate financial entity with its own independent compliance engine. For a payout to be processed, the data must match perfectly:

- It’s crucial that the name and address recorded in your Topstep account perfectly mirror the information stored in your Deel profile.

- If you tell Topstep you’ve moved but your Deel account still lists your old address, the automated payout system will fail the data match, and your payment will be blocked.

View more:

4. The crucial first step: Checking country eligibility

Before you do anything else, you must verify if your new country is supported. Due to the dynamic nature of global financial regulations, a static list on a blog can quickly become outdated and inaccurate.

4.1. Check the official source.

To get the most accurate and up-to-date information, always go straight to the source. Relying on outdated lists can lead to frustration and wasted effort. Here’s how to ensure your country is eligible:

- Go to the Topstep website.

- Your next step is to find the website’s support resources, typically labeled as “Help Center” or “FAQ”.

- Search for their official “Eligibility” or “Restricted Countries” article.

While you must check the official source, countries generally fall into these categories:

- Generally supported: This includes most of North America (USA, Canada), the European Union/EEA, the United Kingdom, Australia, New Zealand, and many countries in Asia, like Japan and Singapore.

- Often supported (Check for specific regulations): Some countries in South America and non-EU Eastern Europe may have specific requirements. It is vital to check the official list.

- Commonly restricted: Topstep is prohibited by law from doing business with individuals in countries on the OFAC sanctions list. This includes, but is not limited to, countries like Iran, North Korea, Syria, Cuba, and the Crimea, Donetsk, and Luhansk regions.

4.2. Topstep’s restricted countries list

KYC, can I change countries? Topstep adheres to specific regulations regarding the country of residence for its participants. If you are a citizen of any nation listed below, you are currently not eligible to trade or receive payouts through Topstep.

This list includes countries subject to sanctions or restrictions mandated by legal frameworks and Topstep’s operational partners.

| A – C | D – L | M – S | T – Z |

|---|---|---|---|

| Afghanistan | Democratic Republic of Congo | Mali | Senegal |

| Albania | Ethiopia | Monaco | Serbia |

| Algeria | Haiti | Morocco | Slovenia |

| Angola | Hong Kong | Montenegro | Somalia |

| Belarus | Iran | Mozambique | South Africa |

| Bosnia and Herzegovina | Iraq | Namibia | South Sudan |

| Bulgaria | Jamaica | Nicaragua | Sudan and Darfur |

| Burkina Faso (Upper Volta) | Kenya | Nigeria | Syria |

| Burma/Myanmar | Kosovo | North Korea | Tanzania |

| Burundi | Lebanon | North Macedonia | Trinidad and Tobago |

| Central African Republic | Liberia | Pakistan | Turkey (Turkiye) |

| Chad | Libya | Philippines | Ukraine |

| Chinese Military Companies | Romania | Venezuela | |

| Cote d’Ivoire (Ivory Coast) | Russia | Vietnam | |

| Croatia | Yemen | ||

| Crimea (Region of Ukraine: Crimea, Donetsk, Luhansk, Kherson, Zaporizhzhia) | Zimbabwe | ||

| Cuba |

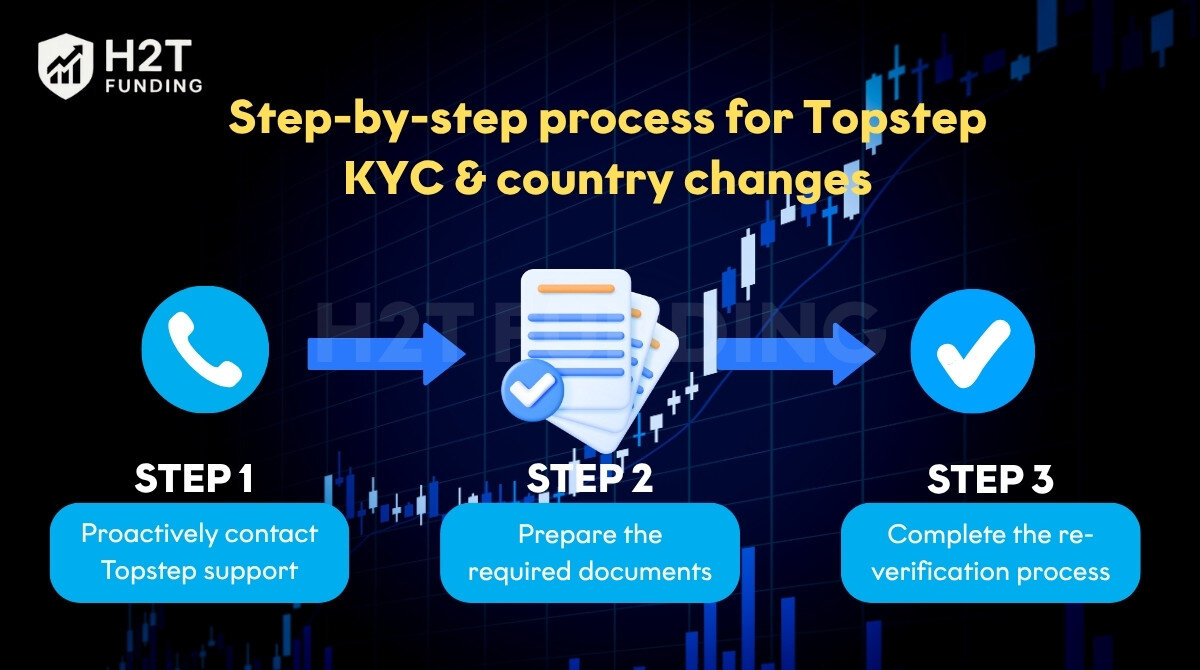

5. The official step-by-step process for Topstep KYC & country changes

For a seamless experience, execute the following steps with precision.

5.1. Step 1: Proactively contact Topstep support

Do not wait. As soon as you have a confirmed moving date, email the Topstep support team. This shows you are a responsible partner. This initiates a formal process where a support ticket is generated to manage your request and provide you with step-by-step instructions.

5.2. Step 2: Prepare the required documents

Having high-quality digital copies ready will dramatically speed up the process. A blurry photo or incomplete document is the most common cause of delays.

- Proof of Identity: A clear, color scan of your unexpired Passport is the gold standard.

- Proof of New Address: This document must show your full name and new residential address and be dated within the last 3 months. The best options are:

- A PDF of a utility bill (electricity, water, gas, internet).

- A formal bank statement.

- A fully signed rental/lease agreement.

5.3. Step 3: Complete the re-verification process

Follow the specific instructions from the support team. This will likely involve uploading your documents to a secure portal. You may also need to log into your Deel account and update your address there, then complete their re-verification, which can sometimes include a “liveness check” via your device’s camera.

6. What happens if you don’t notify Topstep? A realistic scenario

Let’s revisit our trader, Alex. He moves from Germany to Portugal without telling Topstep.

- Week 1- 4: He trades as usual. Everything seems fine.

- Week 5: He has a great month and requests a $5,000 payout. The request is automatically flagged by the compliance system due to the IP/location mismatch.

- Week 6: Alex receives an email stating his payout is on hold and his account is suspended pending a security review. He is now unable to trade and must scramble to provide documents, causing significant stress and delaying his access to his earnings.

7. Expert tips for a smooth transition

Based on observing hundreds of trader journeys, the single most important factor for success is treating this as a professional business process. Communicate clearly and provide clean, accurate documents.

- Create a “KYC” folder in a secure cloud drive (like Google Drive). Keep high-resolution scans of your passport, a recent utility bill, and your bank statements there. This ensures you’re prepared for any future requests.

- Read every document before you upload it. Does the name match your passport exactly? Does the address precisely match the one you provided on the form? A tiny mismatch can cause an automated system to reject it.

8. Frequently asked questions (FAQs) about changing countries with Topstep

Don’t panic. Contact Topstep support immediately. Be honest about the situation, explain that you were unaware of the process, and state that you are ready to provide all necessary documents. Proactive honesty is your best tool.

No. As long as you move to a supported country and complete the KYC update correctly, your funded status, account history, and any profits are completely safe.

Once you submit the correct documents, it typically takes 2-5 business days for the review to be completed by both Topstep and their payment partners.

You should contact Topstep support for guidance. In most cases, financial institutions require documents to be in English or accompanied by a certified translation from a reputable service.

No. Financial regulations require a verifiable physical residential address. Submitting a virtual address or PO Box will result in a failed verification.

No. This process is for a permanent change of residence. Logging in from different countries while traveling is generally fine, though it’s a good practice to notify support if you plan an extended trip to avoid any security flags.

As an independent contractor, you are responsible for your own taxes according to your new country’s laws. Topstep cannot provide tax advice. We strongly recommend consulting with a qualified local tax professional in your new location.

Generally, no. Access to these platforms is usually global. However, it can be subject to local internet regulations or censorship in your new country, which is outside of Topstep’s control.

Yes, Topstep funds traders globally. They state that even non-US citizens can earn a Funded Account.

Topstep cannot legally conduct business with countries on OFAC’s Sanctioned Countries list, or those restricted by their partners. This comprehensive list includes nations like Afghanistan, Cuba, Iran, North Korea, Russia, Syria, and specific regions of Ukraine (Crimea, Donetsk, Luhansk, Kherson, Zaporizhzhia), among many others. It’s best to check their official eligibility page for the most current and complete list.

9. Conclusion: A clear answer and your next step

To directly answer the core question: Yes, you absolutely can change countries while trading with Topstep. The detailed process in this guide isn’t a barrier; it’s a professional framework built on preparation and trust.

It ensures your trading career continues securely, in compliance with the rules that protect you and the entire financial system. By following these steps, you can make your global move a success.

The world of prop trading is constantly evolving. To stay ahead with expert insights, deep-dive firm reviews, and actionable trading strategies, we invite you to follow H2T Funding.

Explore our Prop Firm & Trading Strategies for more valuable content designed to help you succeed on your journey to becoming a funded trader, and confidently answer KYC can I change countries Topstep.