Many traders start with the safe, simple world of intraday strategies, closing everything down before the market shuts its doors. While this offers a sense of security, it leaves a burning question in the minds of ambitious traders: Can you hold futures overnight to capture larger market moves? The answer is a resounding yes, and it opens up a world of possibilities!

The futures market is a dynamic beast, a completely different playground from traditional stock exchanges. It’s full of unique opportunities and thrilling challenges for those who dare to hold positions longer. Understanding these nuances is the key to finally expanding your trading horizons and seizing control of your financial future.

This exclusive H2T Funding article will be your guide, diving deep into everything you need to consider when holding futures contracts beyond a single trading session.

Key takeaway:

- Futures can be held overnight, unlike some instruments, but they require careful management of risks like market gaps and higher margin requirements.

- Choose from day trading, swing trading (days to weeks), or position trading (weeks to months), but always monitor contract expiry and rollover processes.

- Futures markets operate nearly 24/5, offering opportunities to react to global events but with challenges like lower liquidity during off-peak hours.

- No direct overnight fees, but watch for rollover costs, transaction fees, and higher overnight margins to avoid margin calls.

- Use stop-loss orders, proper position sizing, and stay informed about news to mitigate risks like market gaps and volatility.

- Swing trading and hedging are effective for overnight futures, supported by technical and fundamental analysis for better decision-making.

- Select a broker with clear overnight margin rules, robust platforms, and reliable support to enhance your trading experience.

- Learn from traders’ real experiences on platforms like Reddit and Quora to understand practical challenges and tips for overnight trading.

1. Can you hold futures overnight? Understanding the basics

When considering extending your trading beyond the daily close, a fundamental question arises: Can you hold a futures trade overnight? The straightforward answer is yes, but this capability comes with specific considerations.

1.1. The fundamental answer: Yes, but with nuances

You can absolutely hold futures contracts overnight, and this is precisely one of the reasons why this market stands out compared to others that automatically close positions at the end of the day.

Just imagine: the door of opportunity doesn’t shut when you step away from your desk. Instead of chasing small intraday moves, you can now gear up for larger market breakouts. This isn’t just a technical shift; it’s a leap in trading strategy that opens up a world of possibilities.

But don’t rush in just yet! Overnight trading requires a different mindset than day trading. You’ll need to fully understand margin requirements, risk management techniques, and extended trading hours to turn this opportunity into substantial profits.

If you’re looking for a fresh approach after getting too comfortable with the rules of intraday trading, holding positions overnight might be your next big move. Find out more in our guide on can I reset day trade violations.

1.2. How long can you hold a futures position?

The best part about futures? You’re not boxed in! How long you hold a position is entirely up to your strategy and the contract’s expiry. Forget the frantic, day-only pace of some markets. Futures give you the glorious flexibility to pick the timeframe that suits your style and your goals.

Common holding timeframes include:

- Day trading: Quick in, quick out. Perfect for those who love the fast-paced action and want to lock in profits before the day is over.

- Swing trading: This is where the real fun begins! Hold positions for a few days to a few weeks to capture those bigger, more satisfying market trends. It’s the perfect answer for anyone asking if they can hold futures overnight to make the most of a powerful move.

- Position trading: Think big! This strategy lets you hold positions for weeks or even months, allowing you to ride the most significant, long-term market trends to their full potential.

Just remember one key thing: keep an eye on the contract’s expiry date! For example, S&P 500 e-mini futures contracts expire quarterly. For those aiming to ride a long-term wave, you’ll need to master the “rollover” process, closing your expiring contract and seamlessly opening a new one. It’s a small detail that ensures your winning streak never has to end!

Pro tip: Don’t dive in blindly!

As someone who’s felt the thrill and the sting of overnight futures trading, I can’t stress this enough: always explore alternative markets like forex or cryptocurrencies before locking in your strategy.

Each comes with its own overnight trading quirks, think varying spreads or sudden volatility that can make or break your trade. I’ve seen traders get burned by overlooking these details, so take a moment to study the market’s rhythm and lean on our expert resources to guide your next move. Trust me, a little prep now saves a lot of heartache later!

2. Navigating the market hours: Are futures open 24 hours?

Understanding the operational hours of the futures market is key to successful overnight trading. While not strictly 24/7, futures offer extensive trading periods that span across global time zones.

2.1. The almost 24/5 trading schedule

The futures market is your personal playground, open almost all day, every day. Imagine the freedom! With popular products like the S&P 500 e-mini on CME Group’s Globex platform, you get a market that’s buzzing with life nearly 24 hours a day, five days a week. Yes, there are short daily breaks and a little pause for the market to catch its breath, but the vast majority of the time, the world is your oyster.

To make the most of this incredible opportunity, you absolutely must know the exact trading hours for the products you’re interested in. These times can shift, but once you’ve got them down, you can plan your entries and exits with confidence, ready to jump on a new opportunity no matter where you are or what time it is. This is trading on your terms, with a world of possibilities waiting for you around the clock!

Note: Day traders typically close all positions before the end of the trading day to avoid holding any open positions overnight.

2.2. Why overnight trading hours matter

Overnight trading hours present both distinct opportunities and significant challenges for traders. They allow for responsiveness to global events but also introduce new risks.

- Opportunities: These extended hours enable traders to react swiftly to global news events, economic reports, or geopolitical developments that occur outside regular U.S. stock market hours.

- Challenges: During thinner trading sessions, especially late at night or early morning, liquidity can decrease. This often leads to wider bid/ask spreads, potentially increasing your trading costs and slippage.

View more:

3. The financial landscape: Do futures have overnight fees?

When you’re ready to take the leap and hold futures overnight, you’ll be happy to know the financial landscape is incredibly straightforward. Forget the tricky “overnight fees” or swaps you might find in forex.

Futures keep it clean and simple! While direct fees like that are rare, being a savvy trader means you’ll still pay attention to a few other straightforward financial considerations. These costs are predictable and manageable, allowing you to focus on the exciting part: capturing those big, juicy market moves!

3.1. Understanding margin requirements for overnight futures

Margin isn’t just a number; it’s the relentless gatekeeper of futures trading, and its rules change dramatically for overnight positions. You’ll be forced to deal with two unforgiving types:

- Initial margin: The hefty amount you must hand over just to open a new futures position.

- Maintenance margin: The bare minimum you must constantly have in your account to avoid disaster.

Here’s the cold, hard truth: overnight margin requirements are almost always significantly higher than intraday margins. Why? Because when the market closes, you’re exposed to a world of unseen dangers and unpredictable events. This is the broker’s way of protecting themselves, not you.

If you ever fail to meet your maintenance margin, be prepared for a ruthless margin call. Your broker will demand more money, or worse, they will liquidate your position without a second thought.

And believe me, from bitter personal experience, I can tell you that margin requirements are a wild, chaotic mess. They vary wildly between brokers and even between different contracts. Never, ever make assumptions. You must check your broker’s specific rules before you even think about an overnight trade. Your financial survival depends on it.

3.2. Beyond margin: Other potential overnight costs

While it’s a small mercy that futures don’t hit you with daily swap fees like in the forex market, don’t be naive. The real financial dangers lie in other insidious costs that chip away at your capital over the long term.

3.2.1. The rollover trap

This is the most brutal cost of all for positions held over several months. As a contract nears expiration, you are forced into a costly and complicated rollover process. You must close your current position and immediately open a new one in the next contract month, incurring a new round of transaction costs (commissions and wider price spreads).

It’s not a daily fee, but it’s a massive, unavoidable expense that can easily erode your profits and make long-term strategies a financial nightmare.

3.2.2. The broker’s cut

Even when you’re just holding, standard transaction fees for opening and closing positions still apply. And watch out for sneaky, minor account maintenance fees some brokers charge. Always, always scrutinize their fee schedule, because every cent counts when you’re fighting to stay profitable.

4. Managing risk: Can we short futures overnight?

A common question among traders is whether they can hold a futures trade overnight when shorting. Understanding the mechanics and risks involved is essential for both long and short positions.

4.1. Shorting futures overnight: The mechanics

Yes, you can absolutely sell a futures contract short and hold that position overnight, and it’s an incredible advantage! Unlike the messy process of shorting stocks, which requires you to borrow shares, shorting futures is beautifully simple. You’re just taking a position that profits when the price of the underlying asset falls. No borrowing, no complex logistics.

This simple, elegant flexibility is a game-changer. It empowers you to capitalize on bearish market outlooks and profit from declines, even when the market is closed for regular trading hours. You’re not restricted to only making money when the market goes up; you have the freedom to profit in any direction!

4.2. The elevated risks of overnight positions (long & short)

Holding any position overnight, whether long or short, introduces a heightened level of risk. However, it is crucial to recognize the fundamental difference in risk between these two positions.

For Both Long & Short Positions:

- Market gaps: This is the biggest shared risk. Prices can open significantly higher or lower than the previous day’s close due to major news or events that transpired overnight. Your stop-loss might not be triggered at your desired price.

- Unique risk of short positions: While the maximum loss on a long position is limited to the capital you invested, the loss on a short position is theoretically unlimited, as an asset’s price can rise indefinitely. This elevated risk demands even stricter capital management.

- News volatility: Important economic reports, geopolitical developments, or company-specific news (for equity futures) can cause dramatic price swings. These events often occur when you are not actively monitoring the market.

- Low liquidity: During off-peak hours, the market can be much thinner. This means it might be harder to enter or exit positions at favorable prices, leading to increased slippage.

- Margin risk: Rapid, adverse price movements can quickly deplete your account equity. It’s vital to understand how leverage and margin work in prop‑firm accounts to avoid account blowouts.

4.3. Essential risk management strategies for overnight futures

To even consider the perils of overnight futures trading, a bulletproof risk management plan isn’t optional; it’s your only hope for survival. This applies whether you’re long or short.

- The illusion of stop-loss orders: You’ll be told to use stop-loss orders, and you should. But don’t be fooled into thinking they offer perfect protection. In a gapping market, a stop-loss is just a suggestion. It can be filled at a far worse price than you intended, turning a small loss into a major blow.

- The trap of over-leveraging: This is a killer. Never, ever over-leverage your trades. Risking a large percentage of your capital on a single position, especially overnight, is a recipe for disaster. The market loves to punish greed and recklessness.

- The relentless news cycle: The market doesn’t sleep, and neither should your vigilance. You must stay obsessively informed about global economic calendars and political events. Ignoring a single news report can lead to a sudden, violent move that liquidates your position before you even wake up.

- The cruel logic of the charts: Use technical analysis to identify key support and resistance levels. These aren’t guarantees; they’re battle lines. They can offer places to set your stop losses, but remember, the market can and will break them without hesitation.

I’ve learned the hard way that the most brutal part isn’t the charts; it’s the mental war when the market gaps against you. The panic, the fear, that’s what destroys most traders. Sticking to your plan and not panicking is the only thing that will keep you from being wiped out.

5. Strategic approaches to holding futures overnight

Don’t just ask if you can hold a futures trade overnight, ask why! The real power lies in the strategic reasons for doing so. Holding futures positions overnight isn’t just about risk; it’s about aligning with powerful trading methodologies that give you a huge advantage.

Each of these approaches comes with its own incredible benefits, turning a simple overnight hold into a masterful move. It’s time to stop thinking about a single trade and start thinking about your long-term success.

5.1. Swing trading with futures: A popular choice

Swing trading is a strategy that aims to capture short to medium-term gains over a period of a few days to several weeks, making it ideal for those new to futures to learn more in our guide on the best trading strategy for beginners. Instead of focusing on minute-by-minute fluctuations, swing traders look for larger price swings.

Common technical indicators used in swing trading include:

- Moving averages (MA): To identify trends and potential reversals.

- Relative strength index (RSI): To gauge overbought or oversold conditions.

- Moving average convergence divergence (MACD): To spot momentum shifts.

5.2. Hedging with overnight futures

Futures contracts are powerful tools for hedging, allowing investors to offset potential losses in one investment with gains from another. This is particularly relevant for those wondering if they can hold futures overnight for risk management.

For example, a portfolio manager holding a large stock portfolio might short S&P 500 e-mini futures to protect against a broad market downturn. If the stock market falls, the gains from the short futures position can help mitigate losses in the stock portfolio. This strategy is often employed to manage overall portfolio risk during uncertain periods.

5.3. The role of fundamental analysis in overnight futures

While technical analysis is your roadmap, fundamental analysis is your crystal ball. It lets you see the powerful economic and financial forces shaping the market. For overnight futures positions, a deep understanding of these fundamentals isn’t just an advantage; it’s your key to unlocking bigger, more predictable moves.

This means you get to be a true market detective, closely monitoring:

- Economic news: Like thrilling inflation reports, crucial interest rate decisions, and game-changing employment data.

- Political developments: Which can dramatically shift market sentiment in your favor.

- Corporate earnings reports: The heartbeat of futures contracts tied to specific indices or sectors.

These factors are the engines driving significant price movements, especially during overnight hours when the biggest announcements often drop. By incorporating fundamental analysis, you’re not just reacting to charts; you’re anticipating the market’s next move and making brilliantly informed decisions about holding your positions overnight.

6. Choosing the right platform for overnight futures trading

Selecting the right trading platform and broker isn’t just a critical step; it’s the most important decision you’ll make for your overnight futures journey. Your chosen provider is your partner, and their features and policies can either pave the way for an incredible trading experience or hold you back.

By choosing wisely, you’re setting yourself up for success, ensuring you have the robust tools and supportive environment you need to thrive. This is your chance to build a winning team!

6.1. Broker considerations for overnight holding

When evaluating brokers for overnight futures trading, think of yourself as a master scout, meticulously choosing the very best partner for your mission. These key factors aren’t just details; they’re the elements that will empower you to manage your positions brilliantly and keep your costs in check.

Consider the following as your winning checklist:

- Overnight margin requirements: Find a broker whose capital rules feel like a comfortable fit. Their requirements should align perfectly with your own capital and risk tolerance, giving you peace of mind.

- Trading fees and associated costs: Don’t just settle for low commissions. Dig a little deeper and discover a broker with a transparent fee structure. Look for minimal account maintenance fees or other charges, so you know exactly where you stand.

- Trading platform capabilities: A powerful, robust platform is a trader’s best friend. It should offer advanced order types, lightning-fast real-time data, and reliable charting tools. Features like customizable stop-loss and take-profit orders are your secret weapons for managing risk with confidence.

- Customer support and margin call procedures: A great broker has your back. Understand their margin call procedures and know that their support team is always available, especially when you need them most during extended trading hours.

6.2. Navigating futures challenges (referring to proprietary trading firms)

For traders brave enough to take on “futures challenges” from proprietary trading firms, the rules for holding positions overnight are often brutal and unforgiving. These challenges aren’t designed to test your brilliance; they are a harsh trial to assess your discipline and risk management skills in a simulated environment.

One wrong move, one moment of forgetting a rule, and all your hard work can be instantly erased. The house always has the last say, and in these challenges, the rules are everything.

It’s vital to:

- Read the rules carefully: Many prop firms, like The Trading Pit, have specific clauses regarding overnight and weekend holding. Some challenges might prohibit it entirely, while others allow it with certain restrictions. Before choosing one, learn how to choose a prop firm with favorable rules.

- Understand the simulated environment: Remember that these challenges typically use demo accounts with virtual funds. While they simulate real trading, the psychological pressure and capital at risk are different from live trading.

These rules are in place to manage the firm’s risk exposure and to ensure traders adhere to disciplined practices.

7. Common pitfalls and how to avoid them

Even with careful planning, overnight futures trading comes with its share of potential traps. Recognizing these common pitfalls is the first step toward avoiding them and protecting your capital.

7.1. Overleveraging

Using too much leverage is a pervasive danger in trading, especially when holding positions overnight. While leverage can amplify profits, it equally magnifies losses. A small adverse market move can quickly lead to a margin call or even wipe out your account.

7.2. Ignoring news events

The market doesn’t sleep, and neither do global events. Neglecting to monitor the economic calendar or major geopolitical news can leave you vulnerable to sudden, unexpected price swings. A seemingly calm market can erupt with volatility after an important announcement.

7.3. Lack of stop-loss

Trading without a stop-loss order, particularly for overnight positions, is akin to driving without brakes. While market gaps can sometimes render stop-losses ineffective at the exact desired price, having one is still crucial. It acts as your last line of defense against catastrophic losses.

7.4. Chasing gaps

When the market opens with a significant gap, it can be tempting to jump in, hoping to catch the continuation of the move. However, chasing these gaps often leads to poor entry points and increased risk. Prices can quickly reverse, leaving you on the wrong side of the trade.

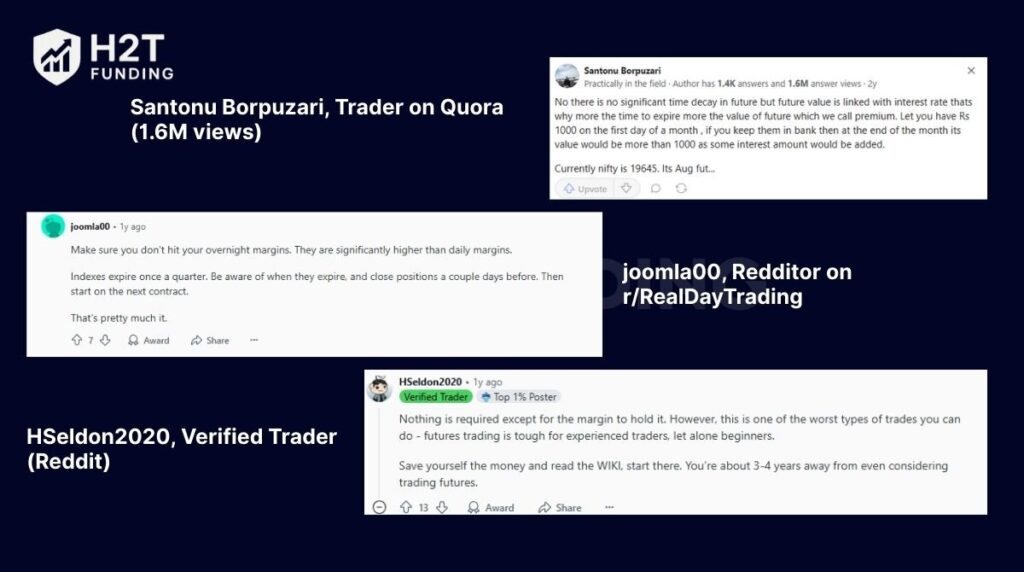

8. Insights from the community: Real people, real experiences

Holding futures positions overnight may seem simple, but in reality, it’s a topic that leaves many traders, even seasoned ones, deep in thought.

During my research, I came across some incredibly honest and emotional shares from traders on Quora, Reddit, and major trading forums. This highlights an important truth: books and theories often fall short of capturing the real challenges of live trading.

Here are some candid quotes from the trading community, reflecting their thoughts, concerns, and practical lessons and insights you can carry into your own trading journey:

No, there is no significant time decay in futures, but the future value is linked with interest rates. That’s why the more time to expire, the higher the value of the future, which we call the premium.

– Santonu Borpuzari, Trader on Quora (1.6M views)

Make sure you don’t hit your overnight margins. They are significantly higher than daily margins.

– joomla00, Redditor on r/RealDayTrading

Nothing is required except for the margin to hold it. However, this is one of the worst types of trades. Futures trading can be tough for experienced traders, let alone beginners.

– HSeldon2020, Verified Trader (Reddit)

I have a tried and true method… but I’ve never held a trade overnight. Now I’m getting signals that tempt me to do it. I’m trying to find out everything about contract rollover before I take the plunge.

– SpriteWorx, Trader on Reddit

These real-life accounts not only help you better understand the risks and preparations involved in holding futures overnight, but also serve as a reminder: emotion, hands-on experience, and community wisdom are invaluable assets on your trading path.

Read more:

9. Frequently asked questions (FAQs)

The most common answer is no. The vast majority of proprietary trading firm challenges have a strict rule requiring all positions to be closed before the market’s daily session ends. Holding positions overnight or over the weekend is typically a rule violation that leads to disqualification. However, a few advanced programs, or once you are actually funded, might allow it, but this is the exception, not the norm. Therefore, always read and strictly adhere to the rules of the specific challenge you are participating in.

If your account equity falls below the maintenance margin requirement for your overnight futures position, your broker will issue a “margin call.” You’ll typically be required to deposit additional funds to bring your account back to the required level. If you fail to do so, the broker may liquidate some or all of your positions to cover the deficit.

While most liquid futures contracts can be held overnight, the specific characteristics (e.g., volatility, liquidity, margin requirements) vary significantly by contract type. Popular contracts like the E-mini S&P 500 futures are commonly held overnight due to their liquidity, but others, such as agricultural or energy futures, might have different dynamics and considerations for overnight holding.

You can hold futures until the contract’s expiry date, typically ranging from days to months, depending on the contract (e.g., S&P 500 e-mini expires quarterly). Always plan for rollovers to extend positions beyond expiry.

A common risk is market gaps, where prices open significantly higher or lower due to overnight news or events, potentially bypassing stop-loss orders and causing unexpected losses.

10. Conclusion

So, what’s the final answer to the question, can you hold futures overnight? Absolutely, but it’s not a decision to be taken lightly. It demands serious preparation and iron discipline.

At the end of the day, effective risk management isn’t just paramount; it’s everything. Understanding the market hours, keeping an eye on the news, and choosing the right broker will be your best allies on this journey.

For more insights into managing these risks and choosing the right broker, visit H2T Funding‘s guides on how funded trading accounts work, especially the one on how Apex Trader Funding works, and explore prop firms that are easiest to pass and, more broadly, the entire Prop Firm & Trading Strategies section.