Have you ever had a trading idea that felt like a guaranteed winner, only to wonder if it would actually work in the real market? Jumping in without proof can turn that excitement into regret faster than you think.

That’s why knowing how to backtest a trading strategy is a skill every trader should master. It lets you see how your idea would have performed in the past, giving you the confidence to move forward with data on your side.

In this ultimate A–Z guide, H2T Funding will walk you through how to backtest a trading strategy step-by-step, explain why it matters, and show you how to read the results. By the end, you’ll be able to trade with clarity, not guesswork.

Key takeaways:

- Backtesting simulates your trading rules on past market data to evaluate strategy performance without risking real capital.

- Choose the right backtesting method: manual, discretionary, or automated, based on your skills and strategy complexity.

- High-quality historical data and clear, rule-based strategies are essential for reliable backtesting results.

- Analyze key metrics like profit factor, max drawdown, and win rate to understand your strategy’s strengths and risks.

- Use iterative backtesting combined with forward testing and scenario analysis to validate and refine your strategy before live trading.

1. What is backtesting in trading?

Before we dive into the nuts and bolts of how to perform a backtest, let’s first get a clear picture of what backtesting actually is and why it’s a game-changing habit for serious traders. When you understand its true value, you’ll see it’s not just a technical step, but a powerful way to turn uncertainty into confidence.

1.1. A simple definition of backtesting

Fundamentally, backtesting is a simulation that applies your predefined trading rules to past market data. It reconstructs the past, allowing you to see how your specific strategy would have fared against historical market movements without risking any real capital.

Think of it as putting your strategy in a time machine. You send it back to see how it would have navigated past market conditions, giving you valuable insights into its potential strengths and weaknesses.

1.2. The crucial role of backtesting for trading success

So, you understand what backtesting is, but why should you spend time doing it? It’s a fundamental question, and the answer lies in its power to transform your trading approach, making it an indispensable step for any serious trader.

Backtesting is a non-negotiable step for serious traders for several key reasons:

- Verifies viability: It provides statistical evidence on whether a strategy is likely to be profitable or not.

- Builds confidence: Trading a strategy that you have thoroughly tested helps you stick to the plan during live market pressure.

- Identifies flaws: It exposes weaknesses in your strategy, such as performing poorly in certain market types.

- Saves money: It prevents you from deploying a flawed, loss-making strategy with your hard-earned capital.

2. What are the three types of backtesting?

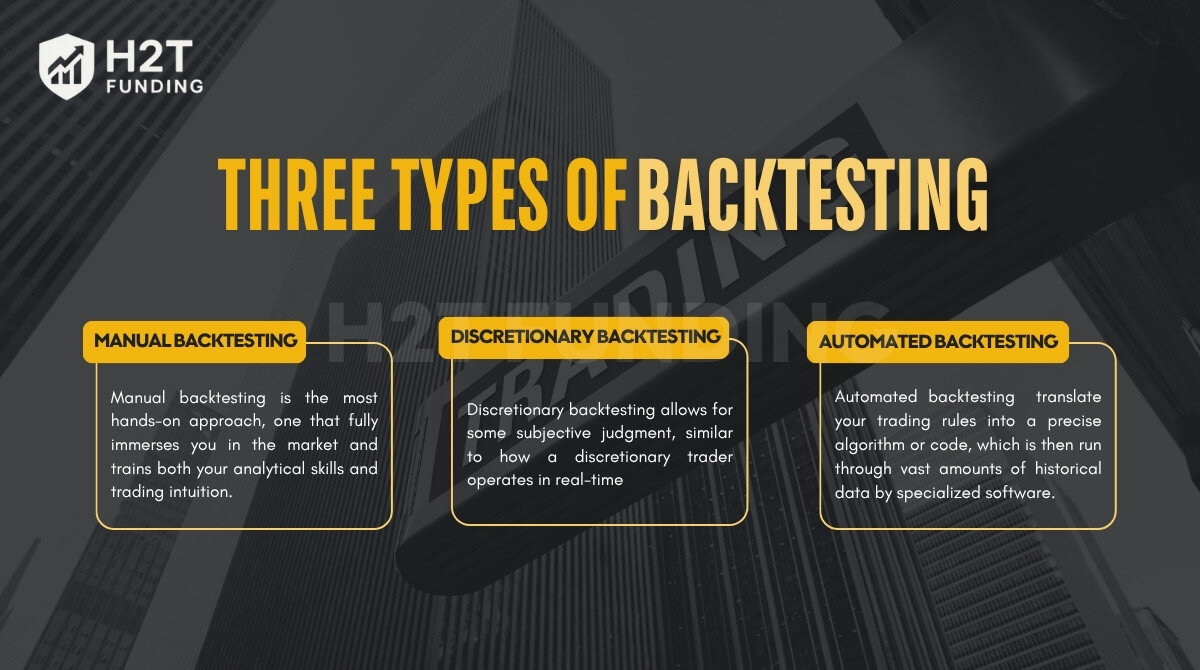

When it comes to backtesting your trading strategies, you generally encounter three primary approaches, each with its own advantages and disadvantages. Understanding these can help you choose the best method for your needs and resources.

2.1. Manual backtesting

This is the most hands-on approach, one that fully immerses you in the market and trains both your analytical skills and trading intuition. You’ll go back through historical charts, bar by bar, applying your strategy’s rules exactly as if you were trading live. Every entry and exit point is identified, every profit or loss calculated, and every result recorded in a spreadsheet.

The process is intensive, but it’s this depth of interaction that delivers the powerful insights outlined in the pros, and also explains the time demands and risks mentioned in the cons.

- Pros: It builds an incredibly deep understanding and intuition for your strategy’s behavior in different market conditions. You develop a feel for the price action and how your rules interact with it.

- Cons: It’s incredibly time-consuming and highly susceptible to hindsight bias (where knowing the future market movement influences your past decisions). It’s also prone to human error in calculations.

2.2. Discretionary backtesting

This type sits between manual and fully automated. While still using historical data, it allows for some subjective judgment, similar to how a discretionary trader operates in real-time. Instead of rigid, automated rules, you might apply your general trading principles or “feel” to past market scenarios to see if your approach would have worked.

- Pros: It can simulate the flexibility and adaptability of a human trader, which strict automated rules might miss. It’s useful for strategies that rely on pattern recognition or nuanced market interpretation.

- Cons: It’s highly subjective and even more prone to hindsight bias than manual backtesting. The results are difficult to replicate consistently, making it challenging to draw objective conclusions.

2.3. Automated backtesting

Automated backtesting is the most rigorous and scalable method. You translate your trading rules into a precise algorithm or code, which is then run through vast amounts of historical data by specialized software. The program automatically executes trades based on your coded rules and generates detailed performance reports.

- Pros: It’s fast, can test across decades of data in minutes, and is completely free from emotional bias or hindsight. The results are objective and reproducible.

- Cons: It requires either coding skills (e.g., Pine Script, MQL4/5, Python) or investment in specialized, often expensive, backtesting software. It also struggles with strategies that rely heavily on human interpretation or “feel.”

Choosing the right type depends on your strategy’s nature, your available time, and your technical skills. Many traders use a combination, perhaps manually testing an idea, then moving to automation once the rules are precise.

Read more:

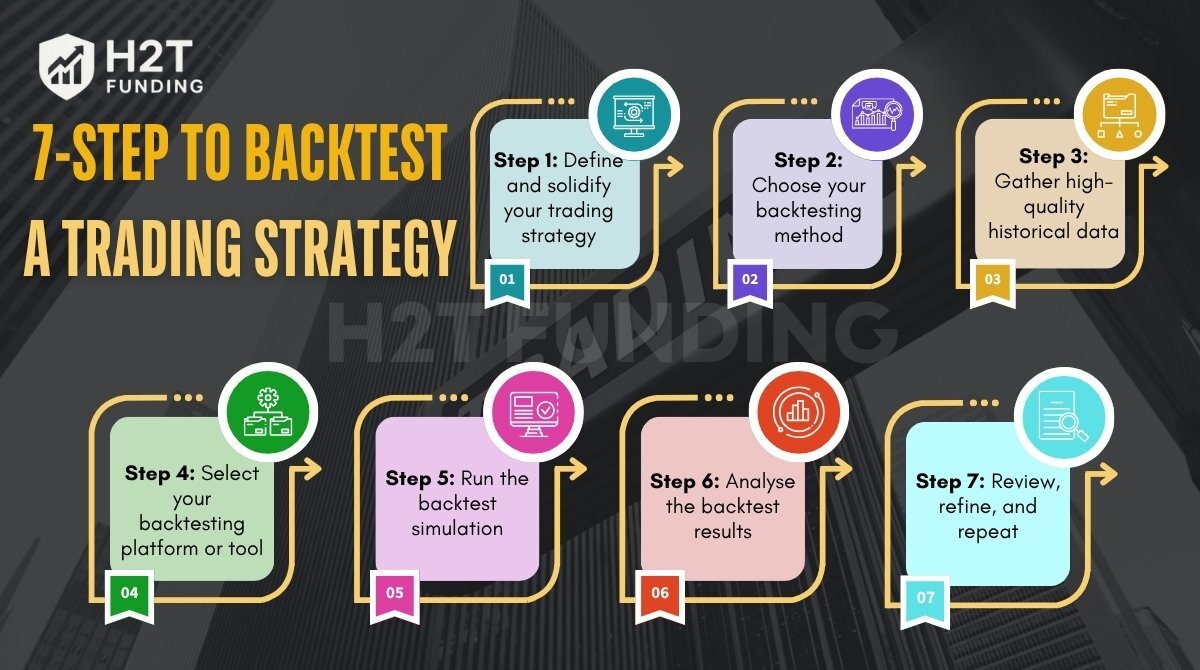

3. How to backtest a trading strategy: A 7-step practical guide

Here is a clear, step-by-step framework to effectively backtest your trading ideas from start to finish.

3.1. Step 1: Define and solidify your trading strategy

Before you can test anything, you need explicit, non-negotiable rules, the kind that keep you disciplined when emotions run high. Without them, backtesting becomes nothing more than guesswork, and unreliable results can mislead you into costly mistakes.

Your strategy must clearly define:

- Market and timeframe: Which asset will you trade and on which chart?

- Entry criteria: The precise market conditions required to initiate a trade.

- Exit rules: How you’ll lock in profits (take-profit) and cut losses (stop-loss).

- Risk management: How much capital you’re willing to put on the line per trade.

3.2. Step 2: Choose your backtesting method: Manual vs. automated

There are two main ways to conduct a backtest:

- Manual Backtesting: You manually go through historical charts bar by bar, identify trade setups based on your rules, and record them in a spreadsheet.

- Pros: Helps you develop a deep, intuitive feel for how your strategy behaves.

- Cons: Extremely time-consuming and prone to human error or bias.

- Automated Backtesting: You use software or coding to automatically apply your rules to historical data.

- Pros: Incredibly fast, can test across years of data in minutes, and eliminates emotional bias.

- Cons: May require coding skills or investment in specialized software.

3.3. Step 3: Gather high-quality historical data

The foundation of any trustworthy backtest is high-quality, accurate historical data. Inaccurate or flawed information will inevitably lead to misleading conclusions. Ensure your data source is reliable and includes the open, high, low, and close (OHLC) prices.

Most reputable brokers and charting platforms like MetaTrader 4 or TradingView offer access to extensive historical data.

3.4. Step 4: Select your backtesting platform or tool

You don’t need expensive tools to start. Your choice depends on your method:

- Spreadsheets (Excel, Google Sheets): The perfect tool for manual backtesting.

- Charting platforms: TradingView’s “Bar Replay” feature is excellent for manual testing.

- Trading platforms: MetaTrader 4 (MT4) has a built-in “Strategy Tester” for automated backtesting.

- Specialized software: Tools like NinjaTrader or Amibroker offer advanced capabilities.

3.5. Step 5: Run the backtest simulation

This is where your strategy comes to life, the exciting execution phase. Apply your rules with confidence to the historical data, whether you’re tracking trades in a spreadsheet or using an automated tool to speed up the process. Faithfully recording every single trade isn’t just a formality; it’s how you capture the full story of your strategy’s potential.

3.6. Step 6: Analyse the backtest results – what to look for

Once the test is complete, you’ll have a list of trades, but numbers alone mean nothing without interpretation. This is the moment where patterns emerge, strengths reveal themselves, and weaknesses you never noticed come to light. Treat this step like a detective examining clues; the deeper you look, the more insights you’ll uncover.

3.7. Step 7: Review, refine, and repeat

Your first backtest will rarely be perfect, and that’s a good thing. Every flaw you find is an opportunity to make your strategy stronger. Maybe your stop-loss is cutting winners too early, or your entry signal needs a sharper filter. The key is to make one small adjustment at a time, then re-run the entire backtest.

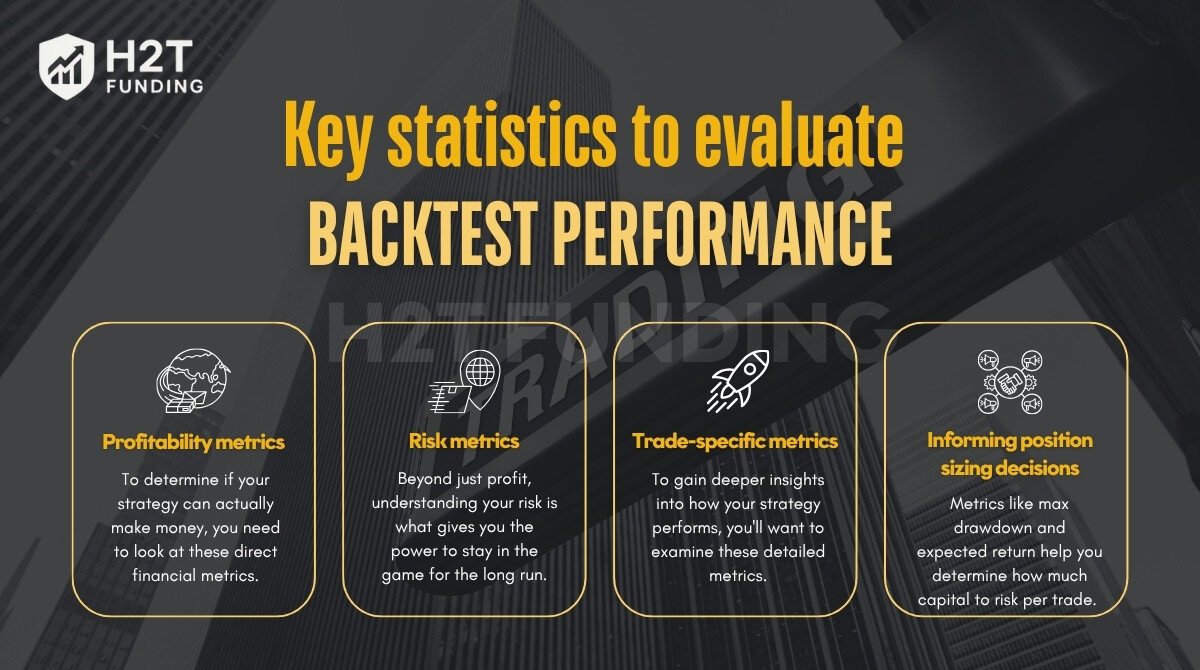

4. Key statistics to evaluate your backtest performance

Over time, I’ve learned that knowing which statistics to focus on can make all the difference between a backtest that’s merely interesting and one that truly guides profitable trading decisions. These key metrics have helped me see beyond simple profits to understand the real strengths and weaknesses of my strategies.

4.1. Profitability metrics

To determine if your strategy can actually make money, you need to look at these direct financial metrics. They will give you the overall picture of your strategy’s earning potential.

- Total net profit/loss: The bottom-line figure. Is the strategy profitable after all trades?

- Profit factor: Gross profits divided by gross losses. A value above 1.5 is often considered good.

- Expected return (expectancy): It answers the core question: ‘On average, how much money does this strategy make or lose per trade?’

4.2. Risk metrics

Beyond just profit, understanding your risk is what gives you the power to stay in the game for the long run. These risk metrics aren’t just numbers; they’re your safety net, helping you assess volatility and protect your capital with confidence. With them, you can navigate different market conditions knowing your strategy is built to endure, not just to win once.

- Max drawdown: The largest percentage drop from a peak in your account equity. This is the most important risk metric.

- Sharpe ratio: Measures your return relative to your risk. A higher Sharpe Ratio indicates better risk-adjusted performance.

4.3. Trade-specific metrics

To gain deeper insights into how your strategy performs at an individual trade level, you’ll want to examine these detailed metrics. They’ll help you understand your success rate and the efficiency of your individual trades.

- Win rate (%): A straightforward metric that measures the proportion of total trades that closed in profit.

- Average win/loss: The average monetary value of a winning trade compared to a losing trade.

- Average risk-reward ratio (RRR): The potential profit of a trade compared to its potential loss.

4.4. Informing position sizing decisions

Beyond just knowing if your strategy is profitable, backtest statistics are crucial for position sizing. Metrics like max drawdown and expected return help you determine how much capital to risk per trade.

Understanding these numbers allows you to size your positions intelligently, balancing potential profits with your capital preservation goals. This integration of data ensures your risk management is as robust as your entry/exit signals.

5. Practical guides: How to backtest on popular platforms

Your choice of platform can dramatically speed up your workflow. While the principles are the same, the execution differs.

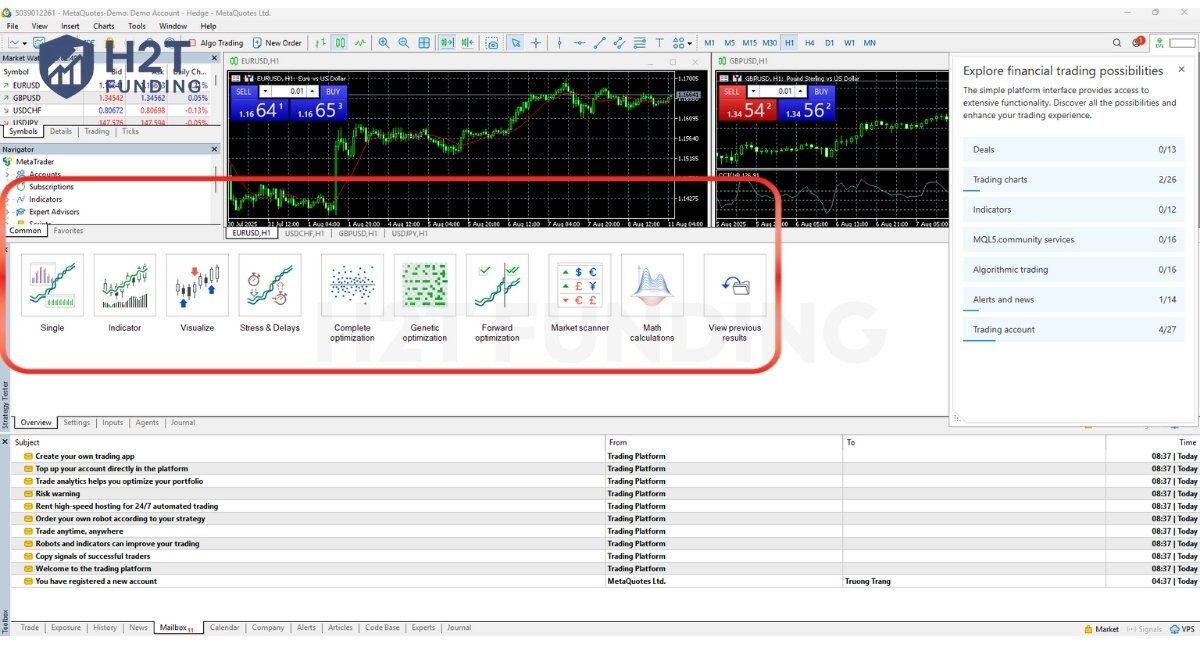

5.1. How to backtest a forex trading strategy on MetaTrader 5 (MT5)

MT5’s Strategy Tester is a built-in tool that lets you test automated trading strategies, known as Expert Advisors (EAs). It allows you to simulate how your strategy would have performed on past market data.

To backtest a strategy on MT5, follow these steps:

Step 1: Open the strategy tester

In MT5, press Ctrl + R or go to the View menu and select Strategy Tester. The window will appear at the bottom of your screen.

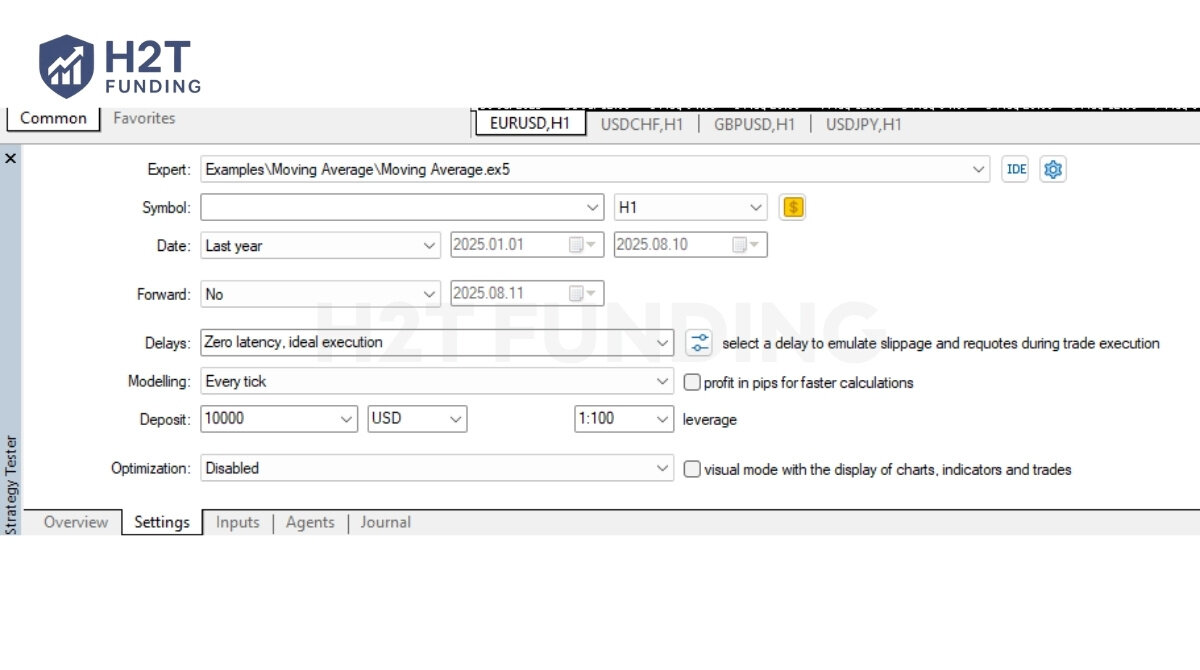

Step 2: Configure your settings

Here, you will customize the parameters to suit your desired strategy and backtest data.

- Expert advisor: Select the EA you want to test from the dropdown list.

- Symbol: Choose the currency pair you want to backtest (e.g., EURUSD).

- Model: Select the testing method. “Every tick” is the most accurate option but also the slowest.

- Period: Choose the timeframe that matches your strategy.

- Date: Define the specific date range for your backtest.

- Visual mode: Check this box if you want to see the trades visually on a chart as the test runs.

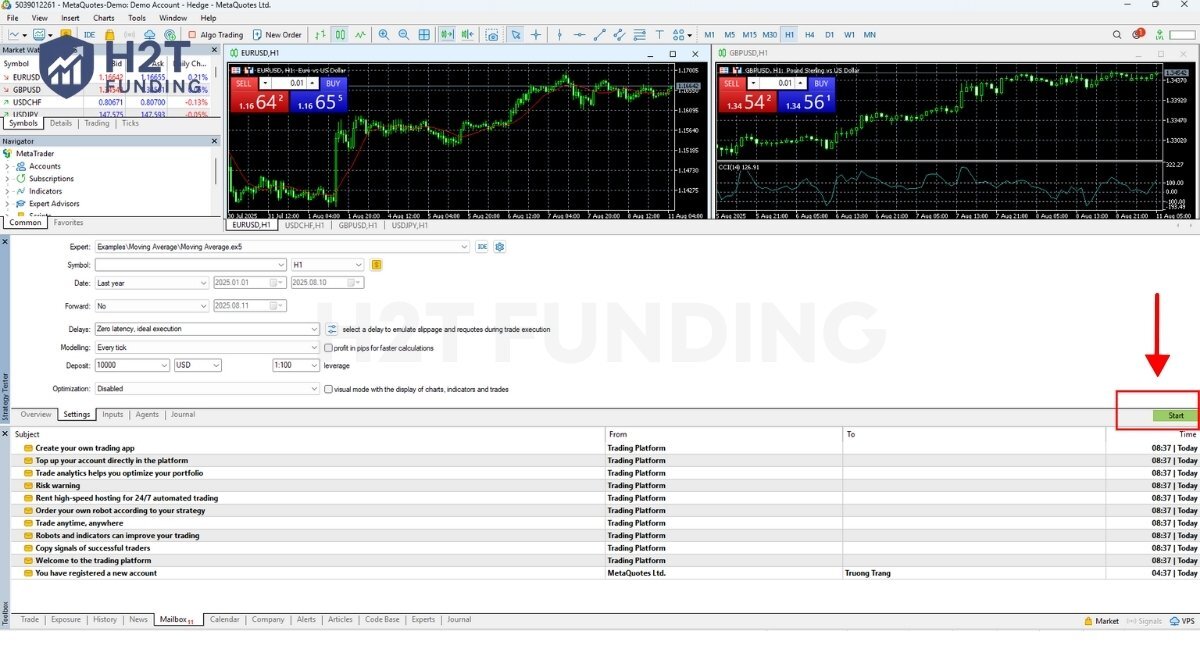

Step 3: Run the backtest

Once all settings are in place, click the Start button. MT5 will begin the simulation and process the historical data.

Step 4: Analyze the results

Review the detailed reports in the Results, Graph, and Journal tabs to evaluate your strategy’s performance, profitability, and drawdown.

A crucial tip: The quality of your backtest depends heavily on the historical data you import. For serious, confidence-boosting analysis, many traders use 1-minute or tick data to achieve an impressive 99.9% modeling quality.

5.2. How to backtest on TradingView

TradingView gives you two main ways to backtest a strategy. You can choose the method that fits your goal: manual testing to sharpen your skills or automated testing for quick data analysis.

This is the best way to practice making trading decisions. The Bar Replay feature hides the current price data and lets you play through historical price action one bar at a time, just as if it were happening live.

Step 1: Open Bar Replay: On the top toolbar of your chart, click the Bar Replay icon (it looks like a rewind button).

Step 2: Select a start point: Your cursor will change. Click on the bar where you want to begin backtesting. All subsequent bars will disappear.

Step 3: Play the chart: Use the playback controls (Play/Pause, Forward) to move through the chart bar by bar. This allows you to make buy or sell decisions without knowing the outcome, which helps reduce hindsight bias.

5.3. How to backtest on ProRealTime

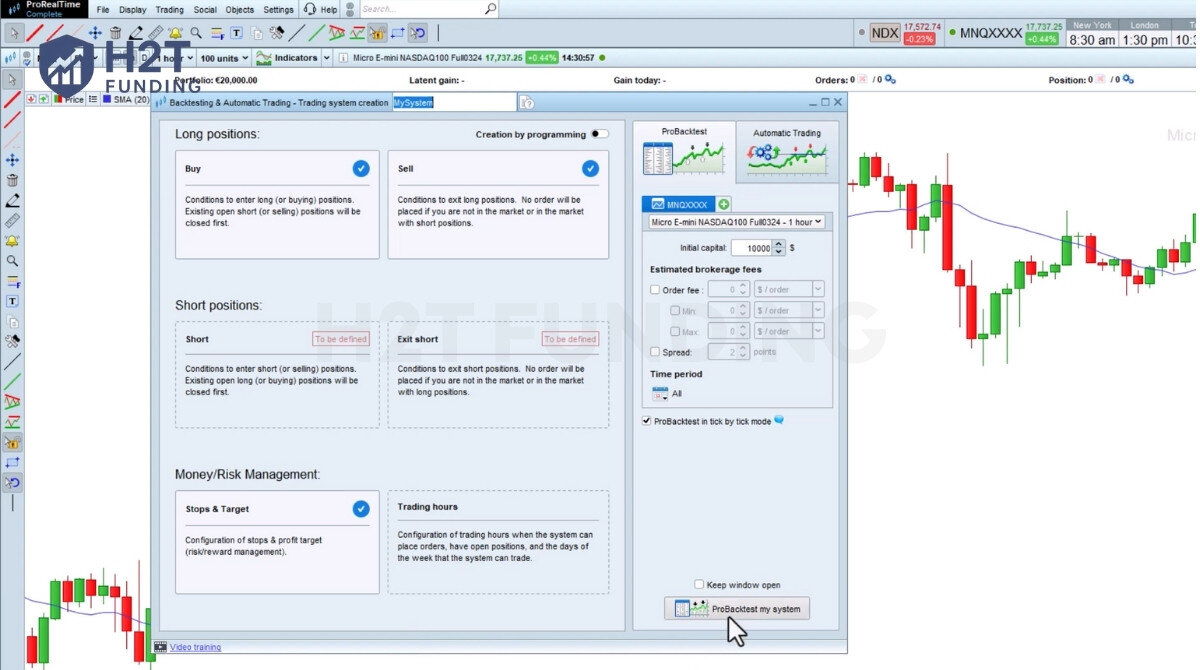

ProRealTime’s powerful ProBacktest module is a major advantage for traders who want to test their strategies without coding. The platform uses a user-friendly interface with dropdown menus to define your rules and generate detailed performance reports.

Here’s how to backtest a strategy using ProRealTime:

Step 1: Open the trading system creation window

- Open the chart of the financial instrument you want to test.

- Click the “Trading Systems” icon at the top of the chart.

- Select the “ProBacktest & Automatic Trading” tab.

Step 2: Create or select your system

- If you have an existing system, select it from the list.

- If not, you can create a new one without programming by using the “Assisted creation” feature to set up your rules and conditions.

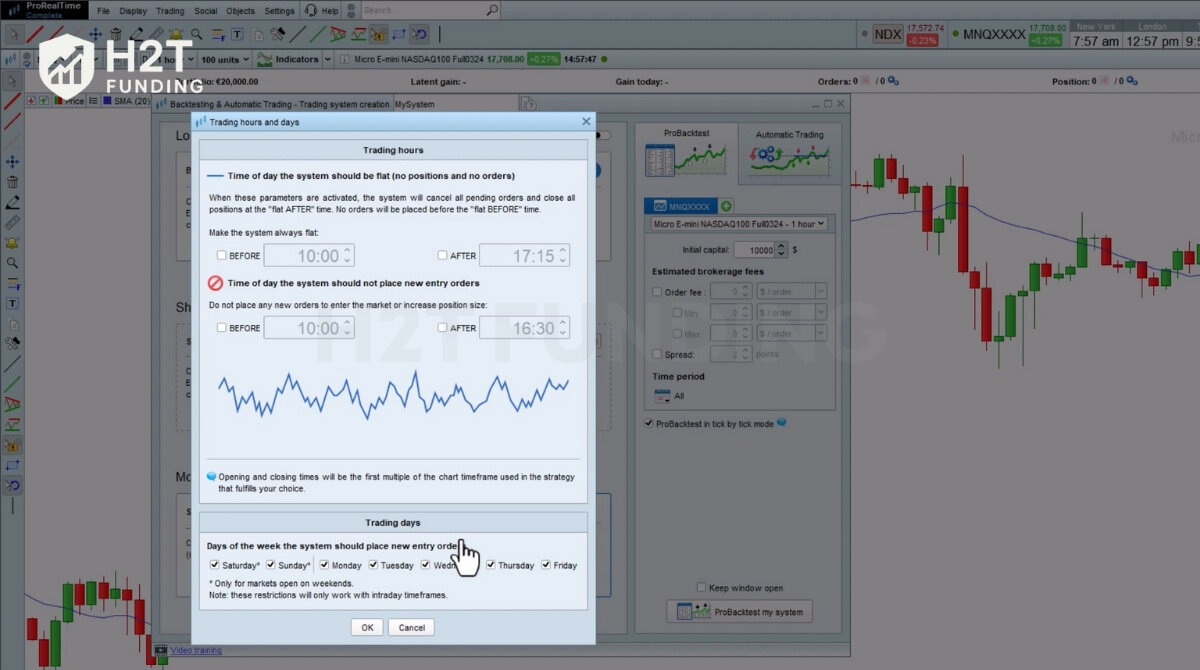

Step 3: Define backtesting parameters

- In the “ProBacktest” tab, enter your initial capital.

- Specify your brokerage fees and timeframe for the test.

- Define the date range you want to backtest over.

Step 4: Run the backtest

Once all settings are in place, click the “ProBacktest my system” button to launch the simulation.

Step 5: Analyze the results

After the backtest is complete, the platform will generate a detailed report. Review the equity curve, position history, and a full statistical report to evaluate your strategy’s performance, profitability, and risk.

View more:

6. The benefits vs. the inherent risks of backtesting

Backtesting is a powerful tool, one that can transform a good trading idea into a strategy you trust. Like any tool, it has its strengths and weaknesses, but that’s what makes mastering it so rewarding. By understanding both the advantages and potential pitfalls, you equip yourself to use backtesting effectively and unlock its full potential for your trading success.

6.1. Key benefits summarized

Before diving into the risks, let’s quickly reiterate why backtesting is so valuable. These core benefits highlight its essential role in a trader’s development.

- Risk-free strategy validation

- Data-driven optimization

- Builds psychological discipline and confidence

6.2. Common pitfalls and how to avoid them

From my own experience, backtesting can feel incredibly rewarding, but it can also trick you if you’re not careful. Early in my trading journey, I made the mistake of trusting a “perfect” backtest, only to watch the strategy fail in live conditions.

That’s when I learned that being aware of common pitfalls isn’t just good practice, it’s essential for getting results you can actually trust in the real market.

- Over-optimization (curve fitting): I once kept tweaking my rules until the historical chart looked flawless. The problem? It was flawless only for the past. When I took it live, it fell apart. Keep your rules simple and logical so they work in different market conditions.

- Hindsight bias: In manual backtests, it’s tempting to skip a losing trade because you “know” what happens next. I’ve been guilty of this too, and it made my results overly optimistic. Follow your rules as if you were trading live, no exceptions.

- Ignoring transaction costs: The first time I factored in spreads, commissions, and slippage, my profitable strategy turned barely breakeven. Always include these costs so your results reflect reality, not fantasy.

7. The next steps: Beyond backtesting

A successful backtest is always an exciting milestone for me; it’s that moment when I can see my idea actually has potential. But I’ve also learned the hard way that this isn’t the finish line; it’s just the launchpad. In the past, I jumped straight from a strong backtest into live trading, only to realize there were still gaps in my validation process.

Now, before I commit any real capital, I make sure to take those extra steps to fully test my strategy so I can trade with confidence, not just optimism.

7.1. Comparing backtesting vs. forward testing vs. scenario analysis

To fully validate your strategy, you need to look beyond just historical data. Each testing method gives you a new lens to see your strategy’s potential and resilience:

- Backtesting: Uses past data to see what would have happened.

- Forward performance testing (paper trading): Trade the strategy in real time with a demo account to confirm results without risking capital.

- Scenario analysis: Stress-test your strategy against hypothetical “what-if” market events to ensure it holds up under pressure.

7.2. Out-of-sample and forward testing: The bridge to live trading

A successful backtest is just the first step. To truly validate your strategy, you need to prove its robustness on unseen data.

- Out-of-sample testing: After developing your strategy on a specific historical period (in-sample data), test its exact rules on a new, completely separate block of historical data (out-of-sample data). If performance drops significantly, your strategy might be over-optimized (curve-fitted) to the initial data.

- Walk-forward analysis: This advanced technique takes out-of-sample testing a step further. You optimize your strategy on an initial data segment, then test it on the next segment of unseen data. This process is repeated sequentially, simulating how you’d adapt and re-optimize your strategy over time in a live market. It offers the most realistic assessment of long-term viability.

8. Frequently asked questions

8.1. What’s the best way to backtest a trading strategy?

The best way combine manual testing for intuition and automated backtesting for rigorous validation. Always follow up with out-of-sample and forward testing for real-world proof.

8.2. How to automatically backtest a trading strategy?

To auto-backtest, code your strategy’s rules (e.g., Pine Script) and run it through the platform’s “Strategy Tester” with historical data. The software handles trades and reports automatically.

8.3. Is backtesting free on TradingView?

Yes, TradingView offers free backtesting. You can manually test with “Bar Replay” on free accounts, and their Strategy Tester for automated scripts is also available, though premium features may require paid plans.

8.4. How far will TradingView let you backtest?

TradingView’s backtesting depth depends on your subscription level and asset. Free accounts have limited history, while paid plans offer significantly more data, often spanning many years or decades.

8.5. Is forward testing better than backtesting?

Neither is strictly “better”; they’re complementary. Backtesting quickly tests past data, while forward testing validates in live, real-time conditions, including psychological pressure. Both are essential.

8.6. How many times should I backtest a trading strategy?

Backtest iteratively until you’re confident in its consistency and robustness. It’s about thorough validation across diverse market conditions, followed by out-of-sample and forward testing, not a fixed number of attempts.

8.7. What are the best backtesting tools if I can’t code?

You do not need to be a programmer. Your best options are manual testing with advanced charts (like TradingView’s Bar Replay) or using platforms with visual strategy builders (like ProRealTime’s ProBacktest).

8.8. Is backtesting different for stocks vs. forex vs. crypto?

The core process is universal, but the data considerations change. For stocks, you must account for dividends and splits. For forex, you must factor in variable spreads and swap fees. For crypto, you need to account for high trading fees and extreme volatility.

9. Conclusion: From data-driven insights to confident trading

Learning how to backtest a trading strategy is not just a technical exercise; it’s a fundamental shift towards becoming a professional, disciplined trader. It moves you from a world of guessing to a world of data-driven decision-making. The goal is to develop a robust system that you understand deeply and can execute with unshakeable confidence.

This process of testing, analyzing, and refining is the true work of a successful trader. It builds the foundation for long-term consistency and performance. To continue building your trading knowledge with the right strategies, expert insights, and explore more helpful articles in our Prop Firm & Trading Strategies at H2T Funding.