Take Profit Trader Payout Rules are the most important thing to understand before planning any withdrawal. Unlike many prop firms, Take Profit Trader uses a profit buffer system, which means having profits does not always mean you can withdraw them immediately.

For PRO accounts, profits must first move beyond the buffer before becoming eligible for payouts, while PRO+ accounts allow direct access to earnings without this restriction. Misunderstanding this rule is one of the main reasons profitable traders fail to receive payouts.

This guide explains how Take Profit Trader payout rules actually work, including profit splits, buffer mechanics, withdrawal steps, and common payout rejection scenarios. By the end, you will know exactly when to withdraw, how much you can withdraw, and how to avoid mistakes that cost traders their payouts.

Key takeaways:

- Traders must pass the Evaluation Phase and complete at least 5 trading days, respect drawdown limits, and meet the 50% profit consistency rule before becoming eligible for any payouts.

- PRO accounts pay 80% of profits but require clearing a profit buffer equal to the maximum drawdown (e.g. a $50,000 account must reach $52,000 before withdrawals are allowed).

- PRO+ accounts pay 90% of profits, trade live markets, and allow withdrawals without a buffer, but freeze $5,000 of PRO profits during the upgrade process.

- There is no Take Profit Trader payout cap, but withdrawals under $250 incur a $50 fee, and all payouts must be approved before reaching the wallet.

1. What is Take Profit Trader?

Take Profit Trader is a futures prop trading firm that allows traders to earn real payouts by trading firm-provided accounts. Instead of risking personal capital, traders are evaluated first and then funded based on performance and risk control.

The Take Profit Trader account journey includes three clear stages:

- Evaluation: Trade in a simulated environment to hit a profit target while respecting drawdown and consistency rules.

- PRO: A funded SIM account with real payouts, an 80/20 profit split, and a required profit buffer before withdrawals.

- PRO+: A live trading account with a 90/10 profit split, no buffer requirement, and end-of-day drawdown rules.

Take Profit Trader is designed for traders who can follow rules, manage risk, and scale responsibly. Understanding how each stage works is essential before diving into the firm’s payout rules and withdrawal mechanics.

2. How traders become eligible for payouts at Take Profit Trader

At Take Profit Trader, payouts are not available immediately. Traders must first pass the Evaluation Phase before gaining access to a funded PRO account. Any profits earned during the evaluation are simulated and cannot be withdrawn.

To become payout-eligible, traders must meet all evaluation requirements at the same time, not just the profit target. Failing a single rule results in disqualification, even if the account is profitable.

Key requirements during the Evaluation Phase include:

- Reaching the profit target for the selected account size

- Respecting the end-of-day (EOD) trailing drawdown

- Staying within maximum position size limits

- Completing a minimum of 5 trading days

Take Profit Trader also enforces a profit consistency rule during the evaluation:

- No single trading day may exceed 50% of total net profits

- Consistency is calculated using net P/L, not gross gains

- The profit goal may adjust automatically based on performance

Trading behavior is also closely monitored. During the evaluation, traders must:

- Trade only approved futures products

- Open and close positions within approved trading hours

- Avoid holding positions past the daily cutoff

- Refrain from using trading bots or counter-position strategies

Below is a breakdown of the Evaluation Phase based on Take Profit Trader’s current parameters:

| Account Size | Profit Target | Max Position Size | EOD Trailing Drawdown | Minimum Trading Days |

|---|---|---|---|---|

| $25,000 | $1,500 | 3 contracts / 30 micros | $1,500 | 5 days |

| $50,000 | $3,000 | 6 contracts / 60 micros | $2,000 | 5 days |

| $75,000 | $4,500 | 9 contracts / 90 micros | $2,500 | 5 days |

| $100,000 | $6,000 | 12 contracts / 120 micros | $3,000 | 5 days |

| $150,000 | $9,000 | 15 contracts / 150 micros | $4,500 | 5 days |

Only after all evaluation conditions are met does a trader advance to a PRO account, where real cash payouts become possible. From that point onward, withdrawals are governed by Take Profit Trader payout rules, which differ between PRO and PRO+ accounts.

According to QuantVPS data, in 2024, only 16.86% of traders successfully passed the evaluation, showing that payout eligibility depends on consistency and discipline, not a few large trades.

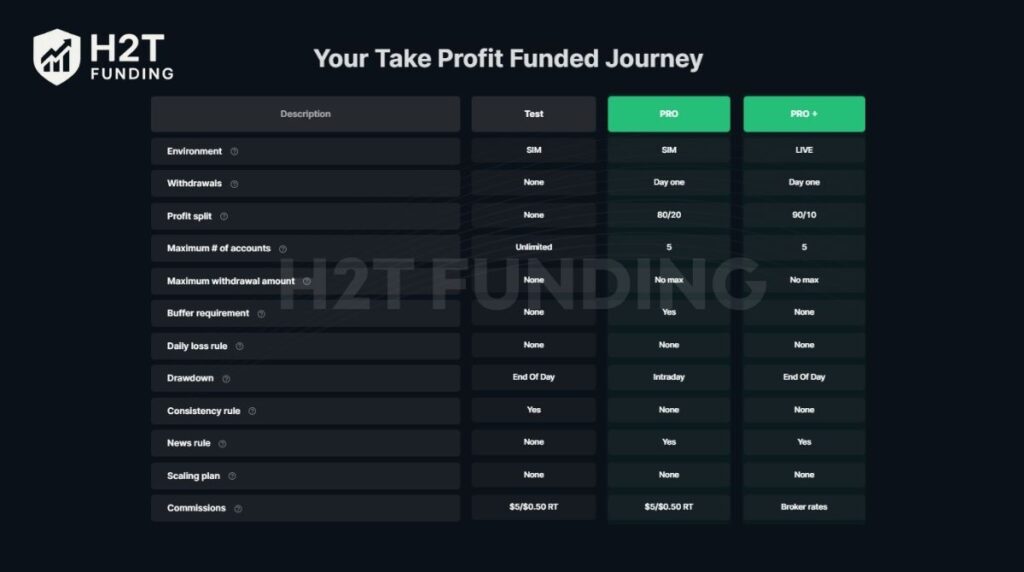

3. Take Profit Trader payout rules: Key differences between PRO and PRO+

After passing the Evaluation Phase, traders receive a PRO account where real payouts become possible. Some traders may later qualify for a PRO+ account, which changes how profits, drawdowns, and withdrawals work. Understanding these differences is critical before planning any payout strategy.

The PRO account is designed to reward consistency over time, while the PRO+ account prioritizes faster and more flexible access to profits. The key differences between the two are outlined below.

| Feature | PRO Account | PRO+ Account |

|---|---|---|

| Trading environment | Simulated (SIM) | Live market |

| Profit split | 80% to trader | 90% to trader |

| Buffer requirement | Yes, equal to max drawdown | No buffer |

| First withdrawal | After profits exceed the buffer | Any time profits exist |

| Drawdown type | Intraday trailing drawdown | End-of-day (EOD) trailing drawdown |

| Withdrawal frequency | On demand (business days) | On demand (business days) |

| Upgrade path | Can upgrade to PRO+ | Top-tier account |

With a PRO account, profits must first move beyond the buffer before becoming withdrawable. In contrast, PRO+ accounts allow traders to withdraw profits without clearing a buffer, making payouts more immediate but also subject to stricter account management.

In short, PRO accounts suit traders who focus on steady growth and long-term consistency. PRO+ accounts are better for traders who want quicker access to profits and are comfortable managing live market risk.

4. Take Profit Trader payout rules explained in detail

Once a trader reaches a PRO or PRO+ account, payouts follow clearly defined rules that control when profits become withdrawable and how withdrawals are handled. These rules depend on account type, buffer status, and account transitions, not just profitability.

Below, we break down each payout rule step by step, starting with how the profit buffer works in PRO accounts.

4.1. The profit buffer explained: How it affects PRO account payouts

The profit buffer is the most misunderstood part of the Take Profit Trader payout rules. It applies only to PRO accounts and determines when profits become withdrawable.

The buffer is equal to your account’s maximum drawdown. Before you can withdraw profits, your account must first move beyond this drawdown level and create a safety margin.

For example, on a $50,000 PRO account:

- Maximum drawdown: $2,000

- Buffer requirement: $2,000

- Withdrawals begin once the balance reaches $52,000

This mechanism ensures the account can absorb losses even after a payout, protecting both the trader and the firm. The table below shows the balance level that must be reached before profits become withdrawable on PRO accounts.

| Account Size | Balance required to clear the buffer |

|---|---|

| $25,000 | $26,500 |

| $50,000 | $52,000 |

| $75,000 | $77,500 |

| $100,000 | $103,000 |

| $150,000 | $154,500 |

Only profits earned above these levels are eligible for withdrawal while the account remains active. For example, if your $50,000 account reaches $52,500:

- Withdrawable profit: $500

- Trader payout (80%): $400

- Firm share (20%): $100

Formula: Withdrawable amount = Profit above buffer × profit split

Note: You can withdraw profits inside the buffer, but only if the PRO account is closed.

If the account is terminated with profits still inside the buffer, the payout depends on how long the account was traded:

| Time active (trading days) | Buffer paid to the trader |

|---|---|

| 60 trading days or less | 50% |

| More than 60 trading days | 80% |

4.2. PRO+ account payout structure (what changes after the upgrade)

Upgrading to a PRO+ account changes how payouts and drawdowns work, but it does not simply “unlock everything” from the PRO account.

Once PRO+ is issued:

- The PRO account is placed on hold

- $5,000 in profit from the PRO account is frozen

- Any profit above $5,000 remains withdrawable under PRO rules

- The PRO+ account starts with a $0 balance

The PRO+ account uses an end-of-day trailing drawdown equal to the original PRO drawdown.

Example: A $50,000 PRO account → PRO+ starts at:

- Balance: $0

- EOD drawdown: -$2,000

As profits accumulate, the minimum balance trails upward until it reaches $0, where it stops.

Important PRO+ payout rules traders must know

- All future trading and withdrawals must be done on the PRO+ account

- The original PRO account can no longer be traded or withdrawn from

- Any PRO profits earned after the upgrade date are not withdrawable

If the PRO+ account is lost:

- Remaining PRO+ profits are withdrawable

- The trader’s share of the frozen $5,000 is paid out

- If PRO+ ends negatively, the loss is deducted from the frozen $5,000

4.3. Payout methods, processing time, and fees

Take Profit Trader supports fast, on-demand payouts through three methods:

Available payout options

- Plaid (U.S. banks only): Instant or ACH transfers

- PayPal: International payouts and some LLC cases

- Wise: International bank transfers and LLC payouts

Only trading and affiliate profits are eligible for withdrawal.

Fees and processing time

- Withdrawals over $250: no fee

- Withdrawals $250 or less: $50 fee

- PayPal may apply additional processing fees

Most payouts are processed within 24 business hours, though delays may occur during reviews or holidays.

See more related articles:

5. Taxes and compliance requirements for Take Profit Trader payouts

Taxes are a separate obligation from payout eligibility. While Take Profit Trader does not withhold taxes, traders must complete the required tax forms before their first withdrawal and handle their own tax reporting based on local regulations:

- U.S. traders: W-9

- International traders: W-8BEN

At year-end, Take Profit Trader provides a summary of your total earnings. You are responsible for handling your own tax filing based on your local regulations.

All payout methods must match the legal identity registered on your Take Profit Trader account. Mismatched details may result in payout delays or rejection due to AML compliance.

Take Profit Trader’s payout system is transparent, but highly structured. Traders who understand buffers, drawdowns, and account transitions are far more likely to receive smooth, consistent payouts without surprises.

6. How to withdraw from the PRO account to the wallet

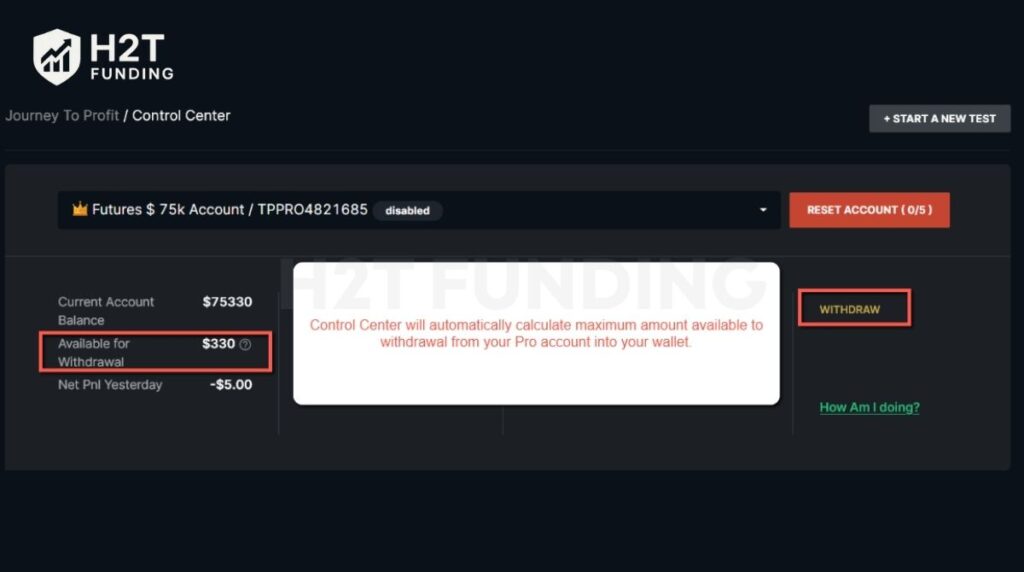

Withdrawing profits from a PRO account is done directly inside the Take Profit Trader dashboard. The Control Center automatically calculates how much you can withdraw based on your buffer status and profit split, so you don’t need to do any manual calculations.

The withdrawal process follows four simple steps:

- Step 1: Log in and select the correct PRO account

- Step 2: Check the amount available for withdrawal

- Step 3: Enter the withdrawal amount and review the payout calculation

- Step 4: Submit the request and wait for processing

Follow the steps below to move profits from your PRO account into your wallet.

6.1. Step 1: Log in and select your PRO account

Start by logging in to your account at takeprofittrader.com. From the dashboard, select the specific PRO account you want to withdraw from.

Make sure the selected account is active and has profits available above the buffer. Only PRO accounts with eligible profits will show a withdrawal option.

6.2. Step 2: Open the Control Center and review available funds

Inside the Control Center, the system automatically displays your Available for Withdrawal amount. This number reflects only the portion of profit that can be withdrawn under current payout rules.

Click the Withdraw button on the right side of the screen to begin the withdrawal request.

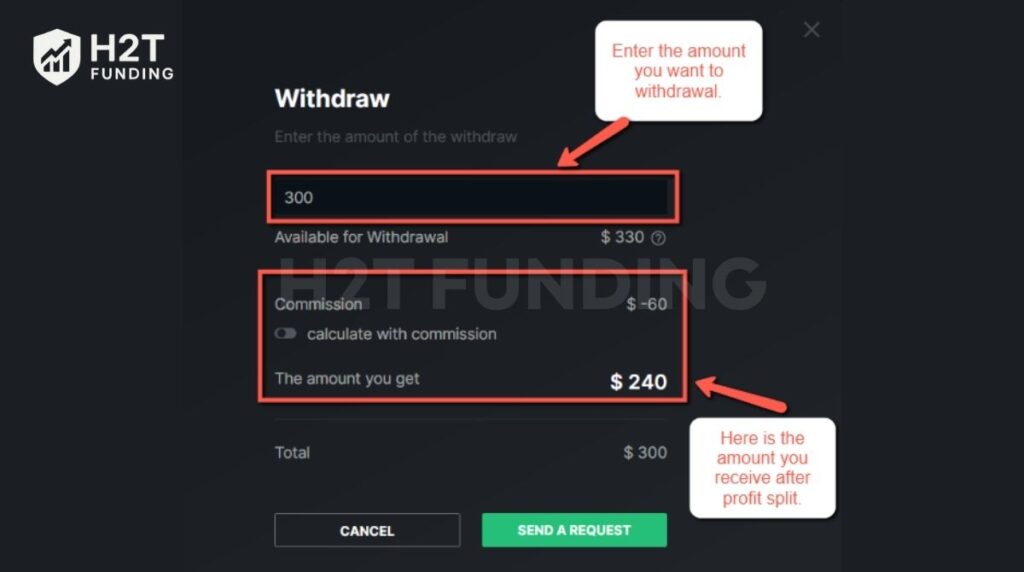

6.3. Step 3: Enter the withdrawal amount and confirm the payout calculation

Enter the amount you want to withdraw in the withdrawal field. The platform will automatically apply the profit split and show the final amount you will receive.

For PRO accounts, the 20% firm share is deducted instantly. The field labeled “The amount you get” shows your net payout after the split.

6.4. Step 4: Submit the request and wait for processing

Once you confirm the amount, click Send a Request. A confirmation message will appear indicating that your withdrawal request is under review.

Most withdrawal requests are processed within 24 business hours. After approval, the funds will appear in your wallet, where you can proceed with the final payout to your bank or payment method.

7. How to withdraw from the wallet

After your withdrawal from the PRO or PRO+ account is approved, the funds are moved into your Take Profit Trader wallet. From there, you must submit a second request to send the money to your bank or payment provider.

The wallet withdrawal process includes the following steps:

- Step 1: Access the wallet from your user dashboard

- Step 2: Submit a withdrawal request from the wallet

- Step 3: Wait for admin approval

- Step 4: Complete the payout through Plaid, Wise, or PayPal

Follow the steps below to complete the final payout from your wallet.

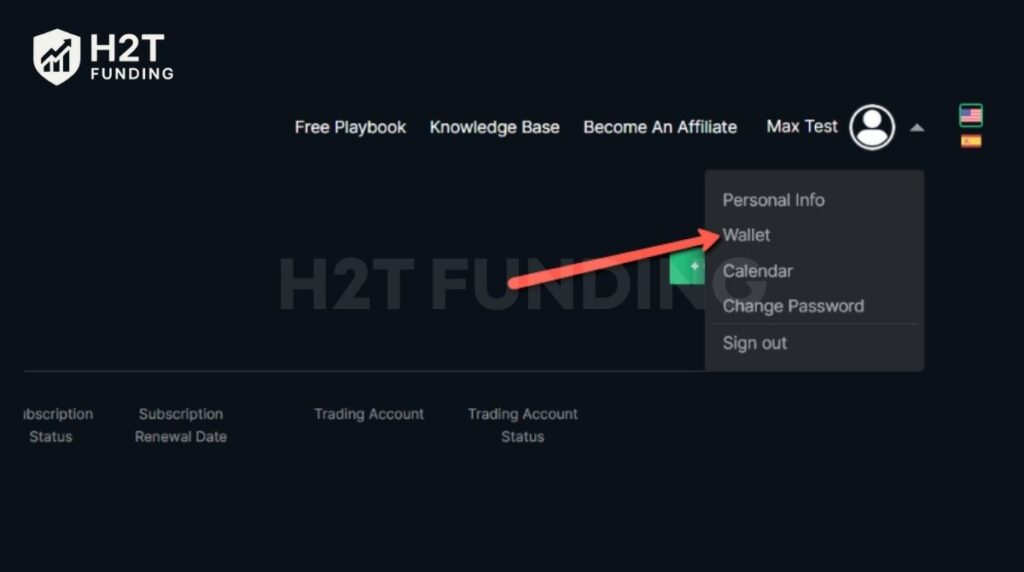

7.1. Step 1: Open the Wallet section from your user menu

Log in to your Take Profit Trader account and click your user icon in the top-right corner. From the dropdown menu, select Wallet to access your available balance.

Your wallet shows the total amount approved for payout and the history of previous transactions.

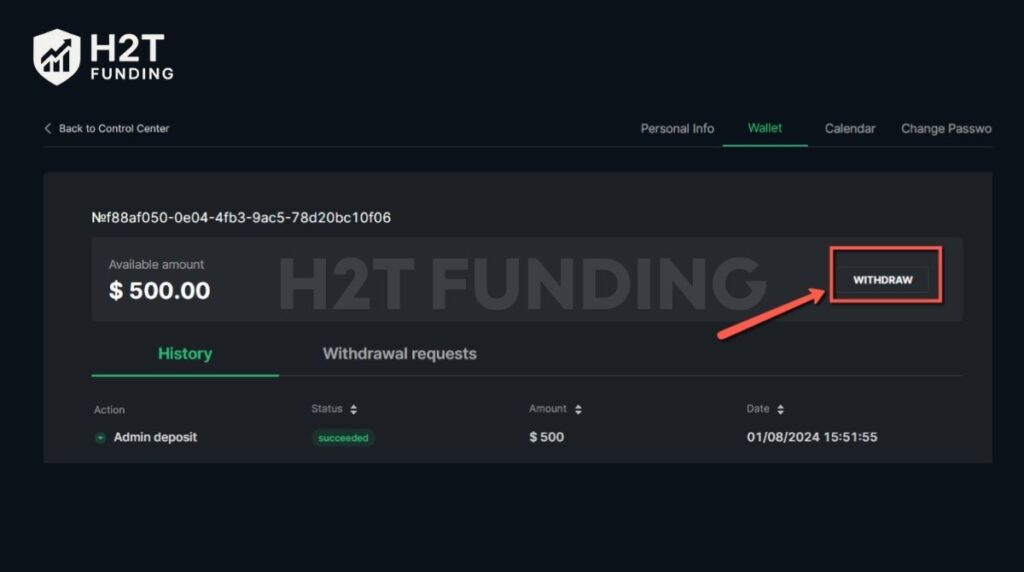

7.2. Step 2: Submit a withdrawal request from the wallet

In the Wallet section, enter the amount you want to withdraw and click the Withdraw button. This sends your payout request to the Take Profit Trader admin team for review.

At this stage, no funds have been sent yet. The request must be approved before you can proceed.

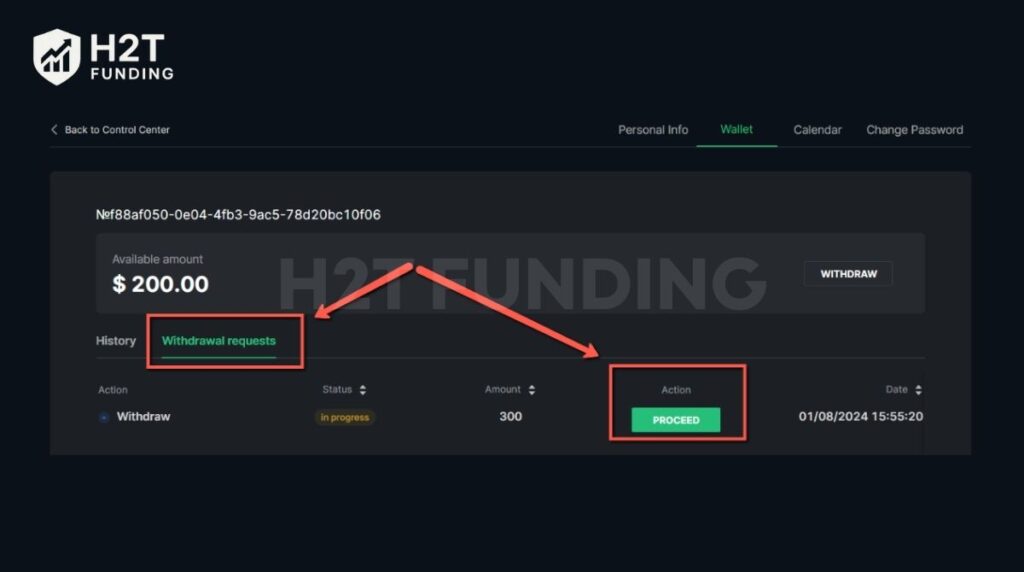

7.3. Step 3: Wait for admin approval and proceed with the payout

Once your request is approved, it will appear under the Withdrawal requests tab with an option to Proceed. Admin approval typically takes up to 12 business hours, but it is often much faster.

Click Proceed to move to the final payout step.

7.4. Step 4: Complete tax verification (first-time withdrawals only)

If this is your first wallet withdrawal, you will be prompted to sign a tax form. The form opens in a pop-up window, so make sure pop-ups are enabled in your browser.

After completing the tax form, click Proceed again to continue.

7.5. Step 5: Choose your payout method and receive funds

You will be asked whether you have a U.S. bank account:

- U.S. bank account: Payouts are processed through Plaid and are often completed in real time, though some banks may take 1–2 business days.

- Non-U.S. bank account: Enter your Wise or PayPal details. These payouts are usually processed within 12 business hours.

Once the payout is completed, you will receive a confirmation email.

The wallet acts as the final checkpoint before funds are sent to you. As long as your account details match and all forms are completed, wallet withdrawals are typically fast and straightforward.

See also:

8. When does a Take Profit Trader refuse to payout? (Mistakes to avoid)

In the prop firm model, a payout is not an automatic right simply because a trader is profitable; it is the result of a comprehensive evaluation process:

Profitability + Risk management + Trading behavior.

With Take Profit Trader, most payout rejections do not stem from traders being unprofitable, but rather from misunderstandings about how the prop firm evaluates trading accounts. Below are the three most common groups of reasons.

8.1. Profitable but not beyond the profit buffer – A systemic mistake

From a financial perspective, the profit buffer is a core capital-protection mechanism of Take Profit Trader. From a trader’s perspective, however, it is the number one reason payouts get rejected.

The profit buffer does not measure how much profit you are making it measures how safe the account is relative to the maximum drawdown. A prop firm only allows payouts when:

Current equity > Drawdown level + A sufficiently large safety buffer

This means:

- A positive balance does not automatically qualify for a payout

- Profit only matters when it has moved out of the capital-risk zone

The financial logic behind this rule:

- Prop firms allocate capital to thousands of traders

- The probability of traders “giving back” profits after a winning streak is statistically high

The profit buffer helps to:

- Reduce the risk of traders withdrawing funds and then immediately violating drawdown rules

- Ensure the account remains viable after a payout

Common trader mistakes:

- Hitting the profit target → requesting a payout immediately

- Failing to recalculate the buffer after previous losing trades

- Focusing on the end-of-day balance instead of real-time equity

👉 Expert insight: Traders are not denied payouts because

8.2. Rule violations traders don’t realize – A perception issue, not a technical one

From a system-analysis perspective, Take Profit Trader does not evaluate payouts based on individual rules in isolation, but on overall trading behavior throughout the entire lifecycle of the account.

Many traders believe:

As long as the account doesn’t blow up, everything is fine.

In reality, a large number of payout requests are rejected due to micro-level rule violations that translate into macro-level risk.

Common violations that traders often fail to notice:

- Hitting the daily drawdown limit during the day

- Intraday equity violations, even if the account is profitable by the end of the day

- Trading during restricted news periods

- Not entering exactly at the news release, yet still trading within the restricted window

Sudden changes in trading behavior

- Abnormally increasing position size

- Overloading positions when approaching the profit target

Why traders don’t realize they violated rules:

- The system does not provide real-time warnings

- Some rules are only reviewed during payout evaluation

- Traders focus on short-term results and ignore the process

👉 Financial insight: Prop firms do not pay traders for winning trades, but for not breaking the risk management system.

8.3. Trading behavior that does not align with prop firm expectations

This is a factor that is not always explicitly stated in the rulebook, yet it has a significant impact on whether a payout is approved.

From a prop firm’s perspective, the key question is not: Is this trader profitable?

But rather, can this trader be funded long-term?

Trading behaviors that raise red flags for prop firms:

- The majority of profit comes from only one or two trades

- Profit concentrated in a single trading day

- Major strategy changes when approaching payout eligibility

- Per-trade risk is significantly higher than the account’s historical behavior

Even without violating any hard rules, these behaviors indicate that:

- The trader is relying on short-term volatility

- Risk control is inconsistent

- The probability of capital loss after payout is high

👉 Analytical insight: A payout is the final test a prop firm uses to determine whether you are a capital manager or merely a target hitter.

9. Take Profit Trader payout Reddit reviews

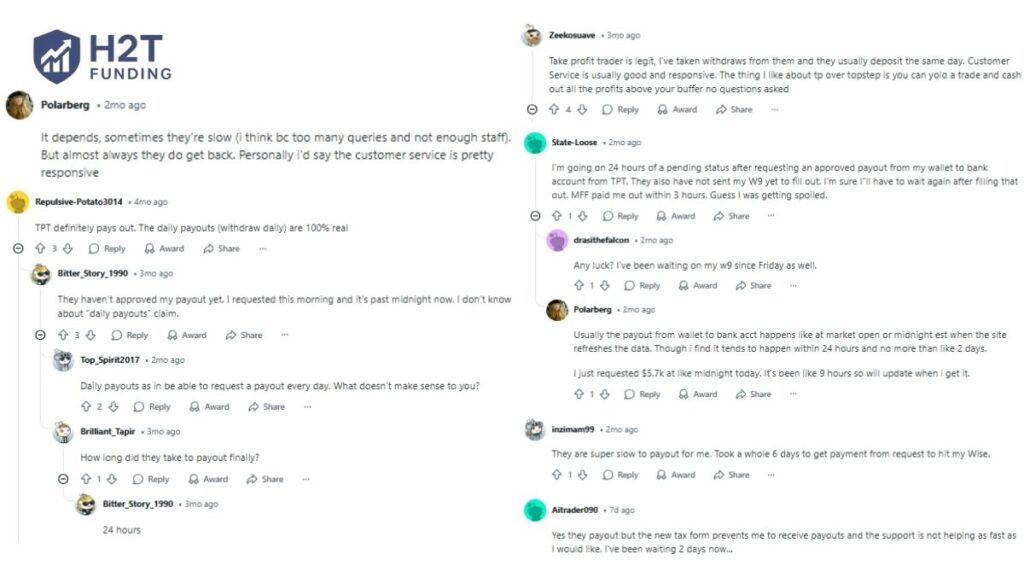

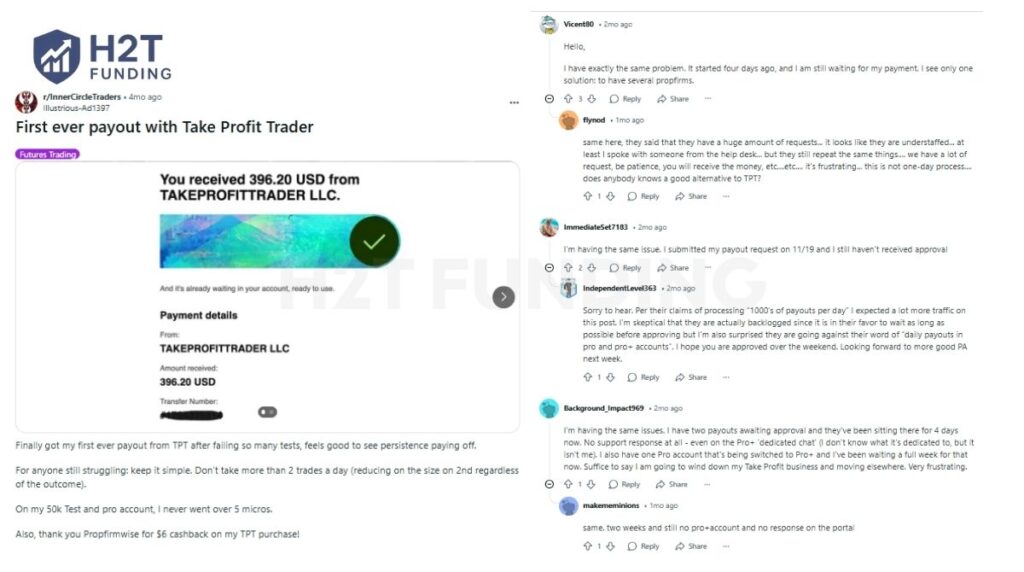

Discussions on Reddit indicate that Take Profit Trader does generate real profits, with many traders sharing screenshots of successful withdrawals from both PRO accounts and wallets. Several users confirm that payouts are often received within the same day or within 24 hours after approval.

At the same time, Reddit threads also highlight occasional delays, especially during periods of high payout volume or when additional verification is required. Some traders report waiting longer for wallet-to-bank transfers, particularly when tax forms or payment methods are not fully set up.

Overall, the sentiment across Reddit is mixed but realistic. Most users agree that payouts are legitimate, while delays are usually related to admin review time, weekends, or compliance checks rather than denied withdrawals.

These community reviews reinforce an important point: understanding Take Profit Trader payout rules and following the correct withdrawal steps significantly reduces payout friction.

10. FAQs

Take Profit Trader pays through Plaid for U.S. bank accounts, and PayPal or Wise for international traders. You can request payouts anytime on business days. Only trading and affiliate profits are eligible for withdrawal.

PRO accounts follow an 80/20 profit split and require you to clear the buffer first. PRO+ accounts offer a 90/10 split with no buffer. You can withdraw on demand, and consistency rules apply only during the evaluation phase.

If your PRO account is closed with a profit, you’ll receive your share of the buffer. For example, with a $2,000 buffer, you’d get $1,600 (80%). No payout is made if the account is closed at a loss.

Yes. You’re responsible for handling your own taxes as an independent trader. Take Profit Trader doesn’t withhold or report your earnings to tax authorities.

Yes, Take Profit Trader is known for reliable and fast payouts. Traders receive funds via Plaid (U.S. only), PayPal, or Wise for international users. As long as your profits meet eligibility criteria, you can withdraw them without unnecessary delays.

The profit split depends on your account type. PRO accounts receive 80% of eligible profits, while PRO+ accounts enjoy a 90% share. These rates apply after clearing the buffer (if applicable) and are calculated automatically during the withdrawal process.

Most PRO-to-wallet withdrawals are processed within 24 business hours, while wallet-to-bank payouts via Plaid, Wise, or PayPal are usually completed within a few hours to 1 business day, depending on verification and payout volume.

Yes, Take Profit Trader allows on-demand daily payout requests on business days, as long as your account has eligible profits and no rule or compliance issues.

An approved payout may still be pending due to wallet processing, bank settlement time, weekends, holidays, or additional compliance checks, especially for first-time withdrawals.

11. Conclusion

Ultimately, the Take Profit Trader payout rules are designed with two distinct paths in mind. The PRO account rewards disciplined, long-term growth, while the PRO+ account is built for traders who prioritize immediate access to their earnings.

The decision comes down to your trading philosophy: are you building for steady growth, or do you require fast, flexible access to your capital? Choose the path that aligns with your strategy, and you’ll be well-positioned for success.

Now that you understand the Take Profit Trader payout rules, the next step is to see how they stack up against other firms or refine your strategies to pass the challenge. Explore our Prop Firm and Trading Strategy sections of H2T Funding for expert-backed content that will guide your next move.

Thanks for sharing! I’m on the second stage of the evals, thinking I can apply some risk management strategies.

Thank you for reading, good luck