Many traders wonder: Is margin still used when in floating profit? At first, it might seem logical that the margin would be released once a trade is in profit. In reality, that’s not the case. Margin remains locked even when you have a floating profit. The broker continues to hold it as collateral until the position is closed.

By reading this guide on H2T Funding, you will see why margin stays locked and how floating profit affects equity and free margin. It also shows practical ways to manage your account effectively, helping traders avoid overtrading and margin calls.

Key takeaways

- Margin is still used when there is a floating profit, and remains locked until you close the trade.

- Floating profit raises equity and free margin, but it never reduces used margin.

- A higher equity improves your margin level, which lowers the chance of a margin call.

- Effective strategies like partial close, stop-loss adjustment, and careful reinvestment turn floating gains into sustainable growth.

1. What is the margin in trading?

Margin in trading is the portion of capital a broker requires to open a position. It acts as collateral to ensure you can cover potential losses. Without margin, leveraged trading in forex, crypto, or stock CFDs would not be possible.

In business, “margin” usually refers to profitability metrics like gross profit margin in corporate finance, showing how revenue compares to expenses, debt, or taxes. For example, gross margin is defined as gross profit divided by revenue, while profit margin is defined as the percentage of revenue that remains after all costs.

There are two key elements here:

- Margin requirement: the percentage of a trade’s value you must provide.

- Leverage: how many times larger your position can be compared to your margin.

For example, if you open a $10,000 position in EUR/USD with 1:100 leverage, the required margin is $10,000 ÷ 100 = $100. This $100 becomes your used margin, while the rest of your account balance stays as free margin to open new trades. Even if your trade shows a floating profit, the used margin remains locked until the position is closed.

You can learn more about managing position size in our guide on how to calculate lot size in Forex.

2. What is floating profit or loss?

Floating profit or loss is the unrealized gain or loss on an open position. In other words, it shows how much you would make or lose if the trade were closed right now. Until you actually close the position, this amount is not locked in.

Floating P/L directly affects your equity and free margin, but it does not change your balance. For example, if your account balance is $1,000 and you have an open trade showing $200 in floating profit, your equity becomes $1,200. However, your balance remains $1,000 until the trade is closed.

This temporary nature is why floating P/L is important for risk management. It shows the current health of your account, but it can change quickly with market volatility.

3. Is margin still used when in floating profit

Yes, margin is still used when you are in a floating profit. The broker continues to keep your margin as collateral until the position is closed. Even if your trade shows a profit, the locked margin does not change.

The reason is simple: the trade is still open. Since markets can move against you, the broker must hold that margin to cover risk. Floating profit only increases your equity, not the used margin.

For example, imagine you open 1 lot EUR/USD with $1,000 margin. If the trade shows $500 floating profit, your equity rises by $500. But the margin used remains $1,000. Only when you close the trade will the margin be released back into free margin.

Continue reading:

4. How the margin works when there is a floating profit

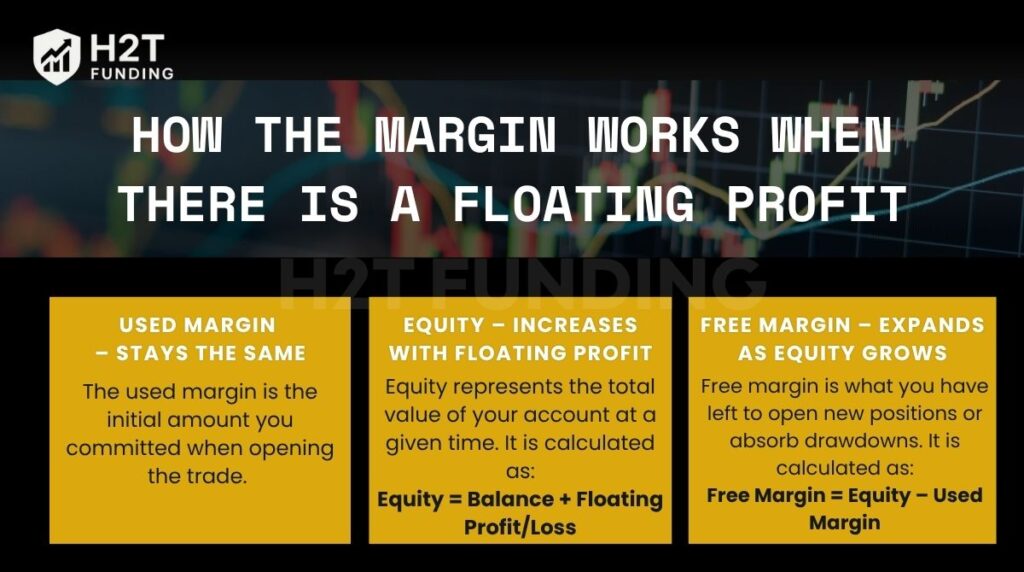

When a trade is in a floating profit, three key elements define how margin behaves: used margin, equity, and free margin.

Each reacts differently. For anyone with a business background, tracking these metrics is like reading the key ratios on an income statement. Similarly, firms watch customer retention and inventory turnover to gauge strength across the economic cycle. In contrast, traders rely on equity, free margin, and used margin for account health.

To stay safe, traders also need to monitor risks such as drawdown in trading, which shows how far equity can drop during a losing streak.

Let’s break it down.

4.1. Used Margin – Stays the same

The used margin is the initial amount you committed when opening the trade. This figure remains unchanged, even if your position shows a gain. Brokers keep it locked as collateral.

Example: If you open a position requiring $100 margin, that $100 remains blocked whether the trade is showing gross profit or a temporary loss.

4.2. Equity – Increases with floating profit

Equity represents the total value of your account at a given time. It is calculated as:

Equity = Balance + Floating Profit/Loss

When floating profit rises, equity increases. Think of it like revenue boosting a firm’s operating profit margin before net profit and taxes are deducted. The profit is visible but not yet realized.

Example: Balance = $1,000, Used Margin = $100, Floating Profit = $50.

Equity = $1,000 + $50 = $1,050.

4.3. Free Margin – Expands as equity grows

Free margin is what you have left to open new positions or absorb drawdowns. It is calculated as:

Free Margin = Equity – Used Margin

Since equity goes up while the used margin stays the same, free margin increases. This boost in trading efficiency is similar to how a business can strengthen its financial position by lowering overhead costs.

Keeping track of these numbers in a trading journal helps traders measure performance and avoid repeating mistakes.

Example: Equity = $1,050, Used Margin = $100.

Free Margin = $1,050 – $100 = $950.

Key point: Floating profit gives you more free margin and profit potential, but it never reduces the used margin until the trade is closed. Knowing this helps traders measure financial health, avoid overtrading, and plan for investment potential.

5. How floating profit affects equity and free margin

Floating profit does more than change numbers on the screen. It directly impacts how much trading capacity you have. When equity rises, your free margin grows as well. This means you can:

- Open additional positions with the extra room provided.

- Hold existing trades longer, since higher equity reduces the chance of a margin call.

- Absorb short-term volatility without closing trades too early.

However, the used margin never changes until the position is closed. This is similar to how fixed costs or COGS (Cost of Goods Sold) remain constant on an income statement, even if revenue grows. The temporary gain increases flexibility but does not reduce your locked collateral.

In practice, a floating profit is the trading equivalent of seeing a healthy gross profit. It’s a positive sign, but it’s not your final net profit margin until all is said and done. This boosts short-term profitability, but the result is not final. If the market turns, your free margin can shrink just as quickly.

Example: Imagine a trader with a $5,000 balance. They open a 1-lot EUR/USD trade requiring $500 margin. If the trade shows $800 floating profit, equity rises to $5,800. Free margin becomes $5,300 ($5,800 – $500).

With this extra room, the trader could open another smaller trade or keep holding the position through market swings. But if the market reverses, that $800 gain could vanish, just like operating profit margin can shrink when unexpected costs increase.

Here’s the bottom line: Floating profit gives you more breathing room, but it’s not money in the bank until you close the trade. Treat it as a temporary advantage to manage your positions better, not as guaranteed capital to take on more risk.

6. What happens to the margin when you close a trade?

When you close a trade, the margin that was locked is released back into your account. At the same time, any floating profit or loss becomes realized. This process changes several parts of your account balance and margin.

- Floating profit becomes realized: Gains or losses that were only on paper are now confirmed. If you closed the trade in profit, that amount is added to your balance.

- Used margin is released: The margin you committed to open the position is no longer required. It is freed up and added back to your free margin.

- Your balance is updated: It increases by the realized profit (or decreases if it was a loss). Equity then matches the new balance because no positions are left open.

Example: Suppose the account starts with $1,500 and a trade requires $300 as collateral. The position shows $200 in floating profit, and once closed, that gain lifts the balance to $1,700. At the same time, the $300 locked amount is released, so the free margin now matches the full $1,700.

Closing a trade not only locks in your profit or loss but also restores your margin capacity. This allows you to reassess and allocate capital more efficiently for the next opportunity.

7. Why understanding this matters

Knowing how margins work is essential for safe and effective trading. Even if a trade is showing a profit, the market can reverse quickly. A large floating loss reduces equity and can trigger a margin call if your margin level drops too low.

Floating profit also increases free margin, giving you more room to open new trades or apply higher leverage. While this creates opportunities, it must be managed carefully to avoid overexposure.

Finally, tracking margin health (often called the margin indicator) reveals the real financial status of an account. It shows whether there are enough resources to hold current positions or enter new ones.

For beginners, combining this awareness with a solid plan, such as a best trading strategy for beginners, can build a safer and more disciplined path to growth.

8. Manage the margin account effectively when there is a floating profit

Seeing a profitable trade can create a false sense of security. The difference between good and great traders is how they protect those unrealized gains. Here’s how to manage your account effectively:

- Avoid overconfidence: A profitable position does not guarantee future results. Markets can shift quickly, so continue to monitor risk and build habits that keep you more disciplined in your trading.

- Consider a partial close: Closing part of a position locks in some profit while reducing used margin. This approach protects your capital and gives you more flexibility for new trades.

- Adjust stop loss to breakeven or profit: Moving your stop loss helps safeguard against reversals. It ensures that the floating profit is not lost and can even turn into a small realized gain. For advanced protection, explore the difference between a trailing stop loss and versus trailing stop limit.

- Reinvest smartly: A Higher free margin from floating profit may tempt you to open more trades. Use this extra capacity selectively, focusing on high-probability setups instead of overtrading.

- Understand broker margin terms: Each broker may calculate or display margin differently. Reading the broker’s margin rules helps you avoid surprises in how free margin, equity, and margin level are shown.

Floating profit can strengthen your account, but it should be managed carefully. Protect gains, adjust stops, and use free margin wisely rather than rushing into new trades.

See more helpful articles:

9. FAQs

Because part of your equity is still tied to the used margin. Floating profit increases equity and free margin, but the locked margin remains until the trade is closed. That’s why you cannot use the full equity amount.

No. Floating profit never reduces the margin requirement. The used margin stays the same as when you opened the trade. Only closing the position releases it.

Yes, to some extent. A floating profit increases equity, which raises free margin and margin level. This extra buffer reduces the chance of a margin call. But if the market reverses, equity can fall quickly, so the risk never disappears.

It can be done, but it carries risk. Floating profit is not realized profit, and relying on it too much may lead to overtrading. Safe practice is to use floating profit carefully, lock in gains when possible, and avoid risking more than your plan allows.

Yes, floating profit increases equity right away, which expands free margin. However, it remains unrealized until the trade is closed, so it should not be treated as guaranteed capital.

Some brokers may adjust margin terms during high volatility or around major news events. Even if you have a floating profit, a sudden increase in margin requirements can reduce free margin and affect your open positions.

Yes. Floating P&L changes equity, and since margin level = Equity ÷ Used Margin × 100%, any gain raises the level while losses reduce it.

It impacts the amount of free margin you have and your ability to open or hold trades. Positive P&L gives more flexibility, while negative P&L increases the risk of a margin call.

10. Conclusion

To wrap it up, the answer to our initial question is margin still used when in floating profit? It is a clear yes. The margin required for a trade remains locked in place as long as the position is open, regardless of any floating profit.

Just as profit margin is calculated by dividing profit by revenue, margin level is calculated by dividing equity by used margin, showing the real strength of your account. Understanding this mechanism helps traders avoid unnecessary risks such as overtrading or unexpected margin calls.

If you found this guide useful, explore more insights in our Prop Firm & Trading Strategies section at H2T Funding. There you’ll find detailed reviews of leading prop firms, practical trading strategies, and margin management tips designed to help you grow as a trader.