Hitting that $100,000 salary mark feels like you’ve finally made it, right? But here’s a reality check that many professionals, including myself, have faced: a high income doesn’t automatically equal financial security. I’ve seen countless colleagues with solid paychecks live in a constant state of “where did all my money go?” by the end of the month.

It’s often not the big expenses that derail a budget, but the sneaky daily coffees and “just one more” online purchase that can erode your financial progress.

That’s why creating the best budget for single person 100k salary is not just smart; it’s essential for building long-term wealth. With a clear strategy, you can cover your needs, enjoy your lifestyle without guilt, and consistently invest in your future.

So, what is the best way to budget for a single person earning this salary? In this article, H2T Funding will explore popular budgeting models, along with real-world examples and practical tips to help you take full control of your income.

Key takeaways:

- The best budget for a single person earning $100k is roughly $5,800–$6,200/month net, allocated smartly across needs, wants, and savings.

- Use a clear budgeting method: 50/30/20 for simplicity, zero-based for precise control, or envelopes for cash discipline.

- Prioritize savings, investments, and emergency funds before discretionary spending to build long-term wealth.

- Avoid lifestyle inflation; keep spending aligned with goals, not income growth or social pressure.

- Track expenses regularly and use apps to maintain control, making your best budget for a single person 100k salary effective and stress-free.

1. What is net and gross?

Before creating any budget, it’s crucial to understand the difference between gross income and net income. Many people assume they can spend their full $100K salary, but taxes, social security contributions, and other deductions reduce the actual amount they can use.

| Term | Definition | Example for $100k Salary |

|---|---|---|

| Gross Income | Gross income is your total salary before any taxes or deductions. This is usually the number shown in job offers. | $100,000/year |

| Net Income | Net income is what actually lands in your bank account after federal & state taxes, Social Security, retirement contributions, and other deductions. It is also called “take-home pay.” | ~$70,000–$75,000/year (varies by location and benefits) |

Many people get a shock the first time they see their net income. I remember back in 2020, the first year I earned six figures, I felt rich, but once the deductions hit, my take-home pay was far less than I imagined. That moment taught me that budgeting for a single person must always start with net income, not gross.

By starting with net income, you can create a realistic budget and avoid the frustration of thinking you have more money than you really do.

Furthermore:

2. Why budgeting still matters with a $100K salary

Earning $100,000 a year sounds like a lot, but in reality, expenses, taxes, and lifestyle choices can quickly eat away at your income. Many single professionals with this salary still find themselves living paycheck-to-paycheck without realizing it.

Even with a six-figure income, budgeting for a single person is essential. Here’s why:

- Take control of your money: Budgeting isn’t just about saving; it’s about understanding exactly where your money goes and making conscious decisions with it.

- Avoid lifestyle inflation: As your income grows, it’s tempting to upgrade apartments, cars, or dining habits. A budget keeps your spending in check so you don’t outgrow your income.

- Save and invest consistently: Planning your budget ensures you can contribute regularly to retirement accounts, emergency funds, and investments without stress.

- Reduce money-related stress: Knowing exactly how much you can spend, save, and invest each month gives peace of mind, even when unexpected expenses pop up.

Even with a high salary, budgeting isn’t about restriction; it’s about control. It turns your income into a tool for building wealth, not just covering bills. Learning to manage money on a 100k salary effectively can set the foundation for financial freedom.

Continue reading: Emergency fund calculator: How much do you really need?

3. How much is $100K after taxes?

Understanding your net income 100k salary is key to effective budgeting. While $100,000 sounds substantial, the reality is that federal and state taxes, Social Security, and Medicare deductions reduce the take-home pay significantly.

For a single person living in the U.S., here’s a typical breakdown:

| Income Component | Approximate Amount (Single, $100k Salary) |

|---|---|

| Gross Income | $100,000/year |

| Federal Income Tax (~22%) | ~$17,000 |

| State Income Tax (varies, e.g., CA ~9%) | ~$5,500–$9,000 |

| Social Security (6.2%) | ~$6,200 |

| Medicare (1.45%) | ~$1,450 |

| Net Income | ~$70,000–$75,000/year |

| Monthly Take-Home | ~$5,800–$6,200/month |

Seeing the difference between gross and net pay can be a wake-up call. Suddenly, that six-figure salary feels a lot less “luxurious.”

With roughly $5,800–$6,200 per month, you can start allocating funds realistically for rent, groceries, utilities, savings, investments, and fun money. These numbers can shift depending on your state, pre-tax contributions like 401(k) or IRA, or health insurance premiums.

4. Best budget for single person 100k salary (monthly)

Now that you know your net income of 100k salary, it’s time to see how to allocate it wisely. There are a few popular budgeting models that make managing your money simple and effective for a single professional.

4.1. The 50/30/20 rule example

A simple way to get started is by following the 50/30/20 rule. You divide your net income into three main categories: Needs, Wants, and Savings/Debt.

| Spending Category | Percentage | Amount per Month |

|---|---|---|

| Needs | 50% | ~$3,000 |

| Wants | 30% | ~$1,800 |

| Savings/Debt | 20% | ~$1,200 |

What goes where:

- Needs: Rent, utilities, groceries, insurance, and other essential bills.

- Wants: Dining out, travel, hobbies, subscriptions, and entertainment.

- Savings/Debt: Emergency fund, investments, debt repayment.

My take on this: While this model is a great starting point for beginners, I honestly find it too simplistic for a $100k earner serious about building wealth. The huge 30% ‘Wants’ category (a potential $1,800/month!) can quickly become a green light for lifestyle inflation if you’re not disciplined. It’s simple, but that simplicity is also its biggest weakness.

4.2. Zero-Based budget – Every dollar has a job

Now, for the method I personally recommend for anyone serious about maximizing a six-figure salary: zero-based budgeting. If the 50/30/20 rule feels too loose and unstructured, this is the precision tool you need.

If you’re aiming for tighter financial control, zero-based budgeting may be the right choice. Every dollar of your net income is assigned a specific purpose, which is ideal for avoiding overspending.

Example for a $100k salary:

| Item | Monthly Amount |

|---|---|

| Rent | $1,800 |

| Groceries | $500 |

| Insurance | $300 |

| Investments | $800 |

| Emergency Savings | $400 |

| Travel Fund | $300 |

| Gym, Hobbies, Misc | $300 |

By assigning each dollar, you can track spending precisely and make adjustments without feeling restricted.

4.3. Envelope/ Cash budget (optional)

The envelope method works well for anyone who prefers using cash to manage different budget categories. Spending stops once the envelope is empty, helping to prevent overspending and giving a clear, tangible sense of control.

Using these budgeting methods, you can tailor your plan to your lifestyle and goals. Whether you prefer a simple 50/30/20 split, zero-based precision, or hands-on envelope control, the key is consistency. Budgeting for a single person on a 100k salary becomes easier when you know exactly how to distribute your income each month.

5. Tips for maximizing your $100K budget as a single person

Earning $100,000 a year feels like a milestone, but without a plan, it’s easy to let the money slip through your fingers. From my experience and observing peers, even six-figure earners can live paycheck-to-paycheck if they don’t actively manage their income. Here’s how to make your salary truly work for you:

5.1. Avoid lifestyle inflation

The temptation to upgrade your life with every raise is real. I’ve learned this firsthand. When I first crossed the six-figure threshold, my immediate thought was to get a bigger apartment in a prime location.

While it was exciting at first, I quickly realized my new “comfortable” lifestyle was consuming almost my entire raise, leaving little room for increased savings or investments.

That experience was a powerful lesson in conscious spending: true financial progress comes from widening the gap between what you earn and what you spend, not just upgrading your expenses to match your income.

5.2. Prioritize high-impact goals early

Instead of splurging on wants first, tackle the moves that create lasting financial security:

- Emergency fund: Save at least 3–6 months of living expenses. This cushion reduces stress when unexpected costs arise, like a car repair or medical bill.

- Retirement contributions: Max out your Roth IRA or 401(k) as early as possible. Compounding works best when you start young.

- Debt management: Pay off high-interest debt before spending on luxuries. I’ve seen colleagues delay debt repayment for lifestyle upgrades, and it costs them years of interest.

By focusing on these priorities early, you build a solid foundation that gives freedom later.

Read more helpful articles: Free debt payoff tracker printable to stay debt-free

5.3. Use budgeting tools & apps

Managing money manually can be exhausting, but apps make it visual and actionable:

- YNAB (You Need a Budget): Perfect for zero-based budgeting and assigning every dollar a purpose.

- Monarch Money: Combines budgeting with investment tracking for a complete view.

- Personal capital: Focused on long-term wealth, ideal for investment planning alongside everyday budgets.

From my professional and personal experience, using a budgeting app provides a level of clarity that’s hard to achieve otherwise. The real eye-opener is often seeing the cumulative effect of small, daily purchases. That data-driven insight is what allows you to make strategic cuts without feeling like you’re sacrificing everything you enjoy.

5.4. Consider value-based spending

Instead of following trends or what friends are buying, spend on what truly matters to you. I like allocating more to travel and experiences, and less to fashion or gadgets I rarely use. This approach makes your spending intentional; it aligns your budget with your values rather than external pressure.

6. Tips for avoiding lifestyle inflation

Avoiding lifestyle inflation is a core part of building the best budget for a single person 100k salary. Even with a six-figure income, it’s easy to feel like you have “extra” money and start upgrading everything, a bigger apartment, fancier car, more dinners out, without thinking about long-term goals.

If this sounds familiar, here are practical ways to keep your spending in check:

- Track where money tends to slip away: Look at last month’s expenses and notice where extra cash was spent impulsively: coffee runs, takeout, subscriptions. Seeing it on paper makes it real.

- Decide limits before spending: When your income rises, set a fixed portion for discretionary spending and direct the rest to savings, investments, or debt repayment.

- Automate savings: Schedule automatic transfers to your emergency fund, retirement accounts, or investment portfolio as soon as your paycheck arrives. This makes saving effortless.

- Spend on what matters most: Prioritize experiences or purchases that truly add value, like travel, education, or hobbies, instead of keeping up with trends or friends’ lifestyles.

- Review your budget monthly: Check how money flowed over the past month and adjust intentionally. Small, unnoticed increases can quietly eat away at your net income if left unchecked.

Controlling lifestyle inflation keeps your $100k salary working for you. You enjoy the benefits of a higher income without letting expenses quietly grow, which is essential for a practical, realistic monthly budget for a single person.

May you need to know:

7. Sample budget scenarios

Applying a budget in real life makes it much easier to follow. Below are three concrete examples for a single person earning $100k/year. Each scenario shows how income can be allocated depending on lifestyle, location, and financial goals.

7.1. Example 1 – Urban apartment living (New York, SF, etc.)

In high-cost cities, rent can take up a significant portion of your income, often 35–40% of take-home pay. Here’s a sample breakdown for a net income of ~$6,000/month:

| Category | Amount/Month |

|---|---|

| Rent | $2,200 |

| Utilities & Bills | $300 |

| Groceries | $500 |

| Transportation | $250 |

| Insurance | $300 |

| Savings/Investments | $1,200 |

| Discretionary/Wants | $1,250 |

To maintain a balanced budget, discretionary spending might be slightly lower than in lower-cost areas. Smart choices like cooking at home, using public transport, or free entertainment can free up more money for savings.

7.2. Example 2 – Suburban or remote work setup

Living outside major cities typically lowers rent and commuting costs. This allows more flexibility for savings and investments while still enjoying a comfortable lifestyle. Example for ~$6,000/month net income:

| Category | Amount/Month |

|---|---|

| Rent | $1,500 |

| Utilities & Bills | $250 |

| Groceries | $500 |

| Transportation | $150 |

| Insurance | $300 |

| Savings/Investments | $1,800 |

| Discretionary/Wants | $1,500 |

Extra savings can go to retirement accounts, stock investments, or emergency funds, helping you grow wealth faster without feeling deprived.

7.3. Example 3 – FIRE-oriented single person

For those aiming for Financial Independence / Early Retirement (FIRE), aggressive saving is the priority. Here, 40–50% of net income goes directly to savings and investments. Sample allocation for ~$6,000/month:

| Category | Amount/Month |

|---|---|

| Rent | $1,200 |

| Utilities & Bills | $200 |

| Groceries | $400 |

| Transportation | $150 |

| Insurance | $250 |

| Savings/Investments | $2,400 |

| Discretionary/Wants | $1,400 |

Lifestyle is modest but intentional. Discretionary spending is still possible, but the focus is on maximizing contributions to investment accounts, retirement funds, and building long-term security.

These scenarios make it clear that the best budget for a single person 100k salary depends on where you live, your priorities, and financial goals. You can adjust allocations for rent, savings, and discretionary spending to fit your own situation while keeping your financial future secure.

8. Saving and Investing: Building wealth on a $100K salary

Earning $100k a year gives you plenty of room to save and grow wealth, but the key is having a structured plan. A good approach combines short-term safety, long-term growth, and strategic risk-taking. Here’s how a single professional can allocate their net income (~$6,000/month):

- Emergency fund (3–6 months of expenses): Start by saving at least 3–6 months of living costs in a high-yield savings account. This gives a financial cushion against unexpected expenses, from medical bills to sudden job changes.

- Retirement accounts (Roth IRA, 401(k), or equivalent): Maximize contributions early to benefit from compounding interest. Even a modest $500–$1,000/month can grow substantially over decades.

- Investments (Stocks, ETFs, or Index Funds): Allocate a portion of income for diversified investments. If you’re comfortable with higher risk, trading or forex can also be an option, but it should be approached cautiously and not replace long-term, diversified investments. Start small, set clear limits, and educate yourself before risking significant capital.

- Debt repayment: If you carry high-interest debt, prioritize paying it off. Interest rates often outweigh potential investment returns, making debt repayment an efficient way to “earn” guaranteed returns.

- Value-Based discretionary spending: Continue allocating a portion of your income for personal enjoyment, travel, learning, or hobbies, but make sure it’s intentional. This helps you maintain balance without sabotaging long-term goals.

Saving and investing consciously makes your best budget for a single person 100k salary more than just a plan; it becomes a tool to achieve financial independence and long-term freedom.

9. Common budgeting mistakes at $100k income (and how to fix them)

Even earning $100k a year doesn’t automatically mean financial security. Many high earners fall into traps that quietly drain their income. Here are some real-world mistakes and ways to avoid them:

1. Assuming income alone is enough

It’s easy to think that a six-figure salary solves all money problems. In reality, without a plan, even $100k can vanish quickly. Many people I know felt flush for a few months and then realized they were living paycheck to paycheck.

How to fix it: Start with a clear budget. Track your net income, allocate for essentials, savings, investments, and discretionary spending. Simple rules like 50/30/20 can keep you on track.

2. Letting social pressure dictate spending

Seeing friends upgrade cars, travel more, or move to fancier apartments can push you to match them, even if it doesn’t fit your goals. Lifestyle inflation sneaks in this way all the time.

How to fix it: Focus on what truly matters to you. Decide which expenses give real satisfaction and trim the rest. Tracking discretionary spending helps you stay mindful.

3. Ignoring where small expenses add up

Daily coffee, subscriptions, or takeout can feel harmless, but over a month, they can consume hundreds of dollars. Not keeping track often leads to surprise deficits.

How to fix it: Use apps like YNAB or Monarch Money to see every dollar flow. Checking your spending each month highlights leaks before they become problems.

4. Waiting too long to invest or putting all eggs in one basket

Some people focus on spending first and investing later, or concentrate only on one type of investment. This limits growth potential and increases risk.

How to fix it: Start early, even with small amounts. Diversify across retirement accounts, index funds, ETFs, and, if you’re interested, trading or forex with a clear plan and risk limit.

5. Skipping an emergency fund

Unexpected expenses can derail even the best-laid budget if you have no buffer. Medical bills, car repairs, or sudden travel needs can force you into debt.

How to fix it: Build 3–6 months of living expenses in a high-yield savings account. Knowing it’s there reduces stress and keeps your investments untouched.

Even at $100k/year, the key is awareness and intentional choices. Keeping track, investing wisely, and controlling lifestyle creep are what make a monthly budget for a single person truly effective.

10. Community insights

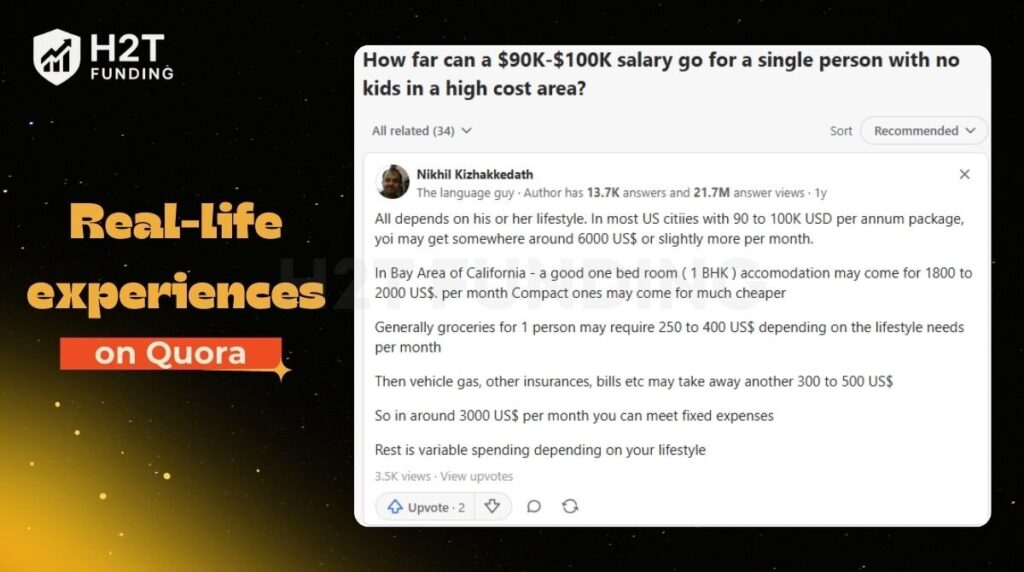

Real-life experiences from people earning $100K a year show how much lifestyle and location can impact your budget. Here are some examples from Reddit and Quora that illustrate practical budgeting challenges for a single professional:

One user shared their experience in U.S. cities:

This example highlights that even a six-figure salary can quickly be absorbed by fixed costs like housing, groceries, and bills. The remainder is flexible, and without a plan, it’s easy to overspend.

That’s why creating a monthly budget for a single person on a $100K salary is essential to allocate funds for essentials, savings, investments, and discretionary spending in a balanced way.

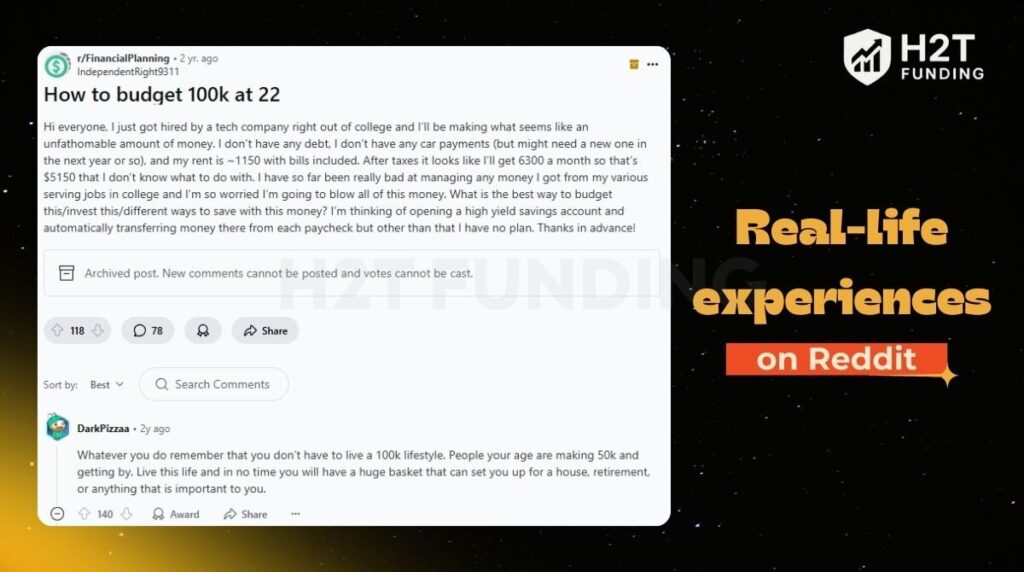

Another person, just out of college, shared:

This story emphasizes that even a high income can feel overwhelming without a clear plan. Practical steps for managing this include:

- Setting up automatic transfers to savings or investment accounts each paycheck.

- Using the 50/30/20 rule or a zero-based budgeting approach to allocate essential costs, discretionary spending, and investments.

- Monitor spending regularly to identify unnecessary expenses and optimize cash flow.

These real-life insights reinforce that the best budget for a single person earning $100K isn’t theoretical; it’s a tool for controlling money, reducing stress, and building long-term wealth, whether you live in a high-cost city or a more affordable area.

11. FAQs

Yes, $100K is generally considered a strong salary for a single person in the U.S., allowing for comfortable living, saving, and investing, though location and lifestyle choices can significantly affect how far it goes.

It can feel substantial, but high living costs in major cities or unchecked lifestyle inflation can make it feel tight. Proper budgeting turns it into a real financial advantage.

A common approach is the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings and investments. For a $100K salary (~$5,800–$6,200/month take-home), that’s about $3,000 for essentials, $1,800 for fun, and $1,200 for savings.

Ideally, keep rent around 30–35% of your net monthly income, which is roughly $1,800–$2,200 per month, adjusting based on your city and other fixed expenses.

It’s possible but requires discipline: minimize lifestyle inflation, live below your means, and prioritize saving and investing immediately after each paycheck.

Apps like YNAB, Monarch Money, or Personal Capital help track expenses, manage investments, and maintain control over a higher-income budget efficiently.

12. Conclusion

Earning $100K a year is a strong milestone, but it doesn’t automatically guarantee financial security. The key is having the best budget for a single person 100k salary that balances essentials, savings, investments, and discretionary spending. Proper planning keeps lifestyle inflation in check and helps your income work for your long-term goals.

Start with a simple framework like the 50/30/20 rule, a zero-based budget, or a budgeting app that suits your style. Track your spending for a month, adjust as needed, and make sure every dollar has a purpose, turning your $100K salary into a tool for building wealth, not just covering bills.

Begin your first month with a 50/30/20 budget template or an app you prefer. If you want a detailed sample, leave a comment and we’ll send it to you! For more tips and real-life strategies, explore the Budgeting Strategies section at H2T Funding.