Understanding how does Topstep works is the first step before committing to its evaluation program. This guide also serves as a Topstep tutorial, giving you a clear roadmap from evaluation to payout and showing how Topstep does it works in practice.

Let’s break down the entire Topstep journey, from the evaluation to your first payout. H2T Funding will get into the essential details: the fees, the make-or-break rules, and how you actually get paid. The goal is to give you a clear, no-nonsense look at Topstep so you can decide if it’s the right fit for you.

Key takeaways:

- Topstep funds traders in futures by testing them first in a rules-based Trading Combine.

- The journey has three stages: Evaluation, Funded Account, and Live Payouts.

- Traders keep 100% of their first $10K profits, then 90% afterward.

- Strict rules like trailing drawdown and daily loss limits enforce discipline.

- Topstep requires compliance with rules such as consistency, minimum trading days, and no overnight positions.

- Costs include monthly Combine fees, a one-time activation fee, and live market data charges.

1. What is Topstep?

Topstep is a proprietary trading firm built around the idea of helping traders grow without putting their own savings at risk. At its core, Topstep explained means you begin by practicing in a simulated trading environment and proving you can meet profit targets while staying within risk limits. Once you do, you earn access to a Live Funded Account backed by the firm’s money.

Founded in 2012 in Chicago, USA, Topstep has grown into one of the most established names in the futures trading space. According to company reports, it has awarded funding to tens of thousands of traders across more than 140 countries, with 10,000+ traders calling up to live. The firm emphasizes trader discipline, risk management, and consistent performance statistics over quick wins, making it a trusted option for serious traders.

2. How does Topstep make money

Topstep’s business model is straightforward. The company earns revenue through monthly subscription fees for its Trading Combine and a profit split from funded traders. This ensures the firm benefits both when traders are practicing and when they succeed in live accounts.

The Trading Combine subscription is the main source of revenue. Fees vary by account size and are billed every 30 days until the trader cancels or passes the evaluation:

- $50,000 Combine: $49 per month

- $100,000 Combine: $99 per month

- $150,000 Combine: $149 per month

In addition, once you pass and move into an Express Funded Account, there is a one-time $149 Activation Fee applied to every account size. This is a fixed cost that unlocks your live trading access.

After funding, Topstep also earns from a profit share. Traders keep 100% of their first $10,000 in payouts, but from that point forward, the firm retains 10% of future profits. This system aligns the incentives of both trader and firm, rewarding consistent performance over time.

To learn more about how Topstep operates behind the scenes, check out our detailed guide on what platform does Topstep uses. You can also explore whether Topstep allows automated trading for advanced strategies.

3. How does Topstep work (3-step process)

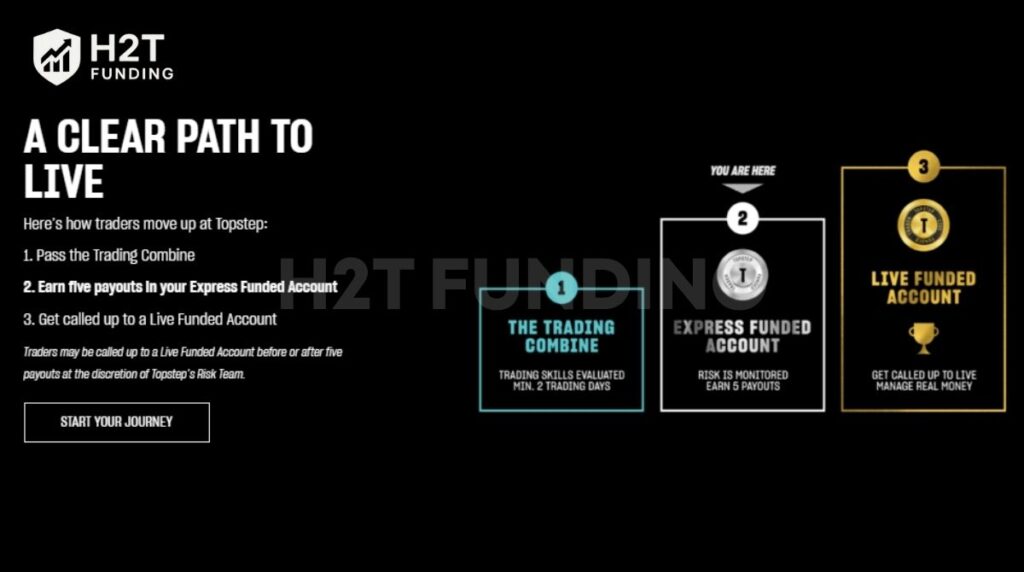

If you’ve ever wondered how Topstep works or searched “Topstep how it works”, the process comes down to three phases: Evaluation, Funded Account, and Payout.

Traders begin in the Trading Combine, an evaluation phase where they prove consistency, target, discipline, and risk management. If they meet the rules and profit targets, they unlock a Live Funded Account and start trading real capital without personal risk.

From there, the goal shifts to earning payouts. Traders can withdraw profits on a scheduled basis, keeping the majority while sharing a small portion with Topstep. The process is designed to reward skill and discipline while giving traders access to capital far larger than their own.

- Step 1: Evaluation – prove your skills in a simulated Trading Combine.

- Step 2: Funded Account – trade live with Topstep’s money under strict rules.

- Step 3: Payout – withdraw profits and share 10% after the first $10,000.

To understand how this journey begins, let’s take a closer look at the Evaluation phase in Step 1.

3.1. Step 1 – Evaluation

Every journey with Topstep starts inside the Trading Combine, a structured evaluation in a simulated futures market. Here, traders use TopstepX, the platform built specifically to keep the process fair and disciplined.

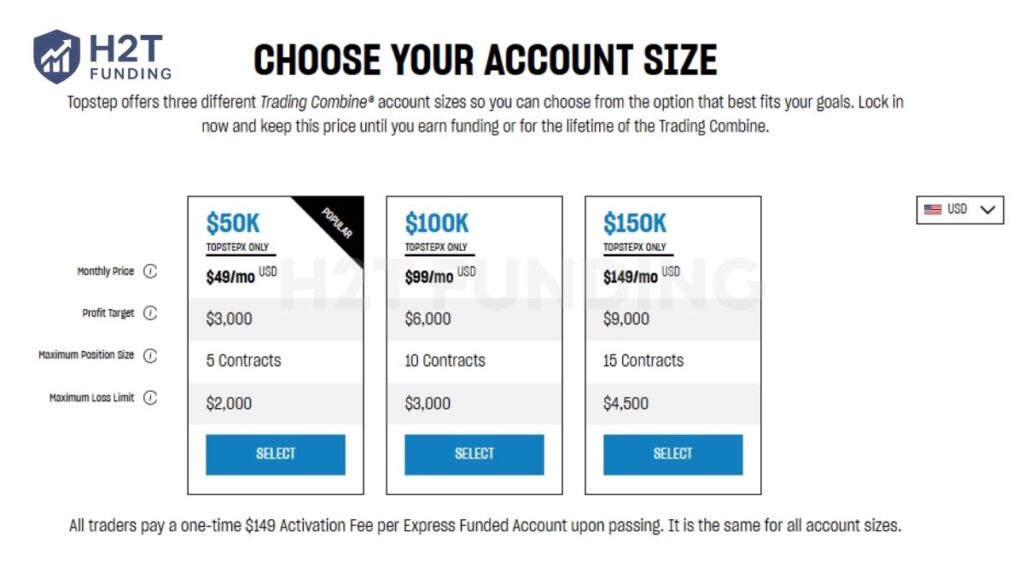

Let’s put the three account sizes side-by-side to see how they stack up:

| Account Size | Monthly Price (USD) | Profit Target | Max Position Size | Max Loss Limit | Daily Loss Limit* |

|---|---|---|---|---|---|

| $50K | $49 | $3,000 | 5 contracts | $2,000 | $1,000 |

| $100K | $99 | $6,000 | 10 contracts | $3,000 | $2,000 |

| $150K | $149 | $9,000 | 15 contracts | $4,500 | $3,000 |

*Daily Loss Limit means you cannot lose more than this amount in a single trading day. Exceeding it ends your Combine immediately.

To move forward, you must hit your target without breaking any rules. For example, in the $50K Combine, a trader needs to earn $3,000 profit while staying above the $2,000 maximum loss limit. As long as they also avoid breaching the $1,000 daily loss, they are eligible to advance. If you fail, the subscription renews monthly, and you can try again until you succeed or cancel.

You can learn more about trading restrictions during news releases in our article on can you trade news on Topstep for additional guidance.

3.2. Step 2 – Funded Account

Many traders ask, How does a Topstep-funded account work. Once you pass the Trading Combine, you unlock the Express Funded Account (XFA). This stage bridges evaluation and payout, helping traders see clearly how Topstep funding works under real trading pressure.

In short, you trade with firm capital under strict rules, follow the scaling plan, and keep payouts up to $5,000 in the Express Funded stage.

Although it still operates in a simulated environment, this is the first stage where payouts become real. The XFA is designed to bridge the gap between evaluation and live trading, giving you a chance to manage the emotional pressure of trading for actual rewards.

Here’s a quick snapshot of the XFA benefits:

| Feature | Details |

|---|---|

| Payout cap | Up to $5,000 |

| Number of accounts | Up to 5 funded accounts |

| Risk to the trader | None – Topstep carries the risk |

| Focus | Discipline under emotional pressure |

The XFA isn’t just about hitting numbers. It’s about preparing your mindset, testing your ability to stay consistent, and proving that you can handle the stress of real financial stakes. Those who succeed here are ready for the final step: a Live Funded Account.

If you use TopstepX and notice mirrored chart movements, check out our troubleshooting guide on why TopstepX charts mirror together for a quick fix.

3.3. Step 3 – Payout

The final stage is the Live Funded Account, which is essentially how does Topstep live account works in reality. At this point, trading results turn into actual payouts while Topstep continues to carry the financial risk.

Topstep provides up to $150,000 in capital, and you can trade directly in live markets. Payouts are structured to be fair and motivating. Traders keep 100% of their first $10,000 in profits, which acts as an early reward for passing the evaluation.

After this threshold, the profit split becomes 90/10, meaning you retain 90% while Topstep takes 10%. Withdrawals can be scheduled weekly or even daily after 30 winning days, giving traders flexible access to earnings.

For example, if a trader makes $2,000 in the first month, the entire amount goes into their pocket since it falls within the initial $10,000 profit window. Once they exceed that level, the 90/10 split applies, ensuring both trader and firm benefit from long-term consistency. This system is designed to reinforce discipline while still making payouts highly attractive.

The payout stage represents the reward for discipline shown in earlier steps. By combining real capital, flexible withdrawal options, and a generous profit split, Topstep turns a trader’s consistency into tangible income while maintaining shared responsibility for risk.

4. Details of Topstep’s important trading rules

Topstep enforces a set of trading rules that apply at every stage, from the Trading Combine to the Live Funded Account. These rules are designed to encourage consistent execution, protect the firm’s capital, and ensure traders succeed through discipline rather than luck.

Pay close attention to the Trailing Drawdown (MTD). Unlike a static limit, it moves according to your highest end-of-day balance. This allows room for intraday volatility but still forces you to maintain consistent progress. If the account balance drops below this threshold, the account is closed.

The Daily Loss Limit (DLL) sets a maximum you can lose in a single day. Breaching it means trading stops immediately. On TopstepX, DLL has recently been removed for new and reset accounts, but it remains active on platforms such as NinjaTrader, TradingView, and Tradovate.

Other key rules include that you need compliance:

- Profit target: set at 6% of the starting balance in the Combine.

- Consistency rule: no single day can make up more than half of the total profits.

- Minimum trading days: at least two active sessions are required, even if the target is reached sooner.

- Position limits: capped according to account size, ensuring traders scale responsibly.

- No overnight or weekend holding: all positions must be closed before the market shuts.

- News trading restrictions: hedging positions during high-impact events is prohibited conduct.

- Resets: available when the trailing drawdown is breached, allowing traders to restart without opening a brand-new account.

In addition, after a payout from a Live Funded Account, the Maximum Loss Limit resets to zero. This means traders must protect their remaining balance carefully, as any loss beyond that will close the account.

Platform update: Since July 2025, all new Combines and resets are only available on TopstepX. Active accounts on other platforms can continue, but they cannot be reset after hitting the Maximum Loss Limit.

5. Costs and fees involved in joining Topstep

Although Topstep provides traders with firm capital, there are several costs to consider before starting. These fees are integral to the program’s structure and cover evaluation access, account activation, and essential trading resources, including market data feed. Understanding them clearly helps avoid surprises along the way.

| Cost Type | Amount (USD) | Notes |

|---|---|---|

| Trading Combine $50K | $49/month | Auto-renews until passed or cancel |

| Trading Combine $100K | $99/month | Auto-renews until passed or cancel |

| Trading Combine $150K | $149/month | Auto-renews until passed or canceled |

| Activation Fee | $149 one-time | Due when entering the Express Funded Account |

| Reset Fee | = monthly subscription | Restart if rules are broken |

| Market Data Fee | From $133/exchange | Up to $540/month for full CME access |

These are the key expenses traders should expect before and after passing the Combine. They form part of Topstep’s structure to provide evaluation, platform access, and live market data.

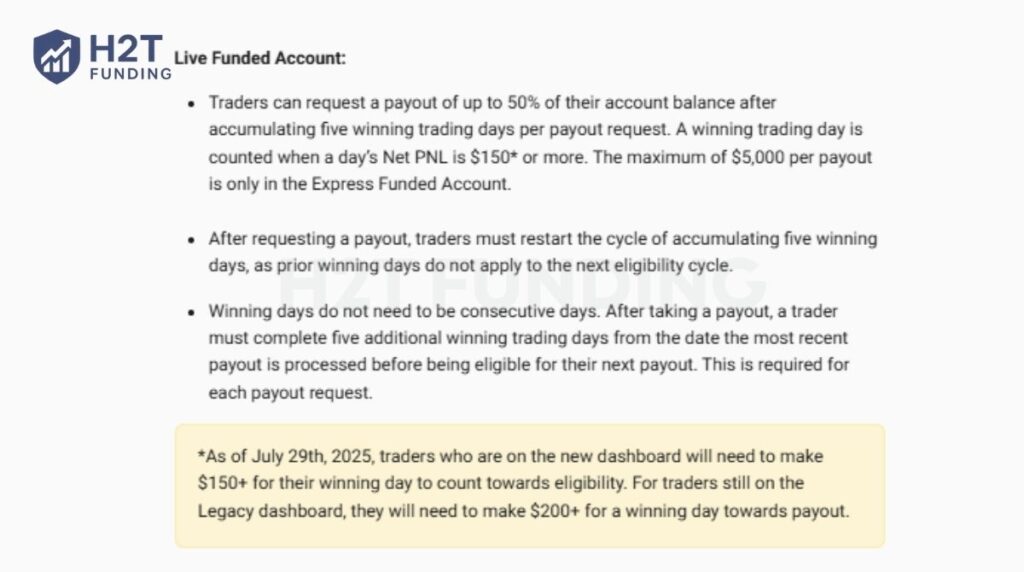

6. Topstep’s payout policy explained – How traders get paid

Topstep rewards disciplined traders through a flexible payout structure. You can start with regular weekly withdrawals and, over time, unlock daily payouts once you prove consistent profitability.

| Account Type | Eligibility | Payout Limit | Important Notes |

|---|---|---|---|

| Express Funded Account | 5 winning trading days (≥ $150 Net PNL per day) | Up to $5,000 or 50% of the balance | Winning days don’t need to be consecutive. After each payout, a new 5-day cycle begins. |

| Live Funded Account | 5 winning trading days (≥ $150 Net PNL per day) | Up to 50% of the balance | The same 5-day rule applies between payout requests. |

| Live Funded Account – Daily Payouts | 30 non-consecutive winning days (≥ $150 per day) | Up to 100% of the balance per request | A full 100% withdrawal closes the account, since the Max Loss Limit resets to 0. |

Notes:

- $150 applies to the new dashboard (Legacy version requires $200).

- Minimum payout request: $125.

- Processing fee: $20 for ACH or Wire transfers.

- Typical processing time:

- Wise / ACH: 1–3 business days

- Wire / SWIFT: 3–5 days (5–10 internationally)

Topstep’s payout policy encourages consistency and risk control rather than short-term luck. By linking withdrawals to a record of winning days, the firm helps traders develop discipline while still rewarding strong performance. It’s a balanced system, one that lets you pay yourself responsibly while continuing to build long-term trading growth.

7. Advantages and disadvantages of Topstep

Like any prop firm, Topstep has its strengths and its challenges. Understanding both sides helps traders decide whether this program fits their goals and trading style.

7.1. Advantages

Topstep has built a solid reputation over the years and offers unique benefits to traders who want a structured path to funding.

- Legitimate and established: Founded in 2012, Topstep has funded thousands of traders and built credibility as a long-standing firm.

- Futures-focused: Unlike many prop firms centered on forex, Topstep gives direct access to CME futures markets.

- Strong education and community: Topstep offers extensive trader education through webinars, performance coaching, and its TopstepTV YouTube channel. The firm also maintains an active Discord and blog with daily market recaps, strategy tips, and community Q&A.

Ultimately, Topstep’s legitimacy, futures market access, and supportive ecosystem make it a reliable choice for disciplined traders seeking growth without risking personal funds.

7.2. Disadvantages

Despite its strengths, Topstep also comes with limitations that traders should carefully consider.

- Higher costs: Monthly subscriptions, activation, and market data fees can add up over time.

- Steeper learning curve: Futures are more complex and volatile than forex, which can be challenging for beginners.

- Strict rules: Loss limits, drawdowns, and consistency requirements leave little margin for error.

Overall, these drawbacks mean Topstep may not be ideal for every trader. The strict structure can be frustrating for some, and the costs may outweigh the benefits if you already trade profitably with personal capital.

8. Compare Topstep with other prop firms

Each prop firm has its own style, rules, and benefits. To see where Topstep stands, it helps to compare it directly with FTMO and Apex Trader Funding across the main features that matter to traders.

| Feature | Topstep | FTMO | Apex Trader Funding |

|---|---|---|---|

| Country | United States | Czech Republic (Prague) | United States |

| Years in Operation | 13 years (since 2012) | 10 years (since 2015) | 4 years (since 2021) |

| Account Size | $50K – $150K | $10K – $200K | $25K – $300K |

| Challenge Fee | $49 – $149 (monthly) | €89 – €1,080 (one-time) | $147 – $687 (monthly) |

| Account Types | Trading Combine, Express Funded Account, Live Funded Account | Normal, Swing Trader | Tradovate, Rithmic, WealthCharts |

| Profit Split | 100% first $10K, then 90% | 80% – 90% | 100% first $25K, then 90% |

| Time Limit | No time limit | No time limit | No time limit |

| Profit Target | 6% | 5% – 20% | 6% |

| Trading Platforms | TopstepX, TradingView | MT4, MT5, cTrader, DXTrade | NinjaTrader 8, Tradovate |

| Markets Offered | CME futures (forex, commodities, indices, currency futures) | Forex, commodities, indices, stocks, crypto | Futures (equity indices, currencies, commodities, rates, crypto) |

So, what’s the bottom line from this comparison? Each firm clearly carves out its own niche:

- Topstep focuses only on futures, with a structured Combine and a strong trader community.

- FTMO is best for forex and multi-asset traders who prefer one-time challenge fees.

- Apex offers the largest account sizes and often lower entry costs, but less educational support.

In the end, Topstep fits traders who want a reputable, futures-only prop firm with strict but fair rules. Those more interested in forex or cheaper evaluation options may find FTMO or Apex a better match.

9. Topstep FAQs

Yes, Topstep is a legitimate prop firm. Founded in 2012 in the United States, it has funded thousands of traders worldwide and paid out millions in profits. Its long track record and transparent rules make it one of the most credible firms in the futures trading space.

Traders can withdraw up to $5,000 while in the Express Funded Account. Once promoted to a Live Funded Account, there are no fixed limits beyond the profit you generate. The first $10,000 in profits is 100% yours, and afterward, you keep 90%.

There is no time limit. Some traders pass within a few weeks, while others take months. Progress depends on your consistency and ability to follow rules without breaching drawdowns or daily loss limits.

No formal experience is required, but having a trading background helps. The rules and futures market structure can be challenging for beginners, so educational resources and practice are strongly recommended.

You don’t lose trading capital since you never risk personal funds. The only cost lost is the monthly subscription fee you’ve already paid for the Trading Combine. You can reset and try again as many times as needed.

Yes, Canadian traders can join Topstep. Access is global, with accounts open to traders in more than 140 countries.

Yes, traders from South Africa are eligible. As long as you have internet access and a supported payment method, you can participate.

Currently, new Trading Combines are only available on TopstepX. Traders with active accounts on Tradovate can continue, but cannot reset once they hit the Maximum Loss Limit.

Yes, Topstep pays out consistently. Traders receive daily or weekly withdrawals once conditions are met, with multiple confirmations online that payments are processed on time.

No, you need at least two active trading days in the Combine to qualify. Even if you hit the profit target on day one, the rules require multiple sessions to prove consistency.

Yes, the Trading Combine works on a monthly subscription model. Payments auto-renew every 30 days until you pass or cancel your subscription.

If losses exceed your Maximum Loss Limit in a Live Funded Account, the account closes. Since the capital belongs to Topstep, you don’t owe additional money, but you would need to restart the process to continue.

10. Conclusion

By now, you should have a clear picture of how does Topstep works. The program is built on strict but fair rules that reward consistency and discipline, helping traders turn skill into sustainable income without risking personal capital.

Topstep is not for everyone; its fees and futures-only focus may deter some traders. But for those who value structure, education, and legitimacy, it remains one of the most trusted paths to professional trading.

If you’d like to continue exploring, check out more in our Prop Firm & Trading Strategies section on H2T Funding. There, you’ll find detailed prop firm reviews, strategy guides, and step-by-step tutorials designed to help you navigate the growing world of proprietary trading with confidence.