Wondering how to track net worth? It’s one of the most important habits for building long-term financial health. Whether you’re paying off debt or aiming to grow your wealth, understanding your net worth helps you see the full picture of where you stand.

As someone who started learning how to find net worth during a debt repayment journey, I’ve seen firsthand how it brings clarity, motivation, and smarter money decisions. This guide breaks down the process step by step, combining expert insights with real-life experience. You’ll also find top tools and practical tips to make net worth tracking accurate, easy, and sustainable over time.

Key takeaways

- Your net worth is simply Assets – Liabilities, giving you the clearest snapshot of your financial position.

- Tracking net worth regularly (monthly or quarterly) reveals trends, builds accountability, and keeps long-term goals on track.

- List all assets and liabilities, subtract to calculate, and use conservative estimates to avoid inflating the number.

- Apps like Empower, Monarch Money, Tiller, PocketSmith, and YNAB make syncing accounts and updating your net worth effortless.

- Knowing how to track net worth helps you reduce debt, grow savings, and align spending with long-term goals.

1. What is net worth?

Net worth is your financial snapshot, calculated as Total Assets – Total Liabilities. Assets include savings, investments, and property, while liabilities cover debts like loans or credit cards. It’s a clear measure of your wealth at any given time. Knowing your net worth helps you track financial progress.

2. Why is tracking your net worth essential?

Tracking your net worth is a powerful way to measure financial progress. It gives you a clear benchmark to see growth over time and highlights areas to improve, such as reducing debt or increasing investments. Understanding concepts like what is compound interest also helps you maximize these gains and accelerate wealth building.

Net worth also creates accountability for your financial choices. Regularly reviewing your net worth shows the real cost of impulsive spending and keeps you aligned with priorities like paying off loans or saving for a dream vacation. More importantly, it acts like a compass for long-term goals. If you’re unsure how to set financial goals, tracking net worth makes the process more practical and achievable.

Finally, net worth helps you allocate resources effectively. For instance, noticing an oversized emergency fund can prompt you to redirect money into retirement savings. Pairing this with smart habits like automating savings ensures consistent progress. Think of it this way: tracking your net worth isn’t just about crunching numbers. It’s about building the habits and the confidence you need to truly take control of your financial future.

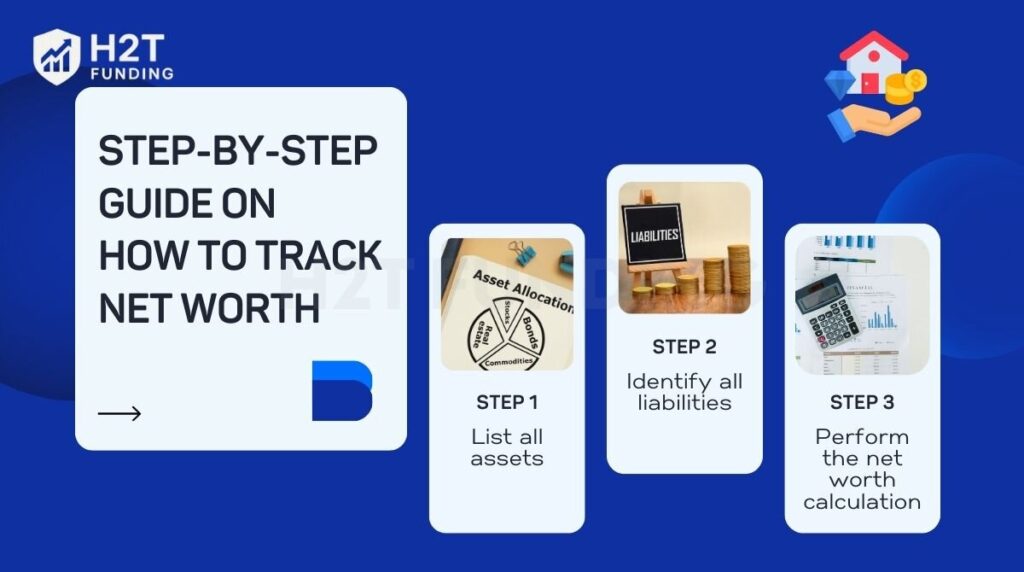

3. Step-by-step guide on how to track net worth

Tracking your net worth doesn’t have to be complicated, but it does require a bit of organization. If you’ve ever wondered how to find net asset value or how to calculate net worth effectively, below is a straightforward process to help you do just that and monitor it over time.

This method ensures you have a clear understanding of your financial position. It’s how I’ve been doing it for years, and it’s helped me stay focused on my goals.

3.1. List all assets

Start by identifying everything you own that has monetary value; these are your assets. Common assets include:

- Cash and savings: Money in your checking, savings, or high-yield savings accounts.

- Investments: Stocks, bonds, mutual funds, or retirement accounts like a 401(k) or IRA.

- Real estate: The market value of your home, rental properties, or other real estate.

- Personal property: Valuable items like vehicles, jewelry, or collectibles (though these can be harder to value accurately).

To get accurate numbers, check your bank statements, investment account balances, and recent appraisals for property. For example, I’d log into my brokerage account for the latest numbers and use an online tool (like Kelley Blue Book) to get a realistic estimate for my car’s value.

Be thorough but realistic, don’t inflate values to make your net worth look better. If you’re unsure about an asset’s value, use conservative estimates to avoid overcomplicating things.

Tip: While listing your assets, make sure you’ve also built an emergency fund as part of your safety net.

3.2. Identify all liabilities

Next, list all your debts; these are your liabilities. Common liabilities include:

- Mortgages: The remaining balance on your home loan.

- Student loans: Outstanding balances on federal or private loans.

- Credit card debt: Any unpaid balances, especially those accruing interest.

- Other loans: Car loans, personal loans, or medical debt.

To ensure accuracy, check your most recent statements or log into your loan accounts.

I’ll be honest, this part can be a gut punch. I remember the first time I did this and saw my $8,000 credit card balance staring back at me. It wasn’t just the total that was scary; it was realizing that with a 21% interest rate, I was throwing away hundreds of dollars a year on nothing. That single realization lit a fire under me to get that debt gone for good.

If debt is affecting your net worth growth, consider reading how to stop overspending and how to improve your personal cash flow for practical strategies.

3.3 Perform the net worth calculation

Now that you have your assets and liabilities, it’s time to calculate your net worth. The formula is simple: Net Worth = Total Assets – Total Liabilities. Here’s how to do it:

- Add up the value of all your assets to get a total.

- Add up all your liabilities to get a total.

- Subtract your total liabilities from your total assets.

For example, if your assets total $250,000 (including $50,000 in savings, $150,000 in investments, and a $50,000 car) and your liabilities total $100,000 (a $80,000 mortgage and $20,000 in student loans), your net worth would be $250,000 – $100,000 = $150,000.

You can also use a net worth tracking app to automate this process. The key is consistency; recalculate your net worth every few months to track your progress. This simple calculation was a total game-changer for me. It’s how I could finally see the real impact of small moves, like saving an extra $100 or paying off a loan chunk early.

Read more related articles:

4. How to increase your net worth

Improving your net worth is a process that takes time and requires steady, thoughtful financial actions. You’re focusing on growing your assets while shrinking your liabilities to build real, long-term security. Below are some practical strategies to help you strengthen your financial position.

- Pay off high-interest debt first: Credit cards and personal loans usually have the highest interest rates. Eliminating them quickly frees up cash flow and prevents your liabilities from growing faster than your assets.

- Save and invest consistently: Automate savings into high-yield accounts and invest regularly in diversified portfolios, such as index funds, retirement accounts, or real estate. Even small, regular contributions can grow significantly over time due to compounding.

- Boost your income streams: Negotiate raises, learn new skills, or explore side hustles. An increase in income not only expands your lifestyle options but also accelerates wealth accumulation when invested wisely.

- Build a strong cash reserve: Keeping 3–6 months of expenses in an emergency fund protects you from relying on debt during unexpected situations. This safeguard helps keep your net worth stable in the face of financial shocks.

- Invest in long-term assets like real estate: Owning property builds equity through mortgage payments and potential appreciation. Over time, this becomes a major contributor to personal net worth.

- Maximize retirement contributions: Take advantage of tax-advantaged accounts such as a 401(k) or IRA. If your employer offers a match, treat it as free money that accelerates your wealth growth.

Increasing your net worth is not about chasing quick wins; it’s about building sustainable habits that compound over the years. By cutting down debt, investing strategically, and protecting yourself with savings, you create a strong foundation for financial stability. The key is consistency: the earlier you start, the more time your money has to grow.

5. Best tools for tracking net worth

Finding the right tool can feel like a job in itself. I’ve personally cycled through countless spreadsheets and apps over the years, from clunky free options to polished premium services. The five I’m sharing below are the ones that actually stuck, the ones that made the process less of a chore and genuinely helped me stay on track. Each offers unique strengths, catering to different financial needs and preferences.

5.1. Empower: Comprehensive wealth tracking

Empower is ideal for those seeking a full financial overview in one place. It offers a free and powerful platform that automatically syncs with your financial accounts to provide a real-time view of your net worth.

- Syncs with bank accounts, credit cards, investments, and loans

- Real-time dashboard that displays your total net worth

- Includes budgeting tools and investment analysis

- Seamless tracking of retirement accounts like 401(k)

- Occasional prompts for paid wealth management if assets exceed $100,000

I personally found it incredibly helpful for tracking my 401(k) and credit card balances all in one place; it really gives you the full picture. However, expect occasional prompts for their paid wealth management if you have over $100,000 in assets.

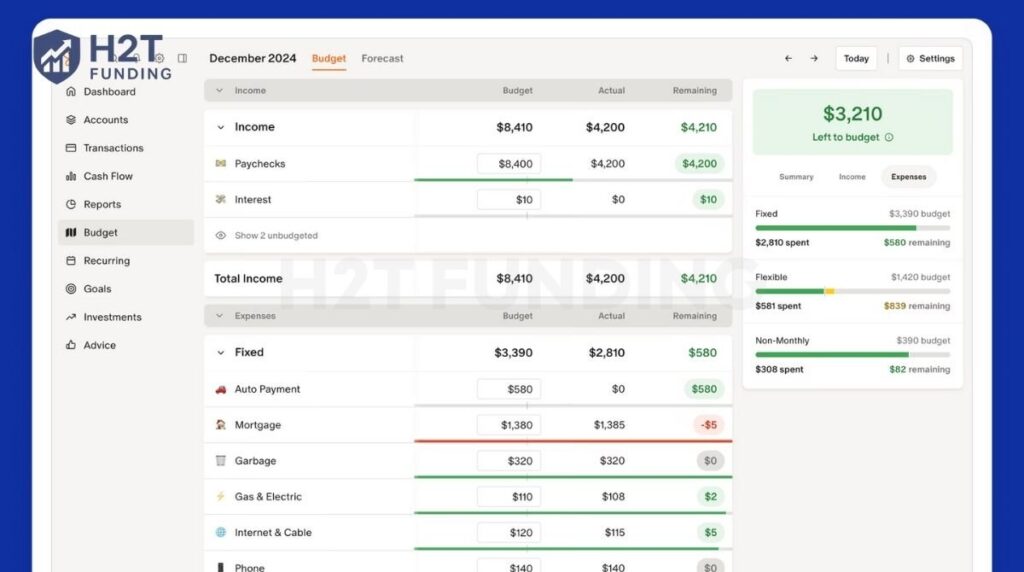

5.2. Monarch Money: Streamlined account management

If you prefer simplicity and clarity in managing your finances, Monarch Money delivers a clean interface and robust syncing capabilities that make tracking multiple accounts easy.

- Supports syncing of banks, credit cards, loans, and investments

- Allows manual input for assets like real estate and collectibles

- Clean, user-friendly design

- Great for tracking properties or side income

- Costs $99.99/year with a 7-day free trial

I appreciated its clean design, which helped me monitor my rental property and loans effortlessly. It costs $99.99 annually, but a 7-day free trial lets you test its full features.

5.3. Tiller Money: Spreadsheet-based tracking

For those who like hands-on control and spreadsheet customization, Tiller Money connects directly to Google Sheets or Excel and updates your data automatically.

- Auto-syncs with your financial accounts

- Offers customizable templates in Google Sheets or Excel

- Ideal for freelancers and users with complex income streams

- Let you create your own categories and formulas

- Priced at $79/year with a 30-day trial

- Limited investment tracking, though improving

5.4. PocketSmith: Forecasting and planning

PocketSmith is a great choice if you want to look ahead. Its forecasting features help you see where your finances are headed, years into the future, based on your current habits.

- Projects net worth up to 60 years

- Features a visual calendar for budgeting

- Supports multiple currencies, ideal for international users

- Free version available with limited features

- Foundation plan at $14.95/month includes automatic syncing

5.5. YNAB: Budgeting and debt reduction

You Need a Budget (YNAB) is designed for those focused on budgeting and debt payoff. It uses a zero-based budgeting method that helps improve financial discipline and increase net worth over time.

- Focuses on budgeting first, net worth second

- Highlights progress through the Net Worth Report

- Great for managing debt repayment strategies

- $109/year with a 34-day free trial

- Limited investment tracking features

6. How to choose the right net worth tracker for you

The best net worth tracker depends on how you manage your money. If you’re detail-oriented and love spreadsheets, Tiller is a great fit. If you need forecasts for future planning, PocketSmith excels. Those who want an all-in-one dashboard should consider Empower or Monarch. For budget-focused users tackling debt, YNAB offers powerful behavioral tools.

From personal experience, I found it most helpful to test 2–3 apps using their free trials before committing. Look for features that align with your goals, whether it’s growing your investments, tracking debt payoff, or understanding your total wealth picture. And if cost is a concern, take time to compare options to find the best free net worth tracking app that still offers the features you need.

Pro tip: Start simple. Even manually entering your assets and liabilities in a free net worth tracker can spark powerful financial awareness.

7. FAQs

The best net worth tracker depends on your needs. Empower is ideal for overall wealth tracking with investment insights, while YNAB suits those focused on budgeting and debt reduction.

Yes, $400,000 is a strong net worth for many, especially under age 40. Its value depends on your age, income, cost of living, and financial goals.

A common benchmark suggests your net worth at 40 should be around 2–3x your annual salary. For example, if you earn $80,000/year, aim for $160,000–$240,000.

Add up all your assets (savings, investments, property) and subtract your liabilities (loans, credit card debt). Net worth = Total Assets – Total Liabilities

I track my net worth by adding up all my assets, such as cash, investments, real estate, and retirement accounts, and then subtracting my liabilities, like debts, loans, or credit card balances. To make it easier, I might use a spreadsheet or a budgeting app that updates automatically.

Yes, a $300k net worth at age 30 is generally considered excellent. Many financial experts suggest having roughly your annual salary saved by 30, so being far above that benchmark shows strong progress.

8. Conclusion

Learning how to track net worth is a foundational step toward long-term financial stability. It helps you understand where you stand financially, identify trends over time, and make smarter money decisions. With the right tools, whether it’s a simple spreadsheet or one of the best net worth tracker apps, you can stay focused and motivated.

Ready to gain control of your finances? Start today with a tool that matches your needs and see the difference for yourself.

For more tips on how to check net worth and build smarter money habits, visit the Strategies section and Cash Flow & Saving Strategies at H2T Funding for expert-backed insights and step-by-step guidance.