Running short on cash for unexpected bills, urgent home repairs, or essential daily expenses can be stressful. I remember the stress when my car suddenly broke down. The repair bill was more than I could handle, and with payday still a week away, I felt stuck.

That’s when I learned about a budgeting advance, a temporary financial support designed to help eligible individuals manage urgent needs without falling behind on obligations.

So, what can I get a budgeting advance for in real life? H2T Funding will explain exactly who qualifies, how much you can request, and provide practical ways to utilize this support.

Key takeaways

- A budgeting advance is an interest-free loan that helps Universal Credit claimants cover urgent or essential expenses.

- It can be used for necessary costs like household goods, moving, travel, clothing, work-related expenses, or funerals.

- You must meet eligibility requirements, including being on benefits for at least six months, having low earnings, and not owing a previous advance.

- The loan amount ranges from £100 to £812, depending on household circumstances and savings.

- Repayments are deducted automatically from Universal Credit over 24 months with no interest added.

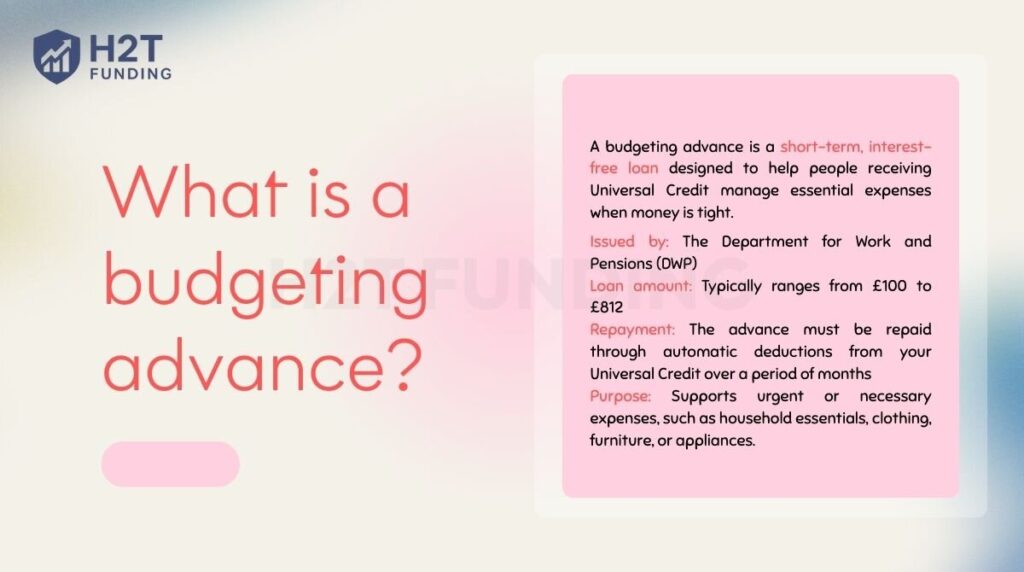

1. What is a budgeting advance?

A budgeting advance is a short-term, interest-free loan designed to help people receiving Universal Credit manage essential expenses when money is tight. It acts as a temporary financial boost to cover costs that can’t wait until your next payment.

Key points about a budgeting advance include:

- Issued by: The Department for Work and Pensions (DWP), the government body responsible for administering Universal Credit.

- Loan amount: Typically ranges from £100 to £812, depending on your personal circumstances, income, and household situation.

- Repayment: The advance must be repaid through automatic deductions from your Universal Credit over a period of months, making it manageable without additional interest.

- Purpose: Supports urgent or necessary expenses, such as household essentials, clothing, furniture, or appliances, ensuring you can maintain a basic standard of living without falling into arrears.

By providing a structured, interest-free option, the budgeting advance helps recipients avoid high-cost loans or financial hardship during difficult periods. Understanding its purpose and rules is the first step in deciding what I can get a budgeting advance for and how much I can responsibly request.

2. What can I get a budgeting advance for?

A common question is what can I ask for a budgeting advance for, and the answer is simple: it’s there to cover urgent, essential costs you cannot delay. For anyone receiving Universal Credit, a budgeting advance can provide a much-needed safety net to manage these pressures without stress piling up.

If you’re asking what can you get a budgeting advance for, here’s a practical guide with real-life scenarios to help you plan wisely.

2.1. Emergency household expenses

Imagine your washing machine breaks down the day your children’s laundry piles up, or your fridge stops working just as you’ve stocked up for the week. A budgeting advance can help you:

- Replace essential appliances and furniture: Buy a fridge, washing machine, bed, or sofa to restore normalcy at home.

- Repair broken items: Fixing a boiler, kitchen equipment, or other critical household items to ensure your family stays safe and comfortable.

These expenses directly impact your day-to-day comfort. By covering urgent repairs or replacements, a budgeting advance can prevent stress from escalating and protect your family’s well-being.

If you often deal with unpredictable costs, learning budgeting for irregular income can help you stay financially prepared. At the same time, avoiding common budgeting mistakes ensures your advance is used effectively and wisely.

Continue reading: How to start an emergency fund

2.2. Rent or moving costs

Moving into a new home can be both exciting and stressful, especially if you don’t have the upfront funds. A budgeting advance can support:

- Rental deposits: Covering the initial deposit required to secure a home.

- Moving costs: Paying for transport, van hire, or professional movers.

- Basic furnishings: Essential items like beds, tables, and chairs to make your new space livable.

Moving to a new home is often stressful, and financial support can reduce anxiety. With a budgeting advance, you can focus on settling in rather than worrying about immediate costs.

For longer-term planning, learning how to save for a big purchase will prepare you for future milestones, while smart budgeting for couples can make moving together smoother and more financially stable.

2.3. Essential travel costs

Urgent travel can be emotionally and financially draining. A budgeting advance can cover:

- Job interviews: Train or bus fares to attend interviews, providing hope for a new opportunity. To make the most of these chances, it’s helpful to know how to negotiate salary so your new role truly supports your financial needs.

- Medical or family emergencies: Travel costs for hospital visits or supporting a loved one in crisis.

Having access to these funds can provide peace of mind when facing critical obligations. It allows you to respond quickly without feeling financially trapped. And if you’re considering a new position, don’t forget to negotiate job offer benefits to secure both financial stability and personal well-being.

2.4. Clothing or footwear

Clothing needs may seem minor, but they impact confidence and comfort. A budgeting advance can help:

- Seasonal wardrobe updates: Replacing worn-out clothing or shoes for yourself or family members.

- Children’s clothing: Ensuring kids have warm, safe, and suitable attire for school or play.

Proper clothing contributes to confidence and well-being. A budgeting advance helps ensure you and your family are prepared for everyday life without added stress.

If you’re balancing a limited income, learning smart budgeting tips for college students or practical budgeting tips for freelancers can make managing clothing costs and other essentials far more effective.

2.5. Work-related costs

Starting a new job or maintaining employment can come with unexpected expenses. A budgeting advance can fund:

- Uniforms or professional attire: Necessary clothing for work or interviews.

- Equipment or tools: Items needed to perform your role effectively.

- Short-term training: Courses or certifications to enhance employability.

Investing in your career can be stressful without financial support. A budgeting advance allows you to pursue opportunities and training while keeping finances manageable.

2.6. Funeral costs

Arranging a funeral is incredibly difficult, and the financial pressure on top of everything else can feel overwhelming. A budgeting advance can help cover essential funeral costs if you do not qualify for a Funeral Expenses Payment.

Basic funeral arrangements: Paying for key services such as burial or cremation, flowers, and necessary administrative fees.

Eligibility note: The Funeral Expenses Payment is a government support that helps with funeral costs for people on certain benefits. It is usually a grant rather than a loan and does not need to be repaid. However, not everyone qualifies for this payment; income thresholds, benefit type, and relationship to the deceased affect eligibility.

By understanding what I can get a budgeting advance for, you can make thoughtful decisions about how to use these funds to relieve financial stress, protect your family’s well-being, and navigate life’s unexpected challenges. It’s not just money; it’s peace of mind when you need it most.

3. What you can’t use a budgeting advance for

While a budgeting advance is meant to ease financial pressure during difficult times, it is not a catch-all solution for every expense. Misusing it can create more stress than relief, so understanding the boundaries is crucial. Here’s what a budgeting advance cannot be used for:

- Repaying credit cards or personal loans: If you’re struggling with debt, it’s natural to want a quick fix. However, a budgeting advance is intended to meet immediate living needs, not to refinance existing loans. For real debt management, learning how to improve your personal cash flow is far more effective.

- Luxury or non-essential spending: Treating yourself with expensive vacations, designer items, or high-end gadgets may feel tempting, especially during stressful times. But budgeting advances are for essentials: basic living costs, not indulgences.

- Investments or business expenses: Whether it’s starting a small business or buying stocks, these are outside the scope of a budgeting advance. The support is personal and temporary, not meant to fund entrepreneurial ventures.

- Supporting people who do not live with you: Helping friends or relatives financially is admirable, but a budgeting advance is only for the needs of your household. Trying to cover costs for others can risk repayment issues and create tension.

Financial stress already takes an emotional toll, and sticking to these rules is about making sure this helping hand doesn’t accidentally create more financial stress down the line.

From my own experience, I’ve learned that avoiding common pitfalls, like overspending, is just as important as using funds wisely. That’s why I strongly recommend checking out these strategies on how to stop overspending to ensure your budgeting advance truly lightens your burden, not adds to it.

Don’t miss out:

4. Eligibility criteria for a budgeting advance

Applying for a budgeting advance can be a lifeline when sudden expenses put extra pressure on your finances. But not everyone can get one. To avoid disappointment, it’s important to know the rules clearly.

The Department for Work and Pensions (DWP) has set out specific eligibility criteria to make sure this support goes to people who need it most and can realistically manage the repayments.

Here are the main conditions you need to meet:

4.1. Continuous receipt of benefits

Applicants need to have claimed Universal Credit or another approved benefit for no less than six months. These include:

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Pension Credit

The only exception is if you urgently need money to help you start or stay in work (for example, buying tools for a new job or paying for travel to attend an interview). In that case, you may qualify even if you’ve claimed benefits for less than six months.

4.2. No outstanding budgeting advance

You cannot apply if you or your partner still have a previous budgeting advance being recovered. This rule prevents people from stacking multiple advances at the same time and ensures repayments remain manageable.

If only a small balance is left, your application may still be considered, but the DWP will decide based on your overall situation.

4.3. Earnings limits

Over the last six Universal Credit assessment periods, your household income must not be higher than:

- £2,600 if you’re applying as a single person (whether you have children or not)

- £3,600 if you’re applying as part of a couple (with or without children)

These earnings include not only wages but also statutory payments such as:

- Statutory Sick Pay (SSP)

- Statutory Maternity Pay (SMP)

- Statutory Paternity Pay (ordinary or additional)

- Statutory Adoption Pay

- Maternity Allowance

This rule ensures budgeting advances go to those who genuinely rely on government support, rather than higher earners who are less likely to need this short-term help.

4.4. Repayment capacity

Finally, the DWP will assess whether you can reasonably repay the loan through deductions from your Universal Credit. They will look at your income, expenses, and any other debts to make sure repayments won’t cause financial hardship.

Meeting these criteria doesn’t just improve your chance of approval; it also ensures the loan is sustainable, giving you the short-term support you need without putting your longer-term finances at risk.

For a stronger foundation, improving your money skills with financial literacy tips for beginners or practical financial literacy for young adults can help you stay prepared beyond the advance itself.

5. When can you get a budgeting advance?

A budgeting advance is designed to step in during those urgent moments when your regular Universal Credit simply isn’t enough. But timing is important; you can only apply under certain conditions. Knowing when you can get a budgeting advance helps you avoid frustration and gives you a clearer idea of your options.

If you need help to get or stay in work

You may be eligible right away if the money will help you find or keep a job. For example:

- Buying train or bus tickets to attend a job interview.

- Covering essential travel costs for a new job.

- Paying for small but necessary work-related expenses, such as uniforms or tools.

In these cases, you don’t have to wait six months on benefits to apply. The advance is meant to remove financial barriers that could stop you from working.

If you need money for other essential expenses

For all other reasons, like household emergencies, moving costs, or urgent family needs, you must have been claiming one of the following benefits for at least six months:

- Universal Credit

- Income Support

- Means-tested Jobseeker’s Allowance (JSA)

- Means-tested Employment and Support Allowance (ESA)

- Pension Credit

This rule makes sure that budgeting advances go to people who have an established need for ongoing financial support.

Finally, remember: You won’t be able to apply if you (or your partner) are still repaying a previous budgeting advance. This helps prevent multiple overlapping loans that could create repayment stress.

Read more:

6. How much budgeting advance can I get?

The amount you can borrow with a budgeting advance depends on your household situation. The Department for Work and Pensions (DWP) sets both a minimum and a maximum limit to ensure that the loan truly covers essential needs while staying affordable to repay.

- Minimum amount: £100

- Maximum amount: depends on your family circumstances

| Household situation | Maximum budgeting advance |

|---|---|

| Single adult | £348 |

| Couple | £464 |

| Single parent or couple with children | £812 |

This tiered system ensures that people with greater responsibilities, such as raising children, can access a higher level of support.

Example scenarios

- A single claimant who urgently needs a new fridge could request £250, which falls within their maximum allowance.

- A couple with children needing help with moving costs may apply for £700, which is under their household cap of £812.

Note: It’s important to know that your savings can affect the amount you can borrow. If you (and your partner, if you have one) have over £1,000 in savings, the maximum advance you can get will be reduced.

For example, if you are eligible for the maximum loan of £348 but you have £1,100 in savings, your loan amount will be reduced by £100. So, the most you could borrow would be £248.

Knowing how much budgeting advance I can get helps you plan realistically and avoid borrowing more than you can comfortably repay.

To manage these limits effectively, creating a clear spending plan is key. Check out how to create a personal budget for step-by-step guidance, or apply the popular 50/30/20 budget rule to balance essentials, wants, and savings more confidently.

7. How to apply for a budgeting advance

Applying for a budgeting advance may feel stressful, especially when you’re already under financial pressure. But the process is straightforward once you know where to start.

Whether you’re applying for essential household costs, job-related expenses, or emergency travel, preparing the right information and choosing the right way to apply will help you get a quick decision.

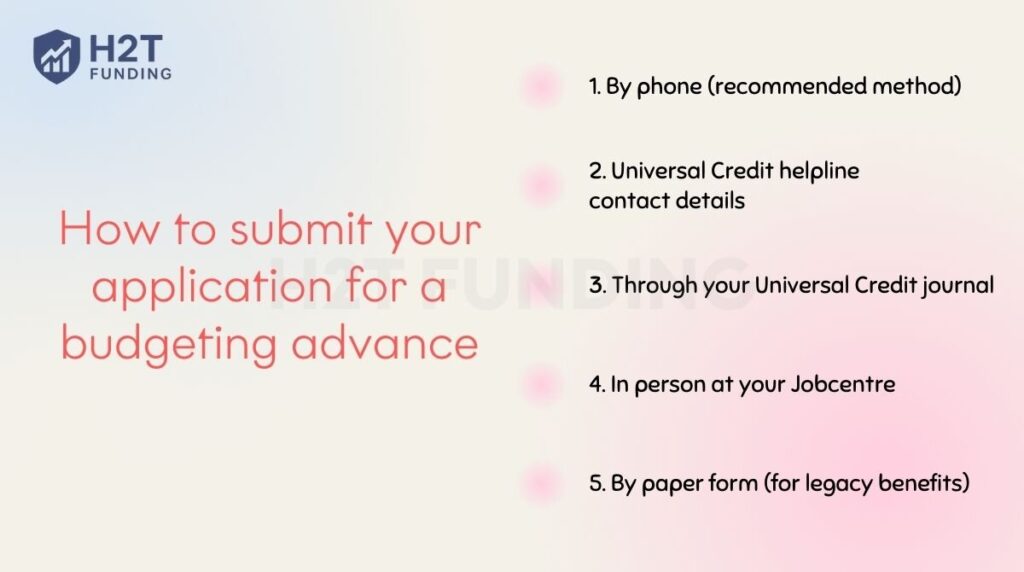

7.1. How to submit your application

You can apply for a budgeting advance in several ways, depending on your circumstances:

1. By phone (recommended method): Most people apply by calling the Universal Credit helpline. An adviser will check your eligibility and calculate how much you can borrow. They’ll look at:

- Whether you can afford to pay the loan back (considering any debts you already have).

- How much do you have in savings or capital?

- Your household situation.

2. You’ll normally receive a decision on the same day.

Universal Credit helpline contact details:

- Telephone (English): 0800 328 5644

- Telephone (Welsh language): 0800 328 1744

- Textphone: 0800 328 1344

- Relay UK: 18001 then 0800 328 5644 (for those who can’t hear or speak on the phone; available via app or textphone, free of charge).

- Video relay: Available for British Sign Language (BSL) users (guides available on YouTube).

- Opening hours: Monday to Friday, 8 am – 6 pm.

Calls are free from both mobiles and landlines.

3. Through your Universal Credit journal: If you manage your benefits online, you can submit a request directly through your UC journal or send a message to your work coach.

4. In person at your Jobcentre: During your regular appointment, you can speak to a DWP work coach about applying. This can be particularly helpful if you’re unsure how much you should ask for or what evidence to provide.

5. By paper form (for legacy benefits): If you’re still on older benefits such as Income Support or income-based JSA/ESA, you may need to fill out a budgeting loan/advance form. This is available at your local Jobcentre.

7.2. Information you’ll need to prepare

When applying, it’s important to have the following information ready. This shows the urgency of your situation and makes it easier for DWP to approve your request quickly:

- Reason for borrowing: Be clear and specific, e.g., replacing a broken fridge, paying a rental deposit, or covering travel for a job interview.

- Amount you’d like to borrow: Keep in mind the minimum (£100) and the maximum based on your family circumstances.

- Supporting evidence: Documents that strengthen your case, such as:

- Bills, invoices, or repair quotes.

- Job interview invitations.

- Medical appointment letters or travel confirmations.

While the process might feel daunting, many people find that calling the helpline and explaining their situation honestly leads to a fair and fast decision. Being prepared with clear reasons and evidence can make all the difference in getting the support you need when it matters most.

8. How long does it take to get a decision?

Most budgeting advance applications are processed quickly, with a decision made within 3–5 working days, but when you apply for a budgeting advance by phone, you will usually get a decision on the same day. If approved, the money is paid directly into the bank account linked to your Universal Credit claim via BACS transfer.

In urgent cases where you don’t have enough funds to cover essentials, a Faster Electronic Payment may be arranged, sometimes on the same day. This is only approved in exceptional circumstances and must be signed off by a DWP manager.

9. How do you repay a budgeting advance?

Repayment of a budgeting advance is designed to be straightforward, so you don’t need to worry about arranging separate payments yourself. The Department for Work and Pensions (DWP) will automatically deduct the agreed amount from your Universal Credit payments each month until the advance is fully repaid.

- Repayment period: The advance is now repaid over 24 months. This longer period means the automatic deductions from your monthly Universal Credit payment are smaller and more manageable.

- Flexible support: If you face serious financial hardship during the repayment period, you may be able to request a temporary reduction or pause in repayments. This is assessed on a case-by-case basis.

- No extra interest: Budgeting advances are completely interest-free, so you only repay the exact amount you borrowed.

This repayment system ensures that you can manage the loan without extra pressure, while still keeping up with daily living costs supported by Universal Credit.

10. Alternatives to budgeting advance

Not everyone will qualify for a budgeting advance, and sometimes the amount offered may not be enough to cover what you need. In these cases, there are other forms of support available that can provide short-term relief.

- Local Welfare Assistance Scheme: Many local councils in the UK offer emergency help for residents facing financial crises. This can include essential household items, energy vouchers, or other one-off support. Availability and rules differ depending on your local authority, so it’s worth checking directly with your council.

- Food banks or voucher schemes: If you’re struggling to afford groceries, food banks can provide short-term support with essentials. Some councils and charities also run voucher schemes to help with food or fuel. You’ll usually need a referral from a professional, such as a GP, social worker, or Jobcentre adviser.

- Short-Term Benefit Advance (STBA): If you’re waiting for your first Universal Credit payment, or for an increase in your benefits, you may be eligible for a Short-Term Benefit Advance. This works like an advance payment that is later deducted from your benefits, similar to a budgeting advance, but it’s meant specifically to cover the gap before your benefits start or change.

- Discretionary Housing Payments (DHP): If you receive Housing Benefit or the housing element of Universal Credit but still struggle with rent, you can apply for a Discretionary Housing Payment from your local council. This can help with shortfalls, deposits, or rent in advance.

These alternatives ensure that even if you can’t access a budgeting advance, you still have options to manage urgent needs and protect your household from financial hardship.

See more helpful articles:

11. FAQs

Yes, budgeting advances can help with housing costs such as rent deposits, moving expenses, or essential furniture.

Most applications are processed within 3–5 working days, with funds paid directly into your bank account.

If repayment is difficult, you can request reduced deductions or a temporary pause due to hardship, but the debt will still need to be cleared.

You can only apply if your previous advance has been repaid, or the outstanding balance is low enough to allow a new loan.

A budgeting advance covers one-off essential expenses, while a benefit advance helps you bridge the gap when waiting for your Universal Credit payment.

Urgent needs such as household goods, moving costs, clothing, funeral expenses, or essential travel, that’s exactly what a budgeting advance can be used for.

Be clear and honest about your needs, explain your situation, the expense you must cover, and provide supporting evidence if asked.

There’s no strict limit, but you must fully or mostly repay the previous advance before applying again.

Eligibility requires receiving Universal Credit (or certain legacy benefits) for at least 6 months, having low earnings, and not owing a previous advance.

Be clear and honest about your urgent need, explain the essential expense, and provide any proof if asked.

Yes, but only if the expense is directly linked to starting or keeping a job, such as travel, tools, or uniforms.

12. Conclusion

A budgeting advance can be a lifeline when temporary financial difficulties strike, giving you the support needed to cover urgent essentials without turning to high-interest loans. However, it is important to remember that this is still a loan, not a free grant; you will need to repay it through deductions from your Universal Credit.

If you’re still unsure what I can have a budgeting advance for, just remember it’s designed to cover genuine essentials, never luxuries. The key is to use it wisely and only for genuine needs. Careful planning and having a clear repayment strategy will keep you in control and reduce financial stress in the long run.

Explore more resources on Budgeting Strategies at H2T Funding to discover practical tips for managing your money smarter and building financial resilience.