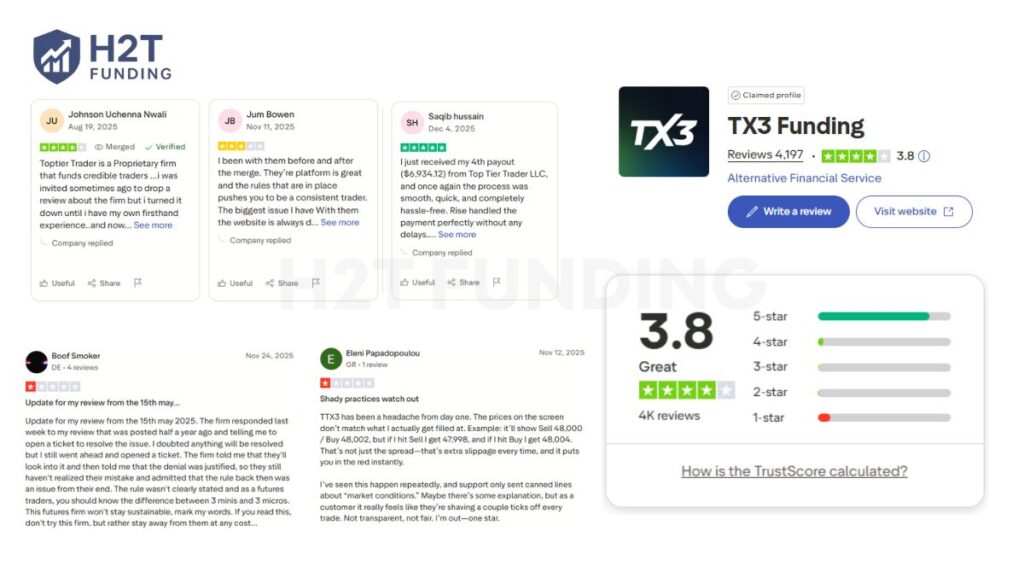

Notification: As part of our ongoing coverage of the prop trading industry, we’d like to highlight a significant update: TopTier Trader officially rebranded to TX3 Funding on 25 September 2025. This rebrand signals a new phase of development for the firm as it restructures its operations with backing from TX3 Markets, a regulated multi-jurisdictional broker that enhances the company’s stability and infrastructure.

What traders should know:

- ✅ The rebrand has no impact on active accounts or ongoing funded programs.

- ✅ All terms, conditions, and challenge stages continue seamlessly under the new TX3 Funding brand.

- ✅ Users are not required to take any action and may continue using the platform as normal.

Overall, the shift to TX3 Funding reflects a strategic step toward a more robust and broker-supported model, while maintaining full continuity for traders who rely on the platform.

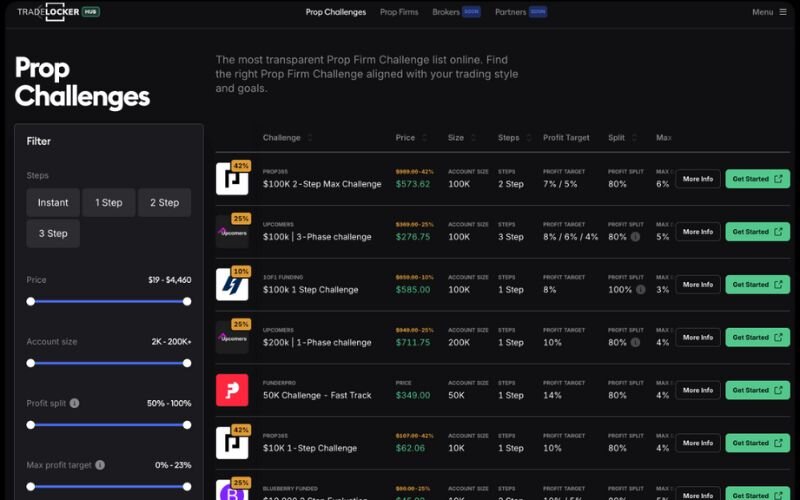

Choosing the right proprietary trading firm can directly shape your long-term profitability and trading discipline. In this TopTier Trader review, we offer not just an analytical breakdown but also real-world insights drawn from trader experiences.

For instance, one user shared on Trustpilot, “I will give it a 3-star cuz I haven’t gotten my email referral point yet, but it’s still a good trading platform” – Kane Bridget.

This mixed yet constructive feedback reflects the broader sentiment among traders: TopTier Trader isn’t perfect, but it provides strong fundamentals, consistent payouts, and a learning-focused environment.

Whether you’re starting out or looking to scale, this TopTier Trader H2T Funding review will help you decide if TopTier is the right partner on your trading journey.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official TX3 Funding websites before purchasing any challenge.

1. Our take on TopTier Trader

TopTier Trader, a proprietary trading firm based in Miami, Florida, offers traders the chance to access funded accounts ranging from $5,000 to $300,000 with profit splits up to 90%. Founded in 2021, it partners with brokers like ThinkMarkets and supports platforms such as TradeLocker.

Key points

- High profit splits: Offers up to 90% profit sharing, competitive in the industry.

- Diverse funding options: Includes two-phase, one-phase, and swing challenges.

- Mixed feedback: Positive Trustpilot ratings (4.0/5), but some concerns about strict rules and payouts.

- Not regulated: Operates as a prop firm, not a broker, which may raise concerns for some traders.

- Strong support: 24/7 customer serviceis praised by many users.

Pros and cons of TopTier Trader

| Pros | Cons |

|---|---|

| Up to 90% profit splits | Strict rules, including hidden lot limits |

| Multiple funding programs (two-phase, one-phase, swing) | Some complaints about payout delays or account terminations |

| Account sizes from $5k to $300k | Not regulated as a broker |

| 24/7 customer support with positive feedback | Potential account deactivation due to inactivity |

| High Trustpilot rating (4.0/5 from 4,100+ reviews) | Mixed feedback on Reddit and other forums |

| TopTier Academy for education, possibly with a free $5k account (verify availability) | |

| Refundable initial challenge fee | |

| 24-hour payout promise with $1,000 guarantee if delayed |

TopTier Trader stands out for its high profit splits, diverse funding programs, and robust customer support, making it an appealing choice for experienced traders. Its partnerships with reputable brokers and educational offerings add value.

However, strict rules, mixed payout feedback, and a lack of regulation require traders to approach with caution. Reviewing terms on the official website and consulting community feedback on Trustpilot and Reddit will help traders make an informed decision. For those comfortable with its rules, TopTier Trader offers significant opportunities to scale trading with funded capital.

2. Funding programs and evaluation rules at TopTier Trader

TopTier Trader offers a variety of funding programs designed to empower traders by providing access to capital without personal financial risk. These programs cater to different trading styles, from fast-paced scalping to swing trading, with account sizes ranging from $5,000 to $300,000 and the potential to scale up to $2,000,000.

Each program includes distinct evaluation processes, profit targets, and risk management rules, ensuring traders can find an option that aligns with their skills and goals.

This TopTier Trader review introduces the structure, requirements, and benefits of each challenge, helping traders choose the best fit for their goals.

| Feature | Flex challenge | Pro challenge | One-phase challenge | Levels program |

|---|---|---|---|---|

| Structure | 2 phases + funded | 2 phases + funded | 1 phase + funded | Milestone-based, no phases |

| Profit targets | 10% (Phase 1), 5% (Phase 2) | 10% (Phase 1), 8% with Hybrid Add-on, 5% (Phase 2) | 10% | Pip-based milestones |

| Min. trading days | 3 days per phase (5 days in Phase 1 due to 2% cap) | 4 days per phase (0 with Add-on) | 3 days | None |

| Max daily drawdown | 5% | 5% | 3% | None |

| Max overall drawdown | 10% | 10% | 6% trailing (locks after 6% growth) | None |

| Profit cap | 2% daily (all stages) | None | None | None |

| News trading | Allowed in challenge; funded requires an Add-on | Allowed with Add-on | Allowed in challenge; funded requires an Add-on | Allowed |

| Weekend holding | Allowed | Allowed with Add-on | Allowed | Allowed |

| Leverage | 1:50 standard (up to 1:100 with Add-on) | 1:50 standard (up to 1:100 with Add-on) | 1:30 standard (up to 1:60 with Add-on) | Varies by instrument |

| Payout structure | First: 10 days; subsequent: every 3 days; min. 2% profit | First: On-demand; subsequent: on-demand; min. 2% profit | First: 14 days; subsequent: every 3 days; min. $100 | Up to $25,000 based on pip milestones |

| Profit split | 80% (90% with Add-on) | 80% (90% with Add-on) | 80% (90% with Add-on) | Up to 95% |

| Consistency rule | None | 40% max from top day (funded only) | 50% max from top day (funded only) | None |

| Max funding cap | $600,000 (no merging) | $600,000 (merging allowed if Add-ons match) | $400,000 (no merging) | $600,000 (scalable to $2M) |

| Reset eligibility | Not available | Available for Tier 1 failures within 24 hours | Not available | Not applicable |

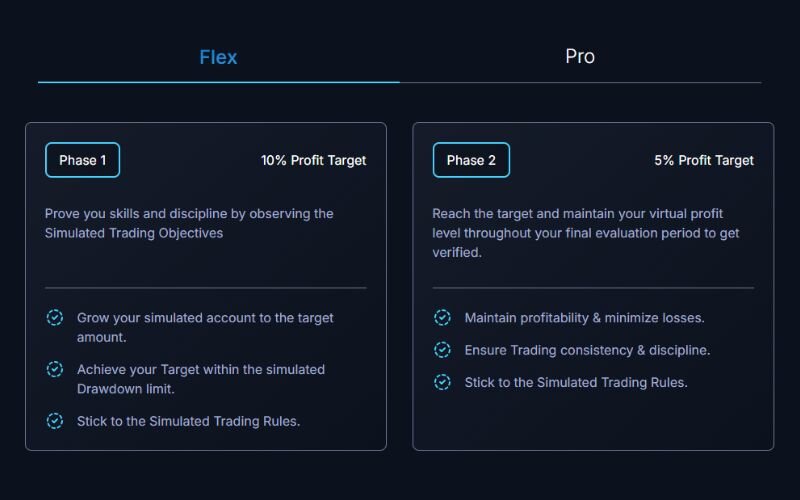

2.1. Two-phase challenge (Flex and pro challenge)

The Two-phase Challenge, also referred to as the Flex or Pro Challenge, is designed to test a trader’s consistency and risk management skills over two distinct evaluation stages. It’s suitable for disciplined traders who value structured progress with clear performance metrics.

Flex challenge:

- Phase 1: Achieve a 10% profit target with a 5% daily drawdown and 10% overall drawdown. A 2% daily profit cap applies, requiring at least 3 trading days (effectively 5 due to the cap).

- Phase 2: Achieve a 5% profit target with the same drawdown limits and profit cap. Minimum 3 trading days.

- Funded stage: No profit targets, maintain 5% daily and 10% overall drawdown. First payout after 10 days, then every 3 days with a 2% minimum.

Pro challenge:

- Phase 1: Achieve a 10% profit target (8% with Hybrid Add-on) with a 5% daily drawdown and 10% overall drawdown (8% with Hybrid Add-on). Minimum 4 trading days (0 with No Minimum Trading Days Add-on).

- Phase 2: Achieve a 5% profit target with the same drawdown limits. Minimum 4 trading days (0 with Add-on).

- Funded stage: No profit targets, maintain drawdown limits. Payouts are on-demand with a 2% minimum, and a 40% consistency rule applies (max profit from a single day cannot exceed 40% of total profits).

Key rules:

- Expert advisors (EAs): Allowed only when the “EAs Allowed” add-on is purchased. Without this add-on, all EA-related activity is strictly prohibited. This includes algorithmic bots, trade mirroring tools, and auto-managed systems.

- Copy trading: Permitted with the corresponding add-on and only when the copied accounts are registered under the same identity. Any form of copy trading across different users or third-party accounts is not allowed.

- Overnight and weekend holding: Fully allowed. Traders can hold open positions overnight and through the weekend on all instruments, though it’s essential to manage the risks associated with market gaps and volatility.

- News trading: Allowed during all stages, including the funded phase, but only if the News Trading add-on is enabled. Without this add-on, traders must avoid placing or closing trades within a 10-minute window around high-impact (red-folder) economic events.

Both challenges allow trading with leverage up to 1:100 (with Double Leverage Add-on) and offer add-ons like 90% profit splits, news trading, and weekend holding for the Pro Challenge. The Flex Challenge is more structured with a profit cap, while the Pro Challenge offers greater payout flexibility.

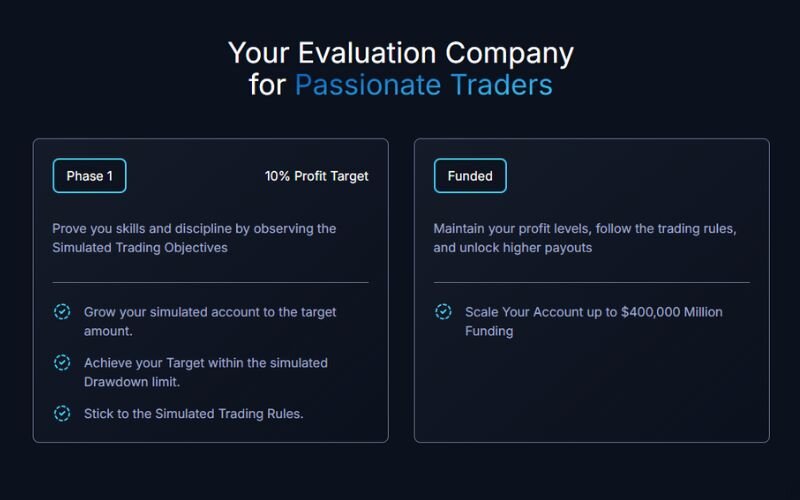

2.2. One-phase challenge

The One-Phase Challenge is a single-step evaluation designed for traders seeking faster funding. Key differences include:

- Single phase: Only one evaluation phase with a 10% profit target, compared to two phases in Flex/Pro Challenges.

- Stricter drawdown: 3% daily and 6% trailing overall drawdown (locks at initial balance after 6% growth) versus 5% daily and 10% overall in two-phase challenges.

- Lower leverage: Standard 1:30 (up to 1:60 with Add-on) versus 1:50 (up to 1:100) in two-phase challenges.

- Smaller account sizes: Caps at $100,000 versus $300,000 for two-phase challenges.

- Payout timing: First payout after 14 days, then every 3 days with a $100 minimum, compared to 10 days or on-demand for two-phase challenges.

Requirements:

- Achieve a 10% profit target.

- Maintain a 3% daily drawdown (e.g., $300 for a $10,000 account) and 6% trailing drawdown (e.g., $600 for a $10,000 account, locking at $10,000 after $600 profit).

- Trade for at least 3 days (consecutive or spread out).

- Adhere to lot size limits (e.g., 1 lot Forex for $5,000 account) and avoid martingale strategies.

Benefits:

- Faster funding with a single evaluation phase.

- 80% to 95% profit split with add-ons like 90% split or news trading.

- Scaling plan identical to two-phase challenges (25% account increase every 3 months).

- No maximum trading day limits, offering flexibility.

Key rules:

- Expert advisors (EAs): Not allowed under any circumstances. The use of automated systems, bots, or EAs is strictly prohibited, regardless of trade performance or risk compliance.

- Copy trading: Not allowed. Any form of mirroring, social trading, or using signals from other accounts is forbidden, even when both accounts belong to the same individual.

- Overnight and weekend holding: Permitted without restriction. Traders are free to hold positions beyond trading sessions or through weekends.

- News trading: Allowed during the challenge phase. In the funded stage, news trading is only permitted if the News Trading add-on is activated. Otherwise, trading is restricted during the 5 minutes before and after major news releases.

The challenge is ideal for disciplined traders confident in meeting tighter risk parameters.

2.3. Levels program

The Levels program is a unique, milestone-based system focused on accumulating pips rather than percentage-based profit targets, offering unparalleled flexibility for traders.

Structure and objectives

- Pip-based progression: Traders advance through levels by banking target pips, with each level unlocking higher payouts (up to $25,000).

- No drawdown limits: Unlike other challenges, there are no maximum daily or overall drawdown limits, reducing pressure on risk management.

- No time limits: Traders can progress at their own pace without minimum or maximum trading day requirements.

- No swap fees or weekend restrictions: Positions can be held over weekends, and no swap fees apply, enhancing flexibility.

Rewards and flexibility

- Payouts: Rewards increase with each level, starting small and scaling to $25,000. Payouts are based on pip milestones, not account balance growth.

- Account sizes: Similar to other challenges, accounts range from $5,000 to $300,000, with a $600,000 total cap across multiple accounts.

- Trading freedom: Traders can use any strategy (except prohibited ones like martingale), including news trading, EAs (with Add-on), and weekend holding.

- Scaling: Accounts can scale up to $2,000,000, with profit splits rising to 95% based on performance.

The Levels program suits traders who prefer a non-traditional evaluation with minimal constraints, focusing on consistent pip gains over time.

3. TopTier Trader payout

TopTier Trader offers a transparent and structured payout system designed to reward traders who meet the firm’s performance and consistency standards. However, to be eligible for a payout, traders must fulfil specific conditions tied to the type of challenge they completed, while strictly adhering to the firm’s trading rules.

To request a payout, traders must meet the following requirements:

- Fulfil the minimum profit and consistency conditions based on their selected challenge type.

- Have no open trades at the time of submitting the request.

- Submit the request directly through their trader dashboard.

- Complete identity verification (KYC) via Sumsub.

When you violate any of the platform’s trading rules, regardless of profitability, you will result in ineligibility for payout.

The payout framework includes:

- Profit sharing: Traders retain 80% of their profits by default, with the opportunity to increase this to 90% through the optional Profit Booster add-on for funded accounts.

- Processing timeline: Withdrawal requests are generally fulfilled within 24 business hours, not including weekends or public holidays.

- Withdrawal frequency: Traders can submit payout requests every 14 calendar days, providing consistent access to earnings.

- Profit Booster add-on: A voluntary feature that enhances the profit split to 90/10 for those on funded accounts.

Each funding challenge has its own payout schedule and minimum profit condition, as outlined below:

| Challenge type | First payout eligibility | Subsequent payout frequency | Minimum profit required |

|---|---|---|---|

| Flex | 10 days after the first trade | Every 3 days thereafter | 2% profit |

| Pro | Anytime after meeting 40% consistency and 2% profit | No fixed interval | 2% profit + consistency rule |

| One-phase | 14 days after the first trade | Every 3 days thereafter | Minimum $100 + consistency rule |

Payout methods

TopTier Trader supports the following payout methods:

- BTC: Available globally

- USDT (ERC-20): Available globally

- Rise: Requires a Rise account registered with the same email as your TopTier Trader account

Once the request is confirmed by the trader and risk checks are completed, payouts are typically processed within 1 business day. Transaction fees are the responsibility of the trader.

Regional restrictions for Rise

As of the latest update, Rise is not supported in the following U.S. regions:

- Iowa (IA)

- Louisiana (LA)

- Minnesota (MN)

- South Carolina (SC)

- Vermont (VT)

- Washington (WA)

- Puerto Rico (PR)

- Guam (GU)

Traders located in these regions may still use BTC or USDT to receive their payouts.

4. TopTier Trader scaling plan

TopTier Trader’s scaling plan helps traders grow their trading capital up to $2 million while keeping risk low. It’s perfect for disciplined traders aiming to boost their earnings without using personal funds.

How it works

- Pass the evaluation: Complete a two-phase challenge with a 10% profit target in Phase 1 and 5% in Phase 2, staying within a 5% daily loss and 10% overall drawdown limit.

- Start trading: Get a funded account from $5,000 to $300,000. You can combine two $300,000 accounts for a $600,000 starting balance.

- Scale up: Every quarter, if you’re profitable and follow risk rules, your account grows by 25%. For example, a $100,000 account becomes $125,000. Your profit split also increases from 80% to 90% (or 95% with add-ons).

Tips to succeed

- Use TradeLocker’s risk tools, like Stop Loss and Take Profit, to manage trades.

- Keep a trading journal to refine your strategy.

- Explore TopTier Academy for free resources to improve your skills.

5. TopTier Trader and trading platforms

TopTier Trader provides a robust trading environment through its partnership with TradeLocker, a next-generation platform designed to enhance the trading experience for proprietary traders.

In early 2024, TopTier Trader fully transitioned from MetaTrader 4 and 5 to TradeLocker, citing its advanced features and stability as key reasons for the switch. This move ensures seamless access for traders, particularly in the U.S., where regulatory restrictions have impacted other platforms.

Why TradeLocker?

- Easy access: Web-based, so you can trade from any device without downloads.

- Powerful tools: Features like one-click trading, a Stop Loss/Take Profit Calculator, and TradingView charts help you trade smarter.

- Versatile trading: Supports forex, commodities, indices, and crypto with micro-lot trading (as low as 0.01 lots).

Benefits for traders

- Smooth experience: Competitive spreads and real-time data through brokers like ThinkMarkets.

- Custom options: Add-ons offer higher leverage (up to 1:100 for forex) or faster payouts.

- 24/7 support: Get help anytime to navigate the platform.

6. TopTier Trader trading instruments

TopTier Trader offers a diverse range of trading instruments, allowing traders to diversify their portfolios across multiple asset classes. Coupled with competitive leverage options, these instruments cater to various trading strategies, from forex scalping to long-term crypto investments.

TopTier Trader offers a wide range of tradable assets, allowing traders to diversify their strategies across major financial markets. With TradeLocker’s advanced tools, you can trade various asset classes efficiently.

Forex Pairs

Access a broad selection of currency pairs for flexible trading:

- Major Pairs: Trade highly liquid pairs like EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD, which dominate global forex markets due to their tight spreads and high volume.

- Minor Pairs: Explore cross-currency pairs such as EUR/GBP, EUR/JPY, and GBP/JPY for additional opportunities in active but less mainstream markets.

Indices

Trade major global stock indices to gain exposure to entire market sectors with a single trade. Popular indices include the S&P 500, NASDAQ, and FTSE 100, offering opportunities to capitalise on broad market trends.

Metals

Focus on precious metals for portfolio diversification:

- Gold (XAU/USD): A safe-haven asset, ideal for hedging against market volatility.

- Silver (XAG/USD): Offers high volatility for short-term trading opportunities.

Commodities

Trade key commodity markets to benefit from global supply and demand:

- Energy: Includes crude oil and natural gas, driven by geopolitical and economic factors.

- Agricultural: Access markets like corn and soybeans for additional diversification.

Cryptocurrencies

Tap into the fast-moving crypto market with major digital currencies like Bitcoin and Ethereum. These assets offer high volatility, creating opportunities for traders seeking short-term gains.

TopTier Trader’s diverse assets and TradeLocker’s platform let traders build flexible strategies across forex, indices, metals, commodities, and cryptocurrencies. With leverage up to 1:100 for forex and competitive spreads, you can maximise opportunities while managing risk.

7. TopTier Trader pricing fees and commissions

Understanding the cost structure is essential before committing to any proprietary trading firm. TopTier Trader’s model is transparent in its pricing, but traders must still evaluate whether the firm’s fees align with their trading frequency, strategy, and profitability targets.

7.1. Evaluation fees

Before traders can access funded accounts, they must pass a challenge phase. This requires paying a one-time evaluation fee based on the chosen account size and challenge type. TopTier Trader offers both 1-phase and 2-phase challenges, each with its own pricing tier.

| Account Size | 2-Phase Challenge Fee (Flex) | 2-Phase Challenge Fee (Pro) | 1-Phase Challenge Fee |

|---|---|---|---|

| $5,000 | $49 | $65 | $59 |

| $10,000 | $79 | $129 | $99 |

| $25,000 | $149 | $229 | $189 |

| $50,000 | $249 | $335 | $289 |

| $100,000 | $399 | $549 | $479 |

| $200,000 | $749 | $1,099 | $949 |

| $300,000 | $1,199 | $1,649 | N/A |

Important note:

- The evaluation fee is non-refundable if you fail the challenge.

- However, it is refunded with your first payout after passing the challenge and generating profits on your funded account.

- No recurring subscription fees are required after funding.

This structure ensures traders are only financially committed during the evaluation phase and incentivised to trade responsibly.

7.2. Trading commissions and spreads

TopTier Trader partners with reputable brokers and liquidity providers, which allows them to offer competitive trading conditions. However, understanding how spreads and commissions are structured is critical, as they directly affect profitability, especially for high-frequency or scalping strategies.

Trading commissions

| Asset Class | Commission (Round-Turn) |

|---|---|

| Forex | $7 per lot |

| Metals | $7 per lot |

| Cryptocurrencies | $7 per lot |

| Indices | $0 (Commission-free) |

| Commodities | $0 (Commission-free) |

- Commissions apply to both the evaluation and funded stages.

- The $7 round-turn commission (equivalent to $3.5 per side) is in line with industry standards but can add up for volume traders.

Spreads

- Spreads are variable and not fixed.

- They depend on market volatility, liquidity, and the underlying broker infrastructure.

- Typical spreads on major currency pairs during normal market conditions are competitive.

- However, spreads may widen significantly during economic news releases or low-liquidity sessions.

TopTier Trader does not charge any additional platform or data fees, and there are no inactivity charges, making it more cost-effective for part-time or discretionary traders.

8. Education and resources

TopTier Trader places strong emphasis on trader development by offering a combination of structured educational content, analytical tools, and community engagement. These resources are designed to support both beginners and experienced traders at different stages of their trading journey.

8.1. TopTier Trader Academy

TopTier Trader Academy is the firm’s in-house education platform, designed to help traders build foundational knowledge and sharpen advanced skills. It’s completely free to access, and all content is structured to guide traders from the basics to more complex strategies.

What the academy offers:

- Beginner-friendly trading fundamentals: Covers how the forex market works, key terms, major/minor currency pairs, and how to read price charts.

- Technical analysis and indicators: Introduces traders to candlestick patterns, support/resistance zones, trendlines, moving averages, RSI, MACD, and other tools commonly used to identify trade opportunities.

- Trading psychology and risk management: Teaches how to maintain discipline, manage losses, and avoid emotionally driven trades. The focus is on long-term sustainability rather than high-risk, short-term wins.

- Live market sessions and webinars: Held periodically to help traders understand real-time setups, entry/exit decisions, and market reactions to news.

- Strategy development: Guides traders in building a structured, personalised trading plan with risk parameters, journaling habits, and performance review routines.

This academy is particularly valuable because it mimics institutional trader training. Whether you’re just starting or have years of experience, the structured progression and emphasis on mindset can help refine your edge.

8.2. Additional support tools

TopTier Trader supplements its educational content with tools designed to enhance decision-making and performance tracking.

- Trader dashboard: An interactive platform that tracks your challenge progress, including profit targets, drawdown limits, number of trading days, and pass/fail status.

- Performance analytics: Visual charts showing trade-by-trade outcomes, win rate, average risk-to-reward ratio, and other key metrics. This data helps traders identify patterns and adjust strategies accordingly.

- Risk calculators: Built-in tools to calculate position size based on stop loss and account balance, ensuring proper risk management before placing a trade.

- TradeLocker integration: The platform used by TopTier Trader features TradingView charting tools, one-click order execution, SL/TP setting assistance, and micro-lot trading for more flexible risk control.

- Daily equity tracking: Automated tools that show your real-time equity and daily drawdown in relation to the firm’s limits, reducing the chance of unintentionally violating rules.

These resources are especially helpful during the evaluation phase, where small missteps can result in disqualification. Having access to real-time analytics helps traders stay aligned with rules and objectives.

8.3. Community engagement via Discord

Education doesn’t stop at courses and dashboards; trader communities can play a vital role in growth, offering live feedback, accountability, and diverse perspectives. TopTier Trader actively nurtures its trader base through an open Discord community.

- Active member base: With over 44,000 traders from around the world, the Discord server offers 24/7 activity across various channels.

- Mentorship and peer support: New traders can ask questions and get feedback from more experienced participants. Many seasoned traders post trade setups, breakdowns, and tips daily.

- Challenge-specific channels: Traders participating in the same evaluation challenges often form accountability groups or discuss strategies relevant to that particular stage.

- Live updates and announcements: All major news, from platform upgrades to upcoming competitions, is communicated directly through the Discord server, keeping traders informed in real time.

- Webinars and AMAs (Ask Me Anything): Occasionally hosted by the TopTier team or guest educators to answer questions, review market trends, or deep-dive into trading topics.

Being part of this community provides not only technical guidance but also psychological support, which is often overlooked but essential in maintaining discipline during stressful trading periods.

9. Toptier Trader Trustpilot rating – Trader feedback and reputation

TopTier Trader has garnered considerable attention within the prop trading community. In this section, we analyse user sentiment through Trustpilot and Reddit reviews, summarise ratings, and highlight both positives and negatives.

| Metric | Score / Sentiment |

|---|---|

| Trustpilot score | 4.0 / 5.0 |

| Positive reviews | ~85% (5-star), ~5% (4-star) |

| Negative reviews | Focus on KYC, rule changes, and tech issues |

| Reddit sentiment | Mixed with strong critiques from scalpers |

TopTier Trader holds a solid 4.0/5 rating on Trustpilot, based on over 4,100 reviews. Positive feedback centres on:

- Responsive customer support: Many traders report swift, helpful replies, with specific praise for staff members.

- Transparent pricing and program structure: Users appreciate clear challenge rules and fee refund policies.

“Samuel was great help, quick answers and very detailed. Made the entire process easy. 5 star service!” – Vincent Delucia, Trustpilot

“I’ve been trading with this prop firm for over a year. I’ve lost funded accounts, I’ve earned funded accounts. I have even received a payout. Whenever I have an issue, it is solved in a professional and timely manner. I’ve had good experiences and I pray the success of this company continues so that TTT can continue to bless and empower traders like myself that have little to no capital.” – Sanquisha Nelson, Trustpilot

However, negative reviews often cite:

- KYC verification issues: Several users claim that minor document mismatches led to challenge rejections or delayed refunds.

- Rule changes and disclosures: Some traders feel restrictions like lot size caps and slippage limits were not communicated clearly or introduced abruptly.

- Technical concerns: Complaints include server outages or abnormal price movements not seen on other platforms.

“By updating the affiliate dashboard, you are putting the responsibility of collecting new affiliate members on us. If I collect affiliate members, is there any guarantee that you will not ask me to search again in the name of updating the affiliate dashboard? I had more than 200 affiliate members, your affiliate cheated me.” – MD. TIPU SULTAN, Trustpilot

10. Customer support

TopTier Trader positions itself as a service-driven firm with fast response times, multiple contact channels, and a visible community presence. But how does it hold up under real trader scrutiny?

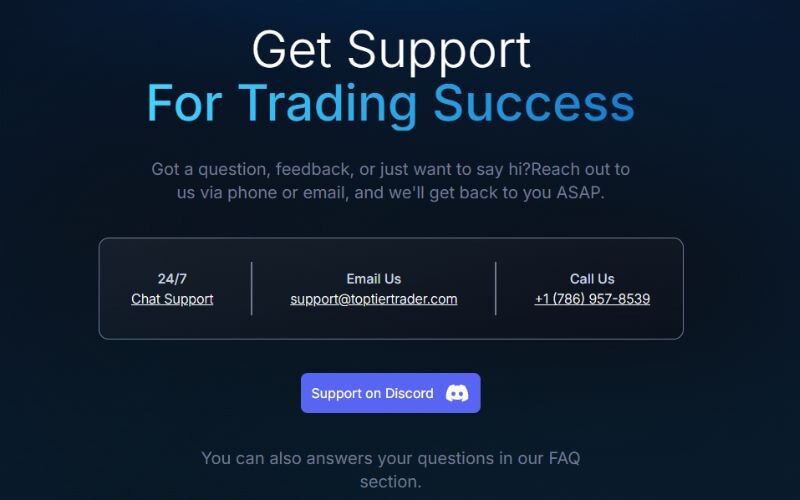

10.1. Support channels

TopTier Trader offers a variety of support options to ensure traders can reach out conveniently and receive timely assistance.

Available contact methods:

- Live chat: Accessible via the official website during business hours. Most users report wait times of under 5 minutes.

- Email support: Suitable for more complex inquiries, especially those involving documentation, account issues, or appeals.

- Discord: Active support presence with moderators and team members responding to questions in real time.

- Help centre: A searchable knowledge base with guides, FAQs, and rule explanations, designed to reduce the need for direct contact.

This multi-channel structure is especially beneficial for global traders operating in different time zones.

10.2. Support quality

While TopTier Trader does not guarantee 24/7 live human support via all channels, traders report round-the-clock coverage on Discord and automated assistance via chatbot systems outside regular business hours.

Key observations:

- Live chat is primarily active during North American trading hours.

- Discord community moderation ensures real-time engagement even during weekends or after hours.

- Email response is typically within 12–24 hours, with faster turnaround for account-related queries.

For traders operating in volatile markets or across time zones, this semi-24/7 approach provides a flexible support experience.

11. Getting started with TopTier Trader

Joining a prop firm like TopTier Trader requires more than just signing up; traders need to understand the process, prepare for evaluations, and comply with identity verification. This section provides a clear breakdown of the steps to register, start a challenge, and complete the KYC (Know Your Customer) process.

11.1. Steps to register and start a challenge

Getting started with TopTier Trader is a streamlined process. Traders can begin their evaluation in just a few steps:

Step-by-step onboarding:

- Create an account: Visit the official TopTier Trader website and sign up using a valid email address. A verification link will be sent to confirm registration.

- Select your challenge type: Choose between a 1-phase or 2-phase evaluation model. Each option has different rules and price points based on account size (e.g., $5K, $25K, $100K, etc.).

- Choose account parameters: Select your trading platform (TradeLocker), preferred leverage (typically up to 1:100), and product types (Forex, indices, metals, crypto).

- Pay the evaluation fee: Complete payment using credit/debit card, cryptocurrency, or other available methods. The fee is a one-time cost and becomes refundable upon your first successful payout.

- Receive challenge credentials: Within minutes after payment, login credentials for the evaluation account are sent via email.

- Start trading: Begin your evaluation, following the rules for profit targets, drawdown limits, and minimum trading days. Real-time dashboards track your progress.

This onboarding is fast, usually completed within 10–15 minutes. The platform is built to accommodate both beginners and seasoned traders.

11.2. KYC requirements and verification

KYC (Know Your Customer) is a standard compliance procedure that verifies the identity of each trader before they receive access to a funded account or payouts. TopTier Trader enforces this after passing the evaluation.

Required documents:

- Government-issued photo ID: Acceptable documents include a passport, national ID, or driver’s license. It must be clear, valid, and match the name on your registration.

- Proof of address: Documents such as a utility bill, bank statement, or lease agreement are accepted. Must be dated within the last 90 days and show full name and address.

- Selfie verification (if requested): Occasionally, traders may be asked to provide a selfie holding their ID to confirm legitimacy.

Tip for smoother KYC: Use the same name and email address across all platforms: registration, payment, and document submission. Even small inconsistencies (e.g., using a nickname) can trigger delays.

12. FAQs

Yes, TopTier Trader does payout. Traders can request their first payout 10 calendar days after starting a funded account, with subsequent payouts available every two weeks. The firm offers up to 90% profit split, and many users have shared verified payout proofs online.

TopTier Trader operates on the TradeLocker platform, which is integrated with Tier-1 liquidity providers. While it doesn’t directly disclose its brokerage partner by name, the execution quality and spreads suggest institutional-grade access.

TopTier Trader is headquartered in the United States, with business operations and support teams located across various regions. Despite being U.S.-based, it accepts traders globally, excluding regions with regulatory restrictions.

TopTier Trader applies a soft daily drawdown limit of 5%, calculated based on the account’s starting balance each day. This means a trader cannot lose more than 5% in equity within a 24-hour period, regardless of open positions.

No, TopTier Trader is not a regulated brokerage firm in the USA. As a proprietary trading firm, it operates under a different legal structure that doesn’t require CFTC or SEC regulation, since it provides simulated accounts and funds to traders internally.

Yes, through periodic promotions and competitions, TopTier Trader sometimes offers a free $5K account. These are typically tied to educational participation, social engagement, or as rewards for active community members.

TopTier Trader hosts trading competitions on a rolling basis, offering prizes such as free challenge accounts, funded account upgrades, and cash rewards. Rules vary by event, but most contests emphasise profitability, drawdown control, and consistency.

Yes, TopTier Trader allows news trading during the challenge phase, but restrictions apply in the funded phase for regular and swing accounts unless using the plus model or news add-on.

Yes, TopTier Trader is legitimate, with a 4.5 rating on Trustpilot, verified contact info, and a solid reputation since 2021.

13. Conclusion

This TopTier Trader H2T Funding review has provided a comprehensive breakdown of the firm’s strengths and limitations. TopTier Trader review stands out for its trader-centric model, offering in-depth educational support, a vibrant Discord community, and a straightforward evaluation process.

That said, the firm is not without its criticisms. Still, for traders who value structured growth, transparent funding rules, and access to real support systems, TopTier Trader remains a strong contender in the proprietary trading space.

We recommend TopTier Trader for:

- Intermediate to advanced traders seeking professional-level evaluation and community support.

- Beginners who want access to structured education and mentorship without upfront capital risk.

- Traders who prioritise payout reliability and detailed performance analytics.

If you’re comparing prop firms or still exploring your options, be sure to check out more in-depth guides and unbiased evaluations from H2T Funding in our Prop Firm Reviews categories. We break down funding rules, payout systems, scaling plans, and trader experiences, so you can make the most informed choice.