With over 9,000 verified reviews and a reputation built across more than a decade, Topstep stands out as one of the most established names in proprietary Topstep futures trading.

In this Topstep review, I provide a detailed breakdown of the firm’s evaluation structure, payout policy, scaling plan, and trader experiences, backed by real data, platform insights, and community feedback.

Whether you’re a new trader seeking structure or a seasoned pro looking for payout flexibility, this review will help you determine if Topstep is the best prop firm for your futures trading journey.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Topstep websites before purchasing any challenge.

1. Our take on Topstep Funded Accounts

Topstep stands out as one of the most reputable proprietary trading firms in the futures market, offering a structured and risk-free pathway for traders to prove their skills and earn funding.

Established in 2012 and headquartered in the United States, the firm has become a preferred choice for futures traders seeking capital without putting their own money at risk.

At the heart of Topstep’s model is the Trading Combine, a simulated trading environment designed to assess a trader’s consistency, discipline, and risk management. Successful participants can move through a clearly defined three-step process:

- Step 1: Trading Combine (simulated)

- Step 2: Express Funded Account

- Step 3: Live Funded Account

Traders can choose account sizes of $50K, $100K, or $150K, with profit targets from $3,000 to $9,000. The profit split is generous, 100% on your first $10K, then 90% after that.

Topstep also invests in trader development through:

- Performance coaching

- TopstepTV live sessions

- A supportive trader community

The firm enforces strict risk rules (2% daily loss, 4% trailing drawdown) and charges monthly fees from $149. This makes it ideal for disciplined traders who value structure, accountability, and professional growth.

Pros and cons of Topstep

| ✅ Pros | ❌ Cons |

|---|---|

| Structured evaluation + risk-free learning: The Trading Combine simulates live conditions and rewards disciplined risk management without risking personal capital. | Monthly subscription fees: Costs range from $49 to $149 per month (plus a $149 activation fee). Some users say this adds up quickly. |

| Educational support + community: Offers extensive coaching, webinars, and active trader communities (Discord, TopstepTV). | Strict drawdown limitations: Daily and trailing loss limits (2–4%) are tight; trader consensus says there’s little room for error. |

| Generous profit split: Traders keep 100% of their first $10K, then enjoy a 90/10 split. | Platform lock-in: Must stick with the platform chosen during evaluation (no switching without re-qualifying). |

| Quick payouts: Fast payout processing once eligibility requirements are met, $125 minimum withdrawal, payouts available after 5 profitable days. | Platform issues: Some users report occasional technical glitches, especially after Topstep dropped phone support. |

| Legitimate and reputable: Multiple Reddit stories confirm that “Topstep is legit, I passed multiple challenges and got paid.” | Cost vs. DIY trading: Some traders argue: if you’re already profitable, it might be cheaper to trade personal capital than pay monthly fees. |

Topstep earns high marks for transparency, community support, and real-world payouts. The clear rules and robust educational resources are ideal for disciplined traders.

However, the strict risk parameters and monthly fees may feel limiting for experienced traders with existing capital. Overall, Topstep is best suited for disciplined, growth-oriented futures traders who value structure, accountability, and long-term potential over short-term freedom.

2. Topstep funded accounts and key trading rules

Topstep offers a structured three-phase program to help futures traders secure funding without risking personal capital. This progression is designed to evaluate trading discipline, consistency, and risk management, core qualities of long-term success.

2.1. Trading Combine

This is the evaluation phase conducted in a simulated environment. Traders choose from account sizes of $50,000, $100,000, or $150,000, each with a corresponding monthly fee. The objective is to hit a 6% profit target without violating key rules.

For example, a $50K account requires $3,000 in net profit to pass. There is no time limit, but traders must complete a minimum of two trading days to ensure results aren’t based on luck.

If the Maximum Trailing Drawdown (MTD) is breached, the evaluation ends. However, traders can reset the Combine at any time by paying the monthly fee again; there’s no limit on the number of resets.

2.2. Express Funded Account (XFA)

After passing the Combine, traders can activate the Express Funded Account by paying a $149 one-time fee. This stage simulates a funded account with real payout eligibility.

To withdraw profits, a trader must achieve at least five trading days with daily gains of over $200. Withdrawals are capped at 50% of the account balance or $5,000, whichever is lower. Traders can hold up to five XFA accounts at once, and no monthly subscription applies.

2.3. Live Funded Account

Upon consistent success in the XFA, traders are promoted to a Live Funded Account backed by actual capital. This phase involves market data fees, starting from $133 per exchange, or up to $540/month for full CME access.

The profit split remains trader-friendly: 100% on the first $10,000, then 90%. After 30 trading days with $200+ in daily profits, traders qualify for daily 100% payouts. However, once a payout is taken, the account’s Maximum Loss Limit (MLL) resets to zero, and any future loss beyond the remaining balance results in account closure.

Key trading rules (Apply mainly to the Combine and XFA stages)

- Profit target: 6% of starting balance ($3K on $50K, $6K on $100K, $9K on $150K).

- Daily loss limit (DLL): Capped at 2% of starting balance. Hitting this limit halts trading for the day but doesn’t end the evaluation.

- MTD: Calculated on the end-of-day high balance, not intraday peaks, offering more flexibility during volatility.

- Consistency rule: No single day may contribute more than 50% of total profits during the Combine.

- Minimum trading days: At least 2 active days required to complete the Combine.

- Position limits:

- $50K account: 5 micro contracts max

- $100K account: 10 micro contracts

- $150K account: 15 micro contracts

- No overnight or weekend holding: All positions must be closed by market close.

- News event rule: Only directional trades are allowed; hedging positions during news releases are prohibited.

Resets: Available anytime at the same monthly cost; only necessary when the trailing drawdown is violated.

Topstep combines the account structure

| Account Size | Monthly Fee | Profit Target (6%) | Max Trailing Drawdown | Daily Loss Limit (2%) | Max Contracts |

|---|---|---|---|---|---|

| $50,000 | $49 | $3,000 | $2,000 | $1,000 | 5 micro contracts |

| $100,000 | $99 | $6,000 | $3,000 | $2,000 | 10 micro contracts |

| $150,000 | $149 | $9,000 | $4,500 | $3,000 | 15 micro contracts |

Verdict on Topstep-funded accounts and trading rules

Topstep’s multi-step process is well-suited for traders serious about long-term success. Rather than offering quick access to capital, it prioritizes accountability and skill-building.

The rules are strict but transparent, designed to filter out gamblers and reward consistent performance. With a generous payout structure and trusted clearing partners, Topstep remains one of the most reputable futures prop firms in the industry.

3. Topstep commission fees and pricing

Topstep applies a tiered pricing structure depending on the stage you’re at in the evaluation process. Unlike most prop firms focused on forex or CFDs, Topstep operates exclusively in the futures market, meaning no spreads, but per-trade commissions, clearing fees, and platform charges do apply.

To help you understand, here’s a breakdown of costs at each stage of your Topstep journey:

3.1. Stage 1: Trading Combine

This is the initial evaluation phase, and you’ll pay a monthly fee based on your chosen account size:

| Account size | Monthly fee | Profit target | Max trailing drawdown | Daily loss limit |

|---|---|---|---|---|

| $50,000 | $49 | $3,000 | $2,000 | $1,000 |

| $100,000 | $99 | $6,000 | $3,000 | $2,000 |

| $150,000 | $149 | $9,000 | $4,500 | $3,000 |

Other costs during Combine:

- Per-trade fees include commission, clearing, and exchange charges.

- Platform fees depend on the software you choose.

- Reset fees (if you break the rules):

- $49 for $50 account

- $99 for $100 account

- $149 for $150 account

Note: Combined fees are recurring each month until you pass. Choose a cost-effective platform to minimize expenses.

3.2. Stage 2: Express funded account

Once you pass the Combine, you move to the Express Funded stage. Here, your trades are still simulated but you’re one step closer to real funding.

Fees include:

- One-time activation fee: $149

- Per-trade fees: Same as in the Combine

- Platform subscription: Optional, depending on your chosen platform

No monthly challenge fee at this stage, but you must still cover trade execution and platform-related costs.

3.3. Stage 3: Live funded account

In this final stage, you’re trading with real capital and can earn real payouts.

Ongoing fees include:

- Exchange data fees: Around $135/month per exchange (CME, NYMEX, etc.)

- Optional platform fees: Varies based on provider (NinjaTrader, ATAS, etc.)

- Level 2 Market Data: Additional $39/month (optional)

Tip: Beginners can save money by trading only one exchange (e.g., CME) and choosing free platforms like Tradovate or TradingView.

Platform comparison snapshot:

| Platform | Commission | Platform Fee | Notes |

|---|---|---|---|

| TopstepX | $0 | $0 | Most cost-effective; limited tools |

| Tradovate/TradingView | $1.18 | $0 | Free to use, user-friendly |

| NinjaTrader/ATAS | $1.06 | Varies | Advanced features; Rithmic data |

| T4 | $1.00 | $1.00 | The highest all-in trading cost |

Switching platforms mid-stage is limited. You can only switch within the same data feed provider (Rithmic <-> Rithmic, CQG <-> CQG). Switching between Rithmic and CQG requires starting a new Combine from scratch.

Verdict on Topstep’s Fees and Pricing

Topstep’s pricing is more layered than most prop firms, but it offers a realistic cost structure that mirrors live futures trading. By simulating real commission and exchange fees during evaluation, traders are better prepared for what to expect in live markets.

New traders can control costs by:

- Choosing a smaller account size to start.

- Using free platforms like TopstepX or TradingView.

- Limiting the number of exchanges accessed in the funded stage.

For those willing to accept a steeper learning curve and upfront cost, Topstep offers a highly professional environment with transparent pricing, ideal for those looking to build serious futures trading skills.

4. Payout structure and funded accounts

Topstep is known for offering one of the most trader-friendly payout systems in the industry. Their structure is designed to reward consistent performance while encouraging disciplined risk management throughout both the Express Funded Account and the Live Funded Account phases.

Express Funded Account

Once traders complete the Trading Combine, Express Funded Account (XFA), a simulated trading stage with real payout eligibility. Payout eligibility begins after the trader records five non-consecutive winning days, each defined as a day where the net P&L is $200 or more.

- Payout amount: Up to 50% of the account balance, capped at $5,000 per request.

- Payout frequency: A minimum of five additional winning days is required between each payout.

- Minimum payout request: $125.

This structure allows traders to steadily extract profits while continuing to prove their consistency before advancing to the Live Funded stage.

Live Funded Account

In the Live Funded Account, traders gain access to more flexible and rewarding payout options. The basic eligibility remains the same: five non-consecutive winning days of $200+ net profit are required for each withdrawal.

- Payout amount: Up to 50% of the account balance per request.

- Payouts are subject to risk limits and account drawdown rules, with higher flexibility unlocked after meeting long-term performance milestones.

- Minimum payout request: $125.

However, the real benefit of Topstep’s system emerges once a trader achieves 30 total winning days (across both the Express and Live Funded Accounts). At this milestone, traders unlock daily payouts of up to 100% of their account balance.

Important note: Withdrawing the full account balance effectively triggers the maximum loss limit, resulting in account termination, as the drawdown limit would be triggered. This option is best for those planning to exit or reset their trading journey.

Summary table of payout eligibility

| Account type | Winning days required | Payout frequency | Max payout per request |

|---|---|---|---|

| Express Funded Account | 5 non-consecutive days | After every 5 winning days | Up to $5,000 or 50% of the balance |

| Live Funded Account | 5 non-consecutive days | After every 5 winning days | Up to 50% of the balance |

| Live Funded (after 30 winning days) | 30 total winning days across both accounts | Daily | Up to 100% of the balance |

Additional scenarios

- Voluntary closure: If a trader decides to close their Express or Live Funded Account, they may request a final payout (up to 100% if eligible), after which the account will be terminated.

- Called up to live account: Traders transitioning from Express to Live may receive a payout, even if they haven’t completed another 5-day cycle, up to $5,000 or 50%, whichever is lower.

5. Topstep scaling plan

Topstep Scaling Plan is a structured system designed to promote disciplined trading and sustainable account growth by adjusting traders’ maximum position sizes based on their account performance.

Applied in both the Express Funded Account and Live Funded Account, this plan ensures traders scale their trading capacity responsibly, preventing over-leveraging during volatile market conditions.

By evaluating end-of-day account equity, the Scaling Plan sets clear position size limits for the next trading session, encouraging consistency and risk management. Below is a detailed overview of how the Scaling Plan operates across different account sizes.

Scaling plan structure

- Purpose: Limits the number of contracts traders can hold based on their account balance, fostering gradual growth and protecting against impulsive trading.

- Evaluation timing: Position size adjustments are calculated at the end of each trading day (after 5 PM CT) and applied to the next session. Intraday scaling changes are not permitted, ensuring stability during active trading.

- Monitoring tools: Topstep’s trading platforms, such as TopstepX, provide real-time indicators to help traders track their current position limits and account status.

Account-specific scaling details

Each account bracket features distinct balance thresholds and corresponding maximum positions:

| Account type | Equity range | Max contracts |

|---|---|---|

| $50K | < $1,500 | 2 contracts |

| $1,500 – $2,000 | 3 contracts | |

| > $2,000 | 5 contracts | |

| $100K | $1,500 – $2,000 | 4 contracts |

| $2,000 – $3,000 | 5 contracts | |

| > $3,000 | 10 contracts | |

| $150K | < $1,500 | 3 contracts |

| $1,500 – $2,000 | 4 contracts | |

| $2,000 – $3,000 | 5 contracts | |

| $3,000 – $4,500 | 10 contracts | |

| > $4,500 | 15 contracts |

If you’re on the Live Funded Account and achieve over $10,000 in cumulative profit, you become eligible to request custom scaling parameters for larger contract capacities

6. Topstep trading platforms

Topstep offers a compelling platform setup tailored to futures traders. You can choose between free and paid platforms, giving both beginners and advanced traders the flexibility they need. Combined with access to a wide range of futures contracts, this makes Topstep a reliable and scalable choice for serious market participants.

6.1. Topstep’s free trading platforms

Topstep offers several no-cost trading platforms during the Trading Combine and Express Funded stages. These platforms are ideal for evaluation without upfront software costs, allowing traders to focus on strategy and execution. Here’s an overview:

| Platform | Data Feed | Mobile-Friendly | Mac-Compatible | Free in Live Funded | Notable Features |

|---|---|---|---|---|---|

| TopstepX | Sim2Funded | Yes | Yes | Yes | Commission-free, exclusive to Topstep |

| Quantower | Rithmic | No | No | Yes | Low-latency data, intuitive desktop UI |

| Tradovate | CQG | Yes | Yes | Yes | Multi-device access, TradingView integration |

| TradingView | CQG | No | Yes | Yes | Robust technical analysis tools |

| T4 | CTS | Yes | No | Yes | Simple interface, mobile access |

Notes:

- TopstepX is commission-free and great for beginners, but once you start with it, you can’t switch platforms.

- Quantower is ideal for traders focused on low-latency execution.

- Tradovate and TradingView offer advanced charting with modern interfaces.

- T4 is mobile-compatible, ideal for traders on the go.

6.2. Paid trading platforms

During the Live Funded stage, or for traders preferring high-level analytical tools, Topstep supports a variety of advanced paid platforms. These typically require a monthly or annual subscription but offer enhanced execution, order flow insight, and institutional-grade features.

| Platform | Data Feed | Mobile-Friendly | Mac-Compatible | Free in Challenge | Free in Live Funded | Best For |

|---|---|---|---|---|---|---|

| NinjaTrader | Rithmic | No | No | Yes | No | Advanced charting and execution tools |

| R | Trader Pro | Rithmic | Yes | Yes | Yes | Basic futures tools for mobile traders |

| ATAS OrderFlow | Rithmic | No | No | Yes | No | Volume analysis and order flow trading |

| MotiveWave | Rithmic | Yes | Yes | No | No | Technical traders using strategy development |

| VolFix | Rithmic | Yes | Yes | No | No | Market data visualization for scalpers |

| Bookmap | Rithmic | No | Yes | No | No | Heatmap-based order flow insights |

| Investor/RT | Rithmic | No | No | No | No | Desktop-based market analytics |

| Jigsaw Daytradr | Rithmic | No | No | No | No | Depth-of-market and order flow tools |

| MultiCharts | Rithmic | No | No | No | No | Algo trading with backtesting |

| Sierra Chart | Rithmic | No | No | No | No | Custom indicators and technical flexibility |

| Trade Navigator | Rithmic | No | No | No | No | Strategy development and backtesting |

My tips for you to select an appropriate platform:

- Beginners should consider starting with TopstepX or Quantower due to ease of use and built-in features.

- Advanced traders seeking an edge through order flow or DOM should explore Bookmap, ATAS, or Jigsaw Daytradr.

- Mac users may prefer TopstepX, MotiveWave, or TradingView for better cross-platform support.

- Choose platforms based on data feed latency (Rithmic is fastest) and compatibility with your preferred brokerage.

Verdict on Topstep trading platforms

Topstep provides one of the most flexible platform environments with a wide selection of free platforms during the evaluation stages and access to advanced paid platforms at the funded level. Traders can scale their tools alongside their progress. Whether you’re trading from Windows, Mac, or mobile, Topstep’s platform ecosystem is designed for adaptability, performance, and discipline.

7. Futures markets, leverage & trading hours

Topstep gives access to over 30 futures markets via CME Group, covering indices, currencies, energy, metals, agriculture, and treasury products. It does not support spot forex, stocks, options, or CFDs; this is strictly a futures trading environment.

Tradable Instruments

| Asset Class | Examples |

|---|---|

| Equity Index | E-mini S&P 500 (ES), Nasdaq (NQ), Dow (YM), Russell 2000 (RTY), micros |

| Currencies | Euro FX, GBP, JPY, AUD, CAD, CHF, MXN (standard + micro contracts) |

| Energy | Crude Oil (CL), Natural Gas (NG), Gasoline (RB), Heating Oil (HO) |

| Metals | Gold (GC), Silver (SI), Copper (HG), Platinum (PL), micro contracts |

| Agriculture | Corn (ZC), Wheat (ZW), Soybeans (ZS), Lean Hogs, Live Cattle |

| Treasuries | 10-Year Notes, 30-Year Bonds, 2-Year Notes, 5-Year Notes, Eurodollar |

Leverage

Leverage is embedded in the margin structure of futures contracts. Traders are not offered adjustable leverage levels like with retail brokers. Instead, Topstep enforces maximum position limits depending on account size.

| Account Size | Max Contracts | Margin Example (ES) |

|---|---|---|

| $50,000 | 5 contracts | ~$12,500 margin needed |

| $100,000 | 10 contracts | ~$25,000 margin needed |

| $150,000 | 15 contracts | ~$37,500 margin needed |

Note: These values vary depending on the specific instrument and market volatility.

Trading Hours

Topstep follows the standard CME Group trading schedule, which allows 23-hour access per day, Sunday to Friday.

| Session | Time (CT) |

|---|---|

| Open | Sunday 5:00 PM |

| Daily Pause | 4:00 PM – 5:00 PM |

| Close | Friday 4:00 PM |

Verdict on futures markets, leverage & trading hours

Topstep gives access to a wide range of futures contracts via CME Group exchanges. Most products are available during extended hours, allowing for pre-market and overnight trading. While retail traders can’t apply traditional leverage, the evaluation structure simulates capital scaling and risk tolerance, mimicking real capital deployment with clear daily and max drawdown limits.

8. Customer support and community

Topstep prioritizes trader success by offering robust customer support and fostering a vibrant community for collaboration and growth. With a blend of AI-driven assistance, human support, and active trader networks, Topstep ensures users have access to help and resources when needed.

This section explores the support channels, community engagement opportunities, and user feedback, highlighting Topstep’s commitment to a positive trading experience.

8.1. Customer support channels

- AI chatbot (Windy): Available via a blue messenger box on the Topstep website, Windy provides quick answers to common queries. The chatbot is effective for basic issues, with an option to escalate to a human agent if needed.

- Live chat and email: Support is accessible Monday through Friday from 7 AM to 6 PM CT. Traders report prompt responses, with agents addressing issues like account setup and platform errors efficiently.

- FAQ section: A comprehensive FAQ on topstep.com covers topics such as Trading Combine rules, payouts, and platform choices, reducing the need for direct support.

- Limitations: Phone support is no longer available, and some users note the absence of a dedicated finance department contact for payout-related concerns. A mobile app for support access is in development but not yet released.

8.2. Community engagement

- Discord channel: Topstep’s official Discord is a hub for traders to connect, share strategies, and interact with coaches. It fosters real-time discussions and provides access to expert insights during trading sessions.

- Facebook group: An active community where traders exchange tips, celebrate successes, and discuss Topstep’s features, enhancing peer-to-peer learning.

- TopstepTV: A live streaming platform where traders can watch experts analyze markets, trade alongside them, and participate in leaderboards or giveaways. This interactive feature strengthens community ties and doubles as an educational tool.

- Events and webinars: Regular webinars and community events, hosted by Topstep coaches, encourage networking and skill development, creating a supportive environment for traders at all levels.

Verdict on customer support and community

Topstep offers solid customer support through AI chat, live chat, and email, ensuring timely assistance despite the lack of phone support. At the same time, its vibrant community, active on Discord, Facebook, and TopstepTV, fosters real-time interaction, peer learning, and expert guidance, creating a well-rounded support ecosystem for traders.

9. Topstep review Trustpilot reputation, and real trader experiences

When choosing a funding firm, reputation matters. Here’s how Topstep fares across review platforms, social media, and real-world feedback:

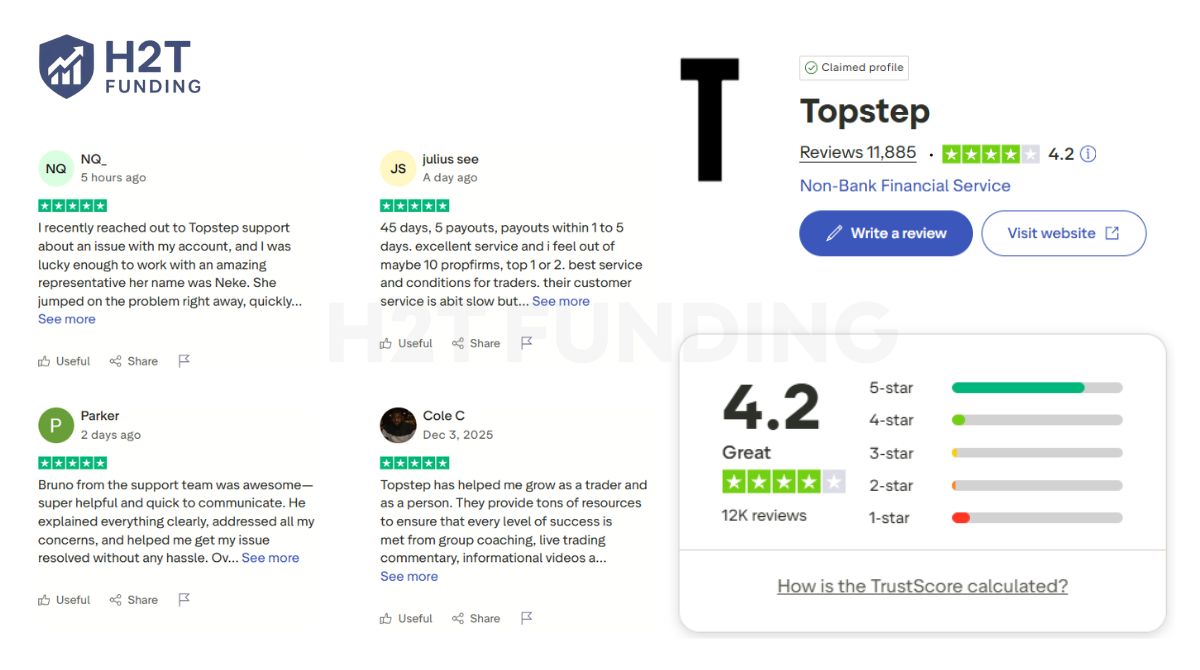

Trustpilot ratings

Topstep holds an impressive 4.2‑star rating on Trustpilot, based on over 11,885 reviews:

- 78% awarded a full 5 stars

- Only 10% left 1-star reviews

- 90% of users rate their experience 4 stars or above

This strong score indicates a high level of trader satisfaction across skill levels, reflecting consistent performance and reliability.

Social media and community

With around 62.9K followers and 1,073+ posts, Topstep’s feed is a hub for education and community, featuring:

- Live streams from TopstepTV

- Tips and rules reminders

- Celebrity-funded traders

- Interactive stories with sections like Funded Traders, Tips, and Rules

Twitter/X: On X, Topstep logs ~59K followers and 41.6K+ tweets, posting timely market insights, platform updates, and nurturing the community with its “1 Step. 1 Rule™” ethos.

What traders say:

“Honestly, I think this good for traders who want to start entering the market with good knowledge because it teaches you the difference between real achievement and a real loss. Teaches you to be more critical on your trading than paper trading in order to advanced to the next level. So glad I found Topstep. I hope to be a live trader with this firm soon hopefully.” – Juan, Trustpilot

“I recently purchased a 50k funded account from topstep for 49$. However, I enocuntered an issue with accessing my account. As a new customer, I expected a smoother onboarding process. Hopping for better support and clearer instructions in the future.” – Anuj Singh Rajput, Trustpilot

“1. Topstep – most influencers won’t give them credit because they don’t have an affiliate program. I don’t care, they’re the best. No consistency rule and the ability to have 5 accounts. No worries of making too much or getting denied by sneaky rules.” – Travis, X

From genuine trader feedback across Trustpilot and social platforms, it’s clear that Topstep is well-regarded and dependable, especially for traders seeking discipline and real-time execution training.

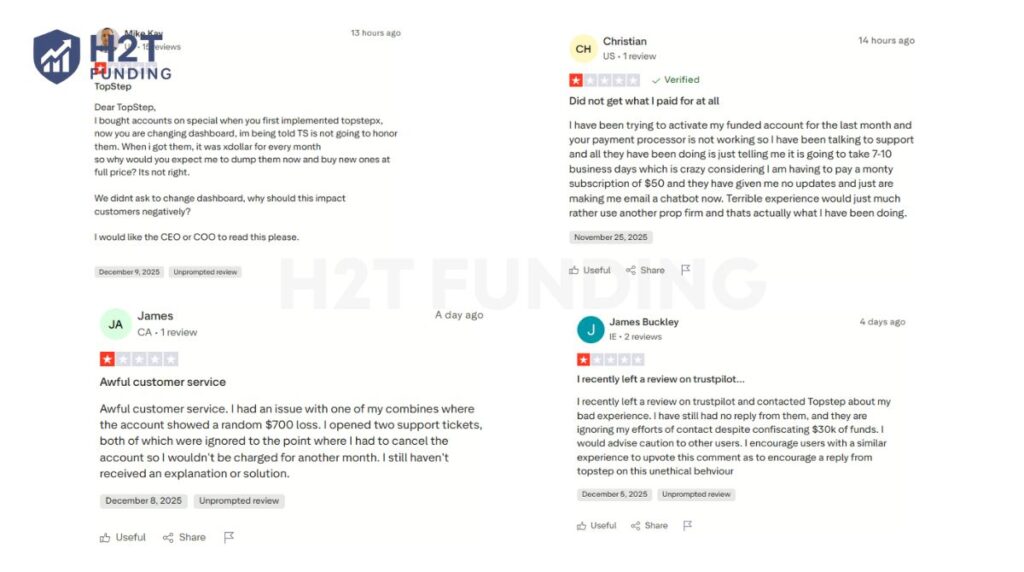

Though occasional onboarding friction arises and technical support can lag behind, these are generally seen as fixable issues rather than systemic flaws.

Verdict on reputation and my experiences:

Topstep stands out as a well-established prop firm with strong community trust. Its 4.3 Trustpilot rating (from 9,000+ reviews) and active presence on social platforms show real engagement, not just marketing. This builds a reputation based on value, not hype.

From my experience, Topstep’s rules are clear and fair, with no hidden traps like consistency rules. The structure encourages disciplined trading, and account flexibility is a major plus for experienced traders. I also found the educational content surprisingly practical.

Of course, no firm is without flaws. Some users have reported onboarding issues or delays in support, and I encountered a brief account login hiccup myself. However, these tend to be situational rather than systemic, and support was ultimately responsive enough to resolve the matter.

Overall, if you’re seeking a prop firm that emphasizes growth through discipline, offers meaningful trader resources, and backs its claims with a solid reputation, Topstep deserves serious consideration.

10. How to sign up with Topstep

Topstep offers a structured path for traders aiming to manage real capital, but success starts with understanding their multi-stage evaluation system. Here’s a simplified breakdown of the signup journey:

Step 1: Register on the Topstep platform

Begin by visiting Topstep’s official website and initiating the registration process.

Step 2: Pick your account tier

Choose a simulated account that suits your strategy. Available balances range from $50,000 to $150,000, with monthly fees scaling accordingly from $49 to $149.

Step 3: Submit your information

Provide basic details like your name, email, and payment method to activate your selected account.

Step 4: Enter the Trading Combine

This is the initial evaluation stage, where you demonstrate your ability to meet profit goals while staying within strict risk limits.

Note: You must complete at least 5 trading days, even if your target is reached early.

Step 5: Progress to Express Funded

If you pass the Combine, you’ll unlock the Express Funded phase after paying a one-time activation fee of $149.

To proceed, achieve 5 profitable days (each over $200) while maintaining discipline.

Step 6: Trade in the Live Funded Account

Here’s where you trade real capital. The focus shifts to sustainable performance and risk control; any breach of maximum drawdown will result in account termination.

Key stages at a glance

- Trading Combine: Simulated trading with specific profit and loss parameters.

- Express Funded: Demonstrate consistency, no monthly fee, but strict daily requirements.

- Live Funded: Trade real funds under Topstep’s supervision and rules.

11. Topstep vs. other prop firms – Who should use Topstep?

When reading any Topstep H2T Funding review, it’s essential to place the firm in context with its peers. The prop trading industry has become increasingly competitive, with firms offering varying pricing models, profit splits, and account structures. Here’s how Topstep compares with several major players:

| Feature | Topstep | Apex Trader Funding | Elite Trader Funding | My Funded Futures | Bulenox |

|---|---|---|---|---|---|

| Account Sizes | $50K – $150K | $25K – $300K | $50K – $300K | $50K – $150K | $25K – $250K |

| Profit Share | 100% of the first $5,000, then 90% | 100% of the first $25,000, then 90% | 100% of the first $12,500, then 90% | 100% up to $10K, then 90% | 100% up to $15K, then 80% |

| Monthly Fees | $49 – $149 | $137 – $677 | $165 – $655 | $80 – $375 | $145 – $535 |

| Profit Targets | $3,000 – $9,000 | $1,500 – $20,000 | $3,000 – $20,000 | $3,000 – $12,000 | $1,500 – $15,000 |

So, Topstep is best for traders serious about futures and value its education and community. If you’re disciplined, patient, and mainly trade E-mini S&P, NASDAQ, Oil, Gold, or other CME products, Topstep’s program can be a great fit.

It helps foster good habits (risk management, consistency) and rewards consistent profits. However, novices or those on a tight budget should be cautious: Topstep explicitly notes the Combine is challenging and “not suggested for individuals with minimal trading experience.”

Also, if you prefer other markets (forex/crypto) or dislike monthly fees, you might explore alternatives. In short, Topstep suits intermediate/advanced futures traders who want structured growth under the guidance of an engaged prop firm.

12. FAQs

Yes, Topstep is a legitimate and well-established prop trading firm with over 10 years of experience and a strong reputation among futures traders.

Yes, Topstep has paid over $23 million since 2020, with payouts processed after five winning days with net profits above $200.

Topstep ranks 3rd in 2026 reviews, behind FXIFY and FundedNext, but stands out for its education and community support.

Yes, traders can earn significant profits, keeping 100% of the first $10,000 and 90% thereafter if they pass the evaluation and trade consistently.

Yes, subscription fees range from $49 to $149 per month during the Trading Combine phase; no fees apply once funded.

13. Conclusion

After a comprehensive Topstep review, it’s clear that this prop firm stands out for its structured approach to evaluation, trader discipline, and transparency.

With strong community feedback (over 9,000 reviews on Trustpilot), Topstep continues to be a reliable option for both beginners and experienced traders looking to trade futures in a low-risk, supportive environment.

For anyone seriously considering a funded trading opportunity, Topstep remains a compelling choice, combining affordability, education, and professional standards into one platform.

To deepen your understanding of prop trading and explore other reputable firms, we invite you to read more insightful articles at H2T Funding. Whether you want detailed prop firm reviews, tips for passing evaluations, or guides to scaling your trading career, our expert content will help you make informed decisions every step of the way.