Is day trading worth it? When people first hear about day trading, it sounds thrilling: fast profits, freedom from a 9-to-5 job, and the promise of being your own boss. But is day trading worth it in reality? According to Investopedia, only 5–10% of traders stay consistently profitable.

Over 90% lose money due to volatility, weak risk management, and emotional decisions. Whether it’s worth it depends entirely on your preparation, discipline, and ability to handle market pressure.

In simple terms, day trading means opening and closing trades within the same day, trying to capture small moves in price. It’s exciting, but the truth is, for most beginners, the market can be unforgiving. Let’s look at what it really means to trade this way, what works, what doesn’t, and how you can tell if it’s right for you.

Key takeaways:

- Day trading is buying and selling within one day, aiming to profit from small price fluctuations.

- It can look rewarding, but most traders lose money due to volatility, poor risk management, and emotions.

- Beginners should start small and try demo accounts or simulated trading before risking real capital.

- The true challenge isn’t timing the market; it’s managing yourself under pressure.

- In 2026, with more competition and AI-driven systems, discipline matters more than luck.

1. What is day trading, and how does it work?

Day trading is the practice of buying and selling financial instruments like stocks, forex, futures, or crypto within the same trading day. The idea is simple: catch quick movements, close out before the day ends, and avoid overnight risk.

However, whether day trading crypto is worth it is a question many traders are asking. Trading in the crypto market brings unique challenges: extreme volatility, thinner liquidity during off-hours, and price swings driven by social media. Understanding these market conditions is essential for 2026 traders.

For example, a trader might buy Apple shares at 10 a.m. when momentum is building, then sell them at 11:15 for a small gain. The trade might last minutes or hours, but never longer than a single session. The profit comes from price fluctuations, sometimes just a few cents per share multiplied by trading volume and capital.

That sounds easy, but here’s where it gets tricky. Markets move because of volatility driven by economic changes, interest rate shifts, and geopolitical developments. When news hits, prices can spike or crash in seconds. To stay alive, traders need a clear trading plan and strict risk management rules, like setting stop-loss orders to cap potential losses.

Many platforms, from MetaTrader to TradingView, make it easier to analyze charts and execute trades quickly. But the real skill lies in reading market conditions, not just indicators.

Why do people choose this path? Freedom and adrenaline. There’s a unique satisfaction in mastering your timing, watching patterns unfold, and earning from your decisions alone. Yet, compared with passive investing, where you hold for long-term gains, day trading demands constant focus and emotional control.

To put it simply, long-term investors rely on time; day traders rely on precision. Both can work, but one will test your nerves every single day.

Read more:

2. Why do people think day trading is worth it?

A quick scroll through social media or Reddit reveals endless posts about quick profits, green charts, and luxury lifestyles, leading many to ask: Reddit is day trading worth it?

I get it; I used to believe that too. The idea of making money from anywhere, just with a laptop and some courage, is incredibly tempting.

Let’s break down why this dream feels so powerful and why, for some people, it actually makes sense.

2.1. The potential for quick profits

The appeal is simple. You buy low and sell high, sometimes within minutes. When market volatility spikes, those small price fluctuations can lead to impressive short-term gains.

As The Motley Fool notes, “The promise of fast profits attracts many beginners, but few master the required trading discipline and risk management.” I’ve seen traders flip a small position in the morning and pay for dinner by noon. Of course, for every story like that, there’s another where someone loses twice as much by the afternoon.

2.2. You control your time and capital

Unlike a regular job, you don’t answer to a boss. You decide when to trade, when to stop, and how much risk to take. That freedom can feel addictive. Some people genuinely love the independence, the quiet hours before the market opens, and the rush of placing the first order.

2.3. Technology makes it easier than ever

With modern trading platforms like TradingView, Webull, or MetaTrader, anyone can enter the market. Data streams live, charts update in real time, and there’s instant access to liquidity. I still remember my first real-time trade: hands sweating, heart racing, thinking I had cracked the code. Spoiler: I hadn’t.

2.4. Risk management separates winners from gamblers

The traders who make it work don’t just rely on luck. They build trading strategies, test them thoroughly (many learn how to backtest a trading strategy first), set clear stop-loss orders, and stick to their plan.

I once met a trader who said, “My best trade was the one I didn’t take.” That stuck with me. It’s discipline, not brilliance, that keeps your account alive.

2.5. The lifestyle fantasy still inspires people

Even if we know those YouTube videos exaggerate, there’s a part of us that wants to believe it’s possible. Maybe it’s not about private jets; maybe it’s just the dream of earning enough to quit a job you hate. That’s real motivation.

In the end, it’s easy to see why people are drawn in. Day trading promises control, excitement, and a shot at freedom. But as we’ll see next, that promise often comes with a cost most beginners underestimate.

3. Why day trading often fails for most traders

Honestly, this is the part that few people want to hear, but it’s the truth. Most traders lose money. Not because they’re lazy or stupid, but because the market is built to test every weakness we have: greed, fear, and overconfidence. I’ve seen people start full of excitement and end up exhausted, wondering where all their capital went.

Here’s why that happens more often than not:

- Unpredictable volatility and constant risk: The market doesn’t care about your plan. Prices swing wildly because of economic changes, interest rates, and even geopolitical developments happening halfway across the world. One tweet, one speech from the Fed, and your position can flip from profit to panic. That’s the harsh reality of market volatility; it’s exciting when you’re right but brutal when you’re wrong.

- No real trading plan or weak risk management: Many beginners enter the market, thinking intuition is enough. It isn’t. Without a proper trading plan, even a small move against you can snowball. I remember once holding a trade too long because I “felt” it would bounce back. It didn’t. A simple stop-loss order would’ve saved me hundreds of dollars that day.

- High trading costs and taxes quietly eat your gains: You can make ten good trades, but after spreads, commissions, platform fees, and taxes, you might still be down. People forget that every click has a cost. Trading costs and short-term taxation are silent killers, slowly cutting into what looks like profit on paper.

- Emotional control is harder than it sounds: This one is huge. The moment real money is on the line, logic fades. Many traders struggle with how to be more disciplined in their trading when facing this pressure. You might revenge trade after a loss or double down to “make it back.” That’s not strategy; it’s emotion. And emotion destroys accounts faster than bad luck ever could.

- Undercapitalization and drawdown pressure: Let’s be honest, most traders simply don’t have enough capital to survive a string of losses. When your account shrinks, so does your confidence. You start taking impulsive trades just to feel in control again. But that pressure, that constant fight to recover, is what wipes most people out.

Day trading looks simple until you realize how many moving parts it hides. It’s not just charts and numbers; it’s psychology and patience. Still, people often ask, “Is day trading reliable?” because results can be unpredictable. Without that, the market becomes an expensive teacher, one that doesn’t forgive mistakes easily.

4. Is day trading worth it for beginners?

Let’s be real: if you’re just starting out, the odds aren’t in your favor. I don’t say that to discourage you, but to prepare you. Day trading is one of those things that looks simple from the outside: charts, buy and sell buttons, and a few candles going green.

But once you step in, everything changes. Your heart starts racing, your palms sweat, and suddenly, it feels like the market is moving just to mess with you.

For beginners, the main challenge isn’t learning the tools; it’s learning yourself. You might think trading is all about patterns or news. In reality, it’s about controlling your reactions when the screen turns red.

I remember my first week trading; I closed my first profit early out of fear, then held my losing trade “hoping” it would recover. Guess which one hit the stop-loss first? Exactly.

Here’s what usually trips new traders up:

- Lack of discipline and trading psychology: It’s easy to create a trading plan, but following it under pressure is another story. One losing streak and you start doubting everything your system, your skills, even yourself.

- Confusing trading with gambling: Some beginners chase quick wins the way gamblers chase luck. They forget that successful traders manage risk first, profits second.

- The steep learning curve: It takes time to read candlestick patterns, understand market conditions, and build a repeatable trading strategy. No shortcut can replace screen time and experience.

- Capital and risk exposure: You don’t need a fortune to start, but you do need enough capital to survive mistakes. Losing 20% on a $500 account hits very differently than on a $50,000 one.

So, is day trading worth it for beginners? Maybe if you treat it like a craft, not a game. My advice? Start small. Use a demo account first, or even better, test yourself through a prop firm evaluation. It’s a safe way to practice under real conditions without risking your own money.

If you can learn to stay calm, follow your plan, and think long-term, then maybe, just maybe, you’ll find that day trading isn’t just about money. It’s about mastering your mind.

See more:

5. The real costs and risks of day trading

Here’s something most YouTube gurus won’t tell you: the real danger of day trading isn’t just losing a trade; it’s death by a thousand cuts. You rarely lose everything in one trade; it’s the small costs, stress, and slow capital drain that break you.

Let’s talk about what those costs actually look like in real life.

- Trading fees and spreads add up fast: Every trade you make, every click, costs something. Whether it’s a small commission, a few pips of spread, platform fees, or market data fees, it all eats into your gains. When I first started, I thought, “It’s just a few cents per trade.” But after a month of overtrading, I realized I’d given away hundreds in fees without even noticing.

- Taxes take a bigger bite than you expect: In many countries, short-term trades are taxed as ordinary income, not long-term gains. That means your profits can be taxed at the highest rate: 25%, 30%, or sometimes more. You can have a great trading month and still end up frustrated once the tax bill lands.

- The opportunity cost is real: Every hour you spend staring at charts is an hour you’re not building a business, improving your skills, or simply living your life. I’ve met traders who realized, years later, that they would’ve earned more (and slept better) by investing passively in an index fund. That’s what opportunity cost really means: the price of what you give up.

- The psychological toll is heavier than you think: There’s stress, sure, but also doubt, regret, and burnout. Losing streaks can mess with your self-esteem. I’ve seen smart, calm people become emotional wrecks after one bad month. They start revenge trading, chasing losses, thinking, “Just one more trade to make it back.” That’s when it usually gets worse.

- One trade can change everything: It’s not dramatic; it’s reality. I once saw a trader wipe out three months of steady growth in one impulsive trade. He broke his own rule, held through a reversal, and couldn’t believe how fast it happened. That’s the thing about market volatility: it doesn’t ask for permission.

So, when people ask me, Is day trading worth the risk? I pause. Because the answer isn’t black and white, for some, it’s a thrilling challenge, a chance to master emotion and strategy. For others, it’s an expensive lesson in humility. The trick is to know which one you’ll be before you start.

6. Pros and cons of day trading

Let’s be honest, day trading isn’t all fast profits and freedom like social media makes it seem. It has real upsides but also tough downsides that can drain your time, emotions, and capital. I’ve been there, and if you’re thinking about diving in, here’s what you should really know.

Pros of day trading:

- Potential for quick profits: When volatility hits, even small moves can turn into solid returns. I’ve seen traders catch a $0.50 swing on a stock and walk away with a day’s wage in minutes. It’s rare, but it happens, and that’s what keeps people hooked. The upside? You control every entry and exit.

- Independence and flexibility: You’re your own boss. No office, no manager breathing down your neck. Just you, your screen, and the market. Honestly, that freedom feels amazing, trading from a café and adjusting your schedule around market hours. It’s not easy, but it’s liberating.

- Fast feedback and skill growth: Unlike investing, where results take months, day trading gives instant feedback. Win or lose, you learn fast. You start noticing patterns, how you react under pressure, when your strategy works, and when it fails. It’s like a crash course in decision-making.

- No overnight risk: Because positions close before the market ends, you don’t wake up to a nasty surprise caused by overnight news or global events. It gives you peace of mind, at least until the next morning’s opening bell.

- Market accessibility: These days, anyone with a laptop and Wi-Fi can trade. Platforms like TradingView, Webull, and MetaTrader make it possible to execute trades instantly. The tools that used to be exclusive to professionals are now in everyone’s hands; that’s a big deal.

Cons of day trading:

- High risk, high stress: The truth is, most day traders lose money. The market can turn against you in seconds. One bad decision, one emotional trade, and your profits vanish. You need iron discipline; not every day will end green.

- Time-consuming and exhausting: People think day trading takes a few clicks a day. Nope. Real traders sit for hours, tracking trends, watching charts, and managing open positions. It’s mentally draining. Some days you’ll feel like you worked a 12-hour shift just without the paycheck.

- Emotional rollercoaster: There’s fear, greed, frustration, and euphoria all before lunch. I’ve seen traders slam their desks one moment and celebrate the next. Keeping your emotions steady might be harder than mastering the charts.

- Trading costs add up: Commissions, spreads, and platform fees look small but pile up fast. I once calculated my first month’s trading costs and realized I’d spent more on fees than I’d earned. It was humbling.

- Potential for addiction: The rush of a winning trade can be intoxicating. Some people start chasing that high and trade compulsively. Before you know it, you’re not trading for strategy, you’re trading for dopamine. That’s when it becomes dangerous.

- Steep learning curve: There’s no shortcut. You’ll have to study, practice, lose, and learn again. Market news, technical setups, global events; it never stops. And if you can’t keep up, the market will remind you quickly.

Day trading can be worth it, but only if you treat it like a business, not a gamble. The profits are real, but so are the risks. If you can handle the pressure, stay disciplined, and think long-term, it might just be the most challenging (and rewarding) thing you’ll ever do.

7. Is being a day trader worth it in 2026?

That’s the big question, isn’t it? Every few years, people claim this is the best time to be a trader: faster internet, smarter tools, and more access to data. But 2026 feels different. Markets are more unpredictable than ever. Volatility swings harder, liquidity shifts in seconds, and algorithms dominate most order flow. So, is being a day trader in 2026 actually worth it? Let’s take a hard look.

First, the playing field has changed. With AI-driven trading platforms, automation tools, and instant data feeds, retail traders have more power than before. You can analyze financial instruments from your phone, set stop-loss orders, and execute trades faster than some old-school pros ever could.

That’s incredible progress, but it also means you’re competing with algorithms that don’t eat, sleep, or second-guess themselves.

Then there’s the human side. I’ve talked to traders who say 2026 feels like a mental marathon. The markets move fast, and you need sharp emotional control to keep up. One moment you’re up $500, the next you’re staring at a red screen, wondering how it slipped away so quickly. That constant tension isn’t for everyone.

Still, it’s not all doom and gloom. If you’ve got clear investment goals, patience, and a solid risk management plan, 2026 can be full of opportunity. I know traders who thrive by focusing on data rather than drama: those who trade small, consistent setups instead of chasing big wins. They treat trading like a profession, not a lottery ticket.

To me, that’s what separates the survivors from the dreamers. Being a day trader in 2026 is worth it only if you treat it like a serious business with structure, discipline, and a plan for when things go wrong. Because they will, eventually.

So, ask yourself this: do you want the thrill, or do you want the craft? If you’re in it for the second, then yes, it might just be worth it.

8. How to decide if day trading is right for you

Let’s be honest: not everyone is built for day trading. Some people love the rush, the charts, and the constant movement. Others feel drained after ten minutes of watching a candle drop. So before you dive in, take a step back and really ask yourself: Is this the kind of stress I want every day?

Here’s a simple way to figure it out.

Start with time. Do you actually have enough of it? Day trading isn’t something you squeeze between meetings or do on your lunch break. You need hours to watch the market, to journal trades, and to think.

If your schedule is already packed, you’ll probably end up rushing trades and making emotional decisions. I’ve been there, trying to trade from my phone while commuting. It never ends well.

Then comes capital. This isn’t like buying a few shares to hold. You need money you can afford to lose, not your rent, not your savings, but truly risk capital because the market doesn’t care about your plans. A sudden move, one bad headline, and your account balance can drop before you can react.

Next, check your mindset. Do you get nervous when your investments dip 5%? Or do you see it as a learning opportunity? Successful traders don’t just manage trades; they manage emotions. They have trading discipline, risk management, and a written trading plan. They know when to walk away.

And finally, think about why you’re doing it. Are you chasing quick profits, or are you genuinely curious about how markets move? If it’s the second one, you’re already ahead. Curiosity and patience build longevity. Greed burns accounts.

I always tell new traders this: if you love analyzing patterns (such as looking for a trendline in trading), enjoy problem-solving under pressure, and don’t mind a few sleepless nights at first, you might actually enjoy day trading.

But if you crave stability, prefer long-term growth, and don’t want to feel your pulse jump every morning when the market opens, passive investing will probably make you much happier.

In the end, there’s no right or wrong answer, just the one that fits your personality. The markets will always be there. The question is whether you’re ready to meet them on your terms.

9. How much do you need to start day trading?

This is probably the first question every beginner trader asks. To be honest, there isn’t one perfect number. It depends on what market you trade, where you live, and how much risk you’re willing to take. But let’s make it simple.

If you plan to trade U.S. stocks using a margin account, you’ll face the Pattern Day Trader (PDT) rule. It requires at least $25,000 in your account if you want to make more than three day trades within five business days. That’s quite a hurdle for most beginners.

So what can you do instead? Some traders start with cash accounts, which don’t have the PDT restriction. You can begin with $500 to $2,000, but your funds need one business day to settle before you can reuse them. Others choose offshore brokers, which usually don’t enforce the PDT rule. Just make sure you research carefully and choose a regulated, reputable platform.

Here’s a quick example. Say you have $1,000, and your broker offers 4x leverage. That gives you control over $4,000 worth of trades. Sounds good, right? But if your trade drops 10%, your account falls by 40%. I’ve been there before, and it’s not a great feeling watching the numbers turn red that fast.

Most experienced traders recommend risking only 1 to 2 percent of your account on each trade. It might seem small, but it’s what keeps you in the game long enough to learn. The real goal at the start isn’t to make big money; it’s to protect your capital and build consistency.

If you dream of trading full-time, save a financial cushion of at least six months of living expenses separate from your trading funds. That way, you won’t trade under pressure or out of fear of missing bills. Emotional trading almost always leads to mistakes.

So, how much do you really need? The honest answer is simple: start with what you can afford to lose without losing sleep. Even a small account can teach you valuable lessons about discipline and patience if you treat it seriously. Build your skills first, and the profits will follow.

10. Common mistakes day traders make

Day trading looks simple until you are the one watching your screen turn red. I have seen many beginners, and honestly, I was one of them, repeat the same mistakes again and again. Here are some of the most common traps new traders fall into and how to avoid them.

- Trading without a plan: Many beginners trade on impulse, chasing every green candle that pops up. Without a written plan for entry, exit, and risk per trade, you are basically gambling. I learned that lesson after a few gut-feeling trades wiped out a week of profit.

- Ignoring risk management: Simply put, your account does not disappear from one big mistake. It fades away slowly through a series of careless trades. Always set a stop-loss and limit your risk to 1–2 percent per position. If you lose several trades in a row, pause and reassess instead of forcing the next one.

- Revenge trading after a loss: This one is brutal. You lose money, then double your trade size to get it back. I have done it. Most of us have. That is emotion, not strategy. The market does not care that you are angry or trying to recover. Step away, clear your head, and come back later.

- Overtrading: Many people think taking more trades means making more money. It does not. It usually means more mistakes and higher fees. Sometimes, the smartest move is to stay out of the market altogether.

- Skipping education: A lot of traders ask, “Are day trading courses worth it?” The truth is, a good course can help you understand fundamentals faster, but no class can replace real market experience. Learn the basics, practice with a demo account, and keep your expectations realistic.

- Trading with emotions: Fear, greed, and excitement all cloud judgment. One trader I admire once told me, “If you are sweating while trading, you are not trading; you are gambling.” Staying calm helps you think clearly and protect your capital.

- Not keeping a trading journal: Many traders do not track their progress, so they keep repeating the same mistakes. Writing down every trade forces you to face your habits and decisions honestly. I still journal every single day, and it keeps me accountable.

Mistakes do not destroy traders. Refusing to learn from them does. Every successful trader I know still makes errors, but they make new ones each time, and that is how real progress happens.

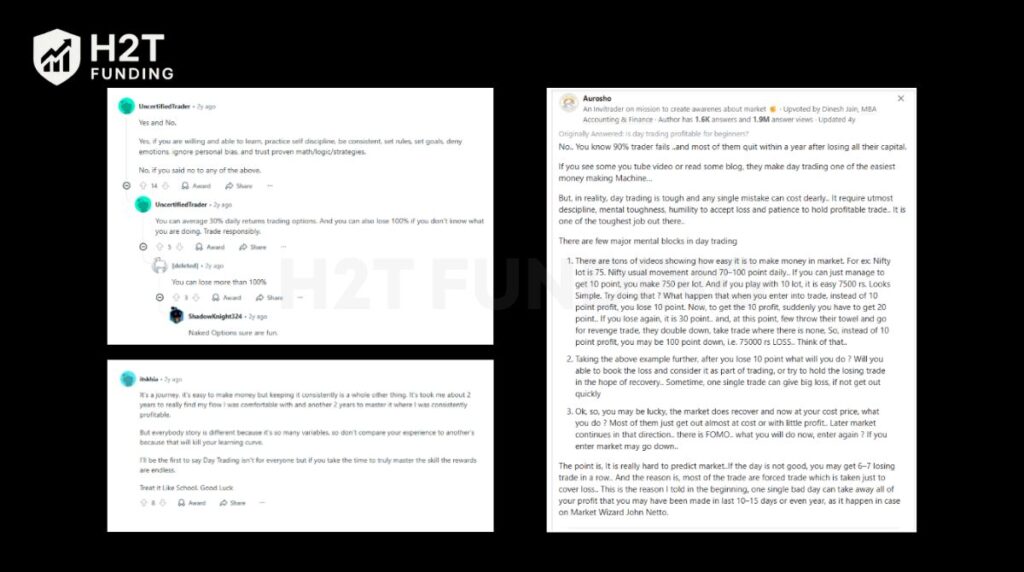

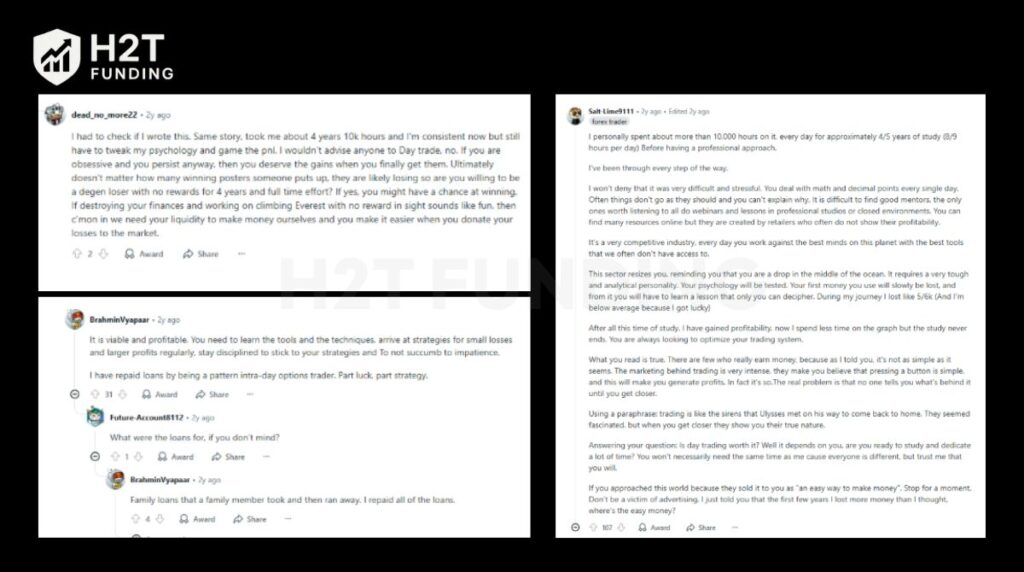

11. Is day trading worth it Reddit and Quora

If you scroll through Reddit or Quora, you’ll quickly see that day trading divides opinions. Some traders describe it as a long, exhausting journey that only pays off after years of discipline and study.

Others admit it nearly broke them before they ever saw a profit. To keep this real, I’ve included screenshots of genuine discussions where traders share what it actually takes to succeed, not just the highlight reels.

Below are the voices worth showing to capture the full picture:

Reading through real stories from Reddit and Quora, one thing becomes clear: day trading isn’t easy money. Most traders spend years learning, losing, and rebuilding before they ever see consistent results. Some call it a brutal test of patience and discipline; others see it as a craft worth mastering.

The truth lies somewhere in between; it can be worth it, but only if you’re ready to treat it like a serious profession, not a shortcut to quick wealth.

12. FAQs: Common questions about day trading

Honestly, it can be, but only for a small percentage of traders who truly know what they’re doing. Most people lose money because they underestimate how tough this game really is. I’ve seen traders spend months learning trading strategies, testing entries, and studying market conditions, and still barely break even. Profitability comes when you stop chasing every setup and start protecting your capital. The goal isn’t to win big every day; it’s to survive long enough to learn.

You can start small, but in the U.S., the PDT rule needs at least $25,000 in a margin account. Futures or forex traders can start with less, but let’s be real: low capital means higher pressure and faster burnout. If you’re underfunded, even a small losing streak can wipe you out. Start small, learn the ropes, and scale when you’ve proven your risk management works.

It can, but it’s not glamorous. Forget the Instagram lifestyle with yachts and sunsets. Real traders spend long hours analyzing charts, managing losses, and waiting: yes, waiting for setups that meet their plan. If you’re consistent, disciplined, and emotionally balanced, it can become a full-time income. But it’s a lonely, mentally demanding job. You’ll need to treat it like running a business, not like a casino.

The biggest one is volatility: prices can move faster than your reaction time. Add to that trading costs, taxes, and emotional pressure, and you’ve got a mix that can drain both your wallet and your energy. There’s also the psychological trap: believing you can outsmart the market. You can’t be consistent. The best you can do is respect it, follow your trading plan, and protect your downside with stop-loss orders.

Not really. They serve different purposes. Day trading is about short-term gains and requires daily attention. Passive investing, on the other hand, builds long-term wealth with less stress and fewer surprises. Most people are better off compounding quietly over the years than trying to out-trade hedge funds. If you enjoy the thrill and can handle the heat, fine. If you just want your money to grow without ruining your weekends, stick to long-term investing.

Yes, it’s completely legal in most countries. The key is to use regulated trading platforms and understand the rules in your region. Just don’t fall for shady “signal groups” or fake gurus selling secret formulas; those are the real traps.

Absolutely. It’s one of the hardest ways to make easy money. You’re up against institutions with better tools, faster execution, and more information. But if you treat it like a craft, studying patterns, managing liquidity, and refining your behavior, it becomes a fascinating challenge. It’s not impossible, but it’s not easy either.

That depends on how you approach it. If you trade without a plan, chase losses, and rely on luck, yes, it’s gambling. But if you follow a tested strategy, apply risk management, and stay disciplined, it’s a calculated form of speculation. The difference is control. Gambling is hoping. Trading is managing probabilities. Which one are you doing?

Yes, it is, but only if you treat it like one. Successful day traders follow strict routines, manage risk carefully, and keep detailed trading journals just like professionals running a business. It requires consistency, patience, and discipline, not luck or guesswork.

There is no single best trader. However, well-known names such as Paul Tudor Jones, Ross Cameron, and Steven Dux are often mentioned for their impressive results and educational impact. Each has a unique style, yet they all focus on risk control and emotional discipline.

It depends on your mindset and goals. If you are chasing quick money, probably not. But if you enjoy analyzing markets, managing risk, and improving your skills, day trading can be rewarding. For most people, it is better to start small and treat it as practice, not a main income source right away.

Earnings vary widely. Some experienced traders make thousands of dollars per month, while many beginners lose money. Studies show that only around 10 percent remain consistently profitable. How much you earn depends on your skill, capital, and discipline.

It is possible, but not realistic for beginners. To reach that level, you would need a large account and a proven trading system. Even then, consistency takes time and patience. Focus on learning first, and profits can follow later.

Most traders fail because they trade emotionally or without a clear plan. They take large risks and try to win every trade. Successful traders think differently; they focus on small, controlled losses and protect their capital above all else.

It can happen, but it depends on your account size and experience. With about $50,000 and solid risk management, that goal might be realistic. If your account is small, focus instead on building consistency and avoiding big mistakes.

Overconfidence is the biggest one. After a few wins, many traders believe they can outsmart the market. That mindset often leads to big losses. Staying humble, disciplined, and analytical is what keeps traders successful in the long run.

Most day traders spend 3 to 6 hours actively trading, but they also need extra time for research, analysis, and journaling. In reality, it is not a quick side job. It takes daily effort, focus, and mental endurance to stay consistent.

13. Conclusion

So, is day trading worth it? After everything we’ve unpacked, I’d say it depends on who you are, not what the market is. The truth is, day trading can teach you incredible lessons about money, emotion, and patience.

But it can also humble you faster than anything else. If you’re looking for quick wins, you’ll likely end up disappointed. If you’re focused on discipline, self-control, and smart risk management, you might just find your rhythm.

At H2T Funding, we’ve seen both sides of the story. Traders who blew up accounts chasing every candle, and others who turned small consistency into long-term success. The difference wasn’t luck; it was mindset and preparation.

So before you jump in, take a moment to reflect. Ask yourself what you really want: excitement or attainability? Because trading isn’t just about money. It’s about knowing yourself under pressure.

If you’re serious about learning the craft, exploring prop firms, or developing structured approaches, check out our Prop Firm & Trading Strategies category at H2T Funding. That’s where you’ll find guides, comparisons, and insights to help you trade smarter, not harder.