The biggest fear for any new trader is seeing a single bad trade wipe out their entire account. It feels like the market is constantly in control until you learn the one skill that puts the power back in your hands. That skill is how to Calculate Lot Size in Forex, the foundation of smart risk management and long-term trading success.

In this guide, H2T Funding breaks down the process clearly and practically, helping you protect your capital, avoid unnecessary losses, and trade with confidence. Keep reading to learn how the right lot size can transform your entire trading strategy.

Key takeaways:

- Calculating lot size in Forex is critical for managing risk, determining trade volume, and ensuring sustainable trading success.

- Understand pip value, lot sizes (standard, mini, micro, nano), account balance, and stop loss to accurately calculate lot size.

- Risk only 1-2% of your account per trade to protect capital, using the formula: Number of Units = Maximum Risk Amount / (Stop Loss in Pips * Pip Value per Unit).

- Pip value depends on the currency pair and exchange rate (e.g., $10 for EUR/USD standard lot, $6.67 for USD/JPY at 150.00).

- Proper lot size calculation prevents over-leveraging and margin calls, ensuring responsible use of trading capital.

1. What do you need before you calculate the lot size in Forex?

Before we dive into the formulas for how to calculate lot size in Forex, let’s break down the fundamental concepts. By truly understanding these basics, you’re not just avoiding pitfalls; you’re building a solid foundation for every single trade you make.

1.1. Lot sizes: Standard, mini, micro, and nano

Lot size refers to the number of currency units you are trading. Choosing the right lot size is a critical step in managing your exposure and directly impacts how to calculate the lot size in Forex.

There are several common lot sizes:

- Standard Lot: This represents 100,000 units of the base currency. Each pip movement typically equates to $10 (for USD-quoted pairs). It’s generally for larger trading accounts.

- Mini Lot: This is 10,000 units of the base currency. A pip movement is usually worth $1 (for USD-quoted pairs). Mini lots offer more flexibility for mid-sized accounts.

- Micro Lot: Representing 1,000 units of the base currency, a micro lot’s pip value is around $0.10 (for USD-quoted pairs). This is an excellent choice for beginners or those with smaller accounts, allowing for fine-tuned risk management.

- Nano Lot: The smallest available, a nano lot is 100 units. Its pip value is approximately $0.01 (for USD-quoted pairs). This size is perfect for testing new strategies with minimal financial risk.

The most sincere advice I can offer is this: start with Micro or even Nano lots. We all make mistakes, and starting with small lots is like paying the lowest possible “tuition fee” for invaluable real-world experience and confidence.

1.2. Pip value: The smallest change, the biggest impact

The “pip” is the smallest unit of price movement in a currency pair. Knowing its value is essential because it directly tells you how much money you gain or lose with each price fluctuation.

The value of a single pip isn’t fixed; it changes based on the currency pair you’re trading and the size of your position. For instance, in most currency pairs, a pip is the fourth decimal place (e.g., 0.0001). For Japanese Yen pairs, it’s the second decimal place (e.g., 0.01).

To calculate pip value for a specific trade:

For JPY pairs (e.g., USD/JPY):

Pip Value = (0.01 / Exchange Rate) * Lot Size (in units)

If you trade a standard lot (100,000 units) of USD/JPY at 150.00, your pip value would be: (0.01/150.00)*100,000=$6.67.

For non-JPY pairs, the calculation depends on the position of the USD in the currency pair (assuming your account is in USD):

- Case 1: USD is the quote currency (listed second), e.g., EUR/USD, GBP/USD, AUD/USD. This is the most common scenario. The pip value in USD is fixed and does not depend on the exchange rate.

- Formula: Pip Value = 0.0001 * Lot Size (in units)

- Example: For a standard lot (100,000 units) of EUR/USD, the pip value will always be: 0.0001 * 100,000 = $10.

- Case 2: USD is the base currency (listed first), e.g., USD/CHF, USD/CAD. In this case, the pip value in USD fluctuates with the exchange rate.

- Formula: Pip Value = (0.0001 / Exchange Rate) * Lot Size (in units)

- Example: If you trade a standard lot (100,000 units) of USD/CHF at an exchange rate of 0.9100, the pip value would be: (0.0001 / 0.9100) * 100,000 ≈ $10.98.

Many new traders overlook this difference, only to get confused when their end-of-day profit or loss figures don’t add up as expected. Taking a few extra minutes to master the calculation for each type of pair will save you from this unnecessary confusion and allow you to trade with much more confidence.

1.3. Account balance & account currency: Your capital base

Your account balance isn’t just a number; it’s your entire foundation, the capital that empowers you to chase your goals. This figure is the starting point for determining your maximum allowable risk, and it’s a powerful one.

Equally important is understanding your account currency. Whether your account is in USD, EUR, or another currency, this will be the anchor for your calculations. Every single risk you take, every strategic move you make, will be built upon this base. Embrace it, because it’s the key to making every calculation count and every trade a step forward.

1.4. Stop loss (SL): Your safety net – defined in pips

A stop loss is more than just a predetermined price level; it’s your ultimate guardian, the line in the sand that protects you from disaster. It’s your unwavering safety net, designed to strictly limit potential losses on any single position so you can trade with confidence, not fear.

The distance of your stop loss from your entry price, measured in pips, is a crucial input for how to calculate lot size in Forex. Remember this simple truth: A wider stop loss demands a smaller lot size to keep your risk in check, while a tighter stop loss allows you to trade a larger size with the same peace of mind. It’s all about balancing risk with reward.

Treat this as an unbreakable, non-negotiable vow to yourself: Always, without fail, define your stop loss before you even think about entering a trade. The market can be wild and unpredictable, but your stop loss is the one safety net that stands between you and those devastating shocks, ensuring you live to trade another day.

Read more:

2. The definitive formula: Step-by-step how to calculate lot size in Forex

This section will guide you through the precise steps to calculate the lot size in Forex. This is where theoretical knowledge transforms into practical application, empowering you to manage your risk with confidence.

2.1. Step 1: Define your risk tolerance (the golden rule of trading)

The very first step in understanding how to calculate lot size in Forex trading is to face a powerful question: how much are you truly willing to risk to achieve your goals? This isn’t just a number; it’s a profound act of self-discipline, a fundamental principle of sound money management that sets you up for victory.

I always advocate for the percentage method because it’s the smart, confident way to trade. This involves deciding what small, manageable percentage of your total trading account balance you are prepared to put on the line for one specific trade. Most seasoned traders, the ones who consistently win, recommend risking no more than 1-2% of their total capital per trade.

For example, if your trading account holds a strong $10,000 and you decide to risk a disciplined 1%, your maximum acceptable loss for that trade is just $100. This small, controlled risk allows you to trade without fear, knowing your capital is protected.

The formula for this is straightforward and empowering:

Maximum Risk Amount ($) = Account Balance ($) * Risk Percentage (%)

From my observations, the biggest mistake new traders make is getting greedy, risking too much on a single trade, and watching their hopes disappear in an instant. But true success in trading isn’t about chasing huge, infrequent gains; it’s about the quiet, powerful consistency of sound risk management that builds wealth over time.

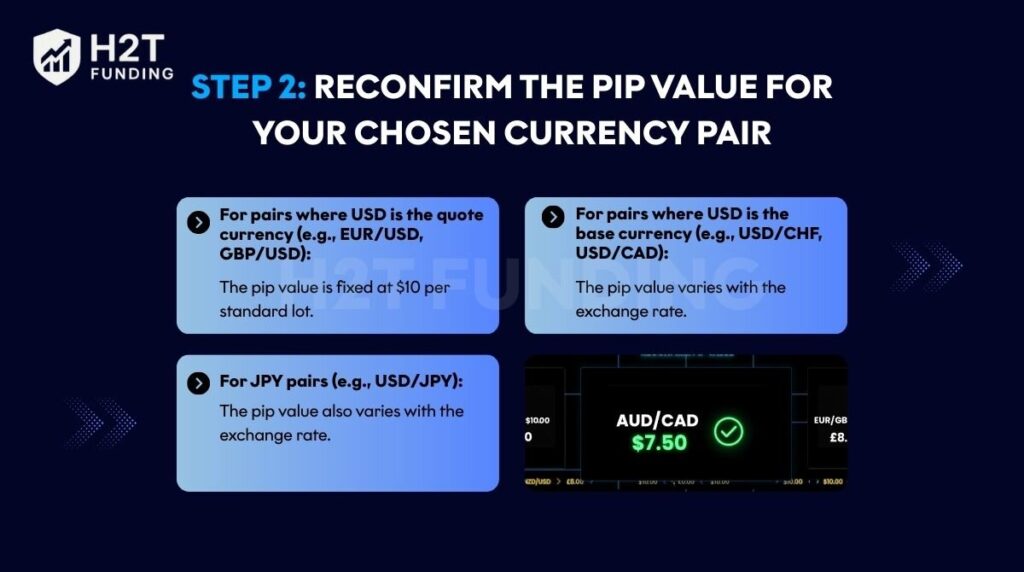

2.2. Step 2: Reconfirm the pip value for your chosen currency pair

As we analyzed in detail in section 1.1, the value of a pip isn’t just a random number; it’s the financial heartbeat of your trade, and it varies depending on the currency pair. In this step, you get to become the master of your destiny by reconfirming the correct value for the pair you’re about to conquer.

Let’s quickly summarize the pip value for a standard lot (100,000 units), assuming your account is in USD:

- For pairs where USD is the quote currency (e.g., EUR/USD, GBP/USD): The pip value is fixed at $10 per standard lot.

- For pairs where USD is the base currency (e.g., USD/CHF, USD/CAD): The pip value varies with the exchange rate. For example, with USD/CHF at 0.9100, the pip value is about $10.98 per standard lot.

- For JPY pairs (e.g., USD/JPY): The pip value also varies with the exchange rate. For example, with USD/JPY at 150.00, the pip value is about $6.67 per standard lot.

Reconfirming the correct pip value is vital for the calculation in Step 4.

2.3. Step 3: Determine your stop loss in pips

Your stop loss isn’t just a point on a chart; it’s your tactical retreat, the pre-planned escape route that saves your capital. This value is the result of your disciplined trading strategy and sharp technical analysis, not the whim of your emotions. It’s the one thing that gives you the power to walk away from a bad trade with your account and your sanity intact.

To calculate your stop loss in pips, simply find the difference between your entry price and your stop loss price. For instance, if you enter a EUR/USD long trade at 1.0750 and decide to place your stop loss at 1.0700, your stop loss distance is 50 pips (1.0750 – 1.0700 = 0.0050).

This step is non-negotiable; it’s your most important rule. I always emphasize that having a clearly defined stop loss before you even consider entering a trade is the fundamental principle that protects your capital. It is your ultimate defense, ensuring that no matter what the market throws at you, you are prepared.

2.4. Step 4: Plug it all in! The lot size calculation formula

Now that you have all the necessary components, you can precisely calculate the lot size in Forex. This formula will tell you the exact number of currency units you should trade to match your predefined risk.

Now it’s time to plug it all in! The core formula to determine the exact number of currency units you should trade is:

Number of Units to Trade = (Maximum Risk Amount ($) / (Stop Loss in Pips * Pip Value per Unit))

In this formula, the “Pip Value per Unit” is simply the value of one pip for a single unit of currency (for example, $0.0001 for most non-JPY pairs, or $0.01 for JPY pairs). Once you have the “Number of Units to Trade,” you just convert this into standard, mini, or micro lots.

Let’s walk through a practical example to solidify your understanding of how to calculate lot size in Forex:

Scenario:

- Account Balance: $5,000

- Risk Percentage: 2%

- Maximum Risk Amount: $5,000 * 0.02 = $100

- Currency Pair: GBP/USD

- Stop Loss: 60 pips

- Current GBP/USD Rate: Let’s assume 1.2500 (for calculation purposes)

Calculation:

- Pip Value per Unit (for GBP/USD): Since GBP/USD is a non-JPY pair, 1 pip for 1 unit of currency is $0.0001.

- Number of Units to Trade: Number of Units = $100 / (60 pips * $0.0001/pip) = $100 / $0.006 = 16,666.67 units

- Convert to Lot Size:

- Since 1 Standard Lot = 100,000 units, and 1 Mini Lot = 10,000 units, and 1 Micro Lot = 1,000 units:

- 16,666.67 units is approximately 0.16 Standard Lots or 1.6 Mini Lots or 16.67 Micro Lots.

Interpretation:

Because most trading platforms don’t allow fractions of a micro lot (e.g., 0.67 of a micro lot), you would typically round down to the nearest tradeable lot size. In this case, you would likely trade 16 micro lots (16,000 units). Rounding down ensures you don’t inadvertently over-risk.

My practical advice here is always to err on the side of caution and round down your calculated lot size. This small adjustment ensures you consistently stay within your predetermined risk parameters, which is vital for long-term trading health.

3. Tools and best practices for calculating lot size in Forex

While manually calculating lot size is crucial for truly understanding the mechanics, various tools can significantly streamline this process. Especially when you’re managing multiple trades, efficiency and accuracy become paramount.

3.1. Leveraging Forex position size calculators

These handy tools automate the entire lot size calculation process. You simply input your account balance, the percentage of risk you’re comfortable with, your stop loss in pips, and the currency pair you intend to trade.

The benefits of using such calculators are clear:

- Speed: They provide instant results, saving you valuable time.

- Accuracy: They minimize the risk of human error that can occur with manual calculations.

It’s important to note that while these tools are incredibly helpful, I always recommend cross-referencing their results with your own manual calculations, especially when you’re first getting started or if you’re using a tool from an unfamiliar source. This practice builds confidence and reinforces your understanding.

3.2. Integrating lot size into your trading plan

Calculating lot size shouldn’t be a one-time event; it needs to be a consistent part of your trading routine. This disciplined approach is a cornerstone of effective risk management.

Consider these best practices:

- Consistency is key: Make lot size calculation an integral part of your pre-trade checklist for every single trade.

- Dynamic risk adjustment: Your account balance will fluctuate with wins and losses. Your risk tolerance might also evolve. Recalculate your lot size regularly to reflect these changes.

- Journaling: Always document the lot size for each trade in your trading journal. This provides invaluable data for post-trade analysis, helping you understand your risk exposure over time and identify patterns.

From my experience, creating a robust trading plan that explicitly outlines your risk management rules, including how you’ll determine lot size for every trade, is a game-changer. It removes emotion from the equation and fosters disciplined execution.

3.3. The relationship between lot size, leverage, and margin

Understanding how to calculate lot size in Forex also requires acknowledging its relationship with leverage and margin. These three concepts are intertwined in how your trading capital is managed.

Leverage, while allowing you to control larger positions with a smaller amount of capital, is a double-edged sword. It amplifies both potential profits and potential losses. A precise lot size calculation helps you use leverage responsibly, avoiding the trap of over-leveraging your account.

Margin refers to the amount of money your broker requires to open and maintain a position. Larger lot sizes naturally demand more margin. If your account equity drops below the required margin level, your broker might issue a “margin call” or even automatically close your positions to prevent further losses. Proper lot size calculation is your first line of defense against such scenarios.

Many new traders, I’ve observed, tend to focus solely on leverage for its potential to magnify gains, often overlooking its amplified risk. My personal belief is that a prudent lot size calculation, combined with a sensible leverage ratio, is the true path to longevity and consistent profitability in trading.

See more blogs in the same category here:

4. Common questions about how to calculate lot size in Forex (FAQs)

The primary formula for determining the number of units to trade, which then translates into your lot size, is: Number of Units to Trade = (Maximum Risk Amount ($) / (Stop Loss in Pips * Pip Value per Unit)) This formula allows you to calculate the exact number of currency units you should trade to align with your predefined risk tolerance and stop loss. You then convert these units into standard, mini, or micro lots, depending on your broker’s offerings.

A 0.01 lot size typically refers to a Micro Lot, which represents 1,000 units of the base currency. For most currency pairs quoted against the USD (e.g., EUR/USD), a 0.01 lot means each pip movement is worth approximately $0.10. This small lot size is an excellent starting point for new traders, allowing for real-market practice with minimal financial exposure.

For a very small account like $10, you would almost exclusively trade Nano Lots (100 units) if your broker offers them. For example, risking 1% of a $10 account ($0.10) with a 10-pip stop loss on a non-JPY pair (pip value per unit $0.0001) would yield 100 units. This directly translates to 1 Nano Lot. This highlights the importance of matching your lot size to your account equity for meaningful risk management.

“Total lot size” usually refers to the aggregate trading volume of all your currently open positions. While you calculate each individual position’s lot size using the formula discussed, you would then sum these up if you need to know your overall market exposure. However, it’s generally more critical to manage the lot size per trade based on your individual risk tolerance rather than focusing on a ‘total’ figure. Always prioritize managing risk on a per-trade basis.

5. Conclusion

Ultimately, the goal isn’t just to learn a formula. The real transformation happens when you realize that knowing how to calculate lot size in Forex is what separates methodical trading from pure gambling. It gives you control, turns risk into a manageable number, and lets you build a real, sustainable trading career.

This belief in disciplined, knowledge-based trading is precisely why we built H2T Funding. Our entire mission is to provide you with the tools and insights to navigate the trading market effectively. If you’re ready to take your knowledge to the next level, dive into our Prop Firm & Trading Strategies section for advanced insights