MetaTrader 5 (MT5) is one of the most popular trading platforms worldwide. But is MetaTrader 5 available in the US, and can American traders legally use it? While MetaTrader 5 isn’t banned in the United States, you’ll find that only a small number of regulated brokers actually offer it.

For most traders, this means limited access compared to global markets. Here, H2T Funding will break down why MT5 is so limited in the US. We’ll also point you to the brokers that do support it in the US and what legal alternatives are available for those who want to trade safely.

Key takeaways

- MT5 is not banned in the US, but broker access is limited.

- Only a few regulated brokers, such as OANDA US, FOREX.com, and IG US, have offered MT5 in restricted forms.

- US traders cannot trade CFDs on stocks, indices, or commodities through MT5.

- Leverage for major forex pairs is capped at 1:50 by regulation.

- Alternatives like Thinkorswim, TradeStation, NinjaTrader, and cTrader (limited in the US) are legal.

1. What is MetaTrader 5 (MT5)?

MetaTrader 5 (MT5) is a multi-asset trading platform designed for forex, stocks, futures, and commodities. It was developed as the successor to MetaTrader 4 (MT4), offering a more modern interface and wider functionality.

Unlike MT4, which focuses mainly on forex, MT5 provides access to additional asset classes, more order types, and advanced charting tools. It also comes with an integrated economic calendar, expanded timeframes, and faster execution speeds, making it attractive to both beginner and professional traders.

For traders aiming to use MT5 effectively, having a trading plan is essential to stay consistent and structured in every decision.

MT4 vs MT5: Key differences

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Asset Classes | Mainly Forex | Forex, stocks, futures, metals |

| Order Types | 4 main order types | 6 order types (incl. stop-limit) |

| Timeframes | 9 | 21 |

| Economic Calendar | Not included | Built-in |

| Hedging & Netting | Hedging only | Both hedging and netting |

| Programming Language | MQL4 | MQL5 (faster, more complex) |

MT5 expands on MT4’s foundation by adding more assets, faster execution, and professional tools. While many global traders prefer MT5 for its versatility, MT4 remains popular in regions like the US due to broker availability and regulatory differences.

Regardless of which platform you choose, discipline in trading is the key to long-term success.

2. Is MetaTrader 5 available in the US?

In the United States, MetaTrader 5 is not widely available because of strict financial regulations. Most American brokers focus on MT5 or their own proprietary platforms. You won’t find MT5 as easily in the US App Store or through international brokers unless they are registered with US regulators.

That said, MT5 is not banned outright. A handful of regulated brokers do support the platform, though access is much more limited than in Europe or Asia. For most US traders, this means fewer choices and restricted features when compared to the global version of MT5.

So if you are wondering, Is MT5 allowed in the USA?, the answer is yes, but only through brokers that meet NFA and CFTC requirements.

See more:

3. Why is MT5 restricted in the US?

The main reason MT5 faces restrictions in the United States lies in regulatory requirements. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) enforce strict rules on forex trading platforms and brokers. These rules are designed to protect retail traders and maintain market transparency.

Key regulations include the FIFO (First In, First Out) rule, under NFA Rule 2-43(b), which prevents traders from closing positions out of order, and the ban on hedging, which limits the ability to hold opposing trades on the same pair.

US law also restricts leverage to a maximum of 1:50 on major currency pairs (and even lower on minors/exotics), far below international standards set by offshore brokers.

For example, if you buy 1 lot of EUR/USD and later open a second buy order, you must close the first order before closing the second one (FIFO). Similarly, you cannot open a buy and sell order on EUR/USD at the same time for hedging.

Since MT5 was designed for global markets where these features are common, adapting it to US rules has been a challenge for brokers. As of 2026, only a few regulated firms, such as FOREX.com and OANDA US, offer MT5, and even then, with limited functionality compared to their international branches.

4. Restrictions on using MetaTrader 5 in the United States

While MT5 is technically available, traders in the US face several restrictions that limit how the platform can be used. These limitations are a direct result of US regulations and how brokers have to adapt MT5 to comply.

- Trading products are limited: Contracts for Difference (CFDs) on stocks, indices, and commodities are not allowed under US law. As a result, US brokers offering MT5 focus mainly on forex and metals, leaving fewer asset choices than international versions.

- Lower leverage levels: According to CFTC regulations, leverage is capped at 1:50 for major currency pairs and even lower (1:20 or 1:10) for minors and exotics. This contrasts sharply with international brokers that may offer 1:200 or higher on MT5.

- Fewer broker options: Many global MT5 brokers do not accept US clients. Only a handful of NFA-registered firms, such as FOREX (as of 2026) and OANDA US, provide MT5 access, and even then, features are more limited than their international branches.

- Mobile app availability issues: In the past, MT4 and MT5 were temporarily removed from the Apple App Store due to compliance concerns. Although restored, US users should still monitor app store updates to ensure continued access.

Overall, US traders using MT5 face a narrower range of products, stricter leverage rules, and fewer broker choices. To adapt better, many traders focus on support and resistance or refine their skills in using indicators to maximize results within these limits.

5. US brokers that use MetaTrader 5

Only a small number of licensed US brokers provide access to MT5. Most firms prefer MT4 or their own proprietary platforms, which align more easily with American regulations.

For anyone asking What broker can I use for MT5 in the USA?, the realistic options are limited to regulated names like OANDA, FOREX.com, and IG US.

- OANDA US: Provides MT5 on web, desktop, and mobile with depth of market, advanced charting, one-click trading, and EA support. However, US traders remain limited by NFA rules, capped leverage, FIFO, and no hedging, making the platform less flexible than OANDA’s international MT5 offering.

- FOREX.com: Supports MT5 with a faster 64-bit platform, advanced charting, and 15 built-in indicators, including Pivot Points. It also offers an improved search function and access to nearly 300 CFD stocks internationally, though in the US, trading is limited to forex and metals under CFTC rules.

- IG US: IG promotes MT5 with strong uptime, low spreads, and 24/7 support, combining its own institutional-grade technology for execution and liquidity. Globally, IG clients can trade thousands of CFDs across markets. But in the US, access is limited mainly to forex, with tighter leverage and fewer features than its international branches.

In practice, most US brokers prioritize MT4 over MT5, given the regulatory hurdles. Traders seeking full MT5 functionality often find it only through international entities, which may not legally serve US clients.

6. Can you legally use MetaTrader 5 in the US?

The legality of using MT5 in the United States depends entirely on the broker you choose. If a US-regulated broker provides MT5, then trading is fully legal. However, many traders look for workarounds that can create risks.

- Using a licensed US broker: Completely legal. Your account is protected by NFA and CFTC rules, and funds are held under strict safeguards.

- Using offshore brokers via VPN or foreign accounts: Risky. While you may access MT5 this way, it can violate US financial laws and leave you without legal protection.

- Unregulated platforms: Dangerous. You face the risk of losing money without recourse, since these brokers operate outside the US jurisdiction.

In short, MT5 is legal only through brokers registered in the US. Trying to bypass these rules is a risky move that could lead to serious financial and legal trouble.

7. Alternative trading platforms legally available in the US

Since MT5 is not widely supported, many US traders turn to alternative platforms that are fully compliant with local regulations. You’ll find these platforms are fully compliant, offering the strong tools and legal protection that US traders expect.

- Thinkorswim (TD Ameritrade): A top choice for stock and options traders. It provides real-time data, advanced charting, and a highly regarded paper trading feature. However, its forex tools are basic and not as flexible as global platforms.

- TradeStation: Well-suited for active traders who want automation and backtesting. It covers stocks, futures, options, and forex, with strong research tools. The downside is its complexity; new traders may find the interface overwhelming.

- NinjaTrader: Popular for futures and forex. It supports algorithmic trading, custom indicators, and flexible charting. Still, it offers fewer assets outside futures and has costs for premium features.

- cTrader (limited in the US): Known for its clean design and fast execution in forex. It supports advanced order types and transparency in pricing. But in the US, broker availability is limited, and overall market access is smaller than MT4/MT5.

Comparison of US trading platforms

| Platform | Strengths | Weaknesses |

|---|---|---|

| Thinkorswim | Advanced for stocks/options, strong paper trading | Limited forex tools, steep learning curve |

| TradeStation | Automation, wide asset coverage, strong analytics | Interface complexity, costs for premium features |

| NinjaTrader | Futures & forex focus, customizable algo trading | Narrow asset selection, extra fees for add-ons |

| cTrader | Simple UI, fast execution, advanced order handling | Rare in the US, fewer brokers, limited market scope |

| MetaTrader 5 (US brokers) | Familiar interface for forex, regulated under NFA/CFTC, and access to metals | No CFDs, leverage capped at 1:50, limited support for EAs, hedging often restricted, fewer pending order types, and higher spreads/commissions |

Each platform has unique strengths but clear trade-offs. None can fully replace MT5’s global flexibility, yet they remain the safest and most practical choices for US traders who want to stay compliant.

See more:

8. What to do if you’re outside the US but planning to move?

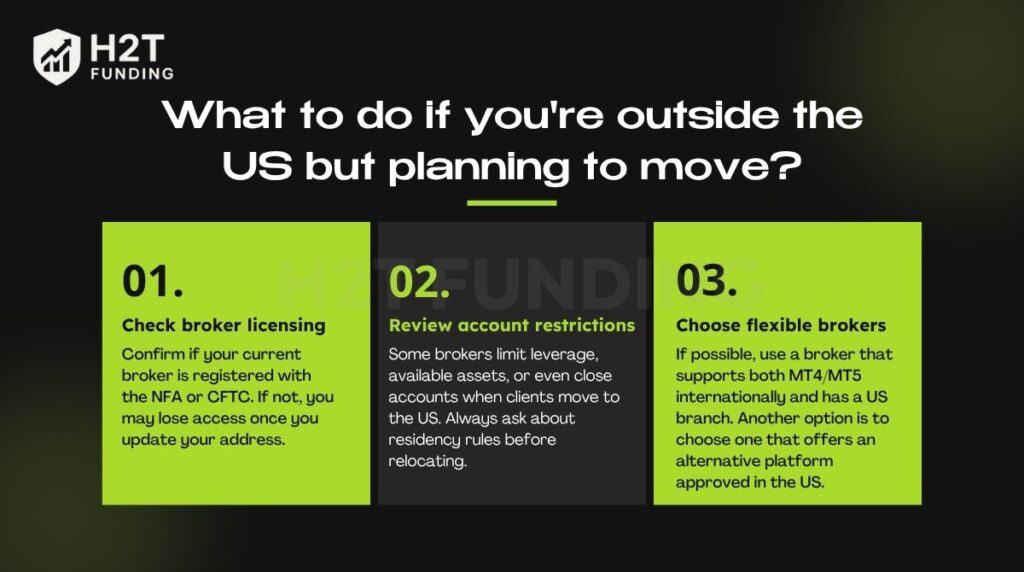

If you currently trade with MT5 abroad and plan to relocate to the United States, it’s important to prepare in advance. Your broker access may change once your residency shifts to the US.

- Check broker licensing: Confirm if your current broker is registered with the NFA or CFTC. If not, you may lose access once you update your address.

- Review account restrictions: Some brokers limit leverage, available assets, or even close accounts when clients move to the US. Always ask about residency rules before relocating.

- Choose flexible brokers: If possible, use a broker that supports both MT4/MT5 internationally and has a US branch. Another option is to choose one that offers an alternative platform approved in the US.

Planning avoids disruptions in your trading journey. By verifying broker licenses and platform compatibility, you can smoothly transition and remain compliant when moving to the US.

9. Advice for US Traders

Trading in the United States comes with unique challenges due to strict regulations. To succeed, US traders need to focus on compliance, risk control, and platform choice when considering MT5 or any alternative.

- Check regulations first: Always ensure your broker is licensed by the NFA or CFTC before funding an account.

- Understand platform limits: Be aware of which products are allowed on MT5 through US brokers, such as forex and metals, and which are not.

- Practice with demo accounts: Before trading live, use a demo account to get familiar with the platform and available markets.

- Compare broker services: Look beyond spreads, evaluate fees, execution quality, tools, and customer support.

- Diversify platforms: Consider using more than one platform if you trade multiple asset classes, since MT5 access is limited in the US.

Following these steps helps traders build a safer trading routine. It also ensures compliance with US financial law, which is crucial for protecting funds and maintaining long-term success.

10. FAQs

Yes, MT5 is currently available in the US App Store, but access depends on the broker you connect to. If the broker is licensed in the US, you can use the app legally without issues.

Most US brokers avoid MT5 because of strict NFA and CFTC regulations. Adapting the platform to rules like FIFO and the ban on hedging requires extra adjustments, so many firms stick with MT4 or proprietary platforms.

Using an offshore broker exposes you to risks such as a lack of legal protection, potential account closure, and even financial loss. Since these brokers are not regulated by US authorities, you have no recourse if problems arise.

Yes, MT4 is more common in the United States. Many brokers continue to support MT4 because it is easier to align with US rules, while MT5 adoption remains limited.

There is no single “best” broker, but well-known choices include OANDA, FOREX.com, and IG US. Each is regulated by the NFA and CFTC, giving traders confidence in security and compliance.

Yes, forex trading is legal in the United States as long as it is done through a broker regulated by the NFA and CFTC. Trading through unlicensed firms is not allowed and can lead to serious risks.

Yes, you can trade on MT5 in the USA, but only if your broker is licensed and supports it. Since a few US brokers offer MT5, access is more limited compared to global markets.

MetaTrader itself does not handle clients, as it is just a platform. Whether US clients can use MT5 depends on the broker’s licensing and compliance with US regulations.

Currently, only a few brokers provide MT5 in the US, and their features are restricted compared to international platforms. Most traders use MT4 or other regulated platforms instead.

Yes, MT5 is available again after temporary removals from app stores in the past. However, its use remains limited by regulation and broker support.

No, MetaTrader 5 is not a broker. It is a trading platform that connects you to licensed brokers, where you open and manage your trading accounts.

MetaTrader 5 is used for trading forex, stocks, futures, and commodities. Traders rely on it for executing trades, analyzing charts, and automating strategies.

Yes, MetaTrader 5 is free to download and use. However, brokers may apply costs such as spreads, commissions, or account fees depending on your trading setup.

11. Conclusion

MetaTrader 5 is a powerful global trading platform, but in the United States, its use is limited. Regulations from the NFA and CFTC mean that only a handful of licensed brokers support MT5, often with fewer products and stricter rules than traders abroad enjoy.

For US traders, the safest option is to use MT5 only through regulated brokers or consider alternative platforms like Thinkorswim, TradeStation, or NinjaTrader. This approach not only keeps you compliant with US law but also gives you peace of mind that your funds are secure.

If you want to explore more about trading strategies, regulations, and platforms beyond the question Is MetaTrader 5 available in the US, check out the Prop Firm & Trading Strategies section on H2T Funding. There you’ll find detailed guides that help traders make smarter and safer decisions in today’s market.