Passing the prop firm challenge may feel like the ultimate test for traders who dream of managing large capital. Yet the reality is brutal, only about 5–10% of traders actually pass these challenges, according to industry estimates from Highstrike (2024). That means over 90% fail, often losing their entry fee and confidence along the way.

I learned this the hard way during my first FTMO challenge last year. I was up 3% in the first week and felt invincible. Then, a surprise news event wiped out my gains. Instead of stepping back, I felt the pressure of the 30-day time limit and started forcing trades on lower-quality setups.

Before I knew it, I was out, not because of the market, but because I abandoned my own system in a panic. That failure was a turning point: success in prop firm challenges isn’t about “quick profits,” it’s about discipline, preparation, and trading psychology.

In this guide, I’ll break down how to pass a prop firm challenge step by step. You’ll learn why so many traders fail, how to prepare properly, and the exact strategies funded traders use to beat the odds.

Key takeaways

- The prop firm challenge is where you prove discipline, risk control, and consistency to access a firm’s capital. Rules include profit targets (8–10%), strict drawdowns, and trading guidelines.

- Most traders fail because of rushing profits, breaking rules, poor planning, and emotional trading, such as fear, greed, or revenge trades.

- Clear strategies improve passing rate: create a written plan, risk only 0.5–1% per trade, focus on high-probability setups, journal every trade, keep methods simple, and scale in/out wisely.

- Mindset and discipline decide success, treat demo as real, avoid revenge trading, and focus on fewer quality trades.

- Common mistakes to avoid include overtrading early, ignoring firm rules, risking too much, or neglecting psychology.

1. What is a prop firm challenge?

A prop firm challenge is essentially a trading exam where you prove your ability to trade responsibly before being trusted with the firm’s capital. Instead of risking your own money, you pay a fee to enter the challenge and must follow strict rules to qualify for a funded account.

Key requirements usually include:

- Profit target: You need to hit a certain return, often around 8–10%.

- Drawdown limits: Both daily loss and total loss caps are enforced to prevent reckless trading.

- Trading rules: Each firm sets guidelines on minimum trading days, news trading, or position holding.

For example, FTMO’s two-step challenge requires traders to earn 10% profit in the first phase without exceeding a 5% daily loss or 10% maximum drawdown. If you pass, you move to the “Verification” stage with a smaller 5% profit target.

Meanwhile, The Funded Trader (TFT) offers a 1-Step Knight’s Challenge, asking for a 10% profit but with tighter loss limits: 3% daily and 8% overall.

In short, these rules exist because prop firms are lending you their money. The challenge ensures only traders with discipline, risk control, and consistent execution move forward, qualities you’ll need if you’re serious about passing the prop firm challenge.

2. Why most traders fail the prop firm challenge

Earlier, I mentioned that only about 5–10% of traders pass a prop firm challenge (Highstrike, 2024). That means more than 9 out of 10 fail, usually not because they lack technical skill, but because of psychology, discipline, and poor preparation.

I personally experienced this when I took my first challenge with FTMO last year: On $100k FTMO challenge, I hit the 5% daily loss limit just a week in after a series of small losses. Frustrated, I put on a massive position on Gold, completely ignoring my 1% risk rule. I was trying to be a hero and make it all back in one trade.

That single trade blew through the max drawdown and ended my challenge. It was a classic, costly case of revenge trading. This personal experience mirrors the broader trend, and the data makes it clear: the majority of failures come from avoidable mistakes. The most common reasons for failure include:

- Forcing profits: Many traders rush to hit the profit target and end up overtrading. This was exactly the trap I fell into during my first attempt, pushing too many trades in a short time just to reach the 10% target, which ultimately caused me to breach FTMO’s loss limits.

- Ignoring rules: Simple errors like violating the 5% daily loss or trading during restricted news events can disqualify you instantly.

- Lack of a trading plan: Without clear rules for entries, exits, and risk, traders often chase the market and lose consistency.

- Emotional trading: Fear after a loss or greed after a win often leads to revenge trading, one of the fastest ways to fail.

- Underestimating discipline: Prop firm challenges are designed to test patience, not just profitability. Many traders forget this and trade as if it’s a race.

I’ve found the challenge isn’t really about making 8–10% profit. Most decent strategies can achieve that over time. The real barrier is doing it while staying inside strict risk parameters. Once I learned to slow down, respect the rules, and stick to a plan, my passing rate improved dramatically.

Remember: If you want to succeed, don’t focus only on profits. Instead, focus on avoiding the mistakes that eliminate most traders in the first place. That’s the real edge when thinking about how to pass a prop firm challenge.

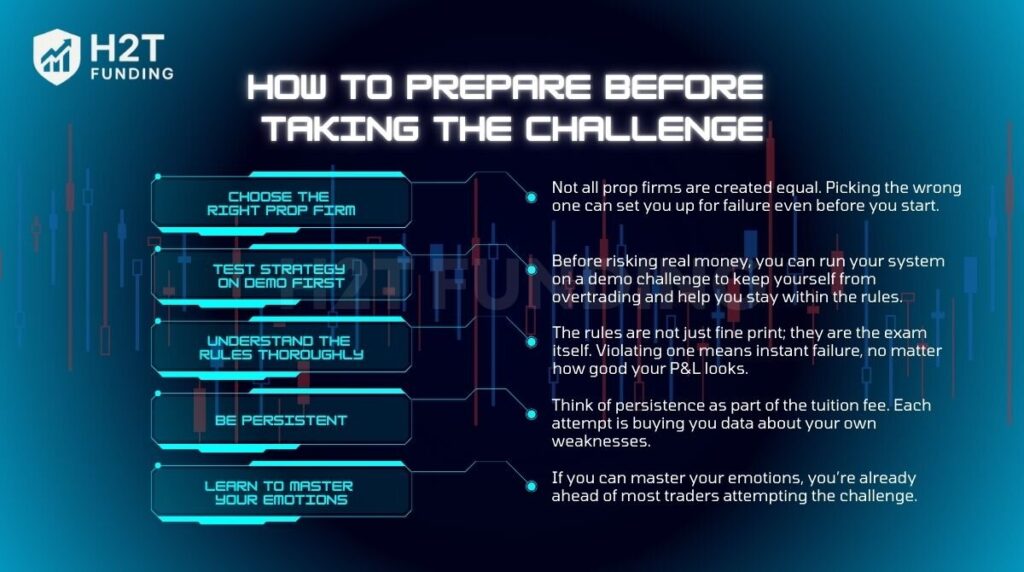

3. How to prepare before taking the challenge

One of the biggest lessons I learned after failing my first challenge was that success often comes before you even place a single trade. Preparation, choosing the right firm, testing your strategy, and mastering the rules make the difference between passing and restarting.

3.1. Choose the right prop firm

Not all prop firms are created equal. Some give you more time, others have stricter rules. Picking the wrong one can set you up for failure even before you start.

- FTMO: Profit target 10% (Phase 1), time limit 30 days, entry fee from ~$540 for a $100,000 account.

- The Funded Trader (TFT): Profit target 10%, no minimum trading days, tighter drawdown (3% daily / 8% total).

- FundedNext: Profit target 10% in Phase 1, offers a refund plus bonus if you pass.

Personally, I trade best as a swing trader, holding positions for days. That’s why I chose FTMO; they allow overnight trades, which suits my style. If you’re a scalper, a firm with lower commissions and fast execution might serve you better.

May you want to know: Easiest prop firms to pass in 2026: 12 best picks

3.2. Test strategy on demo first

Before risking real money, I spent two months running my system on a demo challenge. At first, I was too focused on hitting 10% quickly. The results were inconsistent: one week up 7%, the next week down 5%. But when I slowed down and focused on consistency instead of spikes in profit, my equity curve smoothed out.

3.3. Understand the rules thoroughly

The rules are not just fine print; they are the exam itself. Violating one means instant failure, no matter how good your P&L looks.

For example, FTMO’s 5% daily loss rule disqualified me even when I was up 6% overall. I now keep a sticky note on my screen with:

- Max Daily Loss = 5%

- Max Total Drawdown = 10%

- Minimum Trading Days = 4

- No high-impact news trading (for some firms)

This simple reminder keeps me from breaking the rules under pressure.

Discover more in this article: Decoding 5 minimum trading days meaning in prop firms

3.4. Be persistent

Most traders don’t pass on their first attempt, and that’s okay. I failed twice before finally passing. Each failure showed me where I lacked discipline. If I had quit after the first try, I would have never reached funding.

Think of persistence as part of the tuition fee. Each attempt is buying you data about your own weaknesses.

3.5. Learn to master your emotions

More than strategy, it’s psychology that makes or breaks you. In fact, trading coach Andrew Menaker reports that 70–80% of retail clients fall into excessive risk-taking and revenge trading after a loss, which rarely ends well.

I’ve been there too, doubling my lot size after two losing trades, only to wipe out days of progress in minutes.

How I manage it now:

- Step away from the screen after 2 losses in a row.

- Use smaller position sizes when my confidence is shaky.

- Remind myself: the goal is to stay in the game, not to win today.

The truth is, if you can master your emotions, you’re already ahead of most traders attempting the challenge.

4. Top strategies for how to pass the prop firm challenge

After failing my first FTMO challenge, I realized that learning how to pass a prop firm challenge fast isn’t about chasing a perfect strategy. It’s about building structure, following rules, and managing yourself under pressure. Here are the strategies that helped me move from repeated failure to finally getting funded.

4.1. Step 1: Build an impossible trading plan

When you enter a challenge, you need more than a strategy; you need a trading plan detailed enough that it removes guesswork. At first, I traded purely “by feel” and failed quickly. On my next attempt, I built a structured written plan that included:

- Markets to trade: Stick to one or two markets you know best, ideally those with high liquidity and predictable volatility (EUR/USD, XAU/USD).

- Entry and exit rules: Define your technical triggers clearly, whether it’s support/resistance, candlestick formations, or moving average signals.

- Profit targets: Break down the overall 8–10% challenge requirement into smaller, realistic goals (e.g., 0.5–1% per week).

- Trading hours: Choose sessions that match your strategy. The London – New York overlap (8 AM – 12 PM EST) is widely considered the most liquid and volatile.

When I came back for my second attempt, I restricted myself to EUR/USD only, a maximum of three trades per week, London session. The difference was huge: no more random trades at midnight, no more chasing profits. That structure kept me calm and consistent.

Don’t miss out: Topstep trades closed by what time [New updated]

4.2. Step 2: Focus on risk management first

Your success in a prop firm challenge ultimately hinges on your risk management. You can have a solid strategy, but without strict risk control, one bad day can end the evaluation.

Key principles to apply:

- Risk per trade: Limit yourself to 0.5–1% of the account. For a $100,000 FTMO account, that’s $500–$1,000 max per position.

- Protect the account first: Profit is secondary. Staying within limits keeps you in the game long enough for good setups to play out.

- Respect the drawdown rules: If the firm sets a 10% max drawdown, cap yourself at 7–8%. That cushion prevents disqualification from a single bad trade.

- Stop-loss discipline: Always use stop-loss orders. Place them beyond key support/resistance or use ATR to match volatility. Avoid tight stops that get triggered by normal noise.

- Position sizing formula:

- Decide your dollar risk (e.g., $500).

- Subtract entry price from stop-loss (risk per unit).

- Divide the dollar risk by the risk per unit to get the lot/contract size.

Example: On EUR/USD, if you enter at 1.1000 and stop at 1.0980 (20 pips risk), risking $500 means 2.5 lots ($10/pip).

When I first attempted FTMO, I ignored these rules and risked 3–4% per trade. One bad day cost me the full 5% daily loss limit, and the challenge was over in less than two weeks.

On my third try, I strictly risked 0.5% per trade. Even after three losses in a row, I was down only 1.5%, still safe and composed. That change alone gave me the breathing room to eventually pass.

4.3. Step 3: Strengthen your trading psychology

Many traders underestimate how much emotions influence their performance in a prop firm challenge. But fear, greed, and frustration are often the real reasons behind broken rules and blown accounts.

1. Dealing with fear and greed

Fear often makes traders cut winners too early, while greed pushes them to hold losing trades longer than they should.

In one FTMO attempt, I closed a trade for $500 profit out of fear, only to see it run another $2,000 in my direction. Greed hurt me, too, when I ignored my plan and held losers, hoping they’d “come back.” Both cost me consistency.

2. Controlling emotions after a losing streak: A string of losses is the toughest test. Research by Andrew Menaker (2024) found that up to 80% of retail traders fall into revenge trading after losses, one of the biggest reasons they fail when learning how to pass any prop firm challenge (Business Insider, 2024).

I made the same mistake: after two losing trades in a row, I doubled my lot size to “get it back.” Instead, I hit FTMO’s 5% daily loss limit and ended my challenge within hours.

3. Discipline is gold

The only way I overcame these traps was through strict discipline. Now I follow three personal rules:

- Stop trading after two consecutive losses.

- Never exceed 1% risk per trade, no matter how “sure” I feel.

- End the day once I hit my daily profit target, even if good setups still appear.

Mark Douglas, author of Trading in the Zone (2000), put it simply: “The consistency you seek is in your mind, not in the markets.” The moment I internalized that, I stopped chasing the market and focused on executing my plan.

4.4. Step 4: Trade high-probability setups only

One of the fastest ways to fail a prop firm challenge is overtrading. Instead of trying to hit 10% by forcing trades, focus on setups that match your strategy perfectly. For me, that means:

- Minimum 1:2 risk-to-reward ratio.

- Multiple confirmations (trend + support/resistance + candlestick signal).

- No trade if all conditions aren’t met.

At the start, I overtraded with 3–5 positions a day. Once I focused on only the highest-probability setups, 2 to 3 per week, my equity curve smoothed out, and I finally understood how to pass the prop firm challenge quickly without burning out.

4.5. Step 5: Use a trading journal

A trading journal is the tool that turns mistakes into lessons. What you need to record in your journal:

- Entry & exit prices.

- Position size and stop-loss.

- Market context (news, volatility).

- Emotional state before/during/after.

- Outcome + notes for improvement.

During one demo challenge, I noticed that 70% of my losing trades came within 30 minutes of major news events. I wouldn’t have spotted that pattern without journaling. After cutting out those trades, my win rate improved by nearly 15%.

A trading journal also keeps you accountable. Recording your mistakes helps prevent repeating them, and it’s one of the simplest hacks for anyone wondering how to pass any prop firm challenge consistently.

4.6. Step 6: Stick to a simple trading plan

Challenges are not the time to experiment with new strategies. Prop firm rules are already strict; complexity only adds more chances to slip.

Keep it simple:

- Trade only 1–2 pairs you know best.

- One or two entry strategies that you’ve backtested.

- Clear rules for trading sessions (e.g., only London–NY overlap).

During one challenge, I got tempted to test a new indicator halfway through. That confusion caused me to miss trades I would have normally taken, and I ended up being inconsistent.

On the third try, I went back to basics: EUR/USD only, price action + RSI divergence only, and max 3 trades per week. That simplicity helped me pass.

4.7. Step 7: Use scaling in & out (Advanced trader)

Scaling in and out means adjusting your position size in stages instead of going all in or all out. It’s an advanced tactic, but for experienced traders it can make a big difference in both risk control and profit-taking. Professional traders often use this method to smooth out entries and reduce emotional pressure during volatile markets.

How scaling works:

- Scaling in: Enter part of the position at the breakout, then add more on a confirmed retest.

- Scaling out: Take partial profits at the first target (e.g., 1:1 risk-reward), let the rest run toward 1:2 or higher.

Example: In a $100,000 FTMO challenge, I risk 0.5% ($500) on EUR/USD. I enter half ($250 risk) on the breakout, then add the second half if the price retests successfully. Later, I take partial profit at +$500 and let the remaining position ride. Even if the rest closes at breakeven, I’ve already locked in a win.

I first applied this during my third challenge. Instead of panicking when the price pulled back, I used scaling to add at a better level. The trade ended with a +1.5% gain instead of a scratch. It gave me more flexibility and less stress compared to all-in entries.

For traders aiming to secure a funded account, these strategies apply to many prop firms. Apply them consistently, and you’ll give yourself the best shot at turning challenges into long-term success.

5. Mindset and discipline are the real game changers

When I finally passed my first prop firm challenge with FTMO, it wasn’t because of a new trading strategy. The real shift was in my mindset; I treated every trade as if I were managing real investor money instead of a demo account. That discipline kept me from overtrading and helped me stay within the rules until I hit the profit target.

5.1. Treat it like a real account

Prop firm challenges often run on demo accounts, but the key is to treat them as if they were real. This mindset keeps emotions steady and prevents reckless risk-taking.

When traders respect every dollar as if it were actual capital, they naturally trade with more discipline, stick to their rules, and avoid unnecessary risks.

5.2. Control emotions & avoid revenge trading

One of the most common reasons traders fail is revenge trading, trying to recover losses quickly by increasing size or forcing trades. The best approach is to stop trading after hitting daily limits or after two consecutive losses. Taking breaks allows emotions to reset and prevents a single bad trade from undoing weeks of progress.

5.3. Accept that less is more

Success in prop firm challenges doesn’t require dozens of trades. A 5% profit target spread over 30 days can realistically be reached with only a few high-quality setups. By focusing on precision, traders reduce the stress of constant execution and avoid unnecessary exposure to risk.

Overtrading, on the other hand, multiplies mistakes and increases the chance of breaking firm rules such as daily loss limits. Selective trading not only preserves capital but also creates a consistent performance curve, something prop firms look for when deciding to fund traders.

In summary, mindset and discipline shape the outcome of every challenge. Treating the account seriously, keeping emotions under control, and focusing on quality over quantity together form the mental edge needed to join the small percentage of traders who pass.

See more helpful articles:

6. Common mistakes to avoid

Looking back at my first failed challenge, I realized it wasn’t my strategy that cost me the account; it was basic, preventable mistakes. Many traders, including myself, trip over the same issues. Recognizing them early is the best way to avoid repeating them.

The most common mistakes include:

- Overtrading in the first days: Trying to reach the profit target too quickly often leads to excessive trades, bigger drawdowns, and broken daily loss rules.

- Ignoring firm rules: Every firm has unique guidelines (daily loss, drawdown, minimum trading days, news restrictions). Missing even one detail can disqualify you, no matter your profit.

- Using EA/bots without checking: Some firms ban automated trading or require approval. Deploying an unverified EA can instantly void your account.

- Risking too much to “pass fast”: Oversizing positions in hopes of hitting targets quickly usually backfires. One bad trade can wipe out days or weeks of effort.

- Neglecting trading psychology: Fear, greed, and frustration are powerful. Without practicing emotional control, even solid setups can end in impulsive, rule-breaking trades.

Most traders don’t fail because they lack technical skill. They fail because of avoidable errors. Mastering discipline and awareness of these traps is just as critical as knowing when to enter or exit a trade.

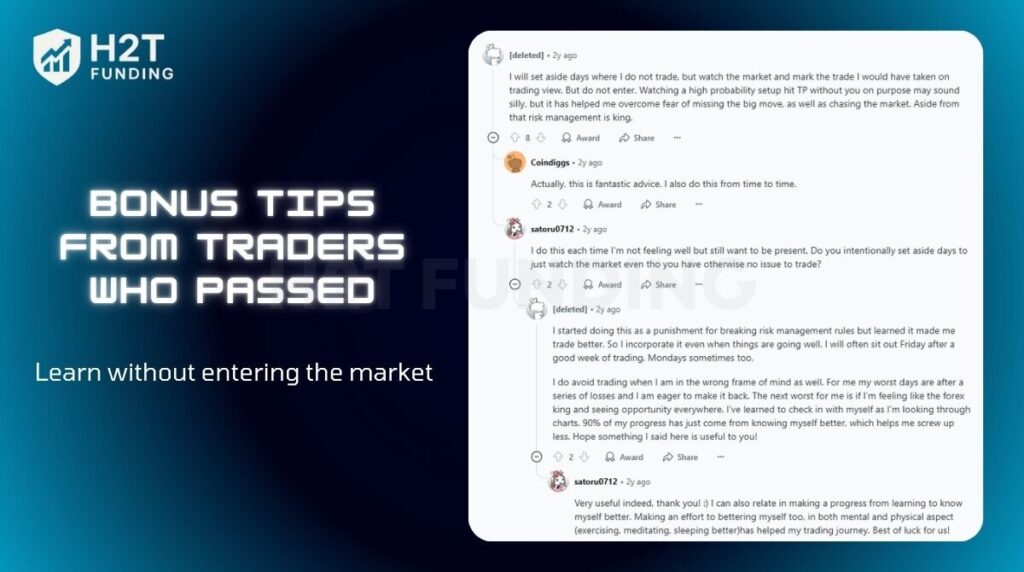

7. Bonus tips from traders who passed

Beyond theory, many traders who successfully passed prop firm challenges shared their experiences openly on forums like Reddit. Their advice is often practical, personal, and rooted in real struggles. Here are a few lessons, illustrated by direct trader comments, that can help you on your journey:

1. Learn without entering the market

One trader explained how they purposely sit out some days, marking setups on TradingView but not taking trades. By doing this, they overcame FOMO and improved discipline. “Watching a high probability setup hit TP without you on purpose may sound silly, but it helped me avoid chasing the market. Risk management is king.” – Reddit

Tip: Sometimes, the best trade is no trade. Sitting out builds patience and sharpens decision-making.

2. Practice with simulators first

Another experienced trader emphasized the importance of paper trading before risking real money:

“Instead of paying to play in a simulator, use a free simulator and paper trade. Practice until you can get a system down.” – Reddit

Tip: A demo or simulator account replicates challenge conditions and prepares your psychology without financial risk.

3. Stick to specific trading hours

Time discipline was also a recurring theme. One trader said they only trade the first hours of the London and New York sessions:

“I only trade the first 2 hours of the London session… any longer and my strategy starts to falter due to lack of volume. If I were you, I wouldn’t trade past 12 pm EST.” – Reddit

Tip: Find the hours where your strategy works best and avoid overextending into low-liquidity periods.

What stands out from these stories is that passing a prop firm challenge isn’t about chasing the “perfect setup.” It’s about discipline, patience, and knowing yourself as a trader. Whether that means sitting out trades, practicing endlessly on simulators, or limiting your active hours, consistency is what gets you funded.

8. FAQs

Traders often point to The 5%ers, thanks to its one-phase structure, moderate profit target (8%), and generous time frame of up to 6 months, making it especially suitable for patient traders.

It depends on the firm. Many allow EAs if disclosed beforehand, but some strictly ban automated strategies. Always review the firm’s rules; violating them can nullify the challenge regardless of results.

Only about 5–10% of traders pass prop firm challenges. Most fail because of poor risk control, rushing for profits, or breaking firm rules (According to Quantpvs).

If you fail, the evaluation ends, and your entry fee is usually non-refundable. However, most firms allow you to try again by purchasing a new challenge, and some offer discounts or partial credits for re-entries.

It depends on consistency. While some disciplined traders finish within a few weeks, most take one to three months. Rushing often leads to mistakes, so steady progress is safer.

Step 1 is the initial Challenge, where you must hit the profit target while staying within drawdown limits. Step 2 is Verification, usually with a lower profit target, designed to confirm consistency before funding.

Some firms occasionally run promotions, giveaways, or competitions where traders can join for free. Staying active in trading communities and following firm announcements increases your chances of finding these offers.

Yes, a few firms offer instant funding accounts. These skip the evaluation phase, but typically come with higher fees and stricter payout conditions to balance the added risk for the firm.

Most challenges allow up to 1–2 months, but passing depends more on your discipline. Traders who wait for quality setups often finish faster than those who overtrade every day.

9. Conclusion

Passing a prop firm challenge is not just about technical setups. It requires discipline, a clear trading plan, and the consistency to follow rules even under pressure. These qualities are what separate the few funded traders from the many who fail.

Remember, the goal is not to “pass fast” but to trade like someone already managing real capital. If you focus on risk management, psychology, and high-quality setups, your chances of success in how to pass a prop firm challenge rise significantly.

If you’re ready, take your shot at a challenge, but prepare carefully first. For more insights, strategies, and real trader experiences, explore the Prop Firm & Trading Strategies section at H2T Funding. And don’t forget to comment, share your journey, and join the community of traders aiming for funding.

There are 2 steps and 1 step evaluation, which one is easier to pass?

The 1-step is faster but a bit stricter. The 2-step takes longer but usually easier to manage.