In the competitive prop firm space, bold promises are common. But when a firm advertises a 99% profit split, it’s natural for traders to ask a simple, crucial question: What’s the catch?

According to PipFarm’s XP Program, a 99% profit split is available at the highest trader rank. However, it is just one piece of a much larger puzzle, earned through the firm’s unique XP progression system.

This comprehensive PipFarm review will analyse every critical aspect, from their flexible funding models to real user feedback. Our H2T Funding’s goal is to provide the clarity you need to decide if this innovative but demanding platform truly aligns with your trading career.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Pipfarm websites before purchasing any challenge.

1. Our take on PipFarm Review

On paper, PipFarm presents a compelling case. It is led by a known industry figure, James Glyde, and built exclusively on the high-performance cTrader platform. This foundation, combined with innovative features like Payout Protection and an engaging XP Program, suggests a forward-thinking and well-designed prop firm.

| Feature | Details |

|---|---|

| Trading platform | cTrader |

| Accounts | From $2,500 to $100,000 (instant funding) |

| Account currency | USD |

| Deposit / Withdrawal | Deposit: Card, PayPal, Crypto / Withdrawal: Rise, Skrill, USDT |

| Minimum deposit | From $40 to $1,200 |

| Leverage | 1:30 (Upgrades to 1:50 via XP Program) |

| Minimum order size | 0.01 lots |

| EUR/USD spread | From 0 pips |

| Trading instruments | Forex, Metals, Oil, Cryptocurrencies, and Indices |

| Mobile trading | Yes |

| Affiliate program | Yes |

| Trading features | Multiple profit targets (5-12%), 3% daily drawdown, 6% Static or 9% Trailing Drawdown options, scalable up to $1,500,000 |

| Contests and bonuses | Yes, including a comprehensive XP Program and trading competitions |

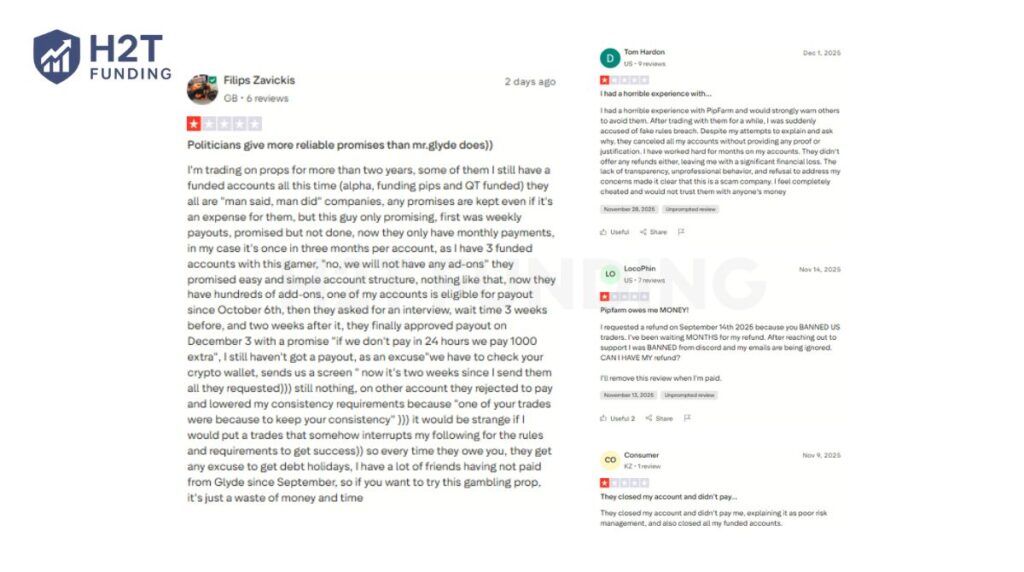

While this presents a compelling package on paper, a dive into recent community feedback reveals a concerning and contradictory picture. Some traders on third-party platforms such as Trustpilot and Reddit report issues such as sudden account closures or payout disputes. Furthermore, reports of poor communication and a lack of transparency in resolving disputes stand in stark contrast to the firm’s professional image.

This creates a significant disconnect between the firm’s stated goals and the actual real-world trader experience being reported. While the platform’s structure is promising, these operational issues are a major red flag that cannot be overlooked by anyone considering their services.

| Pros | Cons |

|---|---|

| Led by a credible industry veteran | Serious allegations of payout refusals & poor support |

| Impressive up to 99% profit split | Lacks dedicated educational resources for new traders |

| Innovative features like Payout Protection & XP Program | The platform is limited to cTrader only |

| Multiple funding models (1-step, 2-step, instant) | Audition fees are non-refundable |

2. Funding program PipFarm

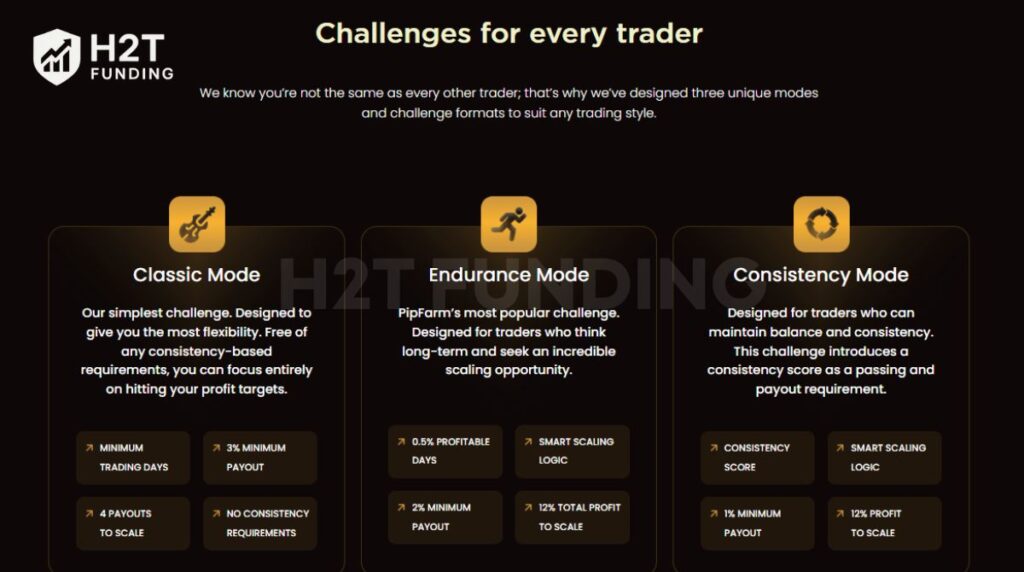

PipFarm moves away from the common one-size-fits-all approach to evaluations. Instead, its funding program is built on three distinct challenge modes: Classic, Endurance, and Consistency. Each mode is designed with a specific type of trader in mind.

This structure allows you to choose an evaluation path that best suits your trading style, whether you prioritize speed, long-term strategy, or steady performance. Let’s break down the specific rules and objectives for each of these unique funding routes.

2.1. Classic Mode Challenge

The Classic Mode is PipFarm’s most straightforward evaluation path. It’s designed for traders who are confident in their strategy and want a direct route to funding without complex consistency rules. The primary focus here is simple: hit the profit target while respecting the drawdown limits.

2.1.1. One-step

The one-step option is the fastest way to get funded in Classic Mode. You only need to pass a single evaluation phase to prove your skills. A key feature here is the choice between two drawdown types: a 6% static drawdown or a 9% trailing drawdown, allowing traders to pick the risk model that best fits their approach.

The main objective is to reach a 12% profit target with a minimum of 3 trading days. This target is ambitious, but the 365-day time limit provides ample flexibility.

Here is a breakdown of the one-step challenge parameters:

| Account Size | Price | Profit Target (12%) | Max Drawdown(Static 6% / Trailing 9%) | Daily Loss Limit (3%) |

|---|---|---|---|---|

| $5,000 | $60 | $600 | $300 / $450 | $150 |

| $10,000 | $120 | $1,200 | $600 / $900 | $300 |

| $20,000 | $200 | $2,400 | $1,200 / $1,800 | $600 |

| $50,000 | $375 | $6,000 | $3,000 / $4,500 | $1,500 |

| $100,000 | $590 | $12,000 | $6,000 / $9,000 | $3,000 |

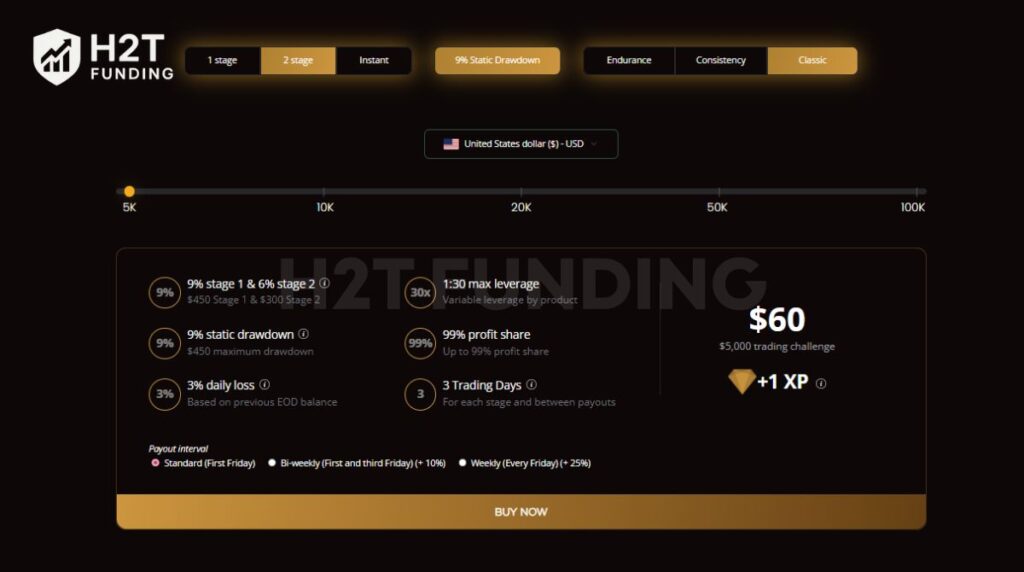

2.1.2. Two-step

The two-step challenge offers a more traditional evaluation route. It breaks the profit target into two manageable phases, which can be preferable for traders who favour a more methodical pace. This approach requires passing both a Challenge phase and a Verification phase to get funded.

In this model, the profit targets are lower for each stage compared to the one-step challenge. You’ll aim for a 9% profit in Stage 1 and a 6% profit in Stage 2. A key advantage here is the fixed 9% static drawdown, which provides a stable and predictable risk limit throughout the process.

| Account Size | Price | Stage 1 Target (9%) | Stage 2 Target (6%) | Max Drawdown (9% Static) | Daily Loss Limit (3%) |

|---|---|---|---|---|---|

| $5,000 | $60 | $450 | $300 | $450 | $150 |

| $10,000 | $120 | $900 | $600 | $900 | $300 |

| $20,000 | $200 | $1,800 | $1,200 | $1,800 | $600 |

| $50,000 | $390 | $4,500 | $3,000 | $4,500 | $1,500 |

2.2. Endurance Mode Challenge

The Endurance Mode is a core challenge within PipFarm’s ecosystem, designed for traders with a long-term mindset. It focuses on consistency and disciplined performance, making it suitable for those aiming to build a reliable track record and unlock structured scaling opportunities over time.

This mode introduces a subtle layer of consistency. While the main goal remains reaching the profit target, traders must also achieve a minimum number of profitable days, promoting a more sustainable trading approach.

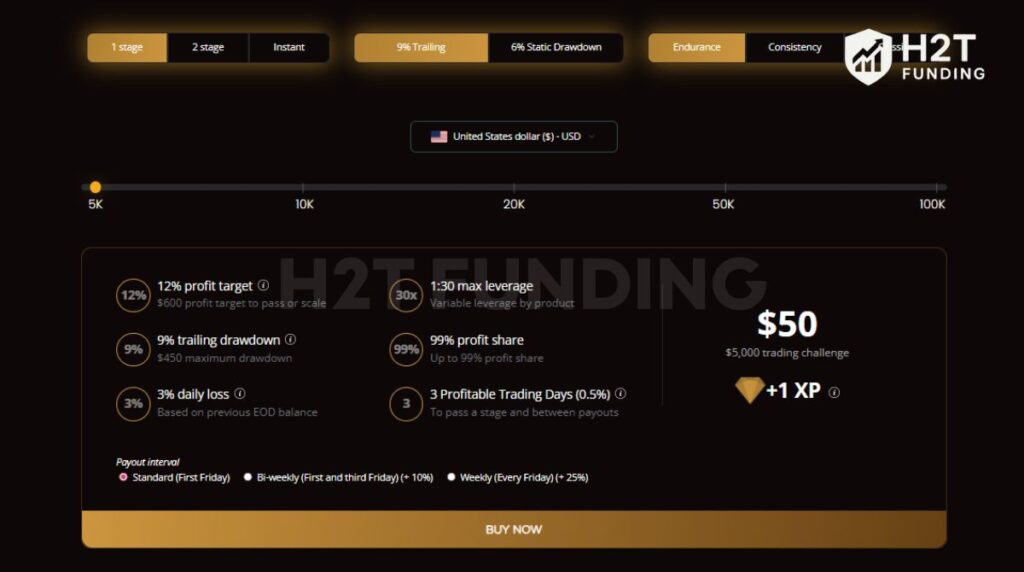

2.1.1. One-step

The one-step Endurance challenge is a single-phase evaluation tailored for patient traders. The objective is to achieve a 12% profit target while adhering to a new rule: you must have at least 3 profitable trading days, with each of those days closing at a minimum profit of 0.5% of the starting balance.

Just like the Classic Mode, you have the crucial choice between a 6% static drawdown or a 9% trailing drawdown. This combination of rules aims to identify traders who can be consistently profitable over time.

| Account Size | Price | Profit Target (12%) | Max Drawdown (Static 6% / Trailing 9%) | Daily Loss Limit (3%) |

|---|---|---|---|---|

| $5,000 | $50 | $600 | $300 / $450 | $150 |

| $10,000 | $100 | $1,200 | $600 / $900 | $300 |

| $20,000 | $175 | $2,400 | $1,200 / $1,800 | $600 |

| $50,000 | $325 | $6,000 | $3,000 / $4,500 | $1,500 |

| $100,000 | $490 | $12,000 | $6,000 / $9,000 | $3,000 |

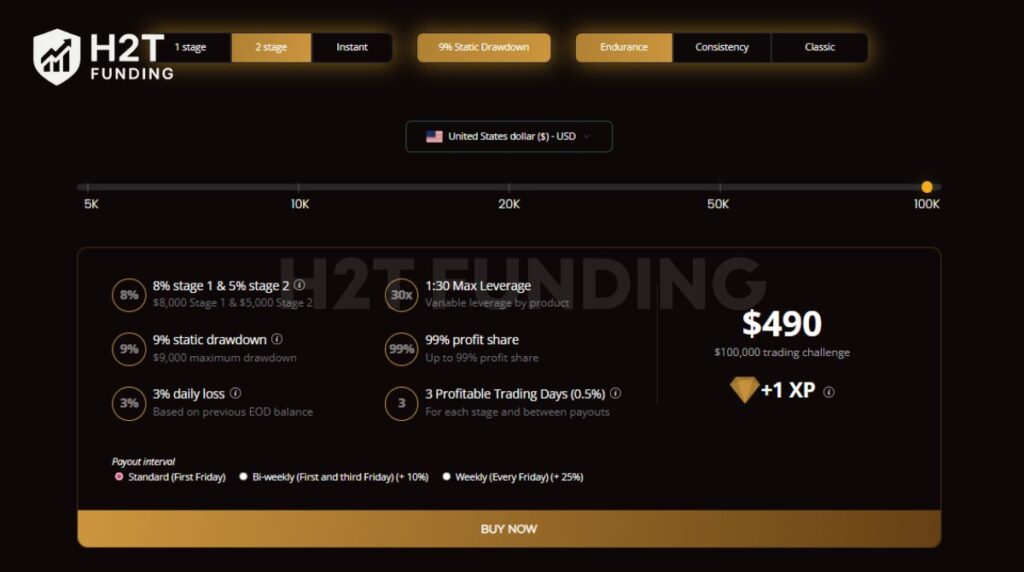

2.1.2. Two-step

The two-step version of the Endurance Mode offers a more structured path for long-term traders. By splitting the evaluation into two phases, it lowers the profit target for each stage, making the goals feel more attainable while still requiring consistent performance.

The profit targets are set at 8% for Stage 1 and 5% for Stage 2. Crucially, the requirement of having at least 3 profitable trading days (of at least 0.5% profit) applies to both stages. This model exclusively uses a 9% static drawdown, providing a fixed and clear risk boundary from the start.

| Account Size | Price | Stage 1 Target (8%) | Stage 2 Target (5%) | Max Drawdown (9% Static) | Daily Loss Limit(3%) |

|---|---|---|---|---|---|

| $5,000 | $50 | $400 | $250 | $450 | $150 |

| $10,000 | $100 | $800 | $500 | $900 | $300 |

| $20,000 | $175 | $1,600 | $1,000 | $1,800 | $600 |

| $50,000 | $325 | $4,000 | $2,500 | $4,500 | $1,500 |

| $100,000 | $490 | $8,000 | $5,000 | $9,000 | $3,000 |

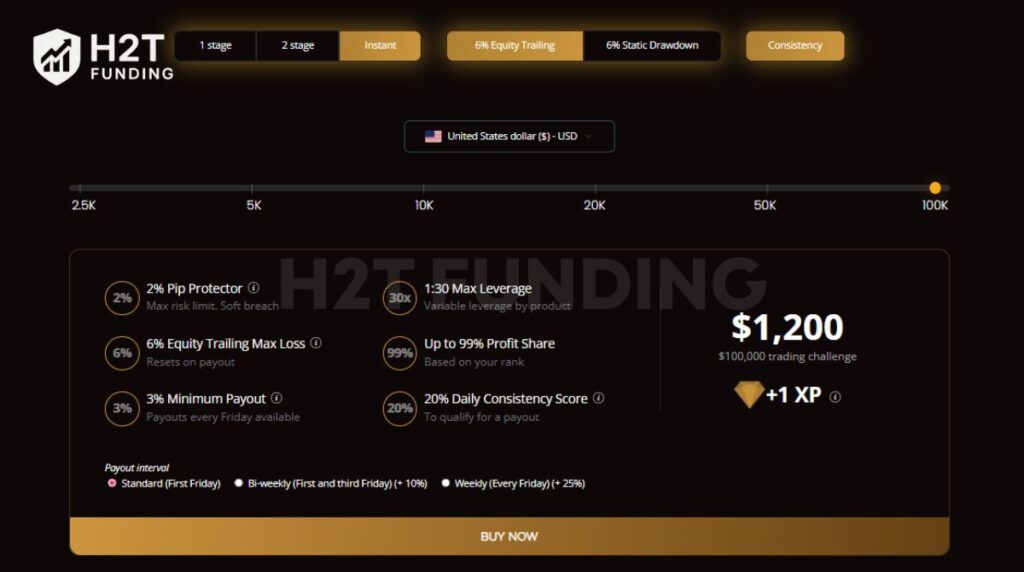

2.3. Consistency Mode Challenge (Instant funding)

The Consistency Mode is PipFarm’s direct funding model, designed for traders who can demonstrate balance and consistent performance from day one. Unlike challenges that require evaluation fees, this mode has no evaluation phase; you pay a higher upfront fee for immediate access to a funded account.

Success in this mode is not about hitting a large, one-time profit. Instead, it revolves around steady risk management and consistent gains. This model introduces specific rules like a Pip Protector and a Daily Consistency Score to ensure a disciplined trading approach, making it ideal for methodical traders.

The rules for this instant funding account are unique:

- No Profit Target: You begin trading for profit immediately.

- 6% Max Loss: This is the hard-stop rule. You can choose between a 6% Equity Trailing or 6% Static drawdown.

- 2% Pip Protector: This acts as a soft breach or maximum risk limit to encourage controlled position sizing.

- 20% Daily Consistency Score: To qualify for a payout, no single trading day can account for more than 20% of your total profits for that period.

- 3% Minimum Payout: You must reach at least a 3% gain to be eligible to request a payout.

Here is a breakdown of the Consistency Mode parameters:

| Account Size | Price | Max Loss (6%) | Pip Protector (2%) | Minimum Payout (3%) |

|---|---|---|---|---|

| $2,500 | $50 | $150 | $50 | $75 |

| $5,000 | $100 | $300 | $100 | $150 |

| $10,000 | $175 | $600 | $200 | $300 |

| $20,000 | $300 | $1,200 | $400 | $600 |

| $50,000 | $600 | $3,000 | $1,000 | $1,500 |

| $100,000 | $1,200 | $6,000 | $2,000 | $3,000 |

Verdict on PipFarm’s funding program

PipFarm’s greatest strength is its genuine commitment to trader flexibility. Offering three distinct modes with options like static vs. trailing drawdown is a sophisticated approach that respects different trading styles, moving far beyond the industry’s common one-size-fits-all model.

This structure puts the onus on the trader to choose wisely. While the high profit targets are demanding and the consistency rules are strict, they create a clear framework for success. Overall, PipFarm has built an intelligent program that empowers self-aware traders with the tools to get funded on their own terms.

3. PipFarm trading rules

Understanding a prop firm’s rules is non-negotiable, and PipFarm provides an exceptionally detailed framework. Their policies are designed to find genuine trading skill while strictly prohibiting any form of system exploitation. A thorough read of their Help Centre is essential before placing any trades.

3.1. Core risk management rules

These are the fundamental parameters that govern your trading on all accounts. Breaching these will result in failing the challenge or losing your funded account.

- Max daily loss: A dynamic 3% limit calculated from the previous end-of-day balance. This value changes daily.

- Static max loss: A fixed percentage of your initial balance (6% for one-step, 9% for two-step programs).

- Consistency score: For specific modes, this ensures no single day’s profit dominates the total, with required scores between 20-40%.

- Inactivity rule: You must place at least one trade every 28 days to keep your account active.

3.2. The pip protector system (Soft breach)

The Pip Protector is a unique, automated risk system for funded accounts that acts as a soft breach to prevent catastrophic losses. It provides warnings and escalating consequences rather than immediate termination.

It monitors two key metrics:

- Max Open Risk: Automatically closes all trades if total unrealised loss hits 3% (2% on Instant) of the starting balance.

- Max Risk per Trade Idea: Limits the total loss on a single trade idea (overlapping trades on the same symbol within one hour) to 3% (2% on Instant).

The consequences for breaching the Pip Protector escalate:

- First Breach: Your next payout cycle is skipped, and you face stricter requirements to qualify again.

- Second Breach: Your profit share is permanently reduced by 50% for that account.

- Third Breach: This is considered a hard breach, and the account is closed.

3.3. Allowed trading practices

PipFarm allows a broad range of legitimate strategies, giving skilled traders the freedom to operate effectively. The key is that all trading decisions must originate from you.

- Manual Trading: Standard strategies like scalping, swing trading, and news trading are permitted, as long as they are executed manually and do not fall into the HFT category.

- Your Own EAs/Bots: Using your own automated strategies or customised commercial bots is allowed.

- Copy Trading (Your Own Accounts): Under a highly flexible policy, you are permitted to replicate trades between your own accounts and PipFarm. This applies to transfers involving a personal brokerage account, accounts with other prop firms, or even across multiple PipFarm accounts under your ownership.

3.4. Prohibited trading practices

Beyond the standard risk parameters, PipFarm enforces strict account restrictions and has a zero-tolerance policy for what it deems exploitative behavior. Violating these rules typically results in immediate account termination.

- Strategy-Based Exploitation:

- High-Frequency Trading (HFT): Any strategy that executes hundreds of trades in a short period to exploit platform inefficiencies is banned.

- The Gap Rule: You cannot profit from price gaps. Any profit made during a market gap (larger than 0.2%) will be deducted.

- Arbitrage: Latency, triangular, or any other form of arbitrage is strictly forbidden.

- Account & Risk Manipulation:

- Hedging Across Accounts: You cannot open opposing positions on the same or highly correlated assets (e.g., long XAUUSD on one account, short XAUUSD on another) to bypass risk rules. This applies even if the other account is with a different firm.

- The 90% Profit Rule: A new rule stating that no single trade can account for more than 90% of your total profit for a challenge or payout period.

- Group Trading: Using highly correlated strategies with other traders to pool risk is not allowed.

- Third-Party & Unauthorised Services:

- Account Passing/Management: Paying someone to pass your challenge or manage your funded account is strictly prohibited.

- Copying Others: You cannot use your PipFarm account to copy trades from another trader or a third-party signal provider.

- Shared Commercial EAs: Using off-the-shelf, popular automated strategies used by many other traders is not permitted.

Verdict on PipFarm’s trading rules

PipFarm’s rulebook is exceptionally granular, offering a level of transparency that is commendable. The Pip Protector system is a standout feature, acting as a trader-centric safety net that provides a chance to correct mistakes before an account is lost.

That transparency also brings strict enforcement. Rules like the Max Risk per Trade Idea or the Gap Rule are nuanced. They can be violated by accident without a clear understanding of the prop firm rules in real trading conditions. It’s clear PipFarm is built for diligent, disciplined traders who are willing to study and master the rules of engagement.

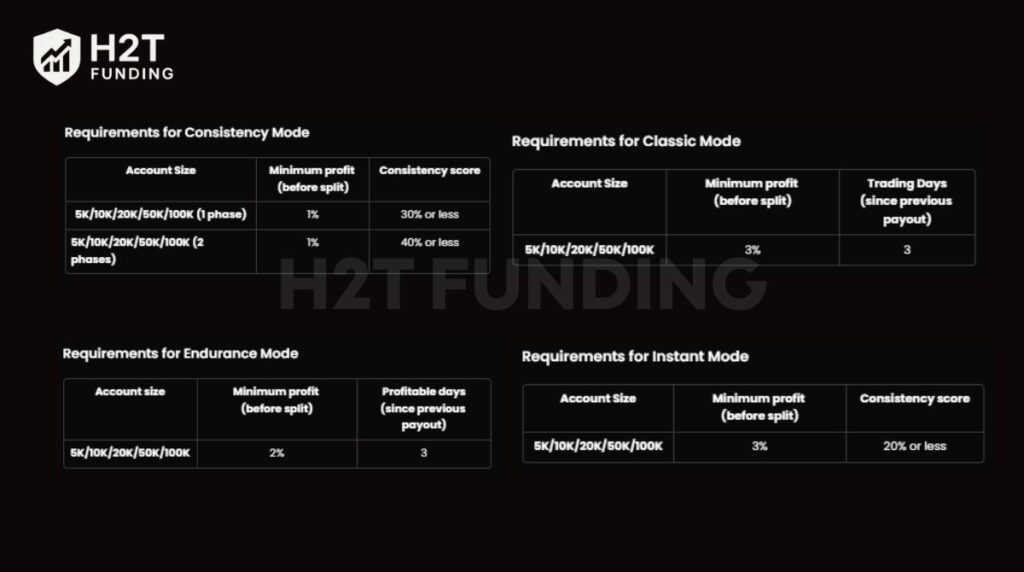

4. PipFarm payout structure

PipFarm has implemented a highly structured payout system for its simulated accounts, built for reliability. By default, payouts are automatically processed on the first Friday of every month. Traders can upgrade this schedule by paying an extra fee during their challenge purchase for bi-weekly or even weekly payouts.

To qualify for a payout, traders must meet specific performance requirements, which vary by account type:

- Classic Mode: 3% minimum profit and 3 trading days since the last payout.

- Endurance Mode: 2% minimum profit and 3 profitable days since the last payout.

- Consistency Mode: 1% minimum profit and a specific consistency score.

A significant new rule is the $5,000 Payout Cap on weekly payouts. However, this cap is removed if your Consistency Score is 30% or lower, rewarding disciplined traders. It is important to note that Instant Mode accounts have a hard cap of $5,000 that cannot be removed.

The system is backed by a $1,000 Payout Promise for any delays and a trader-centric Payout Protection policy. This allows you to get paid for profits earned even if you later breach an account. Payments are processed via Rise or Skrill (with a $500 minimum), and USDT. Traders can also convert profits into gift vouchers for reinvestment.

Verdict on PipFarm’s Payout Structure

This highly detailed payout system is a clear indicator of PipFarm’s commitment to operational transparency and risk management. The scheduled payouts and clear eligibility criteria remove ambiguity, while the $1,000 guarantee provides a strong layer of trust.

The Payout Cap is an interesting mechanism that heavily incentivises consistency over explosive, single-trade profits. While potentially limiting for some, the ability to remove the cap by maintaining a good consistency score is a smart feature that rewards disciplined traders.

5. Scaling plan of PipFarm

The firm offers two scaling models. Simple Scaling for the Classic Mode allows traders to scale after four payouts or hitting a 12% target. Smart Scaling for Endurance and Consistency modes lets traders scale once their cumulative profit (including withdrawals) hits 12%.

However, the scaling increment is just one of many Power-ups earned by ranking up. This progression fundamentally transforms your trading terms:

- Profit Share: Increases from a standard 70% at Rank 0 to an incredible 99% at Rank 6.

- Commissions: Drop from $6 per lot to just $1, and eventually to $0 at the highest rank.

- Risk Parameters: The Daily Loss limit increases from 3% to 4%, and you gain an extra 1% to your Max Loss limit at higher ranks.

- Leverage: Upgrades from 1:30 to a more powerful 1:50.

Also, PipFarm’s approach to account growth is built around its unique Experience Program (XP Program). This system rewards traders with points for key milestones, creating a clear career path where consistent success unlocks progressively better trading conditions.

Verdict on PipFarm’s Scaling Plan

This XP-based system is a powerful and intelligent model for trader development. It goes far beyond simple account scaling, creating a tangible and highly motivating incentive structure that directly links a trader’s loyalty and success to dramatically improved trading conditions.

The Smart Scaling model is a standout, pro-trader feature that rewards cumulative success without penalising withdrawals. This entire ecosystem is clearly designed to attract and retain career traders, making it clear that the most significant rewards are reserved for those who demonstrate true long-term consistency.

6. Spreads & commission fees

PipFarm provides superb trading conditions, offering raw spreads starting from as low as 0.0 pips. The standard commission is set at a competitive $6 per round-trip lot, which is applied to forex and precious metals trades.

For other instruments, including cryptocurrencies, indices, and energies, the trading costs are already factored into the spread. This means traders will not see a separate commission charge for these assets, simplifying the cost structure.

The most compelling feature is the dynamic commission structure tied directly to the XP Program. As you advance in rank, your costs are drastically reduced.

- Rank 0: $6 per lot

- Ranks 1-2: $3 per lot

- Ranks 3-5: $1 per lot

- Rank 6: $0 per lot (Commission-free)

Verdict on PipFarm’s Spreads & Commissions

PipFarm’s baseline trading costs are already highly competitive. A $6 commission paired with the potential for raw spreads is a strong, industry-standard offering that provides a solid foundation for profitability.

The true genius of this model, however, is rewarding loyalty and success through the XP Program. This sliding scale is a powerful incentive for career traders, directly linking consistent performance to progressively lower operating costs.

7. PipFarm trading platform

PipFarm has made a clear and decisive choice for its trading infrastructure: it operates exclusively on the cTrader platform. This decision signals a commitment to a professional-grade trading environment, renowned for its clean interface and a powerful suite of built-in trading tools.

Key features that set the PipFarm cTrader experience apart include:

- Visual trade management: Traders can drag and drop orders, take-profits, and stop-losses directly on the chart.

- Advanced technical analysis: The platform offers over 70 technical indicators and supreme price action capabilities.

- Intuitive risk calculation: Built-in tools allow for easy calculation of position size and risk-to-reward ratios before entry.

- Robust automated trading: A sophisticated environment for developing, backtesting, and executing algorithmic strategies.

- In-depth performance analysis: Native tools provide detailed statistical and visual insights into your trading habits.

The platform is available across all major operating systems (Windows, Mac, Web, Android & iOS). PipFarm provides a simulated trading environment with market data sourced directly from TopFX, and access is managed through a universal cTrader ID.

Verdict on PipFarm’s trading platform

Choosing to be a cTrader-exclusive firm is a bold statement. It signals a focus on attracting serious traders who value advanced technology and a superior user experience over the more common MetaTrader platforms.

This decision will undoubtedly alienate a large segment of traders heavily invested in the MT4/MT5 ecosystem. However, PipFarm smartly mitigates this by explicitly allowing the use of trade copiers.

This shows a deep understanding of traders’ needs, providing a practical workaround for those who wish to use their existing MT4-based EAs while still benefiting from PipFarm’s funding. It is a strategic choice that defines their target audience.

8. Trading instruments & leverage

PipFarm offers a well-curated selection of tradable assets focused on the most liquid and popular global markets. This ensures traders have access to quality instruments with competitive conditions across five main categories.

The available assets include:

- Forex: A comprehensive list of major, minor, and some exotic currency pairs like EURUSD and USDZAR.

- Metals: Key precious metals including Gold (XAUUSD) and Silver (XAGUSD).

- Indices: Major global stock indices such as the US 30, US 100, and Germany 40.

- Cryptocurrencies: A selection of top crypto assets, including BTCUSD and ETHUSD.

- Oil: Core energy products like WTI Oil, Brent Oil, and Natural Gas.

The maximum leverage is directly tied to a trader’s progress within the XP Program, creating a system that rewards experience. The starting leverage is a responsible 1:30 for all traders up to Rank 2. Upon reaching Rank 3, this is permanently upgraded to a more powerful 1:50.

Verdict on PipFarm’s instruments & leverage

In our expert opinion, PipFarm’s asset selection strikes a smart balance, focusing on quality over sheer quantity. While they don’t offer niche stocks, their coverage of the most essential Forex, Indices, and Commodity markets is more than sufficient for the vast majority of trading strategies.

The dynamic leverage model is an intelligent feature that aligns perfectly with their career-progression philosophy. It provides a safe, standard leverage for new traders while offering a tangible and meaningful reward for those who demonstrate long-term skill and consistency.

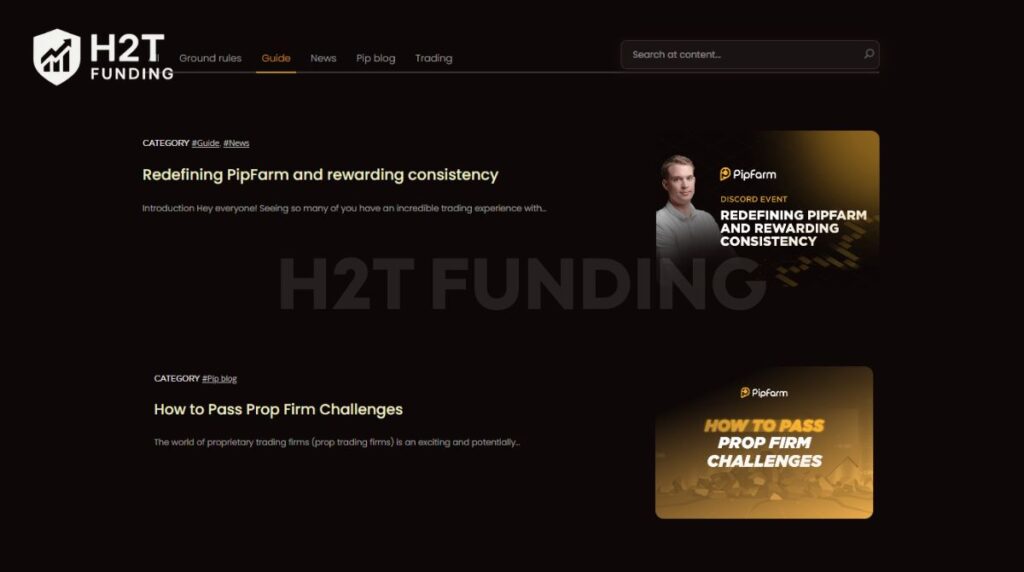

9. Education & resource

PipFarm’s resources are primarily focused on clarifying its own internal rules and processes. The Help Centre is exceptionally detailed, with numerous guides on the drawdown rules, scaling programs, and payout procedures. This ensures traders have all the information needed to operate successfully within the PipFarm ecosystem.

Beyond these platform-specific guides, PipFarm maintains a company blog. The content here is broader, covering general topics relevant to the prop firm industry, such as How to Pass Prop Firm Challenges and comparisons of different funding models.

While these articles are useful, PipFarm does not offer a dedicated educational academy, webinars, or in-depth market analysis. The current resources are more operational than instructional in nature.

Verdict on PipFarm’s Education & Resources

PipFarm excels at creating transparent operational documentation. Their exhaustive guides on their own rules are top-tier and a critical resource for any trader considering the platform. This focus on clarity is a significant strength. However, the firm’s educational content on broader trading strategies and market analysis is noticeably underdeveloped.

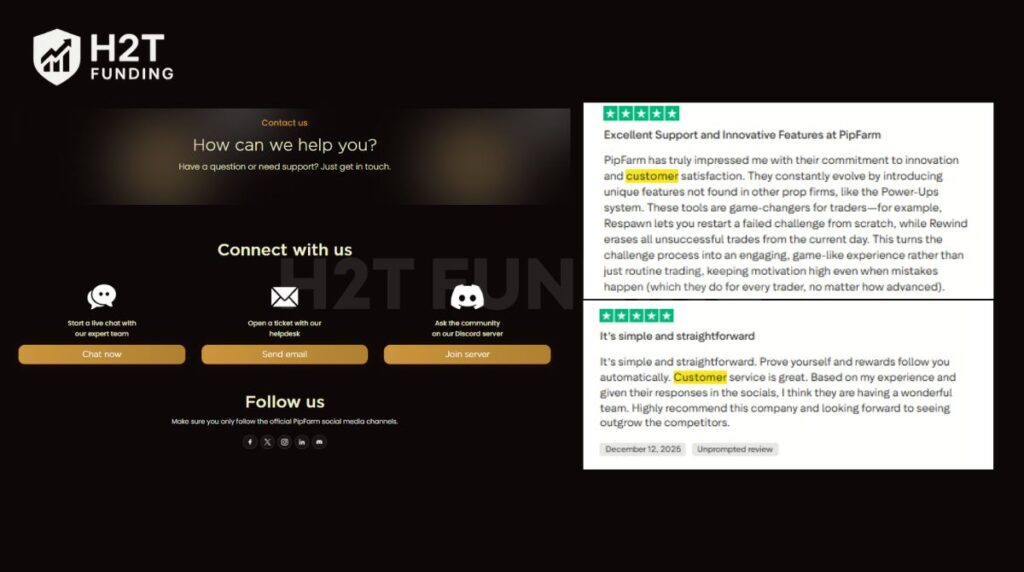

10. PipFarm customer support

PipFarm offers a modern, multi-channel approach to customer support, enabling traders to receive assistance through their preferred method. They offer three primary points of contact for inquiries and issue resolution.

These channels include:

- Live Chat: For immediate, real-time conversations with their expert support team.

- Email Helpdesk: For opening a formal ticket for more detailed or less urgent issues.

- Discord Server: A community hub for asking questions, interacting with staff and other traders, and participating in events like a PipFarm competition.

Recent user review frequently praises the quality of the customer service. That often highlights the team’s responsiveness and helpfulness, suggesting a strong internal focus on providing a positive and supportive trader experience.

Verdict on PipFarm’s Customer Support

Offering three distinct support channels: live, ticket-based, and community, is a comprehensive and effective strategy. The inclusion of an active Discord server is particularly valuable, as it fosters transparency and allows traders to find answers within the community.

While every firm faces challenges, the presence of specific, positive feedback on its support team is a strong indicator of its success. It suggests that PipFarm has invested in a capable and accessible team dedicated to resolving trader issues, which is a crucial element for building long-term trust.

11. PipFarm review with real trader feedback: PipFarm Trustpilot and PipFarm Reddit

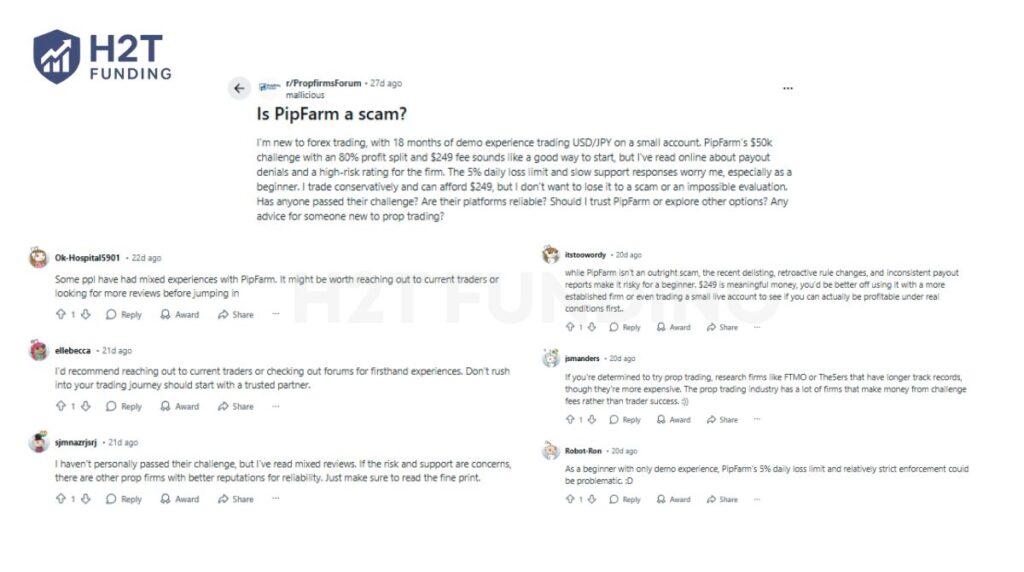

A firm’s marketing promises must be weighed against the real-world experiences of its users. A deep dive into community platforms like Trustpilot and Reddit reveals a highly polarised perception of PipFarm, making it essential for prospective traders to consider all viewpoints.

On the one hand, there is a significant volume of positive feedback. Many traders praise the firm’s innovative features, straightforward challenge rules, and the active support team on Discord. These reviews often describe PipFarm as one of the best new options for traders.

However, this positive sentiment is countered by a substantial number of serious and concerning negative reviews. These are not minor complaints; traders report major issues such as abrupt account terminations, payout refusals with vague explanations, and a lack of transparency when disputes arise.

This pattern of mixed experiences is mirrored on Reddit. In discussion threads, some traders share success stories of passing challenges and receiving payouts. Others, however, repeat Trustpilot complaints, cautioning new traders about payout denials and inconsistent rule enforcement.

While the positive reviews show the model can and does work for some, the recurring themes in the negative reviews, around payouts and support during disputes, are significant red flags. This feedback highlights the importance of thorough due diligence and understanding the potential risks involved.

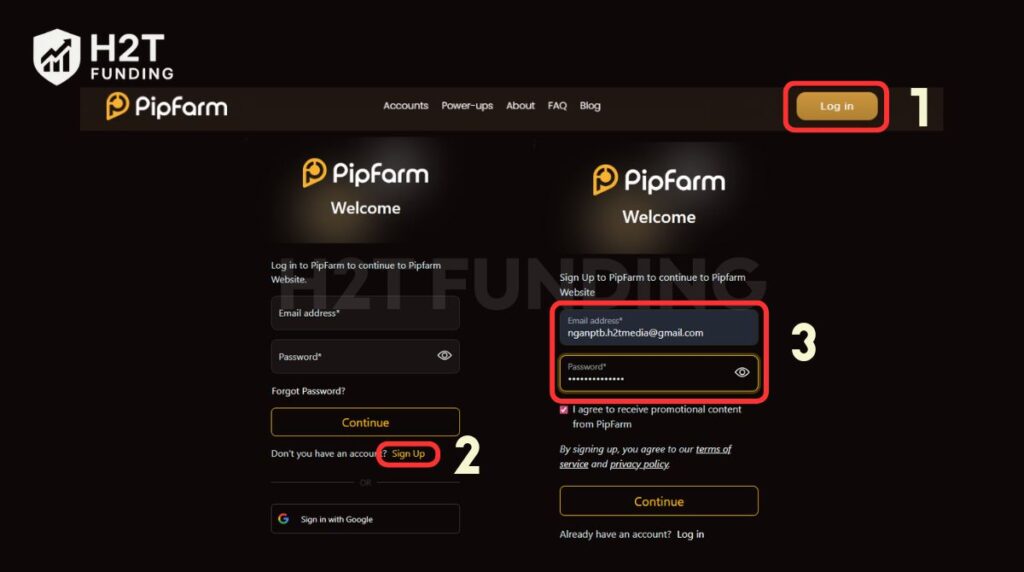

12. How to start with PipFarm

Getting started with PipFarm is a straightforward process that can be completed in a few simple steps. The entire journey, from registration to checkout, is designed to be smooth and intuitive.

Here is a quick overview of the process:

- Step 1: Create your pipfarm account

- Step 2: Choose your trading challenge

- Step 3: Complete the checkout process

- Step 4: Start trading

Let’s walk through each of these steps in more detail.

12.1. Step 1: Create your account

First, navigate to the PipFarm website and click on the Log in -> Sign Up button. You will be prompted to enter your email address and create a secure password. You can also choose the convenient option to sign up using your Google account.

12.2. Step 2: Choose your trading challenge

Once your account is created, you’ll be taken to the challenge selection page. At this stage, you will use the interactive dashboard to configure a funding program tailored to your trading style, selecting the mode, account size, and drawdown structure.

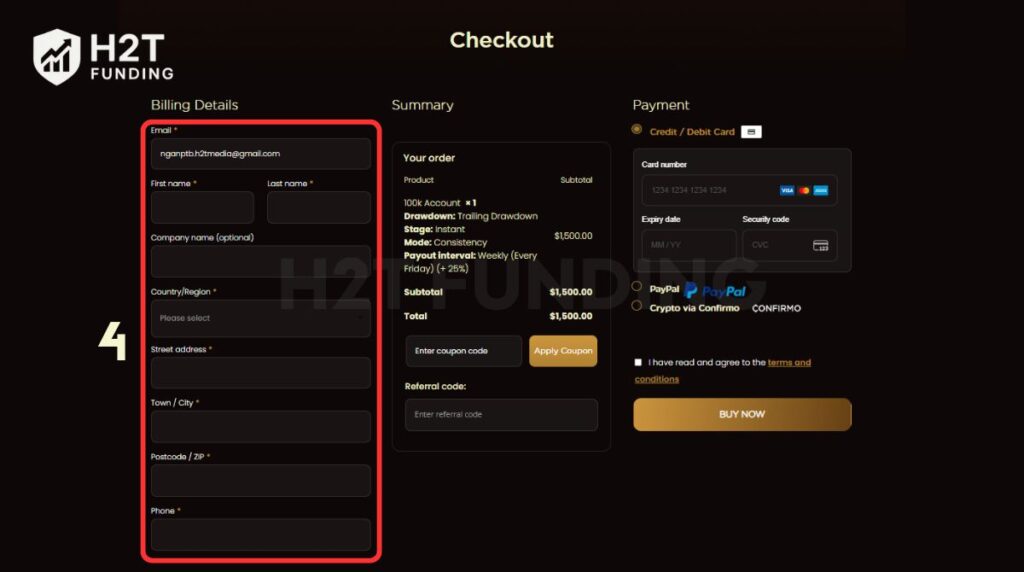

12.3. Step 3: Complete the checkout

After configuring your ideal challenge, proceed to the checkout page. Here, you will need to fill in your billing details and choose your preferred payment method. PipFarm accepts major Credit/Debit Cards, PayPal, and Crypto via Confirmo.

12.4. Step 4: Start trading

Once your payment is successfully processed, your new cTrader account credentials and access to the PipFarm dashboard will be delivered almost instantly. From there, you can download the cTrader platform and begin your evaluation challenge.

13. Who is PipFarm best for?

PipFarm’s demanding structure and highly specialized rules mean it is not a universal solution for every trader. Instead, its ecosystem is deliberately engineered to attract and reward a specific set of professional traits and strategies, making it a powerful partner for those who fit its unique mold.

- Career-oriented professionals: The ideal candidate is a trader with a long-term vision. The innovative XP Program, which unlocks better terms with consistent success, is built specifically for disciplined individuals who value a career progression path over a quick, one-off challenge.

- Native cTrader users: Traders who are already proficient with cTrader will find PipFarm to be a perfect fit. The firm’s exclusive focus on this advanced platform allows these users to immediately leverage its powerful tools without the need for workarounds or trade copiers.

- Low-risk and methodical traders: The platform is exceptionally well-suited for those who prioritize disciplined risk management. Features like the optional Static Drawdown, the Pip Protector system, and the long challenge time limits all reward a cautious and steady approach to the markets.

- Custom EA traders: PipFarm is a strong choice for algorithmic traders, but only if they use their own custom-built or heavily modified EAs. The firm’s rules against off-the-shelf bots, combined with cTrader’s powerful API, make it a haven for developers and quants.

In summary, PipFarm has created a demanding but potentially lucrative environment for a specific type of professional. While it is an excellent choice for the profiles listed above, it is not recommended for beginners due to its complexity. It is also unsuitable for news traders because of the strict Gap Rule.

14. Restricted countries by PipFarm

Like all compliant financial technology companies, PipFarm adheres to international regulations and has a list of jurisdictions from which it cannot accept clients. It is crucial to ensure you are not a resident of a restricted country before purchasing a challenge.

PipFarm is currently unable to provide services to traders residing in the following countries:

- Afghanistan

- Central African Republic

- Congo Republic

- Crimea

- Democratic Republic of Congo

- Iran

- Libya

- North Korea

- Somalia

- South Sudan

- Sudan

- Syria

- Yemen

This list is based on current global sanctions and regulatory requirements. Traders from any country not mentioned above are generally eligible to participate in PipFarm’s funding programs, subject to successful identity verification.

15. Compare PipFarm vs other prop firms

No prop firm exists in a vacuum. To truly understand PipFarm’s value, it’s essential to see how its key features stack up against other trading competition firms in the industry. This comparison provides a clear overview of where PipFarm excels and where other firms might offer a different advantage.

We will compare PipFarm against three notable competitors: Top One Trader, Finotive Funding, and ThinkCapital. Each of these firms has its own unique strengths, providing a good benchmark for a balanced evaluation.

| Feature | PipFarm | Top One Trader | Finotive Funding | ThinkCapital |

|---|---|---|---|---|

| Max Profit Split | Up to 99% (via XP Program) | Up to 100% | Up to 100% | 90% |

| Evaluation Models | 1-step, 2-step, Instant | 1-step, 2-step, Instant | 1-step, 2-step, Instant | 1-step, 2-step, 3-step |

| Time Limit | 365 days | No limit | No limit | No limit |

| Trading Platform | cTrader only | MT5, cTrader, TradingView, Match-Trader, TradeLocker | MT5 | MT5, ThinkTrader |

| Unique Feature | XP Program & Power-ups | No-limit profit target | In-house broker & tech | Backed by a regulated broker |

This comparison makes it clear that the best firm depends entirely on a trader’s individual needs and preferences.

- PipFarm is the ideal choice for a career-oriented cTrader user. Its XP Program is unmatched for rewarding long-term loyalty and consistent performance with progressively better trading conditions.

- Top One Trader appeals to traders who want maximum flexibility and platform choice. With no time limits and a wide array of platforms, including TradingView, it’s built for those who want fewer restrictions.

- Finotive Funding is a strong option for traders who prioritise fast execution and in-house technology. Their integrated broker setup can be a significant advantage for certain strategies.

- ThinkCapital will attract traders who place the highest value on security and regulatory backing. Being supported by a regulated broker provides an extra layer of trust and confidence.

16. Is PipFarm legit?

Yes, the PipFarm Fund is a legitimate prop trading firm. It is a registered company with a public-facing CEO, James Glyde, and offers a structured program with clear, albeit strict, rules. The firm consistently provides proof of payouts to successful traders, demonstrating that its business model is functional and pays traders who adhere to its terms.

However, being legitimate does not mean it is without risk or controversy. A significant volume of user complaints regarding payout denials and strict rule enforcement is a serious concern. These issues suggest that while the firm is not a scam, its operational processes can be unforgiving.

The core issue appears to be one of extremely rigorous rule interpretation rather than fraud. The firm functions and pays out, but traders must be exceptionally diligent to avoid breaching the complex rules, as the consequences can be severe and immediate.

17. FAQs

PipFarm offers three distinct funding models to suit different trading styles. The Classic Mode offers maximum flexibility with no consistency rules. Endurance Mode is designed for long-term traders focused on scaling, while Consistency Mode provides instant funding with stricter risk management.

Yes, but they are extremely generous. All evaluation challenges, whether one-step or two-step, have a 365-day (one-year) time limit to reach the profit target. Once you are funded, there are no time limits to generate profit.

Yes, but with important restrictions. You are allowed to use your own custom-built expert advisors or bots. However, using popular, off-the-shelf commercial bots that are shared by many other traders is a prohibited practice.

The XP Program is PipFarm’s loyalty and progression system. You earn points by hitting key milestones. These points increase your Rank and unlock permanent benefits, including higher profit shares, lower commissions, greater leverage, and more generous drawdown limits.

Hedging is only allowed within a single account. It is strictly prohibited to hedge positions across multiple accounts. Whether they are two PipFarm accounts or a PipFarm account and another firm’s account, this is considered a form of prohibited risk manipulation.

Payout Protection is a unique, trader-friendly rule. It allows you to keep your earned profit share even after a funded account breach, provided all payout requirements, like minimum profit and trading days, were fulfilled beforehand.

PipFarm is not a one-size-fits-all firm and may be a poor choice for certain traders. Those heavily reliant on the MT4/MT5 ecosystem who are unwilling to use a trade copier should look elsewhere. Additionally, new traders seeking educational resources or those who prefer a simple rulebook may find the platform’s highly detailed and unforgiving policies to be a significant challenge.

PipFarm offers three distinct funding models. Classic Mode provides maximum flexibility, Endurance Mode is for long-term traders focused on scaling, and Consistency Mode offers instant funding with stricter risk management rules.

You choose a challenge and pay a one-time fee. You then trade in a simulated environment to meet specific profit targets without breaking drawdown rules. If you succeed, you receive a funded account and can start earning a share of the profits you generate.

The cost varies depending on the account size and challenge type. Audition fees range from approximately $40 for a $2.5K account to over $1,200 for the largest instant funding accounts.

Yes, this is one of the most common complaints from users. While PipFarm provides a detailed rulebook, many traders report having their accounts terminated abruptly for what they believe are minor or unclear violations. The firm’s enforcement is known to be extremely strict.

There are no official statistics, but community feedback is highly polarized. While many traders post proof of successful payouts, a significant number also report payout denials. The success rate appears to be heavily dependent on a trader’s ability to meticulously follow every single rule without exception.

Based on user reports, the most common reasons for payout denial or account closure are flags for HFT-like activity, even when trades are placed manually. Other frequent issues include unintentionally breaching the Max Risk per Trade Idea rule and violating hedging rules across multiple accounts.

The XP Program is PipFarm’s loyalty and progression system. By hitting key milestones, you earn points to increase your Rank. This unlocks permanent benefits, including higher profit shares (up to 99%), lower commissions, and more generous drawdown limits.

The main pros are its innovative XP Program, flexible challenge designs, and high-end cTrader platform. The biggest cons are the extremely strict rule enforcement, the high volume of user complaints about account closures, and the platform being limited to cTrader only.

Yes, depending on the payout method. Withdrawals processed via RiseWorks for amounts under $500 may incur a $25 processing fee. Payouts made via USDT are subject to standard network fees. It is important to review the latest fee structure directly on the dashboard before submitting a payout request.

PipFarm is not a good fit for beginners, news traders (due to the Gap Rule), or those who prefer a simple rulebook. Traders heavily reliant on the MT4/MT5 ecosystem who are unwilling to use a trade copier should also consider other options.

Based on user reports and the firm’s strict rules, the most common reasons are violations that traders may not realize they are committing. These include being flagged for HFT-like activity (even if manual), unintentionally breaching the Max Risk per Trade Idea rule, or violating the nuanced hedging rules across multiple accounts.

18. Conclusion

This PipFarm review set out to answer a key question: Is the 99% profit split real? The answer is yes, but it is not a starting perk. It is the ultimate reward at the pinnacle of their XP Program, reserved for the most consistent and loyal traders who prove their skill over a long period.

PipFarm presents a compelling vision with its innovative features, credible leadership, and a clear path for career growth. However, this potential is shadowed by its unforgiving rule enforcement and the concerning volume of negative community feedback regarding payouts.

Ultimately, PipFarm is not for the casual trader. It is a highly specialised platform built for the disciplined, cTrader-native professional whose trading ambitions align with mastering a complex rulebook in exchange for exceptional long-term rewards.

Choosing the right prop firm is a crucial step in your trading career, and PipFarm is just one of many excellent options. To explore and compare other leading firms, be sure to visit our complete Prop Firm Reviews category for more in-depth analysis from the H2T Funding team.