Living paycheck to paycheck is more than just a budgeting issue; it’s a daily emotional burden. The stress of not knowing whether your next paycheck will cover rent, groceries, or a surprise car repair can leave you constantly on edge.

In fact, a 2023 survey by LendingClub found that 60% of Americans still live paycheck to paycheck, a harsh reality for the majority, not the minority. I know the feeling firsthand. Back in 2022, I was earning $45,000 a year and still ended most months with overdraft fees. I wasn’t reckless with money, just stuck in a cycle I didn’t know how to break.

If this sounds familiar, know that you’re not alone and that change is possible. In this guide, we’ll break down how to stop living paycheck to paycheck through nine practical, proven steps that have helped people just like you regain control, build security, and finally breathe a little easier.

Key takeaways:

- Gain full visibility into your income, fixed costs, and variable spending to identify where your money is actually going.

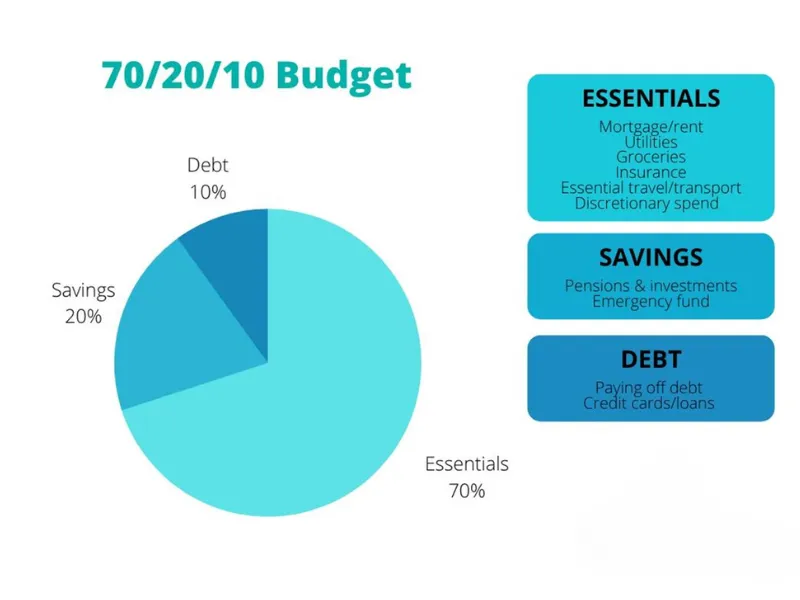

- Adopt a simple, flexible budgeting method, such as the 70/20/10 rule, to allocate funds strategically across needs, savings, and wants.

- Track every expense consistently to uncover wasteful habits and make informed adjustments.

- Build a mini emergency fund of $500–$1,000 to avoid relying on credit for unexpected costs.

- Automate your savings and bill payments to enforce discipline and reduce decision fatigue.

- Increase income through side hustles, freelance work, or upskilling, especially when cost-cutting alone isn’t enough.

1. Why should you stop living paycheck to paycheck?

Living paycheck to paycheck might feel “normal,” especially when so many people around you are in the same boat. But staying stuck in this cycle comes with real costs: financial, emotional, and even physical. Here’s why it’s worth the effort to break free:

- Less stress, better health: Financial uncertainty creates chronic stress, which often leads to poor sleep, anxiety, and even health problems. Building a financial cushion helps you breathe easier and feel more in control.

- Real financial freedom: Without the pressure of living hand-to-mouth, you can start focusing on long-term goals, buying a home, investing, traveling, or simply having money set aside for joy instead of survival.

- Avoid debt traps: Many people stuck in this cycle rely on high-interest credit just to stay afloat. When you’re no longer living paycheck to paycheck, you can stop borrowing just to survive and start using money proactively, not reactively.

- Be prepared for the unexpected: Emergencies stop feeling like financial disasters. Whether it’s a medical issue or sudden job loss, you’ll have options, not just panic.

- Gain control over your life decisions: Financial flexibility empowers you to make better choices, whether it’s switching jobs, moving to a new city, or simply saying no to things that don’t serve you, without fearing the financial fallout.

Take my friend Jenna, for example. When her daughter suddenly needed emergency dental surgery, the $1,200 bill wasn’t something she could cover. With no savings, she had to put it on a high-interest credit card. What started as a necessary decision turned into a long-term burden.

Months later, she was still making minimum payments, watching the interest snowball. That one unexpected bill set her back for nearly a year. And emotionally, the shame and helplessness she felt only deepened the stress.

This is why escaping the paycheck-to-paycheck cycle matters. It’s not just about money; it’s about peace of mind, options, and the ability to handle life without fear.

2. What you’ll need to stop living paycheck to paycheck

Before diving into the steps, here’s what you’ll need to set yourself up for success. Consider this section the part where you gather all the ingredients before cooking. It’s hard to make progress without the right tools and mindset.

- A complete list of your income and monthly expenses

- Access to a spreadsheet (like Google Sheets) or budgeting apps like YNAB or EveryDollar

- An emergency-only savings account.

- 30 minutes weekly for money check-ins

- Discipline in managing every cent

- Openness to changing spending habits and boosting income

3. How to stop living paycheck to paycheck: Your simple action guide

If you’re wondering how to stop living paycheck to paycheck, these practical steps will help you take control of your money, build savings, and reduce financial stress starting from today.

3.1. Step 1: Get clear on your finances

The first step to breaking the cycle of living paycheck to paycheck is gaining a clear understanding of your financial situation. That means reviewing every part of your money flow:

- Income: Include all sources, your salary, side gigs, freelance work, and any passive income.

- Fixed Expenses: These are regular monthly bills like rent or mortgage, utilities, insurance, and subscriptions.

- Debts: Note down all your debt payments, such as credit cards, student loans, or personal loans.

- Variable Spending: This includes everyday expenses that change month to month, like groceries, transportation, and entertainment.

To make this easier, use tools like Google Sheets or personal finance apps like YNAB to map out your cash flow visually. For a beginner-friendly option, check out the free budget template from the Consumer Financial Protection Bureau (CFPB).

Personal tip: When I first started tracking my finances, I was shocked to find I was spending over $250 a month on food delivery. I had assumed it was just part of my grocery budget, but it was eating into my savings without me realizing it. Gaining clarity helped me make better choices moving forward.

3.2. Step 2: Create a simple budget

To take control of your finances, start by picking a budgeting method that works well with your lifestyle and financial situation. One simple and effective approach is the 70/20/10 rule:

- 70% for essential needs: This includes rent or mortgage, groceries, transportation, and other necessary living expenses.

- 20% for savings or paying off debt: This portion goes toward building an emergency fund, saving for the future, or reducing what you owe.

- 10% for personal wants: Use this for entertainment, dining out, hobbies, or anything non-essential that brings you joy.

Example: If your monthly income is $3,000, this breakdown would give you $2,100 for needs, $600 for savings or debt payments, and $300 for wants.

However, your situation might be different. Flexibility is essential. For instance, I personally started with an 80/15/5 split because my rent was unusually high. It’s okay to adjust the percentages to match your current expenses. Revisit your budget monthly and make changes as your circumstances evolve.

3.3. Step 3: Track every expense

Another key to mastering how to stop living paycheck to paycheck is building awareness. That begins by tracking your spending every day or every week.

You can choose any method that fits your style:

- Use budgeting apps such as PocketGuard or Spendee

- Keep a pen and notebook handy to jot down expenses

- Or update a spreadsheet regularly

Why this works: Tracking helps you notice unnecessary spending. These are often small expenses between five and fifteen dollars that you may not think twice about, but add up quickly over time. This could include extra snacks, coffee runs, or subscriptions you forgot about.

Real example: Once I started tracking my spending, I discovered I was paying for three services I no longer used. Canceling them saved me forty dollars each month, which I now set aside for savings.

3.4. Step 4: Cut non-essential spending

One simple but powerful strategy is to apply the 72-hour rule. When you want to buy something that is not urgent, wait three days before making the purchase. In most cases, the urge will pass, and you will realize you did not really need it.

Here are a few easy changes that can help reduce spending right away:

- Cancel memberships or subscriptions you no longer use

- Cook meals at home more often (batch cooking can help save both time and money)

Result: After making just a few of these changes, I cut back on dining out and saved one hundred eighty dollars in my first month. Small adjustments like these can make a big difference.

3.5. Step 5: Prioritize essentials (“The Four Walls”)

According to personal finance expert Dave Ramsey, known for his “Baby Steps” method, your top priority should be paying for the basics that keep you safe and stable. These 4 walls of budgeting include:

- Housing

- Utilities

- Transportation

- Food

Always take care of these expenses before anything else. Doing so protects your ability to live, work, and stay healthy.

Expert insight: The Consumer Financial Protection Bureau also recommends putting essential needs and secured debts first. This helps you avoid serious consequences like eviction, utility shutoffs, or losing access to transportation.

3.6. Step 6: Build a mini emergency fund ($500–$1,000)

Set a simple goal to save between $500 and $1,000 for unexpected expenses. This small emergency fund acts as your first line of defense when life throws you a curveball, a flat tire, a medical copay, or a last-minute bill.

Without a cushion, even minor surprises can force you to rely on credit cards or loans, trapping you in more debt. A mini emergency fund gives you breathing room and helps break the cycle of financial stress, one small win at a time.

Start with simple actions:

- Sell things you no longer need

- Cut one regular expense and put that money into savings

My experience: I sold my bicycle and saved three hundred dollars. After that, I set aside fifty dollars each month until I reached one thousand.

Keep your emergency savings in a separate bank account. This makes it easier to resist the temptation to spend it on non-essentials. Save it for real emergencies only.

3.7. Step 7: Automate savings and bills

Automated savings is a secret weapon for those learning how to stop living paycheck to paycheck. Schedule automatic transfers for the day after payday:

- Send a portion to your savings, even if it’s just a small amount

- Allocate funds for regular bills like rent, phone, and utilities

This creates consistency and helps you avoid impulse spending.

3.8. Step 8: Increase your income

You can only cut so far, and earning more can speed up the process.

- Sell online: Facebook Marketplace, eBay, Poshmark

- Freelance or gig work: tutoring, writing, deliveries

- Ask for a raise or switch roles if you’re underpaid

Even an extra $100/month gives you a yearly buffer of $1,200. A small win that can help you break the paycheck cycle over time.

3.9. Step 9: Live below your means

This is the long game. Spend less than you earn, even when you get a raise.

Tips:

- Avoid lifestyle creep (e.g., upgrading your car or apartment too fast)

- Buy secondhand

- Regularly review what you truly need versus what you want.

Mini Case: I moved to a smaller apartment and saved $400/month, money that went straight into investments.

This mindset is how you stop being broke for good — it’s the long-term habit that supports lasting wealth.

See more useful articles:

4. How to increase your income

When every dollar counts, cutting expenses can help, but it has its limits. If your paycheck barely covers the basics, finding ways to increase your income is the real game-changer. It gives you breathing room, builds savings faster, and creates more options for the life you want. And no, you don’t need to wait for a promotion or a second job with set hours. You can start earning more on your own terms.

- Freelancing: If you can write, design, translate, or manage social media, there’s a market for your skill. Platforms like Upwork, Fiverr, and PeoplePerHour connect you with clients worldwide. Start small, build a portfolio, and raise your rates over time.

- Online tutoring or coaching: Good at math? Speak a second language? Love playing guitar? Sites like Preply, Outschool, or even hosting your own Zoom sessions can help you turn knowledge into income.

- Local or app-based gigs: If you have a car or a bike, consider driving for Uber, delivering via DoorDash, or shopping with Instacart. If you prefer offline work, dog walking, babysitting, or cleaning services in your neighborhood can be steady earners.

- Sell products or services: Open an Etsy shop for handmade items, design shirts on Redbubble, or offer resume writing on LinkedIn. What feels ordinary to you might be valuable to someone else.

These side hustles may not make you rich overnight, but they can add $200, $500, or even more to your monthly income. And that could be the difference between just getting by and finally getting ahead.

Otherwise, think beyond hourly income: learn skills that scale

Once your basic financial needs are under control, it’s time to think long-term. What if you could build income streams that grow over time, without trading hours for dollars?

One option worth exploring is trading, whether in forex, stocks, or crypto. Unlike one-time gigs, trading is a skill-based path to building wealth. It requires learning, discipline, and risk awareness, but it offers unmatched flexibility and independence once mastered.

You don’t need to quit your job or dive in with big capital. Many people start with a demo account or a small investment, learning gradually while still maintaining other income sources. Over time, trading can become a powerful tool to reduce your dependence on a single paycheck and increase your financial confidence.

Don’t wait for your income to change; take control of it. Start a side hustle, explore new skills, or take the first step toward learning how trading works. Every small move forward brings you closer to financial freedom.

5. FAQs – How to Stop Living Paycheck to Paycheck

Living paycheck to paycheck means that all or most of your monthly income goes toward expenses, leaving little or no money left for savings. If you miss just one paycheck, it could be difficult to cover basic needs like rent, groceries, or bills.

Because most people don’t have visibility into their spending. Without tracking income and expenses, it’s easy to overspend or rely on credit. Plus, high fixed costs (like rent or debt payments) can limit flexibility. Breaking the cycle takes awareness, budgeting, and sometimes more income.

Aim for a mini emergency fund of $500 to $1,000. This small cushion helps protect you from going into debt when unexpected costs come up.

The 70/20/10 rule is a great starting point: 70% for needs (rent, food, bills) 20% for savings or debt 10% for wants (fun, hobbies) You can adjust this ratio based on your income and expenses.

Start small: Use a free app like Mint, YNAB, or Spendee Or track manually with a notebook or spreadsheet Dedicate just 10 minutes every few days to review your spending.

Yes! Budgeting isn’t about restriction. It’s about control. You can still allocate money for fun, just be intentional. Even $50/month for hobbies or dining out is better than unplanned overspending.

If your expenses are already trimmed, focus on increasing your income: Freelancing or gig work Selling unused items Asking for a raise or switching to a better-paying job Even small increases (like $100/month) can make a big difference over time.

It depends on your starting point. Many people see results in 3–6 months by: Tracking spending Cutting non-essentials Saving consistently With discipline, you can build your emergency fund and start building real financial freedom within a year or less.

Start by tracking all your expenses for the next 7 days. You’ll be surprised by how much clarity this simple action brings. Then, open a separate savings account and aim to deposit your first $50–$100 this week.

6. Conclusion

How to stop living paycheck to paycheck may seem like an impossible goal, but real change is possible. I’ve done it, and so have thousands of others. By following the right plan, making small habit changes, and staying consistent, you’ll gain control over your financial future.

Ready to take action? Begin with small steps: start tracking your expenses today and open a savings account this week.

Celebrate your first $111 saved. Every step brings you closer to breaking the cycle and mastering how to stop living paycheck to paycheck for good.

Save this article, share it with a friend, or comment below with your favorite tip. Remember this journey is yours, but you’re not alone. You’ve got this.

You can read more practical tips and personal finance guides like this in the strategy section and Cash Flow & Saving Strategies of H2T Funding.