Where did all the money go? If you’ve ever asked yourself this at the end of the month, you’re not alone. I know that helpless feeling of watching your account balance shrink for no clear reason. But budgeting isn’t about putting your spending in handcuffs. It’s the exact opposite; it’s the map that hands you back the power.

In this guide, I’ll walk through how to make a monthly budget in 5 simple steps so you can finally tell your money where to go, instead of wondering where it went.

1. First things first: What exactly is a monthly budget?

A monthly budget is a plan that shows how much money you expect to earn and how you’ll spend it over the month. It works like a roadmap, helping you track where your money goes and making sure it supports your priorities, from essentials to savings goals.

By setting this plan in advance, you avoid surprises and stay in control of your finances, one month at a time.

2. Why is making a monthly budget so important?

Let’s take Sarah’s story, an office admin making $3,200 a month. She always thought she was “doing fine” because the bills got paid on time and she didn’t have credit card debt. But “fine” isn’t the same as “secure.”

That reality hit hard when her car suddenly broke down on the way to work. The $700 repair bill was a punch to the gut because she had zero emergency savings. The worst part? The humiliating call she had to make to her younger sister, who earned less than her, just to borrow enough money to cover groceries for the week.

What happened to Sarah wasn’t about bad decisions. It was about not having visibility or structure. That’s exactly what a monthly budget provides.

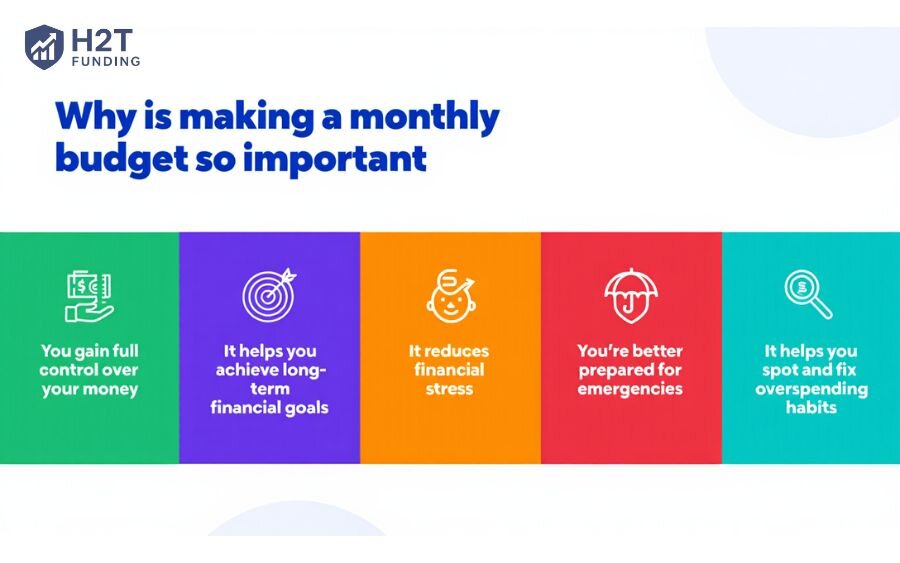

Here’s why building one is more important than most people realize:

- You gain full control over your money: A budget replaces guesswork with clarity. It allows you to decide exactly where your income should go, instead of losing track of spending.

- It helps you achieve long-term financial goals: Big goals, like saving for a house or clearing debt, can feel overwhelming. Budgeting breaks them into smaller, actionable steps.

- It reduces financial stress: Knowing that your essentials are covered and your spending is intentional eases daily money anxiety and builds confidence.

- You’re better prepared for emergency funds: By setting aside even a small amount monthly, you build a safety net that cushions life’s inevitable surprises, like car repairs or medical bills.

- It helps you spot and fix overspending habits: Tracking your expenses reveals patterns. Maybe it’s too many food delivery orders or unused subscriptions, but budgeting makes those habits visible and fixable.

3. How to make a monthly budget in 5 simple steps

The easiest way to build a strong, realistic budget is to break it down into clear, manageable steps. These five steps will help you organize your income, track your spending, and align your money with your goals, no guesswork, no overwhelm.

3.1. Step 1: Calculate your monthly income

Before you can plan where your money should go, you need to know exactly how much is coming in. Start by calculating your total take-home pay, the amount that actually lands in your bank account after taxes and deductions.

If you earn a fixed salary, this part is straightforward. Check your most recent pay stub or bank statement to confirm your net income. Include all consistent sources: full-time wages, part-time jobs, freelance contracts, or government benefits.

For those with irregular or variable income, such as freelancers, commission-based earners, or gig workers, take the average of your income over the past 3 to 6 months. Use conservative estimates. For example, if your income fluctuates between $2,000 and $3,500 monthly, consider budgeting around $2,000 to stay on the safe side.

Also include any additional income that you receive regularly, such as rental income, alimony, or side hustle earnings. Avoid counting one-time payments like bonuses or gifts unless they are guaranteed monthly.

Maybe you need to know: Budgeting for irregular income: 6 essential steps you need to know

3.2. Step 2: List and categorize your monthly expenses

Now that you know your income, the next step is to track where your money goes. Start by reviewing your bank and credit card statements from the past 1–3 months. Write down every recurring or common expense.

To make budgeting easier, group your expenses into three categories:

- Fixed expenses: These are predictable and usually the same every month. Examples include rent or mortgage, insurance, student loans, and subscription services like Netflix or Spotify.

- Variable expenses: These change month to month. Examples include groceries, fuel, dining out, entertainment, and clothing. These are also the easiest to adjust if your budget is tight.

- Sinking funds: These cover large or irregular costs you plan for in advance, like vacations, holiday gifts, car maintenance, or a new phone. Instead of paying all at once, set aside a small amount monthly.

Tracking your spending by category helps you see patterns, find waste, and plan better for both essentials and goals.

Sample monthly expense tracker

| Expense Category | Planned Amount | Actual Amount |

|---|---|---|

| Rent / Mortgage | $1,000 | $1,000 |

| Groceries | $300 | $310 |

| Transportation | $150 | $140 |

| Utilities | $100 | $95 |

| Insurance | $120 | $120 |

| Entertainment | $100 | $130 |

| Savings | $200 | $200 |

| Sinking Fund: Vacation | $100 | $100 |

If you’re more of a spreadsheet person, consider learning how to make a monthly budget in Excel or how to make a monthly budget in Google Sheets. Both platforms offer flexible templates and built-in formulas that automatically calculate totals, making budgeting easier and more visual. You can:

- Use templates with categorized expenses.

- Set up conditional formatting to spot overspending.

- Easily adjust projections month-to-month.

These tools are perfect for people who prefer a DIY, customizable approach, plus, they’re free!

3.3. Step 3: Choose a budgeting method that fits your lifestyle

There’s no perfect budget for everyone. Choose a method that matches how you think and spend:

- 50/30/20 rule: Spend 50% on needs, 30% on wants, and 20% on savings or debt. Great for beginners who want structure without too much detail.

- Envelope system: Use cash, divide it into labeled envelopes by category (like groceries, gas). When one’s empty, stop spending. Ideal for hands-on control.

- Zero-based budgeting: Assign every dollar a job so income minus expenses equals zero. Most detailed, great for those who want full control.

Start with the one that feels manageable, and adjust as your habits evolve.

3.4. Step 4: Do the math and adjust your budget

Now compare your total income (Step 1) with your total expenses (Step 2). This shows whether your plan is balanced or needs adjusting.

- If you have a surplus (Income > Expenses): Great! Assign that extra money to savings, debt payments, or sinking funds. Every dollar should have a purpose.

- If you have a deficit (Expenses > Income): Time to trim. Review variable expenses like dining out, subscriptions, or entertainment. Example: Cutting 2 takeout meals a week could save $100/month.

Small adjustments can quickly bring your budget back in balance, without feeling like a sacrifice.

3.5. Step 5: Track your progress and stay consistent

A budget only works if you follow through. Make it a habit to check in regularly. Spend 15–30 minutes each week to log expenses and compare them to your plan. At the end of the month, review what worked and adjust for the next.

Remember: Consistency is key. The more often you review, the easier it gets, and the faster you’ll see results.

Discover more related articles:

4. The best tools to make your monthly budget

You don’t have to do everything manually. The right tools can make budgeting faster, easier, and more accurate, especially when you’re just starting out.

- A simple spreadsheet: A simple spreadsheet: Spreadsheets let you fully customize your budget. They’re free, flexible, and easy to update each month. If you’re wondering how to make a monthly budget on Excel, start with a basic layout of income, fixed, and variable expenses. Excel even offers budget templates you can tweak to suit your lifestyle.

Click here to download your FREE Monthly Budget Template

- Budgeting apps: Top picks for beginners

- Rocket Money: Helps you track spending and cancel unused subscriptions automatically—great for saving money fast.

- YNAB (You Need A Budget): Follows the zero-based budgeting method. Ideal if you want total control over every dollar.

- Goodbudget: A digital envelope system, perfect for couples or families who budget together.

Use whichever tool fits your style, paper, app, or spreadsheet. What matters is that you use it consistently.

5. Pro tips to make your budget a success

Budgeting gets easier with time, but the right habits make a big difference from the start. Here are a few practical tips to help you stay consistent, avoid frustration, and actually enjoy the process:

- Budget with a partner or family: If you share finances, involve everyone. Open communication helps avoid conflicts and keeps goals aligned. Sit down monthly to review and adjust together.

- Automate your savings and bill payments: Set up automatic transfers to your savings account and schedule bill payments right after payday. This ensures consistency and reduces the risk of missed deadlines.

- Plan for fun money: Budgeting isn’t about cutting all joy. Set aside a small amount each month for guilt-free spending; it keeps you motivated and avoids burnout.

- Embrace that your first budget will be a mess: Yep, you read that right. Your first month’s budget will almost certainly be flawed, messy, and inaccurate. And that is perfectly okay! The goal isn’t to create a perfect plan on your first try; the goal is to simply start. Treat it like a rough draft. Month two will be better, and by month three, it’ll start to feel like a routine.

- Try a budget sheet: If you like things organized visually, using a pre-built monthly budget sheet can be a game-changer. Whether you use Excel or Google Sheets, templates let you track income, expenses, and goals all in one place. It’s a low-effort way to stay consistent.

Small tweaks like these can turn budgeting into a routine you actually enjoy. The more you personalize your system, the more likely it is to stick.

6. How to make a monthly budget sheet

Creating a monthly budget sheet is one of the most effective ways to gain control over your finances. Whether you prefer pen-and-paper, Excel, or Google Sheets, having a clear structure where income and expenses are tracked side-by-side helps you stay accountable and make informed decisions.

Step 1: Start with your income

- List all reliable sources of income (salary, freelance work, side gigs, etc.).

- If your income fluctuates, use the lowest monthly average from the past 3–6 months.

Step 2: Break down your expenses

Divide your costs into three sections:

- Fixed expenses: Rent, loan payments, insurance.

- Variable expenses: Groceries, transportation, and entertainment.

- Savings & sinking funds: Emergency fund, vacation, retirement.

Step 3: Build your table structure

You can create your own table or use a monthly budget sheet template to speed up the process. A typical budget sheet includes these columns:

| Category | Planned Amount | Actual Amount | Difference |

|---|

Step 4: Fill in your planned vs actuals

At the beginning of the month, input your expected (planned) numbers. Throughout the month, track your actual expenses. At month-end, compare and review differences to identify habits and areas for improvement.

A budget sheet gives you a bird’s-eye view of your financial life. It keeps your money intentional, not accidental. More importantly, it shifts budgeting from a guessing game into a clear, repeatable process. Once you’ve built your first sheet, you can duplicate and adjust it month after month, saving time and boosting consistency.

You may also be interested in: Smart weekly budgeting tips every beginner should know

7. Frequently asked questions (FAQs)

The first priority should be paying yourself first. Before covering bills or daily costs, set aside a portion for savings or debt repayment. This ensures your financial goals are met, no matter what comes up during the month.

There’s no single “best” method, but a great place to start is the 50/30/20 rule. Combine that with a simple spreadsheet or budgeting app to track your spending. The most important part is consistency, not the tool you use.

Most people need around 3 months to fully adjust. The first month is about tracking, the second is for tweaking, and by the third, budgeting becomes more natural. Give yourself time to learn and improve.

8. Conclusion

Remember that feeling of stress we talked about at the beginning? You now have the exact tool to replace that anxiety with control. Making a monthly budget isn’t just about numbers on a spreadsheet; it’s a declaration of who’s in charge of your financial life.

Don’t wait for the ‘perfect’ time to start. Begin today, even with a messy plan. Because learning how to make a monthly budget is the first, most powerful step in turning financial freedom from a distant dream into a reachable plan. And if you’re ready to begin, try starting with a simple monthly budget template in Excel or Google Sheets; it’s easier than you think.

Want more practical tips? Explore other expert-backed guides in our Budgeting Strategies section on H2T Funding.