College life is filled with exciting opportunities, but it can also be financially overwhelming. From tuition to textbooks, rent to ramen noodles, managing your money can feel like a full-time job. That’s where budgeting tips for college students come in. With a little planning and the right tools, you can stay in control of your finances and make your college years less stressful and more fulfilling.

These tips are backed by experience and supported by experts. According to a 2023 Sallie Mae study, students who track spending feel more financially confident. Want to see how these tips actually work? Let’s dive in.

Key takeaways

- A clear budget money plan reduces stress and builds habits that last beyond graduation. Even with limited earnings, a realistic plan helps you avoid debt and stay aligned with long-term goals.

- Using a simple framework like the 50/30/20 rule makes it easier to allocate simply across essentials, lifestyle, and a future cushion. Tools such as spreadsheets or apps like YNAB and Goodbudget can streamline the process.

- Tracking every dollar and reviewing budgets weekly is critical for staying on course. Whether through apps or manual spreadsheets, consistent monitoring reveals patterns and areas for improvement.

- Smart money habits like cooking at home, applying for student discounts, avoiding credit card debt, and picking up side hustles can significantly increase financial flexibility. Small daily choices make a big impact over time.

- Common pitfalls like ignoring irregular expenses or failing to adjust budgets monthly can derail progress. Treat your budget as a living plan that evolves with your lifestyle and academic journey.

1. Importance of budgeting as a college student

Learning how to budget as a college student is one of the most valuable skills you can develop. College comes with many expenses like tuition, rent, food, and books. Without a plan, it is easy to overspend or rely on credit cards.

Why budgeting matters:

- Helps you control spending

- Reduces the risk of debt

- Develops thrift habits, even with a small income

- Prepares you for life after graduation

From my own experience, my first year was a financial mess. I was constantly broke the week before I got my next paycheck. In my second year, I finally started tracking my spending… Honestly, the biggest win was just not having that end-of-month panic anymore. I could actually afford groceries that weren’t just ramen.

The key message is that managing money gives you the freedom to enjoy college life without losing control of your money. It helps you prepare for both today and the future.

If you prefer a structured read, think of this guide as a concise budgeting tips for college students essay with clear ideas, quick wins, and tools you can use today.

2. Common financial challenges faced by college students

Managing money in college is something you learn by doing, and often, by messing up first. I definitely learned these lessons the hard way. I remember my own student days, constantly feeling like I was one unexpected expense away from trouble. It’s a common story, and it usually boils down to a few key challenges:

- Living beyond means: Not knowing how to tap financial aid and grants is a missed chance; pairing them with flexible job opportunities keeps you focused on academic goals without extra stress.

- Limited job opportunities: Balancing part-time work with academic goals can be tough. A flexible role, such as tutoring or freelance projects, can help without overwhelming your schedule.

- Overlooking irregular costs: Semester fees, annual subscriptions, or holiday travel are often forgotten, which can disrupt disciplined money management.

- Lack of financial literacy: Not knowing how to use tools like grants, scholarships, or financial aid leads to missed opportunities for support.

- Relying too much on borrowing: Credit cards or overdrafts may seem like a quick fix, but can cause long-term stress if not managed carefully.

Challenges around money at university are common but not impossible to overcome. By seeking support services, applying for grants, exploring part-time roles, and practising disciplined money management, students can reduce financial stress and stay focused on academic goals.

3. How to budget for college students

Let me tell you about a friend of mine, Amira. Last year, she told me she’d managed to save over $2,500 during the school year. That number blew me away, especially since she was juggling classes and a part-time lab job. Her motivation? In an unpaid summer research program in Europe, she was determined to pay for herself.

What struck me wasn’t just the amount she saved, but how clearly she managed her finances, even on a modest student income. Her method was simple, realistic, and most importantly, repeatable. If you’re a college student trying to save for a specific goal or just stay in control of your finances, Amira’s step-by-step approach is a great place to start.

Let’s break down exactly how she did it.

3.1. Step 1: Calculate your total monthly income

The first thing Amira did was figure out exactly how much money she had coming in each month. She combined her $750 monthly paycheck from her on-campus lab assistant job with a $300 monthly allowance from her parents. That gave her a total of $1,050 to work with.

Take the same approach: add up all reliable income streams, whether it’s wages, parental support, scholarships, or freelance gigs. Don’t overestimate. Budget based on your real monthly income, not occasional windfalls like birthday gifts or one-time tutoring gigs.

3.2. Step 2: List your fixed and variable expenses

Once Amira knew her income, she made a list of monthly costs and divided them into two categories:

| Fixed Expenses | Variable Expenses |

|---|---|

| Rent: $600 | Groceries: ~$150 |

| Phone bill: $50 | Dining out: ~$80 |

| Transit pass: $75 | Entertainment: ~$50 |

| Internet: $60 | School supplies: ~$30 |

This helped her see exactly where her money was going, and more importantly, where she could cut back. For example, she realised she was spending over $100 a month on takeout, so she began meal prepping on Sundays to reduce that cost.

Use this method to identify your non-negotiables (like rent and tuition) and your flexible expenses (like streaming subscriptions or eating out), which offer opportunities for adjustment.

3.3. Step 3: Apply a simple budgeting framework (like 50/30/20)

To avoid overspending, Amira structured her budget using the 50/30/20 rule:

- 50% of income to needs (rent, groceries, bills)

- 30% to wants (entertainment, dining out)

- 20% set aside

Out of her $1,050, roughly $525 went to essentials, $315 to wants, and $210 was automatically transferred to her reserve account every month. That’s how she built her $2,500 cushion over two quarters.

You don’t have to follow the 50/30/20 rule strictly. What matters is consistency. If your costs are higher, even a 10% savings rate is a win. Just assign percentages that reflect your reality.

3.4. Step 4: Use practical tools to track spending

Amira used Google Sheets to track her money manually, colour-coded, and updated weekly. It gave her complete control and awareness over every dollar. While she tried a few apps like Goodbudget and PocketGuard, she found a simple spreadsheet worked best for her routine.

You might prefer a budgeting app, especially if you want automation. Consider:

| Tool | Strength |

|---|---|

| Google Sheets | Full control, customizable |

| Goodbudget | Envelope-style budget |

| PocketGuard | Real-time alerts to avoid overspending |

Try a few methods and stick with the one you’ll actually maintain. The budget tools don’t work if you abandon them after two weeks.

3.5. Step 5: Review and adjust your budget weekly

Every Sunday night, Amira spent 15–20 minutes reviewing her spreadsheet, comparing her planned budget to actual outflow. If she overspent on coffee that week, she adjusted the following week’s dining budget accordingly. That habit helped her stay on track and avoid guilt-driven overspending.

Build the same habit: set a weekly check-in to reflect, adjust, and stay accountable. A budget isn’t static; it evolves with your lifestyle, goals, and reality.

4. Top 12 financial tips for college students

College life comes with many outcomes. Here are 12 useful budgeting tips for students to help you manage your money wisely and avoid overspending.

4.1. Track every dollar you spend

Step one in mastering how to manage money in college: know where every dollar goes. Start by tracking every transaction, no matter how small. Budgeting apps like PocketGuard and Goodbudget visualise money flows over time.

- Visual Resource: YouTube – Budget App Tutorial

- Social Proof: Search “#budgettracking” on Instagram or Pinterest for template inspiration and peer routines.

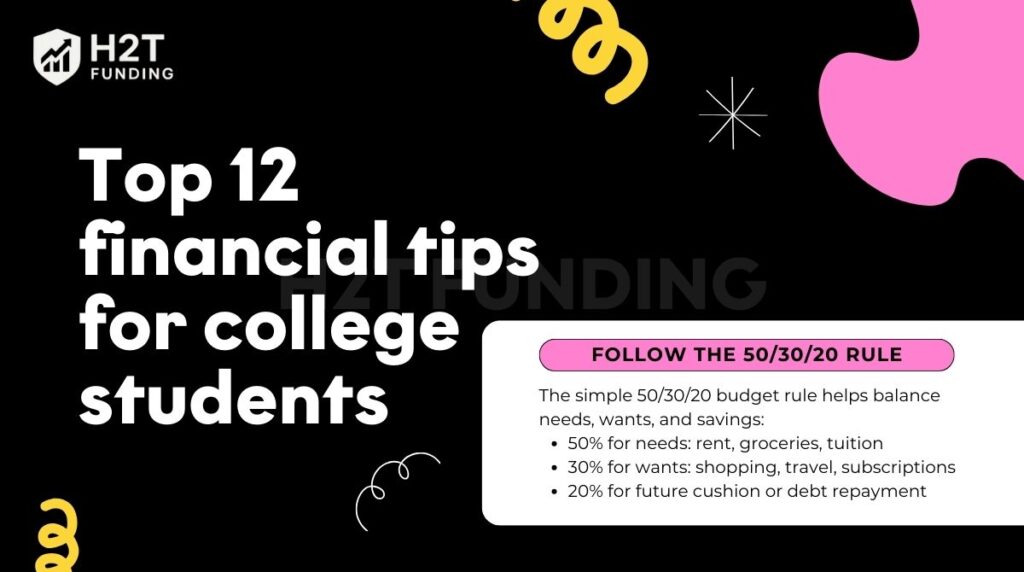

4.2. Follow the 50/30/20 rule

The simple 50/30/20 budget rule helps balance needs, wants, and savings:

- 50% for needs: rent, groceries, tuition

- 30% for wants: shopping, travel, subscriptions

- 20% for future cushion or debt repayment

Use templates in Google Sheets or apps like YNAB to implement this structure.

- YNAB (You Need A Budget): Encourages proactive money management by assigning every dollar a job.

- Google Sheets Templates: Offers pre-made, editable budget spreadsheets that visualise your 50/30/20 plan.

- Resources: YNAB – Budgeting Method

- Infographic Example: Search “50/30/20 rule infographic” on Pinterest.

Following percentage-based plans is one of the most effective budgeting tips for college students who want structure. This rule is an ideal starting point for anyone learning how to budget as a student.

See more methods: Zero-based budgeting method: Save smarter every month

4.3. Apply for student discounts

Taking advantage of student perks is a smart financial habit and part of managing your college money.

- UNiDAYS: Verifies student status and offers deals from brands like Apple, ASOS, and Samsung.

- Student Beans: Another discount portal for students covering fashion, food, and software.

- SheerID App: A background verification tool that confirms eligibility for various student and military discounts.

- Instagram Tip Threads: Try “student discount hacks” to find hidden deals students share online.

4.4. Cook at home more often

Meal prepping and cooking at home saves money and avoids food waste. A single meal out can equal 3 home-cooked portions. For those looking for the best budgeting tips for college students, cooking at home is both financially and health-wise beneficial.

- Recipe Hub: Budget Bytes (A blog and app offering easy, cost-effective recipes tailored to college budgets.)

- Tools: Meal planner templates on Canva or Google Sheets

- YouTube Inspiration: College Meals on a Budget

You can also check out this guide on meal planning to save money and make the process easier.

4.5. Say no to credit card debt

Credit cards can lead to trouble if not used wisely. Don’t borrow what you can’t afford to return. Focus on building credit, not accumulating interest. For a broader view on how to balance short-term spending and long-term growth, check out this guide on saving vs investing pros and cons.

- App to Monitor Credit: Credit Karma

This is a free app that lets users monitor their credit score, track credit report changes, and simulate how financial decisions might impact their score. It offers weekly updates from TransUnion and Equifax, along with personalised tips to help improve your credit health.

For students looking to build credit without falling into debt, Credit Karma is a smart, beginner-friendly option.

4.6. Consider picking up a part-time job or side hustle

Make money by offering services you’re good at. Online freelancing, dog walking, tutoring, or campus jobs can supplement your earnings.

- Freelance Sites: Upwork, Fiverr

- TikTok Tips: Search “student side hustles 2024” for ideas.

Extra earnings create room in your plan and add flexibility. For more ways to strengthen cash flow, see our guide on how to improve your personal cash flow.

Continue reading: 51 surprising hobbies that can actually make you money

4.7. Share expenses with roommates

Splitting rent and shared bills can get messy without a clear system. Living with roommates can get messy when it comes to money. Luckily, there are apps to stop the awkward “you owe me” texts and keep things fair without ruining a friendship.

- Splitwise is a highly intuitive tool designed specifically for shared expenses. It lets you create groups, add bills, and automatically calculates who owes whom, greatly reducing awkward money conversations. A major plus is multi-platform support (web, iOS, Android) and support for multiple currencies.

- Venmo, owned by PayPal, is widely used in the U.S. for peer-to-peer money transfers. With its app, you can quickly send or request money for shared costs. Venmo integrates group payments and even offers a social feed for added convenience. Linking your bank account or debit card allows fee-free transfers, and you can also get cashback rewards with Venmo’s debit/credit card.

If you’re living with others, these tools make cost-sharing hassle-free. For more creative tips, you can explore #roommatediaries on Instagram or read our guide on how to manage bills effectively.

Splitting costs is one of the easiest ways to practice how to budget as a college student without sacrificing comfort or convenience.

4.8. Buy used or rent textbooks

Textbooks are expensive. A simple yet impactful item on the list of best budgeting tips for college students is buying or renting textbooks instead of purchasing new ones.

- Sites:

- Chegg offers textbook rentals at a fraction of the retail price, along with optional study tools and homework help.

- Amazon Rentals is another budget-friendly option with flexible return policies and fast shipping, ideal for students with tight schedules.

- Resource: Free PDFs and open educational resources (OER) from your school library.

Think of it as a small version of a save money challenge: each book you rent instead of buying new is money freed up for coffee runs, trips, or even your reserve account.

View more:

4.9. Use a budget template

If apps aren’t your thing, a spreadsheet works just fine. Customise your budget with free Google Sheets templates.

- Template Gallery: Google Sheets Templates (you can search on Google; there are many templates there)

- Pinterest Ideas: Search “college budget printable”

4.10. Build an emergency fund

Nearly 70% of US college students report they couldn’t cover a $500 emergency expense, relying instead on credit cards or loans. Most financial experts recommend setting aside 3–6 months of essential living costs, including rent, food, and transportation, as a safety net. Based on average student budgets (around $900/month), this means aiming for a $2,700–$5,400 emergency fund.

Start small. Saving just $10–$25 per week can build a $500 cushion within 5–12 months, a solid first milestone. Automate transfers and consider these tools:

- Chime: A no-fee reserve account that automatically “rounds up” debit card purchases and transfers the spare change into a financial buffer.

- Ally Bank: Offers high-yield, interest-bearing savings, with easy online transfers and no monthly fees.

By starting small and automating contributions, students can steadily build toward the recommended 3–6 months of expenses, helping avoid high-interest debt and remain financially resilient.

4.11. Limit Impulse purchases

Pause before buying. The 24-hour rule helps you decide if a purchase is a want or a need. You’ll be surprised how often you don’t go back for it.

Additional Tips:

- Create a Wishlist: Want something? Save it to a wishlist and wait. Revisit it after a week. If it still feels worth it, consider buying. If not, you’ve saved money.

- Set a Monthly “Fun Spending” Limit: Give yourself a fixed budget for non-essential purchases. Once it’s gone, no more impulse buys.

- Unsubscribe from Tempting Emails: Promotional emails often trigger unnecessary purchases. Reduce temptation by unsubscribing from sales alerts.

- Shop with a List: Whether online or in-store, always have a shopping list. Stay disciplined to steer clear of unplanned purchases.

Impulse control is a habit. The more you practice mindful spending, the easier it becomes to resist short-term temptations for long-term gains.

4.12. Don’t forget free campus resources

Your tuition often includes free access to valuable services:

- Gym memberships

- Career services

- Mental health support

- Campus events with food, entertainment, and giveaways

Visuals: Campus bulletin boards or school social media

Pro Tip: Follow your college’s Student Life or Campus Events page on Instagram for updates

4.13. Free tools to help college students manage their budgets

For university students juggling tuition, rent, and day-to-day expenses, a budget tool can be a game-changer. These free apps help you track money use, control impulsive purchases, and build solid financial habits, without adding another cost to your plate.

Goodbudget

- Based on the envelope budget system, assign money to different categories (like groceries, entertainment, and school supplies).

- Simple interface and easy to use for beginners; the free plan includes up to 20 envelopes and syncs across two devices.

- Great for students who prefer to manage their budget manually without linking a bank account.

PocketGuard

- Connects to your bank account and automatically tracks your purchases.

- Highlights how much money is “In My Pocket” after subtracting bills, financial buffer, and subscriptions.

- Ideal for students with irregular cash inflows or those prone to impulse purchases.

YNAB (You Need A Budget)

- Uses a zero-based method approach, giving every dollar a job.

- Helps build long-term financial discipline and tracks progress toward savings goals.

- Free for 12 months for students in university (just sign up with a school email or student ID).

HomeBank

- Free open-source desktop software for Windows, macOS, and Linux.

- Allows you to import bank statements and generate custom reports and graphs.

- Perfect for spreadsheet-savvy students who want full control without cloud syncing.

If you’re looking for something intuitive and mobile-friendly, start with Goodbudget or PocketGuard. For building serious habits, YNAB is an excellent (and student-friendly) option. And if privacy and detailed tracking matter most, HomeBank gives you full control, without the learning curve of Excel.

5. Sample budget plan and case study for a college student

To make the budget less abstract, let’s look at a real case study adapted from James Madison University. This example shows how a first-year student created a zero-based budget to avoid unnecessary debt while living on campus.

Like many of us, he started with limited resources, mixed support from parents, part-time work, and some savings. I relate to this because in my first year, I also had to track every dollar from scholarships, my weekend job, and even summer savings just to cover essentials. Seeing it laid out in a plan made me feel more in control.

Case study profile

- In-state, full-time, living on campus

- Annual university costs: $14,256 (tuition, room/board, internet fee)

- Support: grants, optional federal loans, parental contribution

- Extra: part-time campus job + money saved from summer

Sample Budget Plan (Monthly Breakdown)

| Category | Amount ($) | Notes |

|---|---|---|

| Income | ||

| Grants & Scholarships | 500 | $6,000/year divided monthly |

| Parental Contribution | 542 | $6,500/year divided monthly |

| Part-time Job | 300 | 10 hrs/week at $7.5/hour |

| Savings (summer work) | 333 | $4,000/year divided monthly |

| Total Income | 1,675 | |

| Fixed Expenses | ||

| Tuition/Room/Board | Covered | Paid directly to the university |

| Cell Phone | 50 | Only recurring monthly bill |

| Variable Expenses | ||

| Books/Supplies | 80 | Adjusts each semester |

| Dining Out | 100 | Flexible |

| Personal Care | 40 | Toiletries, shampoo, etc. |

| Clothing | 60 | Seasonal |

| Entertainment | 70 | Movies, concerts |

| Miscellaneous | 60 | Unplanned needs |

| Total Expenses | 460 | Variable categories only |

This plan shows how every dollar is assigned a role. Fixed costs are predictable, while variable items can be adjusted depending on priorities. The mix of financial aid, parental help, part-time job, and savings makes college life manageable without falling into debt.

For me, seeing a breakdown like this in my budget makes it easier to say no to unnecessary spending and focus on what’s important.

6. Mistakes college students often make when budgeting

Making a budget is a great first step, but sticking to it can be challenging. Here are five common mistakes that students often make and how to avoid them:

- Not monitoring cash regularly: You can’t improve what you don’t measure. Without regularly tracking where your money goes, it’s easy to overspend without realising it.

- Confusing wants with needs: It’s tempting to justify a daily coffee or new clothes as essentials, but understanding the difference is key to a smart budget. Many people blur the line between what they truly need to live and what they simply want to enjoy. To spend wisely, you need to identify your priorities clearly.

The table below can help you break down your expenses and rank them based on their importance.

| My needs and wants | Need or want? | Step 3: Priority Level (1 = Must have, 2 = Strongly want, 3 = Nice to have) |

|---|---|---|

| Save for a vacation | Want | 3 |

| Buy a new laptop | Want | 2 |

| Attend college | Need | 1 |

| Buy a more stylish bike | Want | 2 |

| Save for an emergency fund | Need | 1 |

| Plan for large purchases | Need | 2 |

| Pay off credit card debt | Need | 1 |

- Relying on credit cards for emergencies: Credit cards aren’t a safety net. Instead, aim to build a small emergency fund. If you’re unsure where to start, check out these sinking fund examples for practical ways to prepare.

- Overlooking one-off costs: Annual subscriptions like streaming services, cloud storage, and fitness apps, holiday gifts, or semester fees often get overlooked. Set calendar reminders and create budget categories for these predictable but infrequent costs.

- Not revisiting and adjusting your budget each month: Life changes, and so should your budget. Whether your cash inflow increases or new costs arise, make it a habit to revise your budget monthly to keep it aligned with your goals.

For more tips on how to sidestep these common traps, see this full guide on budgeting mistakes to avoid. Avoiding these pitfalls will help you stay on track and make your budget a reliable part of college success.

Don’t miss out: How to stop overspending: 12 actionable strategies

7. FAQs

YNAB is often considered the top choice since it teaches you to assign every dollar a purpose and even gives students a free year. If you want something simpler and more automated, PocketGuard is great for tracking spending and seeing how much you can safely use. For splitting costs with roommates, Splitwise is the most convenient option.

A general rule is to aim for saving 10–20% of your monthly income. If you’re earning from part-time work or scholarships, set aside even $20–$50/month. This habit builds your emergency fund and prepares you for larger expenses later in the semester.

While the 50/30/20 rule is a good framework, it might need tweaking depending on your situation. For example, students with lower incomes might use a 60/30/10 or 70/20/10 rule, focusing more on needs and essentials, with modest long-term goals.

Start by setting a weekly food budget and sticking to a grocery list. Cooking at home, using meal prep, and taking advantage of student meal plans can drastically cut food costs. Avoid shopping when hungry and plan your meals to prevent waste.

Begin by tracking every dollar you spend for one month. Use a free app or spreadsheet to list income and all your expenses. This gives you a baseline to build a realistic budget, showing where to cut costs and where you can start saving.

A student budget should include rent, groceries, transportation, phone bill, textbooks, and tuition. Also include fun money for entertainment, savings, and irregular costs like travel, holiday gifts, or club fees.

The best way is to keep it simple. Start by tracking your income and expenses each month. Divide your spending into needs, wants, and savings. Use free tools like budgeting apps or spreadsheets to stay consistent. Most importantly, review your budget often and adjust when your situation changes.

The 70 20 10 budget rule splits your income into three parts: 70% for living expenses like rent, food, and transportation, 20% for savings or debt payments, and 10% for giving or personal growth. It’s a straightforward framework that helps you balance spending and saving.

The 3 P’s stand for Plan, Prioritise, and Pay. You plan your budget by listing income and expenses, prioritising what matters most, and then paying bills and savings before optional spending. Following this keeps your money organised and purposeful.

8. Conclusion

Budgeting as a college student doesn’t mean giving up fun; it means being intentional about your money. These 12 practical budgeting tips for college students help you start small, track progress, and make confident financial decisions.

As financial educator Dave Ramsey puts it: “A budget is telling your money where to go instead of wondering where it went.”

Personally, I applied several of these budgeting tips during my junior year. I started tracking expenses with YNAB, meal prepping using Budget Bytes recipes, and used Google Sheets to set up a 50/30/20 plan. Within four months, I saved enough to cover an unexpected dental bill without dipping into credit. It feels empowering and proves that small changes can really make a difference.

Which of these tips do you find most helpful? Feel free to share your thoughts or drop a comment below. Your experience might just inspire another student!

Check out the Budgeting Strategy Section on H2T Funding for additional practical tips and personal finance advice.