Understanding what is different between active income and passive income is a crucial step in building financial security. Active income is tied directly to your time and effort, while passive income continues to generate returns even when you are not actively working. Both play unique roles in shaping your path to financial independence.

In this article, H2T Funding will walk you through the clear meaning of each income type, its advantages and limitations, and practical real-life examples. You’ll discover how to identify the right balance between them, and how combining both can help you achieve sustainable financial growth.

By the end of this guide, you’ll not only know what sets active income apart from passive income. You’ll also gain actionable insights to start applying these concepts in your own financial journey toward long-term freedom.

Key takeaways:

- Active income is earned directly through your effort, provides immediate stability, but stops once you stop working.

- Passive income is generated from assets like real estate, dividends, or digital products. It requires upfront effort or investment but continues to produce returns with little daily work.

- The difference between active and passive income is seen in time commitment, stability, initial requirements, and potential to grow beyond your personal labor.

- Prioritizing active income works best when you need money immediately or lack capital, while passive income becomes more valuable once you have a financial cushion and long-term ambitions.

- A strong financial strategy doesn’t choose one over the other; it blends active income for current needs with passive income to build lasting independence.

1. What is active income?

Active income refers to money earned directly from your work, such as salaries, hourly wages, freelance payments, or fees from self-employment.

It is the most traditional way of earning a living, requiring continuous effort in exchange for compensation. Once the work stops, the income also ends.

Real-life examples of active income

- Full-time employment: Working a 9-to-5 office job or any salaried role where your monthly paycheck is directly tied to your attendance and output.

- Freelancing: Providing services such as writing, design, or coding on a project basis, where payment comes only after the work is delivered.

- Part-time or gig jobs: Driving for rideshare platforms, delivering food, or taking on part-time retail shifts to earn immediate cash flow.

- Sales commissions: Professionals in real estate, insurance, or retail often earn commissions that depend entirely on closed deals or transactions.

- Performance bonuses: Extra earnings provided by companies for meeting or exceeding targets, which still rely on consistent effort and achievement.

Active income plays a crucial role in achieving financial stability, particularly during the early stages of building wealth. It offers predictability and immediate returns, but to reach long-term freedom, it often needs to be paired with sources of passive income.

If you’re working with a tight budget, learning how to budget on a low income can help you make the most of your earnings. Additionally, to avoid the stress of living paycheck to paycheck, it’s essential to start planning for the future.

2. What is passive income?

Passive income is money earned with little daily effort once the initial work or investment approach has been made. Unlike active income, which stops when you stop working, passive income can continue flowing without constant labor.

According to the Internal Revenue Service (IRS), active income also includes business earnings if the taxpayer materially participates. This means working 500+ hours a year, doing most of the work, or spending over 100 hours without anyone else contributing. If these criteria aren’t met, the income is classified as passive.

Real-life examples of passive income

- Dividend stocks: Investors receive recurring dividends from companies distributing profits without needing to manage the business.

- Rental income: Property owners collect monthly rent with limited involvement, especially when a management company handles operations.

- Savings or bonds interest: Money left in a high-yield account or government bonds earns returns with no ongoing effort. This aligns well with traditional saving methods. This aligns with saving, but understanding saving vs. investing helps you determine which approach works best for you..

- Royalties from intellectual property: Authors, musicians, or inventors continue earning from each sale or license of their work.

- Automated online businesses: Digital products, drop shipping stores, or online courses generate income once systems are established.

Passive income provides leverage that active work cannot. It allows your money, assets, or intellectual property to work for you over time. Building it may take patience and resources, but it can create the financial stability needed to complement traditional earnings.

If you want to know how to make your money grow over time, learning about compound interest can be a game-changer in maximizing your passive income.

3. Advantages and disadvantages of active income and passive income

Both income types serve different purposes in a financial plan. Active income provides more immediate compensation and a predictable cash flow, but it is more sensitive to economic fluctuations. Passive income may take time to build, but it offers lasting rewards.

But theory only gets you so far. Let’s break down the practical pros and cons of each active income vs passive income to see where they fit in your financial strategy.

| Type of Income | Advantages | Disadvantages |

|---|---|---|

| Active Income | Provides steady cash flow and immediate financial stability. Easy to start with a job, freelance work, or gig. | Requires constant effort and time; income stops when you stop working. Limited flexibility and scalability. |

| Passive Income | Builds long-term wealth and financial independence. It can grow even while you sleep. Offers more flexibility over time. | Requires upfront capital, skills, or effort to set up. Results are often slower and may carry investment risks. |

Each income stream has its strengths and limitations. Active income helps you meet short-term needs, while passive income lays the foundation for future freedom.

To set clear financial goals and track your progress, you may find our guide on how to set financial goals useful. Additionally, consider the pay yourself first method to prioritize saving for your future while building both income streams or automating savings for long-term financial success.

4. Different between active income and passive income

Active and passive income are not just two ways of earning; they represent different approaches to wealth creation, affecting your market participation, financial goals, and even lifestyle preferences.

To understand what is the difference between active and passive income, let’s break it down into time commitment, stability, risk, and scalability.

4.1. Time commitment

Active income requires consistent hours and effort, such as working shifts or completing freelance projects. Passive income, once established, needs far less daily involvement and can continue generating returns even when you are not working.

4.2. Stability

Active income is generally stable in the short term, especially if tied to a fixed salary or regular clients. Passive income tends to fluctuate more at the beginning but becomes more reliable as the system or investment matures.

4.3. Risk and initial requirements

Active income usually requires skills, labor, or time but little upfront capital. Passive income often demands an initial investment of money, knowledge, or creativity, and it carries higher uncertainty in the early stages.

4.4. Scalability

Active income is limited by the number of hours you can work, making it difficult to expand without more effort. Passive income, however, can scale significantly once a strong system, product, or investment is in place.

Understanding these differences can significantly enhance your financial planning. If you’re new to financial concepts, it’s important to build a solid foundation. Check out our financial literacy tips for beginners to get started.

Also, learning how to budget effectively can set you on the right path. Explore our guide on how to budget your money to better manage both active and passive income.

5. How to determine active vs passive income?

The line between active income and passive income can sometimes feel blurry, especially when an activity involves both effort and systems. The easiest way to classify it is to ask: Does the income stop the moment you stop working, or does it continue to flow with little daily involvement?

This simple test helps separate short-term labor-based earnings from long-term asset-based cash flow.

- If the earnings require consistent labor, like a job, gig, or freelance project -> It is active income. This type often provides job security, but is subject to tax treatment according to local regulations.

- If the money continues with limited day-to-day work, like dividends, royalties, or rental returns -> It is passive income.

- Some sources may start as active but evolve into passive, such as building an online business that later runs on automation.

Recognizing the difference between these two types of earnings allows you to plan strategically. Active income covers daily expenses, and passive income creates the foundation for future financial independence.

Furthermore:

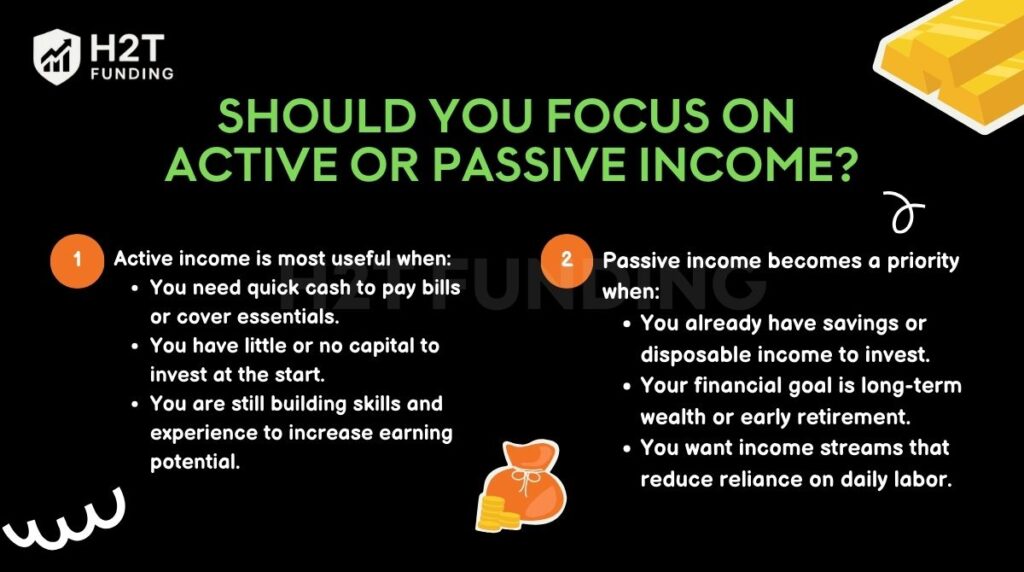

6. Should you focus on active or passive income?

Choosing between active and passive income depends on your financial stage, resources, long-term gains, and suitable tax strategies.. Some people need immediate stability, while others aim to build wealth that lasts for decades.

Understanding when to prioritize each type can help you create a well-rounded financial plan.

6.1. When to prioritize active income

Active income is most useful when:

- You need quick cash to pay bills or cover essentials.

- You have little or no capital to invest at the start.

- You are still building skills and experience to increase earning potential.

Example: A recent graduate taking a full-time job or side gigs like tutoring and delivery work depends on active income to handle short-term expenses.

6.2. When to build passive income

Passive income becomes a priority when:

- You already have savings or disposable income to invest.

- Your financial goal is long-term wealth or early retirement.

- You want income streams that reduce reliance on daily labor.

Example: A professional using extra savings to buy dividend stocks or purchase a rental apartment gradually shifts focus toward passive income for future security.

6.3. Combining active and passive income

The most sustainable strategy is blending both:

- Use active income to cover daily living costs and build savings.

- Channel part of that income into investments or systems that generate passive income.

- Gradually increase passive income so it supplements or replaces active earnings.

Example: A software engineer working full-time while creating an online course on weekends can eventually enjoy steady passive sales, reducing dependence on their job.

Choosing one path alone can create limitations. A balanced mix of active and passive income ensures both short-term stability and long-term independence.

Continue reading our articles: 51 surprising hobbies that can actually make you money

7. Real-life examples comparing active vs passive income

Examples from everyday life show clearly how income types work in practice. Comparing real scenarios makes the difference between active income and passive income easier to grasp and apply to your own situation.

7.1. Freelancer vs YouTuber

Freelancers depend on projects to earn money, while YouTubers can build content that pays over time.

- A freelancer earns $500 for a design project, but once the work is complete, the income stops. To make more, they must take on another client.

- A YouTuber spends weeks creating a video series. After publishing, ads and sponsorships continue to generate income month after month without additional work on that video.

- Freelancing offers quicker payouts, but YouTube content can accumulate passive earnings for years.

The example highlights why many freelancers eventually explore digital platforms: passive channels allow them to leverage their skills for long-term returns.

For tips on managing freelance payments and project-based income, check out essential budgeting tips for freelancers.

7.2. Office worker vs real estate investor

An office worker relies on a monthly salary tied to their hours, while a property investor builds wealth through rental income.

- The office worker receives $2,000 monthly for a fixed 9-to-5 job, but the paycheck stops if they leave the position.

- A real estate investor rents out an apartment for $800 a month. Even after accounting for expenses, the income continues regardless of daily effort.

- The worker’s income is stable and immediate, but the investor’s earnings grow as property values increase or more rentals are acquired.

This contrast shows why combining salary stability with real estate investment can create both short-term security and long-term wealth.

Note: In the U.S., real estate investors also benefit from tax deductions like depreciation. This allows them to lower taxable income by writing off part of the property’s value each year. These deductions make real estate a highly tax-efficient asset.

For advice on saving for large investments like property, see how to save for a big purchase.

7.3. Direct seller vs digital product creator

Selling products directly requires constant effort, while digital creators earn repeatedly from one-time work.

- A direct seller makes $20 profit per item sold but needs to engage daily with customers to keep sales moving.

- A digital product creator, such as someone offering an online course or e-book, invests effort upfront to build the product. Once launched, it can sell hundreds of copies without extra daily labor.

- Direct selling offers fast cash flow, but digital products scale much faster without increasing workload.

As you can see, this example proves how shifting from traditional sales to digital assets can unlock exponential growth and financial freedom.

Real-world comparisons make it clear: active income is essential for stability, but passive income creates leverage and independence. A balanced approach ensures your finances can support both today’s needs and tomorrow’s ambitions.

8. FAQs

Passive income still requires some setup and occasional monitoring. For example, a rental property may need management, or digital content may need updates. It becomes “passive” only after the initial work is done and the system is running with minimal effort.

The timeline depends on the method. Rental properties and dividend stocks may generate returns within months, while online businesses or blogs often take longer to gain traction. Consistency and patience are key to results.

It is possible, but usually only after building multiple streams or investing significant capital. Many people start by combining active income with passive sources, then gradually rely more on passive income as it grows.

A frequent mistake is underestimating the initial effort or overestimating returns. Others include poor diversification, ignoring risks, or abandoning projects too soon. Success usually requires persistence and proper planning.

The right mix depends on your financial stage. Active income provides immediate stability, while passive income builds long-term freedom. Ideally, you should create a balance of both.

Relying on a single income source exposes you to more risk. By diversifying across active and passive streams, you protect yourself from job loss, market downturns, or unexpected expenses, ensuring more financial security.

Yes, some methods like writing an eBook or creating an online course require more time than money. However, larger streams such as real estate typically demand upfront capital before producing steady returns.

In most countries, they do. Active income is often taxed at standard income rates, while some forms of passive income, like long-term capital gains or dividends, may qualify for lower rates. Always check your local regulations.

Yes, especially with digital models. Affiliate marketing, online courses, or drop shipping can run with automation tools. Even in real estate, hiring a property manager can reduce your involvement significantly.

It depends on the income source. Dividend stocks may need only periodic monitoring, while real estate could involve more management. The key is setting up systems or outsourcing tasks to minimize ongoing effort.

9. Conclusion

The concept of the difference between active income and passive income is the foundation for making smarter money choices. Active income gives you immediate strength, while passive income gradually builds financial independence in the background.

By combining the security of active earnings with the growth potential of passive streams, you can work toward lasting financial freedom. The earlier you start, the more time you give your income systems to compound and support your future goals.

If you’re ready to take the next step, explore more insights in the Budgeting Strategies section of H2T Funding. There, you’ll find practical guides on managing money, optimizing savings, and building a framework that helps you get closer to true financial independence.