Alpha Capital vs Funding Pips: Is it better to pay for premium stability or go for the low-cost, high-reward option? Alpha Capital Group is built for disciplined career traders, while Funding Pips is designed for speed and efficiency.

At H2T Funding, we help you cut through the noise. We have compared their trading conditions side-by-side to show you exactly where you can make the most money. Let’s get started.

Key takeaways:

- Alpha Capital Group is ideal for traders seeking stability. It offers structured challenges, consistent and fair rules, reasonable pricing, and reliable weekly payouts, making it a strong choice for beginners and long-term traders.

- Funding Pips is built for speed and flexibility. It stands out with aggressive profit splits (up to 100%), a simplified challenge model, and a more flexible risk environment, appealing to experienced traders who want fewer restrictions.

- Both firms offer valuable features, including a free trial, clear drawdown rules, a good variety of trading instruments, and support for both new and seasoned traders on platforms like cTrader.

- The best choice depends on your trading style. If you prioritize a clear path and dependable risk management, Alpha Capital is the better fit. If you want maximum profit potential with greater freedom, Funding Pips is the one to consider.

1. An overview of each firm: Alpha Capital vs Funding Pips

Diving into an Alpha Capital vs Funding Pips review is like comparing two completely different prop firm philosophies. It’s not just about numbers; it’s about the entire trading experience.

From our experience, Alpha Capital Group is all about discipline and structured growth. They provide a clear, steady path for traders who value consistency and clear risk management. You always know where you stand with them, which is a huge plus for beginners and systematic traders.

On the other hand, Funding Pips champions freedom and aggressive growth. Simply put, they offer a fast-track route with high payouts and greater flexibility. This is incredibly appealing to seasoned traders who want fewer restrictions.

Here’s a quick breakdown of how they stack up side-by-side:

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

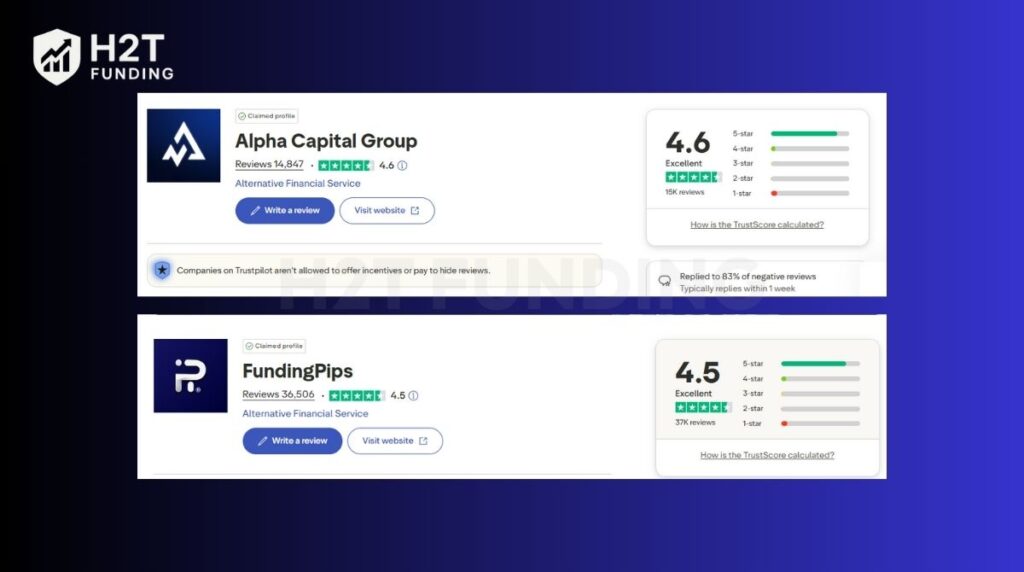

| Founded / Trust Level | 2021 / High (4.6 Trustpilot) | 2022 / High (4.5 Trustpilot) |

| Challenge Models | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, Zero Model (No Evaluation) |

| Tradable Assets | Forex, Indices, Commodities, Crypto | Forex, Crypto, Indices, Metals, and Energies |

| Platforms | cTrader, DXTrade, TradeLocker, MT5 | cTrader, Match-Trader, MT5 |

| Profit Split | 80% | 80% – 100% (at Master Stage) |

| Minimum Trading Days | None | None |

| Scaling Plan | Up to $2,000,000 | Up to $2,000,000 |

| Payout Schedule | Bi-weekly (On-demand available) | Weekly, Bi-weekly, On-demand |

| Drawdown Rules | 10% Max Loss, 5% Daily Loss | 8-10% Max Loss, 4-5% Daily Loss |

| Risk Notes | No restrictions on EAs. News trading restrictions apply to Funded accounts. | Strict rules on HFT and arbitrage. News trading is allowed. |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Alpha Capital and Funding Pips websites before purchasing any challenge.

While the comparison table outlines the key specifications, the real difference lies in the trading experience and ecosystem each firm provides. To give you a clearer perspective, let’s break down the specific strengths and weaknesses of each contender. We begin by examining each prop firm to understand why its structured approach is a top choice for disciplined traders.

Alpha Capital Group

#1

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader, DXTrade, TradeLocker

Profit Target

4% – 10%

Our take on Alpha Capital Group

Founded in the UK in 2021, Alpha Capital Group has built a solid reputation for its structured and trader-centric approach. With a fantastic Trustpilot rating of 4.6/5 from over 14,000 reviews, they’ve clearly earned the community’s trust.

They offer three distinct challenge types (1-step, 2-step, and 3-step), giving traders the freedom to pick a path that suits their style. What we really appreciate are the clear rules and realistic targets, which create a pressure-free environment perfect for steady growth.

| 💳 Challenge Fee | $40 – $1,097 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT5, cTrader, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Metals, Commodities, Indices |

Funding Pips

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Launched in 2022, Funding Pips made a name for itself by focusing on speed and simplicity. They offer a straightforward evaluation with multiple funding models, including the “Zero” model which allows you to skip the evaluation phase entirely and start earning from day one.

Their “Zero Payout Denial” policy is a bold promise that gives traders confidence. With profit splits climbing up to 100% and very low entry fees, it’s an attractive option for traders wanting to maximize returns quickly.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

Ultimately, this initial overview paints a clear picture of two distinct paths in the prop firm. Your choice between Alpha Capital Group and Funding Pips really boils down to a single question: Do you value a structured, reliable journey or a fast, flexible one?

Honestly, there’s no wrong answer here. The right fit depends entirely on your personal trading style and goals. Now, let’s dig deeper into the core models and rules that truly define the trading experience at each firm.

Read more:

2. Core models & key rules about Alpha Capital and Funding Pips

Okay, let’s get into the nitty-gritty. Both firms have clear evaluation processes, but their trading conditions are worlds apart. This is where their core philosophies on risk and performance truly show, and understanding these differences is the most important factor in your decision.

2.1. Profit targets & minimum trading days

At first glance, the trading objectives look similar, but the approach is different.

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| 1-Step Profit Target | 10% | 10% |

| 2-Step Profit Target | Phase 1: 8% <br> Phase 2: 5% | Phase 1: 8% <br> Phase 2: 5% |

| Minimum Trading Days | None (0 days) | None (0 days) |

| Time Limit | Unlimited | Unlimited |

To put it simply, while the numbers are identical, the vibe is different. With Alpha Capital, the structure feels geared towards encouraging consistent, repeatable performance. With Funding Pips, the emphasis is more on speed and efficiency: hit your target, get funded, and start trading for real profit as fast as possible.

2.2. Drawdown & daily loss limits

This is where your daily risk strategy will be defined. Pay close attention here.

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| Maximum Overall Loss | 10% (Of initial balance) | 8% (Main challenge accounts) |

| Maximum Daily Loss | 4% or 5% | 3% – 5% |

| Drawdown Calculation | Fixed (Based on initial balance) | Static (Based on initial balance, not trailing) |

| Mandatory Stop-Loss | No (Not enforced) | No (Not enforced) |

Let’s be real, the difference between a 5% and 4% daily loss is significant. Alpha Capital gives you a bit more breathing room, which is great for swing traders or those whose strategies involve wider stops. Funding Pips demands more precision. That tighter drawdown means you need to be on top of your game with every single trade.

2.3. News, overnight & automation policies

For many traders, these rules are the deal-breakers.

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| News Trading | Allowed during Evaluation. On Funded accounts: no opening/closing trades 2 minutes before/after high-impact news (Pro plans) and 5 minutes for other plans. Swing accounts may trade news if trades are held long enough. | Allowed without restricted time windows. Must avoid prohibited strategies such as tick scalping. Slippage may occur during volatility. |

| Overnight / Weekend Holding | Yes, overnight and weekend holding is allowed. | Yes, overnight and weekend holding is allowed. |

| EAs / Automation | Fully allowed. Very friendly to automated strategies. | Allowed, but strictly prohibits HFT, arbitrage bots, and account management services. |

This is the clearest example of their different philosophies. Alpha Capital offers almost complete freedom, trusting you to manage your own risk. It’s a hands-off approach. Funding Pips is more protective of its capital, stepping in to prevent gambling during the most volatile market moments. If you are a news trader, your choice is pretty much made for you right here.

3. Fees, refunds & cost efficiency of Alpha Capital and Funding Pips

Alright, let’s talk about the money. The initial cost to take on a challenge is a huge factor for most traders, and this is an area where the two firms have noticeably different strategies. It’s not just about which one is cheaper; it’s about the value you get for your investment.

Here’s how the numbers break down:

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| Fee Type | One-time, per challenge | One-time, per challenge |

| Refund Policy | 100% refund with the first profit split | 100% refund with the first profit split |

| Challenge Cost | $40 – $1,097 (wider range for bigger accounts) | $29 – $529 (more affordable at the high end) |

| Transparency | Very clear, no hidden fees | Straightforward, what you see is what you pay |

| Added Fees | None | None |

Our Take:

Honestly, you can’t ignore the numbers here. Funding Pips is the clear winner when it comes to the upfront evaluation fee. Their entry point is incredibly low, which is fantastic for traders who are on a budget or want to try out a firm without a significant financial commitment. It makes getting started in prop trading much more accessible.

So, why would anyone pay more for Alpha Capital Group? Well, I think of it as paying for a premium experience. The slightly higher cost on their larger accounts feels justified by their platform’s reliability, professional dashboard, and the supportive educational environment they’ve built. You’re not just buying a challenge; you’re buying into a more structured system.

The great news is that both firms offer a 100% fee refund once you receive your first payout. This is an industry-standard practice, and it basically turns your fee into a refundable deposit, which is a massive confidence booster.

At the end of the day, your choice depends on your priorities: lower initial risk with Funding Pips, or a higher initial investment for a more robust framework with Alpha Capital.

4. Profit split & scaling of Alpha Capital and Funding Pips

Now for the part everyone really cares about: getting paid and growing your capital. Let’s be honest, this is the ultimate goal of passing a challenge, right? Both firms offer compelling rewards, but their approach to payouts and account growth reveals a lot about the kind of trader they want to attract.

Here’s a side-by-side look at how you’ll earn and grow:

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| Profit Share | 80% (standard) | 80% → 90% → 100% (at Master Stage) |

| Scaling Plans | Up to $2,000,000. Increase the account by 25% every time you hit a 10% profit milestone. | Up to $2,000,000. Scales based on consistent profitability. |

| Payout Frequency | Bi-weekly. First payout is after 14 days. | Weekly. First payout is available after just 5 business days. |

| Conditions | Clear milestones for scaling based on profit. | Scaling is also based on hitting profit targets. The 100% split is achieved after two successful payouts. |

Our Take:

To put it simply, your choice here is about long-term stability versus immediate reward.

Alpha Capital Group provides a predictable journey with its fair 80% profit share and one of the most transparent, adaptable scaling plans you’ll find. It’s perfect for building a trading career brick-by-brick.

In contrast, Funding Pips is all about acceleration. Their incredibly fast path to a 100% split, combined with weekly payments, is designed for high-performing traders who want their rewards now.

So, the question is: are you a builder or a sprinter?

5. Platforms & tradable assets of Alpha Capital and Funding Pips

A prop firm can have the best rules in the world, but if the platform is clunky or you can’t trade your favorite pair, what’s the point? Let’s be real, your trading environment and the tools you’re given are critical. This is where you’ll be spending all your time, so the experience has to be top-notch.

Here’s a look at the toolkit each firm provides:

| Criteria | Alpha Capital Group | Funding Pips |

|---|---|---|

| Supported Platforms | cTrader, DXTrade, TradeLocker, MT5 | cTrader, Match-Trader, MT5 |

| Trading Instruments | Forex, Indices, Commodities, Crypto | Forex, Metals, Indices, Energy, Crypto, CFDs |

| Execution Quality | Stable and reliable | Fast, with tight spreads |

| Leverage | Up to 1:100 | Up to 1:100 |

| Dashboard Quality | Professional Trading Dashboard, data-rich | Streamlined, performance-focused |

Our Take:

In the Alpha Capital vs Funding Pips comparison, your choice really comes down to analytics versus agility.

To be honest, Alpha Capital Group wins on the dashboard front. It’s a professional, data-heavy tool for traders who obsess over their stats. It’s a true command center.

Funding Pips counters with pure opportunity: greater asset variety for better portfolio diversification and execution that’s built for speed. It’s a bigger, faster playground. So, what do you prefer: a state-of-the-art cockpit or a wider field of play?

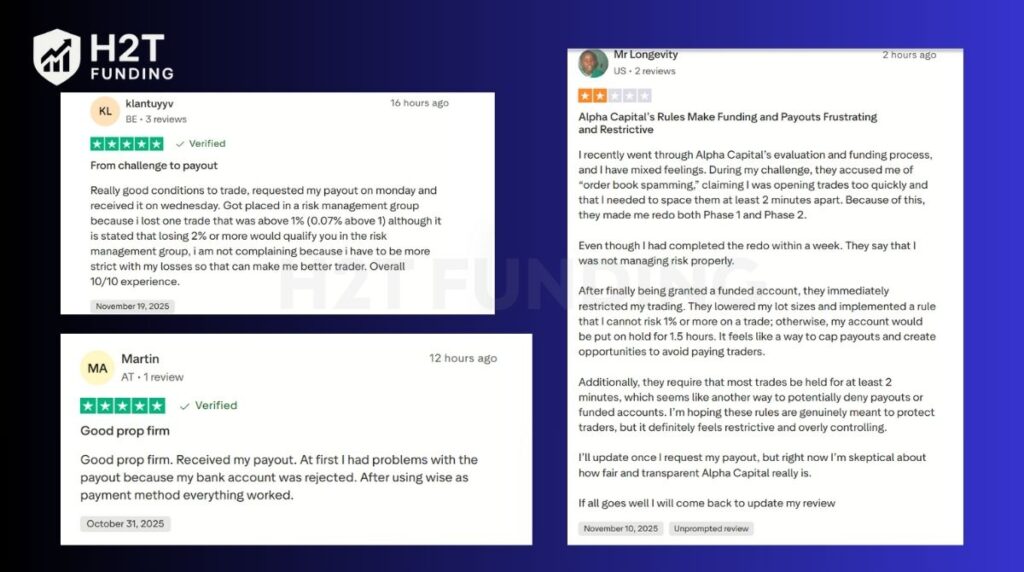

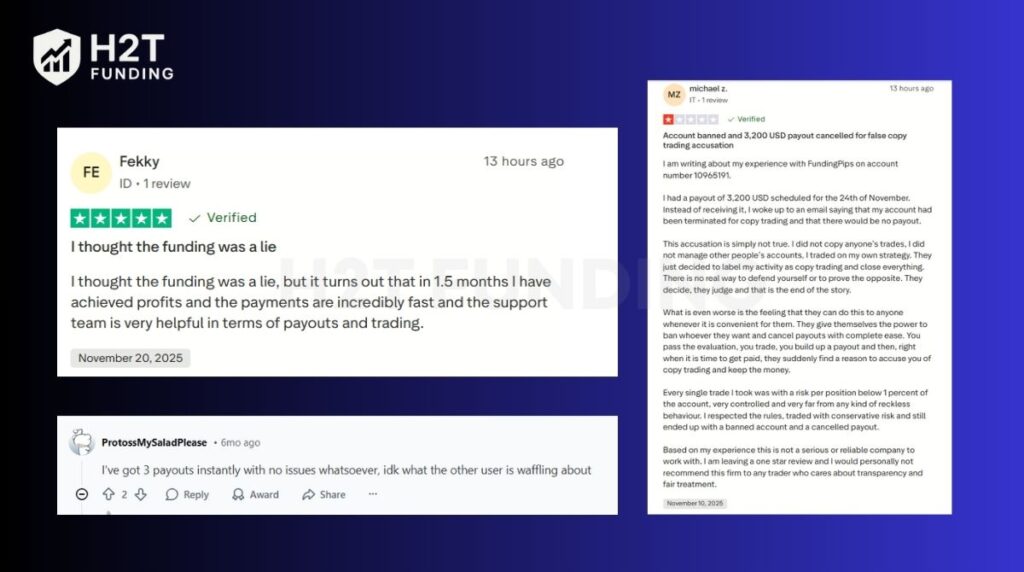

6. Payouts & trust: What real traders are saying

Let’s cut to the chase. Rules, platforms, and profit splits don’t mean a thing if a firm doesn’t pay out. Trust is everything in the prop firm world, so we dug into what real traders are saying on platforms like Reddit and Trustpilot to get the unfiltered truth. Numbers and policies are one thing, but community experience is the ultimate test.

You’ll see a lot of chatter out there, and honestly, it’s a mixed bag for both firms, which is pretty normal. No prop firm has a perfect record. What’s important is looking for patterns in the feedback.

After sifting through all the feedback in this Funding Pips vs Alpha Capital debate, a clear theme emerges.

Alpha Capital Group is overwhelmingly praised for its professionalism, support, and reliable payout system. You see lots of comments like “received my payout” and “great customer service.” However, the negative feedback often centers on their strictness.

Traders feel the rules can be overly restrictive, almost as if they are designed to make you fail. It’s the classic trade-off: safety and reliability in exchange for less freedom.

Funding Pips gets a ton of love for its fast payouts and trader-friendly rules, with many users confirming they’ve been paid multiple times without issue. But the complaints are serious.

They often revolve around accounts being terminated for vague reasons like “copy trading” right before a payout, or issues with platform stability like slippage. This suggests that while the rewards are high, the risks of running into a problem might also be higher.

So, it seems the community confirms our initial analysis. Alpha Capital is the safer, more structured bet. Funding Pips is the high-speed, high-reward option that might come with a bit more turbulence.

7. Which firm is easier to pass?

When asking “which firm is easier to pass,” we need to look beyond the marketing and focus strictly on the math. The probability of passing a challenge depends on two things: how much profit you need to make (targets) vs. how much room you have to fail (drawdown).

Here is the direct comparison of the “Passability Metrics” for their standard 2-Step Challenge:

| Passability Metric | Alpha Capital Group | Funding Pips | Winner |

|---|---|---|---|

| Profit Target (Phase 1) | 8% | 8% | Draw |

| Profit Target (Phase 2) | 5% | 5% | Draw |

| Maximum Drawdown (Buffer) | 10% | 8% (Standard) / 10% (Select Plans) | Alpha Capital |

| Daily Drawdown | 5% | 5% | Draw |

| Time Limit | Unlimited | Unlimited | Draw |

| Trading Conditions | Standard Spreads | Tighter Spreads (Raw) | Funding Pips |

Strictly speaking, Alpha Capital Group is slightly easier to pass for the average trader.

Here is why:

- The 2% Buffer: While profit targets are identical, Alpha Capital typically offers a 10% maximum loss limit on most accounts, whereas Funding Pips’ standard accounts often have a tighter 8% maximum loss (though they have introduced 10% options recently). That extra 2% drawdown buffer is significant; it allows for a few more losing trades before the account is breached.

- Structured Environment: Alpha’s environment is built to prevent over-leveraging, which helps beginners survive longer.

However, Funding Pips is “easier” for scalpers: if your strategy relies on sniper entries and tight stop-losses (scalping), Funding Pips might actually be easier for you. Their raw spreads and fast execution mean you hit your profit targets faster, even if the drawdown limit is slightly tighter.

Summary:

- Choose Alpha Capital Group if you want more room for error (safety).

- Choose Funding Pips if you want better execution speed to hit targets quickly (efficiency).

8. Who should choose which firm?

So, after all of that, it comes down to one simple question: which firm is actually for you? Let’s be honest, the choice between Alpha Capital and Funding Pips depends entirely on your personality, your strategy, and what you value most in a trading partner. There is no single “best” firm, only the one that’s best for you.

To make it as simple as possible, we’ve broken it down by trader type. Find yourself on this list, and your decision should be crystal clear.

| If You Are a… | Your Best Choice Is… | Here’s Why (The Simple Version)… |

|---|---|---|

| Beginner Trader | Alpha Capital Group | It’s a more structured, hand-holding environment. The rules are crystal clear, and the educational support gives you a much better foundation. |

| Fast-Paced, Aggressive Trader | Funding Pips | This is a no-brainer. Faster challenges, weekly payouts, and that juicy 100% profit share. It’s built for traders who want to move quickly. |

| Consistency-Focused Trader | Alpha Capital Group | Their scaling plan is designed to reward consistent profitability over the long term. It’s the perfect place to build a stable trading career. |

| News & Volatility Trader | Funding Pips | Funding Pips allows trading during news events without restrictions on opening/closing trades. Alpha Capital Group has a 2-minute restriction window on its funded accounts, making it less ideal for news scalpers. |

| Risk-Averse Trader | Alpha Capital Group | The slightly higher maximum loss limit (10% vs 8%) and the firm’s overall reputation for reliability just provide more peace of mind. |

| Aggressive Scalper | Funding Pips | Their tight spreads, fast execution, and generous profit split are tailor-made for high-frequency strategies where every pip counts. |

Ultimately, think of it like choosing a car. Alpha Capital Group is like a reliable, well-built sedan; it’s safe, comfortable, and will get you to your destination with minimal drama.

Funding Pips is a high-performance sports car. It’s thrilling, incredibly fast, and offers an unmatched level of performance, but it also demands a more skilled and attentive driver. Neither is better than the other; they’re just built for different journeys.

9. FAQs

To be honest, yes, but for different reasons. Alpha Capital Group is arguably better for a true beginner because its structured environment and educational resources provide a safer learning curve. Funding Pips is also an option, but its focus on speed might be overwhelming if you’re still finding your footing.

Both firms offer excellent scaling plans up to $2,000,000. The real difference is the journey. Alpha Capital offers a steady, milestone-based scaling path. Funding Pips offers a more aggressive path to higher capital and that incredible 100% profit split for top performers.

Absolutely. You won’t be left waiting with either. Funding Pips takes the crown for speed, with its weekly payout cycle available after just 5 days. Alpha Capital is also very reliable with a standard biweekly schedule. Both have great withdrawal options, including bank transfers and crypto. For added convenience, many traders also appreciate that crypto deposits are accepted for the initial fee.

You’re covered with the industry’s best. Both firms support cTrader, so you can use the platform you’re most comfortable with.

They are strict in different ways. Funding Pips is very flexible with news trading but has zero tolerance for high-frequency trading (HFT) and arbitrage strategies. Alpha Capital Group is also flexible but monitors your overall risk management very closely and will step in if it detects gambling behavior or inconsistent lot sizes.

Hands down, Alpha Capital Group. Their entire business model is built around fostering long-term, consistent traders. The clear rules, steady scaling, and proven reliability make it the ideal choice for building a sustainable career.

Good news on this front! Both firms have completely eliminated time limits and minimum trading day requirements on their challenges. This is a huge win for traders, as you can focus on your strategy without a clock ticking in the background.

They are both highly rated and trusted by the community. As of late 2026, Alpha Capital Group holds an excellent 4.6/5 stars, while Funding Pips is right there with a strong 4.5/5 stars.

Yes. Based on their transparent rules, extensive community reviews, and verified payouts, both are considered legitimate and reputable players in the prop trading industry.

They are nearly identical and align with the industry standard. For the popular 2-step challenges, the phase profit target for both firms is 8% in Phase 1 and 5% in Phase 2.

10. Conclusion

So, what’s the final word in the Alpha Capital vs Funding Pips showdown? It’s simple. The UK-based firm is the clear choice for traders building a sustainable career on a foundation of dependability and clear guidelines. It’s the firm for the long game.

Their competitor is the undisputed champion for aggressive traders who prioritize speed, minimal restrictions, and the highest earnings in the industry. It’s built for the fast lane. This isn’t about which firm is better; it’s about which one is better for you. We hope this guide from H2T Funding helps you make that choice. Trade smart.