How to pass Topstep Combine is not about making fast profits, but about proving discipline, risk management, and repeatable performance. Most traders fail the Trading Combine not because of a weak trading strategy, but due to breaking the Consistency Target or hitting the Maximum Loss Limit.

In this H2T Funding guide, we explain how to pass Topstep Trading Combine safely by managing your profit target, avoiding overtrading, and preparing for an Express Funded Account.

Key takeaways

- The Topstep Trading Combine is an evaluation program designed to test consistency, discipline, and risk management before traders progress to an Express Funded Account.

- Topstep enforces a consistency target where your highest-profit day should not exceed 50% of total profits. If it does, you can continue trading to rebalance rather than failing immediately.

- Passing the Topstep Combine requires more than profit; you must respect strict rules like the Maximum Loss Limit, consistency target, and permitted trading hours.

- Small risk and discipline win over speed. Traders who use smaller lot sizes, manage drawdowns carefully, and aim for steady daily profits have the best chance to pass.

- Unlocking an Express Funded Account requires activation. Traders must accept the required agreements and, depending on the selected Trading Combine path, complete the activation requirements within 30 days, or the account expires.

- Common mistakes include overtrading, oversized positions, ignoring rules, and rushing. Avoiding these traps is critical to progress.

- Express Funded Accounts offer a structured payout system: traders keep 100% of profits up to $10,000, followed by a 90/10 profit split thereafter, with payout eligibility based on five qualifying winning trading days.

1. What is Topstep Combine, and why is it important?

The Trading Combine is an evaluation program designed to test a trader’s discipline, risk of loss control, and ability to deliver repeatable performance in a simulated trading environment.

The goal is not only to reach the profit target, but also to respect the Maximum Loss Limit and follow the Consistency Target. These requirements are designed to ensure your behavior aligns with actual trading in a professional trading environment.

By passing the Combine, you unlock the chance to receive an Express Funded Account, where you trade with real capital. Think of it as your entry exam into professional trading: if you succeed, you show repeatable performance and earn the Funded Trader Certificate.

For most traders, the Trading Combine becomes a real test of patience. Many can generate profits, but only those who avoid emotional decision-making and follow the rules step by step reach the funded stage. That’s why many traders search for guidance on how to pass Topstep effectively.

Read more:

2. Understand the Topstep Combine rules

To truly understand how to pass Topstep Trading Combine, traders need to recognize that there is only one actual rule: your account balance must not touch or fall below the Maximum Loss Limit.

Other elements such as the profit target, Consistency Target, and Daily Loss Limit are explained in the Trade Report. These objectives are used to evaluate discipline, risk management, and consistent behavior across your account history.

- Profit target: Each account has a specific profit goal: $3,000 for $ 50,000 (a common choice for traders searching for tips on how to pass Topstep 50K Combine), $6,000 for $ 100,000, and $9,000 for $ 150,000. You must reach this amount while following all other objectives.

- Daily loss limit: Some platforms enforce a Daily Loss Limit (DLL). On TopstepX™, the Daily Loss Limit is no longer enforced on new or reset accounts. However, traders using platforms such as NinjaTrader, Tradovate, or Quantower may still experience trade restrictions if the Daily Loss Limit is breached.

- Trailing drawdown (Maximum Loss Limit): Your account cannot touch the Maximum Loss Limit (MLL). This is a trailing threshold that climbs with your profits but never falls back. Once broken, the account becomes ineligible until reset.

- Minimum trading days: To complete the Combine, you must trade on at least two separate trading days with executed trades, ensuring profits are generated through repeatable performance rather than a single oversized trade. This ensures profits come from repeatable performance, not a single oversized trade.

- The Consistency Target is the most common reason traders fail, even after getting close to the profit target. Under this rule, your Best Day must remain below 50% of total profits. If exceeded, you must generate additional profits to rebalance the percentage, and this data is permanently recorded in your account history and reflected in your Trade Report.

- Permitted products and trading hours: You can only trade CME futures contracts. All positions must be closed by 3:10 PM CT, no overnight or weekend holding. Some futures close earlier, and you must exit before their session ends.

- Prohibited conduct: Topstep prohibits practices such as account stacking, spoofing, exploiting data errors, or high-frequency trading. Any attempt to “game the system” can lead to account closure or payout denial.

- Notification and compliance: Certain actions, like trading outside approved hours or using unauthorized feeds, can trigger compliance checks. Adhering to official guidelines is a key aspect of demonstrating professional behavior.

The Trading Combine isn’t just about making money or promoting a financial product, but about evaluating discipline and consistency. It tests whether you can trade with discipline, consistency, and respect for rules. Mastering these parameters prepares you for the Express Funded Account and real capital.

See also:

3. How to pass Topstep Trading Combine: Step-by-step strategy

When traders ask how many days to pass Topstep Combine, the official minimum is two trading days due to the Consistency Target. However, attempting to pass too quickly often leads to overtrading and Consistency Target violations.

In reality, traders who successfully learn how to pass Topstep Combine 50k focus on discipline, trade smaller size, and prioritize repeatable performance over short-term gains. Passing the Combine works better when you treat it as a slow, repeatable process rather than a quick win, reinforcing habits that support long-term profitability in funded trading.

- Step 1: Start small, focus on survival

- Step 2: Manage drawdown actively

- Step 3: Trade during strong sessions

- Step 4: Prioritize quality over quantity

- Step 5: Control emotions, avoid revenge trades

3.1. Step 1: Start small, focus on survival

Trade with tiny lot sizes and risk under 1% per trade. Survival matters more than fast gains.

Take the example of Jason Love, a futures trader who passed a $50K Combine in 15 days. His key insight was reducing position size during volatile sessions, a personal adjustment that helped him stay within risk limits. This type of approach is commonly discussed among traders learning how to pass Topstep Combine 50K with controlled risk.

3.2. Step 2: Manage drawdown actively

The Maximum Loss Limit is the biggest trap. To avoid it, many traders set a personal daily loss stop at half of the allowed amount. Keeping losses capped early in the day prevents frustration and protects both account balance and confidence.

Strong drawdown control is what makes passing the Trading Combine possible. Even when researching how to pass Topstep Combine in 2 days, rushing often increases the risk of breaking key rules.

3.3. Step 3: Trade during strong sessions

Liquidity for CME futures peaks during the U.S. session, especially around the New York open. Trading during these hours provides cleaner price action and better execution, supported by deeper market data and higher liquidity compared to low-volume periods.

Price action is cleaner, spreads are tighter, and setups unfold with more clarity. Staying away from thin, late-session markets helps traders adapt to changing market conditions and reduce unnecessary losses.

3.4. Step 4: Prioritize quality over quantity

Aim for two to three solid setups each day. A few high-probability trades with at least a 2.5:1 reward-to-risk ratio often outperform dozens of mediocre entries. Traders who passed consistently highlight how less trading meant more control and fewer mistakes.

3.5. Step 5: Control emotions, avoid revenge trades

The most common failure comes from trading after losses out of anger or fear of missing out. Successful traders often set a modest daily goal, such as +$300, and walk away once it’s hit. Protecting mental energy ensures you stay sharp for the next day.

Passing the Trading Combine requires more than technical skill. A trader needs the patience to start small, the ability to respect loss limits, and the discipline to manage profit fluctuations without overreacting. With these steps, the journey to a funded account becomes less about luck and more about building consistent habits.

4. Practical tips from traders who passed the Trading Combine

Many traders who succeed in the Combine share a few practical habits that separate them from those who reset again and again. These insights come from real experiences of funded traders who emphasize discipline over speed.

- Focus on fewer markets: Most recommend sticking to one or two major futures contracts, such as the E-mini S&P (ES) or Nasdaq (NQ). Specializing helps you read price action more clearly and avoid confusion across multiple products.

- Set daily profit goals below the official target: Instead of chasing the full account profit requirement in a single week, traders often aim for a smaller cushion each day, such as $300 to $500 on a $ 50,000 account. This approach prevents oversized risk and keeps the best day profit under 50% of total gains, which directly supports the consistency rule.

- Stop trading once ahead: A common tip is to step away after reaching +2R or hitting the daily goal. Traders who ignored this often turned a winning day into a losing one. Quitting early preserves psychological capital, which is just as important as the balance itself.

- Backtest before going live in the Combine: Several successful candidates stress the importance of testing strategies in a demo environment. Knowing your setups and reviewing your performance statistics builds confidence, so when real evaluation pressure arrives, execution is smoother and less emotional.

- Respect your personal rhythm: Some traders find the morning session works best, while others prefer the first two hours of New York. Passing often comes down to trading during the hours that match your style rather than forcing trades when the market feels slow or unpredictable.

The traders who pass are not always the most skilled technically; they are the ones who control pace, protect wins, and respect their own limits. Practical steps like narrowing focus, reducing goals, and stepping away when ahead may feel simple, but they make the difference between repeated resets and finally earning a funded account.

5. Common mistakes that make traders fail

It’s not just beginners who fail the Combine. Even skilled traders get tripped up by the same repeating mistakes because the evaluation is designed to expose weaknesses in discipline. Most failures fall into a few repeating categories that can be avoided with better preparation and awareness.

- Overtrading and chasing setups are the most common mistakes. Traders feel pressure to hit the target quickly, so they take low-quality trades or keep clicking after a small loss. Instead of building consistent results, they drain their psychological energy and often break risk rules.

- Using oversized lot sizes creates another trap. A trader might believe that doubling contracts will speed up progress, but a single bad move can erase several days of gains. Passing is about survival, and reckless size usually leads to the Maximum Loss Limit being hit sooner than expected.

- Ignoring the written rules also ruins many accounts. It is easy to focus on price action and forget about the trailing drawdown or daily loss thresholds. Yet one violation, even with profits in the account, is enough to fail the Combine and require a reset.

- Lack of patience may be the hardest obstacle. Some traders try to finish in just a few days, only to exceed the 50% best day consistency rule or trigger emotional trading after a drawdown. The Combine rewards those who pace themselves and approach it like a long-term test, not a race.

When researching how to pass Topstep combine Reddit, many traders share similar experiences: those who pass tend to trade smaller sizes, stop after hitting daily goals, and focus on protecting their accounts instead of chasing profits.

These real-world discussions closely align with Topstep’s official rules, reinforcing that discipline and patience matter more than speed.

Most failures happen not because strategies are weak, but because traders overtrade, oversize, skip rule checks, or rush for fast results. Recognizing these traps early and building discipline around them greatly improves the chances of advancing to a funded account.

6. Instructions for receiving an Express Funded account and payout policy

After passing the Combine, the journey does not stop. You must complete the activation process to unlock an Express Funded Account and understand the payout policy that governs how you withdraw profits. Knowing these conditions early helps you avoid delays and manage expectations as you transition to trading real capital.

6.1. Conditions to unlock the Express Funded Account

After your Trade Report is updated to confirm that you passed the Trading Combine, you will receive a Notification via email and your dashboard.

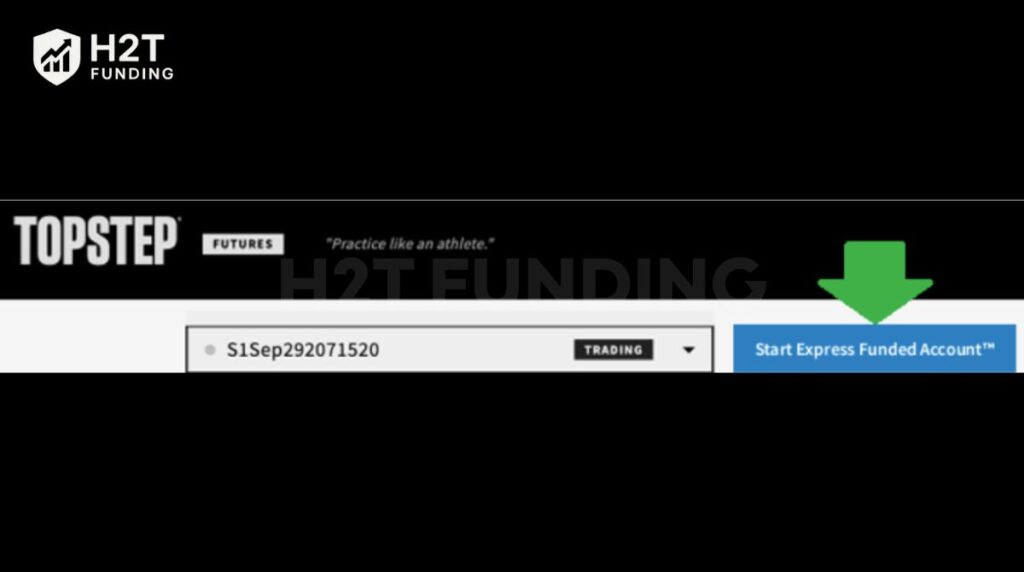

From there, traders can begin the activation process to launch their Express Funded Account, including accepting the agreement and completing account activation as outlined by Topstep. From there, you must:

1. Select the passed Combine in your dashboard.

2. Click “Start Express Funded Account” and confirm account details.

3. Review and accept the Express Funded Account Agreement and the Activation Fee Agreement.

4. Pay the Activation Fee securely via debit or credit card.

5. Confirm activation by clicking “Create Express Funded Account”.

Important: If you already hold five Express Funded Accounts or one Live Funded Account, you cannot activate another until space becomes available. You also have 30 days to pay the fee after passing; otherwise, the account expires.

6.2. Payout rules and profit sharing

Payouts begin after you record five winning trading days, defined as $150+ Net PNL per day on the new dashboard ($200+ on legacy). A winning day does not need to be consecutive, but the cycle resets after every payout.

- The first payout allows traders to withdraw 100% of profits up to $10,000, provided the account remains above the Safety Net. Withdrawals cannot reduce the account below this threshold.

- After the first withdrawal, traders can continue to request payouts as long as they complete another cycle of five new winning days.

- After cumulative payouts exceed $10,000, the profit split moves to a 90/10 split in favor of the trader.

This payout structure rewards steady progress. Many funded traders recommend setting realistic daily goals to build toward these thresholds without unnecessary risk.

6.3. Key notes for funded trading

Trading an Express Funded Account comes with responsibilities, including awareness of system risk such as platform outages or execution delays. You must place at least one trade every 30 days to maintain account access, or the account may be closed for inactivity.

Breaking rules like the Maximum Loss Limit will result in account closure, though the Back2Funded option now allows reactivation up to twice for eligible traders on TopstepX.

Traders should also be mindful of psychological discipline. Once real payouts are possible, the temptation to overleverage grows. Many funded traders succeed by sticking to the same cautious style they used to pass the Trading Combine, rather than trying to accelerate profits too quickly.

Unlocking and managing an Express Funded Account requires the same focus on discipline, clarity, and patience that got you through the Combine. Activation fees, payout rules, and account activity all serve to reinforce consistent performance. Respecting these terms ensures you not only reach funding but also keep it long enough to enjoy real payouts.

To pass the Topstep Trading Combine, focus on protecting your account first, keep your Best Day under 50% of total profits, and avoid rushing the profit target. Traders who prioritize consistency and risk control have the highest chance of reaching the Express Funded Account.

Read more:

7. FAQs about passing Topstep Combine

The fastest path is two trading days, since you must show at least two days of activity. However, most traders take several weeks. Passing quickly is possible, but the safer approach is spreading profits across more days to avoid breaking the consistency rule. This directly answers the common search, How many days to pass Topstep Combine, showing that while two days is possible, most traders take longer.

Topstep does not publish exact numbers, but most funded traders agree that the majority of participants do not pass on their first attempt. The challenge is designed to filter for discipline, so resets are common before traders adapt and succeed.

Yes. One rule violation cancels the attempt, even if the profit target is already reached. For example, hitting the trailing drawdown or daily loss limit automatically disqualifies the account.

It can feel tough because the rules are strict, but the Combine is passable with discipline. Traders who keep risk small, follow rules carefully, and avoid emotional trading often find the evaluation challenging but fair.

The most effective approach is low-risk, selective entries, and consistency. Many funded traders limit themselves to 2–3 trades per day, risk less than 1% per position, and focus on liquid sessions like London or New York.

You’ll receive email and dashboard notifications once your Trade Report updates. From there, you can pay the activation fee to open an Express Funded Account and begin trading real capital under Topstep’s payout structure.

If you break a rule or fall below limits, your account becomes ineligible. You can either continue trading in practice mode or reset by paying a fee to start over. Many traders fail a few times before adjusting and passing.

The rule requires that your Best Day be less than 50% of total profits. If your best day exceeds that threshold, you’ll need to generate additional profits to reduce the percentage. This ensures your success comes from repeatable performance, not one oversized win.

The main pass rule for Topstep is that your account balance must not touch or fall below the Maximum Loss Limit while reaching the profit target. Traders must also respect the Consistency Target, where the Best Day cannot exceed 50% of total profits, and follow permitted trading hours and products.

8. Conclusion

In the end, mastering how to pass Topstep Combine is more about proving discipline under pressure. Success comes from respecting rules such as the Maximum Loss Limit, trading with small risk, and pacing progress across multiple days. These habits not only help you pass the evaluation but also prepare you to manage real capital with confidence.

The Combine should be seen as a training ground, not just a hurdle. Traders who focus on survival and consistency build stronger habits than those who rush. By approaching the challenge with patience and structure, the transition to a funded account becomes smoother and more sustainable.

To continue learning, explore our Prop Firm & Trading Strategies category on H2T Funding. You’ll find detailed guides on Topstep rules, account scaling, and trading psychology, along with insights from real funded traders. These resources are designed to help you trade smarter and stay funded longer.