Choosing a prop firm can be confusing. Even after checking Top One Trader reviews on Trustpilot, many traders still question whether the firm lives up to its claims. The concerns are real: fast payouts, fair rules, and genuine support are what traders need most.

In this Top One Trader review, I’ll share not only the firm’s official details but also my personal perspective after analysing its programs, rules, and payout structure. You’ll see how this prop firm positions itself among competitors, from instant funding features to scaling opportunities.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Top One Trader websites before purchasing any challenge.

1. Our take on Top One Trader

Top One Trader is a prop firm founded in 2023 with the goal of offering traders fast access to capital and simple trading rules. The firm is led by CEO Nicholas Zevallos, who has built a reputation for providing flexible funding programs and fast payouts.

Within just a short time, the company has grown to thousands of traders worldwide, making it a recognisable name in the prop firm space.

The platform offers one-step, two-step, and instant funding accounts with balances ranging from $5K to $200K. Traders can access popular platforms like MT5, cTrader, Match-Trader, and TradeLocker. Profit splits reach 90% to even 100% in certain structures, with no fixed time limits on challenges, a rare advantage in today’s prop firm environment.

What also stands out is the mix of transparency and innovation. The firm’s EquityShield™ risk system, scaling up to $5 million, and fast payout processing (often within 1–2 hours) show a clear focus on trader experience.

Still, the lack of disclosed broker information and limited learning resources remains a weak spot compared to top-tier competitors.

| Pros | Cons |

|---|---|

| Profit split up to 90% – 100% | Broker partnerships are not publicly disclosed |

| One-step, two-step, and instant funding options | Limited educational resources and training |

| No time limits on challenges | Leverage is capped at a lower level on 1-step accounts |

| Allows weekend and news trading | No free trial or demo access |

| Supports Expert Advisors (EAs) | Smaller range of markets vs. some larger firms |

| Fast payouts within hours, bi-weekly or monthly | Evaluation fees are non-refundable if failed |

| Scaling plan up to $5 million | Not available in all jurisdictions |

| EquityShield™ risk management system | No trading competitions or community features |

Overall, this firm balances fast payouts and flexible programs with some gaps in transparency and education. For traders who value simplicity, weekend trading, and the chance to scale quickly, it’s a strong choice. However, those who prefer deeper learning resources or clearer broker backing might find it less appealing.

2. Top One Trader funding program

Top One Trader prop firm builds its model around four funding options: One-Step, Two-Step, Instant Funding, and the newer Instant Prime. Each comes with distinct profit targets, drawdown rules, leverage, and fee structures.

This tiered system lets traders pick between quick evaluations or straight-to-live funding, with flexibility to suit both cautious and aggressive styles.

| Feature | One-Step | Two-Step | Instant Funding | Instant Prime |

|---|---|---|---|---|

| Account Sizes | $5K – $200K | $5K – $100K | $5K – $200K | $5K – $200K |

| Profit Target | 10% | 8% (Phase 1) 5% (Phase 2) | None | None |

| Daily Loss Limit | 4% | 5% | N/A | 2% (per symbol) / 2.5% (all) |

| Max Drawdown | 7% Trailing | 10% Static | 6% Trailing | 5% |

| Profit Split | Up to 90% | Up to 90% | Up to 90% | 100% |

| Leverage | 10:1 | 30:1 | 50:1 | 10:1 |

| Weekend Holding | Yes | Yes | Yes | Yes |

| News Trading | Yes | Yes | Yes | Yes |

| EAs Allowed | Yes | Yes | Yes | Yes |

| Equity Stability Score | N/A | N/A | N/A | 20–30% |

| Trading Platforms | MT5, cTrader, Match-Trader, TradeLocker | Same | Primarily TradeLocker | MT5, cTrader, TradeLocker |

| Fees (From) | $64 – $1079 | $85 – $1291 | $135 – $2537 | $94 – $1776 |

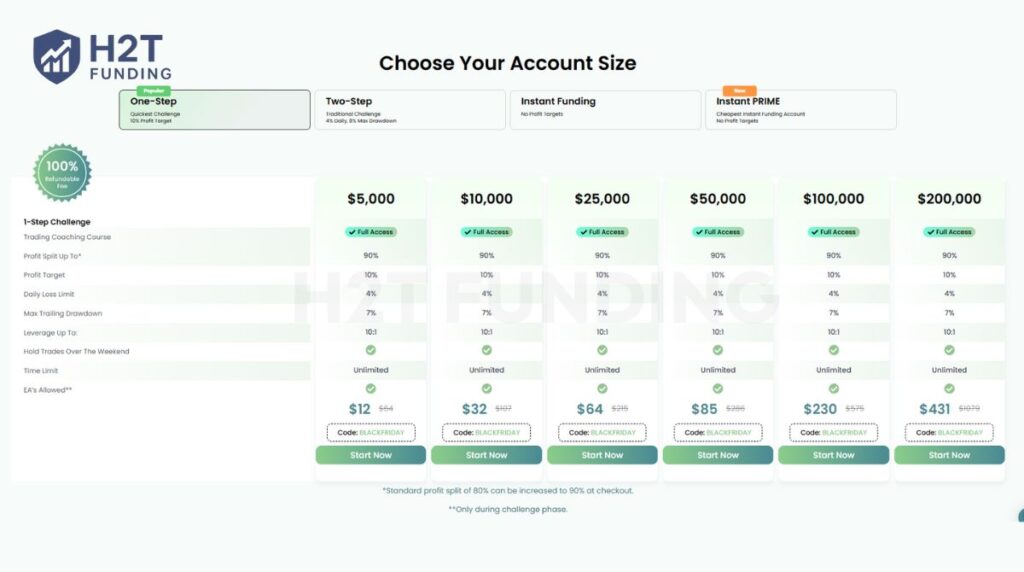

2.1. One-step challenge

The One-Step Challenge is designed for traders who want a fast track to funding. With a 10% profit target, 4% daily loss cap, and a 7% trailing drawdown, it emphasises consistency over speed. There is no time limit, giving traders freedom to work at their own pace.

| Account Size | Profit Target (10%) | Daily Loss Limit (4%) | Max Trailing Drawdown (7%) | Fee |

|---|---|---|---|---|

| $5,000 | $500 | $200 | $350 | $64 |

| $10,000 | $1,000 | $400 | $700 | $107 |

| $25,000 | $2,500 | $1,000 | $1,750 | $215 |

| $50,000 | $5,000 | $2,000 | $3,500 | $286 |

| $100,000 | $10,000 | $4,000 | $7,000 | $575 |

| $200,000 | $20,000 | $8,000 | $14,000 | $1079 |

2.2. Two-step challenge

The Two-Step Challenge is more structured, aimed at traders who can stay consistent across two phases. You’ll need to reach 8% in Phase 1 and 5% in Phase 2, while respecting a 5% daily loss cap and a 10% static drawdown.

What I like here is the 30:1 leverage, which feels more generous than the One-Step model. It gives room for flexible strategies, whether swing or intraday. However, the two-phase setup can be a psychological hurdle for traders who prefer quicker results.

| Account Size | Phase 1 Target (8%) | Phase 2 Target (5%) | Daily Loss Limit (5%) | Max Drawdown (10%) | Fee |

|---|---|---|---|---|---|

| $5,000 | $400 | $250 | $250 | $500 | $85 |

| $10,000 | $800 | $500 | $500 | $1,000 | $135 |

| $25,000 | $2,000 | $1,250 | $1,250 | $2,500 | $254 |

| $50,000 | $4,000 | $2,500 | $2,500 | $5,000 | $351 |

| $100,000 | $8,000 | $5,000 | $5,000 | $10,000 | $755 |

| $200,000 | $16,000 | $10,000 | $10,000 | $20,000 | $1291 |

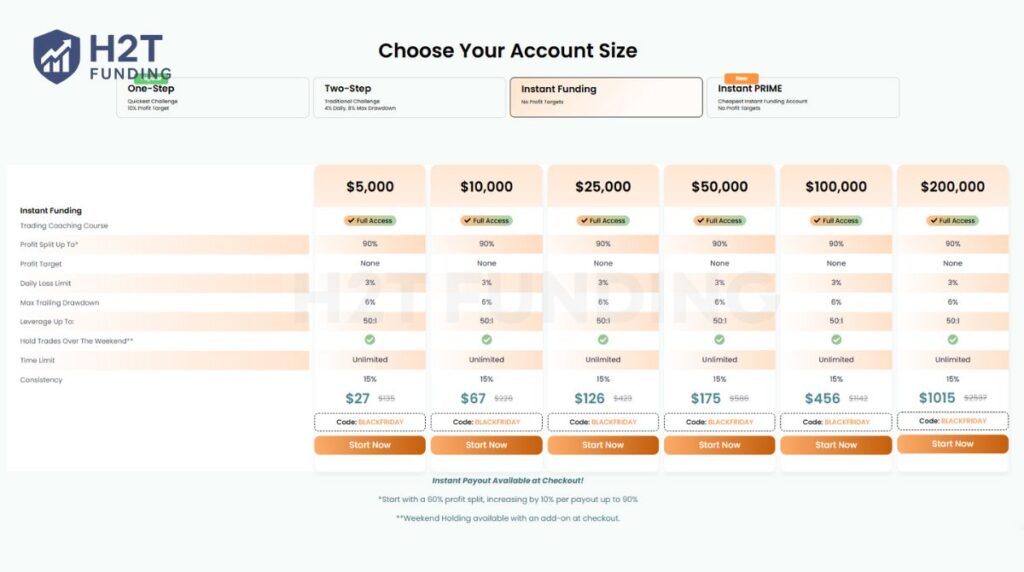

2.3. Instant challenge

Top One Trader instant funding challenge skips evaluations entirely, giving traders direct access to funded accounts. There are no profit targets or daily loss limits, only a 6% trailing drawdown to protect capital. With leverage up to 50:1, it’s the most aggressive option in the lineup.

This is the boldest choice, ideal for experienced traders who already have a proven edge. The appeal lies in immediate payouts and freedom, but the higher entry fees and lack of a safety buffer make it risky for less consistent traders.

| Account Size | Profit Target | Daily Loss Limit | Max Trailing Drawdown (6%) | Fee |

|---|---|---|---|---|

| $5,000 | None | None | $300 | $135 |

| $10,000 | None | None | $600 | $226 |

| $25,000 | None | None | $1,500 | $423 |

| $50,000 | None | None | $3,000 | $586 |

| $100,000 | None | None | $6,000 | $1142 |

| $200,000 | None | None | $12,000 | $2537 |

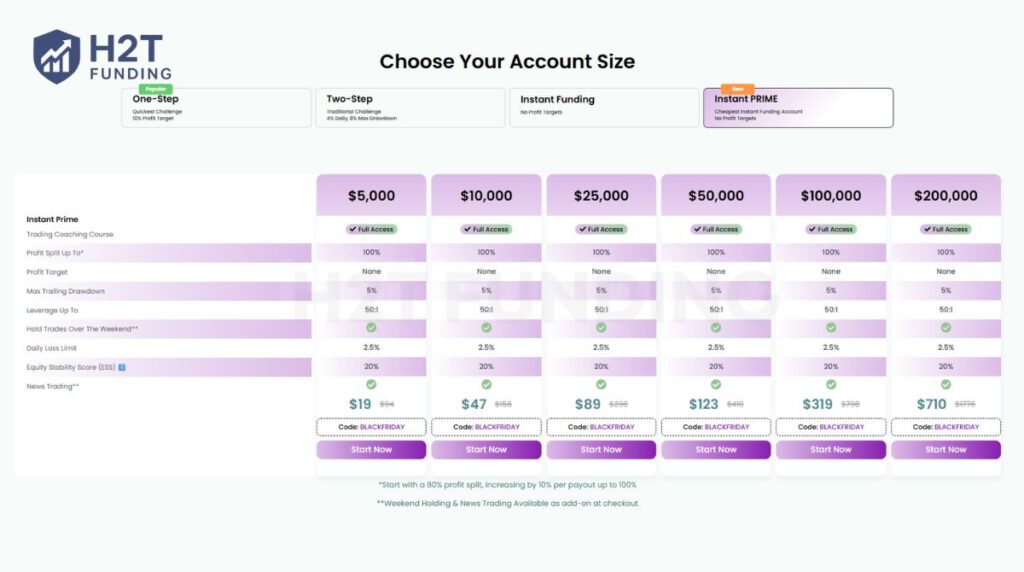

2.4. Instant prime challenge

The Instant Prime Challenge is the premium tier at Top One Trader. Unlike other models, it offers a 100% profit split and stricter risk rules: 2% daily loss per symbol, 2.5% across all trades, and a 5% max drawdown. Accounts start funded right away, with leverage capped at 10:1.

Personally, I find this program appealing for disciplined traders who want to keep every dollar they earn. The tight risk management and Equity Stability Score requirement (20–30%) make it less forgiving, but they also ensure long-term sustainability for consistent performers.

| Account Size | Profit Target | Daily Loss (2% per symbol / 2.5% all) | Max Drawdown (5%) | Fee |

|---|---|---|---|---|

| $5,000 | None | $100 / $125 | $250 | $94 |

| $10,000 | None | $200 / $250 | $500 | $158 |

| $25,000 | None | $500 / $625 | $1,250 | $296 |

| $50,000 | None | $1,000 / $1,250 | $2,500 | $410 |

| $100,000 | None | $2,000 / $2,500 | $5,000 | $798 |

| $200,000 | None | $4,000 / $5,000 | $10,000 | $1776 |

Verdict on Top One Trader challenges

What strikes me most is how each challenge speaks to a different type of trader. I see the One-Step as a good way to test patience under lower leverage, while the Two-Step feels more like a marathon that rewards discipline. The transition between these two shows how Top One Trader tries to filter different skill sets rather than just offering a shortcut to funding.

Instant Funding and Instant Prime are the bolder choices. I like the appeal of trading live capital right away, but the high upfront cost makes me think twice. These programs are less about easy access and more about proving whether a trader is genuinely ready.

3. Top One Trader rules

Top One Trader enforces strict trading rules to ensure fairness, transparency, and platform sustainability. These rules define what is allowed, what is banned, and how traders should behave both during challenges and after being funded.

Following them is critical; violations may lead to account breaches, profit forfeiture, or even blacklisting.

3.1. Allowed trading practices

Traders are given some flexibility to use different strategies, as long as they stay within the firm’s guidelines. The practices below are officially permitted and form the foundation for consistent, fair trading across all account types:

- Weekend trading: Positions can be held over weekends without restrictions.

- News trading: Permitted during challenges. On funded accounts, trades must not be opened or closed within 5 minutes before or after high-impact news unless placed 5+ hours earlier.

- Expert Advisors (EAs): Allowed if transparent and customised. Concealed or off-the-shelf commercial bots are not accepted.

- Copy trading (own accounts): You can copy trades only across accounts under your own name.

- Hedging (same account): Internal hedging inside a single account is fine, but cross-account hedging is strictly forbidden.

- Risk tools: Features like EquityShield™ are supported to safeguard trader capital.

3.2. Prohibited trading practices

Despite the flexibility, Top One Trader strictly bans manipulative or high-risk tactics. These restrictions exist to protect the firm and the trader community, ensuring that profits come from skill rather than exploitation:

- VPN usage: Prohibited, as it may trigger false location alerts. Use a static IP or VPS and notify the firm if the IP changes.

- Hedging across accounts: Not allowed across multiple accounts or firms, even if they belong to the same trader.

- High-Frequency Trading (HFT) / Tick Scalping: Ultra-fast trades or holding positions for just seconds are banned.

- Latency Arbitrage: Exploiting delays in feeds or execution mismatches is not accepted.

- External or group copy trading: Copying trades with unrelated accounts or in groups is prohibited.

- Grid trading: Repeated buy/sell orders at intervals are not permitted.

- Martingale: Doubling trade size after losses is considered too risky and is banned.

- Third-party trading / “Pass Your Challenge”: Outsourcing accounts or hiring services to trade on your behalf is forbidden.

- Gambling or YOLO trading: Reckless over-leverage and risk-taking will lead to breaches.

- Multiple IP addresses: Logging in from shared IPs or multiple devices without approval is not allowed.

- Account rolling/churning: Using many evaluations to pass one while failing others is banned.

- Regional restrictions: U.S. traders cannot use cTrader; MT5 is unavailable for the U.S., Canada, and Puerto Rico.

Verdict on Top One Trader Rules

The rulebook is strict but consistent, clearly designed to protect the firm’s integrity. I find it reassuring that honest traders are safe, while loophole-seekers are quickly filtered out. For serious traders, these restrictions may feel tight, but they create a fairer environment where skill and discipline matter most.

If you want additional examples of how major firms structure their rulebooks, you can browse an industry-focused breakdown of prop firm rules for further insight.

4. Top One Trader payout structure

Top One Trader structures its payout system to balance flexibility with trader discipline. Each program has its own eligibility rules, profit split progression, and consistency requirements. Minimum withdrawal is set at 2% of the initial balance across the board, ensuring traders can access profits without large thresholds.

| Program | Frequency | Profit Split | Requirements | Minimum Payout |

|---|---|---|---|---|

| One-Step | Monthly (bi-weekly add-on after first payout) | 80% default, up to 90% | At least 3 profitable trading days | 2% of the initial balance |

| Two-Step | Bi-weekly (Instant Payouts add-on available) | 80% default, up to 90% | 30% consistency score required | 2% of the initial balance |

| Instant Funding | Monthly (Instant Payouts add-on available) | 1st: 60% → 2nd: 70% → 3rd: 80% → 4th+: 90% | 20% consistency score required | 2% of the initial balance |

| Instant Prime | Monthly | 1st: 80% → 2nd: 90% → 3rd+: 100% | 30% Equity Stability Score (ESS) required | 2% of the initial balance |

Verdict on Top One Trader Payout

What stands out to me is the scaling profit split structure, especially in Instant Funding and Instant Prime. It rewards consistency rather than quick wins, which feels fair for both sides. The 2% minimum withdrawal is practical, but the added conditions, like consistency scores or ESS, can be a hurdle for less disciplined traders.

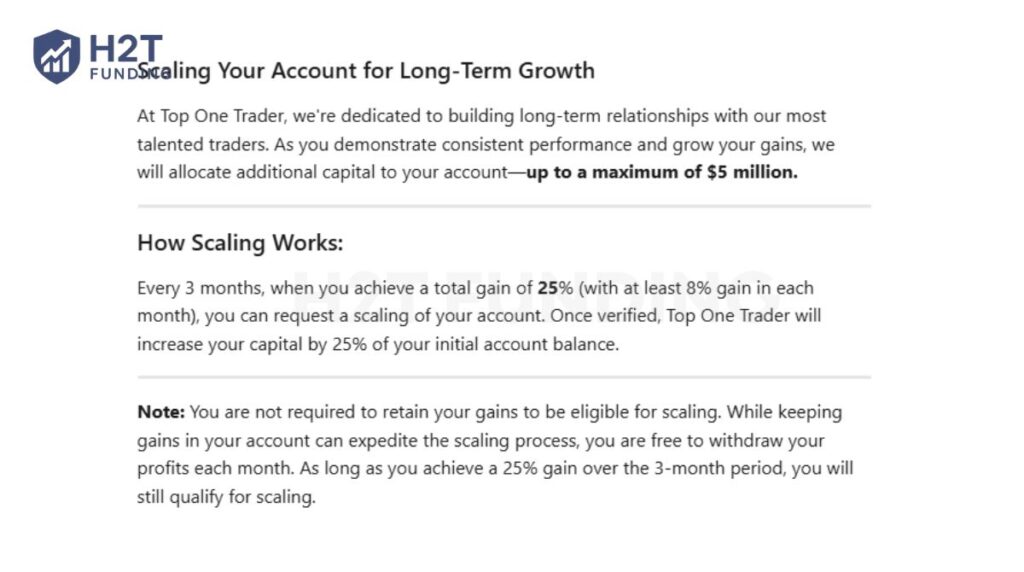

5. Scaling plan

Top One Trader offers a transparent path for traders to grow their capital steadily. All funded accounts up to $200K are eligible, with the chance to scale gradually to as much as $5 million. Reviews take place every three months, ensuring performance is measured fairly over time rather than by short bursts of luck.

To qualify, traders must achieve 25% profit in total over three months, with at least 8% gain each month. Once verified, the account balance increases by 25% of the original funding size.

What makes this plan practical is that withdrawals are still allowed, and profits don’t need to stay in the account to remain eligible for scaling. This combination rewards steady performance while keeping flexibility intact.

Verdict on Top One Trader Scaling Plan

The scaling plan sets realistic but challenging goals that encourage consistent trading habits. The monthly requirement filters out random spikes, while the ability to withdraw along the way shows the firm understands real traders’ needs. For those aiming to build long-term capital, this structure feels both motivating and attainable.

6. Spreads & commissions

Spreads and commissions directly shape trading costs, and at Top One Trader, they vary depending on the platform used. With choices like Match-Trader, TradeLocker, cTrader, and MT5, traders can balance between lower spreads and slightly higher commissions. This flexibility helps align costs with individual strategies.

Trading Commissions by Platform

| Platform | Markets Covered | Commission (per lot per side) |

|---|---|---|

| Match-Trader | FX, Metals, Indices, Crypto | $2.00 |

| TradeLocker | FX, Metals, Indices, Crypto | $2.50 |

| cTrader | FX, Metals, Indices, Crypto | $2.00 |

| MetaTrader 5 | FX, Metals, Indices, Crypto | $2.50 |

Average EUR/USD Spread by Platform

| Platform | EUR/USD Avg. Spread |

|---|---|

| Match-Trader | 2.0 pips |

| TradeLocker | 1.0 pip |

| cTrader | 0.2 pips |

Verdict on Top One Trader Spreads & Commissions

The commission rates are competitive, especially on cTrader and Match-Trader, where costs stay low. Spreads can differ widely, from 0.2 pips on cTrader to 2.0 on Match-Trader, which shows the importance of platform choice. For cost-sensitive traders, cTrader stands out as the most efficient option.

7. Top One Trader platform

Top One Trader gives traders access to four major platforms, each with its own strengths. From the charting power of TradingView integrations to the advanced tools of cTrader and the familiarity of MetaTrader 5, traders have the flexibility to match platform choice with their style. Availability also depends on account type and regional restrictions.

Platforms & Availability

| Platform | Availability | Account types supported | Notes |

|---|---|---|---|

| Match-Trader with TradingView | All approved countries | One-Step ($5K–$200K) Two-Step ($5K–$50K) Instant Prime ($5K–$200K) | Not available for Instant Funding |

| TradeLocker with TradingView (Most Popular) | All approved countries | One-Step ($10K–$200K) Two-Step ($5K–$200K) Instant Funding ($5K–$200K) Instant Prime ($5K–$200K) | Fast interface with TradingView charting |

| cTrader | All approved countries except the U.S. | One-Step ($5K–$200K) Two-Step ($5K–$100K) Instant Funding ($5K–$100K) | Not offered for Instant Prime |

| MetaTrader 5 | All approved countries except the U.S., Canada, and Puerto Rico | One-Step ($5K–$200K) Two-Step ($5K–$200K) Instant Funding ($5K–$200K) Instant Prime ($5K–$200K) | Widely used, supports all assets |

Verdict on Top One Trader Platforms

The platform lineup covers both beginners and advanced traders. TradeLocker stands out for its popularity and ease of use, especially with TradingView integration. cTrader remains the most cost-efficient but is off-limits for U.S. clients, while MT5 offers familiarity and broad support.

For me, the real advantage is having this variety; it means you’re not locked into a single system, but can choose what best supports your trading style.

8. Trading instruments & leverage

Top One Trader gives access to a wide range of assets across Forex, indices, metals, and cryptocurrencies. The selection is broad enough for most traders, though individual stocks are not offered. Each platform has slightly different availability, and crypto carries higher spreads due to volatility.

Tradable Instruments

- Forex: All major pairs (EUR/USD, GBP/USD, USD/JPY, etc.), minors (AUD/NZD, CAD/CHF, GBP/AUD…), and exotics on certain platforms.

- Indices: EU50, FRA40, GER30/GER40, UK100, US30, US500, US100, JAP225, SPA35. Some indices like AUS200, HKIND, and US2000 are still rolling out on TradeLocker.

- Precious Metals: Gold (XAUUSD) and Silver (XAGUSD).

- Cryptocurrencies: Bitcoin (BTCUSD) and Ethereum (ETHUSD). On cTrader, crypto is not available during weekends.

Note: Spreads on crypto are wider than FX due to liquidity and volatility differences.

Leverage Ratios by Account Type

| Account Type | Forex | Indices & Metals | Crypto |

|---|---|---|---|

| 1-Step Challenge | 10:1 | 10:1 (Metals/Indices) | 2:1 |

| 1-Step Funded | 10:1 | 5:1 | 0.3:1 |

| 2-Step Challenge | 50:1 | 10:1 | 2:1 |

| 2-Step Funded | 30:1 (50:1 if purchased before Mar 10, 2025) | 5:1 | 0.3:1 |

| Instant Funding | 50:1 (10:1 pre-Sep 24, 2025) | 10:1 (5:1 pre-Sep 24, 2025) | 1:1 (0.3:1 pre-Sep 24, 2025) |

| Instant Prime Funded | 10:1 | 5:1 | 0.3:1 |

Verdict on Instruments & Leverage

The instrument list is solid, covering all core asset classes while leaving out stocks. Leverage is deliberately lower on riskier products like crypto, which helps prevent overexposure. What stands out most is the flexibility—those who want higher leverage can go for the Two-Step Challenge, while stricter risk controls in Instant Prime keep traders accountable.

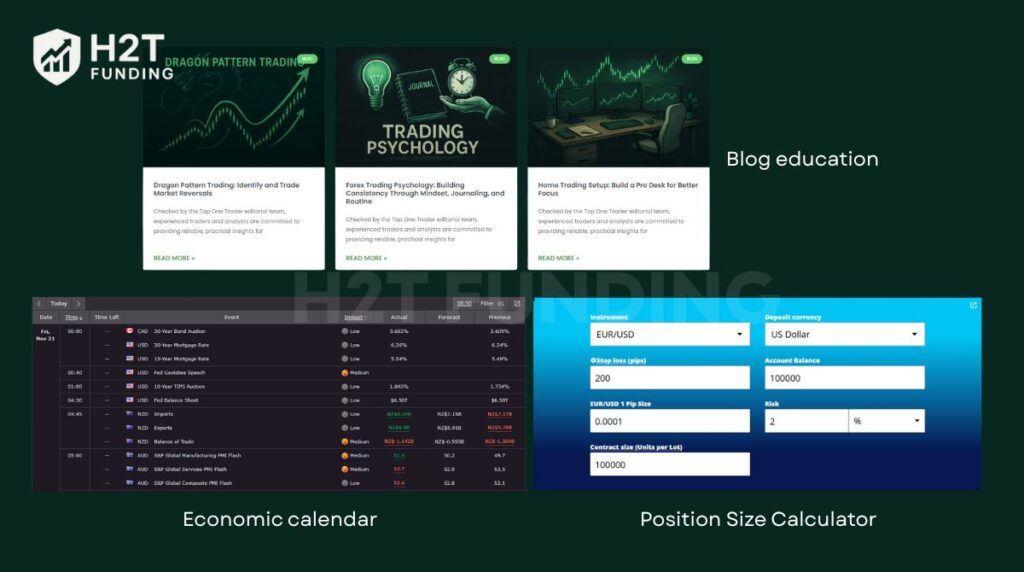

9. Education & resource

Top One Trader focuses mainly on funding rather than education, but they still provide a handful of tools to support traders. These resources aim to improve decision-making and reinforce consistency, though they are not as extensive as what some other prop firms offer.

Available Resources

- Trading Coaching Course (included with challenges):

- Covers winning strategies, trade signals, stop-loss, and take-profit tactics.

- Includes mindset training from a coach ranked among the world’s top 10.

- Designed to give traders both technical and psychological support.

- Economic Calendar: A tool to track key events and indicators shaping the financial markets.

- Position Size Calculator: Helps determine optimal lot sizes for trades based on risk tolerance.

- YouTube content: Limited free videos with occasional tips and insights.

Verdict on Education & Resources

The resources are practical but basic. The coaching course adds value for new traders, especially the mindset component, but outside of that, the tools are minimal. For traders who already have experience, these extras feel like supplements rather than a full learning ecosystem.

10. Customer support

Top One Trader puts noticeable effort into building a responsive support system. Traders can reach out through live chat, email, or social platforms like Discord, Facebook, and Twitter. The team maintains an active presence, which helps create a sense of accessibility beyond just the website.

Feedback from users reflects well on this approach. Reviews consistently mention fast response times, with issues like verification being solved quickly and without hassle. Others highlight the reliability of always getting timely assistance, without the long waits common at many other firms.

Verdict on Customer Support

The impression is of a support team that prioritises speed and personal attention. Instead of generic responses, traders often receive solutions that feel direct and helpful. For a prop firm, this level of service builds trust and makes the overall trading experience smoother.

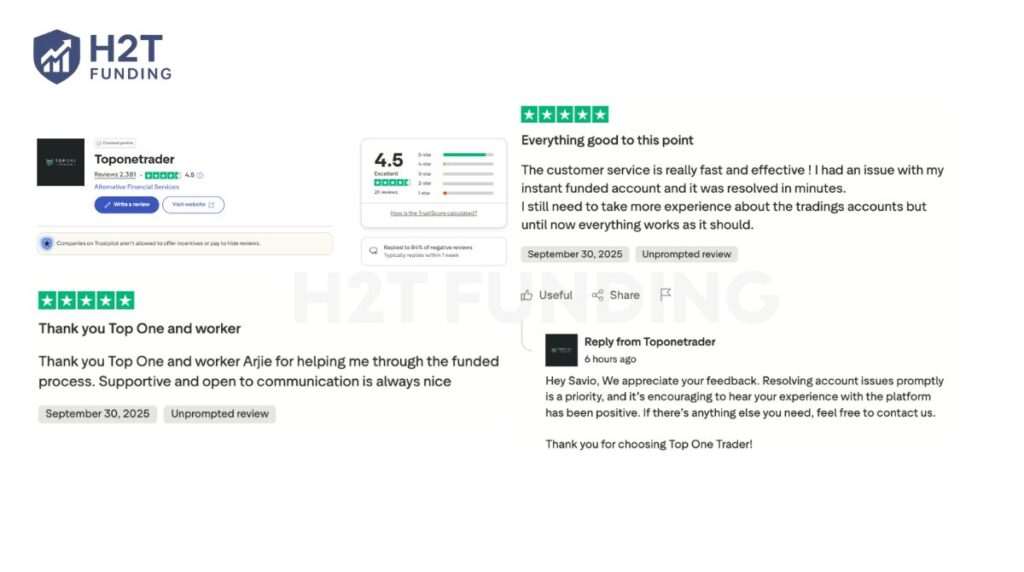

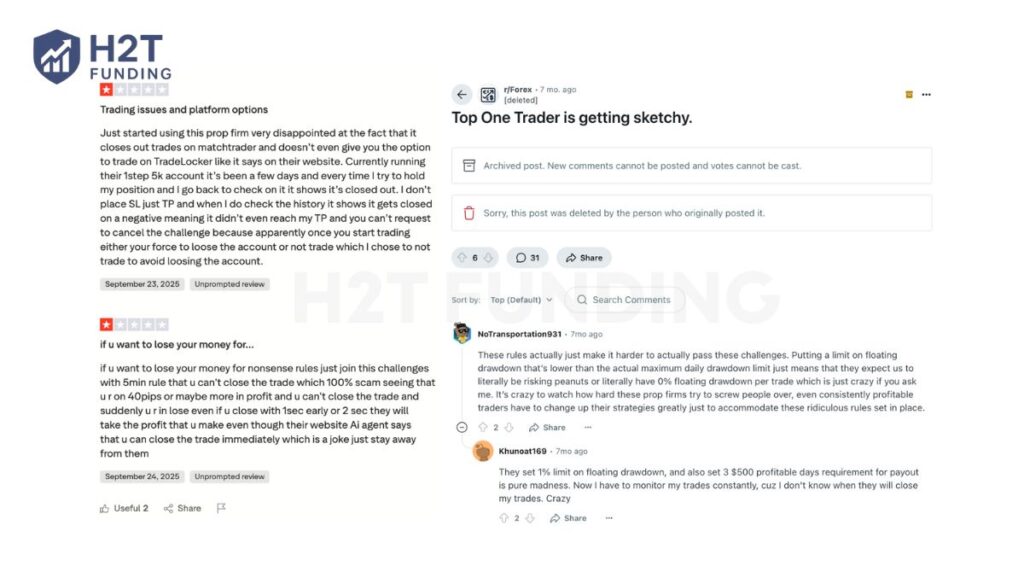

11. Real trader feedback on Top One Trader Trustpilot, and Top One Trader reviews Reddit

Top One Trader maintains a relatively strong reputation across review platforms. On Trustpilot, the firm scores 4.5/5 from more than 2,300 reviews, with the majority being 5-star ratings. Many traders highlight the quick support, smooth payouts, and user-friendly setup as reasons for their positive feedback.

Still, there is criticism within the community. Some Trustpilot users and lower-rated reviews raise concerns about strict rules, such as limitations around news trading or drawdown policies.

Others on Reddit mention frustrations with platform availability or trade closures. These negative reviews remain in the minority but show that not all traders feel the experience is seamless.

Verdict on Trader Feedback & Reputation

Overall sentiment leans positive, supported by thousands of traders praising payout speed and customer service. Yet, the recurring complaints around rules suggest that Top One Trader demands a disciplined style.

For me, the reputation feels credible but also polarised; traders who align with the firm’s strict framework thrive, while those seeking looser conditions often feel restricted.

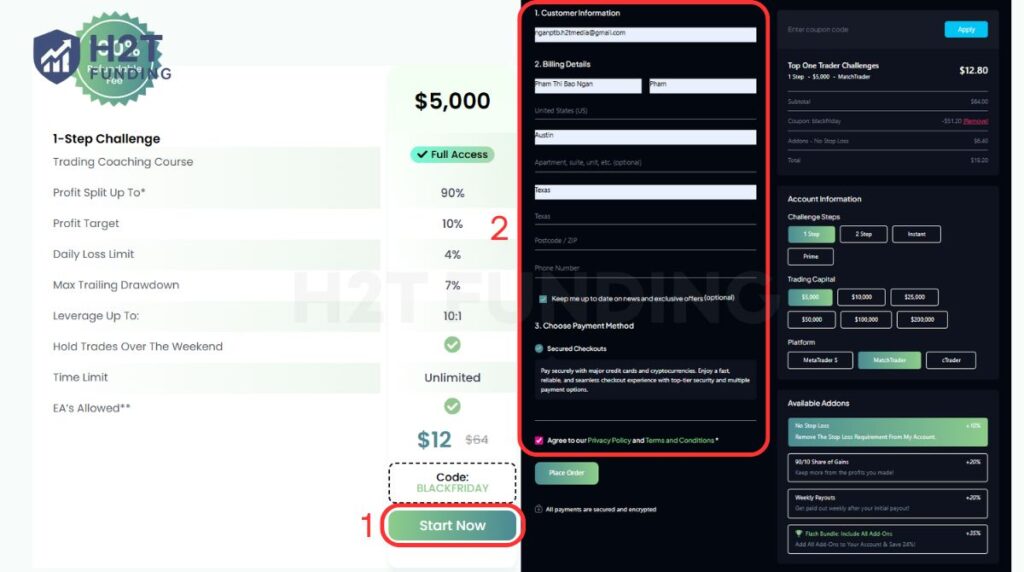

12. How to start with Top One Trader

Opening an account with Top One Trader is designed to be straightforward. After completing your Top One Trader login, the process integrates directly with their funded challenge models. And every trader must complete KYC verification before accessing a live account. This ensures compliance while maintaining an efficient onboarding process.

12.1. Select your funded challenge

Before starting, ensure you understand the available account types and scaling options. This step ensures you pick a challenge that matches your trading style and long-term goals.

- Visit the Top One Trader website and click Start Now.

- Choose the challenge or instant funding program that aligns with your strategy and capital size.

12.2. Enter billing details & platform choice

Once you’ve selected your challenge, the next step is setting up your personal and trading preferences. This information helps the firm create your profile and assign the correct trading environment.

- Provide your email, full name, residential address, and phone number.

- Select the preferred trading platform (MT5, cTrader, Match-Trader, or TradeLocker).

12.3. Complete KYC verification

When receiving your trading account, you must complete identity verification. That process ensures compliance, prevents fraud, and confirms that the account belongs to you.

Log in to the client dashboard and upload the required documents:

- Proof of Identity: Passport or driver’s license

- Proof of Address: Utility bill or bank statement

- Selfie: For identity confirmation

Once verified, your funded account will be activated after passing the evaluation.

Together, these steps ensure that your account is properly set up, compliant, and ready for trading once you pass the evaluation. If you follow each stage carefully, onboarding becomes smooth and straightforward.

13. Compare Top One Trader vs other Prop Firm

Top One Trader competes in a crowded field alongside well-known names like FTMO and TopTier Trader. While all three firms share common traits such as high profit splits and no time limits, their rules, account models, and fee structures make them appeal to different types of traders.

| Criteria | Top One Trader | FTMO | TopTier Trader |

|---|---|---|---|

| Challenge Fee | $17 – $1,175 | €89 – €1,080 | $50 – $298 |

| Account Types | One-Step, Two-Step, Instant Funding, Instant Prime | Normal, Swing Trader | One Phase, Two Phase |

| Profit Split | 80% – 100% | 80% – 90% | 80% – 95% |

| Account Size | $5K – $200K (scales to $5M) | $10K – $200K | $5K – $300K |

| Time Limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 10% (depends on challenge) | 5% – 20% | 5% – 10% |

| Trading Platforms | MT5, cTrader, TradeLocker, Match-Trader | MT4, MT5, cTrader, DXTrade | MT4, MT5 |

| Markets Offered | Forex, Metals, Indices, Crypto | Forex, commodities, indices, stocks, crypto | Forex, commodities, indices, crypto |

Each firm offers unique advantages. Top One Trader stands out for variety in challenge types and a rare 100% profit split in Instant Prime.

FTMO, being the most established, gives a wider asset selection, including stocks, which is missing at Top One. TopTier Trader appeals to budget-conscious traders with lower fees and higher account size flexibility.

- Top One Trader: Best for traders who want payout speed, flexible funding models, and long-term scaling to $5M.

- FTMO: A strong choice for traders wanting broader market access and a globally recognised name.

- TopTier Trader: Suitable for traders seeking low-cost entry and account sizes up to $300K with higher splits.

14. FAQs

Yes. Depending on the program, traders must meet consistency rules before requesting withdrawals. For example, the Two-Step challenge requires a 30% consistency score, while Instant Funding needs 20%. Instant Prime relies on a 30% Equity Stability Score (ESS).

Top One Trader is a registered proprietary trading firm and not a broker. It has built a community of more than 26,000 traders across 100+ countries, with transparent payout policies and fast withdrawal processing.

The firm is headquartered in the United States, with services extended globally to approved countries. However, some restrictions apply, such as U.S. users not being able to trade on cTrader and MT5 being unavailable in certain regions.

Traders can choose from One-Step, Two-Step, or Instant Funding challenges. Each program has profit targets, loss limits, and drawdown rules. Once passed, the account is upgraded to a funded account eligible for payouts.

The firm provides access to Forex majors, minors, and exotics, as well as indices like US30, GER40, and UK100. Precious metals such as Gold and Silver are supported, along with cryptocurrencies including Bitcoin and Ethereum.

Traders can use MetaTrader 5, cTrader, Match-Trader, or TradeLocker. Availability depends on account type, and some platforms, like cTrader, are restricted in the U.S. Each platform has unique spreads and commission profiles.

Leverage varies by account. One-Step accounts provide 10:1, while Two-Step accounts allow up to 30:1. Instant Funding can go as high as 50:1, while Instant Prime caps leverage at 10:1. Cryptocurrencies generally have lower leverage across all programs.

Funding starts as low as $5,000 and goes up to $200,000, depending on the challenge. With the scaling plan, accounts can grow over time up to $5 million in allocated capital.

Payouts depend on the account type. One-Step allows monthly payouts with a bi-weekly add-on, Two-Step pays bi-weekly, and Instant programs support monthly or instant payouts with add-ons. The minimum withdrawal is 2% of the initial balance.

Yes. Evaluation fees are fully refundable once you complete the challenge and receive your first payout. If the challenge fails, the fee is not refunded.

If a trader breaches the drawdown or loss rules, the account is closed. They would need to purchase a new challenge or, in some cases, qualify for a retake depending on the severity of the violation.

No. All Top One Trader challenges are designed without strict time limits. This allows traders to meet profit targets at their own pace instead of rushing trades to beat deadlines.

15. Conclusion

Top One Trader review shows a firm that blends speed, flexibility, and structured rules to stand out in the prop trading space. With multiple challenge types, scaling up to $5 million, and payout options that rival industry leaders, it has become a go-to choice for traders seeking both opportunity and discipline.

Still, strict rules and varying platform availability mean it suits traders who can adapt their strategies, rather than those who prefer looser conditions.

If you are considering prop firms, Top One Trader deserves a close look. For traders evaluating different firms, we recommend exploring more insights in our Prop Firm review section at H2T Funding, where you can compare Top One Trader with other industry leaders and find the model that fits your trading style best.