4% OFF Sale

4% off + free account of the same size if reaching payout on all challenges (excludes 100K 2-Step challenge)

In the fast-paced world of prop trading, Maven Trading has quickly built a reputation for its flexible evaluation models and scalable funding options.

Traders can choose from four challenge account types and earn up to an 80% profit split. They can grow their funded accounts from $2,000 to $100,000, with the potential to scale to $1,000,000 through consistent results.

Combined with transparent drawdown rules, refundable fees, and fast payouts, Maven stands out as one of the more balanced and trader-oriented firms today.

In this Maven prop firm review, I share what really stood out during my testing, including funding rules, trading platforms, and payouts. It also examines whether Maven truly delivers on its promise to support serious traders.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Maven Prop Firm websites before purchasing any challenge.

1. Our take on Maven Trading

Founded in 2022 in the United Kingdom by CEO Jon Alexander, Maven Trading has quickly grown into one of the most recognized names in the prop trading space. The firm’s goal is simple: to create a transparent, fair, and growth-focused environment for traders.

It offers access to more than 75 instruments covering forex pairs, cryptocurrency trading, metals, energies, indices, and agricultural commodities. With a strong global community, Maven prioritizes professional trading standards and long-term skill development over short-term gains.

During my testing, what stood out most was the firm’s structured yet trader-friendly approach. Some special features are worth highlighting. One is the Buyback option, which lets you regain access to a funded account without restarting the entire challenge.

There are also no minimum trading days, giving traders freedom to pass phases at their own pace. However, Martingale, All-in, and excessive scalping are strictly prohibited by this firm, meaning it strongly focuses on risk management and account protection.

| Pros | Cons |

|---|---|

| Entry fees start from just $15, making it accessible for new traders. | Spreads are slightly wider than those of top-tier brokers. |

| Offers multiple evaluation 1-Step, 2-Step, and 3-Step Challenges with an 80% profit share. | Liquidity providers and pricing structure are not publicly disclosed. |

| Large and active trading community with over 50,000 members. | Payouts are capped at $10,000 per two cycles. |

| No minimum trading days, pass as fast as your strategy allows. | Limited customer service contact options. |

| Scalable funding up to $1,000,000 with performance growth. | Lacks MT4/MT5 support; just uses Match Trader alternatives. |

| No swap fees for positions held overnight. | Strict monitoring of IP usage may frustrate multi-device traders. |

Overall, Maven Trading delivers a balanced mix of accessibility and professionalism. While spreads could be tighter, the firm offers a refundable fee and a scaling plan up to $1,000,000. Its responsive platform support also makes it a solid choice for traders seeking both structure and flexibility in their funding journey.

2. Funding program Maven Trading

Maven Trading offers one of the most diverse funding setups in the prop firm industry, tailored to suit different trading styles and experience levels. Traders can choose between the Standard, Instant, and Mini Challenge, each with unique rules for drawdown, payout frequency, and refund eligibility.

Whether you prefer a traditional evaluation process or immediate access to a live account, Maven’s programs offer flexibility and growth potential. Everything is provided under a transparent structure with no hidden limits.

Below is a quick comparison of the three main account types:

| Program Type | Profit Target | Overall drawdown | Daily drawdown | Trading Days | Profit Split | Refund Policy | Payout Frequency |

|---|---|---|---|---|---|---|---|

| Standard Challenge | 8% (1-Step) 8%-5% (2-Step) 3%-3%-3% (3-Step) | 5%-8% / 3%-4% / 3%-2% | Max Drawdown (Trailing) (5%)Equity BasedStatic drawdown (3%) | No limit | 80% | Refund on 3rd withdrawal | Every 10 business days |

| Instant Challenge | 3% min withdrawal | 3% | 2% (Trailing) | No limit | 80% | Refund on 3rd withdrawal | Every 10 business days |

| Mini Challenge | 3% min withdrawal | 2% | 24-hour duration | 80% | Refund on 1st withdrawal | Immediate |

Let’s start with the Standard Challenge to see how it works in practice.

2.1. Standard challenge

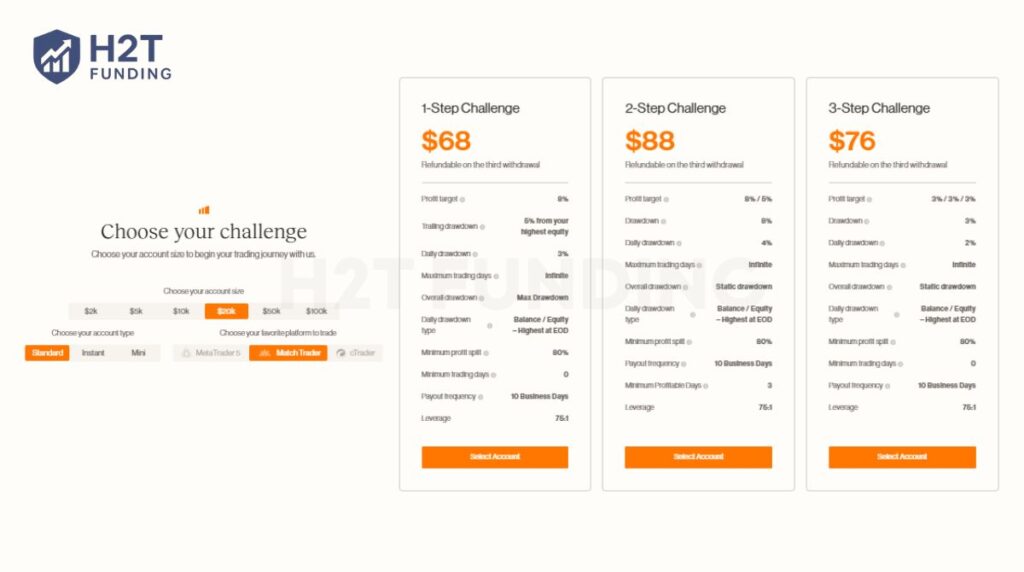

The Standard Challenge is Maven Trading’s most popular program, offering three flexible evaluation paths: 1-Step, 2-Step, and 3-Step. Each model caters to a different trading style, allowing traders to choose between faster qualification or a more gradual, lower-risk route. There’s no time limit, no minimum trading days, and all plans come with an 80% profit split and a refundable fee on the third withdrawal.

2.1.1. One-step challenge

The 1-Step Challenge is designed for confident traders who want direct access to a funded account after meeting a single target. With an 8% profit target, 5% trailing drawdown, and 3% daily drawdown, it’s a straightforward test of consistency and risk control.

| Account Size | Fee | Profit Target (8%) | Max Trailing Drawdown (5%) | Daily Drawdown (3%) | Refund Policy |

|---|---|---|---|---|---|

| $2K | $15 | $160 | $100 | $60 | On 3rd withdrawal |

| $5K | $19 | $400 | $250 | $150 | On 3rd withdrawal |

| $10K | $37 | $800 | $500 | $300 | On 3rd withdrawal |

| $20K | $68 | $1,600 | $1,000 | $600 | On 3rd withdrawal |

| $50K | $170 | $4,000 | $2,500 | $1,500 | On 3rd withdrawal |

| $100K | $380 | $8,000 | $5,000 | $3,000 | On 3rd withdrawal |

2.1.2. Two-step challenge

The 2-Step Challenge balances accessibility and structure. Traders must hit 8% in Phase 1 and 5% in Phase 2, with a static 8% drawdown and 4% daily limit. It’s ideal for traders who want more breathing room and slightly reduced risk per phase.

| Account Size | Fee | Profit Target (8% → 5%) | Max Drawdown (8%) | Daily Drawdown (4%) | Refund Policy |

|---|---|---|---|---|---|

| $2K | $19 | $160 → $100 | $160 | $80 | On 3rd withdrawal |

| $5K | $22 | $400 → $250 | $400 | $200 | On 3rd withdrawal |

| $10K | $44 | $800 → $500 | $800 | $400 | On 3rd withdrawal |

| $20K | $88 | $1,600 → $1,000 | $1,600 | $800 | On 3rd withdrawal |

| $50K | $220 | $4,000 → $2,500 | $4,000 | $2,000 | On 3rd withdrawal |

| $100K | $440 | $8,000 → $5,000 | $8,000 | $4,000 | On 3rd withdrawal |

2.1.3. Three-step challenge

The 3-Step Challenge is designed for those who want the smoothest entry path to funding. It features progressive profit targets (3% – 3% – 3%), with a 3% static drawdown and 2% daily limit. This setup is gentle enough for cautious traders who prefer consistency over aggression.

| Account Size | Fee | Profit Target (3% + 3% + 3%) | Max Drawdown (3%) | Daily Drawdown (2%) | Refund Policy |

|---|---|---|---|---|---|

| $2K | $13 | $60 each phase | $60 | $40 | On 3rd withdrawal |

| $5K | $17 | $150 each phase | $150 | $100 | On 3rd withdrawal |

| $10K | $38 | $300 each phase | $300 | $200 | On 3rd withdrawal |

| $20K | $76 | $600 each phase | $600 | $400 | On 3rd withdrawal |

| $50K | $190 | $1,500 each phase | $1,500 | $1,000 | On 3rd withdrawal |

| $100K | $299 | $3,000 each phase | $3,000 | $2,000 | On 3rd withdrawal |

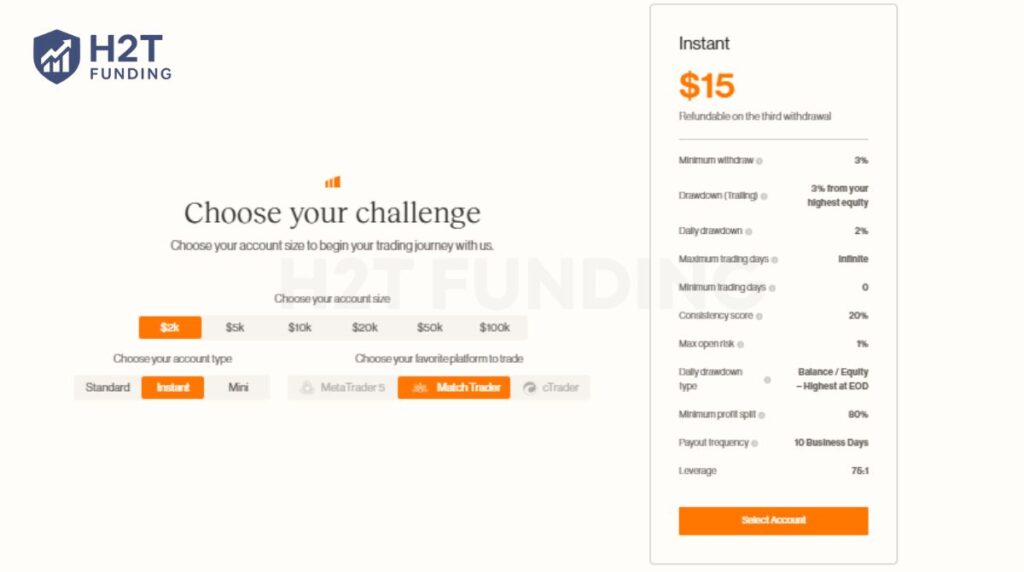

2.2. The Instant challenge

The Instant Challenge is built for traders who want to skip the evaluation phase and start trading funded capital immediately. There’s no time limit and no minimum trading days, making it perfect for active traders who already have a proven strategy. The program keeps things simple with a 3% minimum withdrawal, 3% trailing drawdown, and 2% daily limit, all under an 80% profit split model.

| Account Size | Fee | Min. Withdrawal (3%) | Trailing Drawdown (3%) | Daily Drawdown (2%) | Refund Policy | Payout Frequency |

|---|---|---|---|---|---|---|

| $2K | $15 | $60 | $60 | $40 | On 3rd withdrawal | 10 Business Days |

| $5K | $19 | $150 | $150 | $100 | On 3rd withdrawal | 10 Business Days |

| $10K | $37 | $300 | $300 | $200 | On 3rd withdrawal | 10 Business Days |

| $20K | $68 | $600 | $600 | $400 | On 3rd withdrawal | 10 Business Days |

| $50K | $170 | $1,500 | $1,500 | $1,000 | On 3rd withdrawal | 10 Business Days |

| $100K | $380 | $3,000 | $3,000 | $2,000 | On 3rd withdrawal | 10 Business Days |

This model offers traders immediate access to live conditions with consistent payouts every 10 business days. It’s best suited for those who value flexibility and want to trade without the pressure of reaching a profit target first.

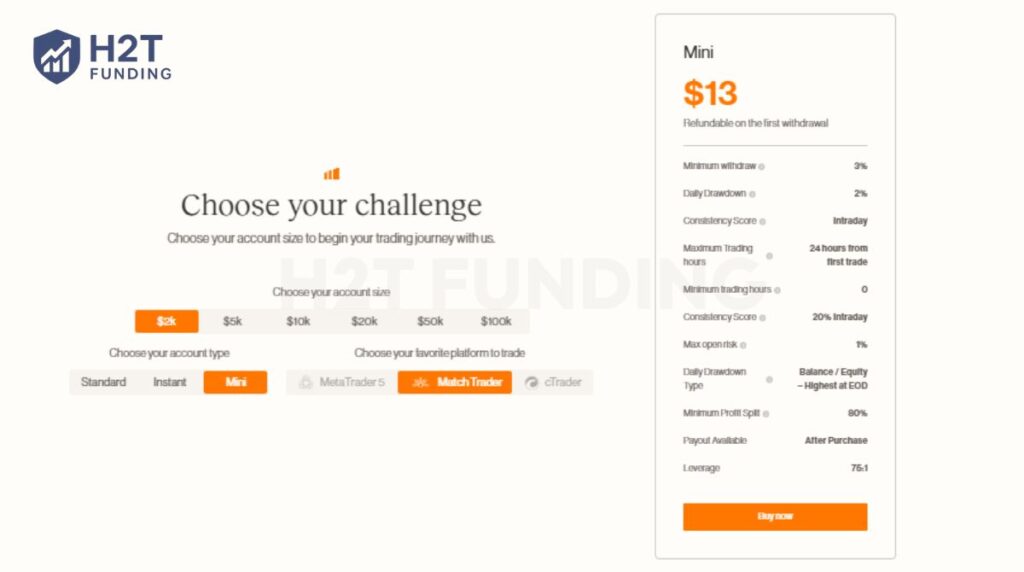

2.3. The Mini challenge

The Mini Challenge is Maven’s fastest funding option, built specifically for intraday traders who want quick access to payouts. With a short 24-hour trading window, 2% daily drawdown, and 3% minimum withdrawal, this program rewards short-term consistency over long evaluation periods.

What makes it even more appealing is the immediate payout system, profits can be withdrawn right after successful trades, and the fee is refunded on the first withdrawal.

| Account Size | Fee | Min. Withdrawal (3%) | Daily Drawdown (2%) | Max Open Risk (1%) | Refund Policy | Payout Frequency |

|---|---|---|---|---|---|---|

| $2K | $13 | $60 | $40 | $20 | On 1st withdrawal | Immediate |

| $5K | $17 | $150 | $100 | $50 | On 1st withdrawal | Immediate |

| $10K | $38 | $300 | $200 | $100 | On 1st withdrawal | Immediate |

| $20K | $76 | $600 | $400 | $200 | On 1st withdrawal | Immediate |

| $50K | $190 | $1,500 | $1,000 | $500 | On 1st withdrawal | Immediate |

| $100K | $299 | $3,000 | $2,000 | $1,000 | On 1st withdrawal | Immediate |

The consistency score of 20% intraday ensures traders don’t rely on luck or oversized positions. Combined with the 1% max open risk rule, this structure is ideal for scalpers or short-term day traders who value quick results and strict discipline.

Verdict on Maven Trading challenges

After testing all three challenges myself for this Maven Trading prop firm review, I’d say Maven Trading does a solid job balancing fairness and flexibility.

The Standard Challenge feels best for traders who prefer structure and gradual scaling, while the Instant Challenge really shines if you want to skip evaluations and start trading right away. The Mini Challenge, on the other hand, is surprisingly fast-paced, great for intraday traders who thrive on short sessions.

What stands out most is Maven’s focus on clarity, flexibility, and trader protection, with no minimum trading days, consistent drawdown logic, and refundable fees. It’s a balanced model that rewards discipline rather than luck, making it a reliable choice for serious traders.

3. Maven Trading rules

Maven prop firm enforces strict trading rules to maintain fairness, consistency, and to ensure traders demonstrate genuine skill, not luck or system manipulation. These Maven trading rules apply throughout the Challenge, KYC verification, and Live Account phases. Following them is essential if you want to avoid a breach and progress toward your funded account.

3.1. Allowed trading practices

Maven allows a range of legitimate and responsible trading behaviors designed to encourage sustainable performance:

- Normal trading activity: You can trade forex pairs, indices, crypto instruments, and engage in commodity trading freely, as long as your trades respect the time restrictions around news events.

- Proper risk management: Maven encourages traders to use solid risk management practices, always set a stop loss, manage leverage carefully, and aim for a healthy risk-to-reward ratio of at least 1:1.5.

- Flexible trading strategies: You can apply multiple trading strategies, such as swing, day trading, or light scalping, provided that less than 50% of your trades are held for under one minute.

- Verified identity (KYC): You must use your own verified personal information and payment card during the KYC process to ensure transparency and compliance.

- Manual trading only: You may open or close trades manually using your preferred analysis method. Maven does not restrict the strategy type as long as trades are entered manually.

- Trading during normal conditions: Opening and closing positions is permitted outside the 2-minute restricted window before and after any Red Folder News events (as defined on ForexFactory).

Tip: Traders who follow these rules not only protect their accounts from breaches but also improve their chances of reaching consistent profit targets and enjoying future profit splits.

3.2. Prohibited trading practices

Maven maintains a zero-tolerance policy for manipulation, automation, or behavior that exploits demo trading inefficiencies. The following actions are strictly prohibited and will result in account termination:

- Excessive scalping: Holding 50% or more of your trades for under one minute.

- Martingale trading: Opening more than five simultaneous losing positions (drawdown) on the same pair. This counts as over-leveraging.

- All-in trading: Risking the complete account balance on a single trade without a stop loss, or going “pass-fail” into the challenge.

- Gamification of the Challenge: Trading two accounts against each other, long on one and short on another, to ensure passing the phase.

- Copy trading or arbitrage: Copying trades from other traders or exploiting latency/order flow inefficiencies is not allowed.

- Hedging or reverse hedging: Utilizing the multi-account method in hedging opposite directions to secure guaranteed wins.

- EA or bot usage: Any kind of automated trading using Expert Advisors or any algorithmic tools is strictly prohibited on all platforms.

- News trading violations: Opening, closing, or triggering any trades within 2 minutes before and after a Red Folder economic news release is considered a violation.

- IP address inconsistency: If the region of your IP address alters without proof provided for such travel, your account may get flagged or even suspended.

Note: Any detected form of cheating, toxic order flow, or arbitrage activity will result in immediate account termination without refund.

Verdict on Maven Trading rules

From personal experience and observation, Maven’s trading rules strike a solid balance between discipline and freedom. They were not designed to restrict traders but to simulate real institutional conditions where consistency, risk control, and professionalism are far more important than lucky trades.

These restrictions on scalping, martingale, and news trading may sound a bit strict, but, actually, they urge traders to develop sustainable strategies that could work in live market conditions. Compared to other prop trading firms, Maven’s framework feels very fair and transparent and is technically well-enforced, especially in their attention to IP verification and the integrity of KYC.

If you’re a trader with solid risk management skills and a data-driven approach, Maven provides a realistic pathway to long-term funding. However, traders who rely on EAs, high-frequency tactics, or gambling behaviors will find it hard to adapt here.

4. Maven payout structure

Maven Prop Firm maintains a clear and performance-based payout system designed to reward traders for consistent and professional trading behavior. Whether you’re using the Maven Mini or Instant Funding program, the firm ensures quick, transparent, and structured payouts.

4.1. Accepted payment methods

Maven supports two main payment methods for both evaluation fees and profit withdrawals:

- Bank Transfer (USD): Available in select supported countries, ideal for traders preferring direct deposits.

- Cryptocurrency Payments: A faster and borderless alternative, suitable for international users.

All fees are denominated in USD, and evaluation fees are non-refundable, except after achieving three successful payouts. This policy reflects Maven’s performance-based refund approach, rewarding traders who maintain steady profitability.

4.2. Profit split and withdrawal schedule

Maven Trading maintains a clear payout structure that supports fairness and transparency for all traders. Combined with Maven’s drawdown structure and focus on sustainable growth, this setup reflects the firm’s commitment to professionalism and trader trust.

- Profit Split: Traders receive 80% of their profits, while Maven retains 20% to cover operational and liquidity costs.

- Payout Frequency: Withdrawals are processed every 10 business days, giving traders regular access to their earned profits.

- Minimum Withdrawal Threshold: You must achieve at least 3% profit (Instant Program) to be eligible for your first payout.

- Consistency Score Requirement:

- Formula → (Biggest Winning Day ÷ Total Profit) × 100%

- Payouts are only available when your Consistency Score ≤ 20%.

- This metric ensures profits are generated through consistent trading, not a single oversized trade.

- Payout Cap: A $10,000 withdrawal cap applies per two payout cycles, which resets after the second payout period.

Example: If your total profit reaches $15,000 within two payout cycles, only $10,000 is withdrawable during that time. The remaining amount rolls forward to future payouts once the cap resets.

4.3. Refund and fee policy

Maven’s refund and fee policy is straightforward and designed to reward long-term commitment. It encourages traders to build consistent results before receiving financial incentives, promoting a healthy trading mindset and accountability within the firm’s forex trading programs.

- Refund Eligibility: Evaluation fees are refundable after three successful withdrawals, a practical incentive for traders who demonstrate long-term consistency.

- Non-Refundable Cases: All purchases and fees are final unless this milestone is achieved.

- Payment Disputes: Any chargeback or dispute will result in immediate account suspension or permanent ban.

Verdict on Maven payout rules

Maven’s payout policy is built around discipline, transparency, and efficiency. The 80% profit split and regular payout schedule make it attractive to consistent traders who prioritize long-term growth. The process is quick, and support teams respond promptly to payout or KYC queries, two aspects that traders often value most.

However, the system’s $10,000 withdrawal cap and consistency score rule introduce a layer of structure that may feel restrictive to high-volume traders or those who prefer more flexibility. These conditions are clearly intended to encourage stable, sustainable trading behavior rather than large, high-risk bursts of profit.

5. Scaling plan of Maven Trading

Maven Prop Firm allows traders to scale their funded accounts up to $1,000,000, giving consistent performers the chance to trade with larger capital. Every trader can start with up to $200,000 in funded capital, and those who show steady profits can unlock higher account tiers through Maven’s scaling program.

To qualify, a trader must earn 10% profit over four months (around 2.5% per month) and process at least one payout each month. Meeting these targets results in a 25% increase in account size, and this process can be repeated until the trader reaches the $1M limit. As your account scales, your withdrawal cap also grows proportionally, ensuring fair access to profits.

For example, a trader starting with a $200,000 funded account who meets all the scaling conditions over four months would see their balance increase to $250,000. Repeating this process can gradually grow the account to $1M, along with higher payout opportunities at each stage.

Verdict on the scaling plan of Maven Trading

Maven’s scaling plan feels practical and well-balanced. The profit target is achievable without forcing traders into risky strategies, and the gradual capital growth encourages a steady trading rhythm. The structure mirrors how professional trading firms reward consistency, through time and discipline rather than short bursts of profit.

From experience using similar scaling systems, Maven’s approach stands out for its clarity and fairness. It gives traders a real opportunity to grow while maintaining control over risk, which is crucial for long-term success.

6. Spreads & commission fees

Maven Prop Firm applies a clear fee system, combining fixed commissions with variable spreads. While spreads can widen depending on market volatility, Maven stands out by charging zero swap fees across all accounts, a big advantage for swing and long-term traders.

The firm’s commission rates are competitive, though total trading costs may rise due to spread fluctuations. All non-USD pairs are automatically converted to USD, keeping pricing consistent and easy to understand.

| Asset Class | Commission (per side) | Round Trip | Swap Fees | Notes |

|---|---|---|---|---|

| Forex | $2 | $4 | None | Auto-converts to USD |

| Precious Metals | $3 | $6 | None | Includes gold, silver |

| Energy | $3 | $6 | None | Covers oil, gas |

| Indices, Commodities, Digital ETFs | $0 | $0 | None | Commission-free |

| Crypto | $0 | $0 | None | Commission-free |

Spreads on Maven vary with market conditions. In practice, they are wider than those at some competitors like Blueberry Funded or DNA, which can make short-term trading slightly more expensive. However, for traders who hold positions longer, the absence of swap fees helps reduce ongoing costs and improve net profit over time.

Verdict on spreads & commissions fee

Maven’s pricing structure is simple and transparent, ideal for traders who value clarity. The zero-swap policy is a strong plus, helping reduce overnight costs for those trading over several days.

That said, spreads can be on the higher side, which may not suit scalpers or traders who rely on tight pricing. Still, for consistent traders focused on long-term gains, Maven offers a fair and balanced fee setup, easy to calculate, stable, and reliable.

7. Maven trading platform

Maven Prop Firm lists three trading platforms on its website: MetaTrader 5, cTrader, and Match-Trader, but in practice, only Match-Trader is currently available for live account use. MT5 and cTrader appear as supported options, yet traders cannot select them when creating or managing accounts.

Match-Trader is a web-based and mobile platform, ideal for traders who prefer convenience without downloads. It integrates with TradingView, giving access to advanced charting and technical tools.

However, it lacks a dedicated desktop version and has limited customization compared to MT5 and cTrader, which may be less appealing for professional traders.

Verdict on Maven Trading platforms

Maven displaying MT5 and cTrader on its website can easily mislead users into expecting a broader platform selection. In reality, your trading journey with Maven will revolve entirely around Match-Trader. Once you accept that limitation, the platform is surprisingly functional, intuitive, and efficient for everyday trading, though not as customizable as the more established terminals.

8. Trading instruments & leverage

Maven Prop Firm gives traders access to a diverse range of markets with leverage up to 75:1. You can trade across Forex, commodities, indices, and digital assets, each offering different leverage levels based on market risk. This flexibility allows traders to apply multiple strategies, from day trading to swing trading, within a single account.

| Asset Class | Leverage | Example Instruments |

|---|---|---|

| Forex | 75:1 | EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CAD, EUR/GBP, NZD/USD, USD/ZAR, USD/TRY |

| Commodities | 20:1 | XAU/USD (Gold), XAG/USD (Silver), WTI, Brent, NGAS, Corn, Wheat, Coffee, Cocoa |

| Indices | 20:1 | US500, US30, US100, GER30, FRA40, UK100, JAP225, HKIND, AUS200 |

| Crypto | 2:1 | BTC/USD, ETH/USD, ETH/BTC, BTCEUR |

Maven’s Forex offering covers major, minor, and exotic pairs with up to 75:1 leverage, allowing traders to manage larger positions efficiently while maintaining strong risk control. Commodities such as gold, silver, oil, and agricultural assets trade at 20:1 leverage, offering steady exposure to global demand trends. Indices like US500, GER30, and JAP225 allow broader market participation, while crypto assets trade more cautiously at 2:1 leverage due to volatility.

These leverage levels are designed to balance trading flexibility and risk management. While Forex traders benefit from higher leverage, commodities and indices maintain lower ratios to prevent overexposure, ensuring all asset classes align with Maven’s disciplined trading framework.

Verdict on Maven Trading Instruments & Leverage

Maven’s selection of assets is broad and well-structured, covering everything most traders need. The leverage levels are realistic, not overly aggressive, which helps maintain account stability.

The balance between high Forex leverage and lower limits on other markets makes the environment fair and sustainable. It’s a setup that suits traders aiming for long-term growth rather than short, high-risk bursts of profit.

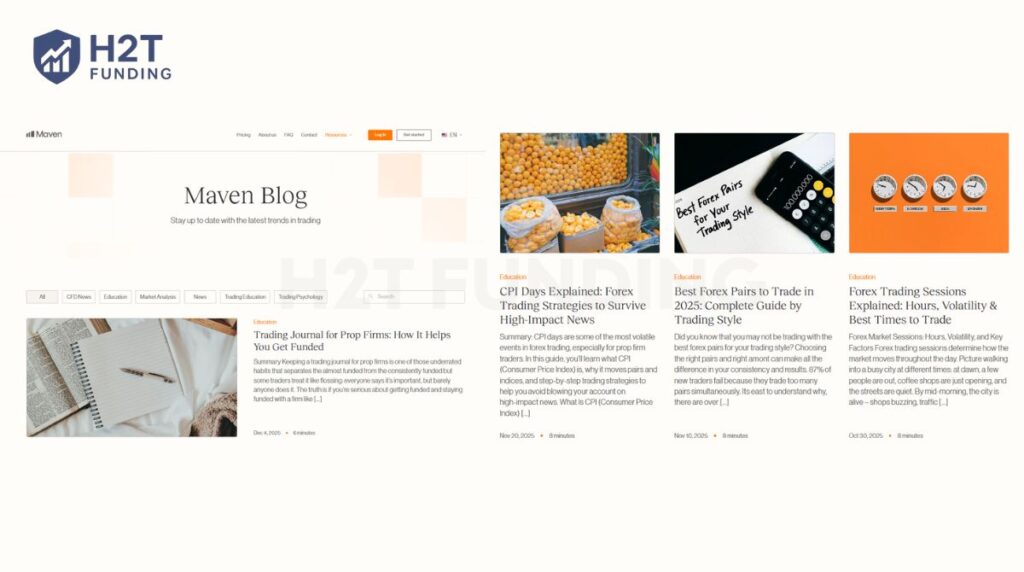

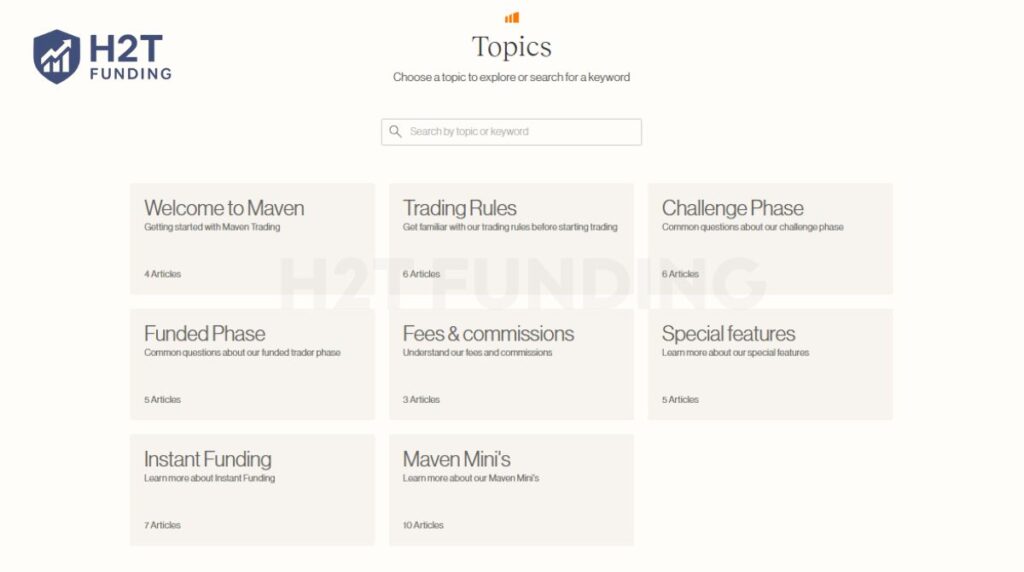

9. Education & resource

While exploring Maven Trading, I found their educational resources and community resources straightforward and easy to use. They focus more on accessibility than depth, which makes them helpful for beginners but somewhat limited for experienced traders.

The Maven Blog was my first stop, and it left a good first impression. The articles are short and easy to follow, covering topics like trading psychology, market slippage, and basic analysis. They’re ideal for new traders who want clear explanations without too much jargon.

However, as someone with trading experience, I noticed the blog doesn’t cover advanced strategies or risk management case studies. Including these would make it far more valuable for seasoned traders.

The FAQ and knowledge base are cleanly structured and genuinely helpful when navigating the platform. They answered key questions about rules, scaling, and fees, which saved me time compared to reaching out to support. Still, some complex issues, like trading rule edge cases, aren’t covered in much detail.

Maven also fosters a strong sense of trust and community. With an active Discord group of over 50,000 members and a 4.6/5 rating on Trustpilot, traders can rely on peer support, shared insights, and responsive staff. This social proof and community engagement reinforce confidence in the platform’s reliability.

Verdict on Education & Resources

Overall, Maven’s educational resources are beginner-friendly and community-driven, but not yet comprehensive. The blog and FAQs are solid starting points. The Discord community adds a more personal, interactive layer, which I found genuinely useful for questions about account setup and rule clarifications.

Maven is investing in communication and community engagement, which makes the overall learning experience more approachable. Still, I’d like to see more advanced content, things like strategy breakdowns or real market case studies, to support traders who want to go beyond the basics.

10. Maven Trading customer support

Maven Trading offers live chat and email support, giving traders a few ways to reach out when issues arise. The live chat is easy to access and usually connects within a few minutes. However, the quality of help can vary depending on the question.

When I tested the chat, the team replied quickly and politely, but detailed or technical questions often received general answers. For example, when I asked about platform functions, I was redirected to look for information elsewhere instead of getting a full explanation. Still, for simple requests like account setup or KYC issues, the team handled them efficiently.

Maven also provides a dedicated email channel at support@maventrading.com, which is helpful for longer or document-related requests. In addition, the firm’s Discord community often responds faster and feels more interactive; many traders share insights or clarify rules there before official support steps in.

Verdict on Maven customer support

Maven’s customer service is quick but basic. The live chat team is responsive and polite, but their answers can feel scripted or too general for complex questions. Additionally, email support and an active Discord group improve the overall experience and give traders more communication options.

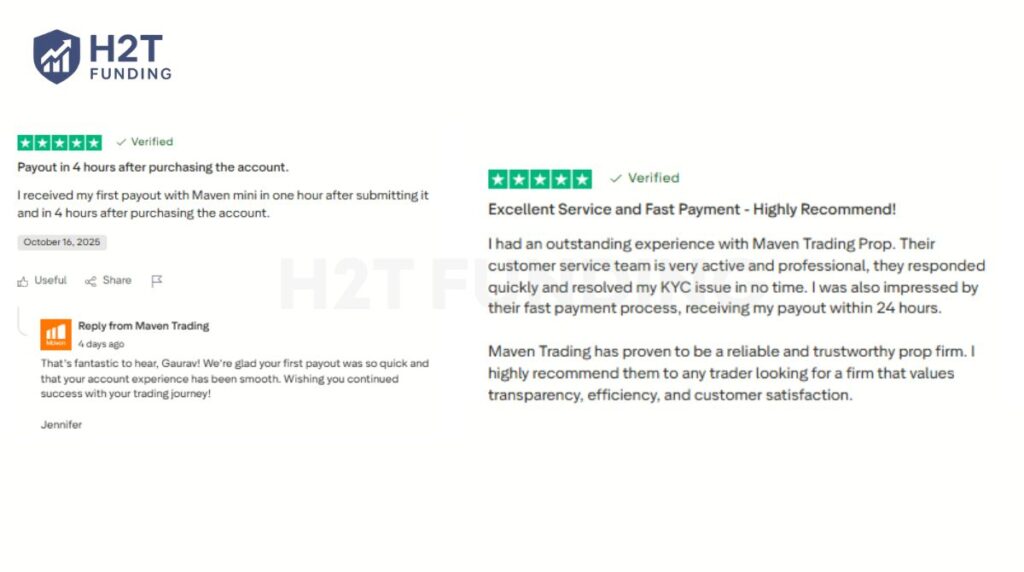

11. Maven prop firm review Trustpilot, Maven Trading Reddit

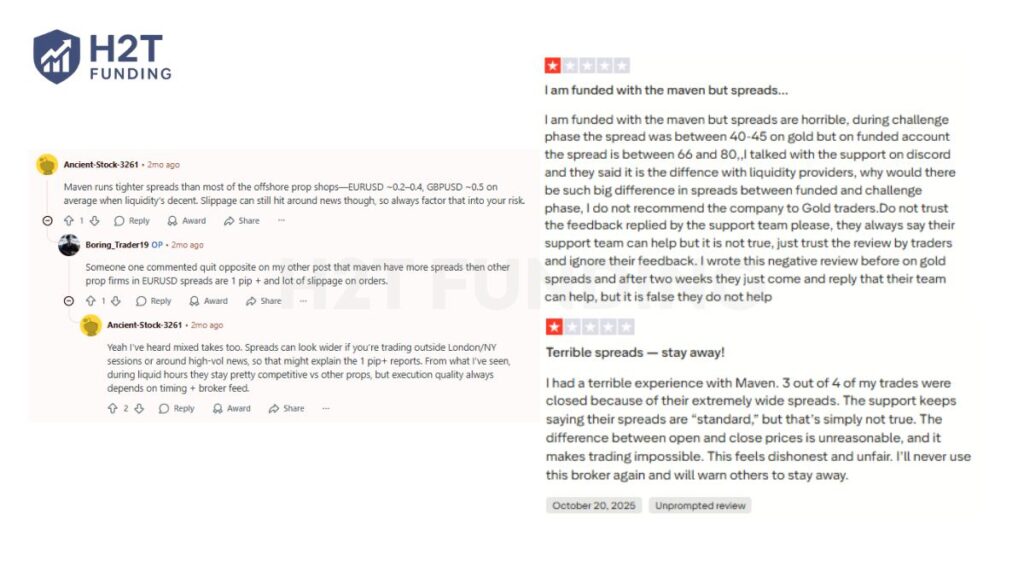

To analyze real user feedback and Maven prop trading reviews, I looked through discussions across Trustpilot and Reddit. The feedback is a mix of strong praise and serious criticism, showing two very different sides of the trading experience.

On Trustpilot, Maven Trading holds an impressive 4.6 out of 5 rating from thousands of users. Many traders highlight fast payouts, reliable funding, and responsive staff. Several reviews mention receiving payouts within hours, which supports Maven’s image as a trustworthy and efficient prop firm. The professional tone of their replies also helps build confidence in new traders joining the platform.

However, not all feedback is positive. Some funded traders shared frustration about spread differences between the challenge and live phases. A few reported that spreads on gold (XAUUSD) became much wider after funding, making trading more difficult. These traders also claimed that support often repeated scripted responses rather than addressing the technical issue directly.

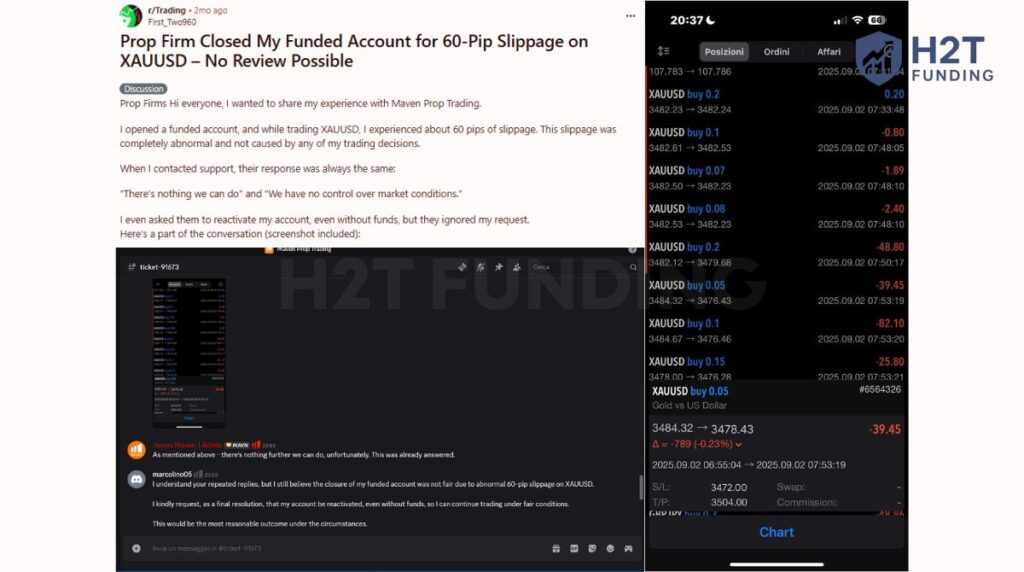

On Reddit, opinions are even more divided. Some users praised Maven for having competitive spreads during normal sessions, while others described major slippage issues on gold trades and slow response times after account closures.

One detailed post shared how a funded account was terminated after a 60-pip slippage on XAUUSD, with the trader claiming there was no review or appeal process. Maven staff replied that they couldn’t control market conditions, an explanation that didn’t sit well with the community.

Trader feedback paints Maven as a firm with potential but uneven consistency. Many users are satisfied with fast payouts and clear rules, while others report issues with slippage, spread changes, and limited post-incident support. Maven still has work to do on execution transparency and customer communication.

12. How to start with Maven Trading

Getting started with Maven Trading is simple and beginner-friendly. The registration and verification process only takes a few minutes, as long as you have the required documents ready. To help new traders avoid confusion, I’ve broken down the exact steps I followed to create an account, join a challenge, and finish the KYC verification.

12.1. Step 1: Visit the Maven Trading website and choose a challenge

Go to the official Maven Trading website and explore the available funding programs. You can choose between different account sizes depending on your experience and goals. Once you’ve decided, click “Buy Now” to begin the sign-up process.

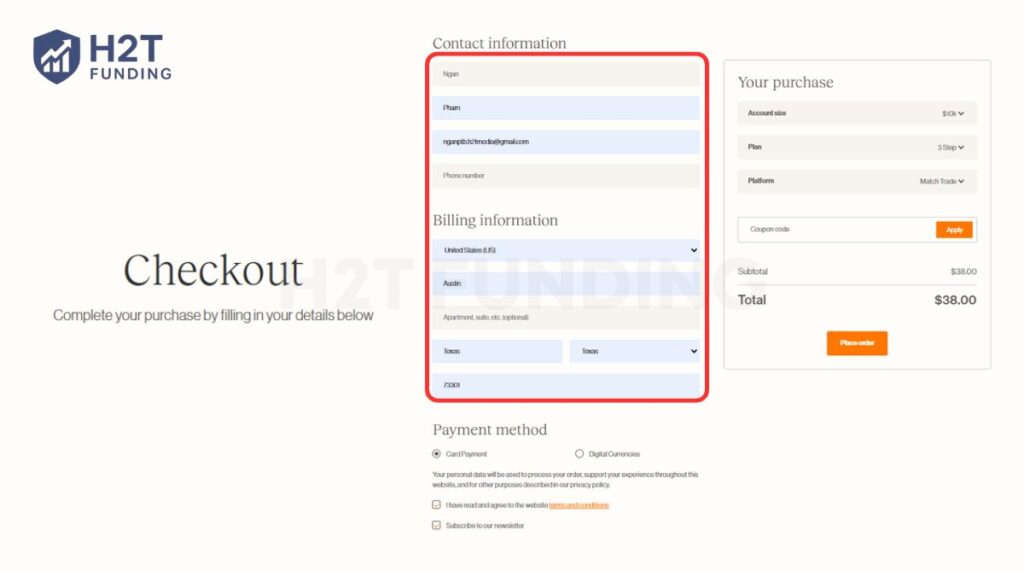

12.2. Step 2: Complete the registration form

You’ll be directed to a checkout page where you need to enter your personal details. This includes your full name, email, country, city, full address, postal code, and phone number. Double-check your information to ensure it matches your ID before submission.

At this stage, you’ll also select your preferred trading platform and your payment method, either by bank transfer or cryptocurrency.

12.3. Step 3: Confirm payment and receive account details

After completing the payment, Maven will send your account credentials and platform login details to the registered email address. From here, you can immediately start your Challenge Phase, following the firm’s trading rules and profit targets.

12.4. Step 4: Complete identity verification (KYC)

Before withdrawing profits or accessing a funded account, you must pass Maven’s KYC verification. Prepare the following documents:

- Identity Verification: Passport, driver’s license, or national ID card

- Proof of Residence: Recent utility bill (water, electricity, gas, or phone) or a bank statement showing your full name and address

The registration process with Maven Trading is straightforward and efficient, suitable even for first-time prop traders. Once verified, your account will be fully active, and you can begin trading under Maven’s funded program.

13. Restricted countries by Maven Trading

Maven Trading restricts access to its programs for traders from certain countries due to regulatory, compliance, and international sanction laws. These restrictions are in place to align with global financial standards and to prevent violations of anti-money-laundering (AML) and counter-terrorism regulations.

Traders from the following countries are not eligible to register, purchase challenges, or participate in Maven Trading’s funded programs:

| A–C | D–H | I–N | P–S | T–Y |

|---|---|---|---|---|

| Afghanistan | Democratic Republic of the Congo (Congo Kinshasa) | Iran | Palestinian Territory | Tunisia |

| Belarus | Eritrea | Lebanon | Papua New Guinea | Ukraine |

| Bosnia and Herzegovina | Guinea | Libya | Russia | Vanuatu |

| Burundi | Haiti | Mali | Saint Helena | Venezuela |

| Central African Republic | Hong Kong | Moldova | Saint Lucia | Vietnam |

| China | Myanmar (Burma) | Saint Pierre and Miquelon | Virgin Islands (British) | |

| Congo (Brazzaville) | Nicaragua | Samoa | Yemen | |

| Cuba | North Korea | Sierra Leone | ||

| Somalia | ||||

| South Sudan | ||||

| Sudan | ||||

| Syria |

Additionally, access is restricted for traders residing in or operating from Crimea (Region of Ukraine) and other regions currently under international sanctions.

These limitations are standard among regulated prop firms and reflect Maven Trading’s commitment to legal compliance and transparency across global markets.

14. Compare Maven Trading vs other prop firms

To understand where Maven Trading stands in today’s prop firm market, it helps to compare it with other popular options like Alpha Capital Group, AquaFunded, and Finotive Funding. While all four firms provide funded trading opportunities, they differ in pricing, flexibility, and the level of trader experience they cater to.

| Criteria | Maven Trading | Alpha Capital Group | AquaFunded | Finotive Funding |

|---|---|---|---|---|

| Country | United Kingdom | Great Britain | United Arab Emirates | Cyprus |

| Account Types | 2-step Challenge, Instant Funding | 1-step, 2-step, 3-step, Swing | 1-step, 2-step, 3-step, Instant | 1-step, 2-step, Instant |

| Profit Split | 80% | 80% | 90–100% | 65–100% |

| Account Size | $5K – $200K | $5K – $200K | $2.5K – $300K | $2.5K – $200K |

| Profit Target | 8–10% | 4–10% | 5–12% | 5–10% |

| Time Limit | No limit | No limit | No limit | No limit |

| Trading Platforms | Match-Trader | MT5, cTrader, DXTrade, TradeLocker | MT5, cTrader, Match-Trader, TradeLocker | MT5 |

| Markets Offered | Forex, Commodities, Indices, Crypto | Forex, Commodities, Indices | Forex, Indices, Commodities, Crypto | FX, Metals, Indices, Energy, Crypto, Stocks |

| Scaling Plan | Up to $1M (25% per cycle) | Up to $1M | Up to $2M | Up to $1.28M |

| Payout Frequency | Every 10 business days | Every 14 days | Bi-weekly | Weekly |

Each prop firm has its own strengths, depending on a trader’s goals and trading style. After comparing their features, funding models, and payout systems, here’s a simple breakdown of which firm suits which type of trader best:

- Maven Trading: Best for traders who prefer structure, clear rules, and reliable payouts. Ideal for disciplined traders who value consistency and a straightforward evaluation system.

- Alpha Capital Group: A great choice for those who want flexibility and variety. Its multiple challenge formats make it suitable for traders who like to test different strategies and risk levels.

- AquaFunded: Perfect for aggressive traders aiming for high profit splits and rapid scaling. Works best for those confident in managing risk under stricter trading limits.

- Finotive Funding: Suitable for traders looking for diverse markets and frequent withdrawals. Offers access to Forex, crypto, and stocks, making it ideal for multi-asset traders.

15. FAQs

Yes, Maven Trading operates transparently, offering real funding, verified payouts, and active trader communities on Discord and Trustpilot. While it’s not a regulated financial broker, it follows strict compliance procedures and maintains a strong reputation among prop firms.

Maven Trading is a proprietary trading firm that funds traders after they complete a challenge phase. You trade on a demo account during evaluation, and once you meet the profit and risk targets, Maven provides a funded account where you keep a portion of the profits.

Funded traders at Maven receive up to 80% of their profits, while the firm keeps the remaining 20%. Payouts are processed every 10 business days, and traders can request withdrawals once they’ve met the minimum profit requirement.

Yes, weekend holding is allowed, but news trading is restricted within two minutes before and after major “Red Folder” events listed on Forex Factory. This rule helps prevent slippage and irregular market execution.

All trading accounts are executed through Match-Trader, available on both web and mobile, offering integrated charting, TradingView tools, and a streamlined trading experience.

Once you pass your evaluation and complete KYC verification, your funded account is usually activated within 24–48 hours. Some traders report even faster approval, depending on document processing speed.

No, Maven Trading is not regulated by any financial authority. The firm operates independently as a proprietary trading company, which gives it more flexibility in offering funding programs and trading conditions. However, traders should understand that this also means Maven doesn’t fall under formal investor protection rules, so it’s important to research the firm carefully before joining.

16. Conclusion: My final verdict on the Maven Trading prop firm

After testing and researching for this Maven prop firm review, I can say Maven Trading offers a genuine funding opportunity for traders who value structure and transparency. The overall setup feels professional, making trading smooth and flexible.

What impressed me most was how quick and consistent the payouts were. The 80% profit split, zero-swap accounts, and the clear 2-step challenge show Maven’s focus on rewarding steady performance. I also found the community on Discord quite active, which made communication easier compared to many other firms I’ve tried.

However, some areas need improvement. The spreads on gold can widen more than expected during volatility, and customer support sometimes feels generic, especially for technical questions. Also, since Maven isn’t regulated, traders should manage risk carefully and rely on their own due diligence.

Despite those drawbacks, Maven stands out for its fast operations, clean funding process, and transparent rules. Although not perfect, Maven is one of the few prop firms that actually delivers on payouts and consistency. This makes it ideal for traders who take a disciplined, long-term approach rather than chasing quick wins.

In the H2T Funding Prop Firm Reviews series, Maven is a worthwhile option for disciplined traders aiming for long-term results.