Dealing with that, where did all my money go? The feeling is the absolute worst. If you’re struggling to keep your spending in check, the envelope budgeting system could be your secret weapon.

It’s such a brilliant, hands-on, fantastic method for everyone. Instead of just seeing digital numbers, you use envelope system budgeting and do cash stuffing into each category.

This simple, old-school technique is fantastic for everyone, whether you’re working toward debt repayment or aiming for greater financial stability. It instantly helps you spend within your means and get serious about your financial goals.

Key takeaways:

- The envelope budgeting system divides your income into spending categories using labeled envelopes.

- Each envelope represents one category, and you stop spending when the cash runs out.

- The system follows five steps: list income and expenses, create categories, allocate cash, spend only from envelopes, and adjust monthly.

- It helps improve financial stability, builds awareness, and reduces impulsive spending.

- The envelope budget system for low-income users supports better debt repayment and consistent savings.

- Digital envelope budgeting apps like YNAB or Goodbudget make it easier to manage without handling cash.

1. Understand the envelope budgeting system

You know, sometimes the simplest ways are the best! I swear by the envelope system for budgeting; it’s a brilliant, hands-on method. Instead of just seeing numbers in an app, you actually do cash stuffing into budget envelopes for each spending category.

Once an envelope is empty, you’re done! It may seem old-school, but this envelope budgeting method gives you real control, steering you toward financial stability and your biggest financial goals.

1.1. What is the envelope budgeting system

At its core, the envelope budgeting system, sometimes called cash stuffing. This means allocating your monthly income into separate envelopes for each expense category, each labeled for a specific category, like groceries, rent, or dining out.

For example, if you plan to spend $400 on groceries, you put $400 in the “Groceries” envelope. Once that cash runs out, you stop spending until next month.

The hands-on budgeting style has been around for decades because it’s grounded in behavioral psychology. According to The Journal of Consumer Research, people spend less when using cash than cards because cash payments trigger a stronger emotional response; it literally feels harder to part with.

Today, the same idea can be applied digitally through budgeting tools like YNAB or Monarch Money, which simulate envelope categories electronically while keeping the same sense of structure and awareness.

1.2. A brief history of the method

Envelope budgeting dates back to the early 20th century, long before credit cards became the norm.

In the post-Depression era, many households managed their finances using envelopes to allocate funds for rent, groceries, utilities, and entertainment.

Personal finance icon Dave Ramsey helped popularize the envelope method in modern times, promoting it as part of his Baby Steps to financial peace program.

Even today, many financial coaches recommend the system for beginners learning to budget.

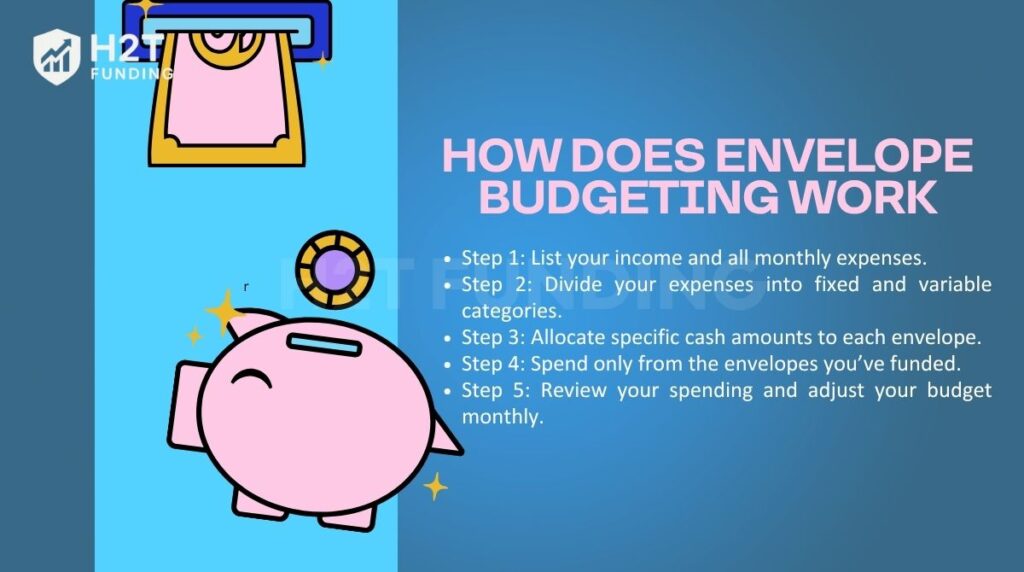

2. Step-by-step: How does envelope budgeting work

Ready to give it a try? Here’s a clear breakdown of how to start a cash envelope system effectively. It’s a simple, repeatable process that helps you stay on track with your money every month:

- Step 1: List your income and all monthly expenses.

- Step 2: Divide your expenses into fixed and variable categories.

- Step 3: Allocate specific cash amounts to each envelope.

- Step 4: Spend only from the envelopes you’ve funded.

- Step 5: Review your spending and adjust your budget monthly.

Ready to give it a try? Below is a clear breakdown of how to start the cash envelope system effectively. You’ll need some cash, envelopes, and a little patience, but the results can be genuinely life-changing.

You’ll need some cash, envelopes, and a little patience. The results can truly be life-changing.

I personally followed these steps a few years ago when I was overwhelmed by inconsistent spending. Within just three months, I paid off a lingering credit card balance and finally felt in control of my finances. That’s why I’m sharing this system with you.

2.1. Step 1: List your income and monthly expenses

Start by identifying how much income you bring in each month, from your salary, side hustles, or other sources. Then, list all your monthly expenses. This includes:

- Fixed costs: rent, utilities, insurance

- Variable costs: groceries, gas, eating out, and entertainment

For accuracy, look at the last 2–3 months of bank statements or receipts to spot patterns.

Example: Let’s say you earn $3,500 monthly. Your rent and utilities total $1,200. You typically spend $400 on groceries, $250 on gas, and $150 on dining out.

2.2. Step 2: Choose budget categories (fixed vs. variable)

Next, divide your expenses into budgeting categories. The envelope system works best for variable spending, where you’re more likely to overspend.

Common categories for envelopes include:

- Groceries

- Dining out

- Gas/transportation

- Entertainment

- Personal care

- Household supplies

- Clothing

Avoid putting fixed expenses (like rent) in envelopes. Those are best handled through auto-pay or traditional banking.

Tip: Keep your category list manageable. 5–8 envelopes are easier to track than 15.

2.3. Step 3: Allocate cash amounts to envelopes

Once your categories are defined, determine how much cash to put in each envelope. Subtract your fixed costs from your income, then distribute the remaining amount into variable categories.

| Category | Amount (USD) | Notes |

|---|---|---|

| Income | $3,500 | Total monthly income |

| Fixed Expenses | $1,800 | Rent, utilities, insurance, subscriptions |

| Remaining Balance | $1,700 | To be allocated across other needs |

| Groceries | $400 | Food and household essentials |

| Gas / Transportation | $250 | Fuel or public transit costs |

| Dining Out | $150 | Occasional restaurant meals |

| Entertainment | $100 | Movies, events, or streaming |

| Miscellaneous | $100 | Unexpected small expenses |

| Savings | $700 | Keep in a bank or savings envelope |

Withdraw the total in cash from your bank and fill each labeled envelope accordingly.

2.4. Step 4: Spend only from envelopes

Now the challenge begins. Use only the cash in each envelope for spending in that category. Want to buy groceries? Use your grocery envelope. Need a haircut? Check your personal care envelope.

If the envelope is empty, you have two options:

- Option 1: Wait until next month.

- Option 2: Shift money from another envelope (with consequences for that category).

This rule introduces natural limits to spending and forces you to prioritize.

Realistic scenario: It’s the 20th of the month, and your entertainment envelope is empty. A buddy suggests heading to the cinema together. You either skip it or move $15 from dining out, but that means fewer meals out later.

2.5. Step 5: Adjust and repeat monthly

It’s normal for your first budget to need adjustments. Review your financial plan at month’s end to see what stuck.

- Were you over budget in any spending area?

- Did you underestimate your grocery costs?

- Did any envelopes have leftover cash?

Adjust your allocations based on actual habits and continue refining. This is where growth happens; envelope budgeting is both a system and a learning process.

Pro tip: Keep a small notebook to jot down transactions for each envelope. Some people even staple receipts to envelopes for tracking.

See more related articles:

3. Real-life example: A month of envelope budgeting in action

It’s one thing to understand the idea. Seeing it in action is what brings the envelope budgeting system to life. This envelope budgeting example will walk through a typical month using the system, from the first week to the final review.

In this section, we’ll walk through a typical month using the system, from the first week to the final review.

This example is based on my own experience when I was just starting. I had a modest income and inconsistent spending habits, especially on food and small weekend activities.

Implementing this method gave me structure and confidence with money.

3.1. Weekly spending tracking

At the beginning of the month, I divided $1,000 across my envelopes. Here’s how I set it up:

- Groceries: $300

- Transportation: $150

- Dining out: $150

- Entertainment: $100

- Personal care: $50

- Miscellaneous: $50

- Savings: $200 (kept in a separate envelope at home)

Each Sunday, I checked how much remained in each envelope. This weekly review helped me adjust my spending pace.

For instance, after spending $90 on groceries in week one, I knew I had $210 left to last the next three weeks. That made me plan meals more carefully and avoid unnecessary snacks.

3.2. What happens when an envelope runs out

Midway through the month, I emptied my entertainment envelope after attending a concert and a movie.

A friend invited me to another event the following weekend. I had two options: say no or borrow from another envelope.

I chose to move $20 from dining out to entertainment. That meant I had less to spend on takeout later. This small trade-off made me reflect on my priorities. And more importantly, it kept my total spending under control.

3.3. End-of-month review

At the end of the month, I sat down with all my envelopes.

Some had leftover cash, especially groceries and personal care. Others, like entertainment and dining out, were empty by week three.

I returned the unused cash to my bank account and added it to my emergency fund. I also reviewed where I had miscalculated and tweaked the next month’s allocations.

This review step was crucial. It showed me where my habits were improving and where I needed more discipline.

What surprised me most was how freeing this system felt. Having cash set aside gave me permission to spend without guilt. At the same time, it built natural limits. It didn’t feel restrictive; it felt intentional.

4. Pros and cons of the envelope budgeting method

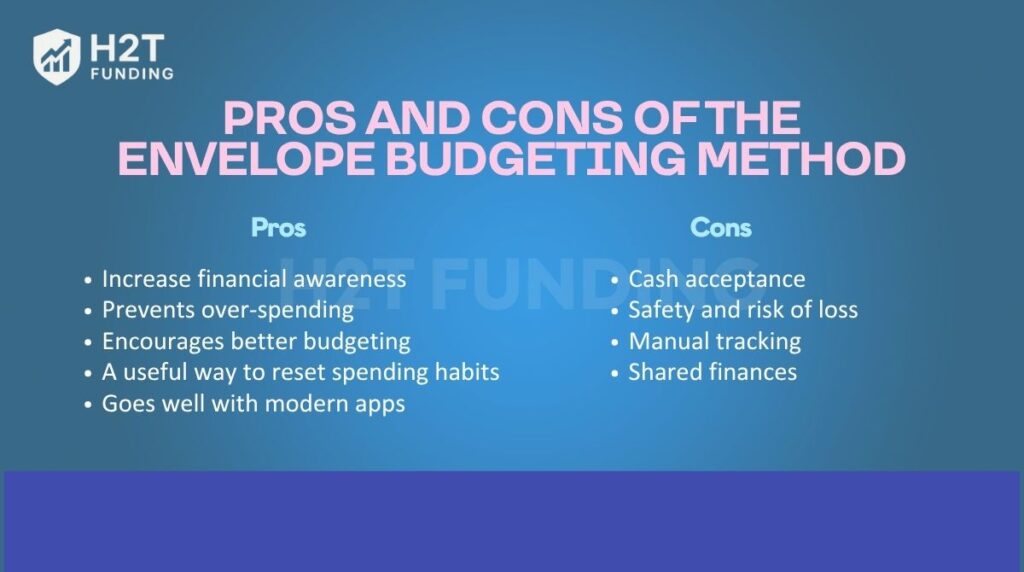

Honestly, the envelope budgeting system is a game-changer for many people, but like anything, it has its trade-offs in our digital age. We need to weigh what works well against the modern inconveniences.

4.1. Advantages of using the envelope method today

One of the key envelope budgeting advantages is how it blends simplicity with effectiveness. Whether you deal with paper envelopes or an envelope budgeting application, the method will help you visualize your spending and hold yourself accountable with your financial goals.

Here are some of the main benefits you can expect:

- Increase financial awareness: Physical cash or a digital budget lets you see how much is left in every category, and hence spend more carefully.

- Prevents overspending: Once the money is spent in a category, you just stop spending. It simply sets a boundary and keeps you within your budget.

- Encourages better budgeting: You are able to set aside money in each category at the beginning of the month to plan for just about everything that’s more important.

- A useful way to reset spending habits: If you are one of those people who always overspend, starting with cash can break the habit. You can upgrade to a digital version later once you’re more disciplined.

- Goes well with modern apps: Digital tools such as YNAB, Goodbudget, and Mvelopes apply this envelope principle with more convenience and in a more traceable manner.

In my case, I began with physical envelopes to recreate control. Then I started to use an application that was based on the same system, finding it much easier to keep up over time.

4.2. Problems with using envelopes in a modern, cashless society

The system remains effective, but there are several envelope budgeting disadvantages to consider, especially in today’s increasingly cashless world.

The following are a few of the most common challenges:

- Cash acceptance: Heavy use of retailers and services online that do not take cash makes this impractical for certain categories.

- Safety and risk of loss: Carrying or having a lot of cash around presents a safety risk when lost or stolen.

- Manual tracking: It involves you logging every expense in the physical system manually, which may be slower as compared to tracking via automated actions through digital apps.

- Shared finances: Managing paper envelopes is an irritating task for partners sharing a budget; a synced digital platform works much better for couples.

The envelope method remains a powerful tool for budgeting. Still, it’s possible to apply this method digitally. Many people today use a mix of both physical and digital tools to get the best of both worlds. You can choose what fits your habits and comfort level.

5. Going digital: Envelope budgeting apps and tools

While the traditional envelope budgeting system is cash-based, modern technology now offers digital alternatives. You can use an envelope budgeting app to follow the same structure, allocating funds and tracking spending, without the hassle of carrying physical cash.

These apps replicate the envelope method by allowing you to assign spending limits to virtual categories.

5.1. Recommended tools for managing envelopes digitally

Several apps are designed specifically for envelope-style budgeting. Check out these highly rated and beginner-friendly picks:

- Goodbudget: Excellent for simplicity and syncing between devices, making it a great choice for shared household finances.

- YNAB (You Need A Budget): Follows the zero-based budgeting philosophy, which is conceptually similar to the envelope system of budgeting. It’s highly recommended for those focused on serious long-term financial change.

- Mvelopes: Designed specifically to automate the envelope management process by syncing with your bank accounts.

Each of these apps supports the core principle of the envelope system: give every dollar a job and stay within category limits.

Tip: Most apps offer a free trial or an envelope budgeting app free version. Try one for a month to see if it fits your style before committing.

5.2. Hybrid approach: Mixing physical and digital tools

For many, the most practical solution is a hybrid envelope budgeting system that combines the best of both worlds.

- Use Cash: Reserve physical envelopes for high-risk, impulsive spending categories like groceries or personal spending.

- Use Digital: Track bills, automatic payments, and long-term savings in a budgeting app for safety and convenience.

My current method is hybrid. I use envelopes for groceries and personal spending, but track rent and subscriptions through a budgeting app. It strikes a good balance between control and flexibility, making it a practical digital envelope budget system for today’s lifestyle.

View more:

6. FAQs

It’s harder, but possible. Some people track spending in a notebook or app and “pretend” envelopes by monitoring category balances. However, this requires discipline and won’t have the same psychological impact as using cash.

You can either stop spending in that category or shift funds from another envelope. The key is to stay within your overall budget and treat it as a learning moment for future planning.

It depends on your income, expenses, and priorities. Start with realistic estimates based on past spending and adjust as you go.

Not at all. The envelope system is about discipline and awareness, not income level. Many high earners use it to control overspending or hit aggressive savings goals.

Yes, though it requires communication and shared goals. Some couples use joint envelopes for shared expenses and separate envelopes for personal spending.

Envelope budgeting isn’t necessarily the best for everyone, but it’s one of the most effective methods for developing spending discipline. It’s especially helpful for people who struggle to track digital payments or often overspend. The visual and hands-on nature of this system makes you more aware of where every dollar goes.

The 200-envelope challenge is a savings game where you label 200 envelopes from $1 to $200. Each day or week, you pick one envelope at random and save that amount. By the end of the challenge, you’ll have saved $20,100 in total, a fun and structured way to build a large savings habit.

The envelope system promotes financial awareness, prevents overspending, and helps you prioritize essential expenses. It’s a simple, low-tech budgeting method that encourages mindful spending and accountability. Even when used digitally, it keeps your financial plan clear and goal-focused.

You can’t literally earn money from envelopes, but you can use the envelope method to save more effectively. Some people adapt the system by setting aside envelopes for income goals or side hustles, helping them manage profits and expenses separately while growing savings over time.

7. Conclusion

The envelope budgeting system is a simple but effective way to stay in control of your spending.

When I first tried it, I finally stopped overspending and actually saved money for the first time in months. Whether you use cash, digital tools, or both, the key is being intentional with your money.

For more tips, visit our Budgeting Strategies section on H2T Funding.

If you found this helpful, feel free to like, comment, and share with others who might need it.