Are you tired of constantly living Paycheck-to-Paycheck and always worrying about upcoming bills?

If you’re trying to manage your expenses on a low income (roughly $1,500–$2,500 per month), you need a clear, actionable plan, not just generic advice. That’s exactly what this guide on how to budget on a low income will help you achieve.

The good news: Budgeting is not about restriction; it’s about empowering you to take control of your finances. I’ve been in your shoes, and with a simple structure, I managed to break free from financial stress.

Key takeaways:

- Budgeting on a low income starts with knowing your total monthly income, including salary, side gigs, and government support.

- Essential expenses like rent, utilities, groceries, and transportation should always be prioritized before anything else.

- Non-essential spending (subscriptions, takeout, impulse buys) must be reduced or capped to free up funds for savings or debt.

- Tracking every expense, even small ones, increases awareness and helps catch wasteful spending habits.

- The 70/20/10 budgeting method (needs/savings/wants) offers a simple structure for managing limited income effectively.

1. What you’ll need to budget on a low income

Before diving into the action plan, here’s what you’ll need to get started with budgeting on a low income:

- Bank statements or pay stubs

- A notebook or free app like Goodbudget, Spendee, or Money Manager

- A simple Google Sheets template (plenty of free options online)

- A pen or your phone to jot down small daily expenses

Alternatives:

If apps feel overwhelming, start simple with a notebook. Personally, I love using Google Sheets. It’s simple, visual, and doesn’t cost a thing.

2. How to budget on a low income: Step-by-step with examples

I know how stressful it can be to feel like there’s never enough. But budgeting on a low income isn’t about depriving yourself; it’s about giving your money a clear purpose.

And, these practical steps aren’t just for individuals; they can apply to couples or even larger households. If you’re supporting more than just yourself, here are some essential budgeting tips for low-income families that still follow the same core principles of clarity, consistency, and cutting non-essentials.

Step 1: Write down all income sources

Goal: Know your total available monthly income so you can plan realistically.

What to do:

The first step in how to budget on a low income is knowing exactly what you earn. This includes:

- Net salary

- Supplemental income through freelancing or side jobs

- Government support (e.g., SNAP – Supplemental Nutrition Assistance Program, SSI – Supplemental Security Income)

- Family support

Add everything up to get your monthly income baseline.

Example:

- Full-time salary: $1,600

- Freelance (Canva design gigs): $250

- SNAP assistance: $150

Total monthly income: $2,000

Expert insight:

According to the Consumer Financial Protection Bureau (CFPB), “The first place to start is getting a complete picture of where your money comes from.”

This emphasizes the importance of understanding all income sources when creating a budget.

Tip: If your income fluctuates, base your budget on the lowest month.

Step 2: Write down your essential costs

Goal: Identify your non-negotiable living expenses.

What to do:

Start by listing your absolute must-pay costs; these are the things you can’t live without. In personal finance, this is called covering your four walls: food, utilities, shelter, and transportation. These should always be your top priority before planning for anything else.

Your essentials list might include:

- Rent or mortgage

- Utilities (electricity, water, internet, phone)

- Groceries (not dining out, only basic food needs)

- Transportation (fuel, public transit fares)

- Healthcare (medications, insurance premiums)

Look back at your last 2–3 months of spending to get an average. Then, set these as fixed categories in your budget.

Remember: If the four walls aren’t secure, everything else can wait.

View more:

Step 3: Limit spending on non-essentials

Goal: Free up money for savings and debt reduction.

What to do:

- Review your bank statement and mark:

- Subscriptions (Netflix, Spotify, Amazon Prime, YouTube Premium,…)

- Dining out, coffee runs, and fast food

- Impulse buys (Amazon, Etsy, or other e-commerce platforms)

Then:

- Stop paying for subscriptions you no longer need.

- Limit “fun money” spending to a fixed weekly amount.

Tip: Follow the “48-hour rule” — wait 2 days before buying anything non-essential.

Step 4: Track every expense – Even the small ones

Goal: Build spending awareness and catch waste.

What to do:

Use some apps like:

| Tool | Key Features | Free or Paid | Pros | Cons |

|---|---|---|---|---|

| Goodbudget | Envelope-style budgeting, manual input | Free (limited), Paid (more envelopes) | Simple, beginner-friendly, no bank linking | Manual entry can be time-consuming |

| Spendee | The free version has limited features | Free, Paid Premium | Visually appealing, helpful insights | Free version has limited features |

| Money Manager (Realbyte) | Offline tracking, detailed stats, cash-focused | Free, Paid (ad-free + backup) | Great for cash users, no internet required | Interface feels dated, no bank sync |

| Google Sheets | Fully customizable spreadsheet-based budgeting | Free | Flexible, works offline, no app needed | Requires spreadsheet skills, no automation |

Remember: Even small purchases like a $1 coffee add up. Tracking every expense keeps you accountable.

Tip: Snap a photo of receipts and enter once a week if daily tracking is too much.

Read more:

Step 5: Categorize and prioritize needs vs. wants

Goal: Separate survival from comfort to focus on what truly matters.

What to do:

Create a simple two-column table:

| Needs | Wants |

|---|---|

| Rent | Netflix |

| Groceries | Takeout/dining out |

| Utilities | Beauty subscriptions |

Categorize and Prioritize Needs vs. Wants

Ask yourself: “If I don’t buy this, will it affect my health, safety, or work?”

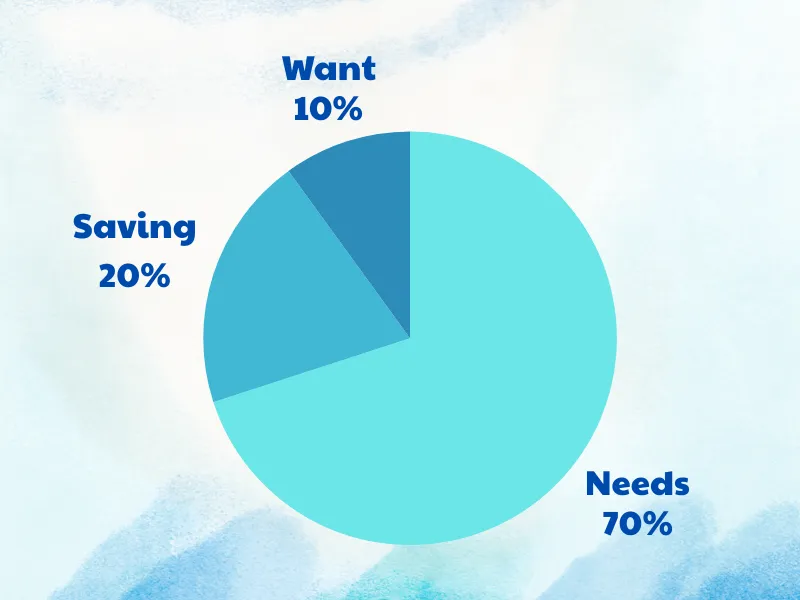

Step 6: Set spending limits by category (70/20/10 Rule)

Goal: Set clear boundaries to avoid overspending.

Budgeting model:

- 70% Needs: Essentials like rent, bills, groceries

- 20% Savings or Debt Payoff

- 10% Wants: Fun money

Example with $2,000 income:

- Needs: $1,400

- Saving/Debt: $400

- Wants: $200

Tip: Use different bank accounts or e-wallets for each category to avoid mixing funds.

Step 7: Review and adjust weekly

Goal: Keep your budget responsive and stress-free.

What to do:

- Block 15 minutes every Sunday.

Check your budget sheet or app. - Ask yourself:

- Did I overspend?

- What categories went well?

- What needs adjusting?

Tip: Think of it as a quick check-in with yourself, just like a mini team meeting.

3. Priority order of budget categories

When your income is limited, budgeting isn’t just about tracking numbers; it’s about survival and stability. To make the most of every dollar, it’s important to prioritize your spending in a smart, structured way.

Here’s a detailed breakdown of the recommended priority order for budget categories:

3.1. Essential living expenses (The four walls)

These are the core costs that keep you safe, sheltered, and functioning. Without these, everything else becomes harder.

- Housing: Rent or mortgage must be your top priority. Losing your home is the fastest path to financial instability.

- Utilities: Electricity, water, gas, phone, and internet. These services are crucial for basic hygiene, communication, and access to work or job searches.

- Groceries: Focus on basic, nutritious food. Skip takeout and convenience items.

- Transportation: Gas, public transport fares, or essential car expenses. You need reliable transportation to earn an income.

3.2. Health and insurance needs

After survival expenses, the next focus should be on protecting your health and reducing your risk of sudden financial setbacks.

- Health insurance premiums

- Medical co-pays, prescriptions, or critical treatments

- Essential insurance: Like auto, life, or renter’s insurance (if applicable)

Even if you’re on a tight budget, going without coverage can lead to much larger costs down the line.

3.3. Minimum debt payments

Keeping up with minimum payments helps avoid late fees, credit damage, and collections.

- Credit card minimums

- Student loan payments

- Car loans or personal loans

Strategy tip: While minimums keep your account in good standing, if you have high-interest debt, try to pay more when possible, after your essentials are covered.

3.4. Emergency fund contributions

It may seem impossible to save when money’s already tight, but even small, consistent savings matter.

- Start with a goal of $500 for emergencies like car repairs, medical needs, or job loss.

- Automate weekly transfers of $5–$10 into a separate savings account.

- Treat this like a bill: non-negotiable and regular.

A small cushion prevents small issues from becoming big financial disasters.

3.5. Long-term goals (savings, retirement, etc.)

Once you’ve stabilized the basics, start working toward your future:

- Retirement contributions (even small ones through your employer plan)

- Sinking funds for annual expenses (car registration, holidays, back-to-school supplies)

- Big goals like moving, starting a business, or further education

This helps shift your mindset from “just getting by” to “moving forward.”

3.6. Non-essential or lifestyle spending

Finally, once everything above is handled, you can allocate a small portion for personal enjoyment.

- Subscriptions (Netflix, YouTube Premium, Spotify)

- Eating out, coffee, and delivery

- Shopping, hobbies, beauty services, gifts

Tip: Give yourself a “fun money” allowance. Even $20–$50/month can satisfy the need for joy without blowing your budget.

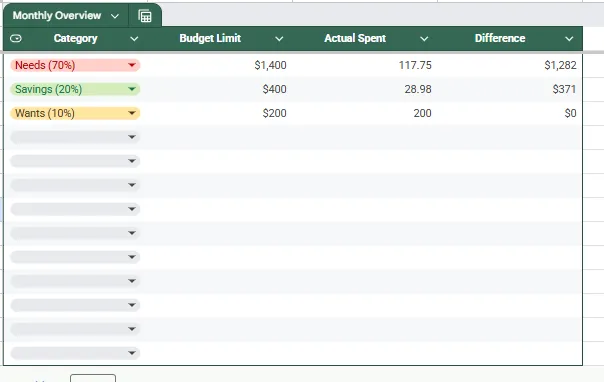

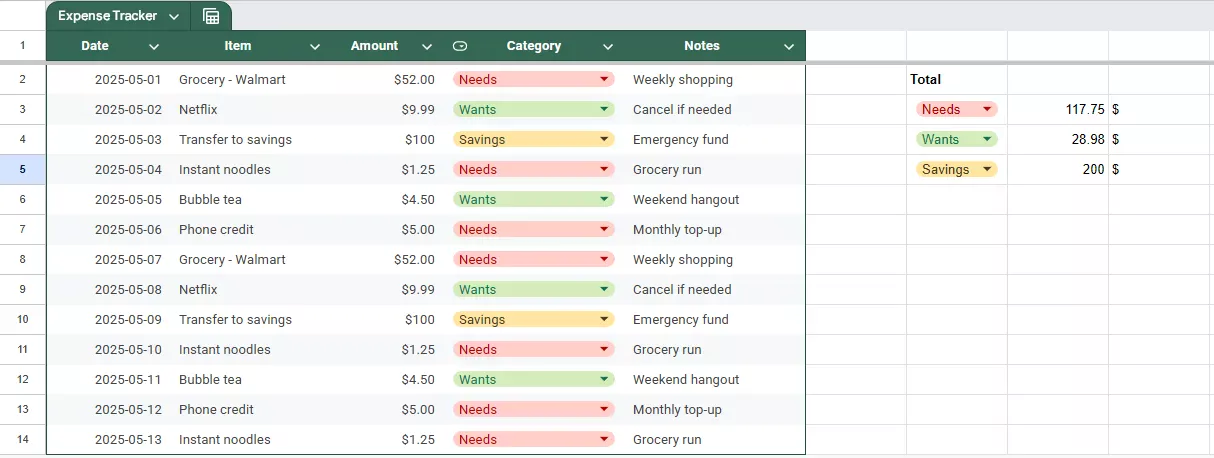

4. Google Sheets template suggestion (70/20/10 budgeting)

Here’s how you can structure your sheet:

My Simple Template, based on the 70/20/10 budgeting method, can help you manage your finances on a low income. Download the simple template for budgeting or choose one of the apps mentioned above.

5. Financial assistance programs for low-income families

If your income isn’t enough to cover basic needs, don’t hesitate to seek help. Across the U.S., there are many government and nonprofit programs that provide free or low-cost support, from food and housing to healthcare and debt advice.

Here’s a quick overview of where to find help:

| Type of support | Program name | What it offers | Monthly grocery funds, food packages, and free groceries |

|---|---|---|---|

| Food assistance | SNAP (Food stamps), WIC, local food banks | Free or low-cost medical, dental, and mental health care | FeedingAmerica.org |

| Housing & utilities | Section 8, LIHEAP, local rental aid | Rent vouchers, energy bill help, emergency housing support | Local housing authority / Benefits.gov |

| Healthcare support | Medicaid, Community Health Centers (CHCs) | Free debt help, budgeting advice, and credit education | State Medicaid office / FindAHealthCenter.hrsa.gov |

| Credit counseling | NFCC, Money Management International (MMI) | Free debt help, budgeting advice, credit education | NFCC.org / moneymanagement.org |

Tip: Search online for “[your city] + nonprofit financial assistance” or visit 211.org to find local support near you. Most services are free and confidential.

6. FAQs

Base your budget on your lowest average income over the past 3–6 months. For example, if your income ranged from $1,500–$2,200, use $1,500 as your baseline. Treat anything above that as a bonus: put 50% of the “extra” into savings or an emergency fund, and enjoy the rest guilt-free.

Aim for 10%–20% of your monthly income, but don’t stress if it’s only $10 or $15 to start. A simple rule: Save first, spend what’s left (not the other way around). Automate $5–$10 weekly to a separate savings account. Over a year, that’s $500+ without noticing. These are small but powerful examples of how to save money on a tight budget; the key is to start, no matter how small.

Absolutely. A pen and notebook or a free Google Sheets template can work just as well, sometimes even better. Try this method: Draw 3 columns: Needs / Wants / Notes Record every expense daily Review weekly and spot patterns

Focus on awareness first. Track for 14 days without judgment, just observe. Often, small leaks (snacks, bank fees, autopay charges) surface. Consider a side hustle like online gigs (e.g., Canva, Fiverr) to earn an extra $50–100/month, just enough to start saving or breathing room.

You’ll feel more in control within the first month. Visible savings may take 2–3 months.

You can download our template above, or you can search on Google; there are many spreadsheets like this on Google.

Start by listing absolute must-pays, then divide what’s left with the 70/20/10 model; even $10 saved counts.

Budgeting is planning your money before you spend it. Tracking is reviewing how closely you followed the plan.

Yes! Budgeting doesn’t mean “no fun”; it just means planned fun. Set a weekly “fun money” limit.

7. Conclusion

Learning how to budget on a low income cannot be easy, but it’s absolutely achievable. With just a notebook or a simple Google Sheet, you can build a plan that works for you. The 70/20/10 model, weekly reviews, and intentional spending will help you stress less and save more.

I’ve been in your shoes, and I can tell you, even starting with just $10 in savings is progress. Don’t wait for the perfect moment. Start this week. Start today.

Got a tip, question, or challenge to share? Drop a comment below, I’d love to hear from you.

Bookmark this guide, and if it helped, share it with someone who could use a little financial peace, too.

You can read more practical tips and personal finance guides like this in the Strategy section, and Budgeting Strategies of H2T Funding.