Managing your personal finances can feel overwhelming, especially if you’re new to budgeting. That’s where the 50/30/20 budget rule, also known as the 50/30/20 rule, comes in: a simple and time-tested method that helps you take control of your money without complex spreadsheets or financial jargon.

This beginner-friendly budgeting strategy divides your income into three clear categories: needs, wants, and savings or debt repayment. If you’re wondering what is the 50 30 20 budgeting rule, it’s essentially a proportional approach to money management that ensures you meet essential needs while still enjoying life and saving for the future.

1. Understanding the 50/30/20 rule of budgeting

Before you can apply the 50/30/20 rule, it’s important to understand where it comes from, how it works, and why it’s so popular among both beginners and financial experts. This section will cover the definition, origins, and core structure of the rule.

1.1. What is the 50/30/20 budget rule?

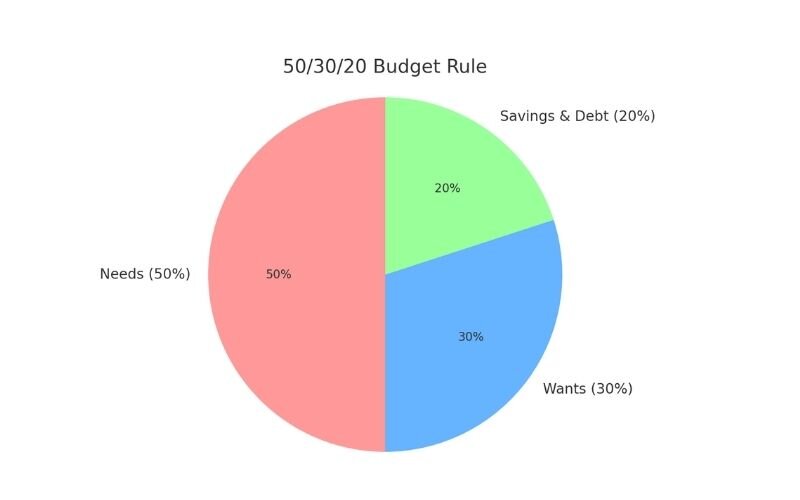

The 50 30 20 budgeting rule is a personal finance strategy that divides your after-tax income into three main spending categories:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

This simple structure, often referred to as the 50 30 20 rule, helps you manage your money with clarity and purpose. Instead of micromanaging every dollar, you follow a balanced ratio that guides your financial decisions.

1.2. Origin and purpose of the rule

The 50-30-20 rule of budgeting was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan. They aimed to simplify personal finance with a rule that works for people of all income levels – what we now call the 50 30 20 rule.

At its core, this method aims to:

- Encourage healthy financial habits

- Prevent lifestyle inflation

- Promote long-term financial security

The rule reflects a balance between financial responsibility and personal enjoyment, making it ideal for people looking for a flexible yet effective budgeting system.

1.3. Basic structure of the rule

Here’s a quick breakdown of the budget rule 50 30 20:

| Category | Percentage | What It Covers |

|---|---|---|

| Needs | 50% | Essential expenses like housing, food, utilities, insurance, transportation |

| Wants | 30% | Non-essential items such as entertainment, dining out, hobbies, subscriptions |

| Savings & Debt | 20% | Emergency fund, retirement savings, paying off loans or credit cards |

This structure gives you a guideline to follow each month. It’s not about perfection, but about consistency. Even small adjustments toward this ratio can lead to better financial health over time.

2. What counts as needs, wants, and savings?

Now that you understand the basic structure of the 50/30/20 budgeting rule, let’s take a closer look at what each category actually includes. Correctly classifying your expenses is essential for making this method work effectively, especially if you want to stay financially balanced.

Below, we break down the differences between needs, wants, and savings or debt repayment, along with examples to help you apply the rule accurately in real life.

2.1. Distinguish between needs, wants, and savings

To take full advantage of the 50/30/20 budgeting method, the first step is learning how to classify your spending accurately. Misplacing an expense into the wrong group, say, treating a want as a need, can quickly lead to financial imbalances. By clearly understanding what defines a need, a want, or a savings goal, you’ll be better equipped to control your finances and make intentional money choices.

| Category | Core Meaning | Typical Expenses |

|---|---|---|

| Needs | These are vital for your basic functioning and daily well-being. You can’t reasonably cut them out without serious consequences. |

|

| Wants | These are non-essential purchases that bring convenience, entertainment, or comfort. While they add joy to life, they’re not mandatory. |

|

| Savings | This includes funds allocated for future use, whether it’s building financial security or achieving long-term goals. |

|

Clearly drawing the line between these categories doesn’t just keep your budget on track; it builds financial discipline and empowers you to spend with purpose.

2.2. How the 50/30/20 rule works in real life

Understanding the 50/30/20 rule is one thing; putting it into practice is another. To help you visualize how this budgeting method works, let’s walk through a real-life example of how a young professional in the U.S. might apply it to their monthly income. This practical approach makes it easier to stay financially balanced, reduce stress, and avoid unnecessary debt.

Jordan Lee, 29, works as a UX designer in Denver, Colorado. He earns $5,000 per month after taxes, a typical income for a mid-level tech professional in a major U.S. city. Like many millennials, Jordan wants to enjoy life without compromising his financial future. Here’s how he applies the 50/30/20 rule to stay in control:

50% for Needs – $2,500/month

Under the 50/30/20 framework, needs include all non-negotiable expenses—costs required to live and work. For Jordan, this means:

- Rent: $1,600 for a one-bedroom apartment

- Utilities and internet: $180

- Groceries (home-cooked meals): $400

- Car payment and gas: $220

- Health insurance premium: $70

- Minimum loan and credit card payments: $30

Tip: If your needs exceed 50% of your income, as Jordan’s initially did, it may be time to reevaluate your fixed costs. Jordan chose to relocate from downtown to a slightly less expensive neighborhood, reducing his rent by $300/month.

30% for Wants – $1,500/month

Wants to cover the lifestyle extras that bring joy and comfort but aren’t strictly necessary. Jordan’s “wants” budget includes:

- Dining out and weekend brunches: $350

- Entertainment subscriptions (Netflix, Spotify, Apple TV): $60

- Domestic travel and weekend getaways: $400

- New clothes, electronics, and hobbies: $300

- Gym and rock climbing membership: $140

- Events (concerts, games, festivals): $250

This category allows Jordan to enjoy his lifestyle guilt-free, without exceeding his financial boundaries. The 30% cap helps prevent overindulgence while still leaving room for fun.

20% for Savings & Extra Debt Repayment – $1,000/month

Finally, 20% of Jordan’s income goes toward building wealth and long-term stability. This includes:

- Roth IRA contribution: $400

- Emergency fund (high-yield savings account): $300

- Investment account (ETFs via brokerage): $150

- Additional student loan payment: $150

Pro tip: Jordan automates all his savings at the beginning of each month, ensuring this category is never skipped or deprioritized.

This example helps you visualize how easy it is to apply the 50/30/20 budgeting rule. Of course, your numbers will vary based on location, goals, and lifestyle, but the structure remains flexible and beginner-friendly.

See more related articles:

3. Pros and cons of the 50/30/20 rule

Before you decide if the 50-30-20 rule of budgeting is the right fit for your financial goals, it’s important to understand its strengths and weaknesses. Let’s explore the advantages and limitations of this popular budgeting method.

3.1. Advantages

The 50/30/20 budget rule offers several benefits, especially for beginners and those looking for a simple, effective way to manage their money:

- Simplicity: The clear 3-category structure makes budgeting straightforward and easy to follow. No complicated tracking or software needed.

- Flexibility: It can be adapted to different income levels and lifestyles, allowing you to adjust percentages if necessary.

- Encourages saving: By allocating 20% specifically for savings and debt repayment, it helps build financial security over time.

- Balanced approach: It encourages a healthy balance between covering essentials, enjoying life, and planning for the future.

- Promotes awareness: Following the rule increases your awareness of spending habits, helping you avoid overspending.

3.2. Limitations

Despite its popularity, the 50/30/20 rule has some drawbacks to consider:

- Not one-size-fits-all: Different financial situations may require different budgeting strategies, especially if living costs or debt levels vary significantly.

- Needs can exceed 50%: In high-cost cities or for those with large family responsibilities, essentials like rent and utilities might easily surpass 50%, making the rule harder to follow.

- Wants vs. needs can blur: Categorizing expenses can sometimes be subjective, leading to confusion about what counts as a “want” or a “need.”

- Savings target might be low for some: For aggressive savers or those with big financial goals, 20% might feel insufficient.

- Limited guidance on investment: The rule focuses mainly on budgeting but doesn’t provide specific advice on growing wealth through investments.

4. Is the 50/30/20 budget rule right for you?

Choosing the right budgeting method depends on your personal financial situation, goals, and lifestyle. The 50 30 20 rule for budgeting is an excellent starting point for many people, but it’s important to consider if it aligns with your needs.

When the 50/30/20 rule works well:

- You are new to budgeting and want a simple, easy-to-follow framework.

- Your essential expenses (needs) don’t exceed 50% of your income.

- You want a balanced approach between spending on essentials, discretionary items, and saving.

- You are aiming to build emergency savings or pay down debt steadily.

- You prefer flexibility without micromanaging every expense category.

When you might need a different approach:

- Your cost of living is high, and necessities take up more than 50% of your income.

- You have aggressive financial goals that require saving more than 20%.

- You have irregular or fluctuating income, making fixed percentages difficult to maintain.

- You want a more detailed or customized budgeting plan that fits your unique financial habits.

- You’re focused heavily on investment growth and need to allocate more resources there.

Ultimately, the budget rule 50 30 20 is a guideline, not a strict law. Feel free to adjust the percentages to suit your lifestyle while maintaining the core idea: balance your needs, wants, and savings to build financial health.

5. Alternatives to the 50/30/20 budgeting method

While the 50/30/20 budget rule is popular for its simplicity, other budgeting methods may better suit different financial goals or lifestyles. Here’s a brief overview of some common alternatives to consider:

- Zero-based budgeting

Zero-based budgeting requires you to allocate every dollar of your income to a specific expense, savings, or debt repayment category until your income minus expenses equals zero. This method helps maximize control over every dollar and reduces waste.

- Best for people who want detailed tracking and full control over their finances.

- It can be time-consuming but very effective for disciplined savers.

- Envelope system

Envelope system is a cash-based method that involves dividing your budget into envelopes labeled with spending categories (e.g., groceries, entertainment). You spend only the cash in each envelope, helping you avoid overspending.

- Ideal for people who struggle with overspending using credit cards.

- Encourages mindful spending, but less convenient in a digital world.

- 70/20/10 rule

This rule allocates 70% of income to needs and wants, 20% to savings, and 10% to debt repayment or charity. It’s simpler for those who want fewer categories or prioritize immediate spending flexibility.

- Good for individuals with less strict saving goals.

- Allows more flexibility for spending while still promoting savings.

- Pay yourself first

Pay yourself first method prioritizes saving or investing a fixed amount at the start of each pay period before budgeting for other expenses.

- Suitable for those who want to build savings aggressively.

- Encourages discipline and long-term financial growth.

Each budgeting method has pros and cons. Choosing the right one depends on your financial goals, habits, and discipline. The 50-30-20 rule of budgeting remains a strong foundation for beginners, but exploring these alternatives can help you tailor your plan to fit your unique needs.

See more:

6. How to start using the 50/30/20 rule step-by-step

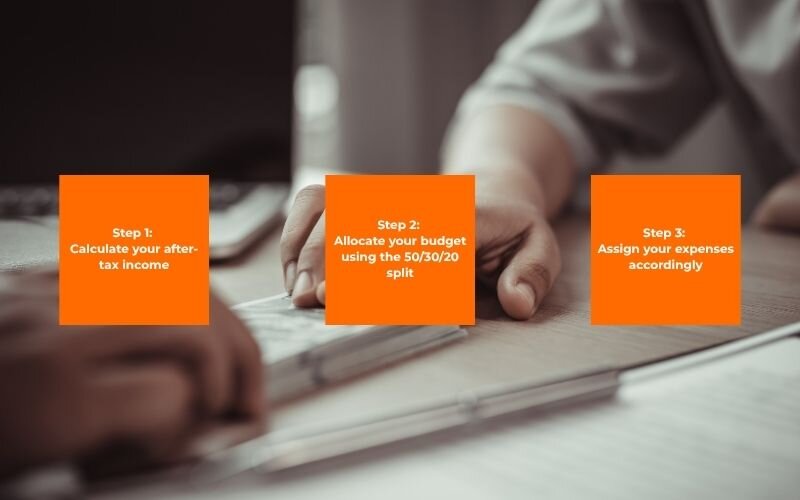

Implementing the 50/30/20 budget rule is straightforward, especially for beginners looking to gain control over their finances. Here’s a simple step-by-step guide to help you get started:

Step 1: Calculate your after-tax income

Start by determining your total monthly income after taxes and deductions. This is the amount you’ll use to allocate into the 50%, 30%, and 20% categories.

Step 2: List your expenses and categorize them

Write down all your monthly expenses and sort them into three main categories:

- Needs (50%): Rent, utilities, groceries, transportation, insurance, and minimum loan payments.

- Wants (30%): Dining out, hobbies, entertainment, subscriptions, vacations.

- Savings and debt repayment (20%): Emergency fund contributions, retirement accounts, extra loan payments.

Step 3: Compare and adjust your spending

Review your current spending against the 50/30/20 percentages. If any category exceeds its target, look for ways to cut back or reallocate funds.

Step 4: Automate your savings

Set up automatic transfers to your savings or investment accounts to ensure the 20% savings goal is met consistently.

Step 5: Track your progress monthly

Use budgeting apps or spreadsheets to monitor your spending and make adjustments as needed. Staying consistent helps build healthy money habits.

Bonus tips for success

- Be flexible: Life changes, so your budget can too.

- Prioritize debt repayment: Reduce high-interest debt first.

- Build an emergency fund: Aim for 3-6 months of living expenses.

- Review regularly: Revisit your budget every few months.

By following these steps, you’ll start managing your money more effectively with the budget rule 50 30 20 and build a solid financial foundation for the future.

7. FAQs

Yes, the 50 30 20 rule is widely considered a good starting point for anyone looking to build financial discipline. It offers a balanced framework that covers essential expenses, lifestyle choices, and future savings. However, if your income or expenses vary greatly, you may need to adjust the percentages.

Absolutely. The 20% portion of the 50/30/20 budgeting rule is dedicated to savings and debt repayment. You can use it to build an emergency fund, contribute to retirement accounts, or work toward long-term goals like buying a home or funding education.

To use the budget rule 50 30 20 effectively: Calculate your monthly after-tax income. Categorize your expenses as needs, wants, or savings. Allocate your money according to the 50/30/20 breakdown. Track spending and adjust monthly to stay within your target percentages.

No. The 50 30 20 rule is based on after-tax income, meaning you should calculate your budget using the amount you take home – not your gross salary. This ensures the percentages reflect what you actually have available to spend and save.

You may want to skip the 50/30/20 rule if your income is very low or highly irregular, making it hard to cover basic needs within 50%. It’s also less effective if you have aggressive debt repayment goals or live in a high-cost city where essentials exceed half your income. In such cases, a more customized budget may serve you better.

8. Final thoughts

The 50/30/20 budget rule is a simple yet powerful tool for managing your personal finances, especially if you are new to budgeting. By dividing your income into clear categories, needs, wants, and savings you can gain better control over your money and work towards financial stability.

While it may not be perfect for everyone, the 50-30-20 rule of budgeting provides a flexible framework that can be adjusted based on your unique financial situation. It encourages balanced spending, prioritizes saving, and reduces financial stress by creating clear boundaries.

If you’re looking for an easy-to-follow method to improve your money management skills, the 50/30/20 budgeting rule is a great place to start. Take the first step today, and watch your financial confidence grow over time.

For more practical financial tips and budgeting strategies, explore related articles on H2T Funding to continue building your financial knowledge.