CRITICAL WARNING: It is crucial for all traders to know that The Funded Trader (TFT) experienced a major operational collapse in March 2024. This collapse caused a temporary shutdown, a backlog of unpaid profits, and a severe loss of trust within the community. It also highlights the need to read each firm’s risk disclosure before participating.

While TFT has since attempted to relaunch, it is operating in a highly unstable environment and is still processing payouts owed from before its collapse.

Therefore, before you follow their advertised path on how to get a funded trading account, we strongly advise that you conduct your own extensive due diligence and research. Consider this article as an analysis of what is promised; your task is to verify the reality by:

- Searching for the latest reviews and feedback from the trading community on international forums (like Forex Peace Army, Trustpilot, and Reddit).

- Verifying the firm’s current payout status through independent, recent sources.

- Researching any recent structural changes, rule updates, or incidents that may not be disclosed in their marketing materials.

By taking these steps, you will gain a complete picture and make the most informed decision for your trading career. Now, let’s analyze what The Funded Trader advertises.

Key takeaways:

- Getting a funded trading account requires proving your skill, discipline, and risk management through a structured evaluation, usually in 1 to 3 phases.

- TFT advertises multiple challenge programs designed for different trading styles, offering profit targets, drawdown rules, and potential payouts up to 95%.

- Despite the attractive structure, TFT carries significant operational risk due to its 2024 collapse, unpaid trader profits, and ongoing instability.

- To get funded, traders must pass TFT’s Challenge → Verification → Funded Account process, while following strict drawdown and trading rules.

- TFT allows full trading flexibility, including EAs, hedging, swing trading, and multi-asset trading, which appeals to forex, indices, crypto, and options-style strategies.

- Many traders fail due to overtrading, poor risk control, misunderstanding rule breaches, or volatility during news events.

- Proper due diligence is essential: verify payout reliability, read recent community reviews, and document all activity before joining any prop firm.

- The fee for TFT challenges should be treated as a high-risk, non-refundable expense, especially given the firm’s unstable payout history.

1. What is a funded trading account, and how does TFT work?

A funded trading account is capital provided by a proprietary trading firm after traders pass an evaluation process. Many firms offer a free trial, but traders researching how to get a free funded trading account should be aware of an important distinction. “Free” typically refers to trials or promotions, not full funding without an evaluation fee.

With this model, traders can access significant virtual capital, trade in a simulated live market environment, and earn real payouts, without risking their own money.

At TFT, instead of offering a one-size-fits-all evaluation, TFT gives traders multiple challenge types tailored to different trading styles, from fast-paced scalping to long-term swing trading.

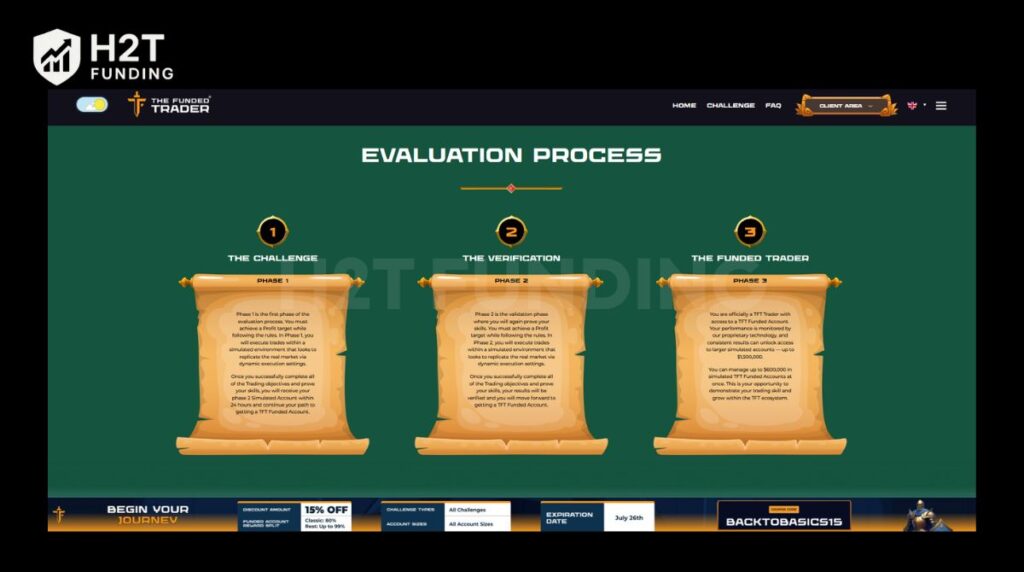

Once you register, your journey to becoming a funded trader involves three main stages:

- Phase 1 – The Challenge: Hit a profit target while following strict risk management rules, including understanding whether the firm uses a static or trailing drawdown model.

- Phase 2 – Verification: Show continued consistency in a slightly more forgiving environment.

- Phase 3 – Funded Account: Trade with TFT’s capital through simulated trading, access various trading instruments, earn up to 95% of your profits, and become eligible to scale up to $1.5 million in capital.

This model lets you focus purely on trading performance, while TFT manages the funding, risk systems, and payouts. It’s also a potential route for traders exploring how to get funding for trading without risking personal capital. For a broader overview, you can read the complete guide on how to get a funded trading account before choosing any prop firm.

2. How to get a funded trading account with TFT

If you’re serious about trading and want to access significant capital without risking your own funds, understanding how to get a funded trading account is the first step, especially for traders searching for how to get a funded trading account for free through discounts, promotions, or low-cost evaluation options.

TFT offers a structured, multi-phase evaluation process similar to a trading combine used by other prop firms. This approach allows you to prove your skills and earn a funded account backed by real capital.

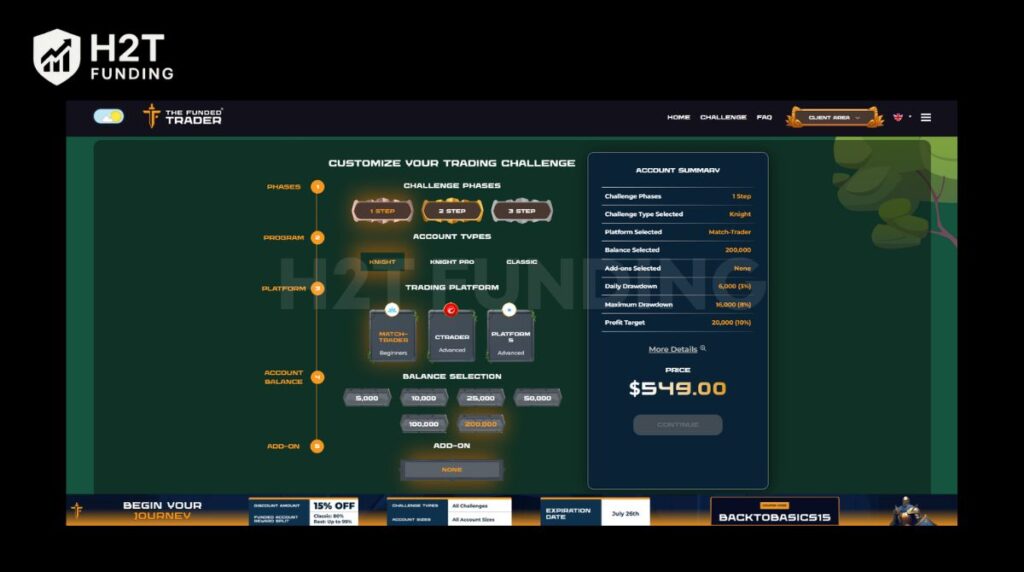

To begin, you must choose one of TFT’s challenge programs, which offer a wide range of account sizes to match different trading styles and risk preferences.

Whether you’re looking for how to get a funded forex trading account or seeking fast payouts and flexibility, TFT provides multiple options. These programs also appeal to traders searching for how to get a funded trading account in India as access to international prop firms grows.

Once you select a challenge, the journey to becoming a TFT-funded trader typically includes the following phases:

- Phase 1: The Challenge: This is the initial test of your trading discipline, strategy, and risk management, executed with real-time market data and reflected in your performance statistics throughout the challenge. You’ll trade in a simulated trading environment that mirrors real market conditions, using real-time market data on platforms like MT5, cTrader, or Match-Trader. To move forward, you must hit a predefined profit target while staying within strict daily and overall drawdown limits.

- Phase 2: The Verification: A second round of evaluation confirms that your performance is consistent, not the result of a one-time high-risk approach. The profit target here is typically lower, but you’re expected to follow the same trading rules.

- Phase 3: The Funded Account: Once both phases are successfully completed, you’ll be granted a funded account and start trading with TFT’s capital. From here, you can earn up to 95% of profits, request payouts in 3–7 days, review the firm’s withdrawal details, and work toward scaling your account up to $1.5 million.

No matter the challenge type, TFT allows full use of EAs, hedging, swing trading, and a wide range of instruments. This flexibility is valuable for traders exploring how to get a funded options trading account or expand their strategies across multiple markets. These are accessible through multiple trading platforms and include forex, indices, and crypto.

This is an ideal path for those wondering how to get a funded trading account. It also helps traders searching for how to get funded as a trader, particularly those who want an evaluation model that supports long-term strategy and growth.

Read more related articles:

3. Breakdown of TFT programs: Choose your path

TFT offers five evaluation programs that function similarly to a trading combine, giving traders a structured path to prove their consistency. Each is tailored to different trading styles, risk profiles, and timelines.

If you want to learn the techniques for successfully completing these evaluations, take a look at the detailed guide on how to pass a prop firm challenge to improve your chances of success. Whether you’re looking for the fastest payout, the lowest evaluation cost, or maximum flexibility, TFT has a challenge built to suit your approach.

| Program | Challenge Phases | Profit Targets | Drawdown | Payout Time | Key Feature |

|---|---|---|---|---|---|

| Royal | 2 | 8% / 5% | 10% overall | ~14 days | Best drawdown-to-target ratio |

| Royal Pro | 2 | 8% / 5% | 10% (soft breach) | 3 days | Fast payout, unlimited freedom |

| Knight | 1 | 10% | 8% | 7–10 days | Quickest route to funding |

| Knight Pro | 1 | 10% (with limit) | 8% (balance-based) | 7–10 days | Steadfast Gains Rule, daily reset |

| Dragon | 3 | Varies | 10% | 7 days | No time limit, lowest fee |

3.1. Royal Challenge

Designed for traders who prefer a balance between risk and reward, the Royal Challenge offers:

- 2-phase evaluation

- Profit target: 8% (Phase 1), 5% (Phase 2)

- Max drawdown: 10%

- Daily drawdown: 5%

- No restrictions on holding trades over the weekend or during news events

- EA, hedging, and swing trading allowed

Its generous drawdown-to-target ratio makes this one of the most cost-effective challenges on the market.

3.2. Royal Pro Challenge

An advanced version of the Royal, the Royal Pro provides more trader-friendly features:

- First payout in 3 days after receiving the funds in the account, a benefit often compared with leading prop firms with the fastest payouts in the industry.

- Soft breach model: Account pauses instead of failing if the daily drawdown is exceeded

- Drawdown resets daily at 5 PM EST

- Full freedom: no limits on news trading, lot size, weekends, or trade copiers

- Suitable for high-frequency or systematic traders using EAs

3.3. Knight Challenge

Built for speed and simplicity, the Knight Challenge is TFT’s 1-phase program, a structure similar to many prop firms with the lowest minimum trading days.

- No verification phase, get funded directly after passing the challenge

- Profit target: 10%

- Drawdown: 8%

- No limits on EA usage or trading style

- First payout possible within 7–10 days

This is an excellent option for traders with consistent, short-term strategies who want to get funded faster.

3.4. Knight Pro Challenge

The Knight Pro introduces TFT’s unique Steadfast Gains Rule, which:

- Cap daily profits at 50% of net profits to promote consistent growth

- Uses balance-based drawdown, recalculated every 24 hours

- Encourages disciplined, methodical trading

- No trading restrictions: EA, trade copier, swing/overnight trades all allowed

This structure helps maintain long-term account stability while still offering fast payout timelines.

3.5. Dragon Challenge

The Dragon Challenge is the most flexible and cost-accessible program TFT offers, featuring some of the lowest trading fees among TFT’s evaluation options:

- 3-phase structure (Challenge -> Verification -> Funded)

- Evaluation fee under $360 for a $100,000 starting balance

- No time limit to complete each phase, ideal for patient, cautious traders

- First payout possible in just 7 days after getting funded

- Unlimited timeframes, full trading freedom

Though longer in duration, the funded trader Dragon Challenge is perfect for those seeking low pressure and low cost.

4. Common reasons why traders fail TFT challenges

Despite the opportunities TFT provides, many traders still struggle to overcome the challenges. Understanding common pitfalls can help you avoid costly mistakes:

- Overtrading to reach the profit target too quickly: Trying to hit profit targets prematurely often leads to reckless trade sizing and poor decision-making, increasing the likelihood of hitting drawdown limits.

- Lack of control over emotions and position sizing: Trading without emotional discipline or proper risk sizing leads to inconsistent performance. This is reflected in your account analytics and often results in costly mistakes during volatile market conditions. For new traders, learning the best trading strategies for beginners can help build confidence and reduce early-stage mistakes.

- Misunderstanding soft breach vs. hard breach: Some traders confuse TFT’s soft breach system, which pauses the account temporarily, with hard breach, which results in failure. Misinterpretation can cause unnecessary frustration or risky behavior.

- Trading during high-impact news events without a risk management strategy: Entering trades during major news releases without appropriate hedging or stop-loss management often leads to sharp drawdowns and account pauses.

- Prop firm failure: The single largest risk to your success with TFT is not your trading strategy, but the firm’s own instability. You can do everything right, pass the challenge, follow the rules, and be profitable, but still fail to get paid because the firm itself is unable or unwilling to pay. Understanding how prop firms make money helps you evaluate the sustainability of their business model and avoid partnering with unstable firms.

Avoiding these common errors by maintaining discipline, educating yourself about TFT’s rules, and implementing sound risk management will significantly improve your chances of success.

5. Realistic tips for navigating the TFT challenge

Successfully navigating the TFT challenge in its current state requires a fundamental shift in perspective. You are no longer just proving your skills; you are assessing the firm’s financial risk to ensure it can pay profitable traders reliably.

The following tips are designed to help you adopt this defensive posture and protect your capital and effort.

5.1. Conduct forensic-level due diligence before you pay

This is the most critical step. Do not rely on TFT’s marketing or older reviews. You must actively search for the most current, unbiased information available. Go to independent platforms like Trustpilot, Reddit (specifically subreddits like r/propfirm), and Forex Peace Army.

Your goal is to find verifiable proof that new traders are receiving payouts in a timely manner and to evaluate how responsive the firm’s customer support is during payout issues.

5.2. Your documentation is your primary shield

Create a dedicated folder for your TFT journey and save everything, including conversations with customer support, as these records are essential if a payout dispute occurs.

This includes screenshots of the specific rules and FAQ sections at the time you signed up (as these can change), your dashboard showing you passed each phase, your account metrics, every payout request you submit, and a complete transcript of any conversation you have with their support team.

This evidence trail is invaluable, especially for traders with less trading experience, because it protects you if a payout is delayed or denied for a subjective reason.

5.3. Acknowledge that the fee is a high-risk, non-refundable investment

Many prop firms advertise a “refundable fee” upon your first payout. In a stable company, this is a great perk. With a firm like TFT that has a documented history of payment failures, you must mentally treat this promise as void.

The refund is contingent on a payout that may be severely delayed or never arrive. Therefore, you must view the fee as the price of admission, a high-risk, non-refundable investment in an unstable venture.

5.4. Your best strategy might be choosing a different firm

This may be the most important tip of all. The skills required to learn how to get a funded trading account, discipline, risk management, and a consistent strategy, are highly transferable.

The time and energy you would spend navigating TFT’s risks, documenting everything, and worrying about payouts is significant. Those same efforts could be more productive at a firm with a long-standing, reliable track record.

The ultimate goal is to get paid for your profitable trading. The most direct path is to partner with a company where payouts are routine, not a source of constant uncertainty.

Don’t miss it: Easiest prop firms to pass in 2026: 12 best picks

6. FAQs

No, participating in TFT’s evaluation requires paying an evaluation fee. This fee varies by program, typically starting under $360 for the Dragon Challenge. The fee covers access to the simulated trading environment and evaluation process.

Yes, you must pay the evaluation fee to begin the challenge. Once funded, there are no additional fees to trade with TFT’s capital.

TFT supports MetaTrader 5 (MT5), Match-Trader, and C-Trader, allowing traders to select the platform they are most comfortable with.

Yes, all TFT programs permit the use of EAs, hedging, and trade copiers, offering flexibility for automated and manual trading styles.

Depending on the program, traders can request payouts as early as 3 to 7 days after their first funded trade.

To get a funded account at TFT, you must complete their trading evaluation challenge, pass Phase 1 and Phase 2, and meet all the rules requirements. To pass Phase 1 by reaching the profit target without violating drawdown rules, and then pass Phase 2 to prove consistency. After both phases are verified, TFT issues a funded account where you can earn a share of profits. Important: Because TFT experienced a major collapse in 2024 and still faces payout instability, verify current payout reports before signing up.

Yes, some TFT programs include implicit or explicit consistency requirements. For example, the Knight Pro Challenge uses the Steadfast Gains Rule, limiting daily profit contributions to encourage steady trading. Even when not stated as a “consistency rule,” traders must avoid high-risk behaviors to prevent breaches.

Yes. TFT allows the use of Expert Advisors (EAs), automated strategies, trade copiers, hedging, swing trading, and news trading, depending on the program. This flexibility is one of their main selling points, but always check screenshots of the rules before purchasing, as TFT frequently updates policies.

Breaking a rule, such as exceeding daily or max loss, results in a hard breach. Traders should read the firm’s risk disclosure to understand the consequences, as this will end the challenge or funded account. Some programs offer a soft breach, which pauses the account instead of immediately failing it. Traders should keep documentation (screenshots, metrics) because rule disputes have occurred in the past.

If you pass Phase 1 quickly, you can reach Phase 2 within 24 hours. Funding is typically issued shortly after Phase 2 results are verified. In the fastest programs (Knight, Royal Pro), traders may complete the process in 7–14 days. However, payout timing is uncertain due to TFT’s past backlog and recent operational instability.

7. Conclusion

Understanding how to get a funded trading account is about more than passing an evaluation; long-term trading success depends on choosing a stable, reliable firm. It’s about choosing a reliable partner. While this guide has outlined the steps advertised by The Funded Trader, it has also highlighted the severe, documented risks that make the company an extremely precarious choice.

The promises of high profit splits and flexible rules are irrelevant if the firm cannot or will not pay you. The real path to success as a funded trader lies in meticulous due diligence and prioritizing safety and reliability above all else. At present, the evidence suggests that traders should seek these qualities elsewhere.

For more insights and practical advice on prop trading and effective trading strategies, explore the extensive resources available at H2T Funding in the Prop Firm & Trading Strategies section. These articles will further guide you on maximizing your chances of success in the competitive world of funded trading.