What is the best trading strategy for beginners? It depends on your time, risk tolerance, and learning style. The best strategies for beginners include trend following, swing trading, and day trading, each offering a unique balance of risk and flexibility.

Want to find out which one fits your style? Keep reading or skip ahead to the strategy that catches your eye! This guide will walk you through the best trading type for beginners to help you choose the one that suits you best.

Key takeaways:

- Choosing the best trading strategy depends on your time, risk tolerance, and learning style, not on luck or complex systems.

- The most beginner-friendly approaches include trend following, swing trading, and day trading, offering a good balance between flexibility and risk control.

- Before trading live, test different trading strategies for beginners using a demo account to avoid unnecessary losses and build real experience safely.

- Risk management is the core of every successful strategy. Always define how much you’re willing to lose before entering any trade.

- Start simple: focus on clean charts, strong support and resistance levels, and one consistent setup before adding more complexity.

- Your mindset matters as much as your method. Maintaining emotional control and trading discipline is what separates consistent traders from impulsive ones.

- If you’re still wondering which type of trading is best for beginners, experiment with scalping, swing, or position trading to see which style aligns best with your lifestyle and mindset.

- Remember: the best trading tips for beginners aren’t about secret indicators but about patience, structure, and learning from every trade.

1. Why every beginner needs a strategy

Whether you’re just getting curious about trading or have already tried a few demo accounts, a solid strategy is your foundation. In this section, you’ll learn what a trading strategy is and why skipping one leads to common mistakes. You’ll also see how this guide helps you discover which approach suits you best.

1.1. What is a trading strategy?

A trading strategy is a defined plan or methodology that guides how a trader buys and sells financial instruments. It includes specific rules on when to enter and exit trades, how much capital to allocate, and how to manage risks. Without one, traders operate on impulse.

Many studies have shown that the majority of retail traders lose money due to a lack of a clear strategy and being driven by emotions such as fear and greed. That’s why understanding core financial concepts matters; you can start with financial literacy tips for beginners to build a stronger foundation before you trade for real. For example, a study cited by Bloomberg found that over 80% of day traders quit the market within their first two years for these reasons.

A trading strategy is simply your roadmap, a rules-based plan that defines how and why you trade. It includes when to enter or exit, how much capital to risk, and how you’ll manage emotions when things get rough. Without one, traders often act on impulse, and that’s where most beginners stumble.

But here’s the thing: your trading strategy is closely tied to your trading style. Think of style as the “tempo” of your trades, while the strategy is the “method.” Scalping and day trading are great for those who enjoy fast-paced action.

Swing or position trading, on the other hand, suits people who prefer patience and a bit more analysis. Algorithmic trading, on the other hand, appeals to those who enjoy coding and letting AI do the heavy lifting.

Personally, I’ve found that your style often reflects your personality. Are you calm and analytical? Swing trading might feel natural. Do you get a thrill from short bursts of activity? Then maybe scalping is your game. There’s no one-size-fits-all, and that’s exactly what makes beginner trading strategies so fascinating.

To give you a quick overview, here are some of the most common styles and strategies traders explore today:

- Scalping: ultra-fast trades aiming for small profits many times a day.

- Day trading: buying and selling within the same day to avoid overnight risks.

- Swing trading: holding trades for several days or weeks to capture medium moves.

- Position trading: long-term trades based on market trends or fundamentals.

- Algorithmic trading: using automated systems to execute trades logically and consistently.

Each of these approaches connects differently with your goals, time, and mindset. The best way to find what works? Test them slowly, one at a time, and see which rhythm truly fits you. If you’re not ready to trade live yet, start with demo trading accounts to practice safely in a risk-free environment.

1.2. Why trading without a plan leads to failure

Trading without a clear strategy is like sailing without a compass. Beginners often fall into traps such as overtrading, chasing losses, or switching strategies too quickly. These actions often result in emotional decisions, leading to losses and burnout.

1.3. How this guide helps you pick the best trading strategy

This guide breaks down the 13 most common trading strategies for beginners. Each section explains how the strategy works, its pros and cons, and who it is best suited for. By the end, you will understand your options and feel confident to try them safely using demo platforms.

Whether you’re just curious or already exploring, this guide explains which trading is best for beginners, highlighting the simplest and most effective ways to start right. If you plan to grow into a funded trader, check out how to get into prop trading, a realistic path many professionals use to turn trading into a career.

Let’s dive in! The first strategy awaits you just below.

Key points:

- A clear trading strategy keeps you from trading on impulse or emotion.

- Most retail traders fail because they lack structure and discipline.

- Your trading style (scalping, swing, position, etc.) should match your personality and time availability.

- Start simple; test one strategy at a time before adding complexity.

- The right trading strategy for new traders is the one you fully understand and can follow with discipline.

- Practice in demo accounts first to build confidence and refine your rules.

2. 13 best trading strategies for beginners (explained simply)

Finding your footing in trading can feel overwhelming at first. That’s why I’ve broken down each beginner-friendly method in plain language, with short examples that show how real traders apply them. These are time-tested approaches, simple, structured, and practical for new traders.

In this section, we’ll cover:

- Trend Following

- Swing Trading

- Day Trading

- Scalping

- News Trading

- Range Trading

- Position Trading

- Pattern Trading

- Breakout Trading

- Macro Trading

- Carry Trading

- Contrarian Trading

- Mean Reversion Trading

Each of these strategies has its pros, cons, and unique tempo. Try to see which one matches your lifestyle, patience, and learning curve before risking real capital.

2.1. Trend Following

- How it works: Buy when the market trends up, sell when it trends down.

- Pros: Simple logic, works in strong trends. Trend following is often considered a simple trading strategy for beginners because of its straightforward rules and visual confirmation signals.

- Cons: Can give false signals in sideways markets.

- Best for: Patient traders who prefer fewer decisions.

Example: Jane, a beginner trader, notices that EUR/USD has been moving upward for weeks. She enters a long trade using a 50-day moving average as confirmation, then rides the move calmly for a 200-pip gain.

Pro tip: Always pair this with basic risk management trends, don’t last forever, and reversals can be brutal.

2.2. Swing Trading

- Overview & Timeframes: Holds trades from a few days to weeks.

- Pros: Fits part-time schedules; less screen time.

- Cons: Requires understanding of chart patterns. Among various swing trading strategies for beginners, pattern recognition and RSI signals remain the most reliable starting points.

- Best for: Busy individuals who can check markets once or twice a day.

Example: Alex trades part-time after work. He spots a bullish signal on Apple’s chart using RSI and candlestick patterns, holds the trade for five days, and exits with a 7% profit.

Observation: Swing trading is perfect if you prefer to follow market trends without being glued to your screen.

2.3. Day Trading

- Strategy basics: Buys and sells within the same day.

- Tools required: Fast execution, reliable trading platforms, and real-time charts.

- Best for: Active learners who enjoy short bursts of decision-making.

Example: Maria starts at 8 AM, analyzing S&P 500 futures in the stock market. She uses trading volume and 5-minute charts to open and close several trades by noon, catching quick intraday moves while avoiding overnight volatility.

Day traders often use leverage to amplify their profits, but it also increases risk. Learn more about what is leverage in trading.

If you’re searching for an effective beginner trading strategy, focus on mastering one setup with clear entry and exit rules before scaling up.

2.4. Scalping

- Fast trades in seconds/minutes: Targets tiny profits through high frequency.

- High risk, high intensity: Needs discipline and lightning-fast reaction.

- Suitable for: Traders with experience, focus, and time to monitor the screen constantly.

Example: Tom uses a low-latency platform to scalp EUR/USD for 5-pip moves dozens of times in a single session.

Caution: Scalping isn’t ideal for complete beginners. It’s more of a precision game than a learning playground.

2.5. News Trading

- Trading events: Earnings, central bank decisions, and economic reports.

- Risk: High volatility and unpredictable swings.

- Best for: Traders who enjoy following macro events and reacting fast.

Example: Emily trades during the U.S. Non-Farm Payroll release. She anticipates strong job data, goes long USD/JPY, and books a 50-pip profit in 15 minutes.

Tip: If you’re new, observe news reactions first using a demo account before jumping in with real funds.

2.6. Range Trading

- Core idea: Buy near support, sell near resistance.

- Best in: Flat or sideways markets with limited price fluctuations.

- Ideal for: Calm, observant traders who prefer defined levels.

Example: Leo spots a range in AUD/NZD and trades between support and resistance three times in one week, earning small, steady gains.

Insight: Combine trading volume with technical analysis tools like Bollinger Bands to confirm entry points and avoid false breakouts.

2.7. Position Trading

- Long-term, fundamentals-based: Holds trades for weeks or months.

- Pros: Low stress, less screen time.

- Good for: Traders focused on economic cycles or long-term investments in markets like stocks, ETFs, or commodities.

Example: Sarah buys Tesla after analyzing earnings and holds it for six months, exiting with a 30% return.

Personal note: This style rewards patience; think of it as long-term fundamental analysis mixed with faith in your research.

2.8. Pattern Trading

- How it works: Recognize and trade chart shapes such as head-and-shoulders, double tops, or triangles.

- Best for: Traders learning technical analysis who enjoy visual setups.

Example: David spots a “cup and handle” formation on gold and enters when the breakout confirms. It’s not luck just discipline and pattern memory.

Thought: Once you understand patterns, you start seeing rhythm in market trends, not chaos.

2.9. Breakout Trading

- Idea: Enter when the price breaks a major support or resistance level.

- Pros: Clear signals, strong momentum.

- Cons: False breakouts can trap the impatient.

Example: Nina trades EUR/USD after a long consolidation. When the price finally breaks upward, she rides the move confidently.

Reminder: Always use stop-loss orders. Breakouts fail as often as they fly.

2.10. Macro Trading

- Focus: Global events, monetary policy, and bonds or currencies driven by world economics.

- Best for: Traders who enjoy connecting big-picture stories with market movement.

Example: Tom predicts rising inflation and buys gold while shorting government bonds, also watching how these changes affect the stock market as he holds his position for months.

Note: Macro trading builds on deep fundamental analysis, not quick reactions.

2.11. Carry Trading

- Core concept: Borrow in a low-interest currency to invest in one with a higher yield.

- Goal: Profit from the rate difference, the “carry.”

Example: A trader borrows in JPY (low rate) and invests in AUD (higher rate), collecting daily interest plus potential currency gain.

Insight: Carry trading can be steady, but it’s exposed to sudden volatility when interest expectations shift.

2.12. Contrarian Trading

- Definition: Go against the crowd buy when others panic, sell when others are euphoric.

- Philosophy: Be fearful when others are greedy.

Example: During a market crash, Lisa buys undervalued shares that everyone else abandoned. Months later, prices recover and so does her confidence.

Caution: Contrarian trading is bold and emotional. Practice with paper trading before risking real capital.

2.13. Mean Reversion Trading

- Concept: Price tends to return to its historical average, the mean.

- Tools: RSI, Bollinger Bands, or stochastic oscillators to spot overbought/oversold zones.

Example: A trader sees gold oversold on RSI and buys. Price snaps back to the mean, booking quick profit.

Observation: It’s a blend of logic and timing, patience and emotional balance matter more than luck.

3. Comparison table: Which strategy is right for you?

There’s no one-size-fits-all approach, but comparing each method’s risk, time, and complexity helps you find what type of trading is best for beginners based on your goals.

| Strategy | Time Commitment | Risk Level | Learning Curve | Tools Needed |

|---|---|---|---|---|

| Trend Following | Low | Medium | Easy | Basic indicators |

| Swing Trading | Medium | Medium | Medium | Charting tools |

| Day Trading | High | High | Steep | Fast execution platforms |

| Scalping | Very High | Very High | Steep | High-speed tools |

| News Trading | Medium | High | Medium | Economic calendar, news feeds |

| Range Trading | Medium | Medium | Medium | Support/resistance charts |

| Position Trading | Low | Low | Easy | Financial news, earnings data |

4. How to choose the right strategy

Choosing the right trading approach starts with knowing yourself, how much time you have, your risk tolerance, and what your investment goals are. In this section, we’ll look at how to align your lifestyle with the right method, test it safely through a demo account, and find the best trading strategy that fits both your goals and personality.

4.1. Assess your time, risk tolerance, and personality

Evaluate how much time you can dedicate daily, your comfort with market volatility, and whether you prefer fast action or slower analysis. Understanding this also helps you decide whether to focus on support and resistance in trading or other technical elements.

4.2. Match strategy to lifestyle

Busy 9-to-5 workers might prefer swing or position trading, while students with flexible schedules may try day trading or trend following. It’s also worth learning more about how to trade using indicators to better align your strategy with your lifestyle.

4.3. Use a demo account first

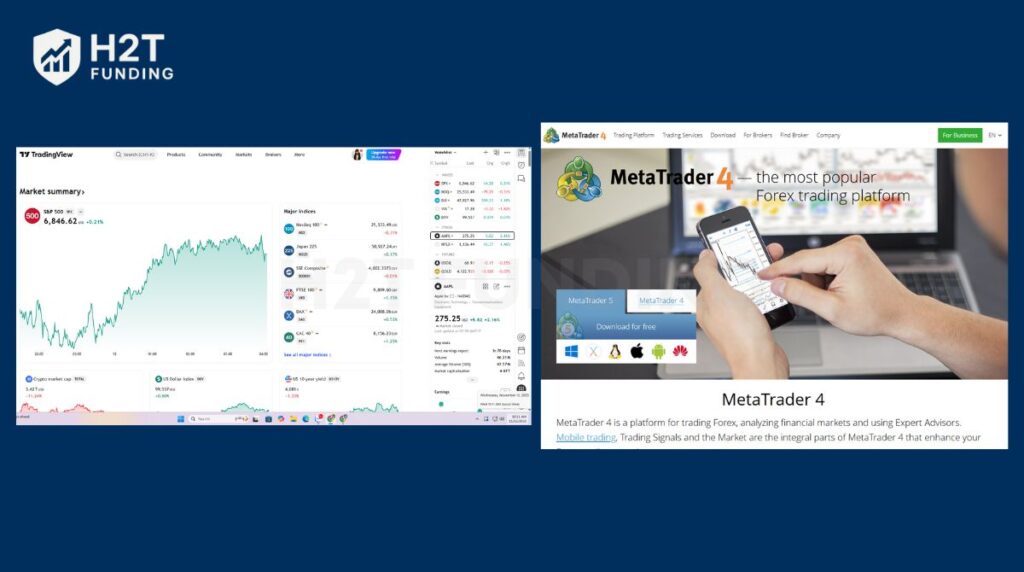

Always test your chosen strategy in a demo environment before risking real money. Platforms like TradingView or MetaTrader 4 offer free demos, allowing you to practice with simple and exponential moving averages (SMA vs EMA) without financial risk. This remains one of the safest ways to discover the best trading strategy.

5. Tools & platforms beginners can use

We recommend tools trusted by professionals and widely reviewed by the trading community. If you’re preparing for funding evaluations, you can also check out how to pass a prop firm challenge to understand how to make the most of these platforms.

5.1. Best demo trading platforms

TradingView

| Pros | Cons |

|---|---|

| User-friendly and clean interface. | Advanced features require a paid subscription. |

| A large social community sharing public trading ideas. | Limited direct trading integration is mainly used for analysis. |

| Rich in charting tools and technical indicators. | |

| Supports multiple asset classes (stocks, forex, crypto, commodities). |

MetaTrader 4 (MT4)

| Pros | Cons |

|---|---|

| Widely supported by forex and CFD brokers. | The outdated user interface and less beginner-friendly. |

| Allows live and automated trading via Expert Advisors (EAs). | Charting and analysis tools are more basic compared to TradingView. |

| Deep historical data for strategy backtesting. |

5.2. Charting tools & indicators to start with

Moving Averages (MA)

| Pros | Cons |

|---|---|

| Simple to understand and effective for identifying trends. | A lagging indicator responds slowly to price changes. |

| Combining short- and long-term moving averages generates clearer trading signals for defining effective entry and exit points. | Ineffective during sideways (range-bound) markets. |

RSI (Relative Strength Index)

| Pros | Cons |

|---|---|

| Identifies overbought and oversold conditions. | Prone to false signals in strong trends. |

| Can be combined with other indicators for better accuracy. | Needs tuning based on asset type and time frame. |

MACD (Moving Average Convergence Divergence)

| Pros | Cons |

|---|---|

| Great for spotting trend direction and momentum. | Slower than RSI and can lag behind price action. |

| Generates signals through crossovers and divergence. | May produce noise in low-volatility markets. |

5.3. Apps for beginners

Investing.com

| Pros | Cons |

|---|---|

| Fast financial news updates and a detailed economic calendar. | Contains ads that can be distracting. |

| Free charting tools and technical indicators. | The interface may feel cluttered for first-time users. |

| Covers a wide range of markets: stocks, forex, and crypto. |

Forex Factory

| Pros | Cons |

|---|---|

| Simple and reliable economic calendar. | Heavily focused on forex, less relevant for stock or crypto traders. |

| A large forum where traders share insights and strategies. | Forums can be overwhelming due to the volume of content. |

Stocktwits

| Pros | Cons |

|---|---|

| Social platform dedicated to stock and crypto trading. | Prone to herd mentality and emotional posts (FOMO/FUD). |

| Real-time market sentiment from other traders. | Lacks technical analysis tools compared to TradingView or MT4. |

Many websites also provide free trading strategies for beginners, PDF downloads to help you practice offline.

6. Risk management for trading strategy for beginners

Risk management is the foundation of every successful trader’s journey. Without it, even the best trading strategies will eventually fail. I’ve learned sometimes the hard way that protecting your capital matters more than chasing quick wins. Think of it like seat belts in a car: you might not need them every day, but when you do, they save everything.

A solid trading plan starts with defining your risk per trade. Most professionals risk only 1–2% of their total balance. This simple rule prevents emotional decision-making when price fluctuations get intense.

For example, if you trade $10,000, risking $100–$200 per position keeps losses small enough to recover. Add clear stop-loss orders and realistic exit strategies to stay consistent even when the market changes direction.

True risk management goes beyond numbers. It’s also about mindset. I believe your biggest opponent isn’t the market; it’s your emotions. The 3-5-7 rule is a guideline some traders use to manage trading mindset and expectations. Take a step back when things get heated; sometimes, doing nothing is the smartest move.

Use technical analysis to find precise entry points, but combine it with fundamental analysis for a broader view. When trading commodities, ETFs, or bonds, liquidity plays a key role in managing risk during unstable market periods.

If you’re a beginner, practice all of this in a demo account or through paper trading before risking real funds. Build habits, not hype. Over time, smart risk control will let you stay in the game longer, and that’s where real trading success begins.

7. Common beginner mistakes

Financial experts from BabyPips and ForexFactory consistently warn about these pitfalls. Their data-backed advice reinforces the importance of discipline. Based on their shared insights and community data, here’s what I’ve concluded as the most critical lessons for beginners:

- Overtrading: Jumping into too many trades without clear setups can quickly erode your capital.

- No stop-loss or risk management: Never trade without a stop-loss. Decide your risk per trade (e.g., 1-2% of capital).

- Changing strategies too fast: Stick with one strategy for at least a month before switching. During that time, you can test and evaluate its performance by backtesting your trading strategy to see whether it delivers consistent results.

- Emotional trading: Control emotions by following a trading journal and plan. Keeping emotions in check is critical when exploring the best trading strategy.

8. Beginner trading tips to get started right

Before you place your first trade, here are some practical, experience-backed tips to help you avoid common mistakes and build strong trading habits from day one:

8.1. Learn with free resources

Start with trusted sources like:

- Babypips.com: Best for forex education

- TradingView’s Ideas: Real trader insights

- YouTube channels like Rayner Teo or The Trading Channel

8.2. Follow one strategy and master it

Don’t jump between systems. Master one before trying others, this is key when committing to the best trading strategiesfor beginners. Once you’re consistent, focus on growing your account over time by understanding what compound interest is in trading and how it helps your profits accelerate.

You can also learn from a simple trading strategy book to build structured knowledge and apply what you’ve learned in real scenarios.

8.3. Track your progress

Use a trading journal to record your trades, thoughts, and lessons. If you haven’t started one yet, check out our guide on what is a trading journal and how it can help you improve your performance every day.

9. Best trading strategy for beginners Reddit

If you’ve ever wondered what real traders say about finding the best trading strategy on Reddit, the community discussions are surprisingly honest and sometimes brutally real. Many beginners share the same story: a bit of luck, followed by confusion, and then a hard reset back to the basics.

On Reddit, traders often strip away the noise, showing that the simplest approaches, clean charts, support and resistance, and solid risk management tend to work best.

Reading through these Reddit insights, one truth stands out: every successful trader eventually learns that simplicity beats complexity. You don’t need ten indicators or a secret formula; you need discipline, patience, and a method that fits your personality. Whether you trade futures, forex, or shares, your consistency and emotional balance matter far more than the setup itself.

So, if you’re looking for the best trading strategy users actually trust, start small, trade smart, and focus on mastering one clean, rules-based strategy before chasing the next shiny idea.

10. FAQs: best trading strategies for beginners

Trend following and position trading are often considered the simplest due to their low complexity and time requirements.

Yes, but it requires discipline, education, and realistic expectations. Many start with demo accounts.

You can begin with as little as $100 on some platforms, but $500-$1,000 is recommended for real trading.

Always start with a demo account until you are confident in your strategy.

Technically, yes, but it’s rare for beginners. You’ll need strong discipline, a tested system, and excellent risk management. Most traders don’t start by making $1000 daily; they start by learning how not to lose it. Focus on small, consistent wins first. Over time, profits scale naturally.

The 3-5-7 rule is a guideline some traders use to manage trading psychology and expectations. It suggests that you’ll likely face 3 losing trades, 5 break-even trades, and 7 winning trades in any cycle. The goal isn’t to win every time; it’s to make sure your winners are larger than your losses. That’s how professional traders stay profitable.

There isn’t a single magic formula. However, strategies based on technical analysis, like trend following, breakout trading, or mean reversion, tend to perform well when combined with sound risk management. The “most profitable” strategy is the one you can apply consistently without breaking your own rules.

Most beginners find success with swing trading strategies or trend-following setups, since they require less screen time and are easier to understand. Keep charts simple with one or two indicators, clear entry points, and defined stop-loss orders. The easier your plan, the easier it is to stick to it.

Always start with a demo account or paper trading. It’s the safest way to learn without financial risk. Once you’ve proven your strategy works consistently for at least a month, then switch to small real trades. Remember: practice doesn’t make perfect; practice makes permanent.

For most beginners, 1-hour or 4-hour charts strike a good balance between clarity and noise. They show enough market structure for technical analysis without the chaos of lower time frames. Once you gain experience, you can explore shorter charts for day trading.

Absolutely. Many professionals use only support and resistance or simple price action. Indicators can help confirm setups, but they’re not required. What matters more is understanding market trends, liquidity, and how prices react to key levels.

Backtesting is your best friend. Test your idea on historical data using tools like TradingView or MetaTrader. Record your results in a trading journal, track your performance, and refine from there. If your edge remains consistent after 50–100 trades, you’re likely on to something real.

11. Conclusion

Choosing the best trading strategy for beginners is about alignment with your goals, time, and mindset. Start slow, practice with a demo, and focus on learning before earning. Your journey begins with the first trade; make sure it’s an informed one.

Still wondering what are the best strategies for beginner traders? The short answer: start with structured systems like trend following, swing trading, or day trading, each suits a different personality and schedule.

Ready to take the next step? Try one strategy today using a free demo account from TradingView or MetaTrader 4, and see what fits your style. Then, come back and explore more tips to sharpen your edge!

You can read more practical tips and guides like this in the Strategy section and Prop Firm & Trading Strategies of H2T Funding.